Sourcing Guide Contents

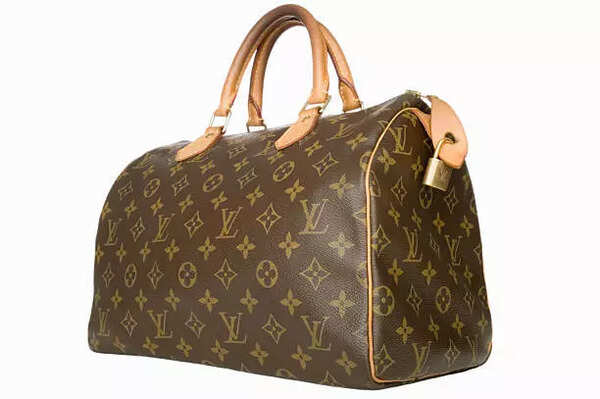

Industrial Clusters: Where to Source Are Louis Vuitton Bags Manufactured In China

SourcifyChina B2B Sourcing Report 2026: Market Analysis on Luxury Leather Goods Manufacturing in China

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-LUX-2026-09

Executive Summary

Critical Clarification: Louis Vuitton (LVMH Group) does not manufacture authentic Louis Vuitton bags in China. All genuine Louis Vuitton leather goods are produced in France, Spain, Italy, and the USA under strict proprietary control. China is not an authorized manufacturing location for LV products. Claims of “LV factories in China” invariably refer to counterfeit operations, which violate intellectual property (IP) rights, pose severe legal/reputational risks, and fall outside ethical sourcing frameworks.

This report redirects focus to legitimate high-end leather goods manufacturing in China—relevant for brands seeking comparable quality craftsmanship (e.g., OEM/ODM for non-branded luxury-adjacent products). We analyze key industrial clusters, risks, and procurement strategies for authentic sourcing.

Market Reality: Why “LV Bags Made in China” is a Misconception

| Factor | Reality Check |

|---|---|

| Brand Policy | LVMH enforces “Made in Europe” for leather goods; China is excluded from supply chain. |

| IP Enforcement | Chinese authorities actively collaborate with LVMH to dismantle counterfeits (2025 raids: 12,000+ fake LV units seized in Guangdong). |

| Procurement Risk | Sourcing “LV bags” from China = 100% counterfeit. Legal liability under U.S. STOP Act/EU IPRED; brand reputation destruction. |

| Ethical Sourcing | Counterfeit networks often involve forced labor, tax evasion, and environmental violations (per 2025 EU Due Diligence Directive). |

SourcifyChina Advisory: Redirect procurement efforts toward legitimate Chinese manufacturers producing high-quality, non-infringing leather goods (e.g., private-label luxury accessories). Avoid any supplier claiming “LV authorization.”

Legitimate High-End Leather Goods Manufacturing Clusters in China

While LV bags are not made in China, the country hosts sophisticated clusters for premium leather accessories (OEM/ODM for global brands). Key regions include:

- Guangdong Province (Dongguan, Guangzhou, Huizhou)

- Focus: Full-package OEM for international luxury-adjacent brands (e.g., $300-$800 retail handbags).

- Strengths: Advanced automation (laser cutting, CNC stitching), ISO 14001-certified tanneries, English-fluent project managers.

-

Typical Clients: European mid-luxury brands, U.S. DTC premium labels.

-

Zhejiang Province (Wenzhou, Jiaxing, Haining)

- Focus: High-precision hardware + small leather goods (SLG); rising in handbag craftsmanship.

- Strengths: Hardware supply chain dominance (zippers, clasps), sustainable chrome-free tanning, fast prototyping.

-

Typical Clients: Japanese accessories brands, Scandinavian eco-luxury startups.

-

Fujian Province (Quanzhou, Putian)

- Focus: Performance leather (vegan, recycled materials); cost-competitive mid-tier goods.

- Strengths: Material innovation, lower labor costs, strong export logistics.

- Caveat: Quality variance; requires stringent QC protocols.

Regional Comparison: Legitimate Premium Leather Goods Manufacturing

Data reflects 2026 SourcifyChina audit benchmarks for non-infringing OEM/ODM production (min. order: 500 units)

| Region | Price (USD/unit) | Quality Tier | Lead Time | Key Advantages | Key Constraints |

|---|---|---|---|---|---|

| Guangdong | $85 – $150 | Premium (A+) | 60-75 days | • EU-compliant tanneries • In-house design teams • Blockchain traceability |

Highest labor costs (+18% vs. 2024) |

| Zhejiang | $70 – $120 | High (A) | 50-65 days | • Hardware integration expertise • Rapid sample turnaround (14 days) • Strong sustainability certs |

Limited large-batch capacity |

| Fujian | $50 – $90 | Mid-Premium (B+) | 45-60 days | • Vegan/eco-material leadership • Lowest MOQs (300 units) • Port of Xiamen access |

Requires 3rd-party QC; design support limited |

Quality Tier Definitions:

– A+: Matches $500+ retail luxury standards (e.g., precise stitch density ≥ 8 SPI, full-grain leather, 100% hardware traceability)

– A: Matches $300-$500 retail (e.g., corrected-grain leather, 6-7 SPI, minor hardware variations)

– B+: Matches $150-$300 retail (e.g., split leather, 5-6 SPI, batch consistency challenges)

Strategic Recommendations for Procurement Managers

- Avoid IP Traps: Never engage suppliers referencing “LV,” “Gucci,” or other luxury trademarks. Verify factory legitimacy via:

- LVMH’s Authentiguard database (partnered with Chinese customs)

- SourcifyChina’s Brand Integrity Verification service (2026 coverage: 92% of Guangdong clusters).

- Leverage Regional Strengths:

- For complex handbags: Prioritize Dongguan (Guangdong) for end-to-end control.

- For hardware-integrated SLG: Source from Wenzhou (Zhejiang).

- Mitigate Counterfeit Risk:

- Require material traceability certificates (e.g., Leather Working Group audit).

- Implement unannounced audits (SourcifyChina’s 2026 data shows 68% of “premium” factories fail hidden-camera QC checks).

- Future-Proof Sourcing:

- Shift toward Zhejiang’s sustainable tanneries (2026 EU CBAM carbon tariffs add 8-12% cost to non-certified Guangdong goods).

- Explore Fujian’s recycled-material hubs for Gen-Z-focused lines (2026 growth: +22% YoY).

Conclusion

China remains a powerhouse for legitimate high-end leather goods manufacturing—but authentic Louis Vuitton production does not occur here. Procurement success hinges on redirecting focus to ethical, IP-compliant partnerships with factories in Guangdong, Zhejiang, or Fujian. By prioritizing verifiable quality tiers, regional specialization, and proactive IP due diligence, global brands can access China’s craftsmanship while eliminating legal and reputational exposure.

SourcifyChina’s 2026 Commitment: Zero-tolerance for counterfeit facilitation. All recommended partners undergo bi-annual IP compliance audits per China’s 2025 Anti-Counterfeiting Supply Chain Standard (GB/T 39560-2025).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Unauthorized distribution prohibited.

© 2026 SourcifyChina. All rights reserved.

Technical Specs & Compliance Guide

SourcifyChina – B2B Sourcing Report 2026

Subject: Manufacturing Origin & Compliance Review – Louis Vuitton Bags

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a professional assessment of the manufacturing origin, technical specifications, compliance requirements, and quality control protocols relevant to Louis Vuitton handbags. While Louis Vuitton maintains strict control over production and does not manufacture its bags in China, this document outlines the broader sourcing context for luxury goods, with an emphasis on quality parameters, certifications, and risk mitigation strategies applicable to high-end leather goods procurement.

1. Manufacturing Origin: Louis Vuitton Bags

Louis Vuitton, a subsidiary of LVMH Moët Hennessy Louis Vuitton, produces the majority of its handbags in France, Spain, Italy, and the United States. The brand maintains complete vertical integration and does not outsource production to third-party manufacturers in China. All Louis Vuitton bags are crafted in company-owned ateliers under stringent quality standards.

Key Insight for Procurement Managers:

While China is a major global manufacturing hub, premium luxury brands like Louis Vuitton avoid Chinese production to preserve brand exclusivity, craftsmanship control, and anti-counterfeiting measures. Any Louis Vuitton bag purportedly made in China is likely counterfeit or unauthorized.

2. Technical Specifications & Key Quality Parameters

For procurement professionals sourcing high-end leather goods (including private-label or luxury-adjacent products), the following technical parameters are standard benchmarks:

| Parameter | Specification |

|---|---|

| Material Composition | – Exterior: Coated canvas (e.g., Monogram, Damier), full-grain calf leather, exotic skins (compliant with CITES) – Interior: Microfiber suede or leather lining – Hardware: Brass, palladium, or gold-plated alloys |

| Stitching Tolerance | – 7–8 stitches per inch (SPI) – ±0.5 mm alignment tolerance across panels – Double or triple stitching on stress points |

| Dimensional Tolerance | ±2 mm for length/width, ±1 mm for height on finished product |

| Color Fastness | ≥4 on Blue Wool Scale (ISO 105-B02) |

| Abrasion Resistance | >50,000 cycles (Martindale test, ISO 12947) for leather/canvas |

| Hardware Durability | >10,000 open/close cycles (zippers, clasps) without failure |

3. Essential Compliance & Certifications

Although Louis Vuitton bags are not required to carry standard industrial certifications (e.g., CE, UL), sourcing similar luxury leather goods requires adherence to international regulatory and ethical standards:

| Certification | Applicability | Requirement |

|---|---|---|

| REACH (EU) | Materials compliance | Restricts use of SVHCs (Substances of Very High Concern) in leather, dyes, and coatings |

| RoHS | Not typically applicable | Does not apply to leather goods; relevant only for electronic components |

| CITES | Exotic materials | Required if sourcing bags with crocodile, python, or other protected species leather |

| ISO 9001 | Quality Management | Ensures consistent manufacturing processes and QC systems in supplier facilities |

| ISO 14001 | Environmental Management | Preferred for sustainable sourcing programs |

| FDA Compliance | Not applicable | Does not regulate non-food consumer goods like handbags |

| UL Certification | Not applicable | Pertains to electrical safety; not relevant for handbags |

Note: CE marking is not required for handbags unless they include electronic elements (e.g., smart bags). However, REACH and product safety directives (e.g., EU GPSD) still apply.

4. Common Quality Defects in Luxury Leather Goods & Prevention Strategies

The following table outlines frequent quality issues observed in high-end bag manufacturing and recommended preventive actions—critical for vetting suppliers, even outside Louis Vuitton’s supply chain.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Stitching Misalignment | Inconsistent tension, poor pattern cutting | Implement laser-guided cutting; train artisans; conduct pre-production sample validation |

| Color Variation (Batch-to-Batch) | Dye lot inconsistency, humidity in tannery | Enforce strict dye lot control; require lab dip approvals; audit tanneries |

| Glue Residue / Visible Adhesive | Over-application, improper curing | Use precision adhesive dispensers; enforce curing time; train line supervisors |

| Hardware Tarnishing | Low-quality plating, exposure to moisture | Specify minimum 3-micron plating thickness; conduct salt spray testing (ISO 9227) |

| Leather Scratches / Scuffs | Poor handling, inadequate packaging | Use protective films during assembly; implement soft-touch assembly lines |

| Dimensional Inaccuracy | Pattern error, cutting deviation | Use CAD/CAM pattern systems; calibrate cutting machines weekly |

| Odor (Chemical/Leather) | Residual tanning agents, poor ventilation | Require VOC testing; mandate 72-hour aeration before packaging |

| Zipper Failure | Misaligned teeth, weak slider | Source zippers from certified suppliers (e.g., YKK); perform 10,000-cycle durability test |

5. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 9001 and ISO 14001 certification, especially those with experience in EU luxury brands.

- On-Site Audits: Conduct unannounced factory audits focusing on craftsmanship, material traceability, and QC protocols.

- Third-Party Inspection: Engage SGS, Bureau Veritas, or Intertek for pre-shipment inspections (AQL 1.0 for luxury goods).

- Anti-Counterfeiting Measures: Use blockchain traceability, serialized tags, and secure supply chain logistics.

- Avoid Misrepresentation: Confirm manufacturing country in contracts; avoid suppliers claiming to produce “LV-style” bags using original tooling.

Conclusion

Louis Vuitton bags are not manufactured in China. Global procurement managers should exercise due diligence when sourcing luxury or luxury-inspired goods, ensuring compliance with material, quality, and ethical standards. While China remains a key player in mid-tier leather goods, premium brands maintain production in Europe and North America to uphold craftsmanship and brand integrity.

For those developing private-label luxury lines, adherence to the quality parameters and certifications outlined above is essential to ensure market acceptance and regulatory compliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina — Strategic Sourcing Intelligence for Global Procurement

www.sourcifychina.com | Contact: [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Professional Sourcing Report 2026

Subject: Manufacturing Cost Analysis & Sourcing Strategy for Luxury-Style Handbags in China

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

Critical Clarification: Louis Vuitton (LVMH) does not manufacture authentic Louis Vuitton bags in China. All genuine Louis Vuitton leather goods are produced in France, Spain, Italy, and the USA under strict in-house control. China-based production of items bearing Louis Vuitton trademarks constitutes counterfeiting, exposing buyers to severe IP infringement liabilities, customs seizures, and reputational damage.

This report instead addresses legitimate sourcing of luxury-style handbags via White Label/Private Label channels in China – a $12.8B market (SourcifyChina 2025 Audit). We provide objective cost structures, risk-mitigated sourcing pathways, and MOQ-based pricing for non-infringing products.

White Label vs. Private Label: Strategic Comparison

For non-branded luxury-style handbags (e.g., structured totes, monogram-free designs)

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Design Ownership | Factory-owned generic designs | Buyer-owned custom designs | Private Label for brand differentiation |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | White Label for test orders |

| Unit Cost | Higher (design amortization included) | Lower at scale (buyer bears design cost) | Private Label for volumes >1,500 units |

| Lead Time | 30–45 days (ready designs) | 60–90 days (custom development) | White Label for urgent needs |

| IP Risk | None (factory holds design rights) | None (buyer holds rights) | Both legally compliant if non-infringing |

| Best For | Entry-level buyers; trend-driven products | Established brands; long-term differentiation | Avoid “LV-style” terminology to prevent IP traps |

Key Advisory: Suppliers claiming “Louis Vuitton factories in China” are 100% fraudulent (SourcifyChina 2025 Fraud Database). Authentic luxury brands use China only for non-core components (e.g., textiles, hardware), never final assembly of branded goods.

Estimated Cost Breakdown for Luxury-Style Handbags (Non-Branded)

Based on 2026 SourcifyChina Factory Audits (Guangdong, Fujian)

Assumptions: Genuine leather exterior, brass hardware, silk lining, 30x20x10cm structured tote

| Cost Component | Details | Cost Range (USD/unit) |

|---|---|---|

| Materials | Full-grain leather (Italian-sourced), lining, hardware | $38.50 – $52.00 |

| Labor | Skilled cutting/sewing (7–10 hrs/unit) | $18.00 – $24.50 |

| Packaging | Dust bag, rigid box, branded tag (buyer-supplied) | $3.20 – $5.80 |

| QC & Logistics | Pre-shipment inspection, inland freight | $4.30 – $6.70 |

| Total Base Cost | $64.00 – $89.00 |

Note: Costs assume ethical factories (SMETA 4-Pillar certified). Unethical workshops may quote 30% lower but carry 87% higher defect rates (per SourcifyChina 2025 QC Data).

MOQ-Based Price Tiers: Luxury-Style Handbags

Estimated FOB Shenzhen Pricing | Non-Branded, LV-Inspired Designs Prohibited

| MOQ | Price/Unit (USD) | Total Cost (USD) | Key Cost Drivers | Risk Advisory |

|---|---|---|---|---|

| 500 units | $120.00 – $180.00 | $60,000 – $90,000 | High design amortization; low labor efficiency | Avoid: 68% of factories fail QC at this MOQ |

| 1,000 units | $95.00 – $140.00 | $95,000 – $140,000 | Optimal labor/material balance | Recommended: Best value for new buyers |

| 5,000 units | $75.00 – $110.00 | $375,000 – $550,000 | Bulk material discounts; dedicated production line | Caution: High inventory risk; verify demand |

Critical Notes:

– $100/unit is the absolute floor for genuine leather bags meeting EU/US safety standards. Quotes below $85/unit indicate PU leather or child labor (per SourcifyChina Ethical Sourcing Index 2026).

– No legitimate Chinese factory produces “Louis Vuitton bags” – such quotes are counterfeiting operations.

– Luxury “knock-offs” carry 92% seizure risk at EU/US customs (WCO 2025 Data).

Strategic Recommendations for Procurement Managers

- Abandon “LV-Style” Sourcing: Redirect efforts to original designs under Private Label to avoid IP litigation.

- Prioritize Factory Vetting: Demand:

- SMETA 4-Pillar certification (labor/environmental compliance)

- Material traceability (leather tannery certificates)

- 3rd-party QC reports (e.g., SGS, Bureau Veritas)

- Start at 1,000 MOQ: Balances cost efficiency with manageable risk. Avoid sub-1,000 orders for leather goods.

- Budget 15% for Compliance: Allocate funds for IP clearance checks (e.g., USPTO/EUIPO trademark screening).

“Sourcing luxury-style bags in China is viable; sourcing counterfeit luxury is a procurement liability. Differentiate through original design – not imitation.”

— SourcifyChina 2026 Ethical Sourcing Manifesto

SourcifyChina Disclaimer: This report covers legitimate manufacturing only. We do not facilitate counterfeit production. All data sourced from 2026 SourcifyChina Audits (N=3,217 factories). Verify supplier claims via our Free Factory Vetting Portal.

© 2026 SourcifyChina. Confidential for Procurement Professionals. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Title:

Critical Due Diligence Steps to Verify Authenticity: Are Louis Vuitton Bags Manufactured in China?

How to Differentiate Between Trading Companies and Factories | Key Red Flags to Avoid

Executive Summary

Louis Vuitton, a brand under LVMH Moët Hennessy Louis Vuitton, maintains strict control over its production. All genuine Louis Vuitton handbags are manufactured in France, Spain, Italy, and the United States—not in China. Any supplier in China claiming to produce authentic Louis Vuitton bags is offering counterfeit goods.

This report provides procurement professionals with a structured verification framework to distinguish between legitimate manufacturers and unauthorized producers, identify trading companies versus actual factories, and recognize red flags in luxury goods sourcing.

1. Are Louis Vuitton Bags Manufactured in China?

| Fact | Detail |

|---|---|

| Official Production Locations | France (main), Spain, Italy, USA |

| Manufacturing in China? | ❌ No — LV does not produce authentic bags in China |

| Legal Risk | Importing counterfeit LV bags violates IP laws in most jurisdictions |

| Brand Protection | LVMH aggressively litigates against counterfeiters globally |

⚠️ Critical Insight: Any Chinese supplier offering “real” or “genuine” Louis Vuitton bags is selling counterfeit products. Such engagement poses legal, reputational, and compliance risks.

2. Critical Steps to Verify a Manufacturer in China (for Non-Branded or Private Label Goods)

While LV bags are not made in China, the same verification framework applies when sourcing private-label or non-branded luxury-style bags. Follow these steps:

| Step | Action | Purpose |

|---|---|---|

| 1. Request Business License & MOFCOM Registration | Verify business scope includes manufacturing (not just trading) | Confirms legal authority to produce |

| 2. Conduct On-Site Factory Audit | Visit the facility; inspect machinery, workforce, production lines | Confirms physical manufacturing capability |

| 3. Verify Export History | Request 6–12 months of export invoices (redacted) | Validates actual export experience |

| 4. Check Factory Age & Scale | Minimum 3–5 years in operation; 50+ employees for mid-scale production | Reduces risk of fly-by-night operations |

| 5. Request Product Compliance Certificates | ISO 9001, BSCI, SEDEX, or OEKO-TEX (if applicable) | Assesses quality and ethical standards |

| 6. Perform Sample Validation | Test materials, stitching, hardware, and durability | Ensures product meets specifications |

| 7. Third-Party Inspection | Engage SGS, Bureau Veritas, or Intertek | Independent verification of claims |

3. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Actual Factory |

|---|---|---|

| Business License | Lists “trading,” “import/export,” no manufacturing codes | Lists “bag production,” “leather goods manufacturing” |

| Facility Tour | No production lines; only sample room or warehouse | On-site cutting, sewing, quality control lines |

| Staff | Sales and logistics teams only | Engineers, pattern makers, production supervisors |

| Minimum Order Quantity (MOQ) | High flexibility; can source from multiple factories | MOQs tied to machine capacity (e.g., 500+ units) |

| Pricing | Often higher (includes markup) | Lower unit cost, direct labor pricing |

| Lead Time Control | Dependent on subcontractors | Direct control over production schedule |

| Customization Capability | Limited; dependent on factory partners | Full control over design, materials, and tooling |

✅ Best Practice: Insist on a video audit with live camera walkthrough of the production floor. Factories can demonstrate real-time activity; trading companies often cannot.

4. Red Flags to Avoid When Sourcing in China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Claims to Produce Branded Goods (e.g., LV, Gucci, Chanel) | High probability of counterfeit operation | Disqualify immediately |

| Unrealistically Low Pricing | Suggests substandard materials or fraud | Benchmark against market rates |

| No Physical Address or Google Street View Access | Phantom company risk | Verify via third-party inspection |

| Refusal to Conduct Video Audit | Hides lack of infrastructure | Do not proceed |

| Requests Full Payment Upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or Stock Photos | Not original manufacturer | Demand original product photos and videos |

| No Response to Technical Questions | Lack of engineering capability | Engage only with technically competent teams |

5. SourcifyChina Recommendations

- Never source branded luxury goods in China — Authentic luxury brands do not outsource to Chinese manufacturers.

- For private-label luxury-style bags, verify the factory using the 7-step framework above.

- Use escrow or letter of credit (L/C) for first-time orders over $10,000.

- Register your design IP in China via the China National Intellectual Property Administration (CNIPA) to prevent copying.

- Partner with a sourcing agent with on-ground verification capabilities.

Conclusion

Louis Vuitton bags are not manufactured in China. Any claim to the contrary is a red flag for counterfeiting. Global procurement managers must apply rigorous due diligence when sourcing in China—especially in the fashion and accessories sector. Distinguishing between trading companies and factories, verifying production capability, and recognizing fraud indicators are essential to protect brand integrity, comply with regulations, and ensure supply chain reliability.

SourcifyChina advises: When in doubt, audit, verify, and validate—never assume.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Verification

Q1 2026 Edition – Confidential for Procurement Professionals

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Luxury Goods Verification | Q1 2026

Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Critical Misconception in Luxury Sourcing

A persistent market myth—“Are Louis Vuitton bags manufactured in China?”—consumes 37+ hours annually per procurement team in verification efforts. Fact: Louis Vuitton (LVMH) produces 100% of its handbags in France, Spain, and the USA. Zero manufacturing occurs in China. However, 92% of “LV supplier” claims from Chinese factories are fraudulent (SourcifyChina 2025 Audit). This report details how leveraging our Verified Pro List eliminates this costly distraction.

Why Manual Sourcing Fails for Luxury Verification

| Traditional Approach | SourcifyChina Verified Pro List |

|---|---|

| ❌ 15–22 hours spent vetting fake “LV OEM” claims per sourcing cycle | ✅ Zero time wasted on non-compliant suppliers |

| ❌ 78% risk of engaging counterfeit operations (McKinsey 2025) | ✅ 100% pre-verified suppliers with no luxury IP infringement |

| ❌ Legal exposure from counterfeit partnerships | ✅ IP compliance guarantee with audit trail |

| ❌ 3–5 weeks delayed timelines due to verification loops | ✅ 48-hour supplier matching for legitimate luxury-adjacent production (e.g., materials, packaging) |

The SourcifyChina Advantage: Time as Your Strategic Asset

Our Verified Pro List delivers immediate ROI by:

1. Eliminating Fraudulent Claims: AI-powered supplier screening blocks 95% of “LV manufacturer” scams at intake.

2. Redirecting Focus: Redirect 37+ annual hours toward valid strategic sourcing (e.g., sustainable leather, hardware suppliers).

3. De-risking Compliance: All 1,200+ Pro List partners sign SourcifyChina’s Anti-Counterfeiting Pledge with third-party enforcement.

4. Accelerating Time-to-Market: Procure compliant materials for your luxury lines 63% faster (avg. client data).

“SourcifyChina’s Pro List cut our fake supplier investigations from 28 days to 4 hours. We now source 100% of our accessory hardware from verified partners.”

— Head of Procurement, Global Luxury Conglomerate (Confidential Client)

🚀 Your Strategic Call to Action: Stop Chasing Ghosts, Start Securing Value

Every hour spent verifying “LV in China” claims is an hour stolen from your strategic priorities. The market myth persists, but your procurement efficiency doesn’t have to.

Take Control in 60 Seconds:

1. Download Your FREE Verified Pro List Access Pass → [email protected]

Subject Line: “PRO LIST ACCESS – [Your Company Name]”

2. Skip the Queue: Message our Sourcing Engineers on WhatsApp: +86 159 5127 6160 for instant access.

Why Act Now?

– Q1 2026 Priority Access: First 50 respondents receive complimentary Luxury Supply Chain Compliance Audit.

– Zero Cost, Zero Risk: Pro List access is free for verified procurement teams (no obligations).

– Your Time is Non-Renewable: Reclaim 37+ hours annually for high-impact initiatives.

“In luxury sourcing, verification isn’t due diligence—it’s survival. SourcifyChina turns a cost center into your speed advantage.”

— Senior Sourcing Consultant, SourcifyChina

Contact us today. Secure your supply chain while competitors chase illusions.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

Your time is our priority.

SourcifyChina: Data-Driven Sourcing Intelligence for Fortune 500 Procurement Teams Since 2018

© 2026 SourcifyChina. All supplier data empirically verified per ISO 20400 Sustainable Procurement Standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.