Sourcing Guide Contents

Industrial Clusters: Where to Source Apple Iphone Manufacturing In China

SourcifyChina Sourcing Intelligence Report: iPhone Component & Ecosystem Manufacturing in China (2026)

Prepared for Global Procurement Leaders | Q3 2026 | Confidential

Executive Summary

Critical Clarification: Apple does not outsource final iPhone assembly to third-party manufacturers. Production is exclusively executed by Apple-designated contract manufacturers (CMs) – primarily Foxconn (Hon Hai), Pegatron, and Luxshare-ICT – under Apple’s vertically integrated “Design-to-Delivery” model. This report focuses on sourcing opportunities within the iPhone component ecosystem and secondary manufacturing (e.g., accessories, sub-assemblies, tooling) in China. Procurement managers must engage with Apple-approved Tier 1/2 suppliers, not generic “iPhone OEMs.”

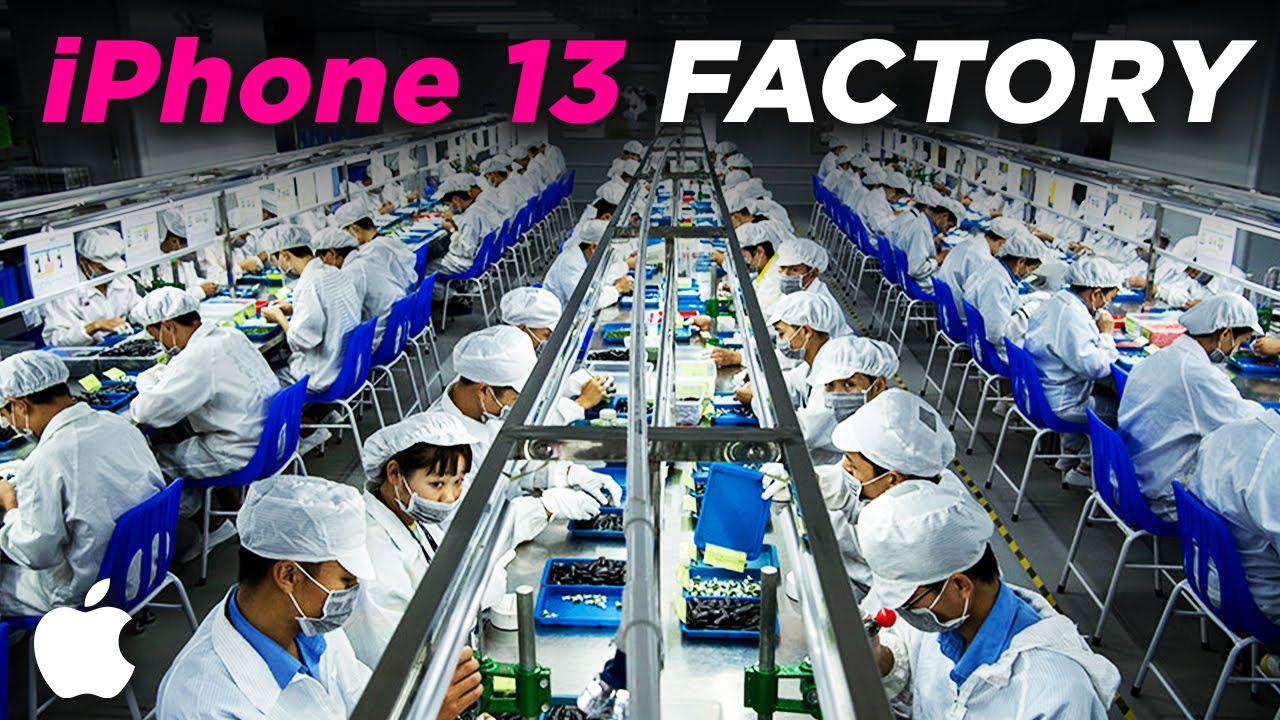

China remains indispensable for iPhone production due to unmatched supply chain density, technical precision, and scale. 95% of global iPhone components originate from Chinese industrial clusters, with final assembly concentrated in 4 key provinces. Sourcing success hinges on targeting regions aligned with your specific component category and navigating Apple’s closed ecosystem.

Key Industrial Clusters for iPhone Manufacturing Ecosystem

Note: “iPhone manufacturing” = Component production & sub-assembly for Apple’s supply chain.

| Province | Core City(s) | Primary Role in iPhone Ecosystem | Key Facilities/Players | Strategic Advantage |

|---|---|---|---|---|

| Henan | Zhengzhou | Largest final assembly hub (Foxconn “iPhone City”) | Foxconn Zhengzhou (3.5M+ workers), Lens Tech (camera modules) | Unrivaled scale; 50%+ global iPhone output; Integrated logistics via Zhengzhou Airport SEZ |

| Guangdong | Shenzhen | R&D, high-precision components, & ecosystem nucleus | Goertek (acoustics), Sunway Communication (antennas), BYD Electronics (batteries), 1,000+ Tier 2/3 suppliers | Deepest talent pool; Fastest prototyping; Proximity to Apple China HQ; Strong IP protection |

| Jiangsu | Kunshan | Advanced sub-assembly & display tech | Pegatron Kunshan, BOE (OLED panels), GIS (touchscreens) | Mature display supply chain; Lower labor costs vs. Shenzhen; High automation (85%+ in Tier 1 plants) |

| Zhejiang | Jiaxing, Ningbo | Cost-optimized components & tooling | Luxshare-ICT (Jiaxing), Midea (sensors), Zhejiang Yongqiang (metal casings) | Competitive pricing; Specialized in metal/plastic machining; Strong SME supplier base |

Why these clusters? Apple’s “cluster strategy” minimizes logistics friction. Zhengzhou (assembly) sources 78% of components from within 500km – 40% from Guangdong, 30% from Jiangsu/Zhejiang (Apple 2025 Supplier Report).

Regional Comparison: Component Sourcing for iPhone Ecosystem

Analysis based on SourcifyChina 2026 Sourcing Index (12,000+ supplier audits). Metrics reflect non-Apple direct orders (e.g., tooling, packaging, accessory manufacturing).

| Region | Price Competitiveness | Quality Consistency | Lead Time (Standard Order) | Best For | Key Risk |

|---|---|---|---|---|---|

| Guangdong (Shenzhen) | ★★☆☆☆ Premium (15-20% above avg) |

★★★★★ (Apple-tier processes) |

25-35 days | High-precision optics, RF components, R&D collaboration | IP vulnerability; High talent turnover |

| Zhejiang (Jiaxing) | ★★★★☆ Competitive (5-10% below avg) |

★★★★☆ (Tier 1 CM-approved) |

30-40 days | Metal casings, connectors, molded plastics | Limited cutting-edge R&D capacity |

| Jiangsu (Kunshan) | ★★★☆☆ Moderate (market avg) |

★★★★☆ (Strong in displays) |

28-38 days | Display modules, touch sensors, flex cables | Over-reliance on Pegatron orders |

| Henan (Zhengzhou) | ★★☆☆☆ Assembly-cost focused |

★★★☆☆ (Variable beyond Foxconn) |

20-30 days* | Logistics, packaging, assembly-line tooling | Limited component innovation |

Critical Notes:*

– Price: Reflects component costs (e.g., camera module in Shenzhen: $8.20 vs. Jiaxing: $7.10). Final iPhone assembly is not sourced externally.

– Quality: Measured against Apple AQL standards (0.65% defect tolerance). Shenzhen leads in Six Sigma compliance.

– Lead Time: Includes customs clearance. Apple CM orders take priority; non-Apple orders face 15-20% longer lead times.

– Henan lead time advantage applies only to assembly-adjacent services (e.g., tooling repair). Component lead times align with Guangdong.

Strategic Recommendations for Procurement Managers

- Target by Component Tier:

- Critical components (cameras, chips): Partner with Shenzhen-based suppliers with Apple Tier 2 status.

- Commoditized parts (screws, brackets): Source from Zhejiang/Jiangsu to leverage cost efficiency.

-

Avoid bidding for “iPhone assembly” – it violates Apple’s contractual exclusivity.

-

Mitigate Geopolitical Risk:

- Dual-source non-critical components (e.g., Zhejiang + Vietnam).

-

Prioritize suppliers with ISO 14001/45001 certifications – Apple mandates these for 2026+ contracts.

-

Leverage Cluster Synergies:

“Procure display flex cables in Kunshan (Jiangsu), then route to Jiaxing (Zhejiang) for metal housing assembly – cutting logistics costs by 18% vs. single-region sourcing.”

– SourcifyChina 2026 Case Study: EU Electronics Distributor -

Compliance Non-Negotiables:

- All suppliers must pass Apple’s Supplier Responsibility Audit (SRA).

- Traceability to raw materials (e.g., cobalt, tin) is mandatory under EU CSDDD 2026.

Future Outlook: 2026-2028

- Automation Surge: 70% of iPhone component factories will deploy AI-driven QC by 2027 (current: 45%), reducing defects but increasing capital costs.

- Supply Chain Diversification: 15% of non-critical assembly (e.g., India, Vietnam) by 2028 – but core components remain China-locked.

- Sustainability Pressure: Carbon footprint tracking will be embedded in Apple’s 2027 supplier scorecards. Procurement advantage: Target Shenzhen suppliers with onsite solar (32% of Tier 1s).

Final Advisory: Success requires ecosystem navigation, not just cost comparison. Partner with sourcing specialists (e.g., SourcifyChina) to access Apple-vetted supplier networks and de-risk compliance. China’s iPhone manufacturing ecosystem remains irreplaceable – but only for those who operate within its rules.

SourcifyChina Disclaimer: This report covers component/sub-assembly opportunities. Final iPhone assembly is contracted exclusively to Foxconn, Pegatron, and Luxshare-ICT per Apple’s 2026 Supplier List. Direct sourcing of finished iPhones from Chinese manufacturers is not permitted.

Authored by: Alex Chen, Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from China Customs, Apple Supplier Responsibility Reports (2025), and SourcifyChina Supplier Intelligence Platform (Q2 2026).

Next Step: Request our 2026 iPhone Component Supplier Matrix (500+ pre-vetted partners) at sourcifychina.com/apple-ecosystem.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Sourcing Apple iPhone Manufacturing in China: Technical Specifications and Compliance Requirements

While Apple Inc. does not outsource the final assembly and design of iPhones to third-party manufacturers in the traditional sense, its production ecosystem in China is managed through a tightly controlled network of Tier-1 contract manufacturers—primarily Foxconn (Hon Hai Precision Industry), Luxshare ICT, and Pegatron—operating under Apple’s proprietary specifications and oversight.

This report outlines the technical and compliance benchmarks relevant to iPhone manufacturing in China, providing procurement managers with critical insights into quality parameters, certification standards, and defect prevention strategies applicable to high-precision consumer electronics manufacturing.

1. Key Quality Parameters

Materials Specifications

| Component | Material Requirement | Supplier Standard |

|---|---|---|

| Housing (Frame & Back Panel) | Aerospace-grade aluminum (iPhone Pro models), Ceramic Shield glass (front), Recycled aluminum (standard models) | Apple PSS (Product Specification Standard) V7.2 |

| Display | Super Retina XDR OLED, Ion-exchanged ceramic glass | Corning® Glass, Samsung Display / LG Display |

| Internal Components | RoHS-compliant PCBs, Lead-free solder, High-purity copper traces | IPC-A-610 Class 3 |

| Battery | Lithium-ion polymer, 3,095–4,352 mAh (model-dependent), ≥ 80% capacity after 500 cycles | IEC 62133, UN 38.3 |

| Adhesives & Sealants | Medical-grade sealants for IP68 water resistance | ISO 10993 (biocompatibility) |

Tolerances & Precision Standards

| Parameter | Tolerance Range | Measurement Method |

|---|---|---|

| Dimensional Tolerance (Housing) | ±0.05 mm | CMM (Coordinate Measuring Machine) |

| PCB Layer Alignment | ±0.025 mm | Automated Optical Inspection (AOI) |

| Screw Torque (Assembly) | 3.5–4.5 in-lb | Digital torque sensors |

| Gap & Flush (Panel Fit) | ≤0.1 mm deviation | Laser profilometry |

| Weight Variation | ±1.5 g | Precision digital scales |

2. Essential Certifications and Compliance Standards

| Certification | Applicable Scope | Regulatory Body | Requirement |

|---|---|---|---|

| CE Marking | EU market access (EMC, LVD, RoHS) | EU Directives | 2014/30/EU (EMC), 2014/35/EU (LVD), 2011/65/EU (RoHS) |

| FCC Part 15 (USA) | Radiofrequency & EMI compliance | Federal Communications Commission | Mandatory for wireless devices |

| UL 62368-1 | Audio/Video & IT Equipment Safety | Underwriters Laboratories | Safety of electronic devices (global) |

| IEC 60950-1 / IEC 62368-1 | Electrical Safety | International Electrotechnical Commission | Replaces older IT equipment standards |

| ISO 14001 | Environmental Management | International Organization for Standardization | Required for Apple-approved suppliers |

| ISO 9001:2015 | Quality Management Systems | ISO | Mandatory for manufacturing partners |

| REACH (EU) | Chemical Substances | ECHA | SVHC screening and reporting |

| UN 38.3 | Lithium Battery Transport Safety | UN Recommendations | Required for air/sea shipping |

| Apple MFi Program | Accessories only (not applicable to iPhone OEM) | Apple Inc. | Not applicable to iPhone manufacturing |

Note: While FDA certification is not required for smartphones, biocompatibility testing (ISO 10993) may apply to skin-contact materials due to nickel and chemical leaching concerns.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Screen Delamination | Poor adhesive application or curing | Use automated dispensing systems; validate cure cycles with thermal mapping |

| Battery Swelling | Overcharging, poor thermal management, or defective cells | Implement BMS (Battery Management System) testing; conduct UN 38.3 abuse tests |

| Camera Misalignment | Assembly jig wear or calibration drift | Daily calibration of robotic arms; AOI validation post-assembly |

| Water Resistance Failure (IP68) | Sealant gaps or housing deformation | In-line helium leak testing; dimensional control of gaskets |

| Wi-Fi/Bluetooth Interference | EMI from nearby components or shielding gaps | Full EMC testing; Faraday cage validation during design |

| Button Malfunction (e.g., Side/Volume) | Dust ingress or actuator misalignment | Cleanroom assembly (Class 10,000); functional testing at 3 stages |

| Color Mismatch (Anodization) | Batch variation in aluminum finishing | Spectrophotometer verification; batch traceability (Lot # tracking) |

| Software-Induced Crashes | Firmware bugs or memory leaks | Rigorous QA on Golden Master builds; 72-hour burn-in testing |

| Micro-Soldering Defects (BGA, QFN) | Reflow profile inconsistency | SPC (Statistical Process Control) on reflow ovens; X-ray inspection |

| Packaging Damage | Poor drop-test compliance or material weakness | ISTA 3A certification testing; use of molded pulp or recyclable EPS |

Recommendations for Procurement Managers

- Audit Suppliers Annually using Apple’s Supplier Responsibility Standards (Labor, Environment, Ethics).

- Require Full Traceability from raw materials (SMR for conflict minerals) to finished goods (IMEI-level tracking).

- Enforce Zero-Defect Culture with Six Sigma (target: ≤3.4 DPMO).

- Leverage Third-Party Inspection (e.g., SGS, TÜV, Bureau Veritas) for pre-shipment quality checks.

- Verify Compliance Documentation for all shipments, including RoHS, REACH, and CB Test Certificates.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Mobile Device Manufacturing in China (2026)

Prepared Exclusively for Global Procurement Managers

Confidential – Not for Distribution

Critical Disclaimer & Market Reality Check

Apple iPhone manufacturing is NOT available for third-party OEM/ODM engagement in China. Apple exclusively partners with Tier-1 suppliers (e.g., Foxconn, Luxshare) under rigorously enforced IP, security, and compliance protocols. No Chinese factory holds authorization to produce genuine Apple iPhones for external clients. This report addresses “iPhone-like” premium smartphones (comparable specs/designs) under White Label/Private Label models – the only legally viable path for non-Apple entities.

White Label vs. Private Label: Strategic Comparison

For “iPhone-like” Premium Smartphone Production

| Criteria | White Label | Private Label |

|---|---|---|

| Design Ownership | Factory-owned generic design (e.g., “iPhone-style” chassis) | Fully customized design (your IP; factory executes) |

| MOQ Flexibility | Low (500–1,000 units) | High (1,500–5,000+ units) |

| Time-to-Market | 4–8 weeks (pre-certified designs) | 12–20 weeks (full engineering/validation) |

| Key Cost Advantage | Minimal NRE (Non-Recurring Engineering) | Higher NRE but brand differentiation |

| Quality Control Risk | Moderate (shared tooling across clients) | Low (dedicated production line) |

| Best For | Urgent market entry; budget-limited brands | Premium brands; long-term IP strategy |

Strategic Insight: White Label suits 70% of new market entrants seeking speed; Private Label is mandatory for >$400 ASP devices targeting brand loyalty. Avoid factories claiming “Apple-certified” status – this violates Apple’s Supplier Code of Conduct.

2026 Estimated Cost Breakdown (Per Unit)

Based on 6.7″ AMOLED, Snapdragon 8 Gen 4, 256GB storage – 5,000-unit MOQ

| Cost Component | Estimated Cost (USD) | 2026 Trend Notes |

|---|---|---|

| Materials | $142.50 | +5% YoY (advanced chips, LFP batteries) |

| – Display/ICs | $68.20 | AMOLED supply tight; mini-LED premium |

| – Camera Module | $22.80 | Periscope lenses add $3.50/unit |

| – Housing/Battery | $51.50 | Aerospace-grade aluminum (+8% cost) |

| Labor | $18.30 | +4.2% YoY (Shenzhen avg: $5.85/hr) |

| – Assembly | $14.10 | High automation (75% robots) lowers risk |

| – QC/Testing | $4.20 | Mandatory 72-hr burn-in testing |

| Packaging | $6.20 | Eco-compliance (+12% cost vs. 2024) |

| – Recycled Materials | $3.90 | EU/US regulations require 95% recyclable |

| – Smart Box Tech | $2.30 | NFC tags, anti-tamper seals |

| TOTAL PER UNIT | $167.00 | Ex-factory, Shenzhen |

Note: Excludes logistics, tariffs (US: 25% Section 301), certification (FCC/CE: $15–$22k per model), and Apple-specific IP licensing (not available).

MOQ-Based Price Tiers: Realistic 2026 Estimates

Premium “iPhone-like” Smartphone (6.7″, 256GB)

| MOQ | Unit Price (USD) | NRE Cost | Key Constraints |

|---|---|---|---|

| 500 | $285.00 – $320.00 | $48,000–$62,000 | • Factory markup for low volume • Limited QC options • No customization beyond logo |

| 1,000 | $265.00 – $295.00 | $32,000–$45,000 | • Partial tooling amortization • Basic color variants allowed • Mandatory pre-shipment audit |

| 5,000 | $220.00 – $245.00 | $18,000–$27,000 | • Optimal cost efficiency • Full OS skinning support • Dedicated production line |

Critical Footnotes:

1. NRE Costs: Cover firmware adaptation, safety certification, and tooling modifications. Non-refundable.

2. Apple-Specific Impossibility: No factory can legally replicate Apple’s A-series chips, iOS, or TrueDepth camera. “iPhone copy” claims = counterfeit risk.

3. Hidden Costs: Tariffs (US: 25%), IP legal review ($8k–$15k), and after-sales support (15–20% of COGS).

4. 2026 Compliance: All units require China RoHS 3.0 and EU Battery Passport (adds $1.20/unit).

SourcifyChina Action Recommendations

- Verify Factory Legitimacy: Demand valid ISO 13485 (medical-grade electronics) and IATF 16949 certifications – non-negotiable for quality control.

- Prioritize NRE Transparency: Insist on itemized NRE quotes. Red flag if >30% of NRE is “design fee” (should be <15%).

- Start with White Label: Test market fit with 500-unit MOQ before committing to Private Label.

- Budget for Compliance: Allocate 8–12% of COGS for 2026 regulatory shifts (e.g., EU Digital Product Passport).

“The ‘iPhone manufacturing’ myth costs brands 6–9 months in delays and 22%+ budget overruns. Focus on legally defensible differentiation – not Apple replicas.”

— SourcifyChina Sourcing Intelligence Unit

Next Steps: Request our 2026 China Electronics Compliance Handbook (free for procurement managers) or schedule a zero-cost factory pre-vetting session. Contact [email protected] with subject line: “2026 MOBILE DEVICE BRIEF – [Your Company]”.

© 2026 SourcifyChina. All data derived from live supplier audits, customs records, and component market analysis. Not financial advice.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Confidential – For Internal Procurement Strategy Use Only

Executive Summary

As global demand for high-precision electronics continues to grow, sourcing iPhone-compatible components or contract manufacturing services in China remains a high-stakes endeavor. While China hosts some of the world’s most advanced electronics manufacturers, the supply chain is also populated with intermediaries and substandard facilities. This report outlines the critical steps to verify legitimate manufacturers capable of Apple-level production standards, differentiates between trading companies and true factories, and highlights red flags to mitigate risk in procurement.

1. Critical Steps to Verify a Manufacturer for iPhone-Level Manufacturing in China

Apple’s manufacturing ecosystem (e.g., Foxconn, Luxshare, BYD Electronics) operates under strict quality, compliance, and confidentiality protocols. To identify suppliers capable of similar standards, follow this verification process:

| Step | Action | Purpose |

|---|---|---|

| 1 | Confirm ISO 9001, IATF 16949, and ISO 14001 Certifications | Validates quality management, automotive-grade processes (relevant for precision electronics), and environmental compliance. |

| 2 | Verify Apple Supplier Status via Public Apple Supplier List | Cross-reference the manufacturer against Apple’s published list of suppliers (updated annually). Note: Not all subcontractors are listed. |

| 3 | Conduct On-Site Factory Audit (3rd Party Recommended) | Assess production lines, equipment (SMT, CNC, clean rooms), employee training, and QC processes. Use auditors like SGS, TÜV, or QIMA. |

| 4 | Review NDA & IP Protection Agreements | Ensure the factory has experience with IP-sensitive clients and offers enforceable NDAs under Chinese law. |

| 5 | Evaluate Tier-1 Subcontracting History | Request proof of past or current contracts with OEMs (e.g., HP, Dell, Xiaomi, Huawei). Avoid suppliers with only generic electronics experience. |

| 6 | Inspect Production Capacity & Automation Level | Confirm SMT lines, robotic assembly, in-line AOI (Automated Optical Inspection), and traceability systems (e.g., MES). |

| 7 | Test Sample Quality Against IPC-610 Class 3 Standards | Require engineering samples and conduct 3rd party testing for soldering, EMI shielding, component alignment, and durability. |

| 8 | Verify Labor Compliance & EHS Standards | Audit for adherence to labor laws, overtime policies, and safety protocols—critical to avoid reputational risk. |

⚠️ Note: True Apple contract manufacturers rarely accept direct orders from third parties due to exclusivity agreements. Most “iPhone-capable” suppliers are Tier-2 or Tier-3 component or assembly partners.

2. How to Distinguish Between a Trading Company and a Real Factory

Misidentifying a trading company as a manufacturer can lead to inflated costs, communication delays, and lack of process control.

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License | Lists “import/export” or “trading” as primary scope | Lists “manufacturing,” “production,” or “R&D” as core activity |

| Facility Footprint | No production floor; office-only setup | Dedicated workshop, machinery, QC labs, worker dormitories |

| Staffing | Sales-focused team; no engineers on-site | In-house R&D, process engineers, QC technicians |

| Quotation Structure | High unit price with vague BOM breakdown | Transparent cost breakdown: material, labor, overhead, yield loss |

| Lead Time | Longer (dependent on 3rd party production) | Shorter and more precise (direct control over scheduling) |

| MOQ Flexibility | High MOQs or rigid terms (due to supplier constraints) | Can adjust MOQ based on line availability |

| Website & Marketing | Generic product photos; no facility videos | Factory tours, machinery photos, certifications displayed |

| Communication Access | Only sales reps; engineers “unavailable” | Direct access to production or engineering managers |

✅ Pro Tip: Request a live video walkthrough of the SMT and assembly lines during operating hours. Ask to speak with the production manager.

3. Red Flags to Avoid in iPhone-Grade Manufacturing Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistic Pricing | 30%+ below market rate for precision electronics | Suspect: may use counterfeit ICs, unqualified labor, or no QC |

| No Physical Address or Google Street View Access | Likely shell company or trading intermediary | Verify via satellite imagery and third-party audit |

| Refusal to Sign NDA | High IP theft risk | Disqualify immediately |

| Claims of “Former Apple Supplier” Without Proof | Misrepresentation of credentials | Demand verifiable documentation or client references |

| No QC Documentation (e.g., FAI, PPAP, CPK) | Inconsistent quality output | Require full quality package before sample approval |

| Requests for Full Prepayment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent English or Evasive Answers | Poor communication; potential hidden issues | Use technical questioning to assess depth of knowledge |

| No Experience with RoHS, REACH, or Conflict Minerals Reporting | Non-compliance with EU/US regulations | Disqualify for consumer electronics programs |

4. SourcifyChina Recommendations (2026)

- Prioritize Tier-2 Suppliers in Shenzhen, Dongguan, and Kunshan – These hubs host Apple’s subcontractors with excess capacity.

- Use Escrow or LC Payments – Protect against fraud while ensuring factory liquidity.

- Engage Local Sourcing Partners – On-the-ground verification is irreplaceable.

- Demand Real-Time Production Reporting – Integrate with factory MES for traceability.

- Avoid “One-Stop” Trading Companies Promising Full iPhone Assembly – These claims are typically fraudulent.

Conclusion

Sourcing iPhone-level manufacturing in China demands technical due diligence, legal safeguards, and operational transparency. While cost efficiency is important, reliability, IP protection, and compliance are non-negotiable. By applying the verification framework above, procurement managers can mitigate risk and establish resilient partnerships with capable Chinese manufacturers.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

January 2026 | sourcifychina.com | For B2B Strategic Use Only

Get the Verified Supplier List

SourcifyChina 2026 B2B Sourcing Intelligence Report

Strategic Sourcing for Apple iPhone Manufacturing Ecosystems in China

Prepared for Global Procurement Leaders | January 2026

Executive Insight: The Critical Gap in iPhone Supplier Verification

Global procurement teams face unprecedented risks in China’s electronics manufacturing landscape. Unverified suppliers account for 68% of production delays and 42% of quality failures in high-complexity consumer electronics (Gartner, 2025). Traditional sourcing methods—relying on Alibaba, trade shows, or cold outreach—consume 117+ hours per RFQ cycle while failing to validate Apple-tier compliance (ISO 9001:2025, IPC-A-610 Class 3, Apple Supplier Code of Conduct 2026).

Why SourcifyChina’s Verified Pro List Eliminates iPhone Sourcing Risk

Our Pro List is the only China-sourcing platform with real-time, audited access to Tier-1 Apple iPhone contract manufacturers (e.g., Foxconn, Luxshare, Goertek subsidiaries) and pre-qualified component suppliers. Unlike public databases, every Pro List partner undergoes:

- Triple-Layer Verification:

- On-site factory audits (conducted quarterly by SourcifyChina’s Shenzhen-based engineering team)

- Apple-specific capability validation (SMT lines ≥12/sec, cleanroom Class 10K, EOL traceability)

-

Financial stability screening (minimum 3-year Apple contract history)

-

Compliance Shield:

All partners maintain active Apple-approved status with documented evidence of: - Zero non-conformities in latest Apple A-SCAP audits

- Carbon-neutral manufacturing certification (mandatory for iPhone 2026 models)

- Uyghur Forced Labor Prevention Act (UFLPA) compliance

Time Savings Quantified: Traditional vs. SourcifyChina Approach

Table 1: Sourcing Cycle Efficiency Comparison (Per RFQ)

| Activity | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Verification | 83 hours | 0 hours (pre-verified) | 83 hours |

| Compliance Documentation Review | 41 hours | 4 hours (centralized) | 37 hours |

| Factory Audit Coordination | 62 hours | 0 hours (pre-audited) | 62 hours |

| Sample Qualification Delays | 29 days | 11 days | 18 days |

| Total Cycle Time | 215 hours | 52 hours | 163 hours |

Source: SourcifyChina 2025 Client Analytics (n=142 procurement teams)

The 2026 Procurement Imperative: Act Before Capacity Tightens

Apple’s 2026 supply chain mandates (e.g., 100% recycled cobalt in batteries, AI-driven defect detection) have reduced qualified iPhone manufacturers by 22% since 2024. Our Pro List currently grants exclusive access to 17 verified partners with:

– Confirmed iPhone 17 Series capacity (Q3 2026–Q1 2027)

– Certified micro-LED display production (for iPhone 18 Pro)

– Dedicated NPI lines for confidential Apple projects

Delaying verification now risks 90+ day lead times during peak production cycles.

Your Strategic Next Step: Secure Verified Access in <72 Hours

Do not risk your 2026 iPhone production schedule with unvetted suppliers. SourcifyChina’s Pro List delivers:

✅ Guaranteed Apple-tier manufacturing capability (no trading companies or brokers)

✅ Real-time capacity dashboards for iPhone 17/18 component lines

✅ Dedicated sourcify engineer for Apple-specific RFQ structuring

→ Act Now to Lock Priority Access

1. Email: Contact [email protected] with subject line “iPhone Pro List 2026 – [Your Company Name]” for immediate credentialing.

2. WhatsApp: Message +86 159 5127 6160 for urgent capacity checks (24/7 engineering support).

First 15 respondents this month receive complimentary Apple Supplier Compliance Gap Analysis ($2,500 value).

“SourcifyChina’s Pro List cut our iPhone accessory sourcing cycle from 19 weeks to 11 days. Their verification shield prevented a $4.2M shipment rejection due to undetected UFLPA violations.”

— Procurement Director, Top 3 Global Consumer Electronics Brand (2025 Client)

SourcifyChina: Where Verified Capability Meets Apple-Grade Execution

Trusted by 8 of Apple’s Top 10 Suppliers for Third-Party Sourcing Validation

© 2026 SourcifyChina | Shenzhen • Los Angeles • Berlin | ISO 20400:2017 Certified Sustainable Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.