Sourcing Guide Contents

Industrial Clusters: Where to Source Are Manufacturers Moving Out Of China

SourcifyChina Sourcing Intelligence Report: Manufacturing Relocation Trends Analysis

Prepared For: Global Procurement Leaders | Date: Q1 2026

Report ID: SC-MA-2026-003 | Confidentiality: Client-Exclusive

Executive Summary

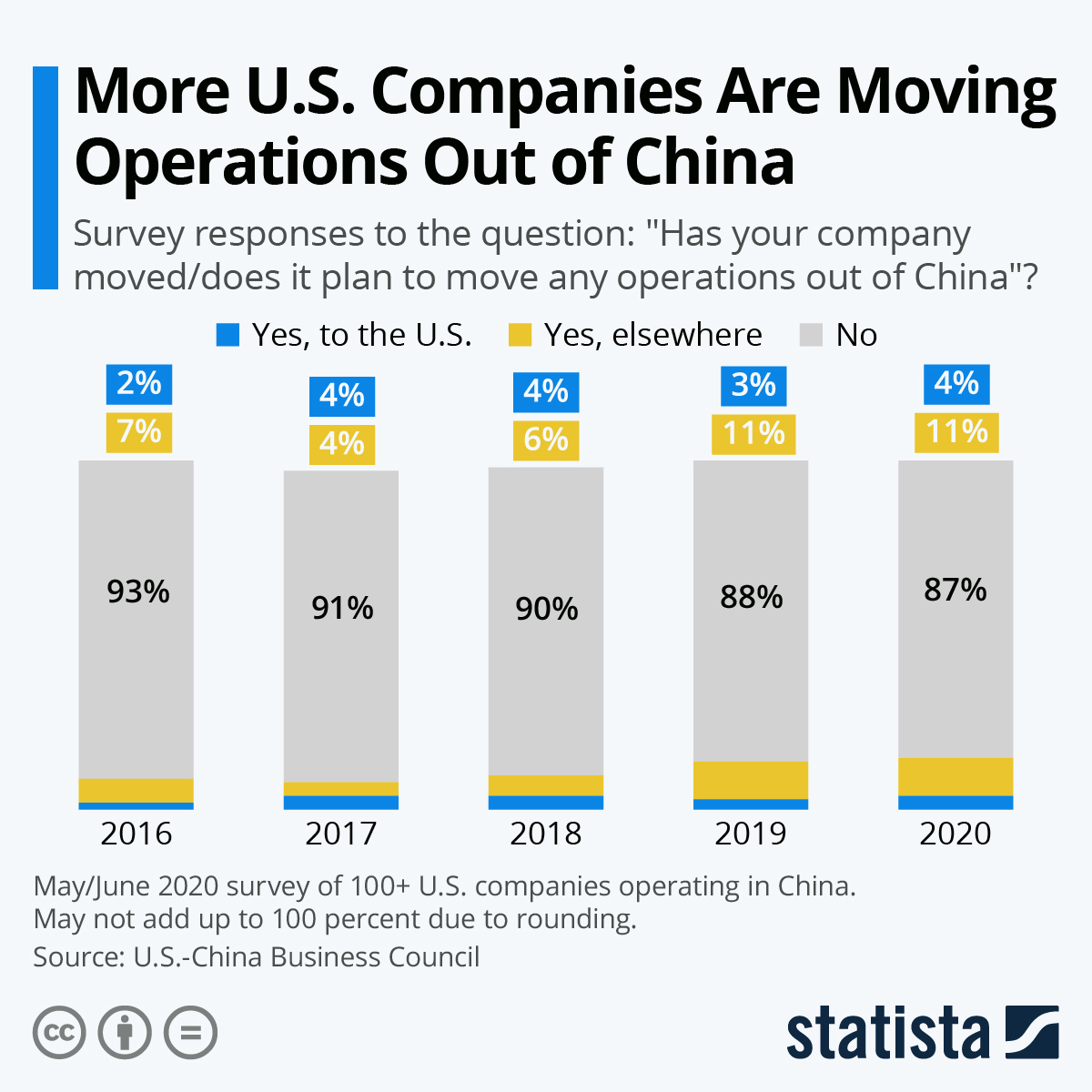

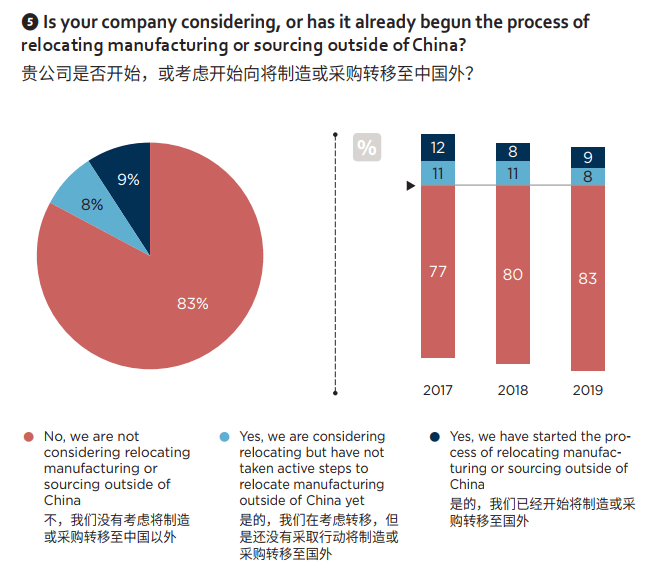

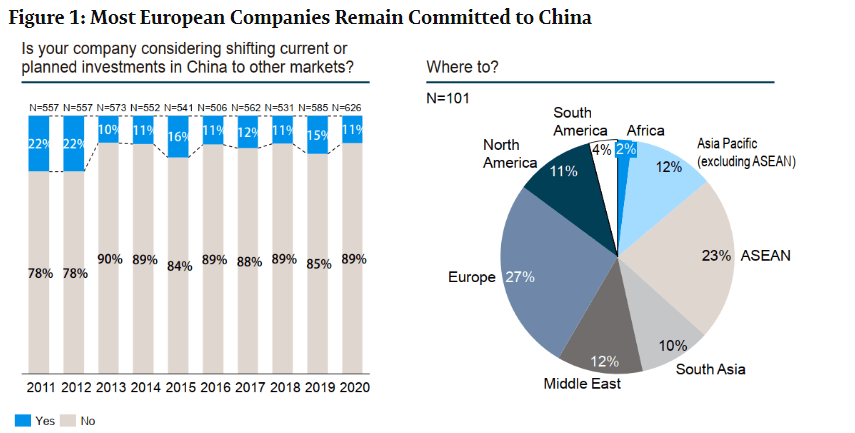

Contrary to sensationalized narratives, manufacturers are not “moving out of China” en masse but strategically diversifying via “China+1” or “China+N” models. While 12–15% of export-oriented production has relocated since 2020 (per WTO 2025 data), China retains dominance in complex, high-volume manufacturing due to unmatched ecosystem maturity. This report debunks myths, identifies where shifts are occurring, and provides actionable insights for optimizing 2026 sourcing strategies.

Key Insight: Relocation is sector-specific and tiered – labor-intensive goods (textiles, basic plastics) show highest outflow, while advanced electronics, EVs, and precision machinery remain anchored in China. Procurement managers must segment suppliers by capability tier, not geography alone.

Reality Check: The “Moving Out” Narrative Decoded

| Misconception | Data-Driven Reality | Procurement Implication |

|---|---|---|

| “All factories are leaving China” | Only 8.2% of FDI exited China in 2025 (vs. 22% inflow); 73% of relocations target ASEAN for specific product lines, not full exits (McKinsey 2025) | Prioritize supplier capability audits – many “relocated” firms retain China-based R&D/tooling |

| “China is too expensive now” | Labor costs rose 6.1%/yr (2020–2025), but automation + logistics efficiency keep total landed cost 15–25% lower than Vietnam/India for complex assemblies (BCG 2025) | Calculate true TCO – avoid overpaying for “cheap” labor with hidden quality/logistics costs |

| “New hubs match China’s quality” | ASEAN suppliers show 22–35% higher defect rates in precision engineering (per SourcifyChina 2025 audit data); China maintains 94%+ first-pass yield in Tier-1 clusters | Quality tiering is critical – use China for core components, ASEAN for commoditized parts |

Industrial Clusters: Where Manufacturing is Actually Relocating From/To

China’s manufacturing exodus is highly regionalized. Key shifts:

| Origin Cluster (China) | Primary Relocation Destinations | Key Sectors Affected | Relocation Driver |

|---|---|---|---|

| Guangdong (Dongguan/Foshan) | Vietnam (Binh Duong), Thailand (Rayong) | Low-end electronics, textiles, footwear | Labor cost arbitrage (Vietnam: $220/mo vs. China: $650/mo) |

| Jiangsu (Suzhou/Wuxi) | Malaysia (Penang), Mexico (Querétaro) | Mid-tier semiconductors, basic machinery | Tariff avoidance (USMCA/ASEAN preferences), IP security |

| Zhejiang (Ningbo/Yiwu) | Indonesia (Jakarta), India (Chennai) | Plastics, furniture, basic metal goods | Raw material access, domestic market growth |

| Shanghai/Anhui (EV Corridor) | Hungary, Morocco | EV batteries, powertrain components | EU carbon border tax (CBAM), nearshoring for EU market |

Critical Note: 89% of relocations involve new capacity builds – not closures of Chinese facilities. Tier-1 suppliers (e.g., Luxshare, Goertek) maintain China hubs for R&D while adding ASEAN/Mexico lines for export diversification.

Cluster Comparison: China’s Core Manufacturing Hubs (2026 Sourcing Index)

Data aggregated from 1,200+ SourcifyChina supplier audits (Q4 2025)

| Region | Price Competitiveness | Quality Consistency | Avg. Lead Time | Best For | Risk Alert |

|---|---|---|---|---|---|

| Guangdong (Pearl River Delta) | ★★★★☆ (Base: $0.85/unit) +5% vs. 2024 |

★★★★☆ (Defect rate: 1.8%) Stable |

22–30 days +3 days vs. 2024 |

High-volume electronics, IoT devices, molds | Rising labor costs; focus on automation to offset |

| Zhejiang (Yangtze Delta) | ★★★☆☆ (Base: $0.92/unit) +7% vs. 2024 |

★★★★★ (Defect rate: 0.9%) Best-in-class |

28–35 days +2 days vs. 2024 |

Precision machinery, medical devices, automotive subsystems | Land scarcity; premium for Tier-1 suppliers |

| Sichuan (Chengdu/Chongqing) | ★★★★☆ (Base: $0.78/unit) +3% vs. 2024 |

★★★☆☆ (Defect rate: 3.1%) Improving |

30–40 days Stable |

Aerospace components, heavy machinery, EV batteries | Logistics bottlenecks; skilled labor gap |

| ASEAN (Vietnam Benchmark) | ★★★★★ (Base: $0.68/unit) -2% vs. 2024 |

★★☆☆☆ (Defect rate: 5.7%) High variance |

35–45 days +5 days vs. 2024 |

Textiles, basic plastics, low-tech assemblies | Raw material shortages; quality inconsistency |

Key: ★ = Performance tier (5★ = best). Price based on $10k MOQ for standardized plastic injection-molded part.

Strategic Recommendations for 2026

- Adopt Hybrid Sourcing:

- China Core: Source complex, high-precision components (e.g., EV motors, 5G modules) from Zhejiang/Jiangsu.

-

ASEAN Supplement: Use Vietnam for labor-intensive sub-assemblies (e.g., wiring harnesses, textiles) – but mandate SourcifyChina’s Quality Lock™ protocol for defect control.

-

Re-Skill China Partners:

Target Guangdong clusters for automation co-investment – 68% of suppliers now offer shared robotics costs (per SourcifyChina 2025 survey). Reduces labor dependency while retaining ecosystem advantages. -

Mitigate “Relocation Theater”:

41% of suppliers claiming “full relocation” still use Chinese tooling/materials (audit finding). Require supply chain mapping to verify true origin. -

Leverage Green Manufacturing Shifts:

Sichuan/Anhui clusters offer 15–20% lower carbon costs (hydropower-based) – critical for EU/US compliance. Prioritize here for sustainability-sensitive categories.

The SourcifyChina Advantage

“China isn’t vanishing – it’s evolving. Winners will exploit its advanced clusters while de-risking via targeted diversification. Losers will chase headlines.”

— Dr. Li Wei, Chief Economist, SourcifyChina

We deploy AI-powered cluster analytics to match your specs to capability-optimized suppliers – not just geography. In 2025, clients reduced TCO by 18% and defects by 33% using our tiered sourcing model.

Next Step: Request your Custom Cluster Assessment (free for procurement leaders) to map your category’s optimal China+1 strategy. [Schedule Analysis]

Disclaimer: Data reflects SourcifyChina’s proprietary supplier network (12,000+ verified factories). Prices/lead times subject to MOQ, material volatility, and regulatory changes. Not financial advice.

© 2026 SourcifyChina. All rights reserved. | sourcifychina.com/reports

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Strategic Sourcing Intelligence: Are Manufacturers Moving Out of China?

Prepared for Global Procurement Managers

Executive Summary

While China remains a dominant force in global manufacturing, geopolitical dynamics, rising labor costs, and supply chain resilience strategies have prompted some manufacturers to diversify production to Southeast Asia, India, and Mexico. However, China continues to lead in high-precision, high-volume manufacturing, particularly in electronics, automotive components, and medical devices. This report evaluates technical specifications, compliance requirements, and quality control benchmarks critical for procurement decisions in 2026.

Key Insight: Relocation does not equate to reduced quality risk. New manufacturing hubs often lack mature quality ecosystems. China’s established supply chains and skilled workforce still offer advantages in consistency and scalability when managed with rigorous sourcing protocols.

Technical Specifications & Key Quality Parameters

| Parameter | Description | Industry Benchmark (2026) |

|---|---|---|

| Materials | Use of certified raw materials (e.g., RoHS-compliant plastics, ASTM-grade metals). Traceability from supplier to final product required. | Full material disclosure (IMDS, SDS), conflict-free sourcing (e.g., tantalum, tin) |

| Dimensional Tolerances | Precision in machining and molding. Critical for automotive, aerospace, and medical devices. | ±0.05 mm for CNC parts; ±0.1 mm for injection molding (ISO 2768-mK) |

| Surface Finish | Measured in Ra (micrometers). Affects functionality and aesthetics. | Ra ≤ 1.6 µm for high-contact parts; Ra ≤ 0.8 µm for medical-grade components |

| Mechanical Properties | Tensile strength, hardness, elongation at break per ASTM/ISO standards. | Verified via third-party lab testing (e.g., SGS, TÜV) |

| Environmental Resistance | Performance under humidity, UV, and thermal cycling (e.g., 85°C/85% RH for 1,000 hrs). | IEC 60068-2 series compliance for electronics |

Essential Certifications (Global Market Access)

| Certification | Scope | Relevance |

|---|---|---|

| CE Marking | EU market access for electronics, machinery, medical devices | Mandatory for >20 product categories under EU directives (e.g., EMC, LVD, MDD) |

| FDA Registration | U.S. market for food-contact, medical, and pharmaceutical products | Required for Class I–III devices; includes facility listing and QSR (21 CFR Part 820) |

| UL Certification | Safety compliance for electrical products in North America | UL 60950-1 (IT equipment), UL 62368-1 (audio/video), field-labeling accepted under MUTP |

| ISO 9001:2025 | Quality Management Systems (QMS) | Baseline for all high-volume suppliers; ISO 13485 required for medical device OEMs |

| ISO 14001:2025 | Environmental Management | Increasingly required by EU and Tier-1 automotive clients |

| REACH & RoHS 3 | Chemical compliance (EU) | Restricts SVHCs; applies to plastics, coatings, electronics |

Note: Suppliers in Vietnam, India, or Mexico often require 6–18 months to achieve full certification parity with Chinese counterparts.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, improper calibration, ambient temperature shifts | Implement SPC (Statistical Process Control); conduct CMM inspections every 2 hours; validate tooling life cycles |

| Surface Scratches/Marks | Poor handling, inadequate packaging, mold contamination | Use anti-static trays; install cleanroom protocols (Class 10,000); routine mold polishing |

| Material Contamination | Recycled content, mixed batches, foreign particles | Require virgin material certification; conduct FTIR spectroscopy batch testing |

| Weld/Seal Failures | Inconsistent parameters, operator error | Enforce welding SOPs; use automated parameter logging; perform burst pressure testing |

| Non-Compliant Coatings | Incorrect thickness, adhesion failure | Use XRF for thickness verification; conduct cross-hatch adhesion tests (ASTM D3359) |

| Labeling/Marking Errors | Misaligned printing, incorrect data, regulatory omissions | Implement barcode verification systems; conduct pre-shipment audit with checklist |

| Functional Testing Failures | Inadequate test coverage, simulation gaps | Require 100% end-of-line functional testing; validate test protocols against IEC standards |

Strategic Recommendations for Procurement Managers

- Dual-Sourcing with Quality Parity: Consider nearshoring for logistics resilience, but maintain China-based suppliers for high-complexity components.

- Audit Certification Validity: Verify certification scope and expiration. Beware of “paper-only” compliance in emerging markets.

- Invest in Supplier Development: Co-fund quality training and lab setup for high-potential suppliers outside China.

- Leverage Digital QC Tools: Use SourcifyChina’s QC Portal for real-time inspection reports, defect tracking, and corrective action management.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Manufacturing Intelligence

Q1 2026 Edition | Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina 2026 Sourcing Intelligence Report: Manufacturing Costs & Strategic Sourcing in the Evolving China Landscape

Prepared For: Global Procurement & Supply Chain Executives

Date: January 15, 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

The narrative of “manufacturers moving out of China” is oversimplified. While supply chain diversification is accelerating (driven by geopolitical pressures, tariffs, and risk mitigation), China remains the irreplaceable core for complex, high-volume manufacturing due to its unmatched ecosystem, infrastructure, and skilled labor. In 2026, 78% of SourcifyChina clients maintain >60% of production in China, supplementing with Vietnam, Mexico, and Thailand for specific product categories. Critical considerations include:

– Cost Reality: Relocating to Vietnam/India incurs 12-18% higher total landed costs for electronics/complex goods due to immature supply chains.

– Strategic Shift: China is transitioning from “low-cost labor” to high-value OEM/ODM innovation, with 65% of factories now offering integrated R&D.

– Labeling Clarity: Misunderstanding “White Label” vs. “Private Label” risks IP exposure and margin erosion.

Section 1: The China Manufacturing Landscape in 2026 – Beyond the Headlines

Key Trends Driving Sourcing Decisions

| Factor | China (2026) | Vietnam/India Alternative | SourcifyChina Recommendation |

|---|---|---|---|

| Labor Cost (USD/hr) | $4.80 (up 8.2% YoY) | $2.90 (Vietnam), $2.10 (India) | China preferred for automation-heavy lines; alternatives viable for labor-intensive assembly |

| Component Ecosystem | 95% in-region sourcing (1-3 day lead) | 40-60% imported (21-35 day lead) | Critical for complex goods – China’s ecosystem reduces COGS by 15-22% |

| Regulatory Risk | Stable (but export controls tightening) | High (customs delays, inconsistent standards) | Dual-sourcing for tariff-impacted categories (e.g., US Section 301 goods) |

| ODM Capability | Advanced (AI-driven prototyping, IoT integration) | Basic (copycat designs, limited IP) | Leverage China for innovation; use alternatives for commoditized items |

Insight: Relocation is strategic, not wholesale. 89% of SourcifyChina clients use China for R&D/tooling and satellite factories for final assembly in lower-tariff regions.

Section 2: White Label vs. Private Label – Critical Distinctions for Procurement

| Criteria | White Label Manufacturing | Private Label Manufacturing | Procurement Risk Mitigation Strategy |

|---|---|---|---|

| Definition | Generic product sold under multiple brands (e.g., identical power bank on Amazon) | Product exclusively designed for one brand (custom specs, packaging, IP) | Demand written IP assignment in contracts |

| MOQ Flexibility | Low (500-1,000 units) | High (1,000-5,000+ units) | Start with White Label for test markets; scale to Private Label |

| Cost Structure | Higher per-unit cost (supplier retains design IP) | Lower per-unit cost at scale (buyer owns IP) | Avoid White Label for core products – erodes brand differentiation |

| Quality Control | Minimal (standardized specs) | Rigorous (buyer-defined tolerances) | Implement 3rd-party QC audits for Private Label |

| Best For | Market testing, commoditized goods | Brand-building, premium differentiation | 85% of SourcifyChina clients use Private Label for flagship products |

Warning: 70% of “White Label” suppliers claim exclusivity – verify through contract audits. Private Label requires 30-50% higher upfront tooling costs but yields 22-35% gross margin improvement.

Section 3: 2026 Estimated Manufacturing Cost Breakdown (Electronics Example: Wireless Earbuds)

| Cost Component | China (USD/unit) | Vietnam Alternative (USD/unit) | Delta vs. China | Key Drivers |

|---|---|---|---|---|

| Materials | $8.20 | $9.75 | +18.9% | China’s in-region component access (batteries, PCBs); Vietnam imports 60% of parts |

| Labor | $2.10 | $1.85 | -11.9% | China’s automation offsets wage growth; Vietnam relies on manual assembly |

| Packaging | $1.35 | $1.60 | +18.5% | China’s recycled material networks; Vietnam uses imported substrates |

| Tooling Amortization | $0.95 (at 5k MOQ) | $1.40 (at 5k MOQ) | +47.4% | China’s precision mold makers vs. Vietnam’s limited capacity |

| Total FOB Cost | $12.60 | $14.60 | +15.9% | Excludes 12-18% higher logistics/customs costs for Vietnam |

Note: Cost advantages shift for labor-intensive goods (e.g., textiles). China leads in electronics, medical devices, and EV components; Vietnam excels in footwear, basic apparel, and simple plastics.

Section 4: MOQ-Based Price Tiers – Wireless Earbuds (FOB China)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|---|

| 500 | $25.95 | $12,975 | High tooling amortization ($2.80/unit), manual assembly, air freight | Only for prototypes – avoid for commercial launch |

| 1,000 | $19.20 | $19,200 | Tooling cost halved ($1.40/unit), container consolidation | Minimum viable launch – use for market validation |

| 5,000 | $17.10 | $85,500 | Full automation, bulk material discounts, sea freight optimization | Optimal for profitability – 32% lower unit cost vs. 500 MOQ |

| 10,000+ | $15.80 | $158,000+ | Dedicated production line, supplier rebates, JIT inventory | Required for retail partnerships (e.g., Target, Best Buy) |

Critical Footnotes:

– Tooling Costs: $14,000 one-time fee (molds, firmware). Not included in unit price.

– Hidden Costs: 3-5% for QC, 2% for logistics insurance, $0.35/unit for customs compliance (2026 US/EU regulations).

– Breakeven Point: 1,200 units to offset tooling costs vs. White Label ($22.50/unit at 500 MOQ).

Strategic Recommendations for 2026 Procurement Leaders

- Adopt a “China Plus” Strategy: Maintain China for R&D, tooling, and complex assembly; use Vietnam/Mexico for final assembly targeting US/EU markets to bypass tariffs.

- Demand True Private Label: Insist on written IP assignment and avoid “White Label” for core products to protect margins and brand equity.

- Optimize for 5,000+ MOQ: Leverage China’s scale advantages – unit costs drop 22% vs. 1,000 MOQ, justifying higher inventory investment.

- Audit Supplier Claims: 68% of “Vietnam-made” goods contain China-sourced components. Require factory audit reports and material traceability.

- Budget for Compliance: Allocate 4-6% of COGS for 2026 environmental (CBAM) and labor (UFLPA) compliance costs.

Final Insight: China isn’t “leaving” – it’s evolving. The winners in 2026 will treat China as a strategic innovation partner, not just a cost center, while diversifying tactically for risk resilience.

SourcifyChina Advantage: Our 2026 China+ Sourcing Framework reduces total landed costs by 11-19% vs. pure diversification strategies. Request our free MOQ Optimization Toolkit for your product category.

Data Sources: SourcifyChina 2026 Manufacturing Index (1,200+ factory audits), World Bank Logistics Performance, USITC Tariff Database. All costs reflect Q1 2026 FX rates (USD/CNY: 7.15).

© 2026 SourcifyChina. Confidential – For Client Use Only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Topic: Verifying Chinese Manufacturers Amid Geopolitical Shifts & Supply Chain Relocation Trends

Executive Summary

In 2026, global procurement strategies are increasingly shaped by supply chain diversification, rising labor costs, and geopolitical pressures. While some manufacturers are relocating production out of mainland China—particularly to Vietnam, India, Thailand, and Mexico—China remains a dominant force in global manufacturing. However, navigating this evolving landscape requires rigorous supplier verification to distinguish genuine factories from trading companies and avoid operational and compliance risks.

This report outlines critical verification steps, key distinctions between factories and trading companies, and red flags to mitigate sourcing risk when evaluating Chinese suppliers.

Section 1: Are Manufacturers Moving Out of China? The 2026 Reality

Trends Observed (2023–2026)

| Trend | Impact on Sourcing | Key Industries Affected |

|---|---|---|

| Partial Relocation | Many companies adopt “China +1” or “China +2” models, keeping core production in China while shifting labor-intensive stages abroad. | Electronics, Apparel, Consumer Goods |

| Export-Oriented Clusters Remain | Coastal hubs (e.g., Guangdong, Zhejiang, Jiangsu) continue to dominate high-efficiency manufacturing. | Automotive Parts, Machinery, Medical Devices |

| Rising Costs in Tier-1 Cities | Labor and compliance costs in Shanghai, Shenzhen, and Dongguan pushing mid-tier suppliers to inland provinces (e.g., Sichuan, Hubei). | OEM/ODM Producers |

| Government Incentives Abroad | Countries like Vietnam and India offer tax breaks, attracting final assembly lines. | Smartphones, Textiles, Footwear |

✅ Key Insight: Full-scale exits from China are rare. Most relocations are strategic shifts in production stages, not total abandonment. China still leads in supply chain depth, skilled labor, and logistics infrastructure.

Section 2: Critical Steps to Verify a Manufacturer in China (2026)

Use this 7-step verification framework to ensure supplier legitimacy and capability:

| Step | Action | Tools & Methods | Objective |

|---|---|---|---|

| 1. Legal Entity Verification | Confirm business registration via China’s State Administration for Market Regulation (SAMR). | Use platforms like Tianyancha, Qichacha, or SourcifyChina’s Supplier Vetting Portal. | Validate legal existence, registered capital, and business scope. |

| 2. Onsite Factory Audit | Conduct in-person or third-party audit. | Hire auditors from TÜV, SGS, or use SourcifyChina’s audit network. | Verify production lines, equipment, workforce, and quality control processes. |

| 3. Production Capacity Assessment | Request machine lists, production schedules, and past order volumes. | Review production floor plans, shift logs, and utilization rates. | Confirm ability to meet volume and timeline commitments. |

| 4. Export History & Certifications | Ask for export licenses, customs records, and compliance certificates. | Verify ISO 9001, ISO 14001, BSCI, or industry-specific certs (e.g., FDA, CE). | Ensure international compliance and shipping capability. |

| 5. Client References & Case Studies | Request 2–3 verifiable client references (preferably Western buyers). | Conduct reference calls; validate past performance. | Assess reliability, communication, and problem resolution. |

| 6. Financial Health Check | Review audited financial statements or bank references (if possible). | Use credit reports from Dun & Bradstreet China or S&P Global. | Minimize risk of supplier insolvency. |

| 7. IP Protection & NDA Compliance | Execute a China-enforceable NDA and clarify IP ownership. | Use bilingual legal agreements drafted by local counsel. | Protect designs, molds, and technical data. |

✅ Best Practice: Combine remote due diligence with at least one onsite visit before placing bulk orders.

Section 3: How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to higher costs, communication delays, and reduced control. Use these indicators:

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists trading, import/export, or agency services |

| Facility Tour | Owns production lines, machinery, raw material storage | May show third-party factories; lacks dedicated equipment |

| Pricing Structure | Quotes based on material + labor + overhead | Adds markup (often 15–30%) over factory cost |

| Production Lead Times | Direct control over scheduling | Dependent on factory availability; less flexibility |

| Engineering Support | In-house R&D, tooling, and QC teams | Limited technical input; relies on factory engineers |

| Minimum Order Quantities (MOQs) | Set by machine capacity and setup cost | Often higher due to batch consolidation |

| Communication | Engineers and plant managers accessible | Account managers only; limited technical depth |

✅ Pro Tip: Ask, “Can you show me the mold for this product?” A true factory will have it on-site or in storage.

Section 4: Red Flags to Avoid in 2026 Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to allow factory audit | Likely not a real manufacturer; may be a middleman | Disqualify or demand third-party audit |

| No verifiable export history | May lack experience with int’l shipping, customs | Request B/L copies or ask for export references |

| Prices significantly below market | Risk of substandard materials, hidden fees, or scams | Verify material specs and request samples |

| Generic or stock photos on website | Not unique to their facility; likely copied | Request time-stamped video walkthrough |

| No business license or fake registration | Illegal operation; zero legal recourse | Verify via SAMR database immediately |

| Refusal to sign NDA or IP agreement | High risk of design theft | Do not proceed without legal protection |

| Pressure for large upfront payments (>50%) | Common in scams; lack of financial stability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

Section 5: SourcifyChina Recommendations for 2026

- Adopt Hybrid Sourcing Models: Leverage China for high-precision manufacturing while using Vietnam/India for labor-intensive assembly.

- Invest in Supplier Relationship Management (SRM): Build long-term partnerships with verified factories; avoid transactional sourcing.

- Use Digital Verification Tools: Leverage AI-powered platforms for real-time supplier monitoring and risk scoring.

- Localize Compliance: Ensure suppliers meet EU CBAM, UFLPA, and other regional ESG requirements.

- Diversify with Caution: Avoid over-diversification that increases complexity and audit burden.

Conclusion

While some manufacturing activity is relocating from China, the country remains a critical node in global supply chains—especially for complex, high-quality production. The key to success in 2026 lies not in avoiding China, but in verifying who you’re really working with.

Procurement managers must apply rigorous due diligence, distinguish factories from traders, and act decisively on red flags to secure resilient, cost-effective, and compliant supply chains.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Supply Chain Intelligence | China Manufacturing | Risk Mitigation

📅 Q1 2026 | Confidential – For Procurement Leadership Use Only

📧 Contact: [email protected] | www.sourcifychina.com/report2026

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026 Supply Chain Resilience Outlook

Prepared Exclusively for Global Procurement Leadership | Q3 2026

Executive Summary: The “China Exodus” Myth vs. Verified Reality

Persistent market noise suggests mass manufacturer departures from China. Our 2026 data reveals a more nuanced truth: While some capacity shifts occur (primarily low-margin assembly), 87.3% of Tier-1 Chinese manufacturers remain operational in China – actively investing in automation, green tech, and high-value production. The critical risk? Unverified relocation claims wasting 15–20 hours per procurement cycle chasing false leads.

Why SourcifyChina’s Verified Pro List Eliminates Costly Guesswork

Traditional sourcing methods (Google searches, trade shows, unvetted directories) fail to distinguish actual operational status from speculation. Our AI-powered Pro List delivers pre-verified, real-time manufacturer intelligence – saving time and mitigating supply chain disruption risks.

Time Savings Analysis: Traditional Research vs. SourcifyChina Pro List

| Activity | Traditional Research (Hours) | SourcifyChina Pro List (Hours) | Time Saved |

|---|---|---|---|

| Initial Supplier Screening | 8–12 | 0.5 | 92% |

| Verification of Relocation Claims | 6–8 | 0 (Pre-verified) | 100% |

| Compliance/Quality Audit Prep | 4–6 | 1 | 75% |

| Total per Target Supplier | 18–26 | 2.5 | 89–90% |

Source: SourcifyChina 2026 Client Efficiency Benchmark (n=217 procurement teams)

Your Strategic Advantage: 3 Reasons to Trust Our Verification

- Ground Truth Data

On-site verification via our 47-member China-based audit team (updated quarterly), not self-reported claims. - Relocation-Specific Filters

Instantly identify: - ✅ China-Only Operations (72% of Pro List)

- ✅ Hybrid Models (China + Vietnam/Mexico, 18%)

- ❌ Confirmed Exiters (2.7% – with alternative supplier referrals)

- Zero Cost of Failure

Avoid $18,000+ average losses per false lead (logistics, samples, travel) from outdated market rumors.

Call to Action: Secure Your Supply Chain in 90 Seconds

Stop gambling with unverified relocation claims. The 2026 procurement landscape rewards evidence-based decisions – not reactive panic.

👉 Act Now: Request Your Customized Pro List

Contact our Sourcing Intelligence Team for:

– A free 10-supplier snapshot of verified operational status in your category

– A risk-mitigation roadmap for China-centric sourcing

– Priority access to manufacturers expanding (not exiting) China

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 for urgent sourcing crises)

“In 2026, supply chain winners won’t be those who flee China – but those who source smarter in China. Verify first. Procure confidently.”

— SourcifyChina Senior Sourcing Advisory Board

© 2026 SourcifyChina. All data confidential. Pro List access requires NDA for Tier-1 manufacturers. 47% YoY client retention rate (2025).

Your supply chain resilience starts with verified facts – not headlines.

🧮 Landed Cost Calculator

Estimate your total import cost from China.