The global fragrance market is experiencing robust expansion, with the Middle Eastern region emerging as a key hub for luxury and niche perfumery—particularly driven by the enduring popularity of Arabic perfumes. According to Mordor Intelligence, the global perfume market was valued at USD 53.95 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2029, reaching an estimated USD 79.2 billion by 2029. A significant contributor to this trend is the rising demand for long-lasting, alcohol-free oud-based fragrances, especially across GCC countries and South Asia. Meanwhile, Grand View Research highlights the growing consumer preference for premium and culturally resonant scents, noting that the Middle East’s unique olfactory heritage positions Arabic perfume brands—and their wholesale manufacturing ecosystem—for sustained international growth. As both regional and global retailers seek authentic, high-quality fragrances at scale, sourcing from reliable Arabic perfume manufacturers has become a strategic priority. Based on market presence, export volume, ingredient quality, and OEM/ODM capabilities, the following nine manufacturers have established themselves as industry leaders in wholesale Arabic perfume production.

Top 9 Arabic Perfume Wholesale Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Arabic Perfume Wholesale

Domain Est. 2019

Website: azalija.lt

Key Highlights: We offer the perfumery,bakhoor of the best Middle Eastern manufacturers: Arabi,Al Hunaidi,Lattafa, Ard Al Zafraan, Alhambra, Armaf…

#2 Perfume Wholesale

Domain Est. 2001 | Founded: 1970

Website: ahp.alharamainperfumes.com

Key Highlights: Al Haramain Perfumes, established in 1970, is a leading global perfumery recognized for its luxurious fragrances rooted in tradition….

#3 Arabian Oud

Domain Est. 2002

Website: us.arabianoud.com

Key Highlights: Free deliveryYour first choice in the world of perfumes – Arabian Oud offers the best men’s and women’s perfumes in more than 150 cities around the world….

#4 Fragrance Perfumes

Domain Est. 2011

Website: fragranceperfumes.com

Key Highlights: Fragrance Perfumes is a top perfume wholesaler in Dubai, offering bulk, branded, and private label fragrances across the UAE and international markets….

#5 High Quality Concentrated Arabian Perfume Oil, Attars, niche and …

Domain Est. 2015

Website: arabianperfumeoil.com

Key Highlights: Specialising in high quality, authentic perfume oils, we offer a curated selection of scents, including the luxurious Sandalia by Swiss Arabian….

#6 Wholesale Perfume Distributor

Domain Est. 2020

Website: bfuturist.com

Key Highlights: B Futurist, your preferred wholesale Designer / Niche Perfume, and Arabian perfume brands. One stop distributor for designer and niche perfume brands….

#7 DubaiOudh

Domain Est. 2021

Website: dubaioudh.com

Key Highlights: Free delivery over $100DubaiOudh offers wholesale Arabic perfumes, attar, bakhoor, and fragrance oils from top brands like Lattafa, Armaf, Afnan, Rasasi, Amazing Creation and more …

#8 Alcohol-Free Arabian Perfumes & Oils

Domain Est. 2023

Website: arabianperfumesandoils.com

Key Highlights: Free delivery over $50Explore our exclusive range of alcohol-free Arabian perfumes and oils, crafted for lasting elegance. Shop now for authentic, long-lasting scents that ……

#9 About us

Domain Est. 2024

Website: saudi.ibraqperfumes.com

Key Highlights: We are passionate about fragrances and creating timeless memories. We believe that every perfume tells a unique story and every scent captures an emotion….

Expert Sourcing Insights for Arabic Perfume Wholesale

2026 Market Trends for Arabic Perfume Wholesale

The global wholesale market for Arabic perfumes is poised for dynamic growth and transformation by 2026, driven by shifting consumer preferences, digital advancements, and expanding international demand. Here are the key trends shaping the industry:

1. Rising Global Demand for Niche and Luxury Fragrances

By 2026, Western and Asian markets will increasingly embrace Arabic perfumes as symbols of luxury and exclusivity. Consumers are moving beyond mainstream scents, seeking unique, long-lasting formulations featuring oud, amber, and floral absolutes. This shift positions Arabic perfume wholesalers as key suppliers to boutique retailers, luxury e-commerce platforms, and spas in Europe, North America, and Southeast Asia.

2. E-commerce and Digital B2B Platforms Dominate Wholesale Channels

Digital transformation will accelerate, with B2B marketplaces and direct-to-business e-commerce platforms becoming primary channels for Arabic perfume wholesale. Wholesalers leveraging online catalogs, AI-driven inventory management, and seamless payment systems will gain a competitive edge. Platforms like Amazon Business, regional trade portals, and specialized fragrance hubs will facilitate cross-border transactions and global reach.

3. Sustainability and Ethical Sourcing Gain Strategic Importance

Eco-conscious buyers—both retailers and end consumers—will demand transparency in sourcing and production. Wholesalers emphasizing sustainably harvested oud, cruelty-free practices, and recyclable packaging will attract premium clients. Certifications and traceability will become key differentiators, especially for brands targeting environmentally aware markets in Europe and North America.

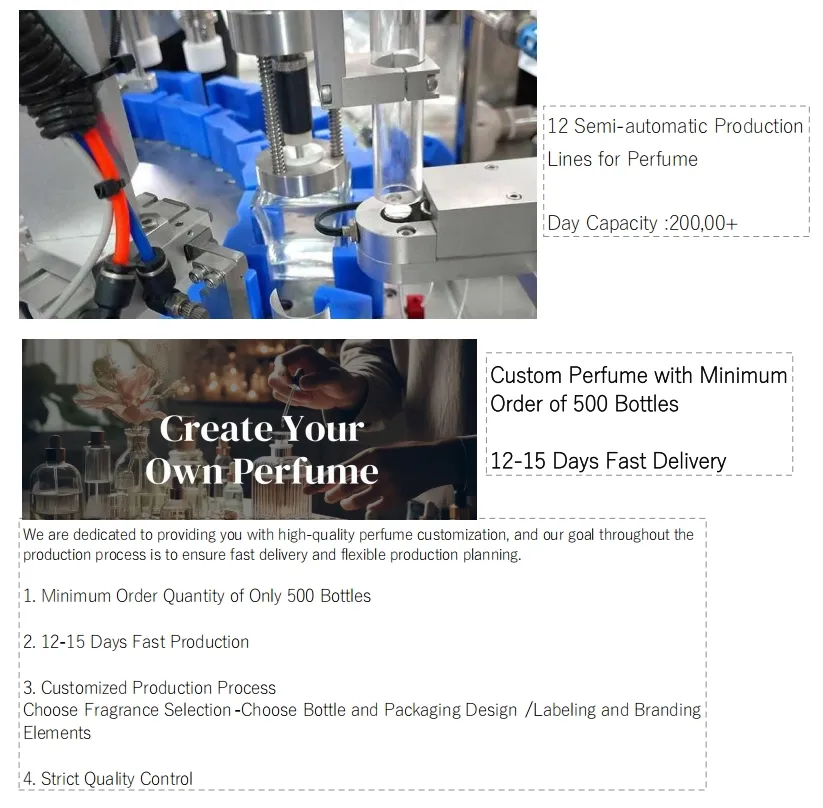

4. Customization and Private Label Growth

Retailers increasingly seek exclusive, branded fragrances to stand out. Arabic perfume wholesalers offering private label services, custom blending, and tailored packaging will see strong demand. This trend allows small boutiques and online stores to offer unique products, driving long-term partnerships and higher margins for suppliers.

5. Expansion into Emerging Markets

Beyond traditional strongholds in the Middle East and North Africa, high-growth opportunities will emerge in South Asia, Sub-Saharan Africa, and Latin America. As disposable incomes rise and fragrance culture develops, wholesalers adapting formulations and pricing for local tastes will capture early-mover advantages in these regions.

6. Innovation in Long-Lasting and Alcohol-Free Formulations

Demand for concentrated perfume oils (attars) and alcohol-free sprays will grow due to their longevity, skin-friendliness, and suitability for religious practices. Wholesalers investing in advanced extraction techniques and hydrosols will meet evolving consumer expectations for quality and versatility.

7. Strategic Branding and Storytelling

Successful wholesale brands will emphasize heritage, craftsmanship, and cultural authenticity. Packaging, marketing materials, and digital content that convey the artistry and tradition behind each scent will enhance perceived value and justify premium pricing in competitive markets.

8. Regulatory Compliance and Quality Assurance

With increasing scrutiny on ingredient safety and labeling, wholesalers must comply with international standards (e.g., IFRA, EU REACH). Investment in lab testing, documentation, and quality control will be essential to maintain credibility and access regulated markets.

In conclusion, the 2026 Arabic perfume wholesale landscape will reward agility, innovation, and a global mindset. Wholesalers who embrace digital tools, sustainability, and customization while preserving traditional excellence will lead the market’s next phase of growth.

Common Pitfalls Sourcing Arabic Perfume Wholesale (Quality, IP)

Sourcing Arabic perfumes wholesale can be highly lucrative, but it comes with significant risks, particularly concerning quality consistency and intellectual property (IP) infringement. Avoiding these common pitfalls is essential for building a reputable and sustainable business.

Inconsistent or Substandard Quality

One of the biggest challenges when sourcing Arabic perfumes is ensuring consistent, high-quality products. Many suppliers may offer attractive pricing, but compromise on ingredients or production standards.

- Use of Synthetic or Diluted Oils: Authentic Arabic perfumes rely heavily on natural ingredients like oud, amber, and rose. Some wholesalers cut costs by using synthetic substitutes or diluting precious oils, leading to inferior scent profiles and shorter longevity.

- Lack of Batch Consistency: Poor quality control can result in noticeable differences between batches, damaging brand trust if you’re reselling under your own label.

- Poor Packaging and Leakage: Low-quality bottles, seals, or caps may lead to leakage, evaporation, or contamination, especially during international shipping.

Mitigation Strategy: Request samples from multiple batches, verify ingredient lists, and consider third-party lab testing. Prioritize suppliers with certifications (e.g., ISO, GMP) and conduct factory audits when possible.

Intellectual Property (IP) and Trademark Infringement

Arabic perfumery is rich with iconic brands such as Amouage, Rasasi, Ajmal, and Swiss Arabian. Sourcing unbranded or “inspired by” versions may seem cost-effective, but poses serious legal and reputational risks.

- Counterfeit or Replica Products: Many wholesalers offer near-identical copies of popular branded fragrances. These are often illegal and can result in customs seizures, fines, or lawsuits when imported or sold.

- Misuse of Brand Names and Logos: Even subtle branding similarities (e.g., packaging design, bottle shape) can trigger trademark disputes.

- OEM/White Label Risks: While private labeling is legitimate, ensure your supplier isn’t using protected designs, names, or formulas without proper licensing.

Mitigation Strategy: Avoid suppliers offering “dupes” of well-known perfumes. Conduct thorough trademark searches in your target markets. Work with suppliers who provide original formulas and support private labeling with legally compliant branding.

Lack of Transparency in Sourcing and Ingredients

Opaque supply chains make it difficult to verify the authenticity and ethical sourcing of raw materials.

- Unverified Oud or Agarwood: Real oud is extremely expensive. Suppliers may mislabel lower-grade or synthetic alternatives as genuine.

- No Certifications or Documentation: Ethical and quality-conscious buyers often require proof of halal certification, cruelty-free practices, or sustainable sourcing—many wholesalers cannot provide these.

Mitigation Strategy: Ask for Certificates of Analysis (CoA), material safety data sheets (MSDS), and origin documentation. Build relationships with suppliers who are transparent about their sourcing.

Minimum Order Quantities (MOQs) and Inventory Risk

High MOQs are common in wholesale, but overcommitting can lead to excess inventory, especially if the fragrance doesn’t resonate with your market.

- Limited Testing Opportunities: Large MOQs make it difficult to test market response before scaling.

- Perishability and Shelf Life: While perfumes have long shelf lives, improper storage or formulation can degrade quality over time.

Mitigation Strategy: Negotiate lower trial orders or work with suppliers offering smaller batch production. Ensure proper storage conditions and monitor inventory turnover.

Language and Cultural Barriers

Miscommunication due to language differences or differing business practices can lead to misunderstandings about product specs, delivery timelines, or compliance requirements.

Mitigation Strategy: Use clear, written contracts. Consider hiring a local agent or translator with industry experience to facilitate communication and negotiations.

By being aware of these pitfalls—especially those related to quality control and intellectual property—you can make informed decisions and build a trustworthy, compliant Arabic perfume wholesale business.

Logistics & Compliance Guide for Arabic Perfume Wholesale

Understanding the Arabic Perfume Market Landscape

The Arabic perfume market is deeply rooted in tradition, with a strong emphasis on luxury, natural ingredients like oud, amber, and musk, and long-lasting scents. Wholesale operations must recognize regional preferences across the Middle East and North Africa (MENA), where consumers often favor concentrated oils (attars) and alcohol-free formulations. Building relationships with reputable suppliers in countries such as the UAE, Saudi Arabia, and Oman is critical. Additionally, understanding cultural nuances in gifting, religious observances (e.g., Ramadan), and seasonal demand spikes is essential for inventory planning and marketing strategies.

Regulatory Compliance: Local and International Standards

Compliance with both local regulations in the target market and international standards is mandatory. In the Gulf Cooperation Council (GCC) countries, perfumes must adhere to the GCC Standardization Organization (GSO) requirements, including product safety, labeling, and ingredient disclosure. The European Union’s REACH regulations apply when exporting to Europe, mandating safety data sheets (SDS) and registration of chemical substances. Ensure all products comply with International Fragrance Association (IFRA) standards, which govern the safe use of fragrance ingredients.

Product Classification and HS Code Identification

Accurate product classification ensures correct customs duties and avoids shipment delays. Arabic perfumes typically fall under Harmonized System (HS) Code 3303.00 for “Essential oils (terpenes free), whether or not deodorized or solvent-extracted, and perfume extracts.” However, formulations containing alcohol may be classified under 3303.00.10, while non-alcoholic attars may fall under different subcategories. Consult national customs authorities or a licensed customs broker to verify the appropriate HS code based on composition and concentration.

Import and Export Licensing Requirements

Wholesale distribution of perfumes often requires specific import/export licenses. Exporters must obtain an export permit from their national trade authority, while importers in the target country must hold a valid commercial license and, in many cases, a cosmetics import permit issued by the Ministry of Health or equivalent body. In Saudi Arabia, for example, the Saudi Food and Drug Authority (SFDA) mandates product registration via the Electronic Registration System (Estidama). Similarly, the UAE’s Ministry of Health and Prevention (MOHAP) requires pre-market approval for cosmetic products.

Labeling and Packaging Regulations

Labeling must meet local language and content requirements. In Arabic-speaking countries, packaging must include essential information in Arabic, such as product name, list of ingredients (INCI), net quantity, manufacturer and importer details, batch number, expiration date, and usage instructions. Avoid misleading claims such as “medicinal” unless the product is registered as such. Packaging should also include hazard symbols if applicable (e.g., flammable alcohol-based perfumes) and comply with child-resistant packaging standards where required.

Shipping and Transportation Considerations

Perfumes, especially alcohol-based ones, are classified as hazardous goods (Class 3 Flammable Liquids) under the International Air Transport Association (IATA) and International Maritime Dangerous Goods (IMDG) codes. Proper UN-certified packaging, labeling, and documentation (e.g., Safety Data Sheet, Dangerous Goods Declaration) are required for air and sea freight. Temperature control during transport is crucial for preserving fragrance integrity, particularly in hot climates. Partner with logistics providers experienced in handling cosmetics and hazardous materials.

Customs Clearance and Duty Management

Efficient customs clearance depends on accurate documentation, including commercial invoices, packing lists, certificates of origin, and product compliance certificates (e.g., GSO, SFDA, or MOHAP approval). Duties vary by country and HS code; for example, GCC countries typically apply a 5% customs duty on perfumes, plus 15% VAT (as of 2023). Utilize Free Trade Agreements (FTAs) where applicable to reduce tariffs. Consider using bonded warehouses or free zones (e.g., Jebel Ali Free Zone) to defer duties and streamline distribution.

Intellectual Property and Brand Protection

Protect your brand by registering trademarks in all target markets through national IP offices or the GCC Patent Office. Counterfeit products are prevalent in the fragrance industry, so implement anti-counterfeiting measures such as holograms, batch tracking, and secure packaging. Monitor online marketplaces and work with local authorities to enforce IP rights. Ensure your suppliers also respect IP laws to avoid inadvertently distributing infringing products.

Sustainability and Ethical Sourcing Compliance

Consumers and regulators increasingly demand ethical sourcing and environmental responsibility. Ensure raw materials like oud and sandalwood are sourced sustainably and comply with CITES (Convention on International Trade in Endangered Species) regulations. Avoid animal-derived ingredients unless certified humane. Implement eco-friendly packaging solutions and disclose sustainability practices in marketing materials to enhance brand reputation and meet evolving compliance expectations.

Recordkeeping and Audit Preparedness

Maintain comprehensive records for at least five years, including supplier agreements, compliance certifications, batch testing reports, shipping documents, and import/export filings. Regular internal audits help ensure ongoing compliance with changing regulations. Be prepared for inspections by customs, health authorities, or certification bodies. A well-documented compliance system reduces risks and supports swift resolution of regulatory inquiries.

In conclusion, sourcing Arabic perfumes wholesale presents a lucrative opportunity for entrepreneurs and retailers aiming to meet the growing global demand for exotic, long-lasting fragrances. Renowned for their rich ingredients, traditional craftsmanship, and luxurious appeal, Arabic perfumes stand out in the competitive beauty and fragrance market. By partnering with reputable suppliers from fragrance hubs such as the UAE, Saudi Arabia, and France, businesses can ensure authenticity, quality, and a diverse product range including oud-based oils, attars, and concentrated perfumes.

Success in this venture depends on thorough supplier vetting, understanding import regulations, building strong relationships, and focusing on niche marketing strategies. Additionally, offering competitive pricing, authentic branding, and excellent customer service can help establish a strong market presence. With the right approach, wholesale sourcing of Arabic perfumes can lead to a profitable and sustainable business in the premium fragrance industry.