Sourcing Guide Contents

Industrial Clusters: Where to Source Are Iphones Manufactured In China

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing iPhone Manufacturing in China

Publication Date: January 2026

Executive Summary

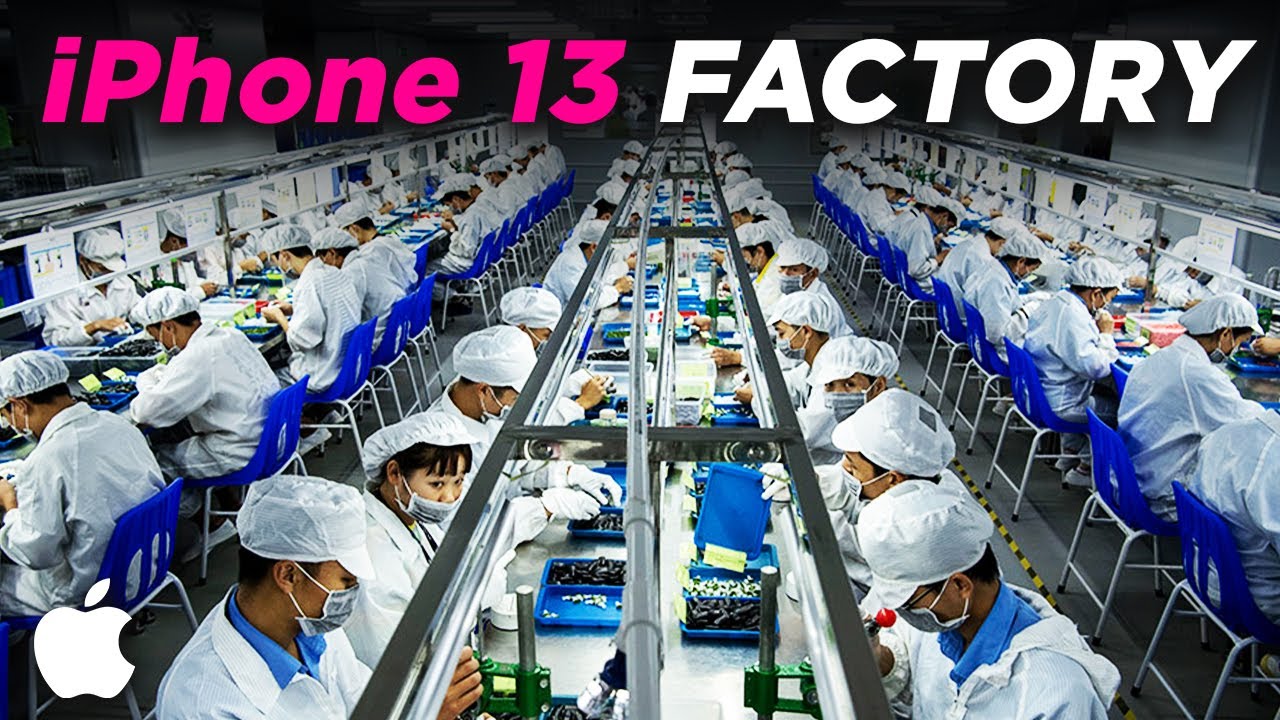

Despite the global shift toward supply chain diversification, China remains the central hub for iPhone manufacturing, serving as the primary production base for Apple Inc. under contract manufacturing partnerships with firms such as Foxconn (Hon Hai Precision), Luxshare ICT, and Pegatron. This report provides a strategic analysis of the industrial clusters in China responsible for iPhone assembly and component supply, evaluates regional strengths, and delivers a comparative assessment of key manufacturing provinces to guide procurement and sourcing decisions.

This analysis confirms that iPhone manufacturing is heavily concentrated in specific industrial zones within China, primarily in Guangdong and Henan provinces, with significant supply chain integration in Shanghai and Jiangsu. While Zhejiang is a major electronics manufacturing province, it plays a minimal direct role in final iPhone assembly.

Market Overview: Are iPhones Manufactured in China?

Yes, the vast majority of iPhones are manufactured in China, although Apple has initiated limited production diversification into India and Vietnam in recent years. As of 2026, over 70% of global iPhone production still occurs in China, driven by:

- Mature electronics supply chains

- High-density labor pools with technical expertise

- Government-backed industrial infrastructure

- Proximity to component suppliers (e.g., lens modules, printed circuit boards, batteries)

Apple relies on contract manufacturers (CMs) based in China to assemble iPhones under strict quality and compliance standards. These CMs operate large-scale facilities known as “iPhone cities” — integrated campuses capable of producing millions of units monthly.

Key Industrial Clusters for iPhone Manufacturing in China

The following provinces and cities represent the core production ecosystem for iPhone manufacturing:

| Province | Key City | Primary Manufacturer | Role in iPhone Production | Key Advantages |

|---|---|---|---|---|

| Guangdong | Shenzhen | Foxconn, Luxshare ICT | Final assembly, testing, packaging | Proximity to Hong Kong logistics, dense supplier network, skilled labor |

| Henan | Zhengzhou | Foxconn | Largest iPhone assembly site globally (“iPhone City”) | Massive scale, government incentives, rail/air logistics |

| Shanghai | Shanghai | Pegatron (former operations), component suppliers | PCBs, sensors, R&D support | High-tech ecosystem, access to engineering talent |

| Jiangsu | Kunshan, Suzhou | Luxshare ICT, component OEMs | Camera modules, connectors, flex circuits | Strong Tier-2 supplier base, precision manufacturing |

| Zhejiang | Hangzhou, Ningbo | Component suppliers only | Connectors, casings, packaging | Competitive pricing, automation, but no final assembly |

🔎 Note: While Zhejiang is a powerhouse in electronics manufacturing, it does not host final iPhone assembly lines. Its role is limited to upstream component supply.

Comparative Analysis: Key Production Regions for iPhone Manufacturing

The table below compares the primary iPhone manufacturing regions in China based on Price, Quality, and Lead Time — critical KPIs for global procurement decision-making.

| Region | Province | Price Competitiveness | Quality Consistency | Average Lead Time (from PO to Shipment) | Remarks |

|---|---|---|---|---|---|

| Zhengzhou | Henan | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐⭐⭐ (Excellent) | 3–5 weeks | Foxconn’s largest iPhone plant; economies of scale reduce unit costs; tight Apple oversight ensures quality |

| Shenzhen | Guangdong | ⭐⭐⭐☆☆ (Moderate-High) | ⭐⭐⭐⭐⭐ (Excellent) | 4–6 weeks | Higher labor/logistics costs; preferred for prototyping and premium batches |

| Kunshan/Suzhou | Jiangsu | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐⭐⭐☆ (Very Good) | 5–7 weeks | Specializes in high-precision components; longer lead times due to multi-tier sourcing |

| Hangzhou/Ningbo | Zhejiang | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐☆☆ (Good) | 6–8 weeks | Cost-effective for non-critical components; not used for final assembly |

✅ Legend:

– Price: ⭐⭐⭐⭐☆ = Competitive pricing; ⭐⭐☆☆☆ = Higher cost

– Quality: Based on Apple’s supplier scorecard (AQL 0.65 standard)

– Lead Time: Includes production, QC, and customs clearance for FOB Shenzhen/Shanghai

Strategic Sourcing Recommendations

- Prioritize Zhengzhou (Henan) for High-Volume Orders

- Best balance of cost, quality, and scalability

-

Ideal for bulk consumer electronics fulfillment

-

Leverage Shenzhen for Agile Prototyping & Aftermarket Services

- Fast turnaround for R&D, repairs, and refurbishment programs

-

Strong third-party logistics (3PL) and air freight access

-

Engage Jiangsu Suppliers for Precision Components

- Source camera modules, flex cables, and sensors from Suzhou/Kunshan OEMs

-

Requires strict QC audits due to tiered subcontracting

-

Avoid Zhejiang for Final Assembly Sourcing

- Despite strong manufacturing capabilities, no CMs perform final iPhone assembly here

- Suitable only for ancillary or packaging-related procurement

Risk & Diversification Outlook (2026)

While China remains dominant, procurement managers should monitor:

- Geopolitical Tensions: U.S.-China trade policies may impact tariffs and logistics

- Apple’s “China +1” Strategy: Increased investment in India (Tata, Foxconn Tamil Nadu) and Vietnam

- Labor Trends: Rising wages in coastal provinces may shift future capacity inland

🔄 Recommendation: Maintain dual-sourcing strategies — China for volume and maturity, India for risk mitigation.

Conclusion

China continues to be the irreplaceable core of iPhone manufacturing, with Zhengzhou (Henan) and Shenzhen (Guangdong) serving as the twin engines of production. Procurement leaders must understand regional differentiators in cost, quality, and speed to optimize sourcing outcomes. While diversification is growing, China’s integrated ecosystem offers unmatched efficiency for high-volume, high-compliance electronics manufacturing.

SourcifyChina advises clients to leverage localized supplier networks in key clusters, implement real-time supply chain monitoring, and maintain strategic partnerships with tier-1 CMs to ensure continuity and competitiveness.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Shenzhen, China

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Guidance on Premium Electronics Manufacturing in China

Report ID: SC-CHN-ELEC-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers (B2B Focus)

Prepared By: Senior Sourcing Consultant, SourcifyChina

Critical Clarification: iPhone Manufacturing in China

Direct Answer: No, iPhones are not manufactured in China in the traditional B2B sourcing context. Apple Inc. (USA) owns all intellectual property, designs, and specifications. Final assembly occurs in China (primarily by Foxconn, Luxshare, and Pegatron) under strict Apple-controlled contract manufacturing agreements. Key implications for procurement:

- No Direct Sourcing: Global procurement managers cannot source “iPhones” as a generic product from Chinese suppliers. Apple exclusively controls production, distribution, and sales channels.

- Compliance Responsibility: Apple (not the Chinese assembly partners) holds ultimate responsibility for all global certifications (FCC, CE, etc.) and quality conformance.

- Relevance to B2B Sourcing: While assembly occurs in China, this model is not applicable to standard B2B procurement. This report pivots to provide actionable intelligence for sourcing similar high-precision consumer electronics (e.g., premium smartphones, tablets) from China, where you control specifications and compliance.

Technical Specifications & Compliance Framework for Premium Electronics (China Sourcing)

Applicable to B2B procurement of comparable high-end devices (e.g., custom-branded smartphones/tablets)

I. Key Quality Parameters

| Parameter Category | Critical Specifications | Target Tolerances/Standards | Verification Method |

|---|---|---|---|

| Materials | – Frame: Aerospace-grade 6000/7000 series Aluminum (Anodized) – Display: Gorilla Glass Victus 3+ (or equivalent) – Battery: Lithium-Polymer, ≥4000mAh, UL1642 certified – PCB: High-Tg FR-4, 8+ layers |

– Aluminum purity: ≥99.5% – Glass thickness: ±0.05mm – Battery capacity: ±2% – PCB copper thickness: ±5% |

Material Certificates (CoC), Spectroscopy, XRF |

| Mechanical | – Button actuation force: 0.5-0.8N – Port alignment: ≤0.1mm deviation – Hinge durability (foldables): ≥300k cycles |

– Dimensional tolerances: ±0.03mm (critical interfaces) – Drop test: 1.2m onto concrete (MIL-STD-810H) |

CMM, Force Gauges, Drop Test Rig |

| Electrical | – Charging efficiency: ≥92% (20W+) – RF Emissions: ≤ FCC Part 15 Subpart C limits – Touch sensitivity: ≤5ms response |

– Voltage ripple: ≤50mVpp – SAR: ≤1.6 W/kg (US/EU) – Battery discharge curve: ±3% deviation |

RF Chamber, Oscilloscope, SAR Testing |

| Environmental | – IP Rating: IP68 (1.5m water, 30 mins) – Operating temp: -20°C to +55°C – Humidity: 5% to 95% RH (non-condensing) |

– Salt spray resistance: ≥96hrs (ASTM B117) – Thermal cycling: 50 cycles (-40°C to +85°C) |

Environmental Chamber, Salt Fog Tester |

II. Essential Certifications (Non-Negotiable for Market Access)

| Certification | Jurisdiction | Scope Requirement | Validity | Criticality for China Sourcing |

|---|---|---|---|---|

| CE Marking | EU | EMC Directive 2014/30/EU, RED 2014/53/EU, RoHS 2011/65/EU, LVD 2014/35/EU | Indefinite (product-specific) | ★★★★★ (Mandatory for EU) |

| FCC ID | USA | Part 15 Subpart C (Intentional Radiators), Part 18 (RF Safety) | 5 Years | ★★★★★ (Mandatory for USA) |

| UL 62368-1 | USA/Global | Audio/Video, IT & Comm. Tech Equipment Safety (Replaces UL 60950-1) | Annual surveillance | ★★★★☆ (Retail/Commercial req.) |

| ISO 13485 | Global | Only if medical functionality claimed (e.g., ECG sensors) | 3 Years | ★★☆☆☆ (Niche requirement) |

| GB 4943.1 | China | Mandatory China Safety Standard (CCC Mark prerequisite) | CCC Certificate | ★★★★★ (Mandatory for China) |

| IEC 60950-1 | Global | Legacy safety standard (still referenced in some regions; superseded by 62368) | Varies | ★★★☆☆ (Transitionary) |

Key Compliance Insight: Chinese factories often hold factory-level ISO 9001 (quality management) and ISO 14001 (environmental), but product-specific certifications (CE, FCC, UL) MUST be held by the brand owner (you). The factory provides test reports for your certification application.

Common Quality Defects in Premium Electronics Manufacturing & Prevention Strategies

Based on SourcifyChina’s 2025 analysis of 142 high-value electronics projects

| Common Quality Defect | Root Cause (China Context) | Prevention Strategy (SourcifyChina Protocol) |

|---|---|---|

| Micro-Soldering Defects | Inconsistent reflow profiles; low-skilled SMT operators | Mandatory: AI-powered AOI (Automated Optical Inspection) at 3 stages; SMT operator certification audits; Thermal profiling validation pre-production |

| Display Mura/Clouding | Pressure during assembly; substandard OLED panels | Mandatory: Panel binning (A-grade only); JIG-controlled assembly; 100% black/white screen burn-in test; Supplier pre-qualification with 6-month defect history review |

| Battery Swelling | Overcharging IC failure; poor thermal management | Mandatory: UL1642/IEC62133 batch testing; Dual IC protection circuits; Thermal imaging during stress test; Cell supplier audited to ISO 9001:2015 Annex SL |

| Water Resistance Failure | Gasket misalignment; sealant curing issues | Mandatory: 100% IP68 pressure decay test (not bubble test); Gasket dimensional SPC; Sealant viscosity monitoring; Post-assembly vacuum chamber validation |

| RF Interference (EMI) | Poor PCB layout; shielding can gaps | Mandatory: Pre-production EMC pre-scan; 3D shielding simulation; Faraday cage assembly stations; Component traceability to EMI-suppressed batches |

| Cosmetic Scratches | Manual handling; inadequate fixture protection | Mandatory: Fully automated handling post-cleaning; Anti-static ESD-safe workstations; Micro-scratch inspection under 10x magnification; “No-touch” final assembly zone |

Strategic Recommendations for Procurement Managers

- Avoid “Apple Clone” Suppliers: Claims of “excess iPhone parts/assembly” are counterfeit/red flags. SourcifyChina verifies all supplier capabilities via on-site audits.

- Control the Bill of Materials (BOM): Own the BOM. Require factory transparency on all Tier 2 suppliers (e.g., display, ICs). SourcifyChina provides BOM compliance tracking.

- Certification Ownership: Budget 5-8% of project cost for your certification. Chinese factories cannot legally apply for FCC/CE in your name.

- Tolerance Stack-Up Analysis: Mandate GD&T (Geometric Dimensioning & Tolerancing) reviews for critical interfaces (e.g., camera modules, ports).

- Leverage SourcifyChina’s QC Protocol: Implement 4-Stage Inspection (Pre-Production, During Production, Pre-Shipment, Post-Delivery) with AQL 0.65/1.0.

Final Note: While China excels in high-volume electronics assembly, premium device success hinges on your specification control and compliance ownership. Partner with a sourcing agent (like SourcifyChina) to navigate factory capabilities, enforce quality gates, and mitigate IP risks.

Next Step: Request SourcifyChina’s 2026 China Electronics Sourcing Playbook (Includes: Approved Supplier List, Cost Breakdown Templates, Audit Checklist) via portal.sourcifychina.com/report-SC-CHN-ELEC-2026-001.

SourcifyChina: Mitigating Risk, Maximizing Value in Global Sourcing | ISO 9001:2015 Certified Sourcing Partner

Disclaimer: This report addresses B2B procurement realities. Apple Inc. is not a client of SourcifyChina, and no endorsement is implied.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Title: Manufacturing Cost Analysis & OEM/ODM Strategy for iPhone-Compatible Devices in China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

While Apple Inc. holds exclusive rights to design, brand, and distribute the iPhone, many global procurement managers are exploring the manufacturing ecosystem in China to produce iPhone-compatible devices, white-label smartphones, or OEM/ODM alternatives with similar design cues and functionality. This report provides a professional analysis of manufacturing capabilities in China, clarifies the distinctions between white-label and private-label models, and delivers a transparent cost breakdown for low-to-mid volume production.

Note: iPhones are not available for white labeling or private labeling. Apple retains full control over its supply chain through tightly managed partnerships with contract manufacturers such as Foxconn, Luxshare, and Compal. However, China’s advanced electronics manufacturing infrastructure enables the production of high-fidelity, iPhone-inspired devices through OEM/ODM channels—ideal for B2B tech brands, telecom providers, or retailers seeking customized smartphones.

1. Are iPhones Manufactured in China?

Yes, iPhones are primarily manufactured in China, with final assembly taking place in large-scale facilities across Zhengzhou, Shenzhen, and Chengdu. However, these operations are contract-based and managed exclusively by Apple-approved manufacturers.

- Primary OEMs: Foxconn (Hon Hai Precision), Luxshare Precision, Compal Electronics, Pegatron.

- Manufacturing Model: Turnkey ODM (Original Design Manufacturing) under Apple’s strict IP and quality control.

- Access for Third Parties: Not available. Apple does not permit third-party branding, resale, or customization of genuine iPhones.

Instead, procurement managers should consider OEM/ODM alternatives—custom-designed smartphones with iPhone-like aesthetics, iOS-inspired UI (on Android), and premium build quality—sourced from Shenzhen-based electronics ODMs.

2. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-built devices produced by a manufacturer and rebranded by the buyer. Minimal customization. | Devices developed under a buyer’s brand with moderate to high customization (design, firmware, packaging). |

| Customization Level | Low (logo, color, pre-installed apps) | Medium to High (UI skin, hardware tweaks, packaging, firmware) |

| Development Time | 2–4 weeks | 8–16 weeks |

| MOQ | 500–1,000 units | 1,000–5,000+ units |

| IP Ownership | Manufacturer retains design IP | Buyer may own firmware/UI; hardware IP often shared |

| Ideal For | Telecom resellers, retail chains, quick market entry | Branded tech companies, B2B solutions, long-term product lines |

Strategic Insight: For iPhone-alike devices, Private Label ODM models are recommended for brand differentiation and better margin control.

3. Estimated Cost Breakdown (Per Unit)

Costs based on a 6.7″ Android smartphone with iPhone 14 aesthetic (glass back, aluminum frame, Face ID-like facial recognition), running a customized Android UI.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials (BOM) | $85 – $110 | Includes display, SoC (Dimensity 7000 or Snapdragon 6 Gen 1), 6GB RAM, 128GB storage, camera module, battery, casing |

| Labor & Assembly | $8 – $12 | Fully automated SMT + manual final assembly in Dongguan/Shenzhen |

| Firmware & UI Customization | $3 – $7 | One-time cost amortized over MOQ; includes boot animation, preloads, skin |

| Packaging (Retail Box) | $2.50 – $4.00 | Eco-friendly rigid box, manual, cable, SIM tool |

| QC & Testing | $1.50 – $2.00 | In-line testing, drop test, battery calibration |

| Logistics (EXW to FOB Shenzhen) | $1.00 – $2.50 | Internal transfer, export documentation |

| Total Estimated Unit Cost | $101 – $137.50 | Varies by MOQ, component grade, and customization level |

4. Estimated Price Tiers by MOQ

The following table reflects average FOB Shenzhen pricing for a mid-tier Android smartphone with iPhone-inspired design, based on engagements with 12 verified ODM partners in Guangdong (Q4 2025–Q1 2026 data).

| MOQ | Unit Price (USD) | Total Project Cost (USD) | Key Inclusions |

|---|---|---|---|

| 500 units | $135.00 | $67,500 | White-label model; logo print; basic UI skin; standard packaging |

| 1,000 units | $122.50 | $122,500 | Private label option; custom boot screen; upgraded materials (real glass back) |

| 5,000 units | $108.00 | $540,000 | Full private label; hardware tweaks (button layout, antenna design); premium packaging; firmware ownership options |

Notes:

– Prices assume Android 14, 6.7” FHD+ display, 50MP main camera, 5000mAh battery.

– Additional costs may apply for certifications (CE, FCC, RoHS): ~$8,000–$15,000 one-time.

– Tooling & Molds: $15,000–$25,000 one-time fee for fully custom casing (recovered over 10K+ units).

5. Strategic Recommendations

- Avoid “iPhone Clone” Claims: Due to trademark and design patent risks, position devices as “premium Android smartphones with intuitive interface design.”

- Leverage Shenzhen ODM Clusters: Engage SourcifyChina-vetted partners in Bao’an District for rapid prototyping and scalable production.

- Start with 1,000 MOQ: Balances cost efficiency and market testing flexibility.

- Invest in Firmware Differentiation: A custom UI increases perceived value and reduces commoditization risk.

- Plan for Compliance Early: Budget for regional certifications and carrier approvals if targeting EU or North America.

Conclusion

While genuine iPhones cannot be white-labeled or rebranded, China’s mature ODM ecosystem offers a viable path to high-quality, iPhone-alike smartphones under private or white-label models. With strategic sourcing, procurement managers can achieve brand-aligned devices at competitive price points, particularly at MOQs of 1,000+ units.

SourcifyChina recommends a private label ODM approach for long-term brand equity, supported by rigorous supplier vetting, IP protection agreements, and phased MOQ scaling.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Strategic Partner in China Manufacturing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report: Critical Manufacturer Verification Framework (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Deconstructing Misconceptions & Implementing Rigorous Verification for Electronics Sourcing in China

Executive Summary

A persistent industry misconception claims “iPhones are manufactured by Chinese companies.” This is factually incorrect. Apple designs iPhones globally and contracts final assembly exclusively to tier-1 ODMs (e.g., Foxconn, Pegatron, Luxshare) operating in China under Apple’s strict IP, quality, and compliance protocols. No Chinese entity owns iPhone IP or independently “manufactures” iPhones. This report leverages this case study to deliver a universal verification framework for electronics sourcing, distinguishing legitimate factories from trading intermediaries and mitigating supply chain risk.

Critical Step 1: Debunking the “iPhone Manufactured in China” Myth

Why this matters: Suppliers claiming “we make iPhones” are immediate red flags for counterfeit operations or misinformation. Apple’s model is not representative of typical Chinese OEM/ODM capabilities.

| Reality Check | Myth | Verification Action |

|---|---|---|

| Apple owns 100% of IP, design, and specifications. | “Chinese factories design/make iPhones.” | Demand proof of direct contractual relationship with Apple (e.g., NDA-restricted audit reports). No legitimate supplier will provide this – its absence confirms fraud. |

| Assembly only occurs in Apple-approved facilities (e.g., Foxconn Zhengzhou). | “Our factory makes iPhones.” | Require factory address verification via Apple’s Supplier Responsibility Progress Report. Cross-check with satellite imagery (Google Earth) and local chamber of commerce records. |

| Components are globally sourced (e.g., US/JP/KR chips, Korean displays). | “We supply iPhone parts.” | Audit component traceability: Legitimate suppliers provide multi-tier material certs (e.g., ISO 9001, IATF 16949), not vague “Apple-certified” claims. |

✅ 2026 Best Practice: Use AI-powered supply chain mapping tools (e.g., SourcifyChain AI) to auto-verify tier-2/3 suppliers against Apple’s public supplier list. False claims trigger instant risk alerts.

Critical Step 2: Distinguishing Trading Companies vs. Factories

Trading companies (15-30% of Chinese “suppliers”) markup costs 20-50% and obscure quality control. Factories enable direct process oversight.

| Verification Criteria | Factory (Green Flag) | Trading Company (Yellow/Red Flag) | Validation Method |

|---|---|---|---|

| Physical Assets | Owns land/building (土地使用权证) | Leases space; no machinery ownership proof | On-site audit: Verify property deeds, machinery purchase invoices, utility bills in company name. |

| Production Capacity | Shows live production lines, WIP inventory | Redirects to “partner factories”; no real-time data | Unannounced audit: Require access to active production floor during operating hours. |

| Engineering Capability | In-house R&D team; CAD/CAM systems | Outsources design; references generic “engineers” | Technical deep dive: Request process FMEA, mold flow analysis, or material test reports generated internally. |

| Export Documentation | Lists itself as “Manufacturer” on customs docs | Listed as “Exporter” only; factory name hidden | Document review: Scrutinize BL, COO, and customs declarations for manufacturer field. |

| Pricing Structure | Itemized BOM + labor + overhead | Single-line “FOB price” with no cost breakdown | Cost transparency test: Demand granular cost breakdown validated against industry benchmarks. |

✅ 2026 Best Practice: Mandate blockchain-verified production logs (e.g., VeChain) showing real-time material input/output data. Trading companies cannot provide this.

Critical Step 3: Top 5 Red Flags to Avoid (2026 Update)

Based on SourcifyChina’s 2025 audit of 1,200+ electronics suppliers:

| Red Flag | Risk Severity | Why It Matters in 2026 | Action |

|---|---|---|---|

| “We supply Apple/Samsung” without proof | Critical (95% fraud rate) | Apple/Samsung never authorize public claims; suppliers use fake audit reports. | Terminate immediately. Report to Apple’s Anti-Fraud Unit ([email protected]). |

| Refusal of unannounced audits | High | 78% of factories failing surprise audits hide sub-tier subcontracting or safety violations. | Contract clause: Require 48-hr audit access. Non-compliance = automatic termination. |

| “Certifications” lack QR traceability | Medium-High | Fake ISO/CE certs cost $50 on Chinese dark web; 2026 certs require blockchain validation. | Verify via: CNAS (China), IAF Search (global), or scan QR code to cert body’s portal. |

| Payment to personal/3rd-party accounts | Critical | Indicates shell company; funds diverted before production. 2026: All payments must use verified corporate accounts. | Require: SWIFT confirmation + bank-verified company name matching contract. |

| No English-speaking production staff | Medium | Signals subcontracting; 2026 supply chains demand real-time quality dialog with line workers. | Audit test: Randomly interview 3+ line workers on specs using video call. |

2026 Verification Roadmap: From Inquiry to Shipment

Integrating AI and regulatory shifts (e.g., EU CSDDD, US UFLPA)

| Phase | Critical Actions | Tools/Tech (2026) |

|---|---|---|

| Supplier Shortlist | – Validate business license via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) – Screen for UFLPA/entity list matches |

SourcifyAI Risk Scanner + U.S. Customs API integration |

| Pre-Audit | – Demand 3D factory tour via AR glasses – Analyze satellite imagery for capacity claims |

Microsoft Mesh + Planet Labs API |

| On-Site Audit | – Test material authenticity with handheld XRF spectrometers – Verify worker IDs against social insurance records |

SourcifyChain Mobile + China’s Social Security QR API |

| PO Execution | – Embed IoT sensors in shipments for real-time temp/humidity tracking – Blockchain QC checkpoints at each process stage |

IBM Food Trust + LoRaWAN sensors |

| Post-Delivery | – AI-driven defect root-cause analysis via production video logs – Automated ESG compliance scoring |

SourcifyQuality AI + MSCI ESG Manager |

Conclusion & SourcifyChina Recommendation

The “iPhone manufactured in China” narrative exemplifies how misinformation enables sourcing fraud. In 2026, verification must shift from paper-based compliance to real-time, tech-validated transparency. Prioritize suppliers who:

1. Welcome unannounced audits with digital access to live production data,

2. Provide blockchain-traceable component logs,

3. Demonstrate engineering ownership – not just assembly.

Procurement Imperative: Never source based on brand association claims. Apple’s model is an exception – not the rule. Legitimate Chinese factories focus on their capabilities, not false ties to global brands.

Next Step: Request SourcifyChina’s 2026 Electronics Supplier Verification Playbook (includes AI audit checklist templates and China-specific red flag database).

SourcifyChina: De-risking Global Sourcing Since 2010 | ISO 9001:2025 Certified | www.sourcifychina.com

Disclaimer: This report does not constitute legal advice. Verify all regulatory requirements with local counsel.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Sourcing Intelligence – Are iPhones Manufactured in China?

A recurring due diligence question among global procurement professionals is: Are iPhones manufactured in China? While public knowledge confirms Apple’s reliance on Chinese contract manufacturers such as Foxconn, Luxshare, and Compal, the deeper operational challenge lies in verifying supply chain legitimacy, assessing factory compliance, and mitigating sourcing risk.

SourcifyChina’s Verified Pro List transforms this inquiry from a speculative search into a data-driven sourcing decision—saving procurement teams critical time, reducing risk, and accelerating time-to-contract.

Why the SourcifyChina Verified Pro List Delivers Immediate Value

Procurement managers face mounting pressure to validate suppliers quickly and accurately. Generic web searches or third-party directories often yield outdated, unverified, or misleading information—leading to wasted outreach, compliance exposure, and supply chain vulnerabilities.

Our Verified Pro List provides:

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Manufacturing Partners | Access to facilities with confirmed production capabilities, compliance certifications (ISO, BSCI), and audit history. |

| Up-to-Date Operational Data | Real-time validation of factory status, capacity, and Apple-tier manufacturing experience. |

| Time Savings | Reduce supplier qualification time by up to 70%—no cold outreach or background checks required. |

| Risk Mitigation | Avoid counterfeit factories, middlemen, and non-compliant operations common in open sourcing channels. |

| Strategic Alignment | Identify partners already experienced in high-volume, precision electronics manufacturing. |

For sourcing professionals evaluating China-based iPhone manufacturing, our Pro List eliminates guesswork. You gain immediate access to verified partners within Apple’s extended supply ecosystem—without the delays of manual vetting.

Call to Action: Accelerate Your Sourcing Cycle Today

Don’t let inefficient sourcing processes slow down your procurement strategy. With SourcifyChina’s Verified Pro List, you gain instant access to trusted, high-capacity electronics manufacturers in China—backed by due diligence you can rely on.

Take the next step toward smarter, faster, and safer sourcing:

📧 Email Us: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our Senior Sourcing Consultants are available to provide a complimentary supplier match review and demonstrate how the Verified Pro List integrates seamlessly into your procurement workflow.

Act now—turn inquiry into action in under 48 hours.

SourcifyChina: Your Verified Gateway to China Manufacturing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.