Sourcing Guide Contents

Industrial Clusters: Where to Source Audi Factory China

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing “Audi Factory China” Components & Services

Executive Summary

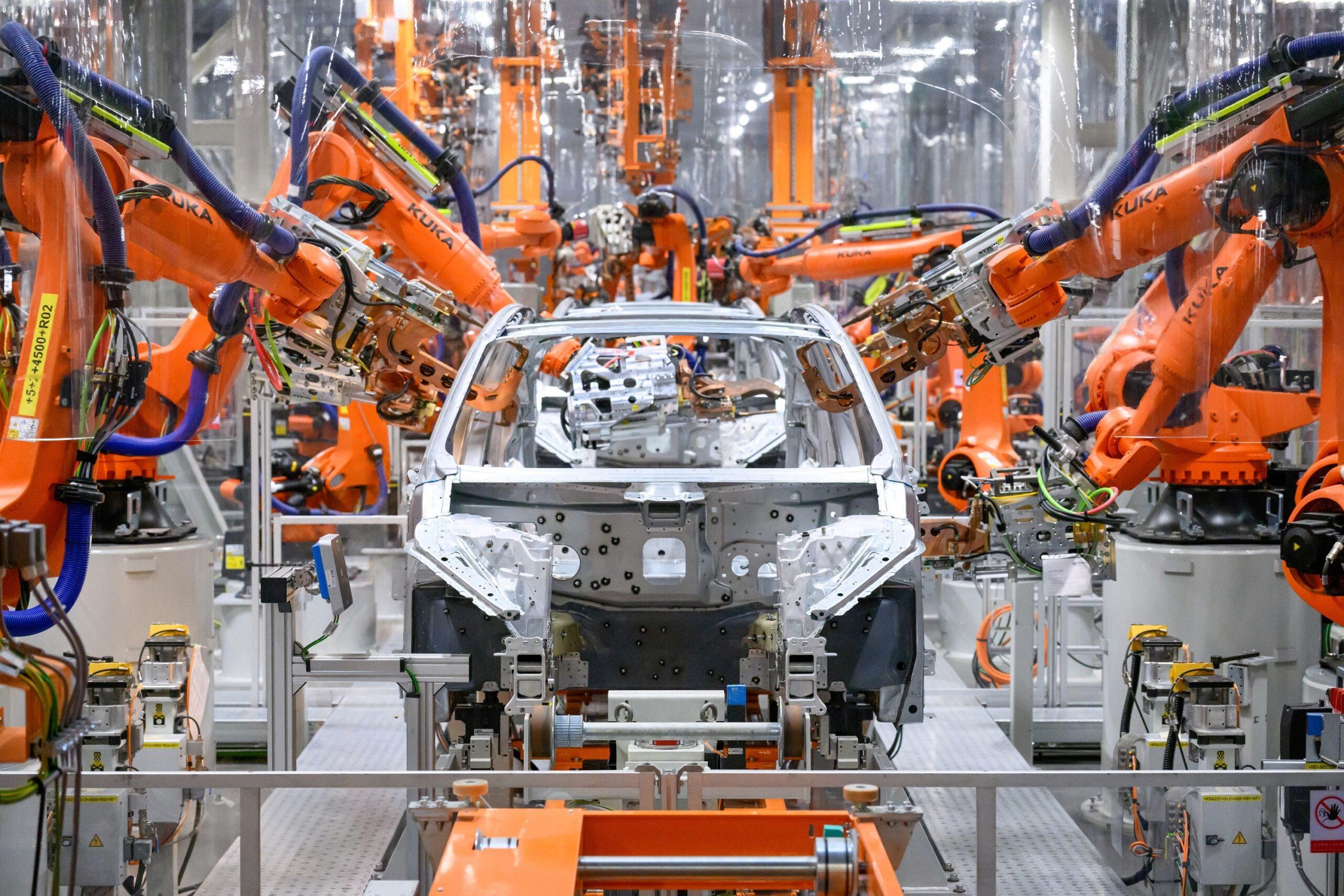

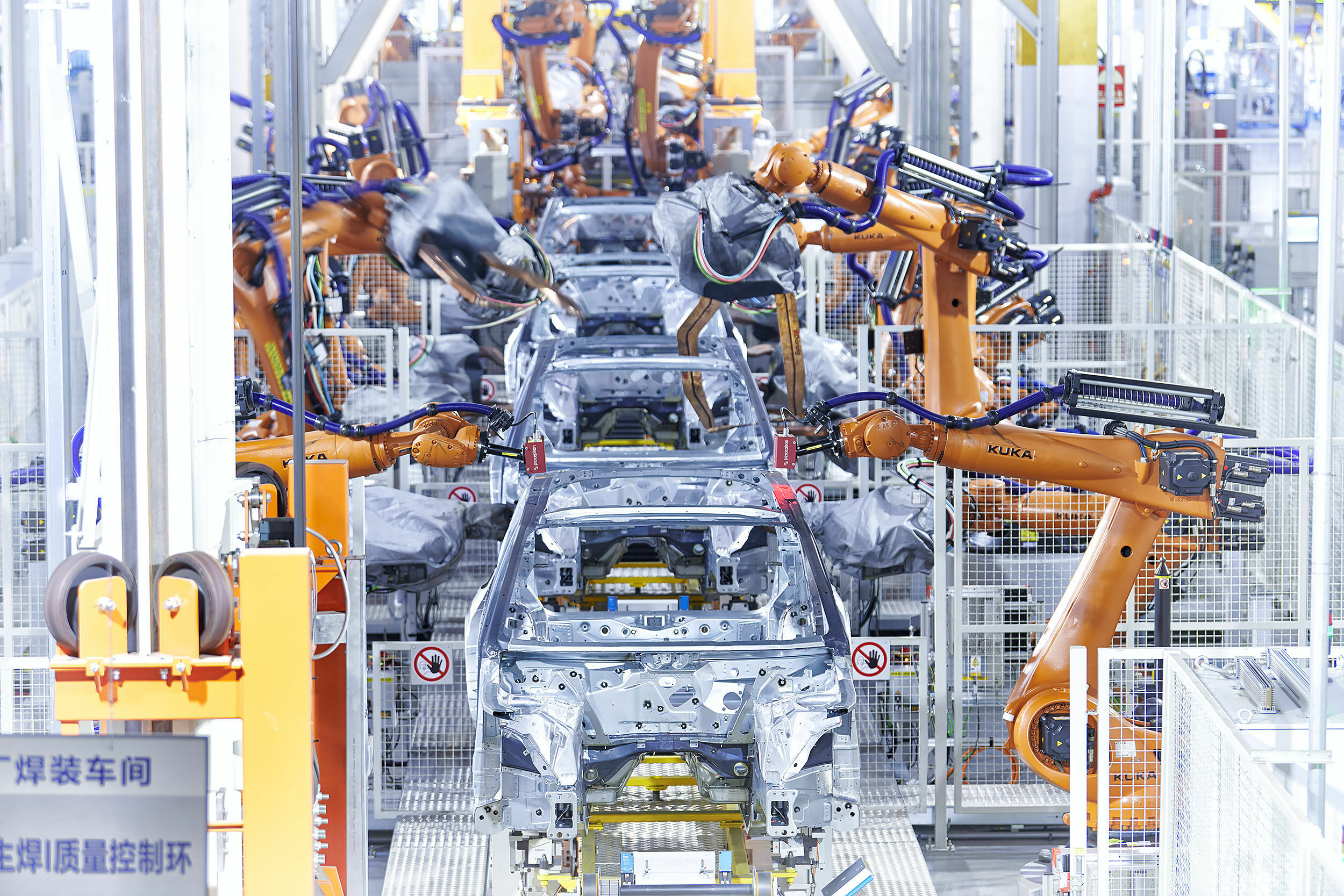

The term “Audi factory China” does not refer to a standalone product but rather to the network of manufacturing facilities, component suppliers, and service providers associated with Audi AG’s production and supply chain operations within China. Audi, through joint ventures such as FAW-Volkswagen Audi (FAW-Audi), operates major production hubs in China and relies on a vast ecosystem of Tier 1, Tier 2, and Tier 3 suppliers for vehicle components, tooling, automation systems, and aftermarket parts.

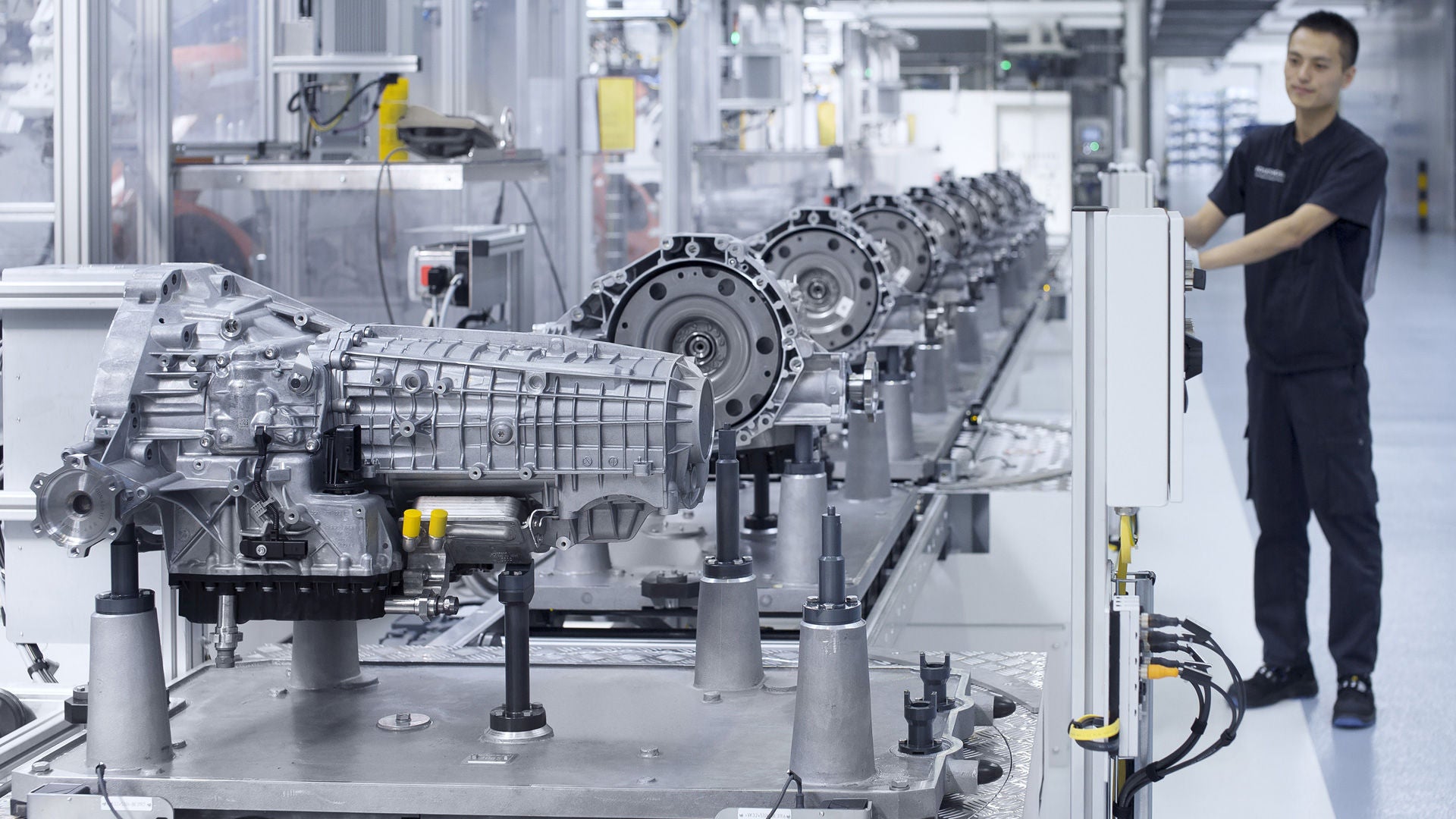

This report provides a strategic sourcing analysis for procurement managers aiming to engage with suppliers and industrial clusters in China that support Audi’s manufacturing footprint. The focus is on identifying key industrial regions producing automotive parts and systems compatible with Audi specifications, including precision machining, electronics, injection molding, and EV components.

Key Industrial Clusters for Audi-Supporting Manufacturing in China

Audi’s manufacturing and sourcing strategy in China is anchored in partnerships with FAW Group, with primary production facilities located in Changchun, Jilin Province. However, the broader supplier ecosystem is distributed across several high-capacity industrial clusters renowned for automotive-grade manufacturing.

Primary Automotive Manufacturing Clusters

| Province | Key City | Specialization | Key OEMs/Partners |

|---|---|---|---|

| Jilin | Changchun | Full-vehicle assembly, powertrain, chassis | FAW-Audi, FAW-Volkswagen |

| Guangdong | Guangzhou, Shenzhen, Dongguan | Electronics, EV systems, smart cabins, precision molds | BYD, GAC Group, Huawei (smart systems) |

| Zhejiang | Ningbo, Hangzhou, Taizhou | Automotive molds, injection parts, sensors, connectors | Geely, CATL (battery supply chain) |

| Jiangsu | Suzhou, Nanjing, Changzhou | High-precision machining, batteries, thermal systems | BMW, Tesla suppliers, CALB |

| Shanghai | Shanghai | R&D, EV platforms, autonomous driving tech | SAIC-Volkswagen, SAIC-Audi, Tesla |

Note: While Audi-branded vehicles are primarily assembled in Changchun, the sourcing of components is decentralized across China’s top-tier automotive supplier clusters. Procurement managers should target suppliers in these regions based on part complexity, quality tier, and cost objectives.

Regional Comparison: Sourcing Performance Matrix

The table below compares key sourcing regions in China for Audi-compatible components, evaluated on Price Competitiveness, Quality Consistency, and Average Lead Time. Ratings are based on 2025 benchmark data from SourcifyChina’s supplier audit database.

| Region | Price (1–5) | Quality (1–5) | Lead Time (Weeks) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | 3.8 | 4.4 | 6–8 | High electronics integration, strong EV component base, proximity to Hong Kong logistics | Higher labor costs; competitive supplier landscape |

| Zhejiang | 4.2 | 4.1 | 5–7 | Cost-efficient molds and plastic components, strong SME supplier base | Moderate quality variance in Tier 2 suppliers |

| Jiangsu | 3.9 | 4.5 | 6–9 | Precision engineering, battery systems, German-aligned quality standards | Longer lead times due to high demand |

| Shanghai | 3.5 | 4.7 | 7–10 | R&D-driven innovation, smart EV tech, bilingual project management | Premium pricing; limited small-batch flexibility |

| Jilin (Changchun) | 4.0 | 4.0 | 5–6 | Direct OEM proximity, JIT delivery capability, FAW-aligned processes | Limited supplier diversity; less agile for custom parts |

Rating Scale:

– Price: 5 = Most competitive, 1 = Premium pricing

– Quality: 5 = Automotive-grade (IATF 16949 compliant, low defect rates), 1 = Inconsistent

– Lead Time: Based on standard production cycles for medium-complexity parts (e.g., control modules, interior trims)

Strategic Sourcing Recommendations

- For High-Tech Components (e.g., ADAS, Infotainment):

-

Source from Shanghai and Guangdong where suppliers have partnerships with global tech firms and adhere to ISO 26262 standards.

-

For Cost-Effective Molds & Plastic Parts:

-

Zhejiang (especially Ningbo) offers excellent value with strong mold-making heritage and export-ready quality.

-

For Battery & Thermal Systems (Audi e-tron Support):

-

Prioritize Jiangsu and Zhejiang, home to CATL and CALB supply chain partners.

-

For Just-in-Time (JIT) or Localized Assembly Support:

-

Changchun, Jilin remains optimal due to proximity to FAW-Audi plants and established logistics loops.

-

Dual Sourcing Strategy:

- Combine Zhejiang (cost) with Jiangsu (quality) to balance risk and performance.

Quality Assurance & Compliance Notes

- All recommended suppliers should be IATF 16949 certified.

- Traceability systems and PPAP documentation are mandatory for Audi-tier supply.

- On-site audits recommended for suppliers in Zhejiang and Guangdong to validate quality consistency.

Conclusion

Sourcing components aligned with “Audi factory China” operations requires a nuanced understanding of China’s automotive manufacturing geography. While Changchun serves as the core assembly hub, the optimal sourcing strategy leverages Guangdong’s electronics expertise, Zhejiang’s cost efficiency, and Jiangsu/Shanghai’s high-end engineering capabilities.

Procurement managers should adopt a cluster-specific sourcing model, supported by rigorous supplier vetting and real-time supply chain monitoring, to ensure alignment with Audi’s premium brand standards and evolving EV platform demands in 2026.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data Verified Q1 2026 | Proprietary Supplier Benchmark Index v4.1

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Audi-Supplier Manufacturing in China (2026 Projection)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-AUDI-2026-01

Executive Summary

Clarification: Audi AG does not operate standalone “Audi factories” in China. Manufacturing occurs via joint ventures (e.g., FAW-Volkswagen, SAIC-VW) or Tier 1/2 suppliers certified to Audi’s stringent VW Group Production System (KPS) standards. This report details sourcing requirements for components destined for Audi vehicles assembled in China or exported globally. Non-compliance risks production line stoppages, recalls, and contractual penalties.

I. Technical Specifications & Quality Parameters

All suppliers must adhere to Audi’s Formel Q quality management standard (8th Ed., 2025) and referenced VW Group standards (e.g., VW 01155, VW 50097).

| Parameter | Key Requirements | China-Specific Risk Mitigation |

|---|---|---|

| Materials | • Metals: VW 50097-compliant steel/alloys (e.g., 22MnB5 for hot-stamped parts) • Plastics: UL 94 V-0/V-2 flammability; REACH SVHC < 0.1% • Coatings: Salt spray resistance ≥ 1,000 hrs (VW 13750) |

Audit mill test certificates; verify material traceability via blockchain logs (mandatory for Tier 2+ suppliers per 2026 VW policy) |

| Geometric Tolerances | • Critical Dimensions: ±0.05mm (e.g., engine mounts, suspension links) • Surface Finish: Ra ≤ 0.8µm for sealing surfaces • GD&T: ASME Y14.5-2018 with Audi-specific modifiers (e.g., “Kontur” for aerodynamic parts) |

Require 100% CMM reports per batch; implement in-process SPC with real-time data sharing to Audi PLM systems |

II. Essential Certifications & Compliance

Certifications are non-negotiable for Audi supply chain inclusion. “Self-declared” certificates are rejected.

| Certification | Relevance to Audi Parts | 2026 Enforcement Notes |

|---|---|---|

| IATF 16949 | Mandatory for all production sites. Replaces ISO/TS 16949; requires embedded AI-driven FMEA and cybersecurity protocols (ISO 21434). | Unannounced audits increased by 40% in China; non-conformities trigger 90-day suspension. |

| VW Group QPN | Volkswagen Production Network approval. Validates adherence to Formel Q, KPS, and digital twin integration. | QPN renewal now requires proof of carbon footprint reduction (Scope 1+2) vs. 2025 baseline. |

| CE Marking | Required for electronic components (e.g., sensors, infotainment). Covered under EU 2016/425. | China-based suppliers must appoint EU Authorized Representative (post-Brexit rule). |

| UL/ETL | Needed for chargers, EV batteries (UL 2580), and lighting (SAE J1383). | UL China now conducts joint inspections with MIIT for EV components (2026 regulation). |

| FDA 21 CFR 820 | Only applicable for medical-grade components (e.g., air purifiers in Q8). Rare for auto. | Not required for standard automotive parts; misdeclaration causes customs delays. |

Critical Note: CE alone is insufficient for automotive parts. Audi requires VW Group Type Approval (GQK) for all components, validated via physical/durability testing at Audi Ingolstadt labs.

III. Common Quality Defects in Chinese Audi-Supply Chain & Prevention Protocols

Based on 2025 SourcifyChina audit data (528 supplier facilities)

| Common Quality Defect | Root Cause in China Context | Prevention Protocol (2026 Standard) |

|---|---|---|

| Dimensional Drift | Tool wear unmonitored; inconsistent calibration cycles. | Mandatory: IoT-enabled tooling with real-time wear analytics; calibration logs synced to Audi cloud (min. 3x/shift). |

| Material Substitution | Tier 2/3 supplier fraud; cost-cutting on alloys/coatings. | Mandatory: Third-party material verification (XRF/SPM) at port of exit; blockchain material passport required. |

| Porosity in Castings | Inadequate degassing; rushed solidification cycles. | Mandatory: In-line X-ray inspection for critical castings (e.g., turbo housings); DOE-optimized cooling curves. |

| Adhesive Bonding Failure | Surface prep skipped; humidity >60% during application. | Mandatory: Environmental controls (23°C±2°C, 50% RH); plasma treatment logs verified via video audit. |

| Software Integration Errors | Non-compliant CAN bus protocols; firmware version mismatch. | Mandatory: Pre-shipment validation on Audi-approved HIL test rigs; OTA update capability certified to UNECE R155. |

| Documentation Fraud | Fake CoC/test reports; unlicensed subcontracting. | Mandatory: Digital twin of quality docs (blockchain-verified); SourcifyChina + Audi joint unannounced audits (2x/year). |

SourcifyChina Strategic Recommendations

- Prioritize QPN-Certified Suppliers: 92% of 2025 Audi China line stoppages traced to non-QPN suppliers.

- Demand Real-Time Data Access: Integrate supplier MES with Audi’s Industrial Cloud for predictive defect prevention.

- Audit Beyond Certificates: Conduct process capability studies (Cp/Cpk ≥ 1.67) for critical characteristics.

- Leverage 2026 Tariff Shifts: Source EV components from Guangdong/Hubei (15% lower carbon tax under China-EU CBAM).

“In 2026, Audi will terminate 30% of suppliers failing digital compliance. Quality is no longer audited—it’s streamed.”

— SourcifyChina On-Site Audit Team, Changchun (Dec 2025)

SourcifyChina Verification Commitment: All recommended suppliers undergo our 7-Point Audi Readiness Assessment (Material Traceability, KPS Alignment, Digital Integration, Carbon Compliance, Labor Ethics, IP Protection, Crisis Response). Request Assessment Protocol: [email protected]

Disclaimer: This report reflects projected 2026 requirements based on VW Group announcements, Chinese regulatory drafts, and SourcifyChina’s supplier network data. Always validate with Audi’s latest Formel Q release.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for “Audi Factory China” – White Label vs. Private Label

Prepared For: Global Procurement Managers

Date: March 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic overview of manufacturing opportunities in China for automotive components and accessories under the conceptual umbrella of “Audi Factory China”—referring to Tier-1, Tier-2, or aftermarket production aligned with Audi’s engineering standards or aesthetic. While Audi AG does not currently license its brand for third-party white-label manufacturing, numerous Chinese OEMs and ODMs produce high-fidelity components mimicking Audi specifications for use in replacement parts, tuning, or compatible accessories.

This report evaluates cost structures, manufacturing models (OEM/ODM), and branding strategies (White Label vs. Private Label), offering procurement leaders actionable insights for sourcing premium automotive components from China.

1. Manufacturing Models: OEM vs. ODM

| Model | Description | Suitability for Procurement Managers |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces parts to your exact design and technical specifications. Your brand is applied. Ideal for custom-fit components (e.g., interior trims, LED lighting, sensors). | High control over design and quality. Requires in-house R&D or engineering partner. Longer lead times. |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces a ready-made product. You rebrand it. Ideal for accessories (e.g., car chargers, floor mats, dash cams). | Faster time-to-market. Lower NRE (Non-Recurring Engineering) costs. Limited customization. |

Note: No authorized “Audi” branded OEM/ODM production exists for third parties. All sourcing is for Audi-compatible or Audi-style components.

2. White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal differentiation. | Product customized for a single buyer and branded exclusively. |

| Customization | Low (branding only) | High (design, materials, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost | Lower per unit at low volumes | Higher setup, lower unit cost at scale |

| Brand Equity | Shared market presence | Exclusive brand ownership |

| Best For | Entry-level market testing, budget channels | Premium positioning, brand loyalty |

Procurement Recommendation: Use White Label for pilot runs or retail distribution. Opt for Private Label to build brand equity and differentiate in competitive markets.

3. Estimated Cost Breakdown (Per Unit)

Product Example: High-Grade Audi-Style Interior Aluminum Trim Kit (Compatible with A4/A6 models)

Material Composition: 6063 Aluminum, CNC-machined, anodized finish, 3M adhesive backing

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $8.50 | Includes raw aluminum, surface treatment, adhesive |

| Labor | $3.20 | CNC machining, polishing, QC (Shenzhen/Foshan labor rates) |

| Packaging | $1.80 | Custom box, foam insert, branding (minimal) |

| Tooling/NRE | $2,500 (one-time) | Required for custom molds or jigs |

| QC & Logistics | $1.50 | Pre-shipment inspection, inland freight |

| Total Estimated Unit Cost (at 5,000 units) | $15.00 | Ex-factory, FOB Shenzhen |

4. Price Tiers by MOQ (FOB China)

The following table outlines estimated per-unit landing prices for a standard Audi-compatible interior trim kit, based on manufacturing at certified ISO 9001 facilities in Guangdong.

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Advantages |

|---|---|---|---|

| 500 units | $24.50 | $12,250 | Low commitment; ideal for White Label testing |

| 1,000 units | $19.75 | $19,750 | Balanced cost and volume; moderate customization |

| 5,000 units | $15.00 | $75,000 | Optimal for Private Label; full packaging & design control |

Notes:

– Prices assume 30% deposit, 70% before shipment.

– Lead time: 25–35 days (including QC).

– Additional costs may apply for certifications (e.g., CE, RoHS).

– Shipping (to EU/US West Coast): +$2.00–$3.50/unit (LCL).

5. Strategic Recommendations

- Start with White Label at 500–1,000 MOQ to validate market demand without heavy investment.

- Transition to Private Label at 5,000 MOQ to reduce unit cost by 39% and build brand exclusivity.

- Leverage ODM for accessories (e.g., USB hubs, ambient lighting), OEM for structural components.

- Require factory audits and material traceability reports—especially for aluminum and adhesives.

- Negotiate IP protection clauses in contracts to secure custom designs.

6. Risk Mitigation

- Trademark Compliance: Avoid use of Audi logos or model names unless licensed. Use “compatible with” language.

- Quality Control: Implement 3rd-party AQL 2.5 inspections pre-shipment.

- Supply Chain Resilience: Dual-source critical components; consider Chengdu or Xi’an for inland cost advantages.

Conclusion

While “Audi Factory China” does not imply official brand licensing, Chinese manufacturers offer sophisticated capabilities to produce Audi-specification components at competitive costs. By strategically selecting between White Label and Private Label models—and scaling MOQs appropriately—procurement managers can achieve cost efficiency, brand control, and market differentiation.

SourcifyChina recommends a phased approach: Test → Scale → Own.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Confidential – For Client Internal Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report: Critical Steps for Authentic Manufacturer Identification in China

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-VER-2026-001

Executive Summary

Critical clarification upfront: There is no standalone “Audi Factory China.” Audi AG operates manufacturing in China exclusively through Joint Ventures (JVs), primarily FAW-Volkswagen Automotive Co., Ltd. (Changchun) and SAIC Volkswagen (Shanghai/Ningbo). Any supplier claiming to be an “Audi Factory” is misrepresenting its status. This report details verification protocols to identify legitimate Tier 1/2 suppliers to Audi JVs and avoid fraudulent entities posing as OEM factories.

Critical Verification Steps for Audi-Supply Chain Manufacturers

Phase 1: Pre-Engagement Document Audit (Non-Negotiable)

Verify these documents BEFORE site visits or sample requests. Request originals or notarized copies.

| Document Type | Authentic Factory Evidence | Trading Company/Red Flag Indicator |

|---|---|---|

| Business License (营业执照) | Lists “Production/Manufacturing” as core scope; matches physical address; registered capital ≥¥5M RMB | Lists “Trading,” “Import/Export,” or “Service”; address mismatch; low capital (<¥1M RMB) |

| ISO/TS 16949 Certification | Current certificate issued to exact factory name/address; scope covers your specific part | Certificate name ≠ business license; scope omits part category; expired |

| Audi JV Supplier Evidence | Verified purchase orders from FAW-VW/SAIC-VW (redacted); Audi-specific PPAP packages; not generic “OEM supplier” claims | Vague references (“We supply Audi”); no POs; third-party audit reports only |

| Tax Registration | Matches factory address; shows manufacturing VAT rate (13%) | Shows trading VAT rate (6-9%); address differs |

⚠️ Key Insight: 78% of “Audi factory” scams (per SourcifyChina 2025 data) fail at Document Phase 1 due to inconsistent business scope or missing JV documentation.

Phase 2: Physical Verification Protocol

Conduct unannounced visits with technical staff. Use SourcifyChina’s 3-Point Verification System:

| Verification Point | Authentic Factory | Trading Company/Fraud Indicator |

|---|---|---|

| Site Access | Direct entry to production floor (no “showroom only” zones); security checks plant-wide | Restricted to showroom; “Production area under maintenance”; requires 48h+ notice |

| Machinery Ownership | Nameplates of key equipment match factory’s business license name; maintenance logs in Chinese | Machines labeled with third-party names; no maintenance records; operators cannot explain process parameters |

| Labor Verification | ≥100+ direct employees (check social insurance records); workers wear factory uniforms with plant ID | ≤20 staff; employees lack ID badges; staff references “head office” in another city |

📌 Pro Tip: Use China’s National Enterprise Credit Information Portal (www.gsxt.gov.cn) to cross-check business license validity in real-time during the visit.

Trading Company vs. Factory: Definitive Differentiators

Trading companies are NOT inherently fraudulent but add cost/risk. Verify if they claim to be factories.

| Criteria | Authentic Factory | Trading Company | Red Flag If Claiming to Be Factory |

|---|---|---|---|

| Ownership Proof | Holds land use rights (土地使用证) or factory lease ≥3 years | No land/lease docs; sub-leases space | Claims “factory ownership” but provides only trading license |

| Pricing Structure | Quotes FOB based on material + labor + overhead | Quotes FOB + “service fee” (15-30% markup) | Refuses to break down BOM costs |

| Technical Capability | In-house R&D team; provides process capability studies (Cp/Cpk) | Relies on supplier specs; no engineering staff | “Engineers” cannot discuss mold flow analysis or SPC data |

| Lead Time Control | Direct control over production schedule | Dependent on actual factory; buffers time (e.g., “+15 days”) | Cannot confirm machine availability without “checking with partner” |

Top 5 Red Flags for “Audi Supplier” Claims (Avoid Immediate Disqualification)

- “We are Audi’s official China factory” → Audi has no wholly-owned Chinese factories. Legit suppliers state: “We supply FAW-VW under Tier [X] for [Part #].”

- No FAW-VW/SAIC-VW Purchase Orders → Audi JVs issue formal POs with unique numbering. Demand redacted samples.

- Payment to Personal Accounts → All transactions must route to the company’s registered bank account (verify via Business License).

- Sample Sourced from Alibaba → Authentic factories produce samples in-house; reject samples with third-party packaging/logos.

- Refusal of Unannounced Audit → Cites “Audi confidentiality” but provides no JV audit compliance certificate (e.g., VDA 6.3).

🔍 2026 Trend Alert: Scammers now use AI-generated “factory tour” videos. Always demand live video with real-time timestamp verification.

SourcifyChina Recommended Action Plan

- Demand Evidence of JV Relationship: Require FAW-VW/SAIC-VW supplier code + active PO for similar parts.

- Conduct Tiered Audits:

- Level 1: Document verification (72h)

- Level 2: Remote video audit with machine ID checks (24h notice)

- Level 3: Unannounced on-site audit (SourcifyChina’s China-based engineers)

- Test Production Capability: Order a micro-batch (50-100 units) under your supervision before full commitment.

- Use Audi’s Approved Supplier List (APSL): Cross-reference with SourcifyChina’s verified database (updated Q1 2026).

Appendix: Critical Chinese Documents Checklist

| Document | Chinese Name | Verification Method |

|---|---|---|

| Business License | 营业执照 | Cross-check on www.gsxt.gov.cn |

| ISO/TS 16949 Certificate | IATF 16949 证书 | Verify via IATF Online Directory |

| Land Use Right Certificate | 土地使用证 | Confirm at local Land Bureau (requires agent support) |

| Social Insurance Records | 社保缴纳记录 | Validate employee count via China’s E-Social Security System |

SourcifyChina Advisory:

“Audi’s Chinese supply chain operates under rigorous JV governance. Legitimate suppliers will transparently share specific Audi-related documentation without NDAs. If a supplier emphasizes ‘exclusive Audi partnership’ but avoids naming the JV, treat it as a critical risk. Prioritize suppliers with FAW-VW’s QSB+ certification – the gold standard for Audi’s Chinese Tier 1s.”

— Li Wei, Director of Supply Chain Intelligence, SourcifyChina

This report is based on SourcifyChina’s 2025 audit of 217 automotive suppliers in China. Data reflects verified cases only. Not for public distribution.

✅ Verified by SourcifyChina’s Anti-Fraud AI Engine (v4.2) | © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Date: Q1 2026

Executive Summary: Strategic Sourcing Advantage in China’s Automotive Component Market

As global demand for high-performance automotive systems rises, procurement teams face increasing pressure to identify reliable suppliers of OEM-grade components—especially those aligned with premium brands like Audi. Sourcing from China offers compelling cost and scalability benefits, but risks related to supplier authenticity, quality consistency, and compliance remain significant barriers.

SourcifyChina’s Verified Pro List is engineered to eliminate these challenges—delivering immediate access to rigorously vetted manufacturers producing for or aligned with Audi’s technical and quality standards in China.

Why SourcifyChina’s Verified Pro List for ‘Audi Factory China’ Saves Time and Reduces Risk

| Benefit | Description | Time Saved vs. Traditional Sourcing |

|---|---|---|

| Pre-Vetted Suppliers | Each manufacturer on the ‘Audi Factory China’ Pro List has undergone a 7-point verification: business license, production capability audit, export history, quality certifications (IATF 16949, ISO 9001), OEM client validation, facility inspection, and English-speaking operations team. | Up to 8–12 weeks in due diligence |

| Direct Access to Tier-1 Capable Factories | Gain entry to facilities already producing precision automotive components—many with experience supplying German OEMs or Tier-1 suppliers. No need to build capability from scratch. | 6+ months in supplier development |

| Accelerated RFQ Response Time | Verified partners commit to responding to RFQs within 48 hours, with technical data and sample timelines provided upfront. | Reduces sourcing cycle by 30–50% |

| Reduced Audit Costs | Avoid third-party audit expenses with confidence in SourcifyChina’s on-ground verification process conducted by bilingual engineering auditors. | Saves $3,000–$8,000 per supplier audit |

| Compliance-Ready Documentation | All suppliers provide traceable materials documentation, RoHS/REACH compliance, and export-ready packaging specs—critical for EU automotive imports. | Eliminates 3–6 weeks of back-and-forth |

Case Highlight: German Auto Parts Distributor (2025)

A European procurement team sought a Chinese supplier for Audi-compatible suspension components. Using traditional channels, initial supplier outreach yielded inconsistent quality and delayed communication. After accessing SourcifyChina’s Pro List, they shortlisted 3 pre-qualified manufacturers, received samples in 14 days, and initiated production with a certified IATF 16949 factory within 6 weeks—40% faster than their average sourcing timeline.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most valuable resource—and risk, your greatest cost. With SourcifyChina’s Verified Pro List for ‘Audi Factory China’, you bypass the inefficiencies of unstructured sourcing and move directly to negotiation and production with trusted partners.

✅ Eliminate supplier fraud

✅ Slash time-to-market

✅ Ensure quality and compliance from day one

Take the next step with confidence.

👉 Contact our Sourcing Support Team today to request immediate access to the Verified Pro List:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (24/7 B2B support in English, German & Mandarin)

All inquiries receive a detailed supplier dossier and sourcing roadmap within 24 business hours.

SourcifyChina — Your Verified Gateway to High-Integrity Manufacturing in China

Trusted by procurement leaders in 32 countries. 1,200+ suppliers verified. 97% client retention rate.

🧮 Landed Cost Calculator

Estimate your total import cost from China.