The global automotive refinish coatings market is experiencing robust growth, driven by rising vehicle production, an expanding aftermarket, and increasing demand for high-performance, aesthetically superior finishes. According to a report by Mordor Intelligence, the market was valued at USD 14.2 billion in 2023 and is projected to grow at a CAGR of over 5.8% from 2024 to 2029. Acrylic enamel paints, in particular, have gained traction due to their durability, quick drying time, and excellent color retention—making them a preferred choice for both OEM and repair applications. With advancements in environmentally compliant formulations and rising consumer preference for premium finishes, the demand for high-quality auto acrylic enamel paints continues to climb. Against this backdrop, several manufacturers have emerged as industry leaders, combining innovation, scale, and technical expertise to capture significant market share. The following list highlights the top 8 auto acrylic enamel paint manufacturers shaping the current and future landscape of automotive coatings.

Top 8 Auto Acrylic Enamel Paint Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Automotive Finishes

Domain Est. 1998

Website: industrial.sherwin-williams.com

Key Highlights: Sherwin-Williams Automotive Finishes is the leading manufacturer and distributer of high-quality paint and coating systems for automotive and fleet ……

#2 Automotive OEM Coatings, OEM Paint Systems & Color Leaders

Domain Est. 1990

Website: ppg.com

Key Highlights: PPG Automotive OEM Coatings is a global leader in high-performance auto paints and technologies including powder primers, clearcoats, and color leadership….

#3 Automotive Paint Colors

Domain Est. 1995

Website: eastwood.com

Key Highlights: 4.5 124 · 1–4 day delivery4 days ago · For those seeking an easy-to-use, budget-friendly option with a classic look, our Acrylic Enamel line provides a durable finish that’s pe…

#4 Automotive Spray Paints

Domain Est. 1995

Website: rustoleum.com

Key Highlights: Rust-Oleum automotive paints include enamel, lacquer and chrome spray paints. Find the automotive spray paint that’s right for your project….

#5 Testors Enamel Paints

Domain Est. 1996

Website: testors.com

Key Highlights: Find Testors enamel paints, markers, primers and more….

#6 Multi-Purpose Enamel

Domain Est. 1997

Website: duplicolor.com

Key Highlights: A high-solids acrylic enamel formulation delivers the ultimate in protection, gloss and color retention while delivering maximum coverage on metal, wood, and ……

#7 Automotive Acrylic Enamel

Domain Est. 1997

Website: krylon.com

Key Highlights: Automotive Acrylic Enamel is formulated for a durable, long lasting finish that will resist fading, chipping, stains, and corrosion. SKILL LEVEL: Beginner….

#8 Acrylic Enamel Paint

Domain Est. 2004

Website: tcpglobal.com

Key Highlights: AE is a Professional Easy-To-Use Single-Stage High Gloss Paint Coating System that is Designed for Overall Automotive Refinishing but is also used as a Fleet ……

Expert Sourcing Insights for Auto Acrylic Enamel Paint

H2: 2026 Market Trends for Auto Acrylic Enamel Paint

The auto acrylic enamel paint market is poised for significant evolution by 2026, driven by technological advancements, environmental regulations, and shifting consumer preferences. Key trends shaping the industry include:

-

Increased Demand for Eco-Friendly Formulations

As global emissions standards tighten, especially in regions like the EU and North America, there is a growing shift toward low-VOC (volatile organic compound) and water-based acrylic enamel paints. By 2026, manufacturers are expected to prioritize sustainable solutions to comply with environmental regulations such as REACH and EPA standards, boosting demand for greener alternatives without compromising on durability or finish quality. -

Growth in Automotive Refinishing Segment

The rising volume of vehicle ownership and accident-related repairs is fueling demand in the automotive refinishing sector. Acrylic enamel paints remain a preferred choice due to their fast drying time, high gloss finish, and excellent adhesion. The aftermarket segment, particularly in emerging economies like India, Brazil, and Southeast Asia, will see robust growth, contributing significantly to market expansion. -

Technological Innovation and Product Differentiation

Leading chemical and paint companies are investing in R&D to enhance the performance of acrylic enamel paints—improving UV resistance, color retention, and scratch resistance. The integration of nanotechnology and self-healing coatings may begin to influence premium product lines by 2026, offering enhanced durability and aesthetic longevity. -

Regional Market Dynamics

Asia-Pacific is projected to dominate the market by 2026 due to rapid urbanization, expanding automotive manufacturing hubs, and increasing disposable incomes. China and India will be key growth engines. Meanwhile, North America and Europe will focus on replacing older solvent-based systems with compliant, high-performance acrylic solutions, supported by established distribution networks and service centers. -

Supply Chain and Raw Material Volatility

Fluctuations in the prices of acrylic resins and petrochemical derivatives may impact production costs. Companies are likely to adopt strategic sourcing, vertical integration, or bio-based raw materials to mitigate risks and maintain profit margins amid economic uncertainties. -

Digitalization and Customization

The rise of digital color-matching tools and AI-driven tinting systems is transforming paint shops. By 2026, customization and precision in color formulation will become standard, enhancing customer experience and reducing waste—key value propositions for acrylic enamel products.

In conclusion, the auto acrylic enamel paint market in 2026 will be shaped by sustainability, innovation, and regional growth disparities. Companies that adapt to regulatory demands, invest in advanced formulations, and leverage digital tools will be best positioned to capture market share.

Common Pitfalls When Sourcing Auto Acrylic Enamel Paint (Quality & IP)

Sourcing high-quality Auto Acrylic Enamel Paint while protecting intellectual property (IP) can be challenging. Falling into common traps can lead to subpar finishes, project delays, or legal issues. Here are key pitfalls to avoid:

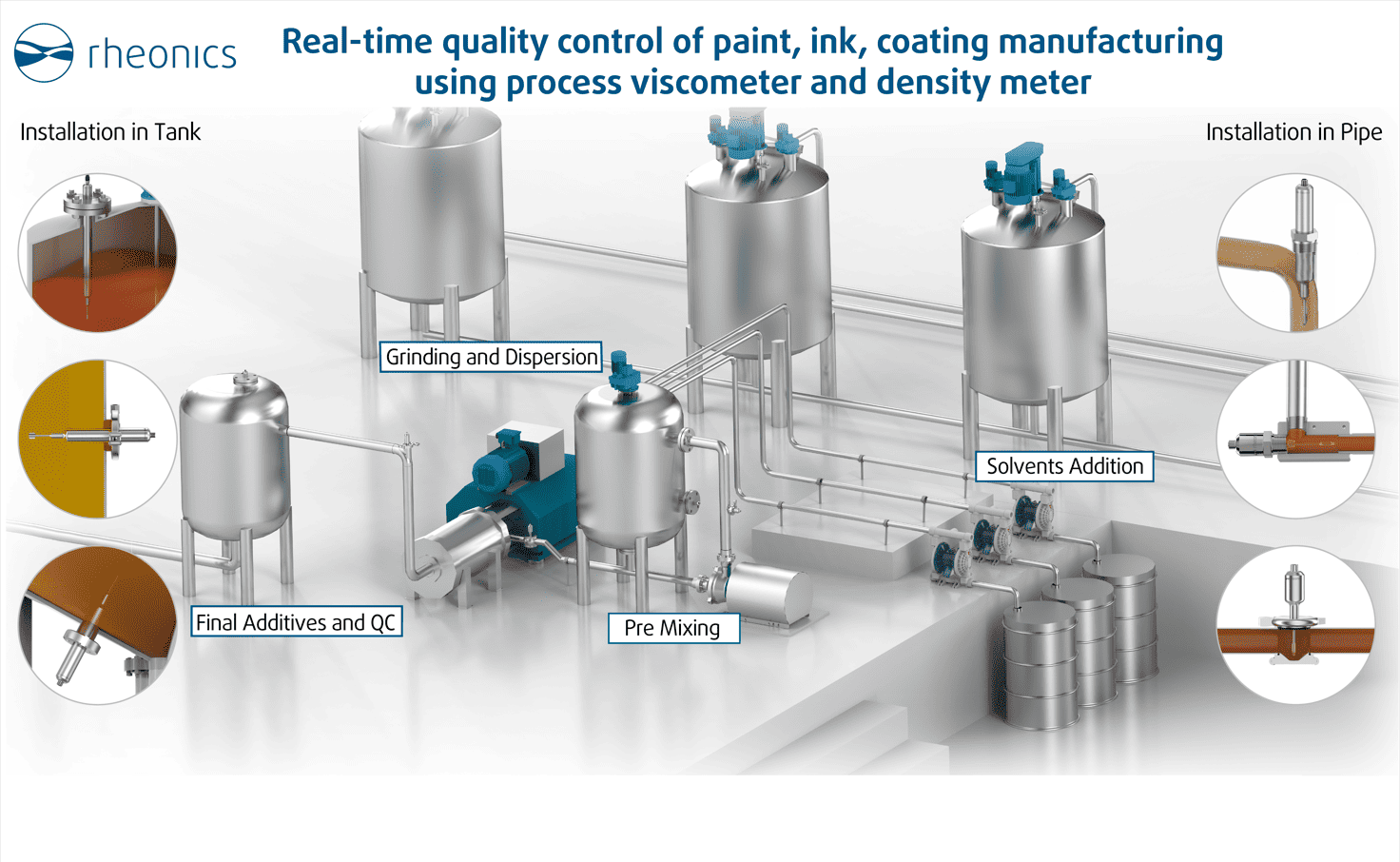

Poor Quality Control and Inconsistent Formulations

One of the biggest risks is selecting a supplier without rigorous quality assurance. Low-cost manufacturers may use inconsistent raw materials or lack proper testing protocols, resulting in batch-to-batch variations. This inconsistency can cause visible defects such as uneven gloss, poor adhesion, or color shifts—especially problematic in auto refinishing where color matching is critical.

Lack of Transparency in Ingredients and Specifications

Some suppliers withhold technical data sheets (TDS) or material safety data sheets (MSDS), making it difficult to verify performance claims. Without clear specifications on VOC content, curing time, or chemical resistance, you risk non-compliance with environmental regulations or unsuitable product performance under real-world conditions.

Counterfeit or Misbranded Products

In markets with weak enforcement, counterfeit paints labeled as premium brands are common. These imitations often use inferior resins and pigments, leading to premature fading, chipping, or delamination. Always verify authenticity through authorized distributors and request batch certifications.

Ignoring Intellectual Property Risks

Copying or reverse-engineering proprietary paint formulas—even unintentionally—can result in IP infringement. Using formulations protected by patents or trade secrets exposes your business to litigation. Always ensure your supplier has legitimate rights to the technology and offers indemnification clauses in contracts.

Inadequate Testing and Qualification of Suppliers

Failing to audit potential suppliers’ facilities, R&D capabilities, and quality systems increases the risk of partnering with unreliable vendors. Conduct on-site visits, request sample testing under real application conditions, and verify compliance with industry standards (e.g., ISO 9001, AAMA).

Overlooking Customization and Color Matching Capabilities

Auto enamel paints often require precise color matching and custom formulations. Suppliers without strong in-house tinting systems or spectrophotometric tools may struggle to deliver accurate matches, leading to rework and customer dissatisfaction.

Weak Contractual Protections for IP and Quality

Contracts that don’t clearly define quality standards, IP ownership, and confidentiality terms leave you vulnerable. Ensure agreements specify performance benchmarks, include audit rights, and protect your proprietary color codes or formulations from misuse.

By avoiding these pitfalls, you can source Auto Acrylic Enamel Paint that meets both performance expectations and legal requirements, ensuring durability, compliance, and brand integrity.

Logistics & Compliance Guide for Auto Acrylic Enamel Paint

Introduction

Auto Acrylic Enamel Paint is a widely used coating in automotive refinishing and industrial applications due to its durability, gloss retention, and ease of application. However, due to its chemical composition—typically containing solvents and pigments—it is subject to various regulatory and logistical requirements. This guide outlines key considerations for the safe handling, transportation, storage, and compliance of Auto Acrylic Enamel Paint.

Regulatory Classification

Auto Acrylic Enamel Paint is generally classified as a hazardous material due to the presence of flammable solvents and potentially harmful chemical constituents. Key regulatory frameworks include:

– GHS (Globally Harmonized System of Classification and Labelling of Chemicals): Paints are typically classified under:

– Flammable Liquids (Category 2 or 3)

– Acute Toxicity (if applicable, e.g., via inhalation)

– Specific Target Organ Toxicity (STOT)

– Hazardous to the Aquatic Environment

– OSHA Hazard Communication Standard (HCS 2012): Requires Safety Data Sheets (SDS) and appropriate workplace labeling.

– DOT (Department of Transportation): Regulates transport under 49 CFR; typically shipped as ORM-D (Other Regulated Material – Domestic) or UN1263, PAINT, 3, PG II (flammable liquid).

– IMO/IMDG Code: For international maritime transport, classified under UN1263, PAINT, 3 (Flammable Liquid), PG II.

– IATA Dangerous Goods Regulations: For air transport, also classified as UN1263, PAINT, 3, PG II; subject to quantity and packaging limitations.

Packaging & Labeling Requirements

Proper packaging and labeling are critical to ensure compliance and safety:

– Primary Container: Use leak-proof, compatible metal or high-density polyethylene (HDPE) containers with secure closures.

– Secondary Packaging: For transport, use outer packaging (e.g., fiberboard boxes) capable of containing leaks and providing cushioning.

– Labeling:

– GHS-compliant labels with hazard pictograms (flame, health hazard, exclamation mark, environment).

– Proper shipping name: “PAINT” or “PAINT, FLAMMABLE LIQUID.”

– UN number: UN1263

– Hazard class: Class 3 (Flammable Liquid)

– Packing Group: II (Medium Danger)

– Orientation arrows and accumulation labels as required.

Transportation Guidelines

- Mode-Specific Rules:

- Ground (DOT): Limited quantities may be shipped under 49 CFR 173.306 (non-bulk packaging, ≤1 gallon per inner container). Full regulations apply for larger shipments.

- Air (IATA): Limited to 1L per inner container for passenger aircraft; up to 5L for cargo aircraft. Quantity limits per package apply.

- Marine (IMDG): Follow stowage and segregation rules; avoid proximity to oxidizers and heat sources.

- Documentation:

- Shipper’s Declaration for Dangerous Goods (required for air and full-regulated ground/marine shipments).

- Safety Data Sheet (SDS) must accompany shipments.

- Proper shipping papers with emergency contact information.

Storage & Handling

- Storage Conditions:

- Store in a cool, dry, well-ventilated area away from direct sunlight and ignition sources.

- Temperature should be maintained between 50°F–80°F (10°C–27°C).

- Use flammable storage cabinets when storing >25 gallons indoors.

- Segregate from oxidizers, acids, and strong bases.

- Handling Practices:

- Use personal protective equipment (PPE): gloves (nitrile), safety goggles, and respiratory protection if vapors are present.

- Ground containers during transfer to prevent static discharge.

- Avoid prolonged skin contact and inhalation of vapors.

- Use local exhaust ventilation in application areas.

Environmental & Disposal Compliance

- Spill Management:

- Contain spills using absorbent materials (e.g., vermiculite, spill pillows).

- Do not flush into sewers or waterways.

- Report large spills per local, state, and federal regulations (e.g., EPA, SPCC).

- Waste Disposal:

- Empty containers may be hazardous waste if not properly cleaned (triple-rinsed or drained).

- Follow RCRA (Resource Conservation and Recovery Act) guidelines for disposal.

- Use licensed hazardous waste disposal facilities.

- Recycle metal containers when feasible.

Safety Data Sheet (SDS) Management

- Maintain up-to-date SDS for every product formulation.

- Ensure SDS is accessible to employees and emergency responders.

- Review SDS Section 14 (Transport Information) for shipping parameters.

- Update SDS when formulation changes affect hazard classification.

Training & Emergency Preparedness

- Employee Training:

- Conduct regular training on hazard communication, safe handling, spill response, and fire safety.

- Include GHS label interpretation and SDS use.

- Emergency Procedures:

- Post emergency contact numbers and first aid instructions.

- Equip areas with fire extinguishers (Class B for flammable liquids).

- Develop and practice spill response and evacuation plans.

International Compliance Considerations

- REACH (EU): Ensure substances in paint (e.g., solvents, pigments) are registered.

- TSCA (USA): Confirm all chemical ingredients are listed on the TSCA Inventory.

- China GB Standards: Verify compliance with local labeling and registration rules.

- Customs Documentation: Include accurate HS codes (e.g., 3208.20 for acrylic paints) and safety certifications.

Conclusion

Auto Acrylic Enamel Paint requires careful attention to logistics and regulatory compliance due to its flammable and potentially toxic nature. Adherence to GHS, DOT, IATA, IMDG, and environmental regulations ensures safe transport, storage, and handling. Maintain thorough documentation, train personnel, and implement proper emergency procedures to minimize risk and remain compliant across all operational stages.

In conclusion, sourcing auto acrylic enamel paint requires careful consideration of quality, consistency, application requirements, and supplier reliability. This type of paint offers excellent durability, color retention, and a high-gloss finish, making it ideal for automotive refinishing and restoration projects. To ensure optimal performance, it is essential to source from reputable manufacturers or suppliers who provide technical support, compliance with environmental regulations (such as low VOC content), and compatibility with various application methods (brush, spray, etc.).

Evaluating factors such as price, availability, lead times, and after-sales service will help in building a sustainable and cost-effective supply chain. Additionally, verifying product specifications—like curing time, chemical resistance, and adhesion properties—ensures the paint meets both aesthetic and functional standards. Ultimately, a well-informed sourcing strategy for auto acrylic enamel paint contributes to superior finish quality, long-term customer satisfaction, and efficient operations in automotive painting applications.