The ASIC (Application-Specific Integrated Circuit) computing market has experienced robust growth, driven by rising demand for high-efficiency hardware in blockchain mining, artificial intelligence, and telecommunications. According to Grand View Research, the global ASIC market size was valued at USD 3.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 13.6% from 2023 to 2030. This growth is fueled by increasing adoption of customized semiconductor solutions in data centers and edge computing, as well as sustained interest in cryptocurrency mining amid advancements in energy-efficient chip design. As competition intensifies and innovation accelerates, a select group of manufacturers have emerged as leaders in delivering high-performance, purpose-built ASIC solutions. Based on market presence, technological innovation, and production scale, the following nine companies represent the top players shaping the future of ASIC computing today.

Top 9 Asic Computers Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Faraday Technology Corporation

Domain Est. 2003

Website: faraday-tech.com

Key Highlights: FPGA-Go-ASIC™ Service. • Reliable IC Development Capability • Complete IP & Process Solution • System BOM Cost Reduction • Long-term Supply Commitment. LEARN ……

#2 Terasic Inc.

Domain Est. 2003

Website: terasic.com

Key Highlights: Terasic is the world’s leading designer and vendor. We offer expertise in FPGA/ASIC Design, Board Design and Layout, Device Drivers, and all other support ……

#3 Swindon Silicon Systems

Domain Est. 2011

Website: swindonsilicon.com

Key Highlights: Swindon Silicon Systems is a global leader in the design and supply of automotive and industrial mixed signal ASIC solutions for today’s increasingly connected ……

#4 ASIC Manufacturers

Domain Est. 2011

Website: anysilicon.com

Key Highlights: ASIC Manufacturers is a a group of companies that provide ASIC manufacturing services. An ASIC Manufacturer will consists of a team of engineers who are ……

#5 ASIC Design Services

Domain Est. 1997

Website: system-to-asic.com

Key Highlights: System to ASIC is a world class leader in the design and manufacture of Analog ASIC and Mixed Signal ASIC systems….

#6 EnSilica

Domain Est. 2001

Website: ensilica.com

Key Highlights: Your trusted IC partner for custom asic design and supply and full-flow IC design services with expertise in analog, mixed signal and digital domains….

#7 Alchip Technologies

Domain Est. 2002

Website: alchip.com

Key Highlights: Alchip Joins Arm Total Design Ecosystem. Enhances collaboration on high-performance computing ASIC CPU designs powered by Arm Neoverse Compute Subsystems….

#8 BITMAIN

Domain Est. 2007

Website: bitmain.com

Key Highlights: Looking for crypto mining products? BITMAIN offers hardware and solutions, for blockchain and artificial intelligence (AI) applications. Order now!…

#9 guc

Domain Est. 2011

Website: guc-asic.com

Key Highlights: GUC offers industry-leading, customized ASIC design services tailored for automotive products, covering a wide range of applications such as ADAS, autonomous ……

Expert Sourcing Insights for Asic Computers

H2: 2026 Market Trends for ASIC Computers

The application-specific integrated circuit (ASIC) computing market is poised for significant transformation by 2026, driven by technological advancements, shifting demand across industries, and evolving regulatory landscapes. Below is an analysis of key trends expected to shape the ASIC computer market in 2026:

1. AI and Machine Learning Acceleration

ASICs designed for artificial intelligence (AI) and machine learning (ML) workloads—such as Google’s Tensor Processing Units (TPUs) and custom AI chips from startups and tech giants—are expected to dominate market growth. The increasing demand for efficient, high-performance computing in data centers, autonomous systems, and edge devices will drive investment in specialized AI ASICs. By 2026, these chips are projected to outperform general-purpose GPUs in specific inference and training tasks, particularly in low-latency, power-constrained environments.

2. Growth in Edge Computing

As edge computing expands, especially in IoT, smart cities, and industrial automation, there will be heightened demand for low-power, high-efficiency ASICs. These chips enable real-time data processing closer to the source, reducing latency and bandwidth usage. In 2026, we anticipate widespread deployment of ASICs in edge devices, including sensors, drones, and automotive systems, where reliability and power efficiency are critical.

3. Cryptocurrency and Blockchain Evolution

While cryptocurrency mining has historically driven ASIC demand, the 2026 landscape will depend on regulatory developments and shifts in consensus mechanisms (e.g., Ethereum’s transition to proof-of-stake). However, ASICs will remain relevant for mining proof-of-work coins like Bitcoin. Additionally, blockchain infrastructure beyond mining—such as verification and transaction processing—may create new niches for secure, high-throughput ASIC solutions.

4. Semiconductor Supply Chain Diversification

Geopolitical tensions and supply chain disruptions have prompted efforts to regionalize semiconductor manufacturing. By 2026, increased investment in domestic fabrication (e.g., U.S. CHIPS Act, EU semiconductor initiatives) could boost ASIC production capacity outside of traditional hubs in Asia. This shift may improve supply resilience and reduce lead times for custom ASIC development.

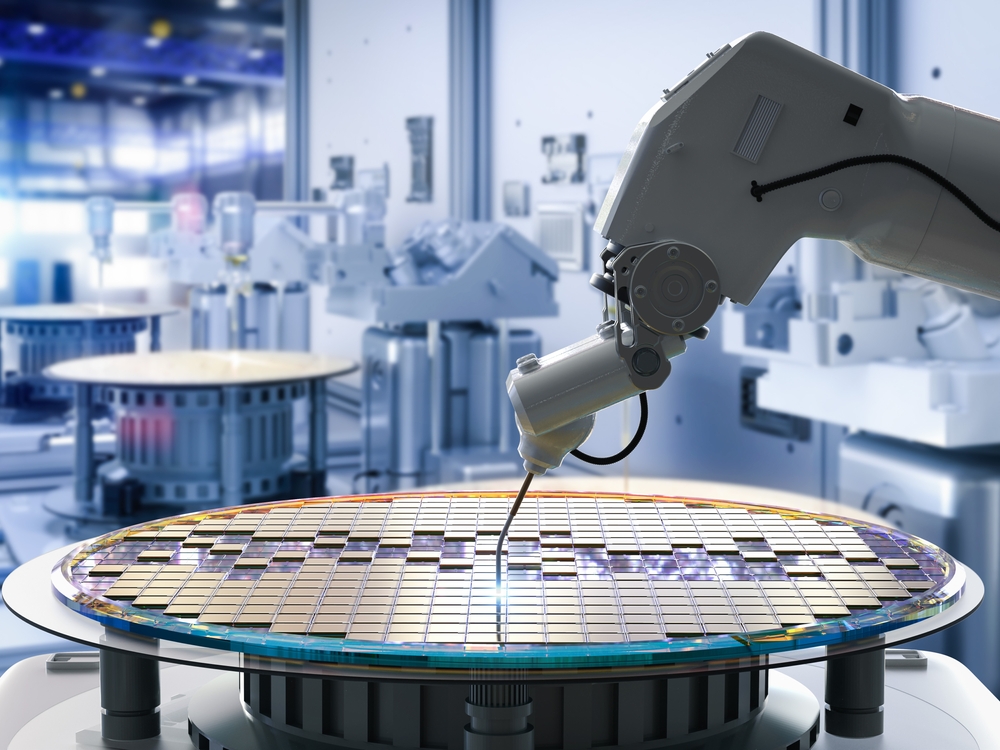

5. Advancements in Process Technology

The migration to advanced nodes (e.g., 3nm and below) will enable more powerful and energy-efficient ASICs. Leading foundries like TSMC and Samsung are expected to refine these processes by 2026, allowing designers to integrate greater functionality into smaller footprints. This will be particularly impactful for mobile, wearable, and high-performance computing applications.

6. Rising Demand for Customization and Time-to-Market Pressure

Enterprises across healthcare, automotive, and telecommunications are increasingly adopting custom ASICs to gain competitive advantages in performance and power efficiency. However, high design costs and long development cycles remain barriers. In response, the market will see growth in modular design platforms, reusable IP blocks, and FPGA-to-ASIC conversion services to accelerate time-to-market.

7. Sustainability and Energy Efficiency Focus

With growing scrutiny on data center energy consumption and e-waste, ASIC manufacturers will prioritize energy-efficient designs and recyclable materials. In 2026, energy-per-computation will be a key differentiator, especially in AI and edge applications. Green computing standards may influence procurement decisions, favoring vendors with strong sustainability commitments.

Conclusion

By 2026, the ASIC computer market will be characterized by specialization, efficiency, and integration across emerging technologies. AI, edge computing, and advanced manufacturing will be primary growth drivers, while sustainability and supply chain resilience will shape competitive strategies. Companies that innovate rapidly, leverage modular design approaches, and align with global technological and regulatory trends will be best positioned to succeed in this dynamic landscape.

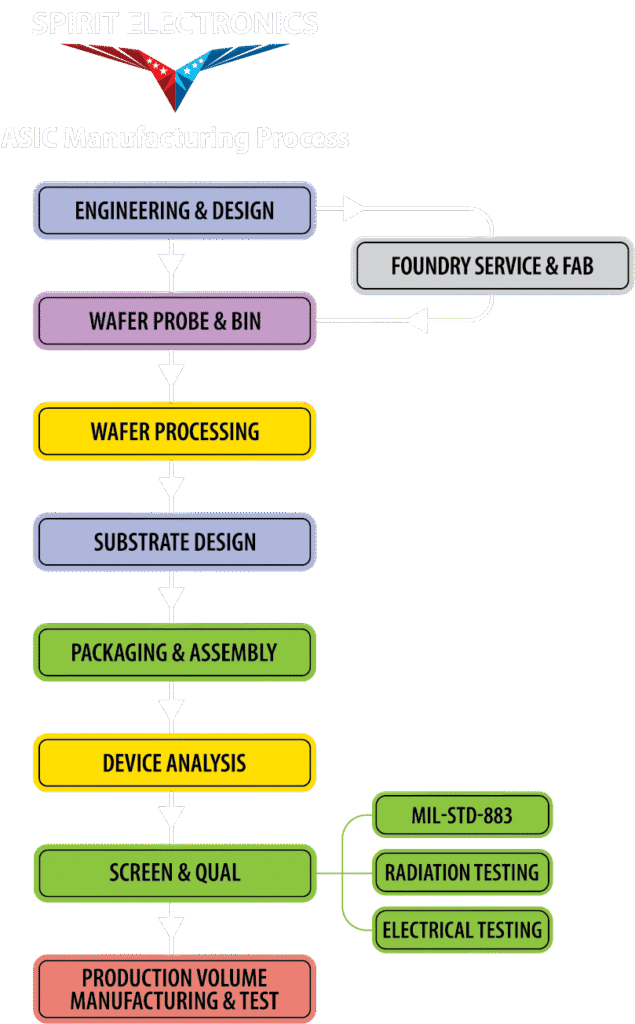

Common Pitfalls When Sourcing ASIC Computers: Quality and Intellectual Property Risks

Sourcing Application-Specific Integrated Circuit (ASIC) computers—whether for cryptocurrency mining, AI acceleration, networking, or other specialized computing tasks—involves navigating complex technical, legal, and supply chain challenges. Two critical areas where organizations frequently encounter problems are quality assurance and intellectual property (IP) protection. Failing to address these properly can lead to project delays, financial losses, legal disputes, and reputational damage.

Quality-Related Pitfalls

-

Insufficient Vendor Due Diligence

Many organizations source ASICs from third-party manufacturers or contractors without thoroughly vetting their capabilities, track record, or manufacturing processes. This can result in substandard components that fail prematurely or underperform relative to specifications. Red flags include lack of transparency in fabrication processes, inconsistent testing protocols, or absence of certifications (e.g., ISO 9001). -

Inadequate Testing and Validation

ASICs require rigorous testing under real-world conditions. Buyers often assume performance claims made by suppliers without independent validation. This includes overlooking thermal performance, power efficiency under load, and long-term reliability. Without burn-in testing or comprehensive functional verification, defective units may go undetected until deployment. -

Reliance on Obsolete or Counterfeit Components

In the secondary market, there’s a risk of receiving outdated, refurbished, or counterfeit ASICs passed off as new. This is especially prevalent with in-demand hardware like Bitcoin mining ASICs. Counterfeits may underperform, overheat, or fail quickly, leading to operational disruptions and safety hazards. -

Poor Thermal and Power Management Design

ASIC systems generate significant heat and require robust thermal and power delivery solutions. Sourcing systems without proper engineering integration—such as inadequate heatsinks, cooling systems, or inefficient power supplies—leads to reduced lifespan and increased failure rates. -

Lack of Firmware and Driver Support

High-quality ASIC computers require mature, secure, and upgradable firmware. Some vendors provide minimal software support, leaving users vulnerable to bugs, security flaws, or obsolescence. Poorly documented APIs or closed-source firmware can hinder integration and maintenance.

Intellectual Property-Related Pitfalls

-

Unclear IP Ownership and Licensing

When sourcing custom ASICs, it’s essential to clarify who owns the design IP—the client, the design house, or the foundry. Ambiguity in contracts can result in shared or lost rights, preventing future modifications, resales, or manufacturing. Always ensure that IP transfer or exclusive licensing terms are explicitly defined. -

Risk of IP Theft or Leakage

Sharing ASIC design files (e.g., GDSII layouts) with overseas manufacturers or untrusted partners increases the risk of IP theft. Unsecured design data can be copied and used to produce knockoff chips. Mitigation includes using trusted foundries, NDAs, watermarking designs, and limiting data access. -

Use of Third-Party IP Without Proper Licensing

ASIC designs often incorporate third-party IP blocks (e.g., processors, interfaces). Sourcing from a vendor who uses unlicensed IP exposes the buyer to legal liability for infringement. Conduct IP audits and require vendors to certify that all embedded IP is properly licensed. -

Geopolitical and Export Control Risks

Certain ASIC technologies—especially those used in defense, surveillance, or high-performance computing—are subject to export controls (e.g., U.S. EAR or ITAR). Sourcing from jurisdictions with lax IP enforcement or under sanctions can result in legal penalties and supply chain disruptions. -

Inadequate Protection of Custom Designs

Buyers may fail to patent or otherwise protect their ASIC innovations. Without proper legal safeguards, competitors can reverse-engineer and replicate the hardware, eroding competitive advantage. Ensure designs are protected through patents, trade secrets, or other IP mechanisms before manufacturing.

Conclusion

To avoid these pitfalls, organizations must implement strong vendor qualification processes, demand full transparency in manufacturing and IP licensing, conduct independent quality assurance testing, and secure legal protections for their designs. Engaging experienced legal counsel and technical advisors during the sourcing process is crucial to ensuring both the quality and IP integrity of ASIC computing systems.

Logistics & Compliance Guide for ASIC Computers

ASIC (Application-Specific Integrated Circuit) computers, particularly those designed for cryptocurrency mining, present unique logistical and regulatory challenges due to their high power consumption, heat output, specialized nature, and evolving legal landscape. This guide outlines key considerations for businesses involved in the import, export, distribution, and operation of ASIC mining hardware.

Import and Export Regulations

Compliance with international trade laws is essential when shipping ASIC computers across borders. Export controls may apply depending on the destination country and the technical specifications of the devices. For example, certain high-performance ASICs could fall under dual-use regulations (items that can be used for both civilian and military applications), especially if they meet certain computational thresholds. Always verify whether export licenses are required under regimes such as the U.S. Export Administration Regulations (EAR) or the EU Dual-Use Regulation. Additionally, import duties, value-added taxes (VAT), and customs documentation must be accurately completed to avoid delays or penalties.

Power and Environmental Compliance

ASIC miners consume significant amounts of electricity and generate substantial heat, which raises environmental and infrastructure concerns. Operators must ensure compliance with local electrical codes and building safety standards. This includes proper ventilation, fire suppression systems, and stable power supply infrastructure. In regions with strict energy regulations or carbon emission goals, large-scale mining operations may require environmental impact assessments or special permits. Some jurisdictions have implemented carbon taxes or energy efficiency standards that could affect operational costs and feasibility.

Product Certification and Safety Standards

ASIC computers must meet applicable product safety and electromagnetic compatibility (EMC) standards to be legally sold in most markets. In the European Union, for instance, devices must carry the CE mark, indicating conformity with health, safety, and environmental protection standards. In the United States, compliance with FCC Part 15 regulations for unintentional radiators is typically required. These certifications ensure that the equipment does not interfere with other electronic devices and operates safely under normal conditions. Manufacturers and importers are responsible for obtaining and maintaining these certifications.

Tax and Financial Reporting

The sale and use of ASIC mining equipment can have complex tax implications. Businesses must track capital expenditures, depreciation schedules, and potential tax incentives related to energy-efficient equipment. In some countries, cryptocurrency mining is classified as a taxable business activity, requiring accurate reporting of income and expenses. Additionally, Value Added Tax (VAT) or Goods and Services Tax (GST) may apply to the sale of ASIC hardware, depending on the jurisdiction. Consult with tax professionals to ensure compliance with local and international financial regulations.

Jurisdictional Legal Considerations

The legality of cryptocurrency mining—and by extension, the use of ASIC computers—varies widely across countries. While some nations welcome mining operations with incentives, others have imposed outright bans or restrictive regulations. Before deploying or shipping ASIC hardware, verify the legal status of cryptocurrency mining in the target jurisdiction. Regulatory risks include potential future bans, restrictions on energy usage for mining, or requirements for operator licensing. Staying informed about legislative developments is critical to long-term compliance.

Supply Chain and Inventory Management

Due to high demand and rapid technological turnover, managing the supply chain for ASIC computers requires careful planning. Lead times from manufacturers can be long, and models quickly become obsolete as more efficient versions are released. Maintain transparent relationships with suppliers, monitor shipment timelines, and consider inventory turnover rates. Additionally, plan for secure storage and transportation, as ASIC units are high-value items susceptible to theft or damage during transit.

End-of-Life and E-Waste Disposal

ASIC computers have a limited operational lifespan, typically 2–4 years, after which they become inefficient or obsolete. Responsible end-of-life management is crucial to comply with e-waste regulations such as the EU’s WEEE Directive or similar laws in other regions. These regulations often require producers or importers to fund the recycling or safe disposal of electronic equipment. Implement take-back programs or partner with certified e-waste recyclers to ensure environmentally sound disposal practices.

Cybersecurity and Firmware Compliance

ASIC mining devices run specialized firmware that can be vulnerable to malware or unauthorized modifications. Ensure that all firmware is sourced from trusted providers and kept up to date. Some jurisdictions may have cybersecurity regulations requiring manufacturers to follow secure development practices or report vulnerabilities. Additionally, avoid distributing or using firmware that enables illegal activities, such as mining on hijacked networks or bypassing hardware restrictions.

By proactively addressing these logistics and compliance issues, businesses can minimize risks, avoid legal penalties, and operate ASIC computer deployments efficiently and responsibly. Regular consultation with legal, tax, and regulatory experts is strongly recommended to adapt to the evolving global landscape.

In conclusion, sourcing ASIC (Application-Specific Integrated Circuit) computers requires careful consideration of factors such as hash rate efficiency, power consumption, cost, availability, and manufacturer reputation. Due to their specialized design for specific cryptographic algorithms, ASICs offer unmatched performance for tasks like cryptocurrency mining compared to general-purpose hardware. However, their high upfront cost, rapid obsolescence, and market volatility necessitate a strategic and informed purchasing approach. Buyers should evaluate long-term profitability, consider second-hand units cautiously, and stay updated on regulatory and technological trends. Ultimately, successful sourcing of ASIC computers hinges on balancing performance, reliability, and cost-effectiveness to meet specific operational goals in a competitive and evolving landscape.