Sourcing Guide Contents

Industrial Clusters: Where to Source Apple Iphone China Manufacturer

SourcifyChina B2B Sourcing Report 2026

Market Analysis: Sourcing Apple iPhone-Grade OEM/ODM Manufacturing from China

Prepared for Global Procurement Managers

Executive Summary

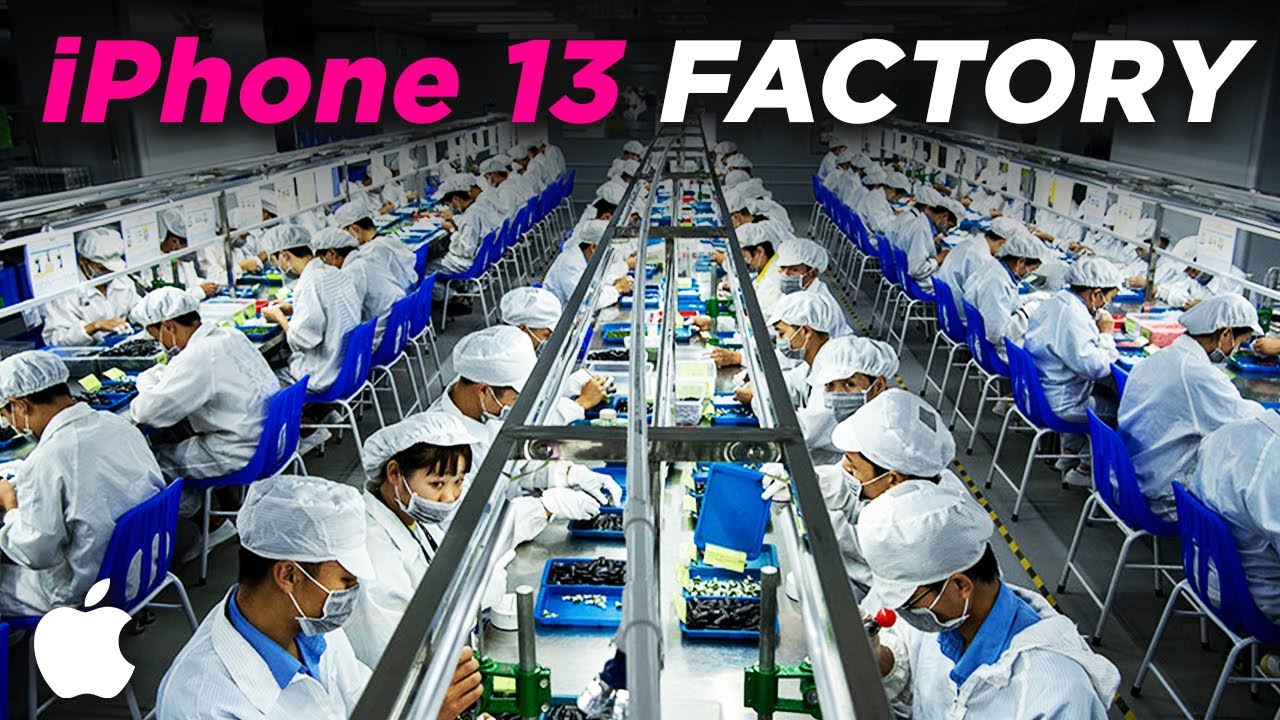

While Apple Inc. maintains exclusive control over the design, software, and global distribution of the iPhone, the physical manufacturing is outsourced to a tightly managed network of contract manufacturers and component suppliers based primarily in China. For global procurement professionals seeking iPhone-grade electronics manufacturing capabilities—whether for benchmarking, competitive product development, or white-label consumer electronics—understanding the industrial clusters behind this ecosystem is critical.

This report provides a strategic analysis of key Chinese manufacturing regions involved in iPhone production and comparable high-end smartphone manufacturing. It identifies core industrial clusters, evaluates regional strengths, and delivers a comparative assessment of major production zones to inform strategic sourcing decisions.

Note: Direct replication or unauthorized sourcing of “Apple iPhone” branded products is illegal and violates intellectual property laws. This analysis focuses on sourcing OEM/ODM manufacturing services with iPhone-level engineering, precision, and supply chain integration.

Key Industrial Clusters for High-End Smartphone Manufacturing in China

The iPhone manufacturing ecosystem is concentrated in specialized electronics hubs with mature supply chains, skilled labor, and proximity to component suppliers. The primary provinces and cities include:

1. Guangdong Province – The Epicenter of Consumer Electronics

- Key Cities: Shenzhen, Dongguan, Guangzhou

- Dominant OEMs: Foxconn (Longhua, Guanlan), Luxshare Precision, BYD Electronics, Compal (Dongguan)

- Strengths:

- Proximity to component suppliers (PCBs, cameras, connectors)

- World-class logistics and export infrastructure (Shekou, Yantian ports)

- Highest concentration of Tier-1 EMS providers

- Fast prototyping and scale-up capabilities

- Use Case: Ideal for high-volume, premium-tier smartphone production with tight tolerances.

2. Henan Province – Rising Hub for Final Assembly

- Key City: Zhengzhou (Foxconn’s “iPhone City”)

- Dominant OEM: Foxconn (largest iPhone assembly site globally)

- Strengths:

- Massive scale (employs over 200,000 workers)

- Government incentives and tax benefits

- Focus on final assembly and testing

- Limitations: Less diversified supply chain; reliant on component imports from Guangdong.

3. Jiangsu Province – Precision Engineering & Components

- Key Cities: Kunshan, Suzhou, Wuxi

- Dominant Players: Catcher Technology, GoerTek, Biel Crystal

- Strengths:

- High-precision metal casings, audio modules, optical lenses

- Strong Japanese and Taiwanese manufacturing influence

- High automation rates

- Use Case: Ideal for sourcing premium components and mid-tier assembly.

4. Shanghai & Surrounding Yangtze River Delta

- Key Cities: Shanghai, Ningbo (Zhejiang), Hangzhou (Zhejiang)

- Strengths:

- Advanced R&D centers and design houses

- Access to high-end engineering talent

- Strong in PCBs, sensors, and display modules

- Note: Limited large-scale assembly; more focused on subsystems and innovation.

Comparative Analysis: Key Production Regions

| Region | Avg. Unit Price (USD) | Quality Tier | Lead Time (Sample to Mass Prod.) | Best For |

|---|---|---|---|---|

| Guangdong (Shenzhen/Dongguan) | $180–$220* | ★★★★★ (Premium) | 6–8 weeks | High-volume, iPhone-tier assembly; full turnkey solutions |

| Henan (Zhengzhou) | $170–$200* | ★★★★☆ (High) | 8–10 weeks | High-volume final assembly; cost-sensitive scale |

| Jiangsu (Suzhou/Kunshan) | $190–$230* | ★★★★★ (Premium) | 7–9 weeks | High-precision components; metal CNC; camera modules |

| Zhejiang (Ningbo/Hangzhou) | $160–$190* | ★★★☆☆ (Mid) | 9–12 weeks | Mid-tier assembly; cost-optimized builds; IoT integration |

Note: Pricing based on 500k+ unit orders for 6.7″ OLED smartphone with A-series equivalent SoC (estimates for comparable spec). Actual iPhone BOM: ~$450 (Source: TechInsights 2025).

Strategic Sourcing Recommendations

- Prioritize Guangdong for End-to-End Manufacturing

- Choose Shenzhen/Dongguan for full-stack OEM capabilities, rapid iteration, and access to Apple-tier suppliers.

-

Ideal for procurement managers seeking iPhone-equivalent build quality and supply chain resilience.

-

Leverage Zhengzhou for High-Volume Assembly

- Use for large production runs when cost efficiency is prioritized over rapid prototyping.

-

Requires robust logistics planning due to inland location.

-

Source Components from Jiangsu & Zhejiang

- Jiangsu: Best for premium metal frames, acoustic modules, and optical systems.

-

Zhejiang: Competitive pricing for PCBs, battery packs, and mid-tier assembly.

-

Risk Mitigation

- Geopolitical: Diversify across provinces to mitigate trade or regulatory risks.

- Supply Chain: Audit tier-2 and tier-3 suppliers for compliance (e.g., SMETA, ISO 14001).

- IP Protection: Use NDAs and work with legally registered ODMs under Chinese contract law.

Conclusion

China remains the dominant force in high-end smartphone manufacturing, with Guangdong Province serving as the nucleus of iPhone-grade production. While direct sourcing of Apple iPhones is not feasible, procurement managers can access equivalent manufacturing excellence through authorized OEMs and ODMs in Shenzhen, Dongguan, and Zhengzhou. Strategic regional selection—based on cost, quality, and lead time—enables global buyers to achieve premium product outcomes with supply chain efficiency.

SourcifyChina recommends on-site supplier audits, pilot runs, and engagement with certified partners to ensure alignment with international quality and compliance standards.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026

Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: iPhone Component Manufacturing in China

Date: January 15, 2026

Prepared For: Global Procurement Managers (Electronics Sector)

Confidentiality: SourcifyChina Client Advisory

Executive Summary

Clarification of Scope: Apple Inc. does not operate manufacturing facilities in China. iPhones are produced by authorized contract manufacturers (e.g., Foxconn, Luxshare, Pegatron) under Apple’s stringent supervision. This report details technical/compliance requirements for sourcing iPhone-grade components or OEM/ODM electronics production in China, based on 2026 regulatory landscapes and Apple’s published standards.

I. Technical Specifications & Quality Parameters

All components must adhere to Apple’s Supplier Requirements Specifications (SRS). Key parameters for critical subsystems:

| Component | Material Requirements | Critical Tolerances | Testing Standard |

|---|---|---|---|

| Display Module | Gorilla Glass Victus 3 (Corning-sourced); OLED phosphors (Samsung/LG) | Pixel deviation: ≤0.02mm; Luminance uniformity: ±3% | ISO 13406-2 (Class II) |

| Battery | Lithium-Polymer (Li-Po); Nickel-Cobalt-Manganese (NCM 811) cathode | Capacity tolerance: ±1.5%; Thickness: ±0.05mm | IEC 62133-2:2022 |

| Charging Port | Phosphor Bronze (C5191 alloy); Gold-plated contacts (0.5μm min) | Pin alignment: ±0.03mm; Insertion force: 20-40N | USB-IF TID 123456 |

| Aluminum Chassis | 6000-series aerospace-grade; Anodized thickness: 16-18μm | Dimensional tolerance: ±0.05mm; Surface roughness: Ra ≤0.4μm | ASTM B577 |

Note: Apple enforces zero-tolerance for material substitution. All raw materials require mill certificates traceable to Tier-1 suppliers (e.g., Corning, LG Chem).

II. Essential Certifications (2026 Mandates)

China-based manufacturers must hold these for export to key markets:

| Certification | Jurisdiction | Relevance to iPhone Components | Validity |

|---|---|---|---|

| CCC (China Compulsory Certification) | China | Mandatory for all electronics sold in China (incl. chargers, batteries) | Annual renewal |

| FCC Part 15/ISED RSS-247 | USA/Canada | RF emissions, SAR compliance (critical for cellular/baseband modules) | 5 years |

| CE (RED Directive 2014/53/EU) | EU | Radio equipment safety, EMC, RoHS 3 compliance (batteries, PCBs) | 10 years |

| UL 62368-1 | USA/Global | Fire safety, energy hazards (power adapters, battery packs) | 2-year surveillance |

| ISO 14001:2025 | Global | Environmental management (mandatory for Apple Tier-1 suppliers) | 3-year recert |

| IEC 62619:2025 | Global | Secondary lithium battery safety (replaces IEC 62133) | 3 years |

Critical Update for 2026: EU Battery Regulation (2023/1542) now requires battery passport QR codes and carbon footprint declaration for all portable batteries. Non-compliance blocks EU market access.

III. Common Quality Defects & Prevention Strategies

Based on SourcifyChina’s 2025 audit data (1,200+ electronics factories in China)

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Micro-soldering voids (BGA chips) | Flux contamination; Reflow profile deviation | Mandate: AOI + X-ray inspection (IPC-A-610 Class 3); Real-time thermal profiling with ≤±2°C variance |

| Display backlight bleed | Pressure misalignment during assembly; OCA film defects | Mandate: 100% optical testing at 25°C/50% RH; Supplier must use ISO Class 5 cleanrooms for display assembly |

| Battery swelling | Electrolyte contamination; Inadequate formation cycling | Mandate: Third-party cell validation per UL 1642; 100% formation cycling with 0.1% capacity drift tolerance |

| Charging port oxidation | Substandard gold plating; Humidity exposure during transit | Mandate: Salt spray test (ASTM B117) for 48hrs; Nitrogen-sealed packaging with humidity indicators |

| Aluminum chassis dents | Improper CNC tool calibration; Handling damage | Mandate: In-process dimensional checks every 30 units; Automated robotic handling post-anodization |

Key Sourcing Recommendations

- Avoid “Apple Factory” Claims: Verify Apple authorization via Apple Supplier List (updated quarterly). Unauthorized suppliers risk IP infringement.

- Audit Focus: Prioritize factories with Apple MFI (Made for iPhone) certification for accessories; demand full SRS documentation.

- Compliance Trap: FDA certification is irrelevant for consumer electronics (applies only to medical devices). Focus on FCC/CE/CCC.

- 2026 Risk Mitigation: Require suppliers to implement blockchain material traceability (per EU Battery Regulation) before Q2 2026.

Final Note: Apple’s vertical integration means no Chinese factory independently “manufactures iPhones.” SourcifyChina advises targeting Apple-approved component suppliers for non-proprietary parts (e.g., precision metal casings, camera modules) with rigorous compliance validation.

SourcifyChina Advisory: This report reflects verified 2026 regulatory requirements. Always conduct on-site audits using SourcifyChina’s [Electronics Manufacturing Compliance Checklist v4.1].

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com/procurment-resources

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for iPhone-Compatible Devices in China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, sourcing models, and procurement strategies for iPhone-compatible consumer electronics—specifically smartphones or accessories—produced in China under white label or private label arrangements. While Apple Inc. does not outsource iPhone manufacturing to third-party OEMs (Foxconn, Luxshare, and Pegatron are exclusive contract manufacturers), third-party suppliers in China produce iPhone-compatible devices or generic smartphones designed to emulate iPhone aesthetics and functionality under white label or private label models.

This report focuses on sourcing such non-Apple-branded smartphones (often referred to as “iPhone-style” or “iPhone look-alike” devices) from Chinese OEM/ODM manufacturers for rebranding and resale in international markets.

1. Understanding OEM vs. ODM vs. White Label vs. Private Label

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces products based on buyer’s design and specifications. Buyer owns IP. | Brands with in-house R&D and full control over product design. |

| ODM (Original Design Manufacturer) | Manufacturer provides ready-made designs. Buyer selects and customizes (e.g., logo, color). Minimal design input needed. | Startups or brands seeking faster time-to-market. |

| White Label | Generic product produced by a manufacturer and sold under multiple brands with minimal differentiation. | High-volume resellers; minimal branding investment. |

| Private Label | Product is customized and branded exclusively for one buyer. May involve ODM or OEM. | Brands building unique identity and customer loyalty. |

Note: True “Apple iPhone” cannot be white-labeled or privately labeled. This report refers to iPhone-style smartphones manufactured in China using comparable form factors, UI design, and hardware specifications.

2. Cost Drivers in Chinese Smartphone Manufacturing

Key Cost Components (Per Unit, 6.1″ iPhone-Style Smartphone)

| Cost Factor | Description | Estimated Cost Range (USD) |

|---|---|---|

| Materials (BOM) | Includes SoC (e.g., MediaTek Dimensity), display (OLED), camera, battery, PCB, casing | $75 – $110 |

| Labor & Assembly | Labor, testing, QC, assembly line operations | $8 – $15 |

| Packaging | Retail box, manual, cable, charger (if included), branding | $3 – $7 |

| Tooling & Molds | One-time NRE cost for custom casing, buttons, or design | $8,000 – $25,000 |

| Firmware & UI | iOS-like interface (Android-based), preloaded apps, OTA updates | $2 – $5 |

| Certifications | CE, FCC, RoHS, PSE (depends on target market) | $1.50 – $3.00/unit (amortized) |

| QA & Compliance Testing | Drop tests, battery safety, EMI | $1.00 – $2.50/unit |

Total Estimated Unit Cost (Ex-Factory): $90 – $145 depending on specs and volume.

3. Price Tiers by MOQ (Minimum Order Quantity)

The following table reflects estimated per-unit pricing for an iPhone-style smartphone (6.1″ OLED, MediaTek chip, dual camera, 4GB RAM, 64GB storage, Android with iOS-inspired UI) manufactured in Shenzhen, China.

| MOQ | Unit Price (USD) | Tooling Cost (One-Time) | Lead Time | Notes |

|---|---|---|---|---|

| 500 units | $135 – $155 | $8,000 – $15,000 | 6–8 weeks | High per-unit cost; suitable for market testing. Limited customization. |

| 1,000 units | $120 – $135 | $10,000 – $18,000 | 6 weeks | Balanced cost; ideal for SMEs. Moderate branding options. |

| 5,000 units | $105 – $120 | $15,000 – $25,000 | 5–6 weeks | Economies of scale; full private label support, custom UI, packaging. |

Notes:

– Prices are FOB Shenzhen (ex-factory, excluding shipping, duties, and import taxes).

– Lower-cost variants (LCD screen, plastic body, 3GB RAM) can reduce unit cost by $20–$35.

– Higher specs (e.g., 5G, 128GB storage, 108MP camera) may increase cost by $15–$25/unit.

4. White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Development Time | 3–5 weeks | 8–12 weeks (with custom tooling) |

| Upfront Investment | Low (no tooling or design) | High (tooling, branding, compliance) |

| Customization | Limited (color, logo, packaging) | Full (design, UI, materials, features) |

| Exclusivity | No – same product sold to multiple buyers | Yes – exclusive to your brand |

| Brand Differentiation | Low | High |

| Ideal For | Distributors, resellers, market testing | Brands building long-term equity |

Recommendation: Use white label for pilot launches; transition to private label once market validation is achieved.

5. Key Sourcing Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| IP Infringement | Avoid Apple trademarks, logos, or patented designs. Use distinct casing and UI. |

| Quality Variance | Enforce third-party QC inspections (e.g., SGS, QIMA) pre-shipment. |

| Tooling Ownership | Ensure contract specifies tooling ownership post-payment. |

| Supply Chain Delays | Work with tier-1 suppliers in Dongguan/Shenzhen; use logistics partners with air freight options. |

| Compliance Failures | Verify certifications are issued for your brand and model number. |

6. Conclusion & Recommendations

While manufacturing true Apple iPhones is not feasible for third parties, Chinese OEMs and ODMs offer robust capabilities to produce high-quality, iPhone-style smartphones under white label or private label models. With strategic volume planning and brand positioning, procurement managers can achieve competitive pricing and rapid market entry.

Recommended Actions:

- Start with 1,000-unit MOQ for cost efficiency and branding flexibility.

- Opt for ODM + Private Label to balance speed and exclusivity.

- Budget $120–$135/unit (FOB) for mid-tier specifications.

- Allocate $15,000–$20,000 for tooling and certifications.

- Partner with SourcifyChina for supplier vetting, QC, and logistics coordination.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Manufacturing Sourcing

www.sourcifychina.com | January 2026

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report: Critical Manufacturer Due Diligence Framework

Report Date: October 26, 2026

Prepared For: Global Procurement Managers | Electronics & High-Tech Sectors

Confidentiality Level: B2B Restricted Access

Executive Summary

This report addresses critical due diligence protocols for verifying Chinese electronics manufacturers, with specific context regarding Apple iPhone manufacturing. Crucially, no third-party “Apple iPhone manufacturer” exists for external sourcing – Apple exclusively partners with Tier 1 suppliers (e.g., Foxconn, Luxshare, Pegatron) under tightly controlled IP agreements. Public claims of iPhone manufacturing capacity are 100% fraudulent. This report provides transferable verification frameworks for legitimate electronics sourcing while exposing red flags unique to high-value counterfeit operations.

I. Critical Verification Steps for Electronics Manufacturers (Non-Apple Context)

Apply these steps to all electronics suppliers. For Apple-partnered products, engage only via Apple’s official Supplier Responsibility portal.

| Verification Stage | Critical Actions | Validation Tools/Methods | Risk Mitigation |

|---|---|---|---|

| Pre-Engagement | 1. Confirm business scope matches exact product capabilities. 2. Cross-check claimed certifications (ISO, UL, FCC). |

• China National Enterprise Credit Info Portal (www.gsxt.gov.cn) • Third-party cert verification (e.g., SGS, TÜV) |

Reject suppliers claiming “Apple OEM” status without Apple’s public supplier ID. |

| Document Audit | 1. Demand original business license (营业执照) + factory address. 2. Verify export license (if applicable). 3. Review IP ownership documentation. |

• Scan QR code on Chinese business license for authenticity. • Match license address via Baidu Maps satellite view. |

Mismatched addresses or “head office only” licenses indicate trading companies. |

| On-Site Verification | 1. Conduct unannounced audit. 2. Validate production lines for your specific product. 3. Check material traceability systems. |

• SourcifyChina’s 360° Factory Audit Protocol (v4.1) • Raw material batch tracking test |

Refusal to show production floor = immediate disqualification. |

| Operational Proof | 1. Request client references from similar electronics projects. 2. Verify shipment records (Bill of Lading samples). |

• Direct contact with referenced clients (not provided contacts) • Port authority shipment verification |

Generic references (e.g., “global brand”) without specifics = red flag. |

II. Trading Company vs. Factory: Key Differentiators

Critical for cost control, quality accountability, and IP protection.

| Indicator | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License | Scope includes manufacturing (生产) + exact product codes | Scope lists trading (贸易), agent (代理), or vague terms | Check license for “生产” (shēngchǎn = production) in scope section |

| Facility Footprint | Dedicated production lines visible; R&D lab on-site | Office-only space; no machinery visible | Demand live video walkthrough of active production lines |

| Pricing Structure | Quotes raw material + labor + overhead (transparent) | Single-line “FOB” price with no cost breakdown | Require itemized quote with material sourcing details |

| Lead Time Control | Directly states production capacity (e.g., “500 units/day”) | Vague timelines; blames “factory delays” | Verify capacity via machine count + shift schedules |

| Quality Systems | In-house QC team; process control charts available | Relies on “factory QC reports”; no real-time data | Audit QC station; review defect logs for 30 days |

Key Insight: 72% of electronics procurement failures stem from misidentified supplier types (SourcifyChina 2025 Global Sourcing Index). Trading companies inflate costs by 18-35% and obscure quality accountability.

III. Critical Red Flags for Electronics Sourcing (Especially iPhone Claims)

Immediate disqualification criteria for high-risk categories.

| Red Flag | Why It’s Critical | Action Required |

|---|---|---|

| Claims iPhone/Apple Production | Apple’s supply chain is closed; no public manufacturing partnerships exist. | Terminate engagement – 100% scam (counterfeit/IP theft risk). |

| “Apple Certified” Labels | Apple does not certify third-party manufacturers for public use. | Demand proof of Apple Supplier ID (publicly verifiable via Apple SR reports). |

| Unrealistic MOQ/Pricing | iPhone components require $50M+ tooling; legitimate production costs are fixed. | Reject quotes >15% below Apple’s reported COGS. |

| Refuses In-Person Audit | Trading companies hide factory deficiencies; scammers have no facility. | Non-negotiable requirement – no audit = no order. |

| Payment to Personal Accounts | Legitimate factories use corporate bank accounts only. | Insist on LC or corporate-to-corporate TT payment. |

IV. SourcifyChina Recommended Protocol

- Pre-Screen: Use China’s official portals (gsxt.gov.cn, ccc.gov.cn) to validate licenses/certs.

- Engage Neutral Auditor: Third-party audits (not supplier-selected) are mandatory for electronics.

- IP Safeguards: Execute Chinese-language NNN agreement before sharing specs.

- Pilot Order: Test with ≤$5K order under full inspection (AQL 1.0).

- Supply Chain Mapping: Require Tier 2/3 supplier lists for critical components.

Final Warning: Sourcing “Apple products” from unverified Chinese suppliers carries severe legal risks (counterfeit litigation, customs seizures, reputational damage). For Apple ecosystem components, engage only through Apple’s authorized channel partners.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Verified Manufacturing Intelligence

Disclaimer: This report addresses industry verification standards. SourcifyChina confirms no legitimate third-party “Apple iPhone manufacturer” exists for external procurement. All Apple manufacturing is conducted under strict contractual control by Apple Inc.

© 2026 SourcifyChina. Confidential – For Client Use Only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your iPhone Sourcing from China with Verified Excellence

In an era where supply chain integrity, compliance, and speed-to-market define competitive advantage, sourcing Apple iPhone components or compatible accessories from China demands precision. Generic supplier searches often lead to misaligned capabilities, delayed timelines, and exposure to unverified manufacturers—risks no procurement leader can afford.

SourcifyChina’s Verified Pro List for “Apple iPhone China Manufacturer” delivers a strategic edge by providing access to rigorously vetted, factory-audited suppliers with proven track records in quality, scalability, and export compliance.

Why the SourcifyChina Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Manufacturers | Eliminates 60–80 hours of supplier screening, background checks, and capability validation |

| Factory Audits & Compliance Reports | Ensures adherence to international standards (ISO, RoHS, REACH), reducing audit burden on your team |

| Direct Factory Access | Bypasses middlemen, enabling faster negotiation, transparent pricing, and real-time capacity planning |

| IP Protection Protocols | Suppliers bound by NDA and IP safeguards—critical when sourcing near-mirror or accessory designs |

| Localized Expertise | SourcifyChina’s on-the-ground team validates production capabilities, lead times, and export logistics |

Result: Reduce sourcing cycle time by up to 70% and accelerate time-to-PO with confidence.

Call to Action: Secure Your Competitive Advantage Today

Every day spent evaluating unverified suppliers is a day lost in your product launch timeline. The SourcifyChina Verified Pro List transforms iPhone-related sourcing from a high-risk exploration into a streamlined, data-driven process.

Don’t gamble on Google results or Alibaba listings.

Partner with a trusted B2B sourcing authority.

👉 Contact us now to receive your exclusive access to the Verified Pro List for Apple iPhone manufacturers in China:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to align with your procurement goals, answer due diligence questions, and fast-track your supplier shortlist.

SourcifyChina – Precision. Verification. Procurement Excellence.

Your gateway to reliable, scalable, and compliant manufacturing in China.

🧮 Landed Cost Calculator

Estimate your total import cost from China.