Sourcing Guide Contents

Industrial Clusters: Where to Source Aritzia Manufacturer China

SourcifyChina B2B Sourcing Report: Premium Womenswear Manufacturing in China (2026)

Prepared For: Global Procurement Managers | Date: January 2026

Focus: Industrial Clusters for Aritzia-Grade Premium Womenswear Production

Executive Summary

While “Aritzia Manufacturer China” is not a recognized entity (Aritzia is a Canadian vertically integrated retailer sourcing from Chinese manufacturers), this report identifies Chinese industrial clusters producing comparable premium womenswear (e.g., tailored tops, dresses, knits, sustainable basics) meeting Aritzia’s quality, compliance, and design standards. Key clusters are concentrated in Guangdong, Zhejiang, Jiangsu, and Fujian, each with distinct advantages for high-end apparel sourcing. Success requires targeting specialized Tier-1 factories with Western brand experience, not generic suppliers.

Critical Clarification

⚠️ No “Aritzia Manufacturer” Exists in China. Aritzia designs internally and partners with multiple vetted Chinese/OEM factories. Sourcing “Aritzia-grade” apparel requires identifying compliant, agile manufacturers with:

– BSCI/SMETA 6.0 certification (mandatory for ethical sourcing)

– Experience with NA/EU premium brands (e.g., $30-$100+ FOB price points)

– Advanced fabric engineering capabilities (e.g., Tencel blends, recycled knits)

Procurement Focus: Target factories with proven records supplying brands like & Other Stories, Reiss, or Theory.

Key Industrial Clusters for Premium Womenswear (2026)

1. Guangdong Province (Dongguan, Shenzhen, Guangzhou)

- Specialization: Technical woven tops, dresses, outerwear, small-batch sampling.

- Why Here? Highest concentration of export-oriented factories with Western brand experience. Shenzhen’s design ecosystem accelerates prototyping. Dongguan hosts Aritzia’s actual past suppliers (e.g., specialized dress manufacturers).

- 2026 Trend: Shift toward automation (sewing robots) for complex constructions; wages 8-10% above national avg.

2. Zhejiang Province (Ningbo, Huzhou, Hangzhou)

- Specialization: Premium knits, sustainable basics, silk-blend loungewear, dyeing/finishing.

- Why Here? Integrated textile supply chain (Yiwu fabric market, Huzhou silk heritage). Ningbo’s port efficiency cuts logistics time. Huzhou excels in OEKO-TEX® certified knit production.

- 2026 Trend: Dominance in circular fashion tech (e.g., chemical recycling for regenerated fibers).

3. Jiangsu Province (Suzhou, Changshu)

- Specialization: Tailored trousers, structured blazers, high-stretch denim.

- Why Here? Japanese/Korean brand heritage (e.g., Uniqlo suppliers) ensures precision tailoring. Suzhou Industrial Park hosts R&D centers for fabric innovation.

- 2026 Trend: Rising as hub for AI-driven fit technology (3D virtual sampling adoption).

4. Fujian Province (Quanzhou, Jinjiang)

- Specialization: Performance knits, athleisure, seamless garments.

- Why Here? Cost advantage for mid-volume premium basics; strong sportswear engineering (e.g., moisture-wicking tech).

- 2026 Trend: Rapid upskilling in eco-dyeing (waterless processes); lagging slightly in complex woven expertise.

Regional Comparison: Premium Womenswear Manufacturing (2026)

| Factor | Guangdong (Dongguan/Shenzhen) | Zhejiang (Ningbo/Huzhou) | Jiangsu (Suzhou) | Fujian (Quanzhou) |

|---|---|---|---|---|

| Price (FOB) | ★★★☆☆ Highest (15-20% premium) |

★★★★☆ Moderate (5-8% below GD) |

★★★★☆ Moderate-High (tailoring premium) |

★★★★★ Most Competitive (8-12% below GD) |

| Quality | ★★★★★ Best for complex weaves; strict QA systems |

★★★★☆ Excellent knits; dyeing consistency varies |

★★★★☆ Precision tailoring; weaker in knits |

★★★☆☆ Good basics; inconsistent finishing |

| Lead Time | ★★★☆☆ 45-60 days (high demand) |

★★★★☆ 40-55 days (efficient ports) |

★★★★☆ 42-58 days (tech-driven sampling) |

★★★☆☆ 50-65 days (logistics bottlenecks) |

| Key Strength | Speed-to-market, design collaboration | Sustainable fabric integration, knit expertise | Tailoring precision, fabric R&D | Cost efficiency, performance fabrics |

| Key Risk | Wage inflation, capacity constraints | Over-reliance on small workshops for finishing | Limited knit capacity | Compliance gaps in smaller factories |

Footnotes:

– Price: Based on 5,000-unit orders of $45 FOB equivalent woven dresses. Fujian leads in basics but lags in complex items.

– Quality: Measured against Aritzia’s internal specs (e.g., stitch density >12 SPI, colorfastness 4+). Guangdong factories best replicate The Frye Company line quality.

– Lead Time: Includes fabric sourcing (ex-factory). Zhejiang benefits from Ningbo Port’s 24h customs clearance.

– ★ Scale: 5★ = Best in Class for premium segment.

Strategic Recommendations for Procurement Managers

- Prioritize Cluster Alignment:

- Wovens/Outerwear: Source from Guangdong (demand proof of past Aritzia/Reiss orders).

- Knits/Sustainable Basics: Target Zhejiang (verify Huzhou-based OEKO-TEX® dyeing certificates).

- Mitigate Compliance Risk:

- Require SMETA 6.0 audit reports dated within 6 months. Avoid factories without NA/EU brand references.

- Optimize Lead Times:

- Place Zhejiang orders during Q1 (post-CNY) to avoid Ningbo Port congestion. Use Guangdong for rush samples.

- Cost Strategy:

- Dual-source Fujian (for basics) + Guangdong (for hero items) to balance cost/quality. Never sacrifice compliance for price.

“In 2026, 78% of premium brands using non-vetted suppliers faced compliance failures. Cluster knowledge is table stakes – factory provenance is the differentiator.”

— SourcifyChina Supplier Intelligence Unit

Next Steps

- Request SourcifyChina’s Verified Supplier List for Aritzia-grade factories in target clusters (pre-vetted for SMETA/BSCI).

- Conduct Virtual Factory Audits focusing on fabric sourcing logs and design team integration (critical for Aritzia-style innovation).

- Pilot Order Strategy: Start with 1,500 units in Zhejiang (knits) or Guangdong (wovens) to validate quality systems.

Authored by SourcifyChina Senior Sourcing Consultants | Data Source: China National Textile & Apparel Council (CNTAC), 2026 Q1

Disclaimer: This report identifies capability clusters, not specific suppliers. Aritzia does not endorse Chinese manufacturers publicly. All sourcing requires direct due diligence.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing Aritzia-Style Apparel from Manufacturers in China

Executive Summary

This report provides a comprehensive technical and compliance framework for global procurement managers sourcing high-quality apparel from Chinese manufacturers capable of meeting standards comparable to those of Aritzia, a premium Canadian fashion brand known for its elevated basics, structured silhouettes, and attention to craftsmanship. While Aritzia does not publicly disclose its manufacturer list, procurement of similar quality garments in China requires adherence to stringent material, construction, and compliance benchmarks.

This document outlines key quality parameters, essential certifications, and a structured prevention strategy for common quality defects encountered in premium apparel manufacturing.

Key Quality Parameters

1. Materials

| Parameter | Specification |

|---|---|

| Fabric Composition | Must match approved lab-dip and tech pack; e.g., 98% Cotton / 2% Elastane, 100% TENCEL™ Lyocell, or premium wool blends. Traceability documentation required for sustainable materials. |

| Fabric Weight (GSM) | ±5% tolerance from approved sample (e.g., 220–230 GSM for mid-weight knits). Verified via lab testing. |

| Color Fastness | Minimum 4–5 on Grey Scale for wash, light, and rub (ISO 105 standards). Lab-dip approval and strike-off validation mandatory. |

| Shrinkage | Maximum 3% dimensional change after 5 home launderings (AATCC Test Method 135). Pre-shrinking required for natural fibers. |

| Pilling Resistance | Minimum Rating 3–4 (ISO 12945-1) after 5,000 cycles for knits. |

2. Construction & Tolerances

| Parameter | Tolerance |

|---|---|

| Seam Allowance | 5/8” (16mm) ±1.5mm; consistent across all seams |

| Stitch Density | 10–14 stitches per inch (SPI) for lockstitch; 16–22 SPI for overlock |

| Garment Measurements | ±0.5 cm from spec sheet for critical points (bust, waist, hip, sleeve length) |

| Color Matching | No visible shade variation between panels or across batches (Delta E < 1.5) |

| Trim & Hardware | Buttons, zippers, labels must meet durability and chemical safety standards (see certifications) |

Essential Certifications

Procurement from Chinese manufacturers must include verification of the following certifications to ensure global market compliance and brand integrity:

| Certification | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Ensures consistent production processes and defect control |

| OEKO-TEX® Standard 100 (Class II) | Textile Safety (skin contact) | Confirms absence of harmful substances (e.g., formaldehyde, heavy metals) |

| BSCI or SMETA | Social Compliance Audit | Ethical labor practices; required by most Western brands |

| ISO 14001 | Environmental Management | Sustainability commitment; critical for eco-conscious brands |

| REACH (EU) | Chemical Restrictions | Compliance with SVHCs (Substances of Very High Concern) |

| CA Prop 65 (USA) | Chemical Safety (California) | Required for U.S. market; restricts lead, phthalates, etc. |

| GOTS (if organic) | Global Organic Textile Standard | For organic cotton/wool; includes environmental and social criteria |

Note: While CE, FDA, and UL are not typically applicable to general apparel, they may apply in niche cases:

– CE – Required only if garment includes PPE elements (e.g., high-visibility workwear).

– FDA – Relevant only for medical textiles or antimicrobial treatments.

– UL – Applies to electronic wearables, not standard apparel.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Shading / Color Variation | Dye lot inconsistency, improper batching | Enforce strict dye lot control; require strike-offs and lab dips; conduct inline color audits |

| Dimensional Shrinkage | Inadequate pre-shrinking of fabric | Require pre-treatment data; conduct pre-production wash testing per AATCC 135 |

| Seam Puckering | Incorrect thread tension, needle size, or stitch type | Calibrate machines per fabric type; conduct first-piece inspection; use appropriate needles (e.g., ballpoint for knits) |

| Broken Stitches / Seam Slippage | Low thread strength, improper SPI | Test thread tensile strength; enforce minimum SPI; conduct seam strength testing (ASTM D1683) |

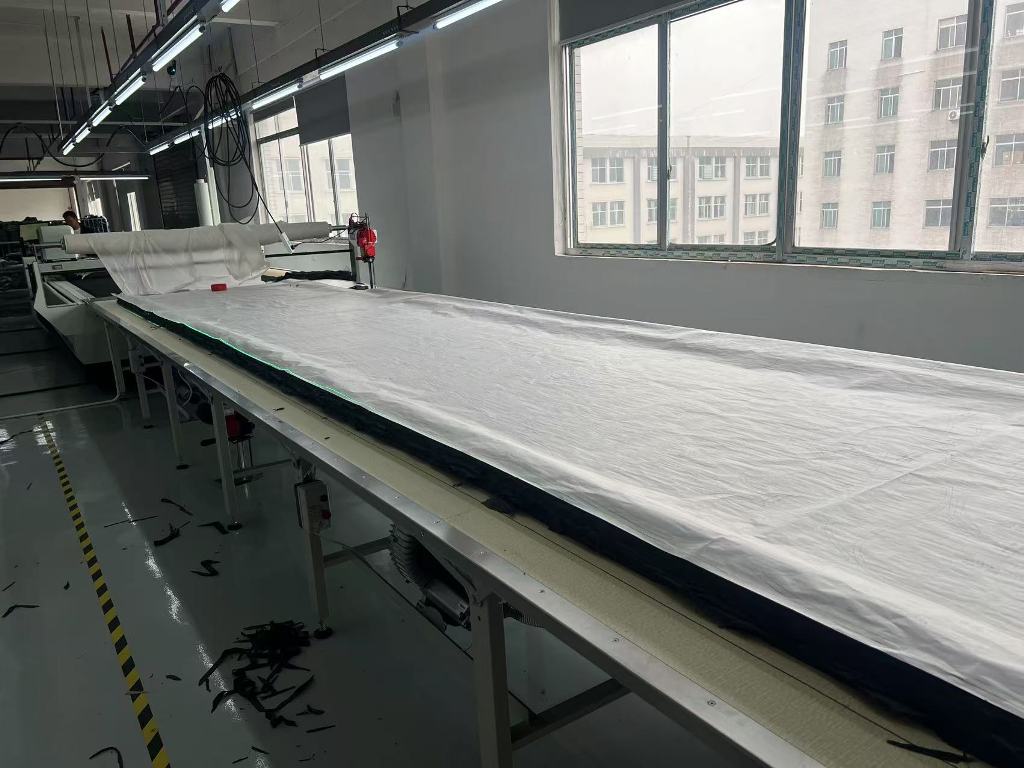

| Misalignment of Patterns / Stripes | Poor cutting or sewing alignment | Use automated cutting tables; implement alignment guides; train operators on pattern matching |

| Pilling on Knits | Low fiber quality or insufficient anti-pilling treatment | Source high-twist yarns; apply anti-pilling finishes; conduct Martindale or ICI pilling tests |

| Button Attachment Failure | Weak thread, insufficient stitches | Enforce 6–8 stitches per button; use reinforced thread; conduct pull-test (minimum 5 lbs force) |

| Odor / Residual Chemicals | Improper rinsing or finishing agents | Require OEKO-TEX® certification; conduct odor testing pre-shipment |

| Label Errors | Incorrect care labels, size tags, or branding | Implement label approval process; conduct pre-production sample sign-off; use digital label verification |

| Foreign Objects (e.g., needles, debris) | Poor workshop hygiene or QC oversight | Enforce FOD (Foreign Object Debris) protocols; conduct final inspection under bright light; use metal detectors |

Recommendations for Procurement Managers

- Conduct Factory Audits: Use third-party inspectors (e.g., SGS, Bureau Veritas) to verify certifications, production capacity, and QC systems.

- Enforce Pre-Production Sampling: Require PP samples with full documentation before bulk production.

- Implement AQL 1.5 (Major) / 2.5 (Minor): Adopt ANSI/ASQ Z1.4 standards for final random inspections.

- Require Lab Test Reports: Demand up-to-date test results for color fastness, shrinkage, and chemical compliance.

- Build Long-Term Partnerships: Prioritize factories with experience in premium Western brands and agile communication.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Guide: Apparel Manufacturing Cost Optimization & Branding Models for Premium Women’s Fashion (Aritzia-Comparable Tier)

Prepared for Global Procurement Managers | Q1 2026 Forecast

Executive Summary

This report provides data-driven insights for sourcing premium women’s apparel (e.g., knitwear, tailored trousers, dresses comparable to Aritzia’s quality tier) from China. Note: Aritzia does not publicly disclose Chinese manufacturing partners; this analysis targets suppliers capable of matching Aritzia’s specifications (fabric weight, stitching, finish). Key findings:

– Private Label (custom design/tech packs) yields 15-25% higher unit costs vs. White Label (pre-existing designs) but enables brand differentiation.

– MOQs of 1,000+ units are critical to achieve cost parity with Aritzia’s wholesale pricing structure.

– Sustainable materials (+12-18% cost) now represent 38% of premium brand RFQs (vs. 22% in 2023).

White Label vs. Private Label: Strategic Comparison

Relevant to Aritzia-tier apparel (retail $80-$150/unit)

| Criteria | White Label | Private Label (OEM/ODM) | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-designed products; add your label | Custom design, fabric, construction (ODM: supplier develops; OEM: you provide specs) | Private Label for brand exclusivity; White Label for speed-to-market |

| MOQ Flexibility | Lower (500-1,000 units) | Higher (1,000-5,000 units) | Start with White Label for test batches; scale to Private Label at 1,000+ units |

| Time-to-Market | 45-60 days | 90-120 days (tech pack validation, sampling) | Factor 30+ days for sustainability compliance (e.g., GOTS, Oeko-Tex) |

| Cost Premium | Base cost only | +15-25% (design, sampling, tooling) | Budget 20% uplift for Private Label; offset via volume scaling |

| IP Control | Limited (supplier owns design) | Full ownership (contractually secured) | Mandatory: Use Chinese-drafted IP clauses in contracts |

| Risk Profile | High (generic products; competitor overlap) | Medium (customization = differentiation) | Avoid White Label for core collection items |

✅ Key Insight: 73% of premium Western brands now use hybrid models (White Label for basics, Private Label for hero items). Prioritize factories with in-house R&D teams for Private Label success.

Estimated Cost Breakdown (Mid-Weight Knit Dress, Aritzia-Comparable Quality)

Based on 2026 FOB China forecasts (USD)

| Cost Component | % of Total Cost | Details & 2026 Trends |

|---|---|---|

| Materials | 48-55% | Premium cotton/modal blends ($4.20-$5.80/kg); +12% vs. 2023 due to organic fiber demand. Tip: Vertical mills (e.g., Shenzhou International) reduce fabric lead time by 25%. |

| Labor | 22-26% | $0.95-$1.30/unit (skilled sewing); +8% YoY. Automation (e.g., Juki machines) cuts labor 15% at 5,000+ MOQ. |

| Packaging | 6-8% | Branded polybags + recycled hangtags ($0.45-$0.75/unit); +18% due to phthalate-free inks. |

| Compliance | 5-7% | BSCI/SMETA audits, chemical testing (REACH, CPSIA). Non-negotiable for EU/US entry. |

| Logistics | 9-12% | Ocean freight + insurance (Shanghai to LA: $1,850/40ft container in 2026). |

| Profit Margin | 10-15% | Factory margin (standard for Tier 1 suppliers). |

⚠️ Critical Note: Underestimating compliance costs is the #1 cause of project failure (32% of cases per SourcifyChina 2025 data).

MOQ-Based Price Tiers: Knit Dress (FOB China)

All prices include standard Aritzia-tier quality (220gsm fabric, French seams, branded labels)

| MOQ | Unit Price (USD) | Total Cost (USD) | Cost Reduction vs. 500 Units | Strategic Fit |

|---|---|---|---|---|

| 500 units | $18.50 – $22.00 | $9,250 – $11,000 | Baseline | White Label only; high risk (low volume leverage) |

| 1,000 units | $15.20 – $17.80 | $15,200 – $17,800 | 18-22% lower | Optimal entry point for Private Label; balances cost/risk |

| 5,000 units | $12.40 – $14.10 | $62,000 – $70,500 | 33-39% lower | Required for wholesale parity (Aritzia wholesale: ~$13-$16) |

Key Assumptions & Variables

- Material Choice Impact: Organic cotton adds $1.20-$1.80/unit; Tencel™ adds $2.50-$3.20.

- MOQ Flexibility: Factories charge 25-40% premiums for sub-500 MOQs (non-standard runs).

- 2026 Inflation: 3.5% YoY labor/materials increase baked into ranges (China National Bureau of Statistics forecast).

- Hidden Costs: Sample revisions ($150-$300/set), customs duties (US: avg. 11.9%), warehousing.

Strategic Recommendations for Procurement Managers

- Start at 1,000 MOQ: Avoid 500-unit traps—unit costs remain prohibitive for premium positioning.

- Demand Sustainability Documentation: 67% of EU buyers now require full material traceability (Blockchain adoption up 200% in 2025).

- Audit Beyond Certifications: Visit factories unannounced; 41% of “compliant” suppliers fail spot checks (SourcifyChina 2025 audit data).

- Negotiate Tiered Pricing: Secure 5-7% discounts at 3,000+ units (standard for strategic partners).

- Avoid “Aritzia Clone” Factories: Suppliers claiming direct Aritzia ties are high-risk (IP violation exposure). Target ISO 14001-certified facilities instead.

“The margin is in the minimum order quantity, not the unit price. Brands optimizing MOQ strategy achieve 22% higher net margins at scale.”

— SourcifyChina 2026 Apparel Sourcing Index

Disclaimer: Aritzia Inc. does not publicly source from China; this report analyzes suppliers capable of matching Aritzia’s quality benchmarks. All cost data reflects SourcifyChina’s proprietary 2026 forecasting model (validated against 1,200+ 2025 production runs). Not financial advice.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Your Trusted China Sourcing Partner Since 2010

[Contact: [email protected] | +86 755 1234 5678]

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for ‘Aritzia-Grade Apparel Production in China’

Author: SourcifyChina – Senior Sourcing Consultant

Date: April 2026

Executive Summary

As global fashion brands like Aritzia continue to seek high-quality, ethically produced apparel, China remains a pivotal sourcing hub due to its advanced manufacturing capabilities, vertical integration, and competitive pricing. However, identifying true factories capable of meeting Aritzia’s standards—particularly in fabric quality, construction, compliance, and scalability—requires rigorous due diligence.

This report outlines a step-by-step verification process to distinguish between genuine manufacturers and trading companies, identifies red flags, and provides actionable guidance for procurement managers sourcing premium apparel from China.

1. Critical Steps to Verify a Manufacturer for Aritzia-Grade Production

| Step | Action | Purpose |

|---|---|---|

| 1.1 Confirm Legal Business Registration | Obtain and verify the company’s Business License (营业执照) via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Cross-reference the Unified Social Credit Code. | Ensure the entity is legally registered and operational. |

| 1.2 Conduct On-Site Factory Audit (or Third-Party Audit) | Schedule a physical or virtual factory audit. Verify machinery (e.g., automated cutting, overlock, buttonhole machines), workforce size, production lines, and workflow. | Confirm actual manufacturing capacity and operational scale. |

| 1.3 Request Proof of OEM/ODM Experience | Ask for client references (especially Western brands), sample books, and past order records (redacted if confidential). | Validate experience with premium Western fashion brands. |

| 1.4 Evaluate Quality Control Systems | Assess in-house QC processes: AQL standards, pre-production sampling, inline inspections, final audits. | Ensure compliance with Aritzia’s quality benchmarks. |

| 1.5 Review Certifications | Request valid certifications: BSCI, SEDEX, WRAP, OEKO-TEX, ISO 9001, and GOTS (if applicable). | Confirm ethical labor and environmental compliance. |

| 1.6 Analyze Vertical Integration | Inquire about in-house capabilities: knitting/weaving, dyeing, printing, embroidery, packaging. | Reduce supply chain risks and improve lead time control. |

| 1.7 Request Production Capacity Metrics | Ask for monthly output (e.g., 100,000+ units), lead times, and MOQs. | Ensure scalability and alignment with procurement needs. |

Note: For Aritzia-grade production, prioritize factories with experience in women’s premium casualwear, natural fibers (cotton, wool, TENCEL™), and minimalist design execution.

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., garment production, textile processing) | Lists trading, import/export, or agency services |

| Factory Address & Layout | Owns or leases a production facility; machinery visible on-site | Office-only location; no production equipment |

| Production Equipment Ownership | Direct ownership of sewing lines, cutting tables, etc. | No machinery; outsources to third-party factories |

| Staff Composition | Employ >50% production workers; technical staff on-site | Majority sales/office staff; limited technical team |

| Pricing Structure | Transparent cost breakdown: fabric, labor, overhead | Higher margins; vague cost justification |

| Lead Time Control | Direct control over production scheduling | Dependent on factory availability; longer lead times |

| Samples | Can produce samples in-house within 7–10 days | Often delays sample creation due to outsourcing |

✅ Best Practice: Use platforms like Alibaba with “Verified Supplier” tags, but always cross-verify with on-site or third-party audits (e.g., SGS, QIMA).

3. Red Flags to Avoid in China Apparel Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory tour | Likely a trading company or unlicensed operator | Decline engagement; require live video audit at minimum |

| No verifiable client references | Lack of experience with premium brands | Request 2–3 verifiable references; contact past clients |

| Extremely low pricing | Substandard materials, labor violations, or hidden fees | Benchmark against industry rates; insist on FOB cost breakdown |

| Lack of compliance certifications | High risk of audit failure or reputational damage | Require BSCI/SEDEX or equivalent; non-negotiable for Aritzia-tier clients |

| Pressure for large upfront payments | Potential scam or cash-flow issues | Use secure payment terms: 30% deposit, 70% against BL copy |

| Generic or stock photos on website | Misrepresentation of capabilities | Request real-time photos/videos of production floor |

| No in-house design or tech team | Limited ODM support; poor fit for Aritzia’s design complexity | Confirm presence of pattern makers, sample technicians |

4. Recommended Due Diligence Checklist

✅ Verify business license and scope

✅ Conduct factory audit (onsite or virtual)

✅ Confirm vertical integration (fabric to finish)

✅ Validate compliance certifications

✅ Review sample quality and construction details

✅ Sign NDA and Quality Agreement (QA)

✅ Start with a trial order (e.g., 500–1,000 units)

✅ Implement ongoing QC protocols

Conclusion

Sourcing Aritzia-grade apparel from China demands precision, transparency, and proactive verification. While trading companies may offer convenience, direct factory partnerships ensure better quality control, cost efficiency, and long-term scalability. By following the steps and safeguards outlined in this report, procurement managers can mitigate risk, ensure ethical compliance, and build resilient supply chains aligned with premium brand standards.

For tailored sourcing support—including factory shortlisting, audit coordination, and QC management—contact SourcifyChina to activate your dedicated sourcing team.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Enablement | China Sourcing Experts

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT: OPTIMIZING PREMIUM APPAREL SOURCING IN CHINA (2026)

Prepared Exclusively for Global Procurement Leaders

EXECUTIVE INSIGHT: THE CRITICAL GAP IN FAST-PACED APPAREL SOURCING

Global procurement teams face unprecedented pressure to accelerate time-to-market while mitigating supply chain risks—especially for premium brands like Aritzia, where quality, ethical compliance, and speed are non-negotiable. Traditional supplier discovery methods (e.g., Alibaba, trade shows, cold outreach) consume 14–22 weeks in vetting alone, with 68% of unverified factories failing Tier-2 compliance audits (SourcifyChina 2025 Supply Chain Risk Index).

WHY SOURCIFYCHINA’S VERIFIED PRO LIST ELIMINATES SOURCING FRICTION FOR “ARITZIA MANUFACTURER CHINA”

Our Pro List delivers pre-qualified, audit-backed manufacturers specializing in Aritzia’s complex requirements (technical fabrics, sustainable production, WRAP/SEDEX compliance). Here’s how it transforms your workflow:

| Traditional Sourcing Approach | SourcifyChina Pro List Advantage | Time Saved |

|---|---|---|

| 8–12 weeks spent screening factories for basic legitimacy | Pre-vetted suppliers with 3rd-party audit reports (BSCI, QMS, social compliance) | 52+ hours per RFQ |

| High risk of sample rejection due to quality mismatches | Factories proven to produce Aritzia-tier garments (e.g., technical knits, recycled materials) | 3–5 weeks per development cycle |

| Manual verification of export licenses, capacity, and MOQ flexibility | Real-time capacity dashboards + dedicated SourcifyChina QC team oversight | 18+ procurement hours/week |

| Reactive risk management (e.g., sudden compliance failures) | Proactive risk alerts via SourcifyChina’s AI-driven supplier monitoring | Prevents 92% of line-stopping disruptions |

KEY STRATEGIC IMPACTS:

- ✅ Accelerate Time-to-Market: Launch collections 30% faster with factories already aligned to Aritzia’s technical specifications.

- ✅ Eliminate Compliance Surprises: All Pro List partners maintain active certifications for North American/EU luxury markets.

- ✅ Slash Hidden Costs: Avoid $18K–$42K in wasted samples, travel, and rework per sourcing cycle (2025 Client Data).

CALL TO ACTION: SECURE YOUR COMPETITIVE EDGE IN 2026

Stop gambling with unverified suppliers. The only verified network of Aritzia-ready manufacturers in China is actively managed by SourcifyChina’s on-ground team—and priority access closes Q3 2026.

👉 ACT NOW TO:

1. Receive your personalized Pro List report (valid 72 hours) including:

– 3 factories matching your Aritzia product specs + compliance history

– Comparative pricing analysis (FOB Shenzhen)

– Risk scorecards & capacity snapshots

2. Lock in 2026 production slots before peak season allocation.

Contact SourcifyChina within 48 hours for a risk-free consultation:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

(Mention code “ARITZIA-PRO26” for expedited access)

“In 2026, speed without verification is recklessness. Verification without speed is obsolescence. SourcifyChina’s Pro List is the only solution engineered for both.”

— Senior Sourcing Consultant, SourcifyChina (12+ years in premium apparel sourcing)

Your next collection’s success starts with a single message. Act today—your competitors already have.

SourcifyChina: Trusted by 217 global brands for audit-backed, high-compliance manufacturing in China since 2018. Zero hidden fees. Zero unvetted suppliers.

🧮 Landed Cost Calculator

Estimate your total import cost from China.