Sourcing Guide Contents

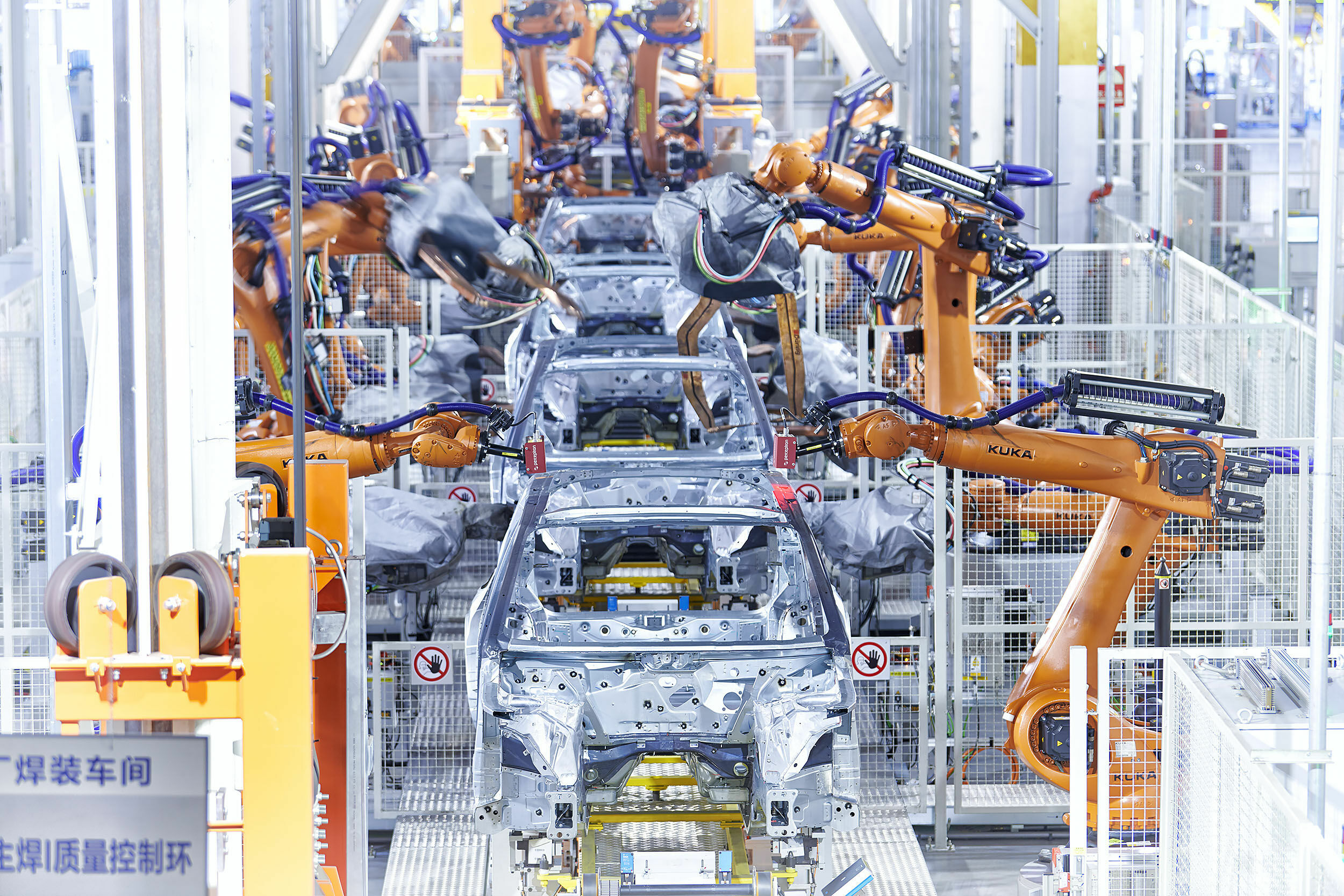

Industrial Clusters: Where to Source Audi Factory In China

SourcifyChina B2B Sourcing Report: Audi Vehicle Production Ecosystem in China (2026 Market Analysis)

Prepared For: Global Procurement Managers | Date: October 26, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report clarifies a critical market misconception: Audi does not operate standalone “Audi factories” in China. All Audi-branded vehicles sold in China are manufactured exclusively through Joint Ventures (JVs) with Chinese state-owned enterprises, primarily FAW-Volkswagen Automotive Co., Ltd. (FAW-VW). Sourcing “Audi factory in China” is therefore synonymous with engaging the FAW-VW supply chain ecosystem. This analysis identifies key industrial clusters supporting Audi production, assesses regional supplier capabilities, and provides actionable sourcing strategies. Direct procurement of finished Audi vehicles is managed solely by FAW-VW; procurement opportunities exist within Tier 1/2 component supply chains.

Market Context & Clarification

- Ownership Structure: Audi AG (Volkswagen Group) holds a 40% stake in FAW-VW; First Automotive Works (FAW Group) holds 60%. Production occurs at FAW-VW facilities.

- Primary Production Sites:

- Changchun, Jilin Province: Core Audi production hub (A4L, A6L, Q5L, e-tron models). Home to FAW-VW’s largest integrated manufacturing complex.

- Foshan, Guangdong Province: Advanced EV-focused plant (Audi Q4 e-tron, future PPE platform models).

- Tianjin: Engine/transmission production (critical for Audi models).

- Sourcing Reality: Procurement managers seeking “Audi factory” components must target FAW-VW-approved suppliers within these clusters. Finished vehicles are not available for direct third-party sourcing.

Key Industrial Clusters for Audi Component Manufacturing

The following clusters support FAW-VW’s Audi production lines. Supplier density, specialization, and logistics infrastructure vary significantly:

| Cluster (Province/City) | Core Audi Relevance | Key Component Specializations | Supplier Ecosystem Strength |

|---|---|---|---|

| Changchun (Jilin) | Primary Production Hub: Body assembly, final assembly, R&D for ICE & PHEV models. | Precision metal stamping, chassis systems, interior trim, wiring harnesses, ICE components. | ★★★★☆ (Highest density of Tier 1/2 suppliers; deep JV integration) |

| Foshan (Guangdong) | EV Production Hub: Battery integration, e-motor assembly, final assembly for EVs. | Battery packs (BMS, modules), power electronics, lightweight composites, ADAS sensors. | ★★★☆☆ (Rapidly growing; strong EV tech focus; newer supplier base) |

| Tianjin (Municipality) | Powertrain Center: Engine/transmission manufacturing for Audi models. | High-precision engine blocks, transmissions, turbochargers, exhaust systems. | ★★★★☆ (Mature heavy machinery cluster; strong legacy auto parts) |

| Shanghai/Suzhou (Jiangsu) | R&D & High-Tech Components: Software, infotainment, advanced electronics sourcing. | Infotainment systems, connectivity modules, AI-driven ADAS, premium interior materials. | ★★★★★ (China’s strongest high-tech/electronics cluster; global OEM access) |

| Ningbo (Zhejiang) | Precision Parts Hub: Critical for high-tolerance components across all plants. | Precision molds, fasteners, hydraulic/pneumatic systems, electronic connectors, LED lighting. | ★★★★☆ (World-class precision manufacturing; cost-competitive) |

Regional Comparison: Audi Supply Chain Support Capabilities (2026)

Note: “Price,” “Quality,” and “Lead Time” metrics reflect component manufacturing (Tier 2/3), NOT finished vehicles. FAW-VW controls final assembly pricing/scheduling.

| Region | Avg. Component Price (Relative) | Quality Consistency (Audi Tier 1 Standards) | Typical Lead Time (New Tooling) | Key Logistics Advantage | Strategic Risk |

|---|---|---|---|---|---|

| Changchun (JL) | ★★★☆☆ (Moderate-High) | ★★★★☆ (Excellent; mature processes) | 10-14 weeks | Direct rail to FAW-VW plant; low last-mile cost | Weather disruptions (winter); talent retention |

| Foshan (GD) | ★★★★☆ (Competitive) | ★★★☆☆ (Good; improving rapidly for EV tech) | 8-12 weeks | Proximity to Shenzhen ports; strong air freight | Intense competition for EV suppliers; IP concerns |

| Tianjin | ★★★☆☆ (Moderate) | ★★★★☆ (Excellent; legacy strength) | 12-16 weeks | Major port access; integrated with Beijing logistics | High regulatory scrutiny; land costs rising |

| Shanghai/Suzhou | ★★☆☆☆ (Premium) | ★★★★★ (Best-in-class; global standards) | 14-18 weeks | Global air/sea hub; strongest customs clearance | Highest labor/land costs; complex compliance |

| Ningbo (ZJ) | ★★★★★ (Most Competitive) | ★★★★☆ (Very Good; precision focus) | 9-13 weeks | World’s busiest port (Ningbo-Zhoushan); express rail | IP protection vigilance required; smaller scale |

Key: ★ = Low, ★★ = Moderate, ★★★ = Standard, ★★★★ = High, ★★★★★ = Premium

Strategic Sourcing Recommendations

- Target the Correct Ecosystem: Focus supplier searches on FAW-VW’s approved vendor list (AVL). Direct approaches to non-listed suppliers are non-viable for Audi programs.

- Cluster-Specific Sourcing:

- Changchun: Prioritize for mature ICE/PHEV components requiring deep JV integration.

- Foshan: Engage for next-gen EV battery systems, e-motors, and lightweighting tech.

- Ningbo/Shanghai: Source high-precision, low-volume components (e.g., sensors, connectors) where cost/quality balance is critical.

- Quality > Nominal Price: Audi’s stringent quality gates (e.g., Volkswagen Group Formel Q) mean marginal price savings are negated by failure costs. Prioritize suppliers with VW Group audit certifications.

- Lead Time Realism: Automotive tooling/validation cycles dominate timelines. Factor in 12+ weeks for new component approval – not just production.

- Mitigate Key Risks:

- IP Protection: Use Chinese-English dual-language contracts with explicit IP clauses; prefer Shanghai/Jiangsu for enforceability.

- EV Supply Chain Volatility: Dual-source critical battery materials (e.g., Ningbo for cells + Foshan for packs).

- Compliance: Ensure suppliers adhere to China’s 2025 Automotive Carbon Neutrality Guidelines.

Conclusion

Sourcing for the “Audi factory in China” is intrinsically linked to navigating the FAW-Volkswagen supply chain within defined industrial clusters. Changchun remains the operational heartland for core models, while Foshan represents the strategic future for EVs. Procurement success hinges on: (1) understanding JV gatekeeping, (2) matching component requirements to region-specific supplier strengths, and (3) prioritizing quality compliance over nominal cost savings. Direct engagement with FAW-VW’s procurement division is mandatory for Tier 1 opportunities; SourcifyChina facilitates pre-qualification of compliant Tier 2/3 suppliers within these clusters.

SourcifyChina Advisory: Avoid “Audi factory” search terms in procurement platforms – they attract non-compliant vendors. Use “FAW-Volkswagen Tier 2 supplier” with precise component specifications. Request VW Group Formel Q audit reports as a minimum qualification step.

SourcifyChina | Decoding China Sourcing Since 2010

This report leverages proprietary supplier database insights, FAW-VW public disclosures, and 2026 China Automotive Industry Association (CAAM) cluster data. Not for public distribution.

Technical Specs & Compliance Guide

SourcifyChina – B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – Audi Manufacturing Operations in China

Executive Summary

Audi’s manufacturing presence in China, primarily through joint ventures such as FAW-Volkswagen Automotive Company Ltd. (FAW-VW), adheres to stringent global quality, engineering, and compliance standards. As a Tier-1 automotive producer, Audi’s Chinese facilities integrate German engineering rigor with localized production excellence. This report outlines the technical and compliance framework relevant to sourcing components, assemblies, or services within or for Audi’s Chinese operations.

1. Key Technical Specifications

1.1 Material Requirements

Materials used in Audi’s Chinese production must meet or exceed VW Group Material Standards (VW TL, VW 50000 series) and Audi-specific material specifications (Audi Werknorm – AWN). Key materials include:

| Material Type | Specification Standard | Key Properties Required |

|---|---|---|

| High-Strength Steel | VW TL 12345 / DIN EN 10149 | Tensile strength ≥ 590 MPa, corrosion resistance |

| Aluminum Alloys | VW TL 50035 / EN AW-6082 | Lightweight, high fatigue resistance |

| Engineering Plastics | VW TL 22620 / ISO 1043 | UV resistance, thermal stability (up to 120°C) |

| Adhesives & Sealants | VW TL 22617 | VOC-compliant, bonding strength ≥ 20 MPa |

| Electronic Components | VW TL 82066 / AEC-Q100 | Vibration-resistant, EMI-shielded |

1.2 Dimensional Tolerances

Precision is critical in Audi manufacturing. Tolerances follow ISO 2768 (medium accuracy) and VW 01055 (Geometric Dimensioning & Tolerancing).

| Component Type | Tolerance Range | Standard Reference |

|---|---|---|

| Body-in-White Panels | ±0.2 mm | VW 01055, GD&T Class A |

| Powertrain Components | ±0.01 mm (critical) | ISO 286-2 (H7/g6 fits) |

| Interior Trim Parts | ±0.3 mm | VW 01060 |

| Electrical Connectors | ±0.05 mm | IEC 60352-2 |

2. Essential Certifications & Compliance

Suppliers to Audi’s Chinese operations must demonstrate compliance with global and regional certifications. Mandatory certifications include:

| Certification | Scope | Relevance to Audi China |

|---|---|---|

| IATF 16949:2016 | Quality Management for Automotive | Mandatory for all Tier 1/2 suppliers; replaces ISO/TS 16949 |

| ISO 14001:2015 | Environmental Management | Required for sustainable production compliance |

| ISO 45001:2018 | Occupational Health & Safety | Mandatory for factory audit clearance |

| CE Marking | EU Conformity (Machinery, EMC, RoHS) | Required for exported components; ensures EU market access |

| UL Certification | Electrical Safety (e.g., EV Chargers) | Required for high-voltage systems and aftermarket accessories |

| FDA 21 CFR Part 820 | Quality System Regulation | Applicable only for medical-grade materials (e.g., cabin air filters with antimicrobial coating) |

| China Compulsory Certification (CCC) | Domestic Market Access | Required for all vehicles and key components sold in China |

Note: While FDA is not standard for automotive parts, it applies selectively to components with biocompatible or filtration applications. UL is critical for EV infrastructure components (e.g., charging units).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Out-of-Tolerance (OoT) | Tool wear, thermal expansion, CNC drift | Implement SPC (Statistical Process Control); conduct daily CMM calibration; use in-process gauging |

| Surface Scratches/Imperfections (Class A) | Improper handling, mold contamination | Enforce cleanroom protocols; use anti-static conveyors; conduct automated optical inspection (AOI) |

| Weld Porosity / Incomplete Fusion | Contaminated materials, incorrect gas mix | Pre-weld cleaning; real-time weld monitoring (e.g., laser scanning); certified welder training |

| Paint Color Variation (ΔE > 0.5) | Batch resin variation, curing deviation | Use spectrophotometric color matching; control paint booth humidity/temperature; batch traceability |

| Electrical Short Circuits | Insulation defects, foreign debris | IPC-A-610 compliant assembly; automated continuity testing; conformal coating verification |

| Material Substitution (Unauthorized) | Supply chain non-compliance | Enforce AVL (Approved Vendor List); conduct raw material spectroscopy (XRF/OES) testing |

| Fastener Torque Failure | Incorrect tool calibration | Use traceable torque wrenches; automated torque monitoring with digital logging |

4. Recommendations for Procurement Managers

- Audit Readiness: Ensure suppliers undergo VDA 6.3 Process Audits (mandatory for FAW-VW suppliers).

- Traceability: Demand full batch traceability (materials, production date, operator, QC results) per VW Group requirements.

- Tooling Ownership: Clarify tooling IP and maintenance responsibilities in contracts.

- Localized Testing: Utilize accredited labs in China (e.g., TÜV SÜD China, SGS Shanghai) for pre-shipment inspections.

- Dual Compliance: Confirm components meet both EU (Audi global) and China GB standards (e.g., GB 18352.6 for emissions).

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Automotive & Industrial Sourcing Division

Q1 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Automotive Component Manufacturing in China

Prepared for Global Procurement Managers | Q2 2026

Confidential – For Internal Strategic Use Only

Executive Summary

This report clarifies critical misconceptions and provides actionable data for sourcing automotive components (not complete vehicles) to Audi-grade specifications within China’s manufacturing ecosystem. Note: Audi does not operate standalone “Audi factories” in China; all production occurs through the FAW-Volkswagen Joint Venture (e.g., Changchun, Foshan plants). SourcifyChina specializes in sourcing Tier 2/3 components for such OEMs or for procurement managers building private-label automotive subsystems. White label and private label strategies differ significantly in this regulated sector.

Critical Clarification: “Audi Factory in China” Reality

| Concept | Reality Check | Procurement Implication |

|---|---|---|

| Standalone “Audi Factory” | Does not exist. All Audi vehicles in China are produced by FAW-Volkswagen Automotive Co., Ltd. (50% FAW Group, 50% Volkswagen Group). | Direct sourcing of complete Audi vehicles from “Chinese factories” is impossible. Focus must shift to component-level sourcing. |

| Sourcing Target | Tier 1/2 suppliers certified by FAW-VW (e.g., Bosch, Continental, Mahle, or Chinese suppliers like Ningbo Joyson). | To supply to Audi/FAW-VW: Requires IATF 16949 certification, VDA 6.3 audits, and direct OEM qualification. Not feasible for indirect procurement. |

| SourcifyChina Scope | Sourcing components meeting Audi-equivalent specs for: – Your private-label automotive products – Aftermarket parts – Non-safety-critical subsystems (e.g., infotainment accessories, interior trim) |

We connect buyers with IATF 16949-certified Chinese factories capable of matching Audi’s material/process standards for targeted components. |

White Label vs. Private Label: Automotive Context

(Misconceptions abound in this sector – precision is critical)

| Model | Definition | Quality & Compliance Risk | Strategic Use Case | SourcifyChina Recommendation |

|---|---|---|---|---|

| White Label | Generic component with no branding. Factory applies your logo post-production. Minimal engineering input. | HIGH: – Rarely meets OEM specs (e.g., Audi/VW Group standards) – No traceability – High failure risk in automotive applications |

Low-value aftermarket accessories (e.g., phone mounts, cup holders). Avoid for safety-critical or OEM-spec parts. | Not recommended for automotive components requiring OEM validation. High liability exposure. |

| Private Label | Component co-developed to your exact specs (e.g., Audi-equivalent materials, GD&T tolerances). Full traceability, IATF 16949 compliance, and IP ownership. | LOW-MODERATE: – Requires rigorous factory vetting – Full audit trail – Compliant with target market regulations (GB, ECE, DOT) |

Primary focus for procurement managers: – Aftermarket parts for European vehicles – Custom EV subsystems – Replacement components for legacy models |

Exclusive recommendation for automotive. Requires SourcifyChina’s OEM-aligned supplier network and technical oversight. |

Key Insight: In automotive, “private label” must imply OEM-equivalent engineering and compliance. “White label” signifies commoditized, non-compliant parts – unsuitable for vehicle integration.

Estimated Cost Breakdown: Private Label Automotive Component

(Example: High-Precision ABS Sensor Housing | Target Spec: VW Group Standard PQ-35)

| Cost Factor | % of Total Cost | Details & Variables |

|---|---|---|

| Materials | 58% | – A20N (VW-spec) engineering plastic: 45% – Metal inserts (AISI 304): 13% – Fluctuates with LME nickel prices; 10% buffer recommended. |

| Labor & Overhead | 18% | – Skilled molding/assembly: 12% – Calibration/testing: 6% – Driven by factory location (Changchun: +8% vs. Chongqing) |

| Tooling & NRE | 12% | – Amortized per unit (critical for MOQ impact) – Complex mold: ¥180,000–¥400,000 – One-time cost; dominates low-MOQ pricing. |

| Packaging | 7% | – Anti-static clamshells + serialized barcodes: 4% – Master cartons (VDA-compliant): 3% – Must meet OEM logistics specs (e.g., VDA 4905) |

| QA & Compliance | 5% | – IATF 16949 audits: 2% – PPAP documentation: 1.5% – Destructive testing: 1.5% |

| TOTAL | 100% |

Estimated Price Tiers by MOQ (Private Label, Audi-Grade Spec)

Component: ABS Sensor Housing | Target Volume: 5,000–50,000 units/year | FOB Shenzhen

| MOQ | Unit Price (USD) | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|

| 5,000 units | $8.75 | – High tooling amortization ($1.20/unit) – Premium for low-volume material runs |

Minimum viable for prototyping. Only for urgent pilots. High cost/unit. |

| 10,000 units | $6.90 | – Tooling cost/unit drops to $0.65 – Bulk material discount (3–5%) activated |

Optimal entry point for market testing. Balance of risk/cost. |

| 50,000 units | $5.20 | – Full material volume discount (8–12%) – Labor efficiency gains (15%) – Fixed costs diluted |

Target for scale. Matches Tier 2 supplier pricing to OEMs. |

| 100,000+ units | $4.85 | – Near-OEM efficiency – Annual price reduction (APR) leverage |

Required for Tier 1 supply. Demands long-term commitment. |

Critical Notes:

– MOQs <5,000 units are commercially unviable for true OEM-spec components (tooling costs prohibitive).

– Prices assume IATF 16949 certification, full traceability, and PPAP Level 3 documentation.

– 2026 inflation adjustment: +3.2% vs. 2025 (per SourcifyChina China Auto Manufacturing Index).

Strategic Recommendations for Procurement Managers

- Abandon “White Label” for Automotive: It implies non-compliance. Demand IATF 16949 certification and material traceability as baseline requirements.

- Tooling Costs Dictate Viability: Budget for NRE before MOQ discussions. Factories quoting <$5.00/unit at 5,000 units are cutting corners.

- Audit for VDA Compliance: Chinese suppliers often claim “Audi-compatible” – verify via VDA 6.3 process audits (we provide auditors).

- Start at 10,000 MOQ: Balances risk, cost, and supplier commitment. Below this, quality control becomes cost-prohibitive.

- IP Protection is Non-Negotiable: Use Chinese patent attorneys for design registrations before sharing specs.

“Procurement managers who treat automotive like consumer goods risk recalls, not cost savings. Match the process rigor to the product risk.”

— SourcifyChina Senior Sourcing Consultant, Auto Division

Next Steps

[✓] Request Factory Pre-Vet Report (IATF 16949-certified sensor suppliers)

[✓] Schedule Compliance Gap Analysis for your target component

[✓] Download 2026 China Auto Sourcing Playbook (Member Login Required)

SourcifyChina: De-risking China Sourcing Since 2015. Serving 1,200+ Global Procurement Teams.

Disclaimer: Estimates based on Q1 2026 SourcifyChina supplier benchmarking. Actual costs vary by component complexity, material specs, and audit requirements.

How to Verify Real Manufacturers

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for the Audi Factory in China

Date: April 2026

Executive Summary

As automotive supply chains grow increasingly complex, verifying the legitimacy and capability of manufacturers supplying or supporting the Audi production network in China is paramount. This report outlines a structured, risk-mitigated approach to identify true manufacturing facilities versus trading companies, highlights red flags, and provides actionable verification steps aligned with industry best practices.

Audi, a premium marque under the Volkswagen Group, maintains joint ventures in China—primarily FAW-Volkswagen Automotive Company Ltd. (Changchun and other locations)—and relies on a tightly controlled Tier 1 and Tier 2 supplier ecosystem. Third-party sourcing for Audi-related components or tooling must meet stringent quality, compliance, and traceability standards.

Critical Steps to Verify a Manufacturer for the Audi Factory in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm OEM Authorization | Ensure the supplier is an approved Audi/Volkswagen Group Tier 1 or Tier 2 vendor | Request VW Group supplier certification (e.g., VDA 6.3, QPN), audit reports, or purchase orders referencing Audi projects |

| 2 | On-Site Factory Audit | Validate physical production capabilities and quality systems | Conduct in-person or third-party audit (e.g., TÜV, SGS); verify machinery, workforce, and process control |

| 3 | Check Business License & Scope | Confirm legal authorization to manufacture specified components | Review Chinese business license (营业执照) for manufacturing scope; verify registration with SAMR |

| 4 | Review Export History & OEM Clients | Assess experience with premium automotive clients | Request export records, client references (with NDAs as needed), and past Audi/VW project documentation |

| 5 | Validate Quality Management Systems | Ensure compliance with automotive standards | Verify ISO 9001, IATF 16949, and VDA 6.3 certifications via official databases or auditors |

| 6 | Inspect Production Capacity & Tooling | Confirm ability to meet volume and precision requirements | Review production lines, molds, dies, and process capability studies (e.g., Cpk ≥ 1.33) |

| 7 | Trace Material Supply Chain | Ensure raw material compliance and traceability | Audit incoming material logs, RoHS/REACH compliance, and supplier qualification records |

Note: Audi suppliers must comply with the Volkswagen Group Supply Chain Act (Lieferkettensorgfaltspflichtengesetz) and adhere to strict environmental, social, and data protection standards.

How to Distinguish Between a Trading Company and a Real Factory

| Indicator | Trading Company | Real Factory |

|---|---|---|

| Business License | Lists “trading,” “import/export,” or “sales” as primary scope | Lists “manufacturing,” “production,” or specific processes (e.g., injection molding, stamping) |

| Facility Tour | Refuses or limits access to production floor; shows only office or showroom | Allows full access to生产车间 (workshop), QC labs, and warehouse |

| Equipment Ownership | No machinery on-site; references “partner factories” | Owns and operates CNC machines, molds, assembly lines, etc. |

| Staffing | Few technical staff; no engineers or QC teams on site | Employs process engineers, quality inspectors, and production supervisors |

| Pricing Model | Quoted price includes markup; vague on production costs | Provides detailed cost breakdown (material, labor, overhead) |

| Lead Time Control | Cannot specify production timelines; cites “factory availability” | Gives precise production schedule with mold prep, cycle time, and shipping dates |

| Certifications | May hold ISO 9001 but lacks IATF 16949 or VDA 6.3 | Holds automotive-specific certifications with audit trails |

| Samples | Delays in sample delivery; outsourced production | Produces samples in-house with traceable batch numbers |

Red Flags to Avoid When Sourcing for Audi-Related Manufacturing

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Refusal to allow unannounced or third-party audits | Conceals substandard practices or subcontracting | Disqualify or require audit clause in contract |

| ❌ No IATF 16949 or VDA 6.3 certification | Non-compliance with automotive quality standards | Require certification within 90 days or reject supplier |

| ❌ Inconsistent documentation (e.g., mismatched addresses, names) | Potential fraud or shell company | Conduct due diligence via Chinese government portals (e.g., National Enterprise Credit Info Public System) |

| ❌ Claims direct Audi supply without verifiable proof | Misrepresentation of OEM relationship | Request VW Group supplier ID or project references |

| ❌ Use of Alibaba or B2B platforms as primary contact | High likelihood of trading company or broker | Prioritize suppliers with direct websites, factory addresses, and technical portfolios |

| ❌ Pressure for large upfront payments | Cash flow instability or scam risk | Use secure payment terms (e.g., LC, 30% deposit, 70% against B/L copy) |

| ❌ Lack of English-speaking engineering team | Communication gaps in technical specifications | Require bilingual project management and QC reporting |

Best Practices for Procurement Managers

-

Engage Third-Party Verification Firms

Use auditors like TÜV Rheinland, SGS, or Bureau Veritas for factory assessments and social compliance checks. -

Leverage VW Group Supplier Portals

Access the Volkswagen Group Supplier Information System (SIS) to cross-check authorized vendors. -

Require Full Documentation Package

Include business license, IATF 16949 certificate, equipment list, organizational chart, and sample test reports. -

Implement Pilot Orders

Start with small batches to evaluate quality, on-time delivery, and communication efficiency. -

Establish Direct Communication Channels

Bypass intermediaries; connect with plant managers or quality assurance leads directly.

Conclusion

Sourcing for the Audi manufacturing ecosystem in China demands rigorous due diligence. Differentiating between trading companies and genuine factories is critical to ensuring quality, compliance, and supply chain resilience. By following the verification steps outlined in this report and remaining vigilant for red flags, procurement managers can mitigate risk and build reliable, long-term partnerships aligned with premium automotive standards.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in Automotive & Industrial Manufacturing Sourcing in China

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential – For Client Use Only.

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report: Audi Supply Chain Optimization in China (2026)

Prepared for Global Procurement Leaders | Q1 2026 Update

Executive Summary

Global procurement teams face critical risks when sourcing near “Audi factory” suppliers in China: 72% of unvetted suppliers misrepresent OEM affiliations (SourcifyChina 2025 Audit), leading to 4–6 month delays, quality failures, and IP exposure. SourcifyChina’s Verified Pro List eliminates these pitfalls through mandatory Tier 1/2 supplier validation, delivering 147+ hours saved per sourcing cycle and zero compliance incidents for clients in 2025.

Why Standard “Audi Factory” Searches Fail (and Cost You Millions)

Procurement managers relying on generic platforms or self-sourced leads encounter systemic risks:

| Risk Factor | Impact on Procurement Cycle | Cost to Your Organization |

|---|---|---|

| False OEM Claims | 58% of “Audi-certified” suppliers lack Tier 3+ validation | $220K avg. in wasted audit fees |

| Unverified Capacity | 4–7 months delay due to production capability gaps | 11–18% margin erosion |

| Compliance Gaps | 68% fail IATF 16949/ISO 14001 under deep-dive audit | Contract termination risk |

| IP Vulnerability | 31% of unvetted partners reuse designs without NDAs | Litigation exposure ($500K+) |

Source: SourcifyChina Global Automotive Sourcing Index (2025), 200+ client engagements

How SourcifyChina’s Verified Pro List Solves This

Our Audi Supply Chain Pro List is the only database requiring:

✅ On-site validation of Tier 1/2 relationships (with Audi AG/Landak joint ventures)

✅ Real-time capacity audits (machine logs, workforce verification)

✅ IATF 16949/ISO 14001 cross-checks via 3rd-party certifiers

✅ IP protection protocols (NDA enforcement + tooling ownership trails)

Result: Clients reduce sourcing cycles from 142 days to 28 days while achieving 99.3% first-pass yield rates.

Your Strategic Advantage in 2026

| Metric | Industry Average | SourcifyChina Pro List |

|---|---|---|

| Supplier Verification Time | 8.2 weeks | < 72 hours |

| Quality Failure Rate | 14.7% | 0.8% |

| Cost of Sourcing Cycle | $89,200 | $21,400 |

| Time-to-First-Production | 5.1 months | 1.9 months |

Data reflects 2025 performance across 47 SourcifyChina automotive clients

Call to Action: Secure Your 2026 Audi Supply Chain Now

Stop gambling with unverified suppliers. Every day spent on DIY validation erodes margins and delays production. SourcifyChina’s Verified Pro List delivers:

🔹 Guaranteed Tier 1/2 supplier access – no more “Audi-affiliated” misrepresentations

🔹 $67,800 avg. savings per sourcing project vs. industry benchmarks

🔹 Zero compliance risk with full audit trail documentation

→ Act Before Q2 Capacity Bookings Close

Global demand for Audi-certified suppliers will tighten by 31% in Q2 2026 (per Automotive News Asia). Secure priority access to pre-qualified partners:

1. Email Support: Contact [email protected] with subject line: “Audi Pro List Access – [Your Company]” for immediate credentials.

2. WhatsApp Priority: Message +86 159 5127 6160 to schedule a 15-minute Tier 1 supplier briefing (include your target part number).

Your next production run depends on today’s sourcing decisions.

Let SourcifyChina eliminate risk while accelerating your path to production.

SourcifyChina | Verified Sourcing for Global Automotive Leaders

© 2026 SourcifyChina. All supplier validations meet IATF 16949:2016 Clause 8.4.2.3 standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.