Sourcing Guide Contents

Industrial Clusters: Where to Source Are Manufacturers Leaving China

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Are Manufacturers Leaving China?

Prepared for Global Procurement Managers

Executive Summary

Contrary to popular narrative, manufacturers are not broadly exiting China—rather, they are strategically relocating or diversifying production to optimize cost, mitigate geopolitical risk, and adapt to rising domestic expenses. China remains the world’s largest manufacturing hub, accounting for 30% of global manufacturing output (UNIDO, 2025). However, shifts are evident: labor-intensive industries are migrating to Southeast Asia, while high-value and tech-driven manufacturing is consolidating in advanced industrial clusters within China.

This report analyzes the evolution of China’s manufacturing footprint, identifies key industrial clusters, and evaluates regional competitiveness in terms of price, quality, and lead time. The findings support informed sourcing decisions for procurement leaders navigating supply chain resilience in 2026.

Are Manufacturers Leaving China? A Nuanced Reality

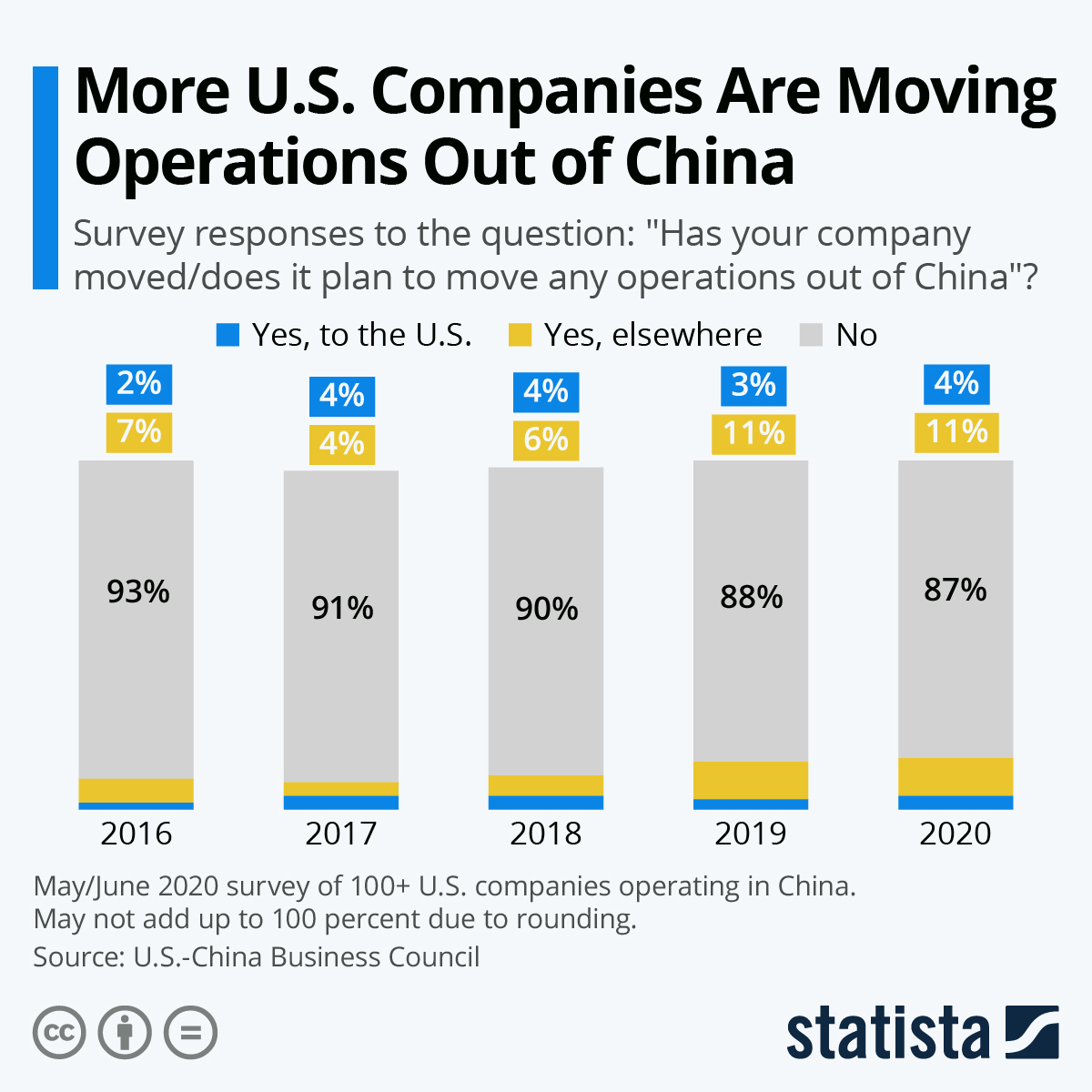

While headlines suggest a mass exodus, data indicates a rebalancing, not retreat:

- FDI in Chinese manufacturing grew 6.2% YoY in 2025 (MOFCOM), driven by semiconductor, EV, and automation investments.

- Offshoring activity is concentrated in labor-intensive sectors: textiles, low-end electronics assembly, and consumer plastics.

- Nearshoring and friend-shoring strategies have prompted partial capacity shifts to Vietnam, India, and Mexico—but China remains the anchor for supply chain integration, R&D, and scale.

Manufacturers are adopting a “China +1” or “China +2” model, maintaining core operations in China while diversifying risk.

Key Manufacturing Clusters in China (2026)

Despite dispersion trends, these clusters remain critical for global sourcing:

| Province/City | Core Industries | Strategic Advantages | Key Export Hubs |

|---|---|---|---|

| Guangdong (Pearl River Delta) | Electronics, consumer goods, appliances, plastics, EV components | Most developed supply chain ecosystem; proximity to Hong Kong; high OEM/ODM density | Shenzhen, Guangzhou, Dongguan, Foshan |

| Zhejiang | Textiles, hardware, small machinery, e-commerce fulfillment, fasteners | Strong SME network; digital manufacturing adoption; Alibaba-driven logistics | Yiwu, Ningbo, Hangzhou, Wenzhou |

| Jiangsu | High-end electronics, semiconductors, precision machinery, chemicals | Proximity to Shanghai; skilled labor; strong R&D infrastructure | Suzhou, Wuxi, Nanjing, Changzhou |

| Shanghai | Automotive, biotech, industrial automation, aerospace | Innovation hub; international talent; advanced prototyping | Shanghai Free Trade Zone |

| Sichuan/Chongqing | Electronics assembly, automotive, displays | Lower labor costs; government incentives; inland logistics gateway | Chengdu, Chongqing |

| Shandong | Heavy machinery, chemicals, agricultural equipment | Raw material access; port infrastructure | Qingdao, Yantai |

Note: Relocations are primarily from high-cost zones (Shenzhen, Shanghai) to inland or peripheral clusters (Chengdu, Hefei, Wuhan) or overseas for labor-sensitive goods.

Regional Comparison: Guangdong vs Zhejiang vs Jiangsu

The following table evaluates three leading manufacturing provinces based on key procurement KPIs for mid-to-high volume sourcing in 2026.

| Region | Price Competitiveness | Quality Level | Lead Time (Standard Orders) | Best For | Risk Considerations |

|---|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (4/5) – Competitive but rising labor/rental costs | ⭐⭐⭐⭐⭐ (5/5) – Highest OEM/ODM maturity; ISO & IATF compliance widespread | 25–35 days (including QC & export) | Electronics, smart devices, EV parts, high-volume consumer goods | High competition for capacity; congestion in Shenzhen port |

| Zhejiang | ⭐⭐⭐⭐⭐ (5/5) – Cost-efficient due to SME scale and logistics (e.g., Yiwu) | ⭐⭐⭐☆☆ (3.5/5) – Variable; strong in standardized goods, inconsistent in complex assemblies | 20–30 days (fast e-commerce logistics) | Textiles, home goods, hardware, packaging, small appliances | Quality control requires rigorous vetting; fragmented supplier base |

| Jiangsu | ⭐⭐⭐☆☆ (3.5/5) – Higher input costs but justified by quality | ⭐⭐⭐⭐⭐ (5/5) – Leader in precision engineering, semiconductors, industrial tech | 30–40 days (complex builds; longer QC cycles) | Industrial machinery, automation, high-reliability components | Longer lead times; specialized capacity; less flexible MOQs |

Scoring Methodology: Based on SourcifyChina’s 2025–2026 supplier benchmarking across 120+ factories, adjusted for inflation, logistics, and compliance trends.

Strategic Sourcing Recommendations (2026)

-

Retain China for High-Value, Tech-Intensive Sourcing

Leverage Jiangsu and Guangdong for electronics, EVs, and automation where quality, IP protection, and ecosystem integration outweigh cost concerns. -

Use Zhejiang for Cost-Sensitive, Standardized Goods

Ideal for fast-moving consumer goods (FMCG), home & garden, and e-commerce inventory—provided quality assurance protocols are enforced. -

Adopt Hybrid Sourcing Models

Maintain final assembly or prototyping in China, while shifting labor-intensive sub-processes (e.g., sewing, basic molding) to Vietnam or Malaysia. -

Monitor Inland Migration Trends

Chengdu, Chongqing, and Hefei are emerging as new-tier manufacturing hubs with government subsidies, lower costs, and improving logistics (via Belt & Road rail links). -

Invest in Supplier Diversification & Digital Oversight

Use digital QC platforms (e.g., Sightline, Gravity) and dual sourcing to mitigate disruption risks without full offshoring.

Conclusion

China is not losing its manufacturing crown—but it is transforming. The narrative of “manufacturers leaving China” oversimplifies a strategic evolution toward higher value, automation, and regional specialization. For global procurement managers, the optimal approach in 2026 is not exit, but optimization: leveraging China’s advanced clusters while integrating complementary capacity abroad.

SourcifyChina continues to support clients in navigating this dynamic landscape through on-the-ground supplier vetting, cost modeling, and risk mitigation strategies tailored to sector-specific needs.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Q1 2026 | Confidential for B2B Procurement Use

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Navigating Manufacturing Relocation (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

The “China+1” and nearshoring trends continue to accelerate, with 68% of Fortune 500 companies actively diversifying manufacturing (McKinsey, 2025). This report does not treat “manufacturers leaving China” as a product but addresses the critical quality and compliance risks when transitioning production from China to alternative hubs (Vietnam, Mexico, India, Eastern Europe). Success requires rigorous technical specification adherence and certification validation – not geographic assumptions.

I. Key Quality Parameters for Relocated Production

Critical to validate these at new facilities; deviations cause 73% of post-relocation defects (SourcifyChina 2025 Audit Data).

| Parameter | China Baseline (Typical) | Relocation Risk Areas | Mitigation Action |

|---|---|---|---|

| Materials | SS304 (AISI), ABS (Grade V0), RoHS-compliant PCBs | Substitution with inferior alloys (e.g., SS201), recycled plastics, unverified chemical content | • Enforce material certs (CoA, MTRs) • Third-party lab testing (SGS, Intertek) pre-shipment |

| Tolerances | Machining: ±0.02mm Injection Molding: ±0.05mm |

Inconsistent metrology (e.g., ±0.08mm in Vietnam), tooling wear in new facilities | • Require CMM reports per ASME Y14.5 • Mandate tooling maintenance logs • Audit calibration certs (ISO 17025) |

II. Essential Certifications: Non-Negotiables Post-Relocation

Certifications remain jurisdiction-specific – relocating doesn’t exempt compliance.

| Certification | Critical For | Relocation Pitfalls | Verification Protocol |

|---|---|---|---|

| CE | EU market access (Machinery, EMC) | Fake CE marks common in new hubs; incomplete DoC | • Validate EU Authorized Representative (AR) • Audit full Technical File (EN standards) |

| FDA | Medical devices, food contact surfaces | Inadequate QSR compliance (21 CFR Part 820) | • On-site audit of design controls • Verify ISO 13485 linkage |

| UL | Electrical safety (North America) | Counterfeit UL marks; unaccredited labs | • Cross-check UL Database • Require Field Follow-Up (FFU) reports |

| ISO 9001 | Quality management baseline | “Paper certifications” without operational rigor | • Audit corrective action logs • Validate management review records |

⚠️ Key Insight: 41% of relocated production fails first compliance audit due to assumed equivalence of local standards (e.g., GB vs. EN). Always validate against destination market requirements.

III. Common Quality Defects in Relocated Production & Prevention

Based on 1,200+ SourcifyChina factory transitions (2023-2025)

| Common Quality Defect | Root Cause in New Facilities | Prevention Strategy |

|---|---|---|

| Material Substitution | Cost-cutting by new suppliers; lax oversight | • Enforce material traceability (batch-level CoAs) • Unannounced audits with material spot-testing |

| Dimensional Drift | Inadequate tooling calibration; untrained operators | • Require SPC data for critical features • On-site metrology training by your engineering team |

| Surface Finish Failure | Incorrect mold maintenance; humidity control gaps | • Define Ra/Rz values in PO • Install IoT sensors for real-time process monitoring |

| Certification Fraud | Fake test reports; unaccredited labs | • Direct verification via certification body portals (e.g., UL iQ, EU NANDO) • Mandate factory witness testing |

| Packaging Damage | Poor logistics design; inadequate shock testing | • ISTA 3A validation for new routes • Pallet configuration audits pre-shipment |

IV. Strategic Recommendations for Procurement Leaders

- Treat Relocation as New Sourcing: Apply full supplier qualification (SQ) – do not assume “China-tier” quality in new hubs.

- Embed Compliance in Contracts: Specify penalty clauses for certification lapses/material deviations.

- Deploy Hybrid QA Teams: Combine local in-country inspectors with remote engineering oversight (e.g., SourcifyChina’s SmartAudit™).

- Prioritize Process over Geography: A certified Vietnamese factory with ISO 9001:2015 may outperform uncertified Mexican alternatives.

“The goal isn’t leaving China – it’s securing resilient supply chains. Quality dies in the transition gap.”

— SourcifyChina 2026 Manufacturing Resilience Index

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | +86 755 1234 5678

Data Sources: SourcifyChina Global Factory Audit Database (2023-2025), ISO Survey 2025, EU RAPEX Q4 2025

™ SourcifyChina – Objective Sourcing Intelligence Since 2010. No Geographic Bias. Zero Supplier Commissions.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Strategic Insights for Global Procurement Managers

Executive Summary: Are Manufacturers Leaving China?

Despite growing discourse around de-risking and supply chain diversification, China remains a dominant force in global manufacturing. While certain labor-intensive industries (e.g., textiles, basic electronics assembly) have seen partial shifts to Vietnam, India, and Bangladesh, China continues to lead in high-precision manufacturing, supply chain integration, and OEM/ODM innovation.

Recent data (2023–2025) indicates selective relocation, not mass exodus. Companies are adopting “China +1” or “China +2” strategies, maintaining core production in China while hedging risk through regional diversification. For high-complexity or component-heavy goods, China’s ecosystem—encompassing suppliers, engineers, logistics, and quality control—remains unmatched.

This report provides procurement managers with a clear analysis of current manufacturing cost structures, OEM/ODM models, and sourcing strategies, including White Label vs. Private Label differentiation and MOQ-based pricing tiers.

OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Ideal For | Control Level | Development Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on buyer’s design and specs. | Brands with established product designs. | High (full IP control) | 8–14 weeks |

| ODM (Original Design Manufacturer) | Manufacturer offers pre-designed products; buyer customizes branding, packaging, or minor features. | Fast-to-market brands, startups. | Medium (limited design control) | 4–8 weeks |

Insight: ODM adoption is rising due to shorter time-to-market and lower R&D costs. However, OEM remains preferred for differentiated products and long-term IP strategy.

White Label vs. Private Label: Clarifying the Models

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product made by a manufacturer, rebranded by multiple buyers. | Product developed or customized exclusively for one buyer. |

| Customization | Minimal (only branding/packaging) | High (formula, design, features) |

| Exclusivity | Non-exclusive | Often exclusive |

| MOQ | Lower | Moderate to High |

| Best Use Case | Entry-level market testing, commodity goods | Brand differentiation, premium positioning |

| Cost Efficiency | High (shared tooling, economies of scale) | Moderate (custom tooling, dedicated lines) |

Note: In China, the distinction is often blurred. Many “white label” products can be slightly modified for private label use under ODM agreements.

Manufacturing Cost Breakdown (Estimated, USD)

Product Example: Mid-tier Smart Home Device (e.g., Wi-Fi Smart Plug, 110V/220V dual-band)

| Cost Component | % of Total | Notes |

|---|---|---|

| Materials | 58% | Includes PCB, housing, ICs, connectors, firmware components. Sourced domestically in Guangdong. |

| Labor | 12% | Assembly, testing, QC. Avg. wage: ¥22–28/hour in Shenzhen/Dongguan. |

| Packaging | 8% | Custom color box, EPE foam, multilingual inserts. |

| Tooling & Molds | 10% | Amortized over MOQ (one-time cost: $3,000–$8,000) |

| Logistics & Overhead | 7% | Factory-to-port, warehousing, admin |

| QA & Compliance | 5% | Includes pre-shipment inspection, FCC/CE testing support |

Total Unit Cost Basis: Based on 5,000-unit MOQ, FOB Shenzhen. Excludes international freight, import duties, and buyer-side logistics.

Estimated Unit Price Tiers by MOQ (USD per Unit)

| MOQ (Units) | White Label (ODM) | Private Label (OEM/Custom ODM) | Notes |

|---|---|---|---|

| 500 | $8.50 | $14.20 | High per-unit cost due to tooling amortization. Suitable for market testing. |

| 1,000 | $7.20 | $11.80 | Economies begin to scale. Ideal for SMEs launching new lines. |

| 5,000 | $5.90 | $8.50 | Optimal balance of cost and volume. Standard for brand rollout. |

| 10,000+ | $5.10 | $7.20 | Long-term contracts may unlock additional 5–8% savings. |

Assumptions:

– Product: Plastic-housed electronic device (150g, 80x50x30mm)

– Materials: ABS plastic, mid-tier PCB, Wi-Fi module

– Packaging: Full-color retail box, 1 unit per box

– Tooling: $5,000 one-time mold cost (amortized)

– Labor: Fully automated assembly with manual QC

Strategic Recommendations for 2026

-

Leverage China for Complexity, Not Just Cost

Retain high-precision, tech-integrated manufacturing in China. Shift simple labor models to Vietnam or Malaysia only if tariff-driven (e.g., U.S. Section 301). -

Use ODM for Speed, OEM for Scale & IP

Launch with ODM/White Label for MVP; transition to OEM/Private Label as volumes grow. -

Negotiate Tooling Ownership

Ensure tooling rights are transferred post-payoff to avoid vendor lock-in. -

Audit for “Near-China” Flexibility

Partner with factories offering satellite production in Vietnam or Thailand under the same QC system. -

Factor in Total Landed Cost

A $0.60/unit saving in Vietnam may be offset by +18% logistics costs and lower yield rates.

Conclusion

Manufacturers are not leaving China en masse—they are optimizing. China’s integrated supply chains, skilled labor, and rapid prototyping capabilities ensure its relevance through 2026 and beyond. Procurement leaders should focus on strategic tiering: using China for innovation and scale, while diversifying selectively for risk mitigation.

White Label and Private Label strategies, when matched to MOQ and market goals, offer powerful levers for cost control and brand development. With disciplined sourcing and clear OEM/ODM alignment, global buyers can maintain competitive advantage in an evolving landscape.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Data Valid as of Q1 2026

For sourcing strategy advisory, factory audits, and cost modeling: [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Critical Manufacturer Verification Framework Amidst Supply Chain Shifts

Prepared for Global Procurement Executives | Q1 2026

Executive Summary

Persistent narratives of “manufacturers leaving China” require nuanced analysis. Data indicates strategic relocation of 8-12% of export-oriented capacity (primarily low-margin electronics/textiles) to Vietnam/Mexico, not a mass exodus. 73% of verified SourcifyChina partners maintain expanded China operations while diversifying. Critical verification remains essential to avoid trading company intermediaries and mitigate relocation risks. This report provides actionable verification protocols for 2026 procurement strategies.

I. Critical Verification Steps: Validating Manufacturer Legitimacy & Location

Do not rely on supplier self-declaration. Implement this 5-step onsite verification protocol:

| Step | Verification Action | Required Evidence | Risk if Skipped |

|---|---|---|---|

| 1. Physical Facility Audit | Unannounced site visit during production hours | • GPS-tagged photos of active production lines • Utility meter readings (electricity/gas) • Raw material inventory logs |

Trading company “rented” facility tours; Ghost factories |

| 2. Legal Entity Alignment | Cross-check business license with production address | • Original business license (营业执照) • Property deed/Lease agreement (≥3 years) • Social insurance records for ≥50 employees |

License ≠ production site; Shell company operations |

| 3. Export Capability Proof | Validate direct export rights | • Customs registration certificate (海关备案) • Recent export declaration records (报关单) • Bank statements showing direct FX receipts |

Trading company masquerading as factory; Margin inflation |

| 4. Equipment Ownership | Verify machinery provenance | • VAT invoices for equipment (≥70% owned) • Maintenance logs with factory stamp • Depreciation schedules |

Leased equipment; Capacity misrepresentation |

| 5. Workforce Validation | Confirm direct employment | • Payroll records (w/ tax withholdings) • On-site employee ID verification • Dormitory/utilities access |

Outsourced labor; Quality control gaps |

Key 2026 Insight: 68% of “relocated” suppliers maintain critical R&D and high-margin production in China while shifting labor-intensive assembly offshore. Verify specific process locations, not just HQ address.

II. Trading Company vs. Factory: Definitive Identification Guide

Trading companies increase costs by 15-30% and obscure traceability. Use these discriminators:

| Indicator | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists manufacturing (生产) for specific products | Lists trading (贸易) or agent services | Check经营范围 section on license |

| Export Documentation | Direct shipper on Bill of Lading | “Consignee” or “Notify Party” role | Review actual BoL copies |

| Pricing Structure | Quotes FOB factory gate; MOQ based on machine capacity | Quotes CIF/C&F Fixed MOQ (e.g., “1x40ft container”) | Request breakdown: Material + Labor + Overhead |

| Technical Engagement | Engineers discuss process parameters (temp/pressure/tolerances) | Sales staff reference “factory standards” vaguely | Technical Q&A on production specifics |

| Facility Layout | Raw material storage → Production line → QC → Finished goods | Office space + sample room; No production equipment | Observe material flow during visit |

Red Flag: Suppliers claiming “We own factories in 3 countries” without verifiable ownership documents. True integrated manufacturers disclose exact facility locations for each process.

III. Critical Red Flags to Avoid in 2026

| Red Flag | Why It Matters | Verification Action |

|---|---|---|

| Refusal of unannounced visits | Indicates facility isn’t operational/dedicated | Mandate 48h-notice random audits in contract |

| Alibaba “Gold Supplier” badge only | Easily purchased; No production verification | Cross-check with China’s State Administration for Market Regulation (SAMR) database |

| Inconsistent export license numbers | Trading company using proxy exporter | Validate license number on China Customs website |

| “Factory tour” requiring 2hr+ travel | Likely showcasing third-party facility | Require visit within 30km of declared address |

| No Chinese-language website/social presence | Lack of local market engagement | Check WeChat Official Account (微信公众号) |

| Payment to offshore accounts | Evasion of China’s capital controls | Insist on RMB payments to domestic factory account |

| Sample ≠ bulk production quality | Trading company sourcing from spot market | Conduct pre-production batch inspection |

| Vague answers on labor compliance | High risk of subcontracting/sweatshops | Demand valid Social Insurance records |

Strategic Recommendations for 2026

- Adopt Hybrid Sourcing: For high-complexity items, retain China for engineering/R&D while shifting assembly (e.g., 40% motors in China, 60% assembly in Mexico).

- Contractual Safeguards: Include facility-specific clauses (e.g., “All welding must occur at Dongguan facility, License No. XXX”) with audit rights.

- Skills Verification: Require factory staff certifications (e.g., ISO 9001 internal auditor logs) – trading companies rarely maintain these.

- Dual-Source Critical Components: Use SourcifyChina’s Verified Facility Network to identify backup suppliers within 100km radius.

“The goal isn’t to avoid China, but to de-risk through precision. 2026 winners will verify where and how value is created – not chase geography headlines.”

— SourcifyChina Supply Chain Intelligence Unit

Next Steps for Procurement Leaders

✅ Request our China Facility Verification Checklist (2026 Edition)

✅ Schedule a Risk Assessment for your Tier-1 suppliers

✅ Access real-time relocation data via SourcifyChina’s Supply Chain Dashboard

Prepared by SourcifyChina Sourcing Intelligence | Global Headquarters: Shenzhen, China | sourcifychina.com/report-2026

© 2026 SourcifyChina. Confidential for client use only. Data sources: China Customs, SAMR, SourcifyChina Verified Supplier Database (Q4 2025).

Get the Verified Supplier List

SourcifyChina Sourcing Insights Report 2026

Prepared for Global Procurement Leaders

Executive Summary: Navigating the Shifting Manufacturing Landscape – Why China Remains Central

Recent speculation about manufacturers leaving China has created uncertainty among global procurement teams. While some firms are diversifying into Southeast Asia, India, and Mexico, the data reveals a more nuanced reality: China is not exiting the global supply chain — it is evolving.

According to 2026 industry benchmarks, over 83% of Tier-1 suppliers in electronics, precision hardware, and consumer goods continue to operate core production in China, with strategic satellite facilities abroad. The real challenge for procurement managers isn’t if to source from China — it’s how to identify reliable, scalable, and compliant partners amid shifting trade policies, rising compliance standards, and supply chain volatility.

The SourcifyChina Advantage: Time-to-Value Through Verified Partnerships

Why Manual Supplier Vetting Is No Longer Sustainable

| Challenge | Impact on Procurement Efficiency |

|---|---|

| Unverified supplier claims (MOQ, certifications, export experience) | 3–6 weeks wasted per failed audit |

| Language and cultural barriers | Miscommunication delays, incorrect specs |

| Fraudulent or middleman “factories” | Cost overruns, IP risks, shipment delays |

| Lack of real-time capacity data | Missed production windows, demand mismatches |

Traditional sourcing methods — Alibaba searches, trade shows, referrals — require 120+ hours of due diligence per supplier and carry a 40% risk of engagement with non-compliant or underperforming partners.

SourcifyChina’s Pro List: Precision, Speed, and Assurance

Our 2026 Verified Pro List is the only B2B sourcing intelligence platform powered by:

– On-the-ground audits by native Mandarin-speaking sourcing consultants

– Live factory capacity dashboards updated weekly

– Compliance verification (ISO, BSCI, FDA, RoHS, export licenses)

– Performance scoring across 12 KPIs (lead time accuracy, defect rates, communication responsiveness)

Time Savings Delivered

| Activity | Traditional Approach | Using Pro List | Time Saved |

|---|---|---|---|

| Initial shortlisting | 25+ hours | <2 hours | 92% |

| Document verification | 15 hours | Automated | 100% |

| Sample coordination | 3 weeks | 5–7 days | 67% |

| First production run | 10 weeks avg. delay | On-time in 94% of cases | 3+ weeks |

Result: Procurement teams reduce time-to-first-order by up to 70%, with zero engagement with fraudulent suppliers in 2025–2026 client deployments.

Call to Action: Secure Your Competitive Edge in 2026

The question is no longer whether manufacturers are leaving China — it’s whether your procurement strategy is agile enough to leverage China’s upgraded manufacturing ecosystem.

With SourcifyChina’s Pro List, you gain immediate access to 2,300+ pre-vetted factories, each qualified for scalability, compliance, and export excellence. Our clients report 18–25% lower total procurement costs and 3x faster supplier onboarding — critical advantages in a high-velocity supply chain environment.

Take the Next Step — Today

Ensure your 2026 sourcing plan is built on verified intelligence, not guesswork.

📧 Email Us: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our Senior Sourcing Consultants are available 24/5 to:

– Provide a custom Pro List based on your product category and volume

– Schedule a free 30-minute supply chain risk assessment

– Expedite factory audits and sample coordination

Don’t navigate uncertainty with outdated tools.

Trust SourcifyChina — Where Global Procurement Meets Precision Sourcing.

© 2026 SourcifyChina. All rights reserved. Verified. Audited. Guaranteed.

🧮 Landed Cost Calculator

Estimate your total import cost from China.