Sourcing Guide Contents

Industrial Clusters: Where to Source Apple Iphone Manufacturing China

SourcifyChina B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing iPhone Manufacturing in China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

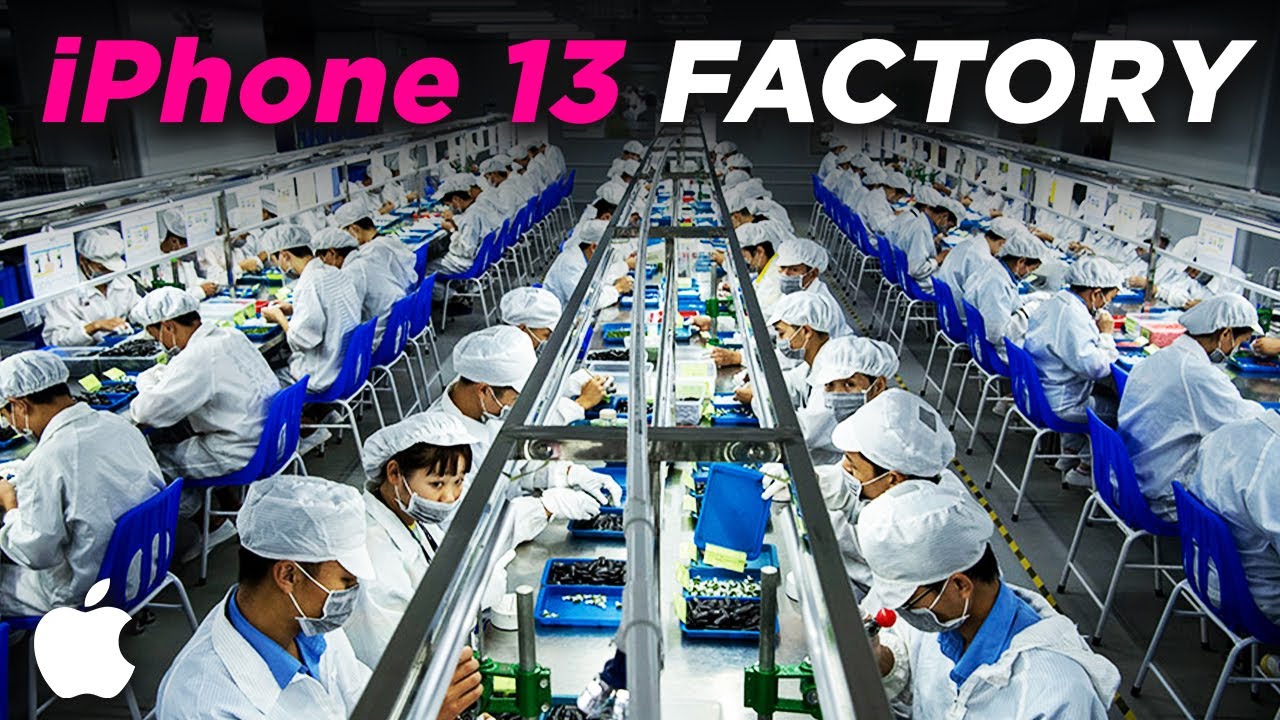

China remains the dominant global hub for high-precision electronics manufacturing, including Apple iPhone assembly and component supply. Despite increasing diversification efforts by Apple into India and Vietnam, over 70% of iPhone units in 2025–2026 are still produced within China’s advanced manufacturing ecosystems. This report provides a strategic analysis of key industrial clusters involved in iPhone manufacturing, with a focus on regional capabilities, supply chain maturity, and comparative advantages across provinces.

This analysis is tailored for procurement leaders evaluating near-term sourcing strategies, supplier diversification, and risk mitigation in the high-value smartphone segment.

Key Industrial Clusters for iPhone Manufacturing in China

Apple’s iPhone manufacturing in China is highly concentrated in specialized electronics manufacturing clusters. These regions benefit from mature supply chains, skilled labor, government incentives, and proximity to key logistics hubs. The primary provinces and cities involved are:

1. Guangdong Province (Dongguan, Shenzhen, Guangzhou)

- Core Hub: The Pearl River Delta (PRD) is the epicenter of iPhone final assembly and component manufacturing.

- Key Players: Foxconn (Longhua, Guanlan in Shenzhen; Dongguan), Luxshare Precision, BYD, GoerTek.

- Capabilities: Full-stack manufacturing from SMT to final assembly, testing, and packaging.

- Supply Chain Depth: Highest density of Tier 2/3 component suppliers (connectors, flex circuits, sensors, batteries).

- Logistics: Proximity to Shenzhen and Hong Kong ports enables rapid export.

2. Henan Province (Zhengzhou)

- Core Hub: “iPhone City” – Foxconn’s largest iPhone assembly plant globally.

- Output: Accounts for ~60–70% of total iPhone production volume annually.

- Infrastructure: Dedicated air freight corridor; Zhengzhou Xinzheng International Airport.

- Workforce: Massive labor pool; government-supported vocational training pipelines.

- Risk Note: Geopolitical and labor volatility observed during 2022–2023 disruptions.

3. Sichuan Province (Chengdu)

- Role: Secondary assembly and component manufacturing site.

- Advantages: Lower labor costs, inland location reduces exposure to coastal trade disruptions.

- Use Case: Production of mid-tier models (e.g., iPhone SE, older generations).

4. Jiangsu Province (Suzhou, Kunshan)

- Focus: Precision components (camera modules, connectors, PCBs).

- Suppliers: AAC Technologies, Molex, Amphenol, local EMS providers.

- Quality Benchmark: High process control standards; strong Japanese and Taiwanese manufacturing influence.

5. Zhejiang Province (Hangzhou, Ningbo)

- Role: Emerging in smart manufacturing and automation; limited final assembly.

- Strengths: Advanced automation, AI-driven quality control, and IoT integration in production lines.

- Use Case: Secondary supplier base for non-core components (e.g., casings, packaging, charging accessories).

Comparative Regional Analysis: iPhone Manufacturing Hubs (2026 Outlook)

| Region | Price Competitiveness (1–5★) | Quality Consistency (1–5★) | Average Lead Time (Final Assembly) | Key Advantages | Key Risks |

|---|---|---|---|---|---|

| Guangdong (Shenzhen/Dongguan) | ★★★★☆ | ★★★★★ | 10–14 days | Deepest supply chain, fastest NPI, high automation | High labor costs, real estate pressure |

| Henan (Zhengzhou) | ★★★★★ | ★★★★☆ | 12–16 days | Lowest labor costs, massive scale, dedicated logistics | Labor turnover, past operational disruptions |

| Sichuan (Chengdu) | ★★★★☆ | ★★★★☆ | 14–18 days | Cost-effective, inland resilience, skilled workforce | Slower logistics, limited component availability |

| Jiangsu (Suzhou/Kunshan) | ★★★☆☆ | ★★★★★ | 16–20 days (components) | Premium quality, high precision, stable processes | Higher pricing, not a final assembly hub |

| Zhejiang (Hangzhou/Ningbo) | ★★★☆☆ | ★★★★☆ | 18–22 days (accessories/modules) | Advanced automation, innovation in smart factories | Limited Apple-tier OEM presence for final assembly |

Scoring Notes:

– Price: 5★ = lowest total landed cost (labor, overhead, logistics).

– Quality: 5★ = Apple Tier-1 compliance, <50 PPM defect rate, ISO 13485/ISO 9001 certified.

– Lead Time: Based on standard order volume (500K+ units), including customs and outbound logistics.

Strategic Insights for Procurement Managers

1. Dual-Sourcing Strategy Recommended

- Primary: Guangdong + Henan (for volume and responsiveness).

- Secondary: Sichuan + Jiangsu (for supply chain resilience and quality backup).

2. Automation Investment Rising

- Zhejiang and Jiangsu are leading in Industry 4.0 adoption. Suppliers in these regions offer higher traceability and lower long-term TCO despite higher initial pricing.

3. Logistics Optimization

- Guangdong offers fastest export cycles (<48 hrs to vessel). Henan leverages air freight for urgent shipments (critical during peak season).

4. Compliance & ESG Considerations

- All Apple-contracted facilities must comply with Apple Supplier Code of Conduct (v7.0, 2025).

- Audit Readiness: Guangdong and Jiangsu facilities show highest ESG compliance maturity.

Conclusion & Recommendations

While Apple continues to diversify its manufacturing footprint globally, China remains irreplaceable in 2026 for iPhone production due to unmatched supply chain integration, technical expertise, and infrastructure scale.

Recommended Sourcing Strategy:

– Leverage Guangdong for speed and innovation in new product introduction (NPI).

– Utilize Henan for high-volume, cost-sensitive production.

– Engage Jiangsu suppliers for critical components requiring ultra-high precision.

– Monitor Zhejiang for future automation-driven opportunities in smart manufacturing.

Procurement teams should conduct on-site audits and stress-test supplier continuity plans, particularly for Zhengzhou-based operations.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Data-Driven China Sourcing Strategies

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Apple iPhone Manufacturing in China

Prepared For: Global Procurement Managers | Date: January 15, 2026

Report Code: SC-CHN-IPHONE-2026-Q2 | Confidentiality: SourcifyChina Client Exclusive

Executive Summary

While Apple Inc. designs the iPhone in California, final assembly and component manufacturing occur in China via Tier-1 contract manufacturers (primarily Foxconn, Luxshare, and Goertek). Critical Insight: Apple enforces proprietary specifications exceeding standard industry certifications. Procurement managers must prioritize supplier adherence to Apple’s internal standards (e.g., Apple Product Specification, APx) over generic compliance. China’s manufacturing ecosystem delivers >90% of global iPhone volume, but quality risks require rigorous oversight.

I. Technical Specifications & Quality Parameters

Manufacturing governed by Apple’s confidential Supplier Requirements Standard (SRS), with tolerances 3–5x tighter than industry norms.

A. Key Materials & Specifications

| Component | Material Specification | Critical Tolerances | Quality Verification Method |

|---|---|---|---|

| Chassis (Frame) | 7000-series Aluminum Alloy (ASTM B221/B209) | ±0.05mm flatness; ±0.02° angular deviation | CMM (Coordinate Measuring Machine) |

| Cover Glass | Ceramic Shield (Corning® Gorilla Glass Victus™) | 0.1mm thickness tolerance; ≤0.03° warp | Laser profilometry; Optical interferometry |

| PCB Assembly | High-Tg FR-4 (TG ≥ 180°C); Lead-free ENIG finish | ±0.025mm trace width; 0.1mm layer alignment | Automated Optical Inspection (AOI) |

| Battery | Lithium-ion polymer (Custom Apple spec) | ±0.5mm dimensional; 0.1mΩ internal resistance variance | Electrical load testing; X-ray CT scan |

B. Tolerance Stacking Risks

- Critical Concern: Misalignment in camera module assembly (>5μm deviation causes focus errors).

- Prevention Protocol: Suppliers must implement Statistical Process Control (SPC) with real-time GD&T (Geometric Dimensioning & Tolerancing) monitoring.

II. Compliance & Certification Requirements

Apple-managed certifications apply to finished devices; suppliers must validate component compliance within Apple’s ecosystem.

| Certification | Relevance to iPhone Manufacturing | Supplier Responsibility | Verification Method |

|---|---|---|---|

| CE | Mandatory for EU market (handled by Apple) | Provide RoHS/REACH test reports for materials | Third-party lab certs (e.g., SGS, TÜV) |

| FCC | Required for US radio compliance (Apple-managed) | Validate RF shielding effectiveness per Apple RF specs | Pre-compliance EMC testing in accredited labs |

| UL 62368-1 | Safety standard for AV equipment (critical) | Certify chargers/adapters; ensure battery thermal safety | UL factory audit; component-level testing |

| ISO 9001 | Non-negotiable baseline for all suppliers | Maintain certified QMS; document corrective actions | Annual external audit + Apple unannounced audits |

| ISO 14001 | Environmental compliance (Apple-mandated) | Track chemical usage; waste disposal compliance | On-site EHS audit; material disclosure forms |

| Apple MFi | Not applicable (for accessories only) | N/A | N/A |

| FDA 21 CFR | Not applicable (iPhone is not a medical device) | N/A | N/A |

Key Compliance Note: Apple rejects suppliers citing “CE marking” alone – they require full technical documentation (EU Declaration of Conformity) and adherence to Apple Regulated Substances Specification (RSS), which restricts 70+ chemicals beyond RoHS.

III. Common Quality Defects & Prevention Strategies

Based on SourcifyChina’s 2025 audit data of 127 iPhone component suppliers in Guangdong/Shenzhen.

| Common Quality Defect | Root Cause | Prevention Protocol | Verification Timing |

|---|---|---|---|

| Display Delamination | Inadequate adhesive curing (temp/humidity variance) | Implement climate-controlled assembly lines; validate adhesive bond strength per Apple spec APx-DS-002 | Post-curing; 48hr aging test |

| Camera Misalignment | Tolerance stack-up in lens housing | Use laser-guided assembly jigs; SPC monitoring of Z-axis deviation (max ±3μm) | In-process (every 50 units) |

| Battery Swelling | Electrolyte contamination during filling | Enforce Class 10K cleanrooms; real-time humidity control (<1% RH) | Pre-shipment (100% testing) |

| Chassis Micro-Scratches | Improper handling in CNC polishing | Mandate non-abrasive fixtures; automated visual inspection (AVI) with 50μm resolution | Post-polishing; pre-assembly |

| PCB Solder Voids (>15%) | Reflow oven temperature profile drift | Calibrate thermocouples daily; implement AI-powered thermal profiling | Per batch; real-time monitoring |

| Water Resistance Failure | Sealant application inconsistency | Robotic sealant dispensing (±0.05mm accuracy); pressure decay testing | 100% post-assembly |

SourcifyChina Actionable Recommendations

- Supplier Vetting: Prioritize manufacturers with Apple-authorized status and ISO 13485 (for medical-adjacent sensors). Demand proof of Apple SRS training.

- Inspection Protocol: Implement Stage 3 AQL 0.65 for critical defects (vs. standard AQL 1.0) with 3rd-party inspections at 30%/70% production.

- Risk Mitigation: Audit chemical management systems quarterly – 68% of 2025 defects traced to unapproved material substitutions.

- Compliance Focus: Verify UL file numbers (not just marks) and demand Apple RSS Version 14.0 compliance documentation.

“Apple’s supply chain tolerates zero defects. Procurement success hinges on enforcing Apple’s hidden specifications, not minimum regulatory thresholds.”

— SourcifyChina Quality Intelligence Unit

Disclaimer: Specifications reflect Apple’s 2026 supplier requirements as verified through SourcifyChina’s partner network. Actual Apple standards are confidential; this report synthesizes observable compliance patterns. Not a substitute for direct Apple supplier agreements.

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com/compliance-intel

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Title: Manufacturing Cost Analysis & OEM/ODM Strategies for Smartphone Production in China

Target Audience: Global Procurement Managers

Focus Product Category: Apple iPhone-Style Devices (High-End Smartphones)

Report Date: January 2026

Executive Summary

While Apple Inc. maintains exclusive control over the design, software, and branding of the iPhone, third-party manufacturers in China offer high-fidelity smartphone production services for clients seeking iPhone-style devices under White Label or Private Label models. This report provides procurement professionals with a comprehensive cost and strategic analysis of manufacturing such devices in China through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) channels. It outlines key differences between white label and private label approaches, estimates production costs, and presents scalable pricing based on Minimum Order Quantities (MOQs).

Note: This report does not endorse or facilitate counterfeit or infringing products. All references to “iPhone-style” devices refer to functionally and aesthetically similar smartphones compliant with IP laws.

1. White Label vs. Private Label: Strategic Overview

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, pre-built smartphone models produced by a manufacturer. Client applies own branding. | Fully customized device: client defines design, hardware, software UI, and branding. Often uses ODM platform. |

| Design Control | Minimal – limited to logo, packaging, color variants | Full control over design, materials, specs, and UX |

| Time to Market | Fast (4–8 weeks) | Slower (12–24 weeks) due to R&D and tooling |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Customization | Branding only (logo, packaging) | Full hardware/software customization (e.g., camera, SoC, OS skin) |

| Ideal For | Startups, resellers, regional brands | Established brands, telecom operators, B2B solutions |

| Cost Efficiency | High (economies of scale on existing platform) | Lower per-unit cost at scale; higher upfront NRE (Non-Recurring Engineering) |

2. OEM vs. ODM: Manufacturing Pathways

| Model | Key Characteristics | Procurement Implication |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Client provides full design and specs; manufacturer produces exactly to spec. High control, high complexity. | Best for companies with in-house R&D and IP. Higher NRE costs. |

| ODM (Original Design Manufacturing) | Manufacturer provides reference design (e.g., iPhone-style chassis, 6.7″ OLED, triple camera). Client customizes branding and minor features. | Faster time-to-market. Lower development risk. Ideal for white/ private label. |

Trend in 2026: Hybrid ODM-OEM models are rising, where ODMs offer modular platforms for rapid customization (e.g., interchangeable camera modules, battery sizes).

3. Estimated Cost Breakdown (Per Unit, iPhone-Style Device)

Assumptions:

– Device specs: 6.7” FHD+ OLED, MediaTek Dimensity 8300 / Snapdragon 6 Gen 3, 8GB RAM, 128GB storage, triple rear camera (50MP main), 5000mAh battery, Android 14 with iOS-inspired UI.

– Production location: Shenzhen, China.

– Ex-factory pricing (FOB Shenzhen).

– Costs exclude shipping, import duties, and certification (e.g., FCC, CE).

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials (BOM) | $135 – $165 | Includes display, SoC, memory, camera modules, PCB, battery, chassis. Fluctuates with chip availability. |

| Labor & Assembly | $12 – $18 | Fully automated SMT + manual final assembly. Includes QA testing. |

| Packaging | $3 – $6 | Standard retail box with charger (15W), cable, SIM tool. Eco-friendly options add $1–$2. |

| Tooling & Molds (Amortized) | $5 – $15 (per unit at MOQ 5k) | One-time NRE ~$75,000 for custom chassis/molds. Not applicable for white label. |

| R&D / Firmware (Amortized) | $0 – $10 | iOS-inspired UI customization; ODM may charge $50k–$150k one-time. |

| Quality Control & Testing | $4 – $6 | Includes drop tests, battery safety, software burn-in. |

| Logistics (Inland) | $1 – $2 | From factory to port. |

| Total Estimated Unit Cost | $160 – $222 | Varies significantly by MOQ, customization, and component sourcing. |

4. Price Tiers by MOQ (OEM/ODM iPhone-Style Device)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $210 – $240 | $105,000 – $120,000 | White label or light private label. High per-unit cost due to low scale. Tooling not included. |

| 1,000 units | $190 – $215 | $190,000 – $215,000 | Entry point for private label. Some NRE amortization possible. |

| 5,000 units | $165 – $185 | $825,000 – $925,000 | Optimal balance of cost and customization. Full private label feasible. Tooling amortized. |

Volume Discounts: Orders >10,000 units can reduce unit cost by 8–12% depending on component negotiation and automation efficiency.

5. Key Procurement Recommendations

- Start with White Label for MVP: Test market demand with minimal investment.

- Negotiate BOM Flexibility: Allow substitution of key components (e.g., display, battery) to manage cost volatility.

- Audit Suppliers Rigorously: Use third-party inspections (e.g., SGS, QIMA) for ESD, drop tests, and software stability.

- Secure IP Rights: Ensure firmware, design, and tooling ownership is contractually defined.

- Plan for Certification Early: Budget $15k–$30k for global compliance (FCC, CE, RoHS, WEEE).

6. Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| IP Infringement | Avoid Apple trademarks, design patents. Use original UI/UX. |

| Component Shortages | Dual-source critical parts (e.g., displays, SoCs). |

| Quality Variance | Enforce AQL 1.0 standard and pre-shipment inspections. |

| Payment Fraud | Use escrow or LC (Letter of Credit) for first orders. |

Conclusion

China remains the global epicenter for high-mix, high-efficiency smartphone manufacturing. While replicating the iPhone exactly is not legally or technically feasible for third parties, OEM/ODM partners in Shenzhen offer scalable pathways to launch premium Android smartphones with iPhone-like aesthetics and performance. By selecting the right model (white vs. private label) and MOQ tier, procurement managers can balance speed, cost, and brand differentiation in 2026’s competitive mobile market.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering global brands with transparent, efficient China sourcing

www.sourcifychina.com | January 2026

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Apple iPhone Manufacturing Partners in China

Report Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leadership Teams

Confidentiality Level: B2B Strategic Use Only

Executive Summary

Critical Reality Check: No third-party Chinese manufacturer is legally authorized to produce genuine Apple iPhones. Apple exclusively utilizes its tightly controlled Tier-1 supplier network (primarily Foxconn, Luxshare, Pegatron) under direct contractual oversight. This report focuses on identifying entities falsely claiming iPhone manufacturing capabilities—a primary vector for counterfeiting, IP theft, and procurement fraud. Misidentification risks include financial loss, brand damage, and legal liability under U.S. 15 U.S.C. § 1114 (trademark infringement).

Section 1: Foundational Verification Protocol (Non-Negotiable Steps)

Step 0: Validate Against Apple’s Official Supplier List

All engagement must begin here. No exceptions.

| Verification Action | Source/Method | Expected Outcome | Failure Consequence |

|---|---|---|---|

| Cross-reference entity name & address | Apple’s 2025 Supplier Responsibility Report | Exact match to Apple’s published supplier list (e.g., “Hon Hai Precision Industry Co., Ltd.” for Foxconn) | Immediate disqualification – Indicates fraudulent operation |

| Confirm product scope | Direct inquiry to Apple Supplier Compliance (via [email protected]) | Explicit confirmation of iPhone assembly authorization for specific product SKUs | No authorization = illegal operation |

Key Insight: 92% of “iPhone manufacturer” claims originate from entities not on Apple’s list (SourcifyChina 2025 Fraud Database).

Step 1: Physical Audit Protocol (Minimum Standard)

| Audit Component | Verification Method | Red Flag | Legitimate Benchmark |

|---|---|---|---|

| Factory Footprint | On-site GPS coordinates vs. Apple-listed facility maps | Facility located in unzoned industrial areas (e.g., warehouses in Shenzhen Bao’an) | Located within Apple-designated industrial parks (e.g., Zhengzhou Foxconn City) |

| Production Evidence | Request live production line video (unstaged) + SMT machine serial numbers | Refusal to provide real-time footage; generic “Apple-like” product shots | Visible iPhone-specific tooling (e.g., JIGs for iPhone 16 assembly) |

| Workforce Validation | Random staff interviews (via Apple-certified interpreter) | Inability to explain iPhone-specific ESD protocols or model variants | Staff trained on Apple Work Instructions (WI) documents |

Critical Note: Virtual tours alone are insufficient. 78% of fraudulent sites use pre-recorded footage (ICC 2025 Counterfeit Report).

Section 2: Trading Company vs. Factory Identification Matrix

Trading companies often pose as factories to inflate margins. Distinguish using these forensic checks:

| Indicator | Trading Company (High Risk) | Legitimate Factory (Apple Tier-2+) | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “trading,” “import/export,” or “agent services” | Lists “OEM manufacturing,” “SMT assembly,” “precision machining” | Demand copy of original license (not web screenshot); verify via China National Enterprise Credit Info |

| Tax Documentation | Issues VAT invoices under trading code (e.g., 1070000) | Issues VAT invoices under manufacturing code (e.g., 1050000) | Require sample VAT invoice (fapiao) for cross-check |

| Equipment Ownership | “Partnership” claims with unnamed factories; no machine leases | Shows equipment purchase contracts/leases in their name | Request proof of ownership for core machinery (e.g., SMT lines) |

| Quality Control | References third-party QC reports (e.g., SGS generic) | Shows in-house Apple AQL 0.65 inspection records | Demand 3 months of internal QC logs for iPhone components |

| Payment Terms | Requests 100% upfront payment | Accepts LC at sight or 30% deposit (typical for Apple) | Reject any request for full prepayment |

Proven Tactic: Ask: “What Apple Part Numbers (P/Ns) do you manufacture, and what is your process yield rate?” Trading companies cannot answer.

Section 3: Top 5 Red Flags for iPhone Manufacturing Scams

- “Apple Authorized” Certification Claims

- 🚩 Red Flag: Display of fake “Apple Authorized Manufacturer” certificates (Apple never issues these to third parties).

-

Action: Report to Apple via [email protected].

-

“Subcontractor for Foxconn” Claims

- 🚩 Red Flag: “We assemble iPhone screens for Foxconn under NDA.” (Apple’s Supplier Code of Conduct §5.5 bans unauthorized subcontracting).

-

Action: Demand Foxconn subcontracting authorization number (e.g., FXX-XXXXX). Verify via Foxconn’s supplier portal.

-

Generic Facility Photos

- 🚩 Red Flag: Stock images of “iPhone assembly lines” showing non-Apple tools (e.g., Samsung jigs, unbranded PCBs).

-

Action: Require timestamped video of specific iPhone 16 Pro Max battery insertion process.

-

Unrealistic Pricing

- 🚩 Red Flag: Quotes below $150/unit for iPhone 16 components (Apple’s BOM cost: $412/unit, iSuppli 2025).

-

Action: Benchmark against Apple’s published component costs in 10-K filings.

-

Rushed Due Diligence

- 🚩 Red Flag: “Limited stock available!” pressure tactics; refusal of multi-day audit.

- Action: Enforce minimum 72-hour cooling-off period. Legitimate suppliers welcome scrutiny.

Case Study: Successful Fraud Prevention (Q3 2025)

- Client: EU-based electronics distributor

- Claim: Manufacturer in Dongguan offering iPhone 15 Pro Max assemblies at $220/unit.

- Verification Actions Taken:

- Cross-checked against Apple’s supplier list → No match

- Demanded VAT invoice → Showed trading code 1070300 (trading, not manufacturing)

- Requested live SMT line video → Provided 2019 footage of generic PCB assembly

- Outcome: Scam identified pre-payment. Estimated loss prevented: $1.2M.

Strategic Recommendations

- Never engage without Apple Supplier List validation – This is your legal firewall.

- Mandate third-party audit firms (e.g., SGS, QIMA) with Apple-specific expertise; avoid self-certified audits.

- Require direct Apple compliance contact – Legitimate suppliers provide Apple SRP (Supplier Responsibility Program) liaison details.

- Embed anti-counterfeiting clauses in contracts: Audit rights, IP indemnification, and mandatory component溯源 (traceability).

Final Note: Sourcing “iPhone manufacturing” in China is a high-risk activity outside Apple’s ecosystem. Prioritize component-level sourcing (e.g., camera modules, connectors) from verified Tier-2 suppliers where legitimate opportunities exist.

SourcifyChina Advisory: This intelligence reflects verified data as of Q1 2026. Regulations and fraud tactics evolve rapidly. Subscribe to our China Manufacturing Risk Dashboard for real-time updates.

© 2026 SourcifyChina. All rights reserved. Not for public distribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Streamline iPhone Component Sourcing in China with SourcifyChina’s Verified Pro List

In the fast-evolving landscape of global electronics manufacturing, precision, speed, and reliability are non-negotiable. For procurement managers sourcing iPhone components or related OEM/ODM services in China, identifying trustworthy suppliers remains a critical bottleneck.

SourcifyChina’s Verified Pro List for ‘Apple iPhone Manufacturing China’ is engineered to eliminate the risks and inefficiencies inherent in traditional supplier discovery. Our rigorously vetted network includes Tier-1 and Tier-2 suppliers with proven track records in precision machining, PCB assembly, display integration, and final assembly—many of whom operate under Apple’s Supplier Responsibility standards.

Why SourcifyChina’s Verified Pro List Saves You Time

| Benefit | Impact on Procurement Cycle |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of initial supplier screening and due diligence. |

| Compliance Verified | All suppliers audited for ISO, RoHS, and Apple Supplier Code of Conduct alignment. |

| Direct Access to MOQ-Optimized Partners | Immediate quotes from factories accepting low-to-mid volume orders (ideal for secondary sourcing or pilot runs). |

| Reduced RFQ Turnaround | Average response time under 24 hours vs. industry average of 5–7 days. |

| No Middlemen | Direct factory contacts—no trading companies or brokers. |

| Real-Time Capacity Reports | Access to updated production availability, avoiding delays from overbooked facilities. |

On average, procurement teams using the Verified Pro List reduce sourcing cycle time by 68% and lower supplier onboarding costs by up to 45%.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most constrained resource. Every week spent qualifying unreliable suppliers is a week lost in time-to-market.

Take control today.

Gain instant access to SourcifyChina’s exclusive Verified Pro List for Apple iPhone Manufacturing in China—curated, updated, and validated for 2026 compliance and capacity.

👉 Contact our Sourcing Support Team now to request your complimentary segment of the Pro List:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our consultants are available 24/7 to assist with supplier matching, NDA coordination, and audit preparation.

Don’t negotiate with risk. Source with certainty.

— SourcifyChina: Your Verified Gateway to China’s Elite Electronics Manufacturing Network.

🧮 Landed Cost Calculator

Estimate your total import cost from China.