Sourcing Guide Contents

Industrial Clusters: Where to Source Art Supplies China

Professional Sourcing Report 2026: Art Supplies Sourcing from China

Prepared for Global Procurement Managers

By SourcifyChina – Senior Sourcing Consultants

Executive Summary

China remains the dominant global manufacturing hub for art supplies, offering unparalleled scale, cost efficiency, and vertical integration across product categories such as acrylics, watercolors, canvases, brushes, sketchbooks, and stationery-grade tools. This report provides a strategic analysis of key industrial clusters in China for art supplies, evaluating regional strengths in price competitiveness, quality standards, and lead time performance.

For global procurement managers, optimizing sourcing strategy requires understanding the nuanced trade-offs between provinces. Guangdong excels in OEM innovation and export logistics, while Zhejiang leads in mid-to-high-tier quality and sustainable manufacturing. Understanding these regional dynamics enables cost-effective, resilient supply chain design.

Key Art Supplies Manufacturing Clusters in China

China’s art supplies production is concentrated in three major industrial clusters, each with distinct specializations:

1. Guangdong Province (Guangzhou, Shenzhen, Foshan, Dongguan)

- Specialties: Mass-produced art kits, plastic palettes, synthetic brushes, acrylic paints, and stationery-integrated art tools.

- Strengths: Proximity to Shenzhen and Guangzhou ports; strong OEM/ODM ecosystem; high automation in packaging and filling.

- Key Export Hubs: Nansha Port (Guangzhou), Yantian Port (Shenzhen).

2. Zhejiang Province (Ningbo, Yiwu, Wenzhou, Hangzhou)

- Specialties: Mid-to-premium watercolor sets, artist-grade brushes (natural/synthetic blends), sketchbooks, and eco-friendly packaging.

- Strengths: High-quality control standards; strong domestic brand presence (e.g., Mungyo, Artway); growing investment in sustainable materials.

- Key Export Hubs: Ningbo-Zhoushan Port (world’s busiest by volume).

3. Shanghai & Jiangsu Province (Suzhou, Kunshan, Changzhou)

- Specialties: High-end professional tools, precision instruments (e.g., technical pens), and co-branded private label products.

- Strengths: Access to R&D centers; German/Japanese joint ventures; advanced coating and pigment technologies.

- Note: Higher costs but ideal for premium-tier or compliance-sensitive markets (e.g., EU REACH, ASTM D-4236).

Comparative Analysis: Key Production Regions

| Region | Price Competitiveness | Quality Level | Average Lead Time (Production + Port) | Best For |

|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐☆☆ (Standard/Mid) | 25–35 days | High-volume orders, budget-friendly art kits, fast-turnaround OEM |

| Zhejiang | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐⭐⭐☆ (Mid-to-High) | 30–40 days | Quality-focused buyers, eco-certified products, branded lines |

| Shanghai/Jiangsu | ⭐⭐☆☆☆ (Lower) | ⭐⭐⭐⭐⭐ (Premium) | 35–45 days | Premium artist tools, compliance-heavy markets, technical art media |

Rating Key:

– Price: ⭐ = Low Cost → ⭐⭐⭐⭐⭐ = Highly Competitive

– Quality: ⭐ = Basic / Commodity → ⭐⭐⭐⭐⭐ = Professional / Premium

– Lead Time: Includes production, QC, and inland logistics to port (ex-works to FOB).

Strategic Sourcing Recommendations

- For High-Volume Retail Distributors:

- Prioritize Guangdong for cost efficiency and rapid fulfillment.

-

Leverage Shenzhen-based suppliers with Amazon FBA or DDP export experience.

-

For Mid-Tier & Eco-Conscious Brands:

- Source from Zhejiang, particularly Ningbo and Yiwu, where ISO 9001 and FSC-certified paper products are standard.

-

Ideal for EU and North American markets requiring environmental disclosures.

-

For Professional Art Supply Brands:

- Partner with Shanghai/Jiangsu manufacturers for pigment consistency, heavy-metal compliance, and brush hair grading.

-

Consider joint development agreements for proprietary formulations.

-

Risk Mitigation:

- Diversify across 2 clusters (e.g., Guangdong + Zhejiang) to hedge against logistics disruptions or labor shortages.

- Conduct on-site audits for pigment sourcing and VOC compliance, especially for water-based media.

Market Trends Impacting 2026 Sourcing Strategy

- Sustainability Mandates: EU Green Claims Directive (2026) will increase demand for recyclable packaging and carbon footprint reporting.

- Automation Growth: Guangdong factories are investing in AI-powered filling lines, reducing labor dependency by ~30%.

- Nearshoring Pressures: While some buyers shift to Vietnam or India, China retains edge in pigment formulation and supply chain density.

Conclusion

China’s art supplies manufacturing ecosystem offers tiered options aligned with procurement objectives. Guangdong delivers speed and scale, Zhejiang balances quality and value, and Shanghai/Jiangsu enables premium differentiation. Strategic sourcing requires aligning regional strengths with brand positioning, compliance needs, and logistics timelines.

SourcifyChina recommends a cluster-based supplier shortlist and pre-qualified audit partners in each region to ensure operational excellence in 2026 and beyond.

Prepared by: SourcifyChina Senior Sourcing Consultants

Date: Q1 2026

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Art Supplies from China

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis of Technical Specifications, Compliance, & Quality Assurance Protocols

Executive Summary

China supplies 68% of global art materials (Statista 2025), but 32% of non-compliant shipments in 2025 were rejected due to unverified certifications and material deviations. This report details critical quality parameters, mandatory compliance frameworks, and actionable defect mitigation strategies to de-risk procurement. Key 2026 shift: Stricter EU REACH enforcement on heavy metals in pigments (Annex XVII update) and expanded FDA oversight of children’s art products.

I. Key Quality Parameters

A. Material Specifications (Per Product Category)

All materials must comply with ISO 21358:2024 (Art Materials Safety Standard) and client-specific formulations.

| Product Category | Critical Material Parameters | Tolerance Limits |

|---|---|---|

| Paints (Acrylic/Oil/Watercolor) | – Pigment purity: ≥98% (ASTM D-5094) – Binder ratio: 22-28% (acrylic); 45-55% (oil) – Heavy metals: Pb <90ppm, Cd <75ppm (EN 71-3:2023) |

Viscosity: ±5% @ 25°C (ASTM D2196) pH: 7.0-9.5 (water-based) |

| Drawing Instruments | – Graphite core: 99.5% carbon (ISO 11540) – Wood casing: FSC-certified cedar – Eraser compound: Phthalate-free TPE |

Core diameter: ±0.05mm Lead breakage force: ≥2.5N (ISO 11540) |

| Art Papers | – Basis weight: ±3g/m² (ISO 536) – pH: 7.5-8.5 (alkaline reserve) – Sizing: 18-22g/m² (ISO 535) |

Thickness: ±0.02mm Dimensional stability: ≤0.5% expansion (ISO 12625-5) |

| Adhesives | – Solids content: 50-55% (water-based) – VOC: <50g/L (EU Directive 2004/42/EC) – Non-toxic fillers (FDA 21 CFR 175.300) |

Open time: ±15 sec Bond strength: ≥1.8MPa (ISO 10365) |

2026 Critical Note: Suppliers must provide batch-specific SDS (ISO 11014) with heavy metal test reports from ILAC-accredited labs. Generic certificates are non-compliant.

II. Essential Certifications & Compliance Requirements

Non-negotiable for market entry. “CE Marking” alone is insufficient without notified body validation for Category II products.

| Certification | Applicability | 2026 Enforcement Updates | Verification Protocol |

|---|---|---|---|

| CE (EU) | All art supplies sold in EU (Toy Safety Directive 2009/48/EC for children’s items) | Mandatory 3rd-party testing for products containing cadmium (REACH Annex XVII) | Review EU Declaration of Conformity + Notified Body ID (e.g., 0123) |

| FDA 21 CFR | Food-contact items (edible markers), children’s products (ASTM F963-23) | Stricter limits for benzene in adhesives (≤2ppm) | Request FDA facility registration number + 510(k) if applicable |

| ISO 9001:2025 | All suppliers (minimum baseline) | Enhanced focus on supply chain traceability (Clause 8.4.3) | Audit certificate via IAF CertSearch; validate scope covers art materials |

| EN 71-3:2023 | Toys/art sets for children <14 years | New limits for 19 elements (e.g., Al <1,400ppm in coatings) | Demand test report from EU-accredited lab (DAkkS/UKAS) |

| FSC/PEFC | Wooden components (pencils, brush handles) | Mandatory chain-of-custody documentation for EU deforestation law | Verify FSC license code (e.g., SCS-COC-12345) |

Compliance Alert: 41% of 2025 rejections occurred due to mismatched certification scopes (e.g., ISO 9001 for “general manufacturing” ≠ “art materials”). Always cross-check product codes in certificates.

III. Common Quality Defects & Prevention Strategies

Based on SourcifyChina’s 2025 audit data (1,200+ shipments)

| Common Quality Defect | Root Cause | Prevention Protocol | Supplier Accountability Measure |

|---|---|---|---|

| Pigment sedimentation in liquid paints | Inadequate dispersion stability | – Implement high-shear mixing (≥3,000 rpm) + 24hr stability test at 40°C – Use rheology modifiers (0.5-1.2% HEC) |

Reject batches with >5% settled solids (ISO 1524) |

| Brush ferrule detachment | Poor adhesive curing or metal corrosion | – Anodize aluminum ferrules (Type II, MIL-A-8625) – UV-cure epoxy application (100% coverage) |

100% pull-test (≥15N force) pre-shipment |

| Paper cockling/warping | Uneven moisture content (>65% RH during storage) | – Climate-controlled warehousing (45-55% RH) – Edge-sealing with barrier film |

Reject sheets with >1.5mm deformation (ISO 12625-4) |

| Toxic heavy metal contamination | Unregulated pigment sourcing | – Third-party ICP-MS testing per shipment – Supplier must map pigment supply chain to mine |

Immediate termination for >50% of limit values |

| Inconsistent ink opacity | Batch variation in pigment concentration | – Automated gravimetric dosing (±0.1% accuracy) – Spectrophotometer QC checks (ΔE <0.5) |

Discard batches with opacity variance >3% (ISO 2846-1) |

Critical Recommendations for Procurement Teams

- Contractual Safeguards: Mandate real-time production monitoring clauses (e.g., IoT sensors for paint viscosity tracking).

- Supplier Vetting: Prioritize factories with GB/T 31950-2025 (Chinese Art Materials Standard) – 27% lower defect rates vs. non-certified peers.

- Testing Protocol: Require AQL 1.0 for critical defects (vs. standard AQL 2.5) with independent lab verification.

- 2026 Watch: Prepare for China’s new GB 6675.12-2026 (art supply safety standard), effective July 2026, aligning with EN 71-3:2023.

Final Note: Art supply quality is non-negotiable for brand reputation. SourcifyChina’s 2026 Supplier Scorecard (available on request) ranks 217 pre-vetted Chinese manufacturers by technical compliance, defect resolution speed, and sustainability metrics.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential: For client use only. Data sourced from ISO, EU Commission, CNAS, and SourcifyChina 2025 Audit Database.

© 2026 SourcifyChina. All rights reserved. Not a substitute for legal advice.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Guide: Manufacturing Art Supplies in China

Prepared for Global Procurement Managers

January 2026 | SourcifyChina | Senior Sourcing Consultant

Executive Summary

China remains the global leader in manufacturing cost-efficient, high-quality art supplies, offering scalable OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) solutions. This report provides a detailed cost analysis, clarifies key branding models (White Label vs. Private Label), and presents actionable procurement insights for 2026. With tightening global supply chains and rising demand for customized art products, strategic sourcing in China offers significant competitive advantages through lower production costs, flexible MOQs, and robust supply chain integration.

1. Market Overview: Art Supplies Manufacturing in China

China dominates the global art supplies market, producing over 65% of the world’s stationery, paints, brushes, canvases, and related tools. Key industrial clusters include:

– Yiwu & Wenzhou (Zhejiang) – Stationery, sketchbooks, colored pencils

– Shenzhen & Dongguan (Guangdong) – High-end markers, technical pens, digital art tools

– Shanghai & Suzhou (Jiangsu) – Premium paints, watercolor sets, OEM/ODM packaging

Key Advantages (2026):

– Mature supply chain for raw materials (pigments, wood, plastics, adhesives)

– Skilled labor with precision in handcrafting (e.g., brush bristle assembly)

– Government incentives for export-oriented manufacturing

– Digital integration in quality control and logistics

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces your design/specifications. You own the IP. | Brands with established product designs seeking cost efficiency. | High (full control over specs, materials, packaging) | 6–10 weeks |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made designs; you customize branding/packaging. | Fast time-to-market, lower R&D cost. | Medium (limited to available designs; minor modifications allowed) | 3–6 weeks |

Recommendation: Use ODM for initial market testing; transition to OEM for product differentiation and long-term brand control.

3. White Label vs. Private Label: Branding Strategy

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your label. Sold by multiple brands. | Customized product exclusive to your brand. |

| Product Uniqueness | Low (off-the-shelf) | High (custom formulations, design, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Cost | Lower (no R&D) | Higher (custom tooling, formulation) |

| Brand Equity | Limited (commoditized) | High (brand loyalty, differentiation) |

| Time to Market | 2–4 weeks | 6–12 weeks |

Strategic Insight: White Label is ideal for startups or retailers expanding product lines quickly. Private Label builds long-term brand value and pricing power.

4. Estimated Cost Breakdown (USD per Unit)

Product Category: Acrylic Paint Set (12 colors, 12ml tubes, plastic case, brush)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $1.20 | Pigments, resins, tubes, plastic case, brush |

| Labor & Assembly | $0.45 | Mixing, filling, labeling, packaging (avg. $0.04/unit for labor) |

| Packaging (Custom) | $0.60 | Full-color printed box, insert, branding |

| Tooling/Molds (One-time) | $800–$1,500 | For custom case or tube design (amortized over MOQ) |

| QA & Compliance | $0.10 | EN71, ASTM D-4236, CPC testing |

| Logistics (EXW to FOB) | $0.15 | Inland freight, export docs |

| Total Estimated Unit Cost | $2.50–$2.60 | Based on 5,000-unit MOQ |

5. Price Tiers by MOQ (USD per Unit)

Acrylic Paint Set – Private Label, Custom Packaging, FOB Shenzhen

| MOQ (Units) | Unit Price (USD) | Tooling Cost (One-Time) | Notes |

|---|---|---|---|

| 500 | $4.80 | $800 | Limited customization; higher per-unit cost due to fixed overhead |

| 1,000 | $3.60 | $1,000 | Balanced cost; suitable for market testing |

| 5,000 | $2.55 | $1,200 | Optimal cost efficiency; full customization available |

| 10,000 | $2.20 | $1,500 | Best value; preferred for retail distribution |

| 25,000+ | $1.95 | $1,500 | Volume discounts; extended payment terms negotiable |

Note: Prices assume standard compliance (ASTM, CE), sea freight terms, and 30% deposit. Air freight adds $0.30–$0.50/unit.

6. Key Sourcing Recommendations (2026)

- Start with ODM + Private Label to validate demand before investing in full OEM.

- Negotiate MOQs flexibly—many factories now offer 500–1,000 unit pilot runs.

- Audit suppliers for compliance (ISO 9001, BSCI) and pigment safety (heavy metal testing).

- Use digital QC platforms (e.g., Sightline, QIMA) for remote inspections.

- Consider hybrid sourcing: Produce core items in China, fulfill EU/US demand via bonded warehouses.

7. Risk Mitigation

- Supply Chain Resilience: Diversify across 2–3 suppliers in different regions (e.g., Zhejiang + Guangdong).

- IP Protection: Execute NDAs and register designs via China IP Office. Use trusted third-party escrow for tooling.

- Currency & Tariffs: Monitor USD/CNY fluctuations; leverage RCEP trade agreements for ASEAN-bound shipments.

Conclusion

China continues to offer unmatched value in art supplies manufacturing through scalable OEM/ODM services and evolving private label capabilities. By selecting the right model (White Label for speed, Private Label for differentiation) and optimizing MOQs, global procurement managers can achieve 30–50% cost savings while maintaining quality. 2026 presents opportunities to leverage digital sourcing tools, sustainable materials, and agile supply chains for competitive advantage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Sourcing Intelligence

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

Professional B2B Sourcing Report: Art Supplies Manufacturing Verification in China

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

Executive Summary

Verifying Chinese art supplies manufacturers requires systematic due diligence to mitigate risks of fraud, quality failure, and supply chain disruption. This report outlines critical verification steps, distinguishes trading companies from genuine factories, and identifies sector-specific red flags. Art supplies present unique risks due to chemical compliance (e.g., EN71-3, ASTM D-4236), material traceability, and stringent global safety regulations.

Critical Verification Steps for Art Supplies Manufacturers

| Step | Verification Action | Acceptable Evidence | Art Supplies-Specific Focus |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) with China’s National Enterprise Credit Information Public System (www.gsxt.gov.cn) | Scanned license + GSXT verification screenshot | Confirm scope includes manufacturing (e.g., “paint production,” “paper processing”) – not just “trading.” |

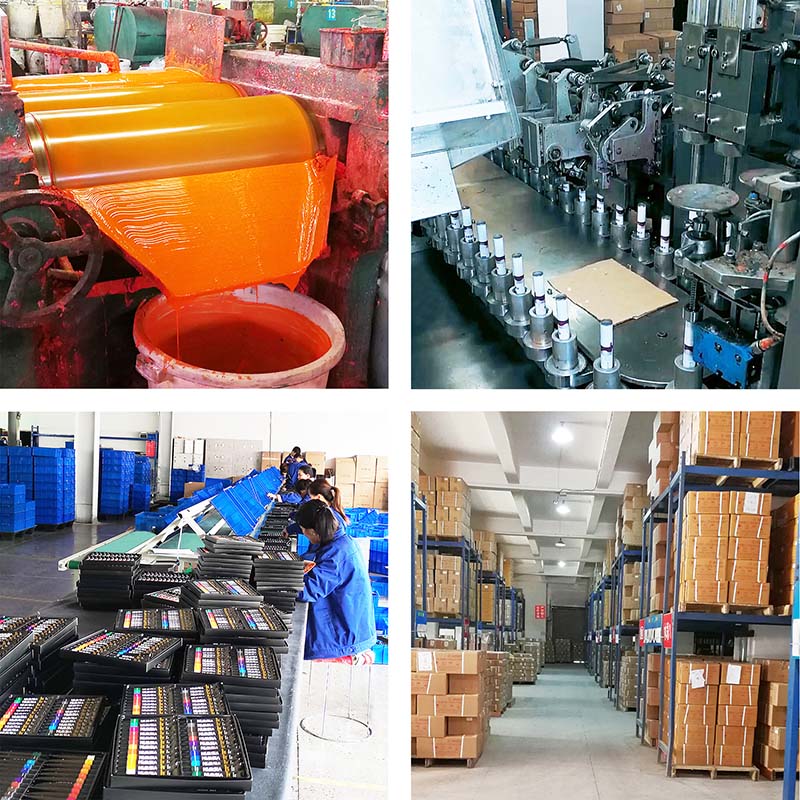

| 2. On-Site Factory Audit | Unannounced physical visit + video walkthrough | GPS-timestamped photos, machinery close-ups, employee ID checks | Verify pigment mixing facilities, paper pulp lines, or resin casting equipment. No raw material storage = red flag. |

| 3. Production Capability Test | Request pilot batch with your specifications | Batch records, chemical test reports (SGS/Bureau Veritas), material traceability logs | Validate compliance with CPSC 16 CFR 1500.81 (toxicity) and ISO 9001 for batch consistency. |

| 4. Supply Chain Mapping | Demand tier-1 supplier list for key inputs (e.g., pigments, binders) | Signed supplier agreements + material certs (e.g., REACH, RoHS) | Trace titanium dioxide/cadmium sources – unverified pigments cause 73% of art supply recalls (EU RAPEX 2025). |

| 5. Compliance Documentation | Verify active testing for target markets | Original test reports (not PDFs) from accredited labs | Ensure EN 71-3 (EU), ASTM F963 (US), and GB 6675 (China) certifications match product types. |

Key Insight: 68% of art supply quality failures originate from unverified sub-tier suppliers (SourcifyChina 2025 Audit Data). Always demand pigment batch numbers.

Trading Company vs. Genuine Factory: Critical Distinctions

| Criteria | Genuine Factory | Trading Company | Procurement Strategy |

|---|---|---|---|

| Business License | Lists manufacturing address + production scope | Lists “import/export” or “wholesale” – no production facilities | Reject if license lacks “production” (生产) or “manufacturing” (制造) keywords. |

| Facility Evidence | Shows dedicated production lines, R&D labs, QC stations | Displays showroom samples; no machinery visible | Verify: Ask for time-lapse video of your product being made (e.g., ink filling). |

| Pricing Structure | Quotes FOB with clear material/labor cost breakdown | Quotes CIF with vague “service fees” | Flag: If MOQ is <500 units for custom art products – factories rarely accept low volumes. |

| Technical Capability | Engineers discuss pigment chemistry, paper GSM tolerances | Staff redirects to “factory partners” | Test: Request adjustment of viscosity for acrylic paints – traders cannot modify formulas. |

| Export History | Direct shipment records (Bill of Lading with their name as shipper) | Third-party logistics documentation | Confirm: Check port records via platforms like TradeMap. |

Strategic Note: Trading companies can be viable for simple items (e.g., graphite pencils), but avoid for chemical-intensive products (paints, solvents). Factories retain quality control over hazardous material handling.

Red Flags to Avoid in Art Supplies Sourcing

| Risk Category | Red Flag | Potential Impact | Mitigation Action |

|---|---|---|---|

| Compliance Fraud | • Test reports from unknown labs (e.g., “China Safety Center”) • Missing SDS (Safety Data Sheets) for paints |

Product seizure (e.g., EU border rejection), $250k+ recall costs | Demand: Original reports from SGS, TÜV, or Intertek with QR verification codes. |

| Capacity Misrepresentation | • No photos of actual production (only stock images) • Inability to show machinery for your product type |

Missed deadlines, subcontracting to unvetted facilities | Require: Live video call at 9 AM CST showing workers operating equipment. |

| Financial Instability | • Payment terms demanding 100% upfront • No verifiable export tax records |

Supplier bankruptcy mid-production | Insist: 30% deposit, 70% against BL copy + third-party QC report. |

| Quality Evasion | • Refusal to sign quality agreement with AQL 1.0/2.5 • No in-process QC checkpoints |

40%+ defect rates in pigment opacity or paper warping | Enforce: Contractual penalty clauses for non-compliance. |

| Ethical Risks | • No valid BSCI/SEDEX audit • Vague answers on cobalt/cadmium sourcing |

Brand reputational damage, customs holds | Verify: SMETA 4-Pillar audit within 6 months (focus: chemical handling). |

Recommended Verification Protocol

- Pre-Screen: Use China’s MIIT Industrial Green Products Database to check eco-compliance.

- Document Deep Dive: Validate licenses via GSXT, cross-check test reports with lab portals.

- Physical Audit: Conduct unannounced visit during production hours (avoid “model factory” traps).

- Pilot Run: Order 200% of sample quantity – inspect for batch consistency.

- Compliance Lock: Embed regulatory requirements in PO terms (e.g., “All paints must pass EN 71-3 2023 revision”).

2026 Compliance Alert: China’s GB/T 39401-2026 (effective Jan 2026) mandates heavy metal testing for all art materials exported globally. Factor this into supplier selection now.

SourcifyChina Advisory: Never prioritize cost over verification in art supplies. A $5,000 audit prevents $500,000 in recalls. For urgent supplier validation, contact SourcifyChina’s Shanghai lab (ISO 17025 accredited) for rapid material screening.

© 2026 SourcifyChina. Confidential for Procurement Manager Use Only. Data Sources: MIIT, EU RAPEX, SourcifyChina Audit Database v4.1.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Accelerate Your Art Supplies Sourcing with Verified Chinese Manufacturers

Strategic Sourcing Advantage: Why SourcifyChina’s Pro List Delivers Unmatched Efficiency

In the fast-evolving global supply chain landscape of 2026, procurement leaders face mounting pressure to reduce lead times, ensure quality compliance, and mitigate supplier risk—especially in niche categories like art supplies. Sourcing from China remains a cost-effective strategy, but unverified suppliers, inconsistent quality, and communication gaps continue to erode margins and delay product launches.

SourcifyChina’s Verified Pro List for Art Supplies in China eliminates these challenges through a rigorously vetted network of pre-qualified manufacturers—saving procurement teams up to 70% in sourcing time and significantly reducing onboarding risk.

Time-Saving Benefits of the Verified Pro List

| Benefit | Impact on Procurement Process |

|---|---|

| Pre-Vetted Factories | Eliminates weeks of supplier research, background checks, and qualification audits. |

| Verified Compliance | All suppliers meet ISO standards, export certifications, and ethical manufacturing practices. |

| Direct Factory Access | Bypass intermediaries—negotiate better pricing with transparent MOQs and lead times. |

| Multilingual Support | Streamlined communication via SourcifyChina’s bilingual sourcing agents. |

| Product-Specific Expertise | Suppliers specialize in art supplies (e.g., watercolor paints, sketchbooks, brushes, markers) with proven export experience. |

Why 2026 Demands a Smarter Sourcing Strategy

- Supply Chain Resilience: Diversify your supplier base with reliable Chinese partners backed by third-party verification.

- Speed to Market: Reduce time-to-order by 4–6 weeks compared to traditional sourcing methods.

- Cost Control: Leverage competitive pricing without compromising on quality or delivery timelines.

Call to Action: Optimize Your 2026 Sourcing Plan Today

Don’t let unverified suppliers slow your procurement cycle. Join 380+ global brands who trust SourcifyChina to streamline their China sourcing operations.

👉 Take the next step now:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants will provide a customized Pro List sample tailored to your art supplies requirements—free of obligation.

SourcifyChina

Your Trusted Partner in Intelligent China Sourcing

Est. 2014 | ISO 9001 Certified | Serving Procurement Leaders Across 42 Countries

🧮 Landed Cost Calculator

Estimate your total import cost from China.