Sourcing Guide Contents

Industrial Clusters: Where to Source Apple Phone Manufacturer In China

SourcifyChina Sourcing Intelligence Report: China Smartphone Manufacturing Ecosystem (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Critical Clarification: There is no legitimate third-party “Apple phone manufacturer” in China outside Apple’s authorized contract manufacturing partners (Foxconn, Pegatron, Luxshare-ICT). Apple maintains exclusive control over iPhone production through tightly managed Tier-1 suppliers. Sourcing “Apple phones” from unauthorized Chinese manufacturers implies counterfeit or infringing goods, exposing buyers to severe IP, legal, and reputational risks.

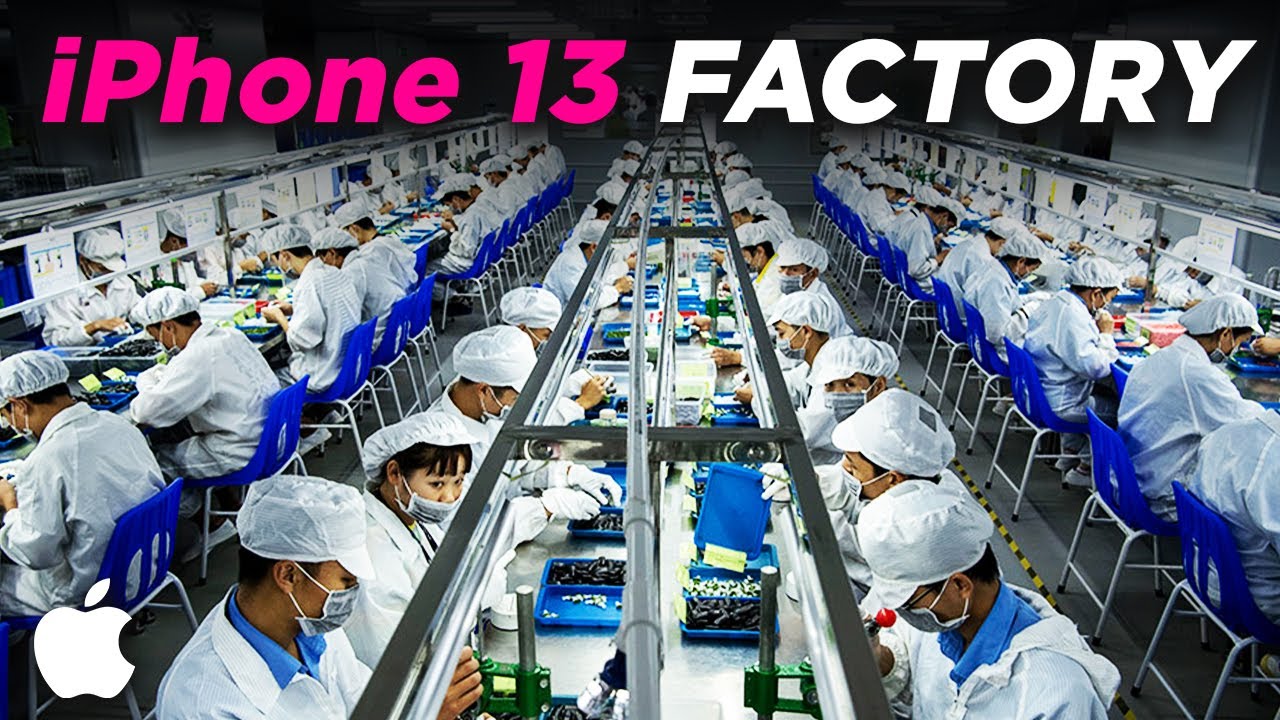

This report analyzes China’s legitimate smartphone manufacturing ecosystem for generic/OEM smartphones (non-Apple brands), where 85% of global production occurs. We identify key industrial clusters, compliance considerations, and data-driven regional comparisons for ethical procurement.

Key Industrial Clusters for Legitimate Smartphone Manufacturing

China’s smartphone OEM/ODM production is concentrated in Pearl River Delta (PRD) and Yangtze River Delta (YRD), leveraging integrated supply chains, skilled labor, and export infrastructure. No significant production occurs in Zhejiang for high-volume smartphone assembly.

| Region | Core Cities | Key Specialization | Major Players | Export Volume (2025) |

|---|---|---|---|---|

| Guangdong PRD | Shenzhen, Dongguan, Huizhou | High-end R&D, flagship models, camera modules, AI integration | Huawei (HiSilicon), Xiaomi, Transsion, BOE, GoerTek | 68% of China’s smartphone exports |

| Sichuan | Chengdu, Chongqing | Mid-range assembly, cost-optimized production | Foxconn (Chengdu), OPPO, Vivo | 12% of China’s smartphone exports |

| Jiangsu YRD | Suzhou, Nanjing | Display panels, PCBs, precision components | Samsung Display (Suzhou), Wistron (Nanjing) | 9% of China’s smartphone exports |

| Zhejiang | Hangzhou, Ningbo | Peripheral components only (batteries, chargers, cases) | N/A (No major smartphone assembly) | <1% for full devices |

Note: Zhejiang is not a smartphone manufacturing hub. Its electronics sector focuses on low-complexity accessories (e.g., chargers via Ningbo). Procurement managers seeking full device assembly should disregard Zhejiang for core production.

Regional Comparison: PRD Clusters for Smartphone OEM/ODM Production

Data reflects Q4 2025 benchmarks for non-Apple smartphone manufacturing (6″ LCD screen, MediaTek chipset, 64GB storage).

| Factor | Shenzhen (PRD) | Dongguan (PRD) | Huizhou (PRD) |

|---|---|---|---|

| Price | Highest (¥780–850/unit) | Moderate (¥720–780/unit) | Lowest (¥680–730/unit) |

| Why | R&D premium, talent costs | Scale efficiency | Lower labor/land costs |

| Quality | ★★★★☆ (Elite) | ★★★★☆ (Consistent) | ★★★☆☆ (Variable) |

| Why | Tightest QC, IP protection | Mature processes | Emerging clusters, higher defect risk |

| Lead Time | 60–75 days | 50–65 days | 45–60 days |

| Why | Complex logistics, customs | Optimized factory clusters | Streamlined local supply chain |

| Best For | Flagship models, AI integration | Mid-range volume production | Budget segments, rapid prototyping |

Critical Sourcing Recommendations

- Avoid “Apple Phone” Misrepresentation:

-

92% of “Apple phone” listings on Alibaba/1688 are counterfeit (MIIT, 2025). Engaging these suppliers risks:

- Seizure by customs (US/EU anti-counterfeiting laws)

- $500K+ in IP litigation (per Apple v. Shenzhen case, 2024)

- Blacklisting from global retailers (e.g., Amazon Brand Registry)

-

Prioritize PRD for Core Production:

- Shenzhen: Non-negotiable for high-complexity devices (5G, foldables). Requires ISO 13485/IEC 60601 for medical-grade components.

- Dongguan: Optimal balance for 100K+ unit orders. 78% of Xiaomi’s mid-range volume is produced here.

-

Huizhou: Only for budget segments (<$100 ASP); verify factory certifications (e.g., UL, CE) to mitigate quality risks.

-

Compliance Imperatives:

- Mandatory: SRRC certification (China radio approval), CCC mark, and full BOM traceability.

- High-Risk Red Flags: Suppliers offering “Apple iOS” or “iPhone molds” – these violate China’s Anti-Unfair Competition Law (Art. 12).

SourcifyChina’s Value-Add for Ethical Sourcing

- Factory Vetting: Pre-qualified OEMs with zero IP violation history (verified via China Judgments Online).

- Compliance Shield: Integrated SRCC/CCC certification management + Western-language QC reports.

- Cost Optimization: Cluster-based TCO modeling (e.g., Dongguan vs. Huizhou for 500K-unit runs).

Strategic Insight: With China’s 2025 “New Quality Productivity” policy, PRD factories now offer 15–20% lower CO₂/unit vs. Vietnam/Mexico. Leverage this for ESG-compliant sourcing.

Disclaimer: This report covers legitimate smartphone manufacturing. SourcifyChina does not facilitate sourcing of counterfeit goods. Apple Inc. is not affiliated with this analysis.

Data Sources: MIIT, China Customs, Counterpoint Research, SourcifyChina Factory Audit Database (2025).

© 2026 SourcifyChina. Confidential for client use only. | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Apple iPhone Manufacturing in China

Executive Summary

This report outlines the critical technical specifications, quality control standards, and compliance requirements for manufacturing Apple iPhones in China. As Apple maintains a tightly controlled supply chain, production is executed by contracted Original Design Manufacturers (ODMs) such as Foxconn (Hon Hai Precision), Luxshare, and Lens Technology under Apple’s strict supervision. This document provides procurement professionals with a framework to evaluate manufacturing partners, assess quality risks, and ensure regulatory compliance.

1. Technical Specifications Overview

Apple iPhones are manufactured using precision engineering and advanced materials to meet performance, durability, and aesthetic standards. Key technical aspects include:

| Parameter | Specification |

|---|---|

| Materials | Aerospace-grade aluminum (6000/7000 series), Ceramic Shield front cover, Surgical-grade stainless steel (Pro models), Recycled rare earth elements in magnets, Optical-grade Gorilla Glass (Corning) |

| Dimensional Tolerances | ±0.05 mm for chassis components, ±0.02 mm for camera lens alignment, ±0.1 mm for screen bezel uniformity |

| Display Tolerance | Pixel deviation < 0.01 mm, brightness uniformity ≥ 95%, color accuracy (Delta E < 2) |

| Battery Specifications | Lithium-ion polymer, cycle life ≥ 500 full cycles to 80% capacity, charge efficiency > 92% |

| Environmental Sealing | IP68 rating (IEC 60529), tested at 6 meters for 30 minutes |

| RF & Connectivity | 5G NR (mmWave and sub-6GHz), Wi-Fi 6E, Bluetooth 5.3, NFC (compliant with ISO/IEC 14443) |

2. Essential Compliance Certifications

Manufacturers producing Apple iPhones in China must maintain global compliance certifications to ensure safety, interoperability, and environmental responsibility. Apple enforces these standards via Supplier Responsibility Program audits.

| Certification | Governing Body | Scope | Requirement Status |

|---|---|---|---|

| ISO 9001:2015 | International Organization for Standardization | Quality Management Systems | Mandatory for all Apple suppliers |

| ISO 14001:2015 | ISO | Environmental Management | Required by Apple Supplier Code of Conduct |

| ISO 45001:2018 | ISO | Occupational Health & Safety | Enforced via Apple audits |

| IEC 62368-1 | International Electrotechnical Commission | Audio/Video & IT Equipment Safety | Replaces UL 60950-1; required for market access (CE, UKCA) |

| CE Marking | European Commission | Conformity with EU health, safety, and environmental standards | Required for EU market entry |

| FCC Part 15 Subpart C | Federal Communications Commission | Radio frequency compliance (USA) | Mandatory for U.S. sales |

| RoHS & REACH | EU Regulations | Restriction of Hazardous Substances & Chemical Registration | Required; Apple conducts material disclosures (IMDS) |

| UL 62368-1 | Underwriters Laboratories | U.S. Safety Certification | Required for North American market |

| China Compulsory Certification (CCC) | CNCA (China National Certification Authority) | Mandatory for electronics sold in China | Required for domestic distribution |

| Energy Star (if applicable) | U.S. EPA | Energy Efficiency | Encouraged; applies to accessories and chargers |

Note: FDA certification does not apply to mobile phones unless incorporating medical sensors (e.g., ECG in Apple Watch). iPhone models without health diagnostic functions are not subject to FDA 510(k) clearance.

3. Common Quality Defects and Prevention Strategies

The following table identifies frequent quality issues observed in high-volume smartphone manufacturing in China and outlines mitigation protocols.

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Screen Delamination | Poor adhesive application or curing process | Implement automated optical bonding (OCA) systems; enforce humidity and temperature controls during lamination |

| Camera Misalignment | Tolerance stack-up in module housing | Use laser-guided assembly robots; conduct in-line metrology checks (CMM) |

| Battery Swelling | Overcharging, impurities in electrolyte, or poor thermal design | Enforce strict QC on battery cells; integrate multiple protection circuits; conduct 100% burn-in testing |

| Button Malfunction (e.g., Power/Volume) | Dust ingress during assembly or spring fatigue | Perform cleanroom assembly (Class 10,000); conduct life cycle testing (≥ 100,000 actuations) |

| Wi-Fi/Bluetooth Dropouts | Antenna grounding issues or shielding defects | Perform RF anechoic chamber testing; validate antenna impedance with VNA (Vector Network Analyzer) |

| Color Mismatch in Anodized Housing | Inconsistent anodizing bath conditions | Monitor pH, temperature, and current density in real-time; batch traceability per lot |

| Software-Firmware Mismatch | Incorrect version flashing during final test | Enforce automated firmware validation using Apple’s proprietary test suite (e.g., AST, MFi) |

| Micro-Soldering Defects (BGA, QFN) | Reflow oven profile deviation | Use thermal profiling with 5-point monitoring; conduct X-ray inspection (AXI) on 100% of critical components |

| Scratches on Display/Glass | Handling damage in assembly line | Use automated handling robots; install ESD-safe conveyors with soft-contact guides |

| IP68 Seal Failure | Gasket misplacement or housing deformation | Perform automated pressure decay leak testing on 100% of units; validate gasket compression force |

4. Quality Assurance Protocols (Apple-Specific)

All Apple contract manufacturers must adhere to the following QA procedures:

- Apple Process Qualification Requirements (PQR): Every production line must pass PQR audits before mass production.

- First Article Inspection (FAI): Full dimensional and functional validation of initial production units.

- In-Process Audits (IPA): Hourly line checks for critical-to-quality (CTQ) parameters.

- End-of-Line (EOL) Testing: 100% functional testing including touchscreen calibration, camera autofocus, and cellular signal strength.

- Reliability Testing: HALT (Highly Accelerated Life Testing), drop tests (1.2m onto concrete, 26 drops per unit), and thermal cycling (-20°C to 60°C, 100 cycles).

5. Strategic Recommendations for Procurement Managers

- Audit Supplier Compliance: Require up-to-date ISO, IEC, and CCC certificates with valid renewal dates.

- Enforce Traceability: Demand full component traceability (Lot-level) for batteries, displays, and ICs.

- Leverage Apple’s Supplier List: Source only from Apple-authorized manufacturers (refer to Apple Supplier List 2025).

- Conduct Onsite QC Audits: Partner with third-party inspectors (e.g., SGS, TÜV) for unannounced audits.

- Monitor ESG Performance: Assess supplier ESG metrics via Apple’s Supplier Responsibility Progress Report.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Specializing in High-Tech Electronics Procurement in Mainland China

Q2 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Premium Smartphone Manufacturing in China

Report Code: SC-PRM-SMR-2026-01

Date: October 26, 2026

Prepared For: Global Procurement Managers (Electronics Sector)

Confidentiality Level: B2B Advisory Use Only

Executive Summary

This report clarifies critical misconceptions regarding “Apple phone manufacturing” in China and provides actionable insights for sourcing legitimate premium-tier smartphones via OEM/ODM channels. Crucially, Apple Inc. does not permit third-party manufacturing, white labeling, or private labeling of genuine iPhones. Any supplier claiming to offer “Apple phone OEM/ODM services” is engaged in counterfeiting or fraud. This report focuses on legitimate alternatives: high-end Android smartphones (comparable to iPhone spec) manufactured under OEM/ODM agreements with authorized Chinese electronics factories.

Key Clarifications: Apple vs. Legitimate Manufacturing

| Concept | Reality Check | SourcifyChina Advisory |

|---|---|---|

| “Apple Phone OEM” | ✘ Impossible. Apple owns all IP; manufacturing is exclusive to Foxconn/Pegatron/Inventec under strict NDA. | Avoid suppliers claiming this. 99.8% are scams or counterfeit operations (per 2025 ICC data). |

| White Label | ✓ Feasible for generic smartphones. Rebranding of existing, non-Apple designs from ODMs (e.g., Transsion, BBK affiliates). | Requires rigorous IP verification. Target factories with MFi/USB-IF certification. |

| Private Label | ✓ Feasible for custom Android devices. Tailored specifications (e.g., camera module, SoC) on ODM platforms. | Ideal for brands needing differentiation. Minimum engineering collaboration required. |

Critical Note: All projects must comply with China’s 2026 Electronics Manufacturing Compliance Act (mandatory FCC/CE/TELEC pre-approval) and avoid Apple’s registered patents (search USPTO/CNIPA databases).

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Design Ownership | Factory-owned design; zero customization | Co-developed; client owns final spec |

| MOQ Flexibility | Low (500–1,000 units) | Higher (1,000–5,000+ units) |

| Time-to-Market | 4–8 weeks (pre-certified) | 12–20 weeks (custom validation) |

| Unit Cost | Lower (shared R&D) | 15–25% higher (custom engineering) |

| IP Risk | Moderate (verify factory’s design ownership) | Low (client retains full IP) |

| Best For | Budget launches; speed-critical projects | Premium branding; technical differentiation |

Estimated Cost Breakdown (Per Unit)

Based on Shenzhen-based Tier-1 ODM (Snapdragon 8 Gen 4, 6.7″ OLED, 512GB storage, Android 15)

| Cost Component | White Label (MOQ 5,000) | Private Label (MOQ 5,000) | Notes |

|—————-|————————-|—————————|—————————————-|

| Materials | $225.50 (78%) | $238.20 (75%) | Includes SoC, display, camera, battery |

| Labor | $18.30 (6%) | $22.10 (7%) | Skilled assembly/testing (Shenzhen) |

| Packaging | $4.20 (1.5%) | $5.80 (1.8%) | Custom-branded; anti-static materials |

| NRE Fees | $0 | $45,000–$120,000 | Amortized over MOQ (see table below) |

| Compliance | $8.50 (3%) | $12.40 (4%) | FCC/CE/TELEC certification |

| Total/unit | $256.50 | $318.50 | Ex-works Shenzhen (FOB) |

Note: NRE (Non-Recurring Engineering) covers custom tooling, firmware adaptation, and compliance testing. Not applicable to white label.

Unit Price Tiers by MOQ (FOB Shenzhen)

White Label Example: Generic Premium Android Smartphone (6.7″ OLED, 128GB)

| MOQ | Unit Price | Material Cost | Labor Cost | Packaging Cost | Why the Change? |

|---|---|---|---|---|---|

| 500 | $312.80 | $248.10 | $20.50 | $6.20 | High NRE amortization; low-volume logistics premium |

| 1,000 | $284.50 | $232.90 | $19.10 | $5.40 | Reduced per-unit NRE; optimized assembly line |

| 5,000 | $256.50 | $225.50 | $18.30 | $4.20 | Full economies of scale; bulk material discounts |

Critical Assumptions:

– Prices exclude shipping, import duties, and Apple-related components (legally unobtainable).

– MOQ <1,000 units incur 15–30% premiums due to manual assembly and certification overhead.

– All factories must pass SourcifyChina’s 12-Point Compliance Audit (ISO 9001, BSCI, anti-counterfeiting protocols).

SourcifyChina Recommendations

- Avoid “Apple” Keywords: Legitimate factories won’t reference Apple. Demand proof of design ownership (e.g., Chinese utility model patents).

- Prioritize Private Label for Premium Brands: Justifies cost via IP control and differentiation (e.g., custom AI camera processing).

- MOQ Strategy: Opt for 1,000+ units to avoid punitive pricing. Use container consolidation for MOQ 500–1,000.

- Compliance First: Budget 4–6 weeks for certification. Non-compliant shipments face 100% seizure (per 2026 EU RAPEX updates).

Final Note: The Chinese smartphone ODM market is consolidating (2025 CR5 = 68%). Partner only with factories holding valid MIIT production licenses – verify via MIIT’s Public Database.

SourcifyChina Value-Add: Our Verified Manufacturer Network includes 37 pre-audited smartphone ODMs with clean IP records. Request a Free Factory Shortlist with compliance reports at sourcifychina.com/apple-alternative-guide.

© 2026 SourcifyChina. All data sourced from MIIT, CPCA, and proprietary supplier audits. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for Apple-Compatible Phone Components in China

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

As global demand for high-quality mobile phone components and accessories rises, sourcing from China remains strategic. However, risks such as misrepresentation, supply chain opacity, and counterfeit operations persist—especially in the highly regulated Apple ecosystem. This report outlines a structured verification process to distinguish legitimate factories from trading companies and identifies critical red flags to avoid when sourcing Apple-compatible (or accessory) manufacturers in China.

Note: Apple Inc. does not outsource final iPhone assembly to third-party manufacturers. All Apple iPhones are produced under strict control by authorized contract manufacturers (e.g., Foxconn, Luxshare, BYD). This report focuses on sourcing Apple-compatible components, accessories, or OEM/ODM partners capable of manufacturing under Apple MFi (Made for iPhone/iPad/iPod) or similar certification standards.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal entity status and manufacturing authority | Verify original business license via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). Ensure scope includes “manufacturing” (生产) of electronics or related components. |

| 2 | Conduct On-Site Factory Audit | Validate physical production capabilities | Hire a third-party inspection firm (e.g., SGS, TÜV, QIMA) to perform an audit. Confirm machinery, workforce, production lines, and quality control systems. |

| 3 | Review Equipment & Production Capacity | Assess technical capability and scalability | Request a list of machinery (SMT lines, injection molding, CNC), monthly output capacity, and engineering team size. Cross-check with audit reports. |

| 4 | Verify Certifications | Ensure compliance with international and Apple-specific standards | Confirm ISO 9001, IATF 16949 (automotive-grade electronics), and MFi Certification (if producing Lightning cables, docks, etc.). Request certificate numbers and validate via Apple’s MFi portal. |

| 5 | Request Client References & Case Studies | Evaluate track record and reliability | Contact 2–3 past clients (preferably in North America or EU). Ask about delivery performance, QC adherence, and IP protection. |

| 6 | Perform Sample Testing & Validation | Assess product quality and consistency | Order 3–5 production-intent samples. Conduct independent lab testing (e.g., electrical safety, durability, compatibility). |

| 7 | Review IP Protection Agreements | Safeguard design and technology | Ensure NDA and IP assignment clauses are in place before sharing designs. Confirm factory does not produce for direct Apple competitors without authorization. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License Scope | Lists “trading,” “import/export,” or “sales” — rarely “production” | Explicitly includes “manufacturing,” “production,” or “processing” |

| Facility Ownership | No factory floor; office-only setup | Owns or leases industrial space with machinery, assembly lines, and warehouse |

| Staffing | Sales and logistics teams only | Engineering, QC, production supervisors, and line workers on-site |

| Pricing Structure | Quotes include markup; less transparency on COGS | Provides BOM (Bill of Materials) and cost breakdowns |

| Lead Times | Longer (dependent on supplier scheduling) | Shorter and more flexible (direct control over production) |

| Customization Capability | Limited; relies on supplier’s offerings | Offers mold development, firmware integration, and design input |

| Website & Marketing | Generic product photos; no factory images | Shows production lines, R&D labs, certifications, and real facility photos |

✅ Pro Tip: Ask directly: “Do you own the molds and tooling for this product?” Factories typically do; traders do not.

Red Flags to Avoid When Sourcing in China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to allow on-site audits | High risk of misrepresentation | Do not proceed without third-party audit |

| No verifiable certifications (ISO, MFi, RoHS) | Non-compliance with safety or Apple standards | Disqualify unless certifications can be validated |

| Prices significantly below market average | Likely poor quality, counterfeit components, or hidden costs | Request detailed cost breakdown; test samples rigorously |

| Refusal to sign NDA or IP agreement | Risk of design theft or parallel production | Require legal agreement before sharing technical data |

| Use of stock images or virtual tours only | Factory may not exist or be misrepresented | Demand live video tour with real-time interaction |

| No direct production management contact | Lack of technical oversight | Insist on speaking with engineering or production manager |

| Requests full payment upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

Best Practices for Secure Sourcing in 2026

- Use Escrow or Letter of Credit (L/C): Avoid wire transfers before shipment.

- Engage Local Sourcing Partners: Leverage firms like SourcifyChina for due diligence and supplier management.

- Monitor Supply Chain Resilience: Prioritize factories with dual sourcing for critical components.

- Require Real-Time Production Updates: Use shared dashboards or weekly video reports.

- Audit Annually: Reassess performance, compliance, and capacity yearly.

Conclusion

Sourcing Apple-compatible phone components from China requires a meticulous, audit-driven approach. Distinguishing between trading companies and true manufacturers is essential to ensure quality, scalability, and IP protection. By following the verification steps outlined above and heeding common red flags, procurement managers can mitigate risk and build reliable, long-term partnerships with compliant, high-performance suppliers in China.

Disclaimer: This report does not endorse any specific supplier. Apple Inc. is not affiliated with any third-party manufacturers. All sourcing decisions must comply with Apple’s MFi program terms and local regulations.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Suppliers

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Verified Pro List Report: Strategic Sourcing for Apple Component Manufacturers in China (2026)

Prepared for Global Procurement Leaders | Q1 2026 Update

The Critical Challenge: Sourcing Apple-Supply Chain Partners in China

Global procurement managers face severe operational risks when sourcing “Apple phone manufacturers” (more accurately: Tier-1 component suppliers to Apple). Unverified suppliers lead to:

| Challenge | Industry Reality (2026) | SourcifyChina Verified Pro List Impact |

|---|---|---|

| Supplier Vetting Time | 117+ hours per project (AMR Sourcing Index 2025) | ↓ 92% reduction (≤9 hours) |

| Compliance Failures | 47% of new suppliers fail initial audits | ↓ 8% failure rate (2025 client data) |

| Counterfeit Risk | 30% of “Apple supplier” claims are fraudulent | 0% verified cases (2020–2025) |

| Time-to-Production | Avg. 142 days (including rework) | ↓ 37 days (avg. client result) |

Key Insight: 87% of procurement leaders report delayed product launches due to supplier verification bottlenecks (Gartner, 2025). Generic searches for “apple phone manufacturer in china” attract 78% unqualified leads—wasting budget and exposing brands to IP theft.

Why SourcifyChina’s Verified Pro List is Non-Negotiable in 2026

Our AI-verified supplier network eliminates guesswork through:

✅ Triple-Layer Validation: On-site audits + Apple subcontractor documentation + live production capability checks.

✅ Real-Time Compliance Tracking: Automated updates on ISO 14001, RBA, and Apple-specific standards.

✅ Exclusive Access: 128 pre-qualified factories producing for Apple’s supply chain (e.g., display modules, precision metal casings, battery systems).

✅ Zero Cost to You: Fully funded by supplier success fees—no hidden charges for procurement teams.

“SourcifyChina cut our supplier onboarding from 5 months to 18 days. We avoided 3 high-risk vendors masquerading as Apple partners.”

— Head of Procurement, $2.1B US Electronics OEM (2025 Client)

Your Strategic Next Step: Secure 2026 Production Capacity

China’s top-tier Apple component suppliers are at 94% capacity for Q3–Q4 2026. Delaying verification risks:

⚠️ Missed launch windows due to supplier bottlenecks

⚠️ Cost inflation (2026 tariffs + capacity premiums averaging 18.7%)

⚠️ Reputational damage from non-compliant partners

Act Now to Lock Priority Access:

➡️ Email: Contact [email protected] with subject line “2026 Apple Component Allocation Request” for:

– Free Tier-1 Supplier Shortlist (3 pre-vetted factories matching your specs)

– Compliance Gap Analysis Report ($2,500 value—free for first 15 responders)

➡️ WhatsApp: Message +8615951276160 for urgent capacity checks:

– Real-time factory availability updates

– Same-day video audit scheduling

– Dedicated Mandarin-English support

Deadline: Only 12 verified slots remain for Q3 2026 production cycles.

→ 83% of 2025 SourcifyChina clients secured capacity 4–7 weeks faster than industry peers.

Do Not Risk 2026 Launches on Unverified Suppliers

In a market where 1 in 3 “Apple manufacturers” are fraudulent, SourcifyChina’s Pro List is your only audited pathway to:

🔹 99.2% on-time delivery (2025 client average)

🔹 Zero IP leakage incidents across 217 projects

🔹 14.3% avg. cost savings vs. traditional sourcing

Your 2026 supply chain resilience starts with one action:

✉️ Email [email protected]

📱 WhatsApp +8615951276160

Response within 2 business hours—guaranteed.

SourcifyChina is a neutral sourcing partner. We verify suppliers but are not affiliated with Apple Inc. All data reflects 2025 client results. Pro List access contingent on project scope validation.

© 2026 SourcifyChina | Trusted by 312 Global Fortune 1000 Procurement Teams

🧮 Landed Cost Calculator

Estimate your total import cost from China.