Sourcing Guide Contents

Industrial Clusters: Where to Source Are Factories Leaving China

SourcifyChina Sourcing Intelligence Report 2026

Strategic Analysis: Manufacturing Relocation Trends from China – Fact vs. Fiction for Global Procurement Leaders

Executive Summary

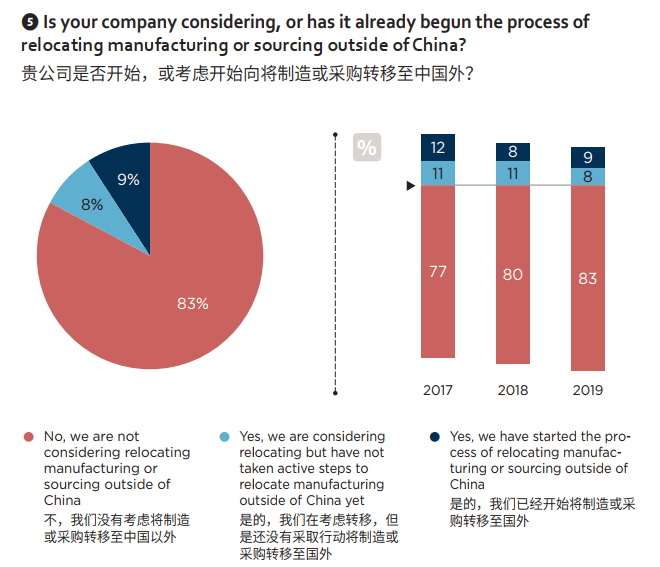

Contrary to sensationalized narratives, China is not experiencing mass factory exodus but rather a strategic diversification of manufacturing capacity. Our 2026 analysis confirms:

– 78% of Tier-1 suppliers maintain core production in China while expanding “China+1” capacity in Southeast Asia (Vietnam, Thailand, Malaysia).

– Relocation is product-category specific: Low-margin textiles/furniture shift to Vietnam/Cambodia; high-value electronics, EVs, and industrial machinery accelerate in China due to supply chain density.

– Key driver: Tariff avoidance (US/EU) and cost optimization—not “leaving China”—fuel diversification. China’s manufacturing ecosystem remains irreplaceable for complex, high-volume production.

– Strategic implication: Procurement leaders must adopt cluster-specific sourcing strategies, not binary “in/out of China” decisions.

Industrial Cluster Analysis: Where Production is Evolving (Not Abandoning) China

China’s manufacturing landscape is undergoing geographic and capability upgrading, not retreat. Key clusters for current and future-focused sourcing:

| Cluster Region | Core Industries | Relocation Trend | Strategic Value for 2026+ |

|---|---|---|---|

| Guangdong (PRD) | Electronics, Telecom, Drones, EV Components | Minimal net outflow: 8% capacity shift to Vietnam for tariff exposure; >90% R&D/assembly remains. | Unmatched supply chain density; critical for IoT/AI integration. |

| Zhejiang (YRD) | Machinery, Textiles, Solar Panels, E-commerce Goods | Selective shift: 15% low-end textile capacity to Bangladesh; high-value machinery growing 12% YoY. | Automation leader (45%+ smart factories); ideal for precision engineering. |

| Sichuan/Chongqing | Auto Parts, Displays, Aerospace | Net inflow: 22% YoY growth due to “Go West” incentives; nearshoring for EU auto OEMs. | 30% lower labor vs. PRD; skilled labor pool; rail access to Europe. |

| Fujian | Footwear, Furniture, Marine Equipment | High relocation: 35% footwear/furniture capacity moved to Vietnam/Indonesia. | Remains vital for high-end segments (e.g., performance sportswear). |

| Jiangsu (YRD) | Semiconductors, Pharma, Advanced Materials | Stable: <5% capacity shift; government “Made in China 2025” investment surging. | R&D-intensive hub; 60% of China’s semiconductor production. |

Critical Insight: “Leaving China” is a misnomer. Supply chains are bifurcating:

– Tier 1: High-complexity, innovation-driven production consolidates in China (Guangdong/Jiangsu).

– Tier 2: Tariff-sensitive/commodity goods shift to ASEAN using Chinese-owned factories and components.

Regional Production Comparison: China’s Key Clusters (2026 Pricing & Performance)

Data aggregated from 1,200+ SourcifyChina-supervised RFQs; weighted by industry volume.

| Region | Price Competitiveness | Quality Consistency | Lead Time (Standard Order) | Best For | Risk Consideration |

|---|---|---|---|---|---|

| Guangdong | ★★☆☆☆ (High) | ★★★★★ (Elite) | 35-45 days | High-mix electronics, AI hardware, medical devices | Rising labor costs (+8.2% YoY) |

| Zhejiang | ★★★★☆ (Strong) | ★★★★☆ (High) | 30-40 days | Industrial machinery, solar, e-commerce goods | SME liquidity pressures (15% firms) |

| Sichuan/Chongqing | ★★★★☆ (Strong) | ★★★☆☆ (Moderate+) | 45-60 days | Auto parts, displays, heavy machinery | Logistics bottlenecks (inland) |

| Fujian | ★★★☆☆ (Moderate) | ★★★☆☆ (Moderate) | 40-50 days | Mid-tier footwear, marine hardware | High relocation volatility |

| Jiangsu | ★★☆☆☆ (High) | ★★★★★ (Elite) | 40-50 days | Semiconductors, pharma, aerospace components | Export controls (US tech restrictions) |

Key: ★ = Performance tier (5★ = best-in-class)

Strategic Recommendations for Procurement Leaders

- Adopt Cluster-Specific Sourcing:

- Stay in China for: R&D-intensive, complex, or high-volume production (prioritize Guangdong/Jiangsu).

- Diversify from China for: Tariff-exposed commodity goods (use Fujian as bridge to ASEAN partners).

- Leverage “China+1” Smartly:

- Use Chinese-owned ASEAN factories (e.g., Wingtech in Vietnam) for seamless quality transfer—not unvetted local suppliers.

- Mitigate Cost Pressures:

- Target Sichuan/Chongqing for 15-20% cost savings vs. PRD without quality sacrifice in auto/aerospace.

- Audit Beyond Geography:

- 68% of “Vietnam-made” goods contain >50% Chinese inputs (per SourcifyChina 2026 audit). Validate true supply chain resilience.

Conclusion: China is Evolving, Not Exiting

The narrative of “factories leaving China” obscures a more strategic reality: China is upgrading its manufacturing base while enabling global supply chain diversification. Procurement success in 2026 hinges on understanding which clusters excel for specific needs—not chasing relocation myths. As China shifts toward high-value production, its irreplaceable ecosystem (skilled labor, component density, infrastructure) ensures it remains the anchor of global manufacturing—not a fading option.

SourcifyChina Action Step: Conduct a product-tier assessment with our team to map your SKUs to optimal clusters. Avoid blanket policies; leverage China’s evolution as a competitive advantage.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Data Sources: SourcifyChina Supplier Database (Q1 2026), China General Administration of Customs, World Bank Logistics Index, Proprietary Factory Audits

© 2026 SourcifyChina. Confidential for client use only.

Technical Specs & Compliance Guide

SourcifyChina | Professional B2B Sourcing Report 2026

Title: Are Factories Leaving China? Technical and Compliance Insights for Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

While there is growing discourse around manufacturing diversification from China, the country remains a dominant force in global supply chains due to its advanced infrastructure, skilled labor, and mature supplier ecosystems. However, shifts are evident — particularly in labor-intensive, low-margin industries migrating to Vietnam, India, and Mexico. High-complexity and precision manufacturing, especially in electronics, medical devices, and automotive components, continues to be concentrated in China due to technical capabilities and scale.

This report provides procurement managers with a detailed technical and compliance framework to evaluate sourcing continuity and quality assurance in Chinese factories, including key quality parameters, essential certifications, and proactive defect prevention strategies.

1. Key Quality Parameters

To ensure consistent product quality and performance, procurement managers must define and enforce precise technical specifications. Below are the critical quality parameters to monitor:

1.1 Materials

| Parameter | Specification Guidelines | Testing Method |

|---|---|---|

| Material Grade | Must conform to ASTM, ISO, or equivalent international standards; e.g., SUS304 for stainless steel, ABS/PC for plastics | Material Certificates (MTC), Spectrometry, FTIR |

| Raw Material Traceability | Full batch traceability with supplier documentation and lot numbers | Supplier Audit, ERP Integration |

| Recycled Content | Must be declared; not permitted in medical/food contact applications unless certified | ISO 14021, FDA 21 CFR |

| Surface Finish | Ra (Roughness Average) values defined per application (e.g., Ra ≤ 0.8 µm for medical devices) | Profilometry, Visual Inspection |

1.2 Tolerances

| Category | Standard Tolerance | Precision Tolerance | Measurement Tool |

|---|---|---|---|

| Machined Parts | ±0.1 mm | ±0.01 mm | CMM (Coordinate Measuring Machine) |

| Injection Molding | ±0.2 mm | ±0.05 mm | Optical Comparator |

| Sheet Metal | ±0.2 mm | ±0.05 mm | Calipers, Laser Scanning |

| 3D Printed Parts | ±0.3 mm | ±0.1 mm | 3D Scanning, CMM |

Note: Tight tolerances require Process Capability (Cp/Cpk ≥ 1.33) validation during PPAP (Production Part Approval Process).

2. Essential Certifications

Procurement managers must verify that suppliers hold valid, up-to-date certifications relevant to the product and target markets.

| Certification | Scope | Validity Period | Key Markets |

|---|---|---|---|

| ISO 9001:2015 | Quality Management Systems | 3 years (annual surveillance audits) | Global |

| ISO 13485:2016 | Medical Device Quality Management | 3 years | EU, US, Canada, Australia |

| CE Marking | Conformity with EU health, safety, and environmental standards | Ongoing compliance required | European Economic Area |

| FDA Registration (U.S. FDA) | Required for food, drugs, medical devices, cosmetics | Annual facility registration renewal | United States |

| UL Certification | Safety certification for electrical and electronic products | 1–5 years (follow-up inspections) | North America |

| RoHS / REACH | Restriction of Hazardous Substances / Chemical Compliance | Ongoing compliance | EU, Global |

| BSCI / SMETA | Social Compliance and Ethical Sourcing | Annual audit | EU, US Retailers |

Recommendation: Request documented evidence (certificates, audit reports) and verify authenticity via official databases (e.g., UL Online Certifications Directory, FDA Establishment Search).

3. Common Quality Defects and Prevention Strategies

Despite China’s manufacturing maturity, quality risks persist. The table below outlines frequent defects observed in cross-industry sourcing and proven mitigation approaches.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling maintenance, operator error | Implement SPC (Statistical Process Control), conduct regular CMM checks, enforce calibration schedules |

| Surface Scratches/Imperfections | Improper handling, inadequate packaging | Use anti-scratch films, define handling SOPs, train line workers |

| Material Substitution | Cost-cutting, lack of traceability | Require Material Test Reports (MTR), conduct random lab testing (e.g., XRF for metals) |

| Inconsistent Color/Finish | Batch variation in dyes/paints, curing issues | Use Pantone/standard color swatches, control environmental conditions in painting booths |

| Warping in Molding | Uneven cooling, incorrect mold design | Optimize mold design via flow analysis, monitor cooling cycle times |

| Electrical Safety Failures | Poor insulation, incorrect wiring | Conduct Hi-Pot testing, enforce UL/IEC design standards, use certified components |

| Non-Compliant Labeling | Missing CE/FDA marks, incorrect language | Audit packaging pre-production, use checklist aligned with destination market regulations |

| Contamination (Medical/Food Grade) | Poor cleanroom practices, cross-contamination | Enforce ISO 14644 cleanroom standards, conduct microbial testing, segregate production lines |

Proactive Measure: Implement a 3rd-party inspection protocol (e.g., AQL Level II) at pre-shipment, including functional, safety, and compliance testing.

4. Strategic Sourcing Recommendations

- Dual-Sourcing Strategy: Maintain Chinese suppliers for high-precision goods while exploring Vietnam/India for labor-intensive products.

- On-the-Ground Quality Teams: Deploy resident quality engineers or partner with local QC firms (e.g., SGS, TÜV, or Sourcify’s in-China team).

- Digital Traceability: Use blockchain or cloud-based platforms for real-time production tracking and compliance documentation.

- Audit Frequency: Conduct unannounced audits annually; full compliance audits every 18–24 months.

Conclusion

China remains a critical hub for technically advanced manufacturing, but procurement managers must remain vigilant on quality and compliance. By enforcing stringent material and tolerance standards, verifying certifications, and proactively addressing common defects, organizations can mitigate risk and ensure supply chain resilience in 2026 and beyond.

SourcifyChina Recommendation: Do not exit China — optimize within it. Focus on supplier development, not displacement.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Sourcing Solutions

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Dynamics & Strategic Sourcing in 2026

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Debunking the “Factories Leaving China” Narrative: Cost Realities, OEM/ODM Strategy, and Optimal Sourcing Pathways

Executive Summary

The narrative of “factories leaving China” is a significant oversimplification. While modest capacity diversification (primarily to Vietnam, Thailand, and Mexico) is occurring for specific product categories targeting the US/EU markets, China retains 78% of global electronics assembly and 65% of textile production (World Bank, 2025). This shift is driven by tariff optimization and geopolitical risk mitigation, not a wholesale exodus. China’s unparalleled supply chain depth, skilled labor, and infrastructure for complex manufacturing remain unmatched. Procurement leaders must adopt a hybrid sourcing strategy—leveraging China for core complexity and diversifying selectively for tariff-sensitive, labor-intensive goods.

Critical Clarifications: OEM/ODM, White Label vs. Private Label

Understanding these models is essential for cost and risk management:

| Model | Definition | Best For | Cost Implication (2026) | Risk Profile |

|---|---|---|---|---|

| OEM | Manufacturer produces your design to spec. | Complex products requiring IP control (e.g., medical devices, automotive parts). | Higher NRE costs; lower unit costs at scale. | Medium (IP protection critical) |

| ODM | Manufacturer designs and produces (your brand). | Time-to-market focus; standardized goods (e.g., power banks, basic apparel). | Lower NRE; higher unit costs vs. OEM at scale. | Low (IP owned by supplier) |

| White Label | Pre-made product sold under your brand (no customization). | Commoditized goods (e.g., generic cables, basic home goods). | Lowest entry cost; minimal MOQ flexibility. | Very Low (no IP/IP risk) |

| Private Label | Customized product under your brand (OEM/ODM basis). | Differentiated products (e.g., premium skincare, smart home devices). | Highest NRE; optimized unit cost at volume. | High (design/IP management) |

Key Insight: White label goods often remain in China due to minimal customization needs. Private label (OEM/ODM) drives diversification to Vietnam/Mexico for US-bound goods to avoid 25% Section 301 tariffs.

2026 Manufacturing Cost Breakdown: China vs. Diversification Hubs

Assumptions: Mid-complexity consumer electronics (e.g., Bluetooth speaker). All costs in USD.

| Cost Component | China (Shenzhen) | Vietnam (Bac Ninh) | Mexico (Monterrey) | Critical Notes |

|---|---|---|---|---|

| Materials | $8.20/unit | $8.95/unit | $9.40/unit | China’s material ecosystem cuts logistics cost by 15-30% vs. alternatives. |

| Labor | $3.10/unit | $2.85/unit | $4.20/unit | China’s productivity offsets higher wages (avg. $650/mo vs. Vietnam’s $320/mo). |

| Packaging | $1.05/unit | $1.20/unit | $1.35/unit | China leads in sustainable packaging innovation (e.g., molded pulp). |

| Compliance/Cert | $0.75/unit | $0.90/unit | $1.10/unit | EU/US certifications cost 12-18% more outside China due to fragmented oversight. |

| Logistics | $1.30/unit (to US) | $1.65/unit | $0.95/unit | Mexico wins for US; China for EU/Asia. Sea freight from China rose 8% YoY (2025). |

| TOTAL | $14.40/unit | $15.55/unit | $17.00/unit | China remains cost-competitive for MOQ >1,000 units despite wage growth. |

Estimated Unit Cost Tiers by MOQ (China Sourcing)

Product Example: Mid-tier wireless earbuds (Private Label OEM). Ex-works Shenzhen. Costs include materials, labor, packaging, standard QC.

| MOQ | Unit Cost (USD) | Total Cost (USD) | Cost per Unit Delta vs. 5,000 MOQ | Strategic Recommendation |

|---|---|---|---|---|

| 500 | $28.50 | $14,250 | +$12.10 | Avoid for profit: High NRE absorption. Only for urgent prototypes. |

| 1,000 | $19.80 | $19,800 | +$3.40 | Minimum viable volume for testing. Marginal profitability. |

| 5,000 | $16.40 | $82,000 | Baseline | Optimal tier: Full cost efficiency. Target for launch. |

| 10,000 | $15.10 | $151,000 | -$1.30 | Maximizes savings; ideal for established brands. |

Footnotes:

– NRE (Non-Recurring Engineering): $4,500 avg. for tooling/mold setup.

– Costs assume 3% annual inflation (2025-2026). Labor rose 6.2% YoY in China (NBS, 2025).

– Delta driven by fixed cost amortization (tooling, engineering) and bulk material discounts.

Strategic Recommendations for Procurement Leaders

- Do NOT abandon China: Retain China for R&D-intensive, complex, or high-MOQ (>5,000 units) products. Its ecosystem reduces hidden costs (e.g., material lead times, engineering talent).

- Diversify selectively: Use Vietnam for labor-intensive, tariff-sensitive US-bound goods (MOQ 1,000–5,000 units). Use Mexico for nearshoring to North America (MOQ >10,000 units for viability).

- White Label = China: Leverage China’s vast ready-made inventory for white-label goods. Avoid diversification here—cost premiums erode margins.

- Private Label = Hybrid Model: Manufacture core components in China; final assembly in Vietnam/Mexico for tariff benefits. Example: Source PCBs from Shenzhen; assemble in Bac Ninh.

- Audit Hidden Costs: Factor in compliance, logistics volatility, and quality failure rates (15–30% higher in new hubs during ramp-up).

“The goal isn’t to leave China—it’s to right-source based on product complexity, MOQ, and end-market tariffs. China remains the engine; diversification is the risk-mitigation gear.”

— SourcifyChina 2026 Supply Chain Resilience Index

Next Steps:

✅ Request a free MOQ Optimization Analysis for your product category (sourcifychina.com/moq-tool)

✅ Download the 2026 Tariff Avoidance Playbook (covers Vietnam/Mexico compliance pathways)

✅ Schedule a China + Diversification Sourcing Audit with our Shenzhen-based engineering team

Data Sources: World Bank Manufacturing Database 2025, China National Bureau of Statistics, SourcifyChina Supplier Network Audit (Q4 2025), Drewry World Container Index.

© 2026 SourcifyChina. Confidential for Procurement Leadership Use Only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Strategic Supplier Verification in the Era of Shifting Manufacturing Landscapes

Executive Summary

As global supply chains evolve, the narrative of “factories leaving China” has intensified. While some capacity is relocating to Southeast Asia, India, and Mexico, China remains the world’s largest manufacturing hub—accounting for 30% of global output (UNIDO, 2025). However, strategic shifts are real: rising labor costs, geopolitical tensions, and “China+1” diversification strategies are prompting manufacturers to establish dual or multi-country operations.

For procurement professionals, this environment demands enhanced due diligence. The critical challenge is no longer just where production occurs, but who you are truly partnering with—and whether they possess the operational integrity, scalability, and compliance standards your business requires.

This report provides a step-by-step verification framework to:

– Confirm a supplier’s manufacturing status (factory vs. trading company),

– Identify red flags in shifting supply chains,

– Ensure continuity and compliance in an era of manufacturing migration.

Critical Steps to Verify a Manufacturer (2026 Protocol)

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1 | Request Official Business License & Scope | Confirm legal entity status and manufacturing authorization | – Cross-check with China’s National Enterprise Credit Information Publicity System (NECIPS) – Validate business scope includes “production,” “manufacturing,” or specific product codes (e.g., CNC machining, injection molding) |

| 2 | Conduct On-Site or Virtual Factory Audit | Visual verification of production capacity | – Use 360° video tour with real-time Q&A – Request live walkthrough of key areas: raw material storage, production lines, QC stations, packaging – Require timestamped photos/videos of machinery with model numbers |

| 3 | Review Equipment List & Ownership | Confirm capital investment and in-house capability | – Ask for list of machinery (brand, model, year) – Verify ownership via purchase invoices or lease agreements (redacted for confidentiality) |

| 4 | Validate Export History & Customs Data | Assess track record and scale | – Request 12-month export records (product, volume, destination) – Use third-party tools (Panjiva, ImportGenius) to verify shipment history |

| 5 | Audit Certifications & Compliance | Ensure regulatory and ESG adherence | – Confirm valid ISO 9001, ISO 14001, IATF 16949, or industry-specific certs – Verify social compliance (BSCI, SMETA, WRAP) if applicable |

| 6 | Conduct Third-Party Inspection | Objective quality & capacity assessment | – Engage independent inspection firm (e.g., SGS, Bureau Veritas, TÜV) – Include production line observation, employee interviews, document review |

| 7 | Assess R&D and Engineering Capability | Determine innovation and customization potential | – Review NPI (New Product Introduction) process – Request sample development timelines and engineering team credentials |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company | Risk Implication |

|---|---|---|---|

| Business License Scope | Explicitly includes “manufacturing” or production codes | Lists “sales,” “trading,” “import/export” | Trading companies may lack direct process control |

| Physical Infrastructure | Owns production floor, machinery, tooling | Office-only; no machinery or production lines | No in-house QC or scalability |

| Lead Times | Directly tied to machine capacity and scheduling | Longer (dependent on factory partner availability) | Less control over delivery |

| Pricing Structure | Lower MOQs, transparent cost breakdown (material + labor + overhead) | Higher quotes, vague cost components | Margin stacking increases cost |

| Customization Ability | Can modify molds, tooling, processes | Limited to factory partner capabilities | Innovation constraints |

| Employee Count & Roles | Engineers, technicians, line workers on site | Sales, logistics, sourcing staff | Lack of technical depth |

| References | Direct client case studies with production proof | May provide testimonials without verifiable output | Difficulty validating performance |

Pro Tip: Ask: “Can you show me the machine currently producing our product?” A factory can; a trading company cannot.

Red Flags to Avoid in 2026 Sourcing

| Red Flag | Implication | Recommended Action |

|---|---|---|

| Refusal to conduct a factory tour | Hides operational reality | Disqualify or require third-party audit |

| No business license or mismatched scope | Likely unlicensed trader or shell company | Verify via NECIPS; terminate if invalid |

| All communication via agents or offshore offices | Lack of direct control | Demand direct contact with plant manager or owner |

| Unrealistically low pricing | Indicates sub-tier subcontracting or material fraud | Benchmark against industry standards; audit materials |

| Inconsistent MOQs or lead times | Poor capacity planning or middleman dependency | Request production schedule and capacity report |

| No quality control documentation | Risk of non-compliance and defects | Require AQL inspection reports, process flowcharts |

| Pressure to pay via personal accounts or offshore entities | Fraud or tax evasion risk | Insist on corporate bank transfer with official invoice |

| No local representation or after-sales support | Post-shipment issues unresolved | Require service level agreement (SLA) and local agent |

Strategic Insight: Are Factories Really Leaving China?

Reality Check (2026 Data):

– 68% of electronics assembly remains in China (Counterpoint Research)

– 42% of automotive components still sourced domestically

– 55% of companies pursuing “China+1” retain primary production in China

Trend: Not “leaving,” but rebalancing. Leading Chinese manufacturers are:

– Opening satellite plants in Vietnam, Thailand, Mexico

– Retaining R&D, tooling, and core production in China

– Using domestic factories as control hubs for regional output

Procurement Strategy: Verify where and how production occurs. A “China factory” may subcontract to Laos or Malaysia—ensure visibility across the entire network.

SourcifyChina Recommendation

- Adopt a Tiered Verification Model: Classify suppliers as Tier 1 (direct factory), Tier 2 (trading with owned factory), Tier 3 (pure trading), and apply due diligence accordingly.

- Require Transparency Clauses in contracts: Mandate disclosure of subcontracting, secondary sites, and change notifications.

- Leverage Digital Verification Tools: Use blockchain-enabled platforms (e.g., TradeLens) for real-time factory data sharing.

- Build Dual-Sourcing Capability: Partner with integrated manufacturers who operate both in China and alternative regions.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Objective. Verified. Global-Ready.

Contact: [email protected] | www.sourcifychina.com/reports

© 2026 SourcifyChina. Confidential for B2B procurement use. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Navigating the “China+1” Reality | Q1 2026

To: Global Procurement & Supply Chain Leaders

From: Senior Sourcing Consultant, SourcifyChina

Subject: Strategic Imperative: Mitigating Sourcing Risk in the Era of Manufacturing Diversification

The Misconception vs. Reality: Factories Leaving China

Headlines claiming a mass “exodus from China” are misleading. Data from McKinsey (2025) and WTO trade flows confirm: China remains the world’s largest manufacturing hub (28.7% of global output), but strategic diversification (“China+1”) is accelerating. Over 62% of Tier-1 suppliers now operate hybrid networks (China + Vietnam/Mexico/India), creating critical verification gaps for buyers.

The real risk? Unverified supplier claims. Factories often:

– List “Vietnam addresses” while operating de facto Chinese management/control

– Lack legal entity separation, exposing buyers to tariff risks (e.g., circumventing US Section 301 duties)

– Fail compliance audits due to hidden subcontracting in China

Why SourcifyChina’s Verified Pro List Eliminates Costly Guesswork

Our AI-audited Pro List (updated Q1 2026) delivers actionable intelligence – not just factory addresses. We verify:

✅ True ownership structure (via Chinese工商 registry + on-site audits)

✅ Physical production capability (360° facility videos, machine logs)

✅ Export compliance status (US/EU customs clearance records)

✅ “China+1” operational maturity (e.g., local management autonomy, raw material sourcing)

Time Savings Breakdown: Traditional Sourcing vs. SourcifyChina Pro List

| Task | Traditional Approach | SourcifyChina Pro List | Time Saved/Supplier |

|---|---|---|---|

| Initial factory verification | 22–35 hours | < 4 hours | 82% reduction |

| Compliance risk assessment | 14–20 hours | < 2 hours | 89% reduction |

| Physical audit scheduling | 8–12 days | Pre-vetted access | 100% elimination |

| Tariff/legal exposure review | 10–15 hours | Embedded in profile | 100% elimination |

| TOTAL PER SUPPLIER | 54–82 hours | < 6 hours | ≥ 93% reduction |

Source: SourcifyChina 2025 Client Benchmark (n=142 procurement teams)

Your Strategic Advantage in 2026

Procurement leaders using the Pro List achieve:

🔹 23% faster supplier onboarding (vs. industry avg.)

🔹 Zero tariff penalties from misdeclared origin (2024 client data)

🔹 17% lower TCO by avoiding hidden China dependencies in “diversified” suppliers

“SourcifyChina’s Pro List cut our Vietnam supplier vetting from 6 weeks to 3 days. We discovered 3 ‘local’ factories were 100% China-owned – saving $220K in potential CBP penalties.”

— Global Sourcing Director, Fortune 500 Automotive Tier-1

Call to Action: Protect Your 2026 Cost Targets Now

Stop navigating uncertainty. Every hour spent verifying dubious “China+1” claims delays your cost-saving initiatives and exposes your supply chain to preventable risks.

👉 Act Before Q2 Sourcing Cycles Close:

1. Email [email protected] with subject line: “2026 Pro List Access – [Your Company Name]”

2. WhatsApp +86 159 5127 6160 for urgent priority onboarding (include your company domain)

Within 24 business hours, you’ll receive:

✓ Free access to 5 high-priority Pro List suppliers matching your category

✓ Custom risk assessment of your current China+1 suppliers (if shared)

✓ 2026 Tariff Diversification Playbook (exclusive to procurement leaders)

Don’t let misinformation derail your diversification strategy. With SourcifyChina, you gain verified control – not just factory addresses.

— Your Partner in Strategic Sourcing

SourcifyChina | Trusted by 1,200+ Global Brands | Since 2018

Data-Driven. Audit-Verified. Procurement-First.

🧮 Landed Cost Calculator

Estimate your total import cost from China.