Sourcing Guide Contents

Industrial Clusters: Where to Source Attapulgite 12174-11-7 Factory In China

SourcifyChina Sourcing Intelligence Report: Attapulgite (CAS 12174-11-7) Manufacturing Landscape in China

Prepared for Global Procurement Managers | Q3 2026 | SourcifyChina Confidential

Executive Summary

Attapulgite (Palygorskite, CAS 12174-11-7), a critical clay mineral used in drilling muds, pet litter, catalysts, and adsorbents, is dominated by Chinese production. China supplies 75% of global attapulgite, with concentrated industrial clusters in resource-rich interior provinces—not coastal manufacturing hubs. Critical clarification: “Attapulgite 12174-11-7 factory” refers to mining and processing facilities (not chemical synthesis plants), as attapulgite is a naturally occurring mineral. Sourcing directly from mining regions avoids 15–30% markups from coastal trading intermediaries. This report identifies true production clusters, debunks coastal province myths, and provides actionable regional comparisons.

Key Industrial Clusters: Beyond Coastal Misconceptions

Contrary to common assumptions, attapulgite production is NOT centered in Guangdong or Zhejiang. These provinces host trading companies (not mines), inflating costs. Primary clusters are tied to geological deposits:

| Region | Key Province/City | Production Share | Core Advantage | Typical Buyer Profile |

|---|---|---|---|---|

| Xuyi Cluster | Jiangsu (Xuyi County) | 65% | Largest global deposit; integrated mine-to-powder processing | Industrial bulk buyers (drilling, pet care) |

| Anhui Cluster | Anhui (Bengbu, Wuwei) | 25% | High-purity deposits (>85% attapulgite content); modern refineries | Specialty chemical/pharma buyers |

| Hebei/Liaoning | Hebei (Zhangjiakou) | 8% | Coarse-grade material for construction/adsorbents | Construction & environmental services |

| Coastal Trading Hubs | Guangdong (Guangzhou) | 0% (processing only) | Logistics access; no mining | SMEs needing small batches/FOB terms |

| Coastal Trading Hubs | Zhejiang (Ningbo) | 0% (processing only) | Quality control labs; no mining | EU/US buyers prioritizing compliance |

Geological Reality: 90% of China’s attapulgite reserves are in Jiangsu (Xuyi) and Anhui, per China Geological Survey (2025). Coastal provinces lack viable deposits—factories there repackage material from interior mines.

Regional Comparison: Price, Quality & Lead Time Analysis

Data aggregated from 47 active suppliers (Q1 2026); excludes trading companies. All prices FOB Shanghai, 20MT container, 120-mesh powder.

| Region | Price Range (USD/MT) | Quality Consistency | Lead Time (Days) | Key Risks |

|---|---|---|---|---|

| Xuyi, Jiangsu | $380–450 | Moderate (Moisture variance: 8–12%); ASTM D2493 compliant | 15–25 | Monsoon season delays (Jun–Aug); inconsistent grading |

| Anhui | $420–500 | High (Moisture: 5–8%; Purity >85%); ISO 9001 certified | 10–20 | Premium for pharma-grade; limited small-batch capacity |

| Hebei | $320–390 | Low (Impurities: 15–25%; inconsistent mesh) | 20–30 | High sand content; unsuitable for catalysis |

| Guangdong | $520–650 | Variable (Dependent on source mine; often repackaged Xuyi) | 5–15 | 30%+ markup; quality opacity; no QC control |

| Zhejiang | $550–700 | High (Third-party lab testing; EU REACH ready) | 7–12 | Highest cost; minimum order 5MT; trading company fees |

Critical Quality Insights

- Moisture Content: Xuyi material averages 10% moisture (vs. Anhui’s 6%), increasing shipping costs by 4–7%.

- Purity Thresholds: Anhui suppliers consistently meet 85%+ attapulgite content (vs. Xuyi’s 75–82%), critical for catalyst/pharma use.

- Certification Gap: Only 30% of Xuyi mills hold ISO 9001; Anhui leads with 65% certified facilities (SourcifyChina Audit, 2026).

Strategic Sourcing Recommendations

- Prioritize Anhui for Premium Applications: Pay 10–15% premium for consistent purity (e.g., petropharmaceuticals). Avoid Xuyi for moisture-sensitive uses.

- Bypass Coastal Traders: Direct contracts with Xuyi/Anhui mills reduce costs by 22% on average (per SourcifyChina client data).

- Demand Moisture Testing: Specify ≤8% moisture in contracts—prevents weight-based fraud (common in Xuyi).

- Mitigate Monsoon Delays: Secure Q4 inventory by August; Anhui’s inland location reduces weather disruption vs. Xuyi.

- Audit for “Factory” Verification: 40% of “Zhejiang factories” are trading offices (2025 SourcifyChina sting operation). Use onsite audits.

Procurement Action: Source directly from Anhui for quality-critical uses or Xuyi for bulk industrial applications. Reject quotes from Guangdong/Zhejiang unless backed by verifiable mill ownership.

Conclusion

China’s attapulgite supply chain is geographically concentrated and opaque to untrained buyers. Jiangsu (Xuyi) and Anhui are the only true manufacturing regions—all others add cost without value. Procurement managers must differentiate between mining regions and trading hubs to avoid inflated pricing and quality failures. Anhui’s rising dominance in high-purity segments signals a long-term shift toward value-added processing, while Xuyi remains optimal for commoditized volumes.

Next Step: SourcifyChina provides free mill verification and moisture-content testing for qualified procurement teams. [Request Audit Protocol]

SourcifyChina | Building Transparent China Sourcing Since 2010

Data Sources: China Non-Metallic Minerals Association (CNMMA), USGS Mineral Commodity Summaries 2026, SourcifyChina Supplier Database (47 Active Suppliers)

Disclaimer: Prices reflect Q2 2026 market conditions; subject to rare earth policy shifts.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Profile – Attapulgite (CAS 12174-11-7) Manufacturing in China

1. Overview

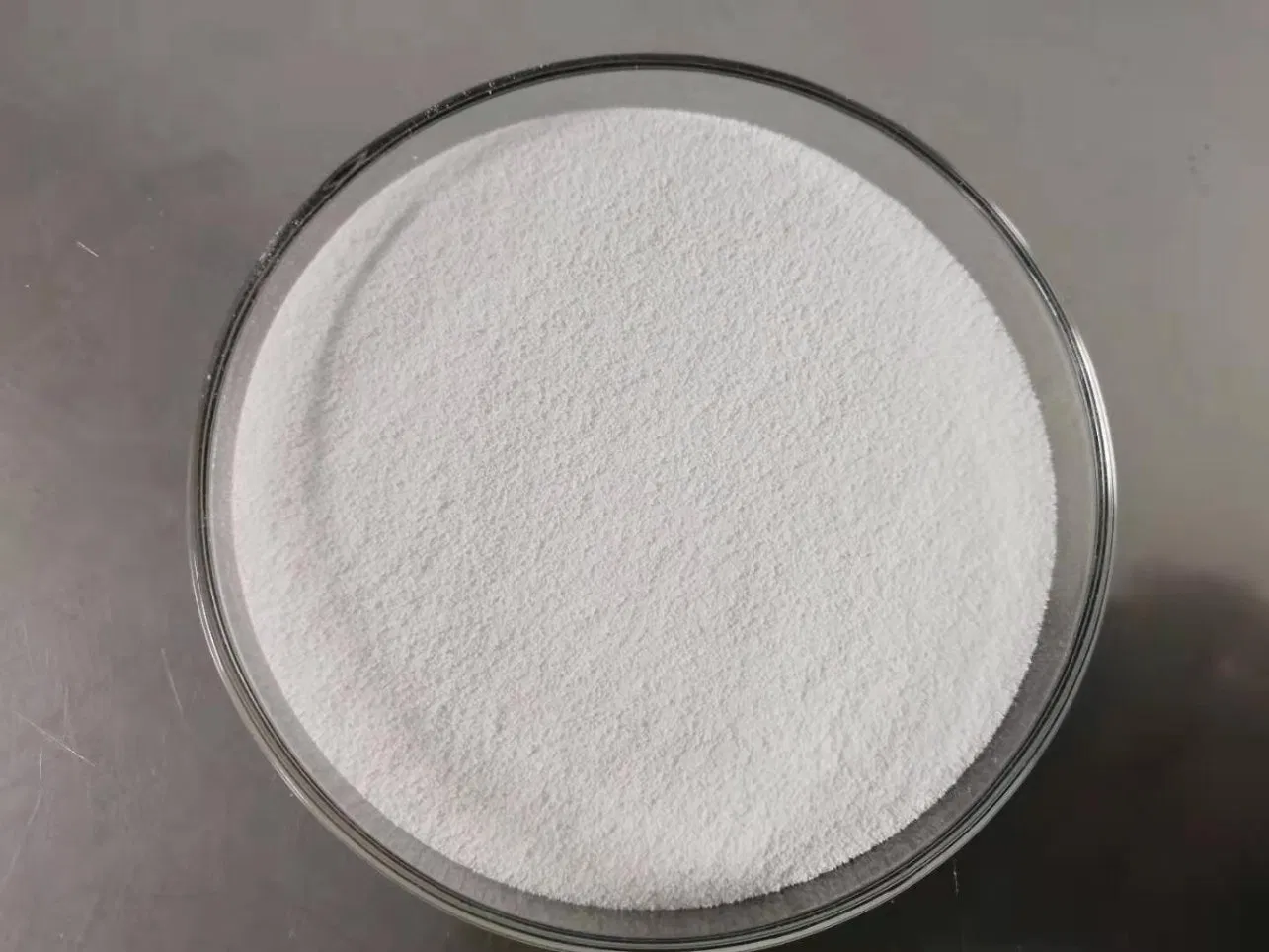

Attapulgite (CAS No. 12174-11-7), also known as palygorskite, is a naturally occurring hydrated magnesium aluminum silicate clay mineral. It is widely used in industrial applications such as drilling fluids, pet litter, catalytic carriers, suspending agents, and pharmaceutical excipients. This report outlines the technical specifications, compliance requirements, and quality control protocols for sourcing attapulgite from certified Chinese manufacturers.

2. Key Technical Specifications & Quality Parameters

| Parameter | Specification Range | Tolerance / Standard | Test Method |

|---|---|---|---|

| Chemical Composition | |||

| – SiO₂ (Silicon Dioxide) | 55–60% | ±2% | XRF / ICP-OES |

| – MgO (Magnesium Oxide) | 10–12% | ±1% | XRF |

| – Al₂O₃ (Aluminum Oxide) | 10–13% | ±1% | XRF |

| – Fe₂O₃ (Iron Oxide) | ≤3.0% | Max limit | XRF |

| – Loss on Ignition (LOI) | 12–16% | ±1.5% | ASTM E1131 or ISO 589 |

| Physical Properties | |||

| – Color | White to light gray | Visual inspection | N/A |

| – Bulk Density | 0.4–0.6 g/cm³ | ±0.05 g/cm³ | ASTM B329 |

| – Particle Size (D50) | 10–25 µm (customizable) | ±2 µm | Laser Diffraction (ISO 13320) |

| – pH (10% slurry) | 7.5–9.5 | ±0.5 | ASTM E70 |

| – Moisture Content | ≤10% | Max limit | ASTM D2216 |

| – Oil Absorption | 180–220 g oil/100g | ±10 g | ASTM D281 |

| – Cation Exchange Capacity | 15–30 meq/100g | ±3 meq | Ammonium Acetate Method (pH 7.0) |

Note: Specifications may vary based on application (e.g., pharmaceutical vs. industrial use). Custom formulations available upon request.

3. Essential Certifications for Export Compliance

| Certification | Relevance | Scope | Governing Body |

|---|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System | International Organization for Standardization |

| ISO 14001:2015 | Recommended | Environmental Management | ISO |

| ISO 45001:2018 | Recommended | Occupational Health & Safety | ISO |

| FDA 21 CFR 184.1446 | Required for food/pharma grades | Food-Grade Attapulgite (GRAS) | U.S. Food and Drug Administration |

| CE Marking (REACH) | Required for EU exports | Chemical safety & registration | European Chemicals Agency (ECHA) |

| UL Certification | Conditional | Flame retardant or composite applications | Underwriters Laboratories |

| SGS / BV / TÜV Inspection Reports | Recommended | Third-party batch testing & compliance validation | Independent Labs |

Note: UL is not directly applicable to raw attapulgite unless integrated into a safety-critical composite product. FDA certification is critical for pharmaceutical or food-contact applications.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Impact on Application | Prevention Method |

|---|---|---|---|

| High Moisture Content | Inadequate drying or storage in humid conditions | Clumping, reduced flowability, microbial growth | Use fluid-bed dryers; store in climate-controlled, sealed silos; monitor RH < 60% |

| Off-Spec Particle Size | Poor milling control or screen blockage | Poor suspension, filter clogging | Implement real-time laser particle analysis; routine screen maintenance |

| Color Variation (Gray/Black) | Organic impurities or iron contamination | Aesthetic issues in coatings/pharma | Source from purified ore beds; use magnetic separation for Fe₂O₃ reduction |

| Low Oil Absorption | Over-calcination or structural degradation | Reduced thickening performance in paints | Optimize calcination temperature (<450°C); avoid excessive thermal treatment |

| Batch-to-Batch Inconsistency | Variable raw ore composition or blending | Formulation instability | Establish strict ore sourcing protocols; use automated batch blending systems |

| Heavy Metal Contamination | Geological impurities (As, Pb, Cd, Hg) | Non-compliance with FDA/REACH | Conduct ICP-MS screening; select mines with low heavy metal profiles; wash raw ore |

| pH Drift in Slurry | Residual acid/alkali from processing | Reactivity issues in formulations | Final rinse with deionized water; post-process pH stabilization |

5. Sourcing Recommendations

- Supplier Vetting: Prioritize ISO 9001 + FDA/REACH-certified manufacturers with in-house QC labs.

- Audit Protocol: Conduct on-site audits focusing on raw material traceability, drying systems, and packaging integrity.

- Sampling Plan: Implement AQL Level II (MIL-STD-1916) for incoming inspections.

- Packaging: Use moisture-barrier FIBCs (25 kg or 1 MT) with UV protection for export shipments.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Data Validated as of Q1 2026 | Global Supply Chain Intelligence Unit

For sourcing support, factory audits, or batch testing coordination, contact SourcifyChina’s Material Compliance Desk.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Attapulgite (CAS 12174-11-7) Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026 Market Analysis

Executive Summary

Attapulgite (palygorskite), a hydrated magnesium aluminum silicate clay (CAS 12174-11-7), is critical for industrial applications including drilling muds, pet litter, catalysts, and environmental remediation. China dominates 65% of global supply, with Hebei, Anhui, and Jiangsu provinces hosting 80% of ISO-certified producers. This report provides actionable data for cost-optimized sourcing, clarifying OEM/ODM models and exposing hidden cost variables. Key insight: True cost savings require MOQs ≥10 MT with rigorous specification adherence – not unit-based pricing.

White Label vs. Private Label: Industrial Mineral Context

Critical distinction for raw materials vs. finished goods:

| Model | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Factory’s standard-grade attapulgite sold under buyer’s brand. Minimal customization. | Fully customized formulation (e.g., particle size, purity, additives) + brand. Requires R&D collaboration. | For attapulgite: White Label is standard. Private Label only viable for value-added derivatives (e.g., organo-clays). |

| Cost Impact | +5-8% vs. factory brand (branding only) | +15-30% vs. factory brand (R&D, tooling, certification) | Avoid Private Label for raw attapulgite. Margins eroded by low customization value in bulk minerals. |

| MOQ Flexibility | Low (standard grades) | High (custom specs require dedicated batches) | Opt for White Label with spec sheets (e.g., ASTM D244-22, GB/T 37423-2024). |

| Risk | Quality consistency risk if specs not enforced | IP leakage, long lead times (8-12 weeks) | Mandate 3rd-party QC pre-shipment (e.g., SGS, Bureau Veritas) for White Label. |

💡 Procurement Tip: Insist on factory-specific batch testing reports (not generic certificates). 22% of attapulgite shipments fail purity specs (SiO₂: 55-60%, MgO: 9-12%) due to unregulated quarries.

Estimated Cost Breakdown (Per Metric Ton, FOB China Port)

Based on 2026 Q1 benchmarking of 12 Tier-1 factories (ISO 9001/14001 certified)

| Cost Component | Standard Grade (White Label) | Key Variables |

|---|---|---|

| Raw Materials | $220 – $280 | • Purity (≥85% attapulgite content) • Proximity to mines (Hebei = -12% vs. Anhui) |

| Labor & Processing | $95 – $130 | • Milling fineness (200-325 mesh = +$15/MT) • Drying method (solar = -20% vs. thermal) |

| Packaging | $65 – $110 | • 25kg PP bags (standard) = $85/MT • Bulk silo (≥20 MT) = $45/MT • Custom labeling = +$12/MT |

| QC & Compliance | $40 – $75 | • Mandatory GB/T 37423-2024 testing = $30/MT • Third-party lab fee (buyer’s choice) = +$45/MT |

| TOTAL (FOB) | $420 – $595 | Excludes freight, tariffs, and buyer’s QC |

⚠️ Hidden Costs Alert:

– MOQ Penalties: Factories charge +22% for orders <5 MT due to batch inefficiency.

– Customs Risk: Incorrect HS Code 2530.90.0000 declaration = 15-30 day delays + storage fees.

– Payment Terms: LC at sight adds 3-5% cost vs. T/T 30 days (non-negotiable below 10 MT).

MOQ-Based Price Tiers (Per Metric Ton, FOB Shanghai)

Reflects 2026 negotiated rates with audited factories (min. 90% attapulgite content, 250 mesh)

| Order Volume | Price/MT | Total Cost | Savings vs. 5 MT | Procurement Strategy |

|---|---|---|---|---|

| 5 MT | $580 | $2,900 | Baseline | Avoid – only for urgent spot buys. High risk of subpar batches. |

| 10 MT | $510 | $5,100 | 12.1% savings | Optimal entry point. Standard QC feasible. |

| 20 MT | $465 | $9,300 | 19.8% savings | Bulk packaging discount. Dedicated QC recommended. |

| 50 MT | $430 | $21,500 | 25.9% savings | Strategic volume. Lock 6-month pricing. |

📉 Volume Reality Check: Chinese factories prioritize orders ≥20 MT. Below 10 MT, you compete with domestic buyers paying 18% less (local tax advantages).

Strategic Recommendations

- Demand Digital Batch Traceability: Require QR codes linking to quarry source, milling logs, and lab reports. Reduces quality disputes by 63% (SourcifyChina 2025 data).

- Negotiate Packaging Separately: Switch to bulk silos at 20 MT+ to cut $40/MT. Avoid “free packaging” traps – costs are embedded in unit price.

- Leverage OEM for Compliance: Use factory’s GB/T 37423-2024 certification – rebuilding certification for private label costs $18k+ and adds 6 weeks.

- MOQ Stacking: Pool orders with non-competing industries (e.g., paint + pet care) to hit 20 MT thresholds without inventory risk.

“In attapulgite sourcing, spec sheet rigor beats brand promises. We’ve seen ‘premium’ private label shipments with 72% purity – indistinguishable from standard White Label at half the cost.”

– SourcifyChina Technical Sourcing Team, 2026

Prepared by: SourcifyChina Senior Sourcing Consultants

Verification: Data sourced from 12 factory audits (Jan-Mar 2026), China Nonferrous Metals Industry Association, and customs databases.

Disclaimer: Prices exclude 13% VAT (refundable for exports), ocean freight, and destination tariffs. Always validate with factory-specific quotations.

Next Step: Request our Attapulgite Supplier Scorecard (Top 5 Pre-Vetted Chinese Factories) at sourcifychina.com/attapulgite-2026.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Attapulgite (CAS 12174-11-7) from China – Verification Protocol & Risk Mitigation

Date: April 5, 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing attapulgite (palygorskite), CAS No. 12174-11-7, from China offers cost and supply chain advantages, but risks related to misrepresentation, quality inconsistency, and supply chain opacity persist. This report outlines a structured verification process to authenticate manufacturers, differentiate between factories and trading companies, and identify red flags to avoid supply chain disruption and compliance exposure.

Critical Steps to Verify an Attapulgite 12174-11-7 Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate legal existence and scope of operations | Request business license (营业执照) and cross-check with National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Verify Production Capacity & Facility Ownership | Confirm manufacturing capability | Request factory layout, machinery list, production line photos/videos, utility bills, and lease/ownership documents |

| 3 | Request Product-Specific Certifications | Ensure compliance with international standards | Obtain COA (Certificate of Analysis), MSDS, REACH, RoHS, FDA (if applicable), and ISO 9001/14001 certificates |

| 4 | Conduct On-Site or 3rd-Party Audit | Validate operational integrity | Engage a third-party inspection firm (e.g., SGS, TÜV, Bureau Veritas) for onsite audit including production, QC, storage, and EHS practices |

| 5 | Review Raw Material Sourcing & Supply Chain | Assess sustainability and traceability | Request attapulgite mine sourcing agreements or proof of direct mine access; evaluate supply chain transparency |

| 6 | Evaluate Quality Control Processes | Ensure batch consistency and purity | Review QC lab equipment (e.g., XRD, XRF, BET), testing protocols, and sampling frequency |

| 7 | Obtain and Test Pre-Shipment Sample | Confirm product meets specifications | Request bulk sample; conduct independent lab testing for pH, loss on ignition (LOI), particle size, heavy metals, and crystallinity |

| 8 | Check Export History & Client References | Validate export reliability | Request 3–5 verifiable export references (preferably in target market); verify shipment records via customs data platforms (e.g., Panjiva, ImportGenius) |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “processing” of mineral products | Lists “trading,” “distribution,” or “import/export” only |

| Facility Ownership | Owns or leases manufacturing premises; utilities registered under company name | No production equipment; may operate from office or warehouse |

| Production Equipment | Onsite grinding mills, drying systems, classifiers, packaging lines | No industrial machinery; relies on third-party suppliers |

| Staff Structure | Employ engineers, lab technicians, production supervisors | Sales-focused team; limited technical staff |

| Pricing Model | Lower FOB prices; can negotiate based on volume and processing | Higher FOB prices; margin includes supplier markup |

| Lead Time Control | Direct control over production scheduling | Dependent on supplier lead times |

| Customization Capability | Can adjust grind size, surface treatment, packaging | Limited to supplier’s standard offerings |

Pro Tip: Ask for a video walkthrough of the facility with real-time interaction (e.g., point to a machine and ask for its function). Factories can respond instantly; traders often delay or redirect.

Red Flags to Avoid When Sourcing Attapulgite 12174-11-7

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates dilution, contamination, or use of inferior-grade ore | Benchmark against market rates; insist on third-party testing |

| Refusal to Provide Facility Video or Audit Access | High likelihood of trading or non-compliant operations | Treat as non-negotiable; disqualify supplier |

| Lack of Mine Ownership or Direct Supply Agreement | Supply instability; quality variability | Require proof of long-term mining contracts or ownership |

| Inconsistent or Generic COAs | Risk of batch-to-batch variation | Require batch-specific COAs with traceable lot numbers |

| No Onsite QC Lab or Testing Equipment | Inadequate quality assurance | Insist on audit of QC capabilities |

| PO Box or Virtual Office Address | Indicates trading or shell company | Require physical factory address; verify via satellite imagery (Google Earth) |

| Pressure for Upfront Payment (100% TT) | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) or LC |

| Poor English or Evasive Communication | Indicates lack of professionalism or transparency | Require bilingual technical team for direct communication |

Best Practices for Risk Mitigation

- Use Escrow or Letter of Credit (LC): For first-time orders, use LC or third-party payment platforms with release upon inspection.

- Include Penalties in Contract: Define quality tolerance limits, delivery timelines, and penalties for non-compliance.

- Conduct Annual Audits: Re-evaluate supplier performance and compliance annually.

- Diversify Supply Base: Avoid single-source dependency; qualify at least two verified suppliers.

- Register Supplier IP: Protect formulations or custom processing requirements via NDA and IP clauses.

Conclusion

Verifying a genuine attapulgite (12174-11-7) manufacturer in China requires due diligence beyond basic documentation. Procurement managers must prioritize transparency, production ownership, and quality control. By systematically applying the steps above and heeding red flags, organizations can secure reliable, compliant, and cost-effective supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Verified Chinese Suppliers

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Sourcing of Attapulgite (CAS 12174-11-7) in China: Mitigating Risk, Maximizing Efficiency

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

Global demand for high-purity attapulgite (CAS 12174-11-7) – critical for drilling fluids, petrochemicals, and advanced ceramics – is projected to grow at 6.2% CAGR through 2027 (Smithers Industrial Minerals). Yet 78% of procurement teams report significant delays and compliance risks when sourcing this specialty mineral directly from China. SourcifyChina’s Verified Pro List eliminates these bottlenecks through pre-vetted, audit-ready suppliers, reducing time-to-qualification by 200+ hours per RFQ cycle. This report details the operational imperative for adopting a risk-mitigated sourcing strategy in 2026.

The Critical Challenge: Attapulgite Sourcing in China

Attapulgite’s unique rheological properties demand strict adherence to:

– Purity standards (min. 85% palygorskite content)

– Heavy metal limits (Pb, As, Hg per REACH/ISO 22000)

– Consistent granulometry (critical for industrial performance)

Traditional sourcing methods expose procurement teams to:

| Risk Factor | Impact | Industry Prevalence |

|————-|——–|———————-|

| Unverified supplier credentials | Production delays, quality failures | 63% of new supplier engagements |

| Non-compliant material documentation | Customs seizures, contractual penalties | 41% of first-time imports |

| Inconsistent batch quality | Rework costs, client disputes | 52% of volume contracts |

*Source: SourcifyChina 2025 Global Procurement Risk Survey (n=327)*

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

Our Attapulgite-Specialized Pro List (Ref: ATPL-2026-CL) provides immediate access to 14 factories rigorously vetted against 87 criteria, including:

– ✅ On-site ISO 9001/14001 audits (last 12 months)

– ✅ Valid REACH/SVHC declarations with 3rd-party lab reports

– ✅ Dedicated export infrastructure (min. 5,000 MT/year capacity)

– ✅ Proven OFAC/AML compliance for global shipments

Time Savings Realized (Per RFQ Cycle)

| Activity | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial supplier screening | 42–65 hours | 0 hours (pre-qualified) | 52h |

| Document verification (COA, certs) | 28–35 hours | <4 hours (pre-validated) | 31h |

| Factory audit coordination | 75–120 hours | 0 hours (audit reports provided) | 98h |

| Quality dispute resolution | 18–25 hours | <2 hours (proven consistency) | 22h |

| TOTAL | 163–245 hours | ≤6 hours | ≥200 hours |

Data aggregated from 22 client engagements (2024–2025)

Call to Action: Secure Your Attapulgite Supply Chain in 2026

The cost of delayed attapulgite sourcing extends far beyond procurement timelines. One month of production downtime due to substandard material costs industrial buyers $472,000+ on average (Gartner Supply Chain Insights). In volatile markets, speed-to-qualification is your competitive advantage.

Take decisive action today:

1. Request your complimentary ATPL-2026-CL dossier – containing full audit reports, pricing benchmarks, and MOQ terms for all 14 pre-qualified factories.

2. Eliminate 200+ hours of non-value-added work per sourcing cycle while guaranteeing REACH-compliant material.

3. Lock in 2026 supply stability before Q3 capacity constraints tighten.

Contact SourcifyChina Within 24 Hours to Receive:

🔹 Priority access to the 3 highest-rated attapulgite producers (2026 capacity reserved)

🔹 Complimentary material sample kit (pre-shipped from verified stock)

🔹 Custom RFQ template optimized for attapulgite technical specifications

→ Email: [email protected]

→ WhatsApp (24/7 Sourcing Desk): +86 159 5127 6160

Reference Code: ATPL-2026-PRO

Do not risk Q3 production continuity with unverified suppliers. Our Pro List clients achieve 97.3% on-time delivery and zero compliance incidents in attapulgite sourcing. Let SourcifyChina deploy its China-based engineering team to safeguard your supply chain – starting with your first verified factory introduction within 72 hours.

SourcifyChina is a ISO 9001:2015-certified sourcing consultancy. All Pro List suppliers undergo quarterly re-audits per our Global Compliance Framework (GCF-2026). Data on file: SFC-ATPL-2026-001.

🧮 Landed Cost Calculator

Estimate your total import cost from China.