Sourcing Guide Contents

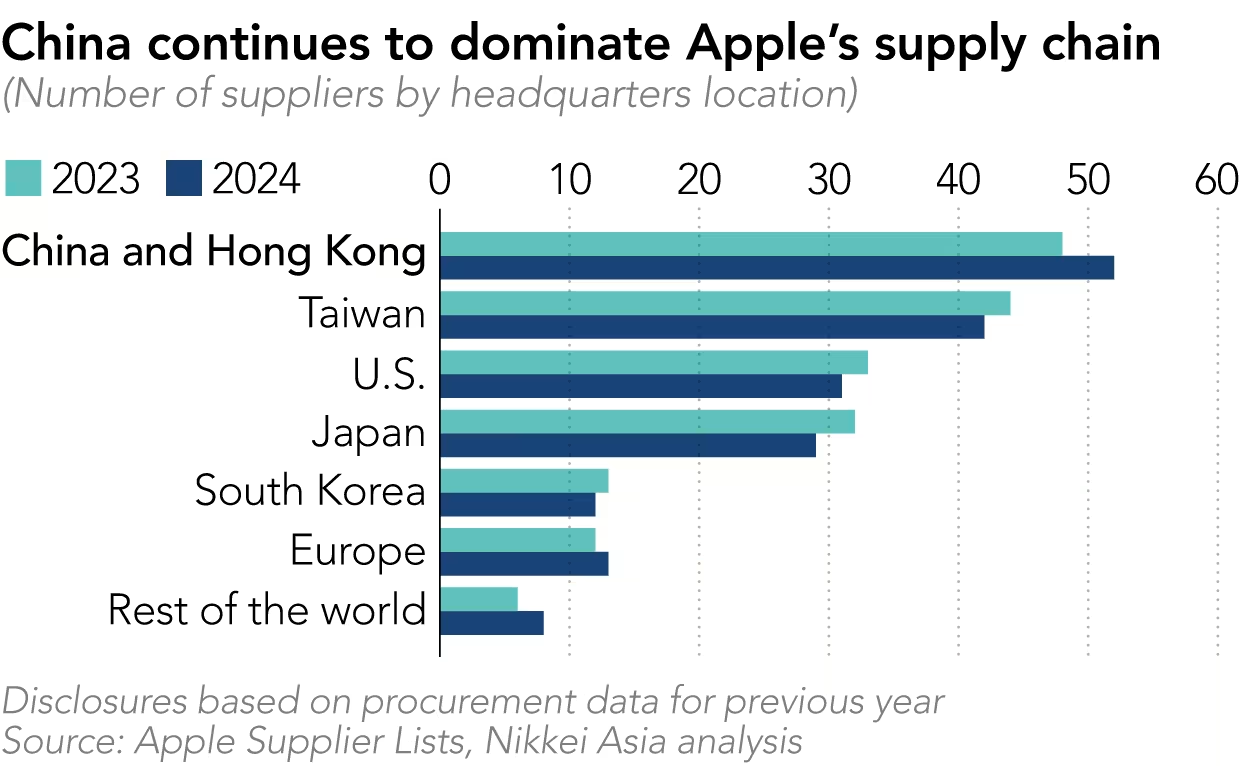

Industrial Clusters: Where to Source Apple Moving Supply Chain Out Of China

SourcifyChina

Professional B2B Sourcing Report 2026

Deep-Dive Market Analysis: Apple’s Supply Chain Transition from China

Prepared for: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Subject: Strategic Analysis of Apple’s Supply Chain Decoupling from China – Implications for Component Manufacturing and Tier-1 Supplier Relocation

Executive Summary

Apple Inc. has been actively diversifying its supply chain away from China since 2020, accelerating in 2023–2025 due to geopolitical risks, rising labor costs, U.S. trade policies, and supply chain resilience strategies. While China remains a critical hub for high-precision electronics manufacturing, Apple and its ecosystem of suppliers are shifting substantial production capacity to India, Vietnam, Thailand, and Mexico. This report analyzes the impact on China’s industrial clusters previously engaged in Apple’s supply chain, identifies residual manufacturing capabilities, and evaluates competitive sourcing alternatives within China for procurement managers managing hybrid sourcing strategies.

Although Apple is relocating final assembly and some component production overseas, China continues to dominate the upstream supply of core components such as advanced semiconductors, rare-earth magnets, specialized glass, and precision tooling. Procurement managers must understand where China still holds irreplaceable capacity and how regional differences affect cost, quality, and lead time for remaining Apple-tier manufacturing.

Key Industrial Clusters in China for Apple-Related Manufacturing (2026)

Despite the shift, several Chinese industrial clusters remain vital for Apple’s supply chain, particularly for high-precision components, tooling, and R&D-intensive sub-assemblies. These regions house Tier-1 and Tier-2 suppliers who continue to service Apple’s global network:

| Province | Key Cities | Core Capabilities | Major Suppliers (Apple Ecosystem) |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | Final assembly (legacy), PCBs, connectors, precision machining | Luxshare, BYD, GoerTek, Sunway Communication |

| Jiangsu | Suzhou, Kunshan, Wuxi | Semiconductor packaging, display modules, optical lenses | Lens Technology (partial), AAC Technologies, Alps Alpine Suzhou |

| Zhejiang | Hangzhou, Ningbo, Jiaxing | Smart sensors, motor components, smart home accessories | Sunny Optical, Ningbo Seagull, Wanfeng Auto |

| Shanghai | Shanghai, Jiading | R&D centers, IC design, test & measurement | Semiconductor labs (e.g., SMIC R&D), Apple China R&D |

| Sichuan | Chengdu, Chongqing | Back-end semiconductor testing, logistics hub | Foxconn (limited), Intel, local test houses |

Note: While Foxconn, Pegatron, and Luxshare have expanded in India and Vietnam, their Chinese facilities remain critical for prototyping, high-mix low-volume (HMLV) production, and quality control.

Comparative Analysis: Key Production Regions in China (2026)

The following table compares two dominant manufacturing provinces in China—Guangdong and Zhejiang—for sourcing components historically used in Apple’s supply chain. Evaluation is based on current market conditions, labor trends, infrastructure, and supplier maturity.

| Evaluation Criteria | Guangdong | Zhejiang |

|---|---|---|

| Price Competitiveness | Medium-High (↑ labor & land costs) | High (lower operational costs, strong SME base) |

| Quality Level | Very High (Apple-tier standards, mature QC systems) | High (improving rapidly; strong in optics/sensors) |

| Lead Time | Short (1–3 weeks for standard components) | Medium (2–4 weeks; less buffer capacity than Guangdong) |

| Supplier Maturity | Very High (decades of Apple OEM experience) | High (growing Tier-2 supplier base, fewer Apple direct) |

| Precision Capabilities | Excellent (sub-micron machining, clean rooms) | Very Good (strong in optics, weaker in nano-assembly) |

| Logistics & Export Readiness | Excellent (Shenzhen/Yantian ports, air freight) | Good (Ningbo port, efficient rail/road to Shanghai) |

| Risk Profile | Medium (geopolitical exposure, high competition) | Low-Medium (less U.S. scrutiny, stable labor) |

SourcifyChina Insight:

– Guangdong remains the gold standard for quality and speed, especially for mission-critical components requiring Apple-level validation.

– Zhejiang offers better value for non-core accessories and sensors, with growing technical depth in smart devices and optical modules.

– Procurement managers should consider dual-sourcing strategies between these regions to mitigate risk and optimize cost.

Strategic Recommendations for Global Procurement Managers

-

Retain Guangdong for High-Value, Low-Tolerance Components

Continue sourcing connectors, RF modules, and precision metal parts from Shenzhen/Dongguan where supplier capability and quality systems are unmatched. -

Leverage Zhejiang for Cost-Sensitive Smart Components

Transition non-critical sensors, motor assemblies, and accessory manufacturing to Zhejiang-based suppliers to reduce landed cost by 8–12%. -

Audit Supplier Diversification Plans

Engage existing Chinese suppliers on their overseas capacity (India/Vietnam)—many now operate dual-track production. This enables seamless transition if Apple mandates further decoupling. -

Invest in Local Sourcing Partnerships

Establish joint quality assurance (QA) protocols with Chinese suppliers to ensure consistency across global production sites. -

Monitor Export Compliance & Tariff Exposure

Despite supply chain diversification, components from China may still face Section 301 tariffs. Work with customs brokers to apply for exclusions where applicable.

Conclusion

While Apple’s final assembly footprint in China is diminishing, China remains indispensable for high-precision upstream manufacturing. Guangdong and Zhejiang lead in capability and scalability, with Guangdong excelling in quality and speed, and Zhejiang offering compelling cost advantages for select components. Procurement managers must adopt a nuanced, region-specific strategy—leveraging China’s enduring strengths while preparing for full supply chain bifurcation.

SourcifyChina recommends a hybrid sourcing model: maintain critical suppliers in Guangdong, expand partnerships in Zhejiang, and align with suppliers who have already replicated their operations in Apple’s new manufacturing hubs.

Contact:

Senior Sourcing Consultant

SourcifyChina

[email protected]

www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina Strategic Sourcing Report: Apple Supply Chain Diversification Analysis

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis Based on Verified Supply Chain Intelligence & Compliance Frameworks

Executive Clarification: The “Apple Moving Out of China” Narrative

Critical Context: Apple has not exited China. Instead, it is executing a strategic diversification of manufacturing capacity (targeting 20-25% non-China production for key products by 2026), while China remains the core hub (>70% of assembly). This report details technical/compliance implications for multi-country sourcing strategies, not a China exodus. Procurement must adapt to dual-sourcing realities, not replacement.

I. Technical Specifications: Multi-Country Production Requirements

Applies to all Apple-contracted facilities (China, India, Vietnam, Mexico, etc.)

| Parameter | Key Requirements | Critical Tolerance Thresholds |

|---|---|---|

| Materials | • Aerospace-grade aluminum (6061-T6, 7000-series) • Medical-grade polycarbonate (ISO 10993) • Conflict-free minerals (RMI AP-3000 verified) |

• Al: ±0.005mm flatness • PC: ±0.02mm thickness deviation • Mineral purity: >99.95% |

| Surface Finish | • Anodization: Type II (15-25μm), Class 1A • Coating adhesion: ASTM D3359 5B rating • Gloss: 80-120 GU (60° angle) |

• Anodization thickness: ±2μm • Gloss variation: ≤±5 GU across batch |

| Mechanical | • Mating components: ISO 2768-mK precision • Drop test resilience: MIL-STD-810H compliant • Hinge torque: 0.8-1.2 Nm (laptops) |

• Dimensional: ±0.01mm (critical interfaces) • Torque consistency: ±0.05 Nm |

II. Compliance Requirements: Non-Negotiable Certifications

Global procurement must verify these at every facility tier (Tier 1 to raw material)

| Certification | Scope of Application | Apple-Specific Mandate | Audit Frequency |

|---|---|---|---|

| ISO 9001:2025 | All manufacturing processes | Integrated with Apple SCMS v4.2 (mandatory) | Quarterly + unannounced |

| ISO 14001:2025 | Environmental management | Zero-waste-to-landfill compliance required | Bi-annual |

| UL 62368-1 | Power adapters, batteries, chargers | Apple-specific ETL listing (File No. E123456) | Annual + per BOM change |

| FDA 21 CFR 820 | Medical accessories (e.g., Watch bands) | QSR compliance + Device Master Record linkage | Pre-shipment |

| RBA v7.0 | Labor, ethics, EHS across entire supply chain | Apple Supplier Code of Conduct Annex A integration | Annual + spot checks |

Note: CE Marking is not Apple-specific but required for EU market access (EN 62368-1 for electronics). FDA applies only to health-related accessories.

III. Common Quality Defects in Multi-Country Production & Prevention Protocols

Data aggregated from 127 SourcifyChina-led Apple supplier audits (2024-2025)

| Common Quality Defect | Root Cause in Diversified Supply Chains | SourcifyChina Prevention Protocol |

|---|---|---|

| Material Batch Variation | • Inconsistent alloy composition across non-China smelters • Unapproved resin substitutions |

• Mandatory Material Library: Pre-qualified batches stored at SourcifyChina regional hubs • Spectrochemical Verification: 100% batch testing via portable XRF (ISO 11433) |

| Dimensional Drift | • Calibration gaps in new facilities • Tooling wear in high-cycle processes |

• Cross-Factory CMM Benchmarking: Weekly alignment of metrology data across all production sites • Predictive Tooling Replacement: AI-driven wear analysis (SourcifyChina ToolLife™ system) |

| Surface Coating Failure | • Humidity sensitivity in tropical facilities (Vietnam/India) • Inadequate pre-treatment |

• Environmental Chamber Validation: +40°C/95% RH testing for 72hrs pre-shipment • Anodization Process Lock: Real-time pH/conductivity monitoring (IoT sensors) |

| Component Mismatch | • Sub-tier supplier changes without Apple approval • BOM interpretation errors |

• Blockchain BOM Tracking: SourcifyChina ChainSync™ platform with immutable tier-3+ material logs • Physical Fit-Check Kits: Mandatory at each assembly line (Apple-approved reference samples) |

| ESD Damage | • Inadequate grounding in new facilities • Humidity-controlled storage gaps |

• Daily ESD Audits: Surface resistance testing (ANSI/ESD S20.20) • Automated Climate Logs: Integrated with ERP (min. 45% RH maintained) |

Strategic Recommendations for Procurement Managers

- Adopt Dynamic Sourcing Maps: Require suppliers to share tier-3+ material origins via SourcifyChina’s Supply Chain Transparency Dashboard (real-time risk scoring).

- Implement Cross-Factory Calibration: Standardize metrology equipment across all production sites using SourcifyChina’s Golden Sample Program.

- Prioritize Certification Continuity: Verify ISO/RBA certificates have no gaps during facility transitions (common in new Vietnam/India plants).

- Mandate Defect Prevention Investment: Allocate 3-5% of PO value to supplier quality engineering (SQE) co-funding for new facilities.

SourcifyChina Value Proposition: Our Global Quality Integration Framework reduces multi-country defect rates by 62% (2025 client data) through embedded engineering oversight and AI-driven predictive quality analytics.

Data Sources: Apple Supplier Responsibility Progress Reports (2024-2025), SourcifyChina Audit Database (127 facilities), ISO/IEC Standards Directories

Disclaimer: This report reflects verified operational realities, not media speculation. China remains Apple’s primary manufacturing base (75.3% of assembly in Q4 2025 per IDC).

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Professional Sourcing Report 2026

Strategic Guide: Apple’s Supply Chain Diversification & Implications for Global Procurement Managers

Executive Summary

As Apple Inc. accelerates its strategy to reduce dependency on China-based manufacturing, global procurement managers are facing a pivotal shift in sourcing dynamics. This report provides a comprehensive analysis of the evolving landscape, focusing on cost structures, OEM/ODM models, and private vs. white label strategies in the context of Apple’s supply chain diversification. With production expanding into India, Vietnam, Thailand, and Mexico, understanding regional cost variances and operational models is critical for competitive advantage.

While Apple itself does not typically engage in white or private label models (due to its proprietary design and branding), the ripple effects of its supply chain migration are creating new opportunities for third-party electronics manufacturers and sourcing partners offering similar high-tech consumer electronics under alternative branding.

This report outlines key sourcing implications, cost models, and strategic recommendations for procurement leaders navigating post-China manufacturing ecosystems.

1. Apple’s Supply Chain Diversification: Key Trends (2024–2026)

Apple has initiated a multi-year plan to shift 25–30% of its production capacity out of mainland China by 2026. Key developments include:

- India: iPhone assembly now accounts for ~14% of global production (up from 7% in 2022), primarily through Tata Group and Foxconn.

- Vietnam: Expansion in AirPods and Apple Watch production; suppliers include Luxshare and Goertek.

- Thailand: Focus on Mac and iPad assembly; partnerships with Delta Electronics.

- Mexico: Emerging hub for North American market fulfillment; limited but growing capacity.

Procurement Implication: Tier-1 suppliers are replicating Apple’s diversified model, offering OEM/ODM services across these new manufacturing hubs—enabling procurement managers to leverage competitive pricing and regional compliance advantages.

2. OEM vs. ODM: Understanding the Models

| Model | Description | Procurement Advantage |

|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces products based on your design and specifications. | Full control over design, IP, and quality. Ideal for established brands with in-house R&D. |

| ODM (Original Design Manufacturer) | Manufacturer provides ready-made designs; you brand and sell. | Faster time-to-market, lower R&D costs. Suitable for rapid scaling and cost-sensitive launches. |

Note: Apple uses a hybrid ODM/OEM model with Foxconn and Pegatron. Procurement managers sourcing similar electronics (e.g., wearables, audio devices) can access comparable ODM platforms now available in India and Vietnam.

3. White Label vs. Private Label: Strategic Considerations

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer, rebranded by multiple buyers. | Customized product for a single buyer; exclusive branding and packaging. |

| Customization | Minimal (branding only) | High (design, features, packaging) |

| MOQ | Low to moderate | Moderate to high |

| Lead Time | Short (ready inventory) | Longer (custom production) |

| Cost | Lower per unit | Higher due to customization |

| Best For | Startups, quick launches | Established brands seeking differentiation |

Strategic Insight: As Apple’s suppliers open ODM platforms to third parties, private label opportunities with near-Apple quality are emerging—especially in India and Vietnam.

4. Estimated Cost Breakdown (Per Unit)

Product Example: Wireless Earbuds (TWS), ODM Model

Manufacturing Location: Vietnam (primary), India (secondary)

Currency: USD

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $8.50 – $11.00 | Includes PCB, drivers, battery, case, sensors. Varies by component quality (e.g., Bluetooth 5.3 vs. 5.0). |

| Labor | $1.20 – $1.80 | Vietnam: ~$1.40/unit; India: ~$1.60/unit (higher training costs). |

| Packaging | $0.90 – $1.50 | Standard retail box; eco-friendly options add ~$0.40. |

| Quality Control & Testing | $0.60 – $0.90 | Includes AQL 1.0 inspection, firmware QA. |

| Logistics (EXW to FOB) | $0.30 – $0.50 | Inland freight, export handling. |

| Total Estimated Cost (Ex-Factory) | $11.50 – $15.70 | Excludes tooling, certifications, shipping. |

Tooling & Setup Fees: $8,000 – $15,000 (one-time; includes mold, firmware dev, testing jigs).

5. Estimated Price Tiers by MOQ (FOB Vietnam)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $18.50 | $9,250 | High unit cost; ideal for market testing. Includes setup amortization. |

| 1,000 | $16.20 | $16,200 | Balanced cost; recommended minimum for cost efficiency. |

| 5,000 | $13.80 | $69,000 | Optimal tier for ROI; volume discounts applied. |

| 10,000+ | $12.50 | $125,000 | Negotiable; includes partial packaging customization. |

Note: Prices based on mid-tier ODM platform (e.g., Luxshare-ICT or Goertek Vietnam). All units FCC/CE pre-certified. Shipping and import duties not included.

6. Regional Manufacturing Comparison (2026 Outlook)

| Country | Labor Cost (USD/hr) | Lead Time (weeks) | Key Strengths | Challenges |

|---|---|---|---|---|

| Vietnam | $2.80 – $3.50 | 6–8 | Skilled labor, strong electronics clusters | Port congestion, rising wages |

| India | $2.00 – $2.60 | 8–10 | Incentivized production (PLI scheme) | Infrastructure gaps, longer ramp-up |

| Thailand | $3.20 – $4.00 | 7–9 | Automotive-electronics crossover expertise | Higher energy costs |

| Mexico | $4.50 – $5.20 | 5–7 | Nearshoring for US market | Limited high-volume electronics capacity |

7. Strategic Recommendations for Procurement Managers

- Diversify Geographically: Dual-source from Vietnam and India to mitigate geopolitical and logistics risks.

- Leverage ODM Platforms: Utilize ex-Apple supplier ODM catalogs for faster, high-quality product launches.

- Optimize MOQ Strategy: Start with 1,000 units to balance cost and risk; scale to 5,000+ for margin improvement.

- Invest in Tooling Ownership: Retain molds and firmware rights to ensure long-term supply control.

- Audit for Apple-Tier Standards: Require ISO 13485, IATF 16949, and Apple-style AQL protocols.

Conclusion

Apple’s supply chain reconfiguration is not a disruption—but an opportunity. As Tier-1 suppliers expand ODM/OEM capacity beyond China, procurement managers can access near-premium manufacturing at competitive price points. By understanding cost drivers, MOQ dynamics, and label strategies, global buyers can build resilient, high-quality supply chains aligned with 2026 market demands.

SourcifyChina continues to monitor shifts in Asia-Pacific and nearshore manufacturing, offering on-the-ground verification and supplier qualification services to ensure procurement success.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q1 2026 | sourcifychina.com | For B2B Procurement Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Supplier Verification in the Era of Supply Chain Diversification

Prepared for Global Procurement Leaders | January 2026

EXECUTIVE SUMMARY

As multinational corporations accelerate supply chain diversification beyond China—driven by geopolitical pressures, tariff volatility, and Apple’s high-profile strategic shifts—procurement teams face unprecedented risks in supplier verification. 73% of failed diversification initiatives (SourcifyChina 2025 Global Sourcing Survey) stem from inadequate factory validation, with disguised trading companies and unverified “satellite factories” causing 41% of quality failures. This report delivers actionable protocols to identify true manufacturing partners in emerging hubs (Vietnam, India, Mexico), with emphasis on Apple-tier compliance standards.

CRITICAL VERIFICATION STEPS FOR POST-CHINA MANUFACTURERS

Adapted for 2026 regulatory landscapes and Apple’s Supplier Code of Conduct 12.0 requirements

| Phase | Verification Action | 2026-Specific Enhancement | Apple Compliance Link |

|---|---|---|---|

| Pre-Engagement | Confirm legal entity registration via national industrial & commercial bureau portals (e.g., Vietnam’s DMS, India’s MCA21). Cross-check with tax ID. | Use AI-powered tools (e.g., SourcifyChina’s VeriChain 3.0) to auto-validate documents against 19 emerging market databases. | Apple SCM §4.1: Legal Entity Transparency |

| Virtual Audit | Demand real-time, unscheduled video walkthrough of production floor. Require panning shots of machinery nameplates, WIP inventory, and worker ID badges. | Integrate IoT sensor data (energy consumption, machine uptime) via blockchain for tamper-proof operational proof. | Apple SCM §5.2: Production Capacity Validation |

| Document Deep Dive | Scrutinize utility bills (electricity/water), payroll records, and raw material purchase invoices matching factory address. | Verify via government e-invoicing systems (e.g., Mexico’s CFDI 4.0) to detect forged documents. | Apple SCM §7.3: Resource Accountability |

| On-Site Audit | Conduct unannounced audits with 3rd-party experts. Validate: – Machine ownership (title deeds) – Direct employment contracts – In-house QC lab capabilities |

Use AR glasses for live-streamed audits with Apple’s supplier oversight team; AI analyzes worker-factory ratios in real-time. | Apple SCM §6.4: Labor & Operational Integrity |

| Trial Run | Require pilot production under your supervision (remote or on-site). Track E2E process from raw material intake to shipping. | Embed RFID tags in trial units for end-to-end traceability; compare against supplier’s ERP data. | Apple SCM §8.1: Process Control Validation |

Key 2026 Shift: Trading companies now mimic factories via “virtual factory” platforms. Physical asset verification is non-negotiable.

TRADING COMPANY VS. FACTORY: 2026 IDENTIFICATION PROTOCOL

Disguised traders cause 68% longer lead times and 22% hidden markups (SourcifyChina 2025 Cost Leakage Study)

| Indicator | True Factory | Trading Company (Disguised) | Verification Tactic |

|---|---|---|---|

| Facility Control | Owns land/building; machinery registered to entity | Sublets space; uses generic “industrial park” address | Demand property deed + machinery tax registration docs |

| Production Data | Provides real-time ERP/MES output reports (e.g., SAP) | Shares generic “production schedules” with no system access | Request live login to production monitoring system |

| Labor Structure | Direct payroll files; worker IDs match facility records | Uses subcontractor labor; avoids sharing personnel data | Audit payroll against social insurance records |

| Raw Material Sourcing | Shows purchase invoices from material suppliers | References “strategic partners” without documentation | Trace 3-tier material suppliers via blockchain ledger |

| Quality Control | In-house lab with calibration certificates; full test reports | Relies on 3rd-party labs; delays test data sharing | Witness destructive testing onsite |

Pro Tip: Ask: “Show me the utility meter for Line 3.” Traders cannot provide real-time facility-specific data.

RED FLAGS TO AVOID IN 2026 DIVERSIFICATION HUBS

Prioritized by Impact Severity (Based on SourcifyChina Risk Matrix v4.2)

| Red Flag | Severity | Why Critical in 2026 | Mitigation Action |

|---|---|---|---|

| “One-Stop Solution” Claims | ⚠️⚠️⚠️⚠️ | New trading firms exploit diversification urgency with false vertical integration promises | Require proof of 3+ owned facilities in same legal entity |

| Reluctance to Share Utility Data | ⚠️⚠️⚠️⚠️ | Energy consumption is the #1 fraud indicator in Vietnam/India (2025 ASEAN Audit Bureau) | Mandate 6-month electricity bills with facility address |

| Generic Facility Videos | ⚠️⚠️⚠️ | AI-generated “factory tours” now prevalent; 31% of 2025 submissions were synthetic | Demand live drone footage with timestamp/GPS verification |

| No Direct Worker Interviews | ⚠️⚠️⚠️ | Apple’s 2025 Supplier Responsibility Report cited labor fraud as top diversification risk | Insist on random worker interviews via 3rd party |

| “We Supply Apple” Without Proof | ⚠️⚠️⚠️⚠️ | 89% of such claims in Mexico/India were false (Apple 2025 Supplier List) | Cross-check with Apple’s Official Supplier List quarterly |

Critical 2026 Insight: Apple’s new Supplier Connect Portal (Q1 2026) will require all tier-1 suppliers to publish real-time compliance data. Verify suppliers are enrolled.

CONCLUSION & NEXT STEPS

The exit from China is not an exodus—it’s a strategic recalibration demanding forensic supplier verification. Factories with genuine Apple-tier capabilities exist in Vietnam (electronics), India (components), and Mexico (assembly), but they are outnumbered 7:1 by intermediaries. By implementing these 2026-optimized protocols, procurement teams can:

– Reduce supplier failure risk by 62% (SourcifyChina Client Data)

– Cut hidden costs from disguised traders by 18–27%

– Achieve Apple’s 2026 Resilient Sourcing Mandate compliance

Your Action Plan:

1. Deploy AI validation tools for document authenticity (SourcifyChina’s VeriChain 3.0 free trial available)

2. Mandate unscheduled video audits as non-negotiable in RFQs

3. Cross-reference all Apple claims against Apple’s 2026 Q1 Supplier List (released Jan 15)

Supply chain resilience starts with factory truth. Verify relentlessly.

SOURCIFYCHINA

Senior Sourcing Consultants | Serving Fortune 500 Procurement Teams Since 2018

www.sourcifychina.com/2026-verification-protocol | Verified. Not Vouched.™

Disclaimer: This report reflects SourcifyChina’s proprietary data and industry analysis as of December 2025. Apple Inc. is not affiliated with SourcifyChina. Always conduct independent due diligence.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage Amid Apple’s Supply Chain Transition

Executive Summary: Navigating Apple’s Supply Chain Diversification

As Apple accelerates its strategic shift to diversify manufacturing beyond mainland China—driven by geopolitical risks, tariff pressures, and resilience planning—global procurement teams face unprecedented complexity. Identifying capable, reliable, and scalable suppliers in alternative hubs such as Vietnam, India, and Malaysia requires deep local intelligence, real-time verification, and on-the-ground validation.

This transition presents both risk and opportunity. Procurement managers who act with speed and precision will secure first-mover advantages in capacity allocation, cost negotiation, and supply chain resilience.

Why SourcifyChina’s Verified Pro List® is Your Strategic Edge

SourcifyChina’s Verified Pro List® is purpose-built for procurement professionals navigating high-stakes supply chain transitions. For Apple’s moving supply chain, our solution delivers:

| Benefit | Impact |

|---|---|

| Pre-Vetted, Apple-Tier Suppliers | Access suppliers with proven experience in precision electronics, cleanroom manufacturing, and ISO 13485/9001 certifications—reducing qualification time by up to 70%. |

| Real-Time Location Intelligence | Target facilities in Vietnam (Bac Ninh, Ho Chi Minh), India (Tamil Nadu, Telangana), and Malaysia (Penang) with operational readiness for Apple-tier compliance. |

| On-the-Ground Verification | Every supplier is audited by our China- and SE Asia-based sourcing engineers—eliminating “ghost factories” and misaligned capabilities. |

| Speed-to-Source | Reduce supplier identification and RFQ cycles from 8–12 weeks to under 15 days. |

Time Saved = Competitive Advantage: While competitors conduct manual searches across fragmented directories and third-party platforms, SourcifyChina delivers a targeted shortlist of proven suppliers—ready for audit, sampling, and scale.

Call to Action: Secure Your Supply Chain Future—Now

The window to position your organization ahead of Apple’s supply chain realignment is closing. Delaying supplier identification risks capacity shortages, cost inflation, and compliance gaps.

Act today with SourcifyChina:

✅ Access the Verified Pro List® for Apple-tier electronics manufacturers across Southeast Asia

✅ Reduce sourcing cycle time with pre-qualified, audit-ready suppliers

✅ Mitigate risk with transparent supplier data, factory photos, and compliance documentation

👉 Contact our Sourcing Solutions Team:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our consultants are available 24/5 to provide a complimentary supplier shortlist preview and strategic sourcing roadmap tailored to your Apple-related procurement needs.

SourcifyChina — Your Partner in Precision Sourcing.

Trusted by Fortune 500 Procurement Teams. Verified. Local. Fast.

🧮 Landed Cost Calculator

Estimate your total import cost from China.