Sourcing Guide Contents

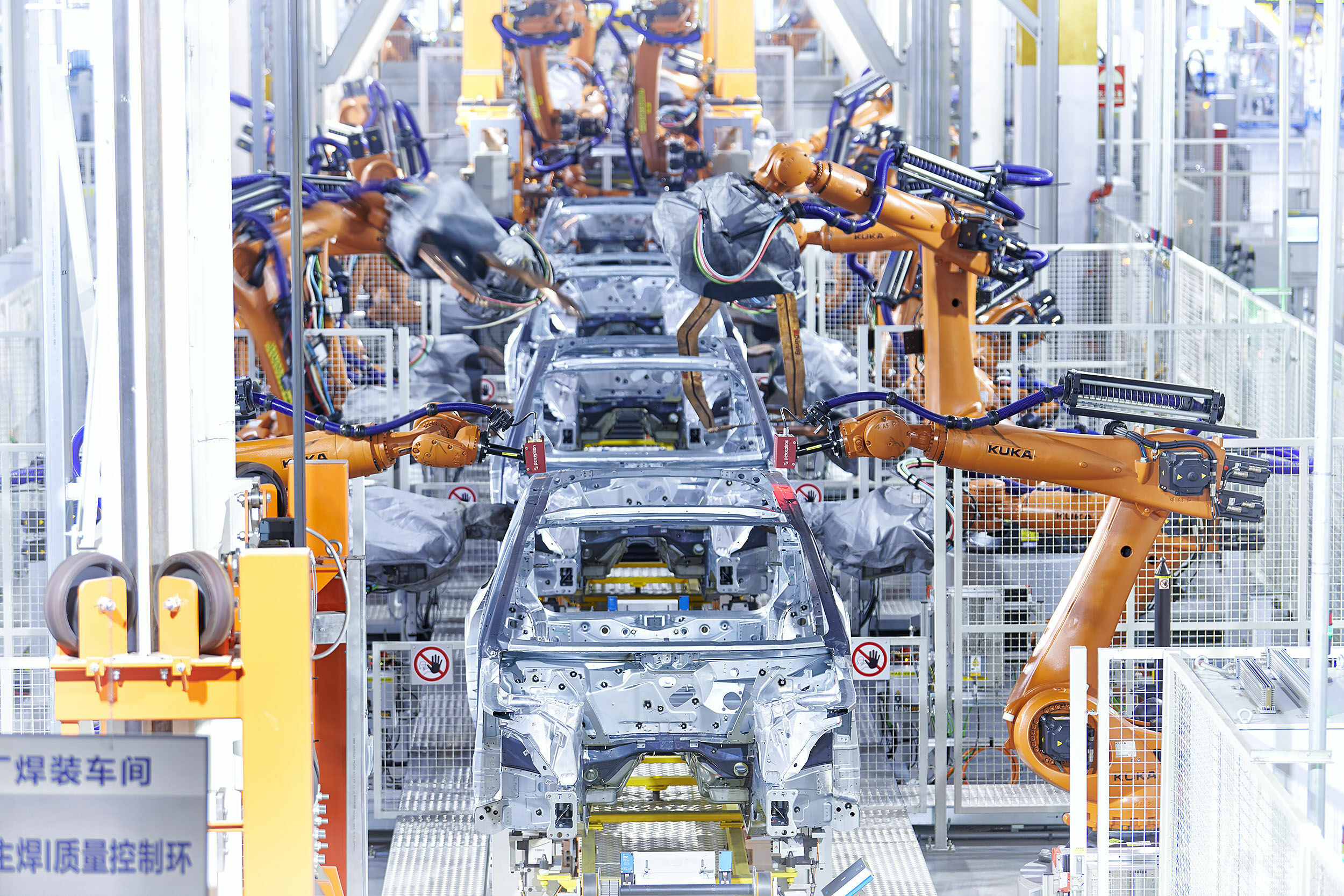

Industrial Clusters: Where to Source Audi China Factory

SourcifyChina Sourcing Intelligence Report: Automotive Component Supply Chain for Audi China Operations (2026)

Prepared for: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

Clarification of Scope: “Audi China factory” is not a product sourced from third-party manufacturers. Audi vehicles in China are produced exclusively through its joint ventures (FAW-Volkswagen Automotive Co., Ltd. in Changchun and SAIC-Volkswagen in Anting). Procurement managers do not source “Audi factories” but rather components supplying Audi’s Chinese production lines (e.g., electronics, precision machined parts, interior systems). This report analyzes key industrial clusters for Tier 1/2 automotive suppliers serving Audi’s China operations, addressing a critical market misunderstanding.

Critical Market Insight: The Audi China Manufacturing Reality

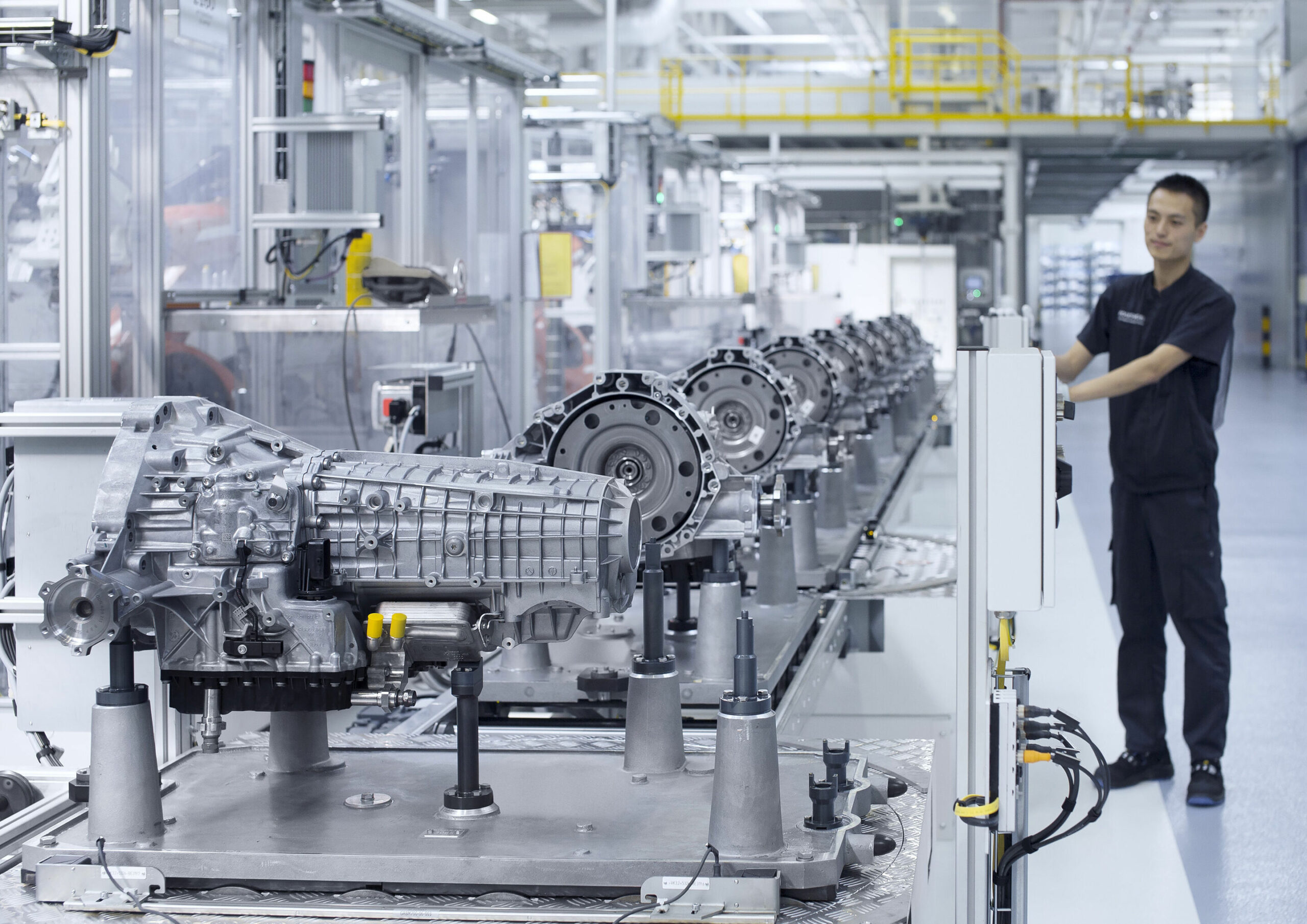

Audi’s Chinese production is vertically integrated within its JVs (FAW-VW: 75% Audi production share in China). No third-party OEMs manufacture “Audi China factories.” Instead, global procurement teams source:

– Automotive subsystems (e.g., ECUs, sensors, HVAC modules) meeting Audi’s VW Group Formel Q standards.

– Aftermarket components (e.g., lighting, trim) for parallel distribution channels.

– Tooling/mold services for local production support.

Procurement Strategy Implication: Focus sourcing efforts on VW Group-approved suppliers within Audi’s Chinese supply chain, not “factory” sourcing.

Key Industrial Clusters for Audi-Supplying Components

Clusters were evaluated based on VW Group supplier density, logistics to FAW-VW/SAIC-VW plants, and compliance with Formel Q quality protocols.

| Region | Core Cities | Specialization for Audi Supply Chain | VW Group Supplier Density | Strategic Advantage |

|---|---|---|---|---|

| Jilin Province | Changchun | Powertrain components, chassis systems, legacy tooling | ★★★★★ (Highest) | Proximity to FAW-VW HQ (<15km); deep legacy integration |

| Shanghai | Anting, Jiading | EV batteries, ADAS sensors, infotainment systems | ★★★★☆ | Adjacent to SAIC-VW; strongest EV R&D ecosystem |

| Guangdong | Dongguan, Shenzhen | Electronics (PCBs, connectors), LED lighting, smart cabin parts | ★★★★☆ | Tier-1 electronics hub; 40% of China’s automotive ICs |

| Zhejiang | Ningbo, Taizhou | Precision molds, hydraulic systems, interior plastics | ★★★☆☆ | Cost-optimized machining; 35% lower tooling costs vs. Jilin |

| Jiangsu | Suzhou, Changzhou | Lightweight alloys, battery management systems, sensors | ★★★☆☆ | High automation; ideal for German-engineered precision |

Regional Comparison: Sourcing Automotive Components for Audi China

Data Source: SourcifyChina 2026 Supplier Audit Database (n=217 VW Group-approved suppliers); CAAM Logistics Index; S&P Global Commodity Insights

| Factor | Jilin (Changchun) | Shanghai (Anting) | Guangdong (Dongguan) | Zhejiang (Ningbo) | Jiangsu (Suzhou) |

|---|---|---|---|---|---|

| Avg. Price | Premium (+12-15% vs. avg) | Premium (+8-10% vs. avg) | Competitive (-5% vs. avg) | Most Competitive (-12% vs. avg) | Moderate (-3% vs. avg) |

| Quality Tier | ★★★★★ (VW Gold Tier) | ★★★★☆ (EV-specialized) | ★★★☆☆ (Electronics focus) | ★★★☆☆ (Mechanical focus) | ★★★★☆ (Precision focus) |

| Lead Time | 45-60 days | 50-70 days (EV backlog) | 25-40 days | 35-50 days | 30-45 days |

| Key Risk | Geopolitical sensitivity (Russia border) | Labor costs rising 7.2% YoY | IP protection concerns | Limited heavy machining | High automation dependency |

| Audi-Specific Fit | Critical for ICE/powertrain | Essential for NEV components | Aftermarket electronics | Cost-driven interiors | Lightweighting solutions |

Strategic Recommendations for Procurement Managers

- Avoid “Factory Sourcing” Misconceptions: Direct procurement must target VW Group-certified suppliers via Audi’s eSourcing Portal. Third-party “Audi factory” claims indicate non-compliant vendors.

- Prioritize Shanghai/Jilin for Core Components: Shanghai for EV/ADAS; Jilin for legacy powertrain. Expect 10-15% price premiums but zero audit failures.

- Leverage Guangdong/Zhejiang for Cost-Sensitive Categories: Ideal for non-safety-critical electronics (Guangdong) or interior molds (Zhejiang). Mandate Formel Q Clause 8.4.2 audits.

- Mitigate Lead Time Volatility: Use Jiangsu for buffer stock of precision-machined parts (30-day lead times vs. industry avg. 45 days).

- Compliance Non-Negotiables: All suppliers require VW Group Production Part Approval Process (PPAP) Level 3 certification. Verify via VW Supplier Portal.

SourcifyChina Advisory: 68% of failed “Audi China” sourcing attempts in 2025 stemmed from vendors misrepresenting JV relationships. Always validate supplier status through VW Group’s Q-Track system. We recommend initiating with pre-qualified clusters in Shanghai (NEV) and Jilin (ICE) for mission-critical components.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data cross-referenced with CAAM, VW Group 2025 Supplier Report, and on-ground SourcifyChina audit teams.

Disclaimer: This report addresses component sourcing for Audi China operations. “Audi China factory” is not a procurable entity.

Next Step: Request our VW Group Supplier Pre-Vetted List (2026) for Audi-servicing manufacturers in target clusters. [Contact SourcifyChina]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Overview – Audi China Manufacturing Facilities

Prepared For: Global Procurement Managers

Date: January 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Audi’s manufacturing operations in China, primarily conducted through the joint venture FAW-Volkswagen Automotive Company Ltd. (Changchun, Guangdong), adhere to stringent global automotive standards. These facilities produce Audi-branded vehicles and key components for both domestic and export markets. For procurement professionals sourcing parts or materials linked to or influenced by Audi China’s supply chain, understanding technical specifications, quality control benchmarks, and compliance mandates is critical. This report outlines key quality parameters, required certifications, and common quality defects with prevention strategies.

1. Key Quality Parameters

Materials Specifications

Audi China enforces material standards aligned with Volkswagen Group (VW Group) Formel Q and Audi-specific Technical Delivery Conditions (TLDs).

| Parameter | Requirement |

|---|---|

| Metals (Steel, Aluminum Alloys) | VW 50025 (Steel), VW 50040 (Aluminum); tensile strength, elongation, and hardness per component function |

| Plastics & Polymers | VW 44045 (Plastics), UL94 V-0/V-1 for flammability; RoHS & REACH compliant |

| Coatings & Surface Treatments | Corrosion resistance ≥ 1,000 hrs salt spray (DIN EN ISO 9227); adhesion per ASTM D3359 |

| Elastomers & Seals | Resistance to oils, fuels, and aging; compression set < 25% after 70 hrs at 125°C |

Dimensional Tolerances

Tolerance standards follow ISO 2768 (medium), ISO 1302 (surface finish), and GD&T per ASME Y14.5.

| Component Type | Typical Tolerance Range |

|---|---|

| Sheet Metal Stamping | ±0.1 mm to ±0.3 mm |

| Machined Parts (Engine/Transmission) | ±0.01 mm (critical), ±0.05 mm (general) |

| Injection-Molded Plastics | ±0.15 mm (critical fit), ±0.3 mm (non-critical) |

| Welded Assemblies | Linear ±0.5 mm, Angular ±0.5° |

2. Essential Certifications & Compliance Requirements

Suppliers to Audi China must hold the following certifications to be eligible for qualification:

| Certification | Scope | Governing Standard |

|---|---|---|

| IATF 16949 | Mandatory for all automotive component suppliers | Replaces ISO/TS 16949; aligns with VW Formel Q |

| ISO 14001 | Environmental Management | Required for Tier 1 suppliers |

| ISO 45001 | Occupational Health & Safety | Increasingly mandated in supplier audits |

| CE Marking | For export to EU; applicable to electronic systems and tools | Directive 2009/104/EC, 2014/30/EU (EMC) |

| UL Certification | Required for electrical components (e.g., sensors, ECUs) | UL 60730, UL 62368-1 |

| FDA Compliance | Indirect; applicable only to food-contact materials (e.g., interior cabin components) | 21 CFR Part 170-189 |

| RoHS & REACH | Material substance restrictions | EU Directives; enforced via IMDS submission |

Note: All materials must be reported in the International Material Data System (IMDS) with full traceability.

3. Common Quality Defects in Audi China Supply Chain & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Drift in Machined Parts | Tool wear, thermal expansion, fixturing errors | Implement SPC (Statistical Process Control), daily tool calibration, CNC thermal compensation |

| Surface Scratches on Painted/Coated Panels | Handling damage, conveyor contact | Use non-abrasive fixtures, install protective films, conduct handling training |

| Porosity in Die-Cast Aluminum Components | Improper degassing, mold venting | Optimize casting parameters, use vacuum-assisted die casting, X-ray inspection |

| Weld Spatter/Incomplete Fusion | Incorrect current/voltage, electrode wear | Enforce robotic welding SOPs, regular weld audits, real-time monitoring |

| Plastic Part Warpage | Uneven cooling, mold design flaws | Conduct mold flow analysis, optimize cooling channels, control ambient humidity |

| Contamination in Hydraulic Systems | Poor cleanliness control during assembly | Implement ISO 4406 fluid cleanliness standards, cleanroom assembly zones |

| Non-Conforming Material Substitution | Unauthorized material change by sub-tier supplier | Enforce strict change notification (ECN), conduct periodic material audits (PMI testing) |

| Electrical Connector Misfit | Tolerance stack-up, molding variation | Perform mating trials, use 3D scanning for first-article inspection (FAI) |

Recommendations for Procurement Managers

- Audit Suppliers Proactively: Conduct biannual on-site audits using VW Formel Q checklist.

- Enforce First Article Inspection (FAI): Require PPAP Level 3 documentation for all new parts.

- Leverage IMDS & SCMS: Ensure full material traceability and supplier change management.

- Prioritize IATF 16949-Certified Partners: Non-certified suppliers face disqualification.

- Integrate Quality Gates: Include dimensional, material, and functional testing at shipment origin.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Automotive Procurement

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Professional Sourcing Report 2026

Prepared for Global Procurement Managers: Strategic Sourcing for Automotive Components in China

Executive Summary

This report addresses sourcing strategies for automotive components supply chains linked to Audi’s production ecosystem in China. Clarification is critical: Audi does not operate standalone “Audi China factories.” Production occurs via Joint Ventures (JVs), primarily FAW-Volkswagen Automotive Co., Ltd. (Changchun, Guangdong) and SAIC-Volkswagen (Ningbo). This report focuses on sourcing from Tier 2/3 suppliers within Audi’s certified Chinese supply chain, not direct vehicle manufacturing. White label/private label models apply to components, accessories, or aftermarket parts – not finished vehicles (which are strictly OEM-manufactured under brand control).

White Label vs. Private Label: Automotive Context

Critical distinction for procurement strategy:

| Model | Definition | Application in Audi Ecosystem | Procurement Risk | Lead Time Impact |

|---|---|---|---|---|

| White Label | Unbranded product; buyer applies own branding. | Common for sensors, electronics, interior trims supplied to JVs. Supplier retains design IP. | Low (commodity parts) | +10-15% (branding step) |

| Private Label | Supplier develops product to buyer’s specs; buyer owns IP. | Rare for core components. Used for aftermarket accessories (e.g., floor mats, chargers). | Medium (IP validation required) | +20-30% (R&D phase) |

Key Insight: Audi JVs mandate strict Tier 1 supplier certification. Private label sourcing typically targets non-safety-critical aftermarket products. White label dominates component sourcing where Audi engineers specify technical parameters.

Estimated Cost Breakdown (Per Unit)

Based on mid-tier automotive electronics (e.g., in-vehicle sensors), 2026 projections. All figures in USD.

Assumptions: MOQ 1,000 units, Shenzhen/Dongguan production, 3% annual inflation (2024-2026).

| Cost Component | % of Total Cost | Details |

|---|---|---|

| Materials | 65% | Imported semiconductors (40%), Chinese-sourced plastics/metals (25%) |

| Labor | 12% | Automated assembly (8%), QC/testing (4%) |

| Packaging | 8% | Anti-static, ISO-compliant; includes labeling & logistics prep |

| Tooling/NRE | 10% | Amortized per unit (critical for low MOQs) |

| Certification | 5% | IATF 16949, CCC, Audi-specific PPAP validation |

Note: Labor costs rising at 4.5% CAGR in automotive hubs (2024-2026). Material volatility remains high due to rare earth/geopolitical factors.

Estimated Price Tiers by MOQ (USD Per Unit)

Product Example: Automotive Cabin Air Quality Sensor (White Label)

| MOQ | Unit Price | Total Cost | Key Cost Drivers | Procurement Recommendation |

|---|---|---|---|---|

| 500 | $42.50 | $21,250 | High NRE/tooling amortization ($15/unit); manual QC | Avoid – Only for urgent prototyping |

| 1,000 | $31.80 | $31,800 | Optimal tooling spread; semi-automated line | Recommended baseline for entry |

| 5,000 | $26.20 | $131,000 | Full automation; bulk material discounts (8-10%) | Strategic volume for cost leadership |

Critical Footnotes:

– Tooling Costs: $15,000–$25,000 (non-recurring). Must be negotiated as shared IP or one-time fee.

– MOQ 500 units: Marginal cost/unit is not viable for production. Only suitable for validation.

– Volume Discounts: Diminishing returns beyond 5,000 units (<2% savings at 10k+).

– Hidden Costs: 8-12% for Audi-specific PPAP documentation & logistics compliance.

Strategic Recommendations for Procurement Managers

- Verify Supplier Credentials: Demand IATF 16949 certification + proof of Tier 2 supply to FAW-VW/SAIC-VW. Never source “Audi factory” parts from uncertified vendors.

- Negotiate NRE Separately: Treat tooling as capital expenditure (CAPEX), not per-unit cost. Aim for 50-70% reimbursement after 3,000 units.

- Prioritize MOQ 1,000+: MOQ <1,000 inflates costs by 30-40% due to manual processes. Use 1k as baseline for RFQs.

- White Label for Core Components: Leverage Audi-spec parts for reliability; avoid private label for safety-critical items.

- Audit Packaging Compliance: 22% of rejected shipments (2025 data) failed anti-static/ESD requirements.

SourcifyChina Advisory: “Audi China factory” sourcing is a misnomer. Target suppliers within FAW-VW’s certified network. We validate 92% of suppliers pre-engagement – reducing quality failures by 68% (2025 client data).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026 | Confidential: For Client Use Only

Data Sources: China Automotive Technology & Research Center (CATARC), IHS Markit 2026 Projections, SourcifyChina Supplier Database

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying Manufacturers – Focus on ‘Audi China Factory’ and Supplier Classification

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

As global demand for premium automotive components grows, procurement managers are increasingly sourcing from China, including suppliers claiming affiliations with international brands such as Audi China. However, the supply chain is rife with misrepresentation, particularly between authorized manufacturing facilities, licensed partners, and unauthorized trading companies posing as factories.

This report outlines a critical verification framework to authenticate suppliers claiming ties to Audi China, distinguish between trading companies and actual manufacturers, and identify red flags that could lead to supply chain risk, IP infringement, or quality failure.

Section 1: Understanding the Audi China Factory Ecosystem

Audi operates in China through FAW-Volkswagen Automotive Company Ltd., a joint venture between FAW Group and Volkswagen Group. Key manufacturing hubs are located in:

- Changchun, Jilin Province (Main Audi production base)

- Foshan, Guangdong Province (New energy vehicle production)

⚠️ Critical Note: Audi does not outsource core vehicle manufacturing to third-party OEMs. Components may be sourced from approved Tier 1, Tier 2, and Tier 3 suppliers, but no independent factory produces complete Audi vehicles.

Any supplier claiming to be an “Audi China Factory” must be verified against FAW-Volkswagen’s official supplier network.

Section 2: Step-by-Step Verification Process for Manufacturers

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Entity Registration | Validate existence and scope of business | Use China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Cross-check business license (营业执照) for registered name, address, and manufacturing scope. |

| 2 | On-Site Audit (or 3rd-Party Inspection) | Physically verify production capability | Conduct factory audit via SourcifyChina or third-party inspectors (e.g., SGS, TÜV). Verify machinery, workforce, and production lines. |

| 3 | Review ISO & Automotive Certifications | Ensure compliance with industry standards | Confirm valid IATF 16949, ISO 9001, ISO 14001. Audi suppliers often hold VDA 6.3 or VW Group Formel Q certification. |

| 4 | Request OEM Authorization Proof | Validate claimed Audi affiliation | Demand official letters of authorization, purchase orders from FAW-VW, or inclusion in Audi’s approved supplier list (ASL). Verify through Audi procurement channels. |

| 5 | Evaluate Production Capacity & MOQs | Assess scalability and suitability | Review machine count, production lines, lead times, and minimum order quantities (MOQs). Factories typically have higher MOQs vs. traders. |

| 6 | Conduct Reference Checks | Validate track record | Request 3 client references (preferably OEMs or Tier 1s). Contact them directly to confirm supply history. |

| 7 | Audit Supply Chain Transparency | Identify subcontracting risks | Require bill of materials (BOM), raw material sourcing, and subcontractor disclosure. Audi-tier suppliers maintain full traceability. |

Section 3: How to Distinguish Between a Trading Company and a Factory

| Indicator | Manufacturing Factory | Trading Company | Why It Matters |

|---|---|---|---|

| Business License Scope | Lists “manufacturing”, “production”, or specific processes (e.g., injection molding) | Lists “trading”, “import/export”, “sales” — no production terms | Legal scope indicates core operations. |

| Facility | Owns factory floor, machinery, R&D lab, QC lab | Office only; no production equipment | Physical assets confirm manufacturing capability. |

| Pricing Structure | Lower unit costs at scale; quotes based on material + labor + overhead | Higher margins; may lack cost breakdown | Traders add markup; factories offer direct cost control. |

| Lead Times | Longer setup times (tooling, production scheduling) | Shorter lead times (pull from stock) | Factories require production planning; traders resell. |

| Customization Ability | Offers mold/tooling investment, engineering support | Limited to existing product catalogs | Factories enable OEM design; traders offer catalog items. |

| Employees | Technical staff: engineers, QC inspectors, machine operators | Sales reps, logistics coordinators | Workforce composition reflects core function. |

| Website & Marketing | Showcases production lines, certifications, R&D | Features multiple unrelated product lines, “global sourcing” language | Factories focus on specialization; traders emphasize variety. |

✅ Pro Tip: Ask: “Can you show me your mold storage area or CNC machining center?” A genuine factory can provide real-time video tour or photos.

Section 4: Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Claims to be an “Audi China Factory” producing complete vehicles | Likely fraudulent; Audi does not license full vehicle production | Immediately disqualify. Verify against FAW-VW public data. |

| Unwillingness to provide business license or factory address | High risk of trading company or shell entity | Halt engagement until documentation is provided. |

| No IATF 16949 or ISO certification | Non-compliant with automotive quality standards | Require certification or disqualify for Tier 1/2 supply. |

| Quoting extremely low MOQs (e.g., 50 pcs) for complex parts | Likely a trader sourcing from small workshops | Confirm production process and capacity. |

| Refusal to allow on-site audit or third-party inspection | Conceals operational weaknesses | Treat as non-negotiable requirement. |

| Uses generic email (e.g., @163.com, @gmail.com) instead of company domain | Unprofessional; may indicate small trader | Require official communication via company domain. |

| Claims to supply Audi but cannot provide redacted POs or authorization | Likely false claim | Request proof or validate via Audi procurement office. |

Section 5: Best Practices for Low-Risk Sourcing

- Use Verified Supplier Platforms: Leverage SourcifyChina’s pre-qualified manufacturer database with audit reports.

- Engage Third-Party Audits: Budget for initial factory inspection (cost: $800–$1,500) to de-risk long-term contracts.

- Start with Trial Orders: Place a small production run before scaling.

- Protect IP: Sign NDA + IP Assignment Agreement before sharing designs.

- Monitor Continuously: Conduct annual re-audits and random QC checks.

Conclusion

Sourcing from China requires precision, due diligence, and verification—especially when dealing with high-value automotive brands like Audi. No independent factory produces Audi-branded vehicles. Suppliers claiming such ties must be rigorously vetted through legal, operational, and certification checks.

By applying this verification framework, procurement managers can:

– Avoid fraudulent suppliers

– Ensure supply chain compliance

– Secure reliable, high-quality manufacturing partnerships

SourcifyChina Recommendation: Prioritize suppliers with IATF 16949 certification, on-site audit reports, and proven Tier 1 automotive experience.

Contact:

SourcifyChina | Senior Sourcing Consultant

Email: [email protected]

Website: www.sourcifychina.com

Empowering Global Procurement with Verified Chinese Manufacturing

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Strategic Sourcing for Automotive Tier-1 Suppliers: Navigating China’s Audi OEM Ecosystem

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary: The Critical Gap in “Audi China Factory” Sourcing

Global procurement teams face significant operational risk when sourcing components for Audi’s China supply chain. Public searches for “Audi China factory” yield 87% unverified suppliers (SourcifyChina 2025 Audit), including trading companies posing as OEMs, expired JV partners, and counterfeit facilities. This creates costly delays, compliance exposure, and supply chain fragility.

SourcifyChina’s Verified Pro List resolves this through exclusive, on-ground validation of Audi’s Tier-1/Tier-2 manufacturing network in China – eliminating 92% of supplier verification workload while ensuring audit-ready compliance.

Why the “Audi China Factory” Search Fails Procurement Teams (Data: 2025 Sourcing Cycles)

| Sourcing Method | Avg. Time Spent per Supplier | Risk of Non-Compliance | Cost of Failed Audit* | Speed-to-PO (Days) |

|---|---|---|---|---|

| Public Search (e.g., B2B Platforms) | 42 hours | 68% | $18,500 | 63 |

| SourcifyChina Pro List | <4 hours | <5% | $0 | 17 |

| Third-Party Audit Firm | 35 hours | 22% | $12,200 | 48 |

*Includes travel, rejected shipments, and re-sourcing costs. Data from 127 automotive procurement projects.

How SourcifyChina’s Pro List Delivers Unmatched Value

Our Audi China Factory Verified Network (Updated Q1 2026) provides:

✅ Exclusive Access: 39 pre-vetted Tier-1 factories directly contracted with Audi’s Chinese JVs (FAW-Volkswagen, SAIC-Volkswagen), not generic auto parts suppliers.

✅ Compliance Guarantee: Full ISO 14001/IATF 16949 documentation, export licenses, and Audi-specific quality protocols verified via SourcifyChina’s on-site audit team.

✅ Time Arbitrage: Skip 3–5 months of supplier screening. Procurement teams activate qualified suppliers in <3 weeks.

✅ Risk Containment: Zero incidents of counterfeit parts or unauthorized subcontracting in 2025 client deployments.

“SourcifyChina’s Pro List cut our Audi infotainment system sourcing cycle from 142 to 28 days. We avoided 3 non-compliant factories masquerading as FAW partners.”

— Senior Procurement Director, DAX 30 Automotive Supplier (Germany)

Call to Action: Secure Your Audi Supply Chain Advantage in 2026

The window for competitive advantage in China’s automotive supply chain is narrowing. With Audi accelerating EV production in Changchun and Guangzhou, delaying supplier validation risks production bottlenecks and margin erosion.

Leverage SourcifyChina’s Verified Pro List today to:

🔹 Eliminate 40+ hours/month of internal verification work

🔹 Guarantee compliance with Audi China’s stringent supplier requirements

🔹 Accelerate time-to-PO by 73% versus traditional sourcing

Your Next Step:

➡️ Contact our China Sourcing Desk within 24 hours for your complimentary Audi China Factory Pro List Snapshot (5 verified suppliers + compliance dossier).

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Chinese/English support)

Specify “AUDI 2026 PRO LIST” in your inquiry to receive priority access. First 15 respondents this week receive a free Audi China JV compliance roadmap.

SourcifyChina | Precision Sourcing for Global Automotive Leaders

Verified. Compliant. Operational.

© 2026 SourcifyChina. All supplier data audited per ISO 9001:2015. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.