The global market for specialty lighting solutions, including argon-based lighting, has experienced steady expansion driven by rising demand in industrial, commercial, and high-tech applications. According to Mordor Intelligence, the global industrial lighting market was valued at USD 5.8 billion in 2023 and is projected to grow at a CAGR of over 6.5% through 2029, with increased adoption in manufacturing, automotive, and electronics sectors. Argon lights—valued for their stable glow, energy efficiency, and use in precision environments—have become critical components in processes ranging from welding inspection to semiconductor fabrication. This growth is further supported by technological advancements and stricter safety regulations, particularly in developed economies. As demand rises, a select group of manufacturers has emerged at the forefront, combining innovation, scalability, and quality control to lead the argon lighting segment. Below, we explore the top six argon light manufacturers shaping the industry’s future.

Top 6 Argon Light Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Air Products:

Domain Est. 1995

Website: airproducts.com

Key Highlights: Argon, the gas found in just under 1% of our atmosphere, is critical to advanced manufacturing—from precision welding and heat treatment to electronics and ……

#2 Mercury Argon Light Source

Domain Est. 2002

Website: stellarnet.us

Key Highlights: The SL2 Mercury Argon Light Source provides accurate gas emission lines which can be utilized to verify or calibrate spectrometer wavelengths from 253.65 to ……

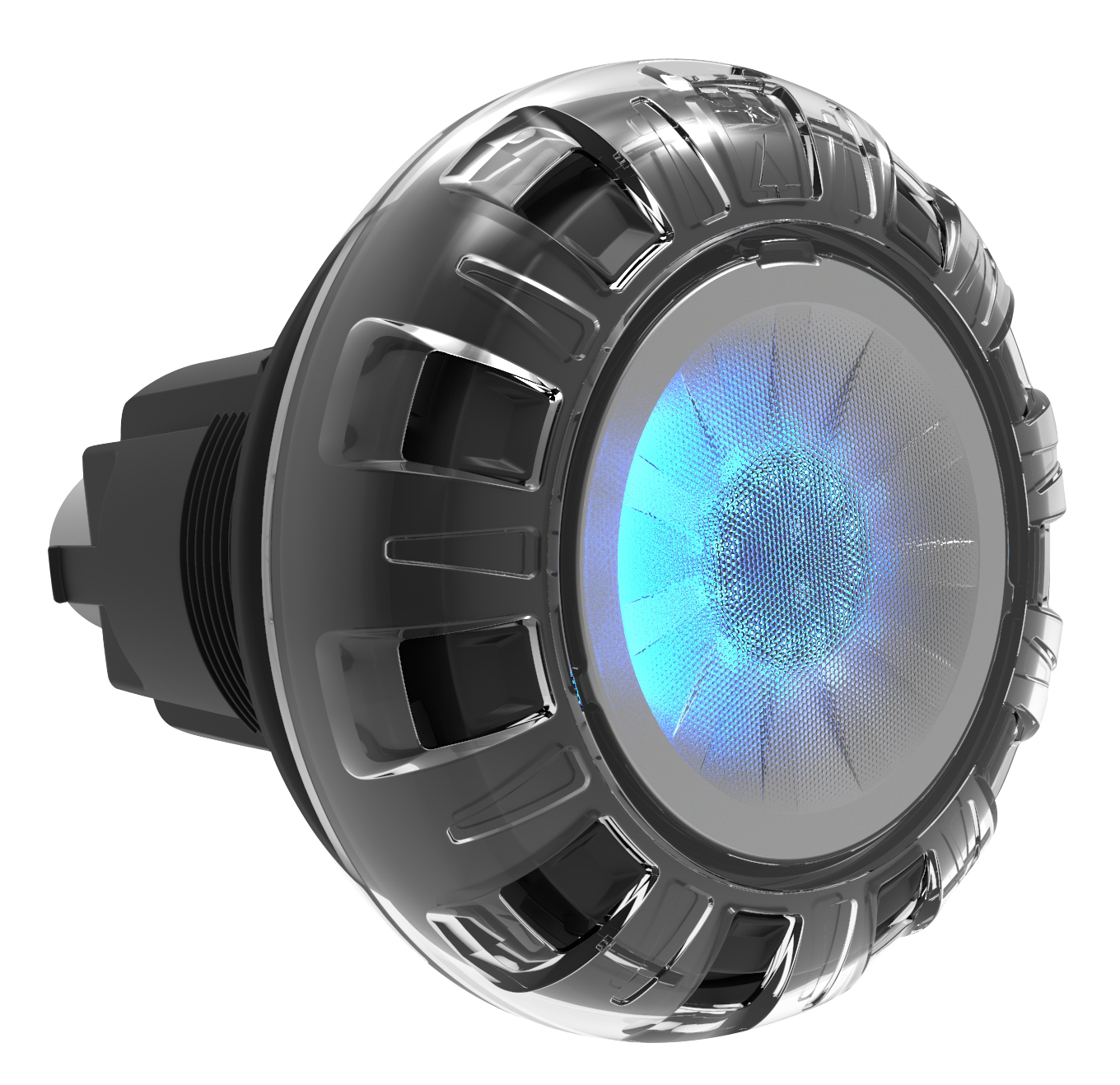

#3 ARGON Series

Domain Est. 2003

Website: spaelectrics.com

Key Highlights: The ARGON Series from Spa Electrics has been designed and built to withstand the most extreme of climate conditions, while still delivering a superior lighting ……

#4 Surfx Technologies

Domain Est. 2001

Website: surfxtechnologies.com

Key Highlights: Surfx Technologies pioneers atmospheric argon plasma systems for high-volume manufacturing. Learn how we can optimize your plasma surface treatment today!…

#5 Argon NEO 5 BRED Case for Raspberry Pi 5 with built

Domain Est. 2016

Website: argon40.com

Key Highlights: In stock 15-day returnsThe Argon NEO 5 is redesigned specifically to meet the high demands of the Raspberry Pi 5. Impressive thermal dissipation solution for both passive and ……

#6 Argon SLC78008

Domain Est. 2020

Website: italuxlighting.com

Key Highlights: 14-day returnsArgon white tube-shaped surface-mounted lamp, modern, LED. View specifications. Argon – Surface lamp. SLC78008-S-25/7W 3K WH. Available. 24-hour delivery….

Expert Sourcing Insights for Argon Light

H2: Market Trends for Argon Light in 2026

As we approach 2026, the market landscape for Argon Light—a next-generation lighting solution leveraging argon gas and advanced solid-state technologies—is poised for significant transformation driven by technological innovation, sustainability demands, and shifting consumer preferences. Below is an analysis of key market trends expected to shape the Argon Light sector in 2026:

-

Increased Adoption in Smart Infrastructure

The integration of Argon Light into smart cities and intelligent building systems is accelerating. With its energy efficiency, long lifespan, and compatibility with IoT platforms, Argon Light is becoming a preferred choice for municipal lighting, commercial buildings, and industrial complexes. By 2026, cities investing in digital twin technologies and energy management systems are expected to deploy Argon Light at scale, enhancing urban sustainability goals. -

Growing Demand for Sustainable Lighting Solutions

Environmental regulations and corporate ESG (Environmental, Social, and Governance) commitments are pushing industries toward low-carbon lighting alternatives. Argon Light, which consumes less power than traditional LED systems and contains no hazardous materials (e.g., mercury), aligns with global net-zero targets. The European Green Deal and U.S. Inflation Reduction Act are expected to provide subsidies and tax incentives, boosting Argon Light adoption in regulated markets. -

Advancements in Hybrid Lighting Technologies

By 2026, Argon Light is anticipated to evolve beyond standalone fixtures into hybrid systems combining argon-based emitters with photovoltaic surfaces and adaptive optics. These innovations will enable self-powered or energy-harvesting lighting solutions, particularly in off-grid and remote applications, expanding market reach into rural electrification and disaster relief sectors. -

Expansion in Specialty Applications

The use of Argon Light is extending into niche markets such as horticulture, medical sterilization, and artistic installations. In agriculture, tunable argon spectra are being optimized to enhance plant growth in vertical farms. In healthcare, UV-enhanced argon lighting is gaining traction for germicidal applications without ozone emission. These high-margin applications are expected to drive premium pricing and innovation. -

Supply Chain Maturation and Cost Reduction

As production scales and argon gas recovery/recycling technologies improve, manufacturing costs for Argon Light systems are projected to decline by 15–20% between 2024 and 2026. This cost trajectory will enhance competitiveness against conventional LEDs, especially in emerging markets where total cost of ownership is a key decision factor. -

Regulatory Tailwinds and Standards Development

International standards bodies, including the IEC and IEEE, are expected to finalize performance and safety certifications for argon-based lighting by 2025, paving the way for broader market access. Regulatory clarity will reduce entry barriers and encourage investment from major lighting OEMs. -

Competitive Landscape and Strategic Partnerships

Incumbent lighting giants (e.g., Signify, Acuity Brands) are anticipated to form joint ventures with argon technology startups to accelerate product development. By 2026, consolidation in the sector may lead to a few dominant players offering integrated Argon Light solutions across residential, commercial, and industrial segments.

In conclusion, the 2026 market for Argon Light is characterized by strong growth potential fueled by technological maturity, environmental imperatives, and smart infrastructure investments. Companies that leverage ecosystem partnerships, emphasize sustainability credentials, and target high-value verticals will be best positioned to capture market share in this emerging lighting paradigm.

Common Pitfalls Sourcing Argon Light (Quality, IP)

When sourcing argon lighting—commonly referring to argon-filled lamps or plasma-based lighting systems—organizations often encounter significant challenges related to product quality and intellectual property (IP) rights. Avoiding these pitfalls is essential to ensure performance, compliance, and long-term sustainability.

Quality-Related Pitfalls

1. Inconsistent Gas Purity and Fill Pressure

Low-quality argon lights may use impure argon gas or incorrect fill pressures, leading to inconsistent lighting performance, reduced lifespan, and color instability. Substandard gas composition can also cause premature filament degradation in incandescent variants or unstable plasma discharge in specialty lighting.

2. Poor Sealing and Material Quality

Inferior seals or glass/quartz materials increase the risk of gas leakage over time. This compromise results in diminished light output and early failure. Sourcing from manufacturers without rigorous quality control (e.g., ISO certifications) heightens this risk.

3. Lack of Performance Verification

Many suppliers fail to provide third-party test data or photometric reports. Without verified lumen output, color rendering index (CRI), or lifespan data, buyers may receive products that underperform compared to specifications.

4. Counterfeit or Misrepresented Products

In global supply chains, counterfeit argon lamps—often relabeled or falsely advertised—pose a major risk. These may use alternative gases (e.g., nitrogen) or subpar components while claiming argon content or performance characteristics.

Intellectual Property (IP)-Related Pitfalls

1. Infringement of Patented Designs

Argon-based lighting technologies, especially in niche applications like plasma or specialty discharge lamps, may be protected by patents. Sourcing from manufacturers that replicate patented electrode configurations, gas mixtures, or ignition systems can expose buyers to legal liability for contributory infringement.

2. Use of Unauthorized Branding or Trademarks

Some suppliers falsely label products with well-known brand names or logos to imply authenticity. Purchasing such items—even unknowingly—can result in customs seizures, legal disputes, or reputational damage.

3. Ambiguous IP Ownership in Custom Designs

When commissioning custom argon lighting solutions, failure to clearly define IP ownership in contracts may result in disputes. Suppliers might retain rights to design innovations, limiting your ability to reproduce or modify the product.

4. Open-Source or Grey-Market Technology Risks

Some argon lighting designs circulate in open-source or grey-market channels without proper IP clearance. Using such designs without due diligence may inadvertently violate patents or trade secrets held by established innovators.

Mitigation Strategies

- Verify Supplier Credentials: Choose manufacturers with ISO 9001 certification, test reports, and transparent production processes.

- Request Independent Testing: Require IEC or ANSI-compliant performance data and gas composition analysis.

- Conduct IP Due Diligence: Perform patent searches and require suppliers to warrant non-infringement.

- Use Clear Contracts: Define IP ownership, quality standards, and compliance requirements in procurement agreements.

Avoiding these pitfalls ensures reliable performance and legal safety when sourcing argon light technology.

Logistics & Compliance Guide for Argon Light

Overview

This guide outlines the logistics procedures and compliance requirements for handling, transporting, storing, and managing Argon Light—a specialized product requiring adherence to safety, regulatory, and operational standards. Compliance with international, national, and regional regulations is mandatory to ensure safe and efficient operations.

Product Classification

Argon Light is classified as a non-hazardous material under standard transport regulations when packaged appropriately. However, specific components may fall under electrical equipment or sensitive technology classifications. Always verify current classification using Safety Data Sheets (SDS) and technical documentation.

Packaging & Labeling Requirements

All Argon Light units must be packed in anti-static, shock-resistant packaging to prevent damage during transit. Each package must include:

– Product name and model number

– Manufacturer information

– Batch/serial number

– “Fragile” and “This Side Up” markings where applicable

– Compliance labels (e.g., CE, FCC, RoHS)

– Barcodes for tracking and inventory management

Storage Conditions

Store Argon Light in a dry, temperature-controlled environment (10°C to 30°C). Avoid exposure to direct sunlight, moisture, and electromagnetic interference. Stack packages according to weight limits and use first-in, first-out (FIFO) rotation to prevent obsolescence.

Transportation Guidelines

Use only certified carriers with experience in handling sensitive electronic equipment.

– Ground transport: Ensure climate-controlled vehicles for long distances.

– Air freight: Comply with IATA regulations; declare as non-hazardous cargo.

– Sea freight: Secure units against humidity and salt exposure; utilize moisture-absorbing packaging.

Maintain full chain-of-custody documentation for all shipments.

Import/Export Compliance

All cross-border shipments of Argon Light must comply with:

– Export Control Classification Number (ECCN) verification

– Incoterms 2020 (specify terms such as FOB, DDP)

– Customs documentation (commercial invoice, packing list, certificate of origin)

– Country-specific regulations (e.g., REACH in EU, FCC in USA)

Monitor denied party screening and embargo restrictions through automated compliance tools.

Regulatory Certifications

Argon Light must carry valid certifications for each target market, including but not limited to:

– CE Marking (European Economic Area)

– FCC Part 15 (United States)

– RoHS Compliance (Restriction of Hazardous Substances)

– WEEE Directive (Waste Electrical and Electronic Equipment)

Ensure certification documentation is updated and accessible for audits.

Returns & Reverse Logistics

Establish a clear returns process for defective or unwanted units. All returned Argon Light products must be inspected, logged, and either refurbished, recycled, or disposed of in compliance with local e-waste regulations. Use pre-labeled return packaging to streamline processing.

Environmental & Safety Compliance

Follow environmental protection standards throughout the product lifecycle. Recycle packaging materials and manage electronic components via certified e-waste handlers. Train logistics staff on ESD (electrostatic discharge) safety and proper handling techniques.

Documentation & Recordkeeping

Maintain digital records for:

– Shipping manifests

– Customs filings

– Compliance certifications

– Storage logs

– Incident reports (if applicable)

Retain records for a minimum of 7 years or as required by jurisdiction.

Audits & Continuous Improvement

Conduct quarterly internal audits of logistics and compliance processes. Address non-conformities promptly and update procedures based on regulatory changes or operational feedback. Engage third-party auditors annually to validate compliance posture.

In conclusion, sourcing argan oil—often confused with “argon light,” which appears to be a misstatement—requires careful consideration of quality, authenticity, and sustainability. To ensure the best results, it is essential to obtain argan oil from reputable suppliers, preferably those involved in fair-trade practices and cooperatives that support local Moroccan communities. Cold-pressed, cosmetic-grade, or food-grade argan oil depending on the intended use, should be prioritized to maintain its beneficial properties. Proper verification of certifications, transparency in sourcing, and ethical production methods are key factors in making a responsible and effective purchase decision. If “argon light” was intended to reference a different product (such as lighting using argon gas), sourcing should focus on industrial gas suppliers with safety and purity standards in place. Clarifying the intended product is crucial for an accurate and actionable conclusion.