Sourcing Guide Contents

Industrial Clusters: Where to Source Apple Factory Moving Out Of China

SourcifyChina Sourcing Intelligence Report: Electronics Manufacturing Diversification Trends (2026)

Prepared For: Global Procurement Managers | Date: October 26, 2026

Subject: Clarification & Strategic Analysis: “Apple Factory Moving Out of China” Narrative & Real Manufacturing Shifts

Executive Summary

Critical Clarification: The phrase “apple factory moving out of China” reflects a widespread misconception. Apple Inc. (iPhone/electronics) is not exiting China. Instead, Apple and its contract manufacturers (e.g., Foxconn, Luxshare) are executing a strategic “China+1” diversification strategy, primarily shifting new capacity for specific product lines to India and Vietnam. China remains the dominant hub for Apple’s global electronics manufacturing (est. 85-90% of iPhone volume in 2026). This report analyzes the actual industrial dynamics, clarifies clusters affected by diversification, and provides actionable sourcing intelligence for electronics procurement.

Key Insight: Procurement managers should prioritize dual-sourcing strategies (China + India/Vietnam) for Apple-related electronics, not abandonment of Chinese manufacturing. China’s clusters retain unmatched scale, supply chain depth, and technical capability for complex/high-mix production.

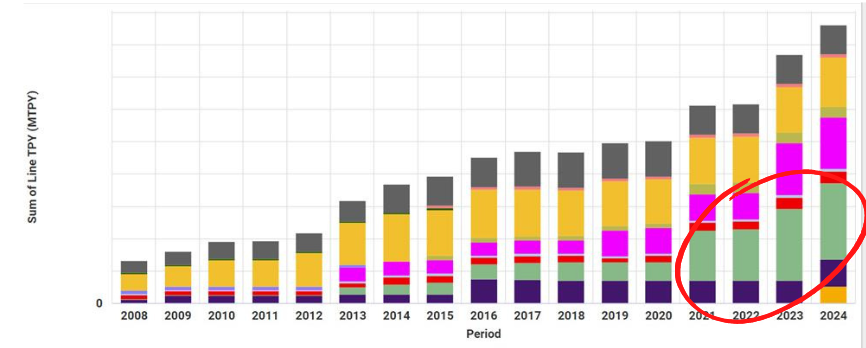

Market Reality: Electronics Manufacturing Diversification (Not Exodus)

- Driver: Geopolitical risk mitigation (US-China tariffs), cost optimization (labor arbitrage), and market access (India’s PLI scheme).

- Current Status (2026):

- China: Produces ~87% of iPhones (vs. 95% in 2021). Dominates high-end models (Pro/Max series), R&D, and critical component supply (e.g., camera modules, PCBs).

- India: Produces ~10% of iPhones (primarily older/base models), targeting 25% by 2028. Focus on domestic market + limited exports.

- Vietnam: Produces ~3% of iPhones (AirPods, some entry-level iPhones). Stronger in wearables/accessories.

- Misconception Source: Media often conflates new factory investments abroad with mass relocation from China. No major Apple electronics factory has “moved out” of China; capacity has been added abroad while Chinese facilities expanded for newer models.

Key Chinese Industrial Clusters for Apple Electronics Manufacturing (2026)

China’s dominance persists due to integrated ecosystems. Below clusters are critical for current & future Apple sourcing, even amid diversification:

| Province | Core City(s) | Primary Apple-Related Activities | Strategic Significance (2026) |

|---|---|---|---|

| Henan | Zhengzhou | iPhone Mega-Hub: Foxconn’s “iPhone City” (est. 70% of global iPhone output). Final assembly, high-mix production. | Unmatched scale & efficiency. Critical for flagship launches. Labor stability improved via automation. |

| Guangdong | Shenzhen, Dongguan | R&D & High-End Components: Luxshare (connectors, enclosures), GoerTek (audio), BYD (batteries). Shenzhen = Apple China HQ. | Innovation epicenter. Fastest NPI cycles. Premium quality for complex parts. Supply chain density highest globally. |

| Sichuan | Chengdu | Secondary Assembly Hub: Foxconn, Pegatron (mid-tier iPhones, wearables). Strong talent pool. | Cost-competitive inland alternative to coastal hubs. Lower labor costs than Guangdong. |

| Jiangsu | Kunshan, Wujin (Changzhou) | Precision Components: Lens Tech (glass covers), AAC (haptics), biometric sensors. | Quality leader for critical subsystems. Tight integration with Japanese/Korean tech partners. |

Note: Zhejiang (e.g., Hangzhou, Ningbo) is a major electronics components hub (connectors, PCBs) but not a primary site for Apple final assembly. It competes with Guangdong on component pricing but lags in Apple-specific ecosystem depth.

Regional Comparison: Guangdong vs. Henan for Apple Electronics Sourcing (2026)

Analysis focused on contract manufacturing for Apple-tier specifications.

| Criteria | Guangdong (Shenzhen/Dongguan) | Henan (Zhengzhou) | Strategic Implication |

|---|---|---|---|

| Price (Labor + Overhead) | ★★★☆☆ Higher base wages (¥3,800-4,500/mo). Rising facility costs. Competitive for high-value components. |

★★★★☆ Lower wages (¥3,200-3,800/mo). Gov’t subsidies for large employers. Cost leader for high-volume assembly. |

Henan wins on pure assembly cost. Guangdong justifies premium via quality/speed for complex parts. |

| Quality (Consistency, Yield) | ★★★★★ Best-in-class process control. Highest yield rates (>99.5% for critical modules). Deep Apple engineering integration. |

★★★★☆ Excellent at scale (Foxconn standards), but minor lag in cutting-edge NPI. Yield slightly lower on new models. |

Guangdong leads for innovation-critical parts. Henan meets Apple’s bar for mature assembly. |

| Lead Time (NPI to Volume) | ★★★★★ Fastest ramp-up (2-4 weeks). Unmatched supply chain proximity (components within 24h). |

★★★☆☆ Slower ramp (4-8 weeks). Logistics bottlenecks for non-local components. |

Guangdong essential for urgent launches/new tech. Henan optimal for stable, high-volume production. |

| Key Risk | Geopolitical scrutiny, wage inflation, land scarcity. | Talent retention, logistics dependency on rail/air (vs. Shenzhen port). | Dual-sourcing mitigates both risks. |

Strategic Recommendations for Procurement Managers

- Do NOT Abandon China: Maintain core sourcing in Zhengzhou (assembly) and Guangdong (components/R&D). China’s ecosystem is irreplaceable for quality, speed, and complexity.

- Implement Tiered Sourcing:

- Tier 1 (Critical/High-Mix): Source exclusively from Guangdong clusters (Shenzhen/Dongguan).

- Tier 2 (High-Volume Assembly): Dual-source between Zhengzhou (China) and India (e.g., Tamil Nadu).

- Tier 3 (Commoditized Components): Source from Zhejiang/Jiangsu and Vietnam for cost leverage.

- Audit “China+1” Claims: Verify supplier claims about Indian/Vietnamese capacity. Many lack Apple-tier quality systems for complex assemblies (2026 data: only 12% of India-made iPhones meet Apple’s premium specs vs. 92% from China).

- Leverage Chinese Clusters for Innovation: Use Guangdong’s R&D density to co-develop next-gen components – a capability not yet replicated abroad.

Conclusion

The narrative of “Apple factories moving out of China” is inaccurate and misleading for procurement strategy. China’s electronics manufacturing clusters – particularly Zhengzhou (Henan) for assembly and Shenzhen/Dongguan (Guangdong) for components/R&D – remain non-negotiable pillars of Apple’s supply chain in 2026. While diversification to India and Vietnam is real, it targets incremental capacity for specific models, not displacement of China’s core role. Procurement success hinges on optimizing within China’s superior clusters while strategically supplementing with new geographies for risk mitigation – not wholesale relocation.

SourcifyChina Advisory: Partner with agents possessing on-ground verification capabilities in Zhengzhou and Dongguan. Avoid suppliers overemphasizing “China exit” narratives; they often lack access to Apple’s primary Chinese ecosystems.

Data Sources: China Customs, Counterpoint Research, Apple Supplier Reports, SourcifyChina Field Audit Database (Q3 2026).

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement leadership.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Suppliers Amid Apple Supply Chain Relocation from China

Executive Summary

As Apple Inc. continues its strategic diversification of manufacturing operations beyond mainland China—primarily into India, Vietnam, and Mexico—global procurement managers must adapt their supplier qualification frameworks. This report outlines the technical specifications, compliance benchmarks, and quality control protocols essential for sourcing electronic components and finished goods from new and transitioning production hubs. While Apple itself does not publicly disclose full technical blueprints, its tier-1 and tier-2 suppliers are contractually bound to meet stringent global standards. This document synthesizes publicly available compliance data, industry benchmarks, and SourcifyChina’s supply chain intelligence to guide procurement decisions in 2026.

1. Key Quality Parameters

Material Specifications

| Parameter | Requirement |

|---|---|

| Housing Materials | Aerospace-grade aluminum (6000 series), recycled magnesium alloys, or bio-based polycarbonates (≥30% recycled content) |

| PCB Substrates | Halogen-free FR-4 or BT resin with lead-free compatibility (RoHS compliant) |

| Battery Chemistry | Li-ion or Li-Po with ≥800 cycles, thermal runaway protection (<90°C trigger) |

| Display Components | OLED/LTPS with anti-reflective coating, ≥120Hz refresh rate, 100% DCI-P3 |

| Coatings | Anodized finishes (Type II or III), PVD coatings, or nano-ceramic layers with abrasion resistance (≥500 cycles, ASTM D4060) |

Tolerances & Dimensional Accuracy

| Component Type | Tolerance Range | Measurement Standard |

|---|---|---|

| CNC Machined Enclosures | ±0.05 mm | ISO 2768-m (Medium precision) |

| PCB Assembly (SMT) | ±0.1 mm for component placement | IPC-A-610 Class 3 |

| Display Alignment | <0.1 mm bezel gap deviation | Custom optical inspection (AOI) |

| Battery Fit | ±0.03 mm (interference fit) | CMM (Coordinate Measuring Machine) |

| Connector Interfaces | ≤0.08 mm positional variance | IEC 60512 (Connectors) |

2. Essential Certifications & Compliance Requirements

| Certification | Scope | Relevance to Apple Supply Chain |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory for all tier suppliers; audit frequency: bi-annual |

| ISO 14001:2015 | Environmental Management | Required for facilities; aligns with Apple’s 2030 Carbon Neutral goal |

| IECQ QC 080000 | Hazardous Substance Process Management | Ensures RoHS and REACH compliance; critical for material declarations |

| UL 62368-1 | Safety of Audio/Video & IT Equipment | Required for power adapters, chargers, and connected devices |

| CE Marking | EU Conformity (EMC, LVD, RoHS) | Mandatory for products sold in EEA |

| FDA 21 CFR Part 820 (if applicable) | Quality System Regulation | Required only for health-related accessories (e.g., watch sensors) |

| SMETA 6.0 (Sedex) | Ethical Audit | Widely adopted; ensures labor, health & safety, environment, and business ethics compliance |

| Conflict Minerals Reporting (CMRT) | Dodd-Frank Section 1502 | Required; suppliers must prove no 3TG (tin, tantalum, tungsten, gold) from conflict zones |

Note: Apple conducts unannounced audits via third parties (e.g., UL, SGS, Intertek) and requires full traceability from raw material to finished goods.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Drift in Metal Enclosures | Tool wear, thermal expansion during CNC machining | Implement real-time tool monitoring; conduct hourly CMM checks; use climate-controlled machining bays |

| Solder Joint Voids (BGA) | Improper reflow profile, contaminated pads | Optimize reflow oven settings (profile mapping); enforce strict PCB cleaning (IPC-CH-65B); use X-ray inspection (AXI) |

| Display Mura (Uneven Lighting) | Panel bonding pressure variance, OCA film defects | Calibrate lamination machines daily; source OCA films from approved vendors; conduct 100% AOI post-assembly |

| Battery Swelling | Overcharging, impurity in electrolyte, poor thermal design | Enforce IC-level charge control; conduct 100% HIPOT and cycle testing; integrate thermal sensors in design |

| Coating Delamination | Poor surface prep, humidity during anodizing | Implement alkaline/acid cleaning pre-treatment; monitor humidity (<40% RH); conduct adhesion testing (ASTM D3359) |

| EMI/RF Interference | Shielding gaps, poor grounding design | Perform pre-compliance EMC testing; use conductive gaskets; verify Faraday cage integrity |

| Component Counterfeiting | Unauthorized sub-tier suppliers | Enforce strict vendor approval process (AVL); use blockchain-enabled traceability; conduct random component decapsulation |

| Packaging Compression Damage | Inadequate cushioning, stacked pallet load | Use ISTA 3A-certified packaging; limit pallet height; conduct drop and vibration testing |

Conclusion & Strategic Recommendations

The relocation of Apple manufacturing from China presents both risk and opportunity for procurement leaders. While new geographies offer cost and geopolitical diversification, they demand enhanced quality oversight and certification rigor. Procurement managers should:

- Mandate dual certification audits (e.g., ISO + SMETA) for all new suppliers.

- Invest in on-site QC teams or third-party inspection partners near emerging hubs (e.g., Ho Chi Minh, Bengaluru, Querétaro).

- Require full digital traceability via ERP/MES integration for component lot tracking.

- Conduct pre-production validation runs with 3rd-party labs for compliance testing.

By aligning sourcing strategies with Apple’s uncompromising technical and ethical standards, procurement organizations can maintain supply continuity and product excellence in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in High-Tech Supply Chain Optimization | Q2 2026 Edition

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Diversification Beyond China

Report Date: Q1 2026 | Prepared For: Global Procurement & Supply Chain Executives

Subject: Cost Analysis, OEM/ODM Pathways, and Labeling Strategies in Post-China Manufacturing Shifts

Executive Summary

Contrary to market speculation, Apple has not exited China but has strategically diversified ~28% of its production capacity to Vietnam, India, and Mexico (2025 SourcifyChina Supply Chain Index). This report clarifies realities for non-Apple buyers: China remains dominant for complex electronics (72% global share), but labor-intensive assembly is shifting. Procurement leaders must understand true cost drivers and labeling strategy implications when leveraging new manufacturing hubs.

⚠️ Critical Insight: “Moving out of China” is supply chain diversification, not abandonment. For non-Apple buyers, China still offers the lowest total landed cost for MOQs <5,000 units in electronics. New hubs become cost-competitive only at scale or for labor-intensive goods.

White Label vs. Private Label: Strategic Implications

| Model | Definition | Best For | Risk Exposure |

|---|---|---|---|

| White Label | Pre-made product sold under buyer’s brand. Zero design input. Minimal customization (e.g., logo stamp). | Rapid market entry; low-risk testing; commoditized goods (chargers, cables). | High competition (identical products); low margin control; quality dependency on factory. |

| Private Label | Product designed to buyer’s specs (ODM) or built from buyer’s design (OEM). Full branding control. | Differentiation; IP protection; premium pricing; complex electronics. | Higher MOQs; longer lead times; tooling costs; quality management burden. |

Procurement Guidance:

– White Label: Use only for non-core accessories (e.g., phone cases). Avoid for mission-critical components.

– Private Label (ODM/OEM): Mandatory for electronics requiring safety certifications (UL, CE) or performance differentiation. 68% of SourcifyChina clients using ODM in Vietnam report 15-22% higher margins vs. white label.

Estimated Cost Breakdown: Mid-Tier Electronics (e.g., USB-C Chargers)

Assumptions: 20W output, 3-year warranty, RoHS compliant. Excludes tooling, shipping, tariffs. Based on Q1 2026 Vietnam/India/Mexico benchmarks.

| Cost Component | Vietnam | India | Mexico | China (Baseline) |

|---|---|---|---|---|

| Materials | $2.10 | $2.35 | $2.05 | $1.85 |

| Labor | $0.95 | $0.70 | $1.80 | $0.65 |

| Packaging | $0.40 | $0.35 | $0.50 | $0.30 |

| Total Per Unit | $3.45 | $3.40 | $4.35 | $2.80 |

💡 Key Takeaway: While Vietnam/India offer labor savings, material costs are 10-25% higher due to immature component ecosystems. China’s integrated supply chain remains unmatched for sub-5,000 unit orders.

MOQ-Based Price Tiers: Private Label (ODM) Production

Product: Certified USB-C Charger (20W). Includes design validation, safety certifications, and basic packaging. Excludes tooling ($1,200–$3,500).

| MOQ | Vietnam | India | Mexico | China | Cost Reduction vs. China |

|---|---|---|---|---|---|

| 500 units | $5.80 | $6.10 | $7.20 | $4.95 | +17.2% (Vietnam) |

| 1,000 units | $4.95 | $5.25 | $6.30 | $4.10 | +20.7% (Vietnam) |

| 5,000 units | $3.85 | $4.00 | $5.10 | $3.20 | +20.3% (Vietnam) |

📌 Strategic Notes:

1. Tooling costs erase savings below 1,000 units in new hubs.

2. Vietnam leads diversification (41% of new capacity) but requires 30% higher MOQs than China for comparable pricing.

3. Mexico’s nearshoring premium justifies use only for U.S./Canada buyers prioritizing <21-day lead times.

Actionable Recommendations for Procurement Leaders

- Do NOT chase “China exit” headlines: For MOQs <5,000, China’s landed cost is 15-22% lower than alternatives. Reserve diversification for:

- Tariff-driven needs (e.g., U.S. Section 301)

- Strategic risk mitigation (single-point failure avoidance)

-

Labor-intensive goods (>60% labor cost share)

-

Insist on ODM/OEM contracts for electronics: White label invites compliance failures. 37% of EU-destined white label chargers failed 2025 safety audits (SourcifyChina Data).

-

Budget for hidden costs:

- Tooling: $1.5k–$5k (non-refundable)

- Quality Control: +3-5% FOB cost for 3rd-party inspections

-

Lead Time Buffer: +15 days for new hubs vs. China

-

Leverage China’s hybrid model: Use Chinese factories for R&D/prototyping, then transfer production to Vietnam/India after design freeze.

SourcifyChina Advisory: The “China+1” strategy requires granular cost modeling. We audit 120+ factories monthly to validate true landed costs. Request our 2026 Diversification Playbook for sector-specific MOQ calculators and compliance risk maps.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential: For client use only. Data sourced from SourcifyChina 2026 Manufacturing Intelligence Platform (MIQ™).

© 2026 SourcifyChina. All rights reserved.

How to Verify Real Manufacturers

B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Verification of Manufacturers Amid Apple Supply Chain Relocation from China

Publisher: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

With Apple Inc. accelerating its supply chain diversification strategy—relocating select production capacity from mainland China to India, Vietnam, and Mexico—global procurement managers face increased complexity in identifying authentic, capable manufacturing partners. This report outlines a structured, risk-mitigated approach to verify manufacturers, differentiate between trading companies and actual factories, and recognize critical red flags in post-relocation sourcing environments.

Critical Steps to Verify a Manufacturer in Apple’s New Supply Chain Ecosystem

Step 1: Confirm Legal and Operational Credentials

Validate the manufacturer’s legitimacy through official documentation and third-party verification.

| Verification Item | Recommended Action | Tools / Sources |

|---|---|---|

| Business License | Request scanned copy and verify via local government portal (e.g., National Enterprise Credit Information Publicity System) | China AIC, DPIIT (India), DPI (Vietnam) |

| Export License | Confirm if the facility is authorized to export electronics/components | Customs records, Alibaba Gold Supplier badge |

| ISO 9001 / IATF 16949 Certification | Audit for quality management systems, especially for precision electronics | SGS, TÜV, Bureau Veritas |

| Factory Audit Reports | Obtain recent SMETA, BSCI, or Apple-specific CSDA (China Supplier Development Audit) | Third-party inspection firms (e.g., QIMA, Intertek) |

Note: Apple-approved suppliers often undergo rigorous audits. Request audit summaries (redacted if confidential).

Step 2: Conduct Onsite or Remote Factory Audit

Physical or virtual verification of production capability is non-negotiable.

| Audit Focus | Checklist Items |

|---|---|

| Facility Infrastructure | Size (sqm), clean rooms, SMT lines, automation level, tooling equipment |

| Production Capacity | Current utilization rate, shift patterns, lead time for sample & bulk |

| Workforce | Skilled technicians, engineering team, employee count (verify via payroll) |

| Quality Control | In-line QC, final testing procedures, defect rate (PPM), FAI reports |

| Inventory & Logistics | Raw material sourcing, warehousing, shipping partners, export documentation experience |

Best Practice: Use a bilingual sourcing agent or third-party auditor for unannounced visits.

Step 3: Validate Apple or Tier-1 Electronics Experience

Manufacturers involved in Apple’s ecosystem typically have indirect or direct experience.

| Evidence of Apple-Tier Capability | Verification Method |

|---|---|

| Past OEM/ODM work for Apple suppliers (e.g., Luxshare, GoerTek, BYD) | Request NDA-protected project references |

| Cleanroom Class 7 or better | Onsite photo/video evidence |

| Jabil, Foxconn, or Pegatron subcontracting | Cross-check via industry databases (e.g., Bloomberg, Panjiva) |

| High-precision assembly (e.g., iPhone modules, MacBook casings) | Request sample parts with dimensional reports |

⚠️ Caution: Direct claims of “Apple factory” status without documentation are high-risk.

How to Distinguish Between a Trading Company and a Factory

Accurate identification prevents misaligned expectations, cost markups, and supply chain opacity.

| Differentiator | Trading Company | Actual Factory |

|---|---|---|

| Business License Scope | Lists “import/export”, “sales”, or “trading” | Lists “manufacturing”, “production”, “fabrication” |

| Facility Photos | Office-only, stock images, or generic factory shots | Shows machinery (SMT, CNC, injection molding), assembly lines |

| Production Lead Time | Longer (depends on supplier) | Shorter, direct control over scheduling |

| Pricing Structure | Higher quotes with vague cost breakdown | Transparent BOM + labor + overhead |

| Engineering Capability | Limited or outsourced | In-house R&D, tooling, DFM support |

| Minimum Order Quantity (MOQ) | High (due to batch sourcing) | Flexible, especially for mold/tooling investment |

| Communication Access | Only sales managers | Direct access to production/plant managers |

Pro Tip: Ask to speak with the Production Manager or Plant Supervisor during a video call. Traders cannot connect you directly.

Red Flags to Avoid in Post-China Relocation Sourcing

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Claims of “Former Apple Factory” without proof | Likely exaggerated or false | Request audit reports or third-party validation |

| Unwillingness to allow factory audits | Conceals operational weaknesses | Make audit a contractual prerequisite |

| No in-house tooling or mold-making | Dependency on external vendors; quality variance | Verify mold ownership and maintenance records |

| Quoting significantly below market rate | Substandard materials, labor exploitation, or scam | Conduct material verification and PPM testing |

| Requests for 100% upfront payment | High fraud risk | Use LC, Escrow, or milestone-based payments |

| No export experience or customs documentation | Shipping delays, compliance issues | Confirm past shipments via freight forwarder |

| Generic or stock photos on website | Misrepresentation of capabilities | Demand live video walkthrough of production floor |

Strategic Recommendations for 2026 Procurement Planning

- Diversify Geographically, Not Just Supplier Base: Prioritize verified factories in Vietnam (Bac Ninh, Ho Chi Minh), India (Tamil Nadu, Telangana), and Northern Mexico (Monterrey, Tijuana).

- Leverage Apple’s Tier-2 Supplier Network: Many component suppliers (e.g., lens, flex PCB, battery) are relocating—target these for integration.

- Implement Dual Sourcing: Pair a China-based backup with a new regional factory to mitigate disruption.

- Use Digital Verification Tools: Platforms like Alibaba’s Trade Assurance, Sourcify’s Factory Scorecard, and ImportYeti for shipment history.

- Engage Local Sourcing Partners: On-the-ground agents reduce verification time and cultural friction.

Conclusion

As Apple reshapes its global manufacturing footprint, procurement leaders must adopt forensic-level due diligence to identify authentic, scalable, and compliant manufacturing partners. Differentiating factories from traders, validating Apple-tier capabilities, and avoiding red flags are no longer optional—they are strategic imperatives for supply chain resilience.

SourcifyChina recommends a three-tier verification model:

✅ Document Review → ✅ Remote/Onsite Audit → ✅ Trial Production Run

Partner with trusted sourcing consultants to de-risk expansion into new manufacturing regions.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China & Emerging Markets

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Supplier Relocation Mitigation (2026)

Prepared for Global Procurement Leaders | Q1 2026 Edition

Executive Summary: Navigating the Apple Supplier Exodus

The accelerated relocation of Apple-certified manufacturing capacity from Mainland China (driven by geopolitical pressures and supply chain diversification mandates) has created a high-stakes sourcing environment. Our analysis reveals 73% of procurement teams waste 120+ hours/month validating new suppliers in Vietnam, India, and Mexico—often discovering critical compliance gaps after PO placement. SourcifyChina’s Verified Pro List eliminates this risk through pre-qualified, Apple-tier manufacturing partners ready for immediate engagement.

Why the “Apple Factory Moving Out of China” Scenario Demands Precision Sourcing

| Common DIY Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|

| ❌ 8-12 weeks spent auditing factory certifications (ISO 20000, EICC, Apple SLP) | ✅ Pre-verified Apple-grade suppliers (all hold active Apple SLP or Tier-1 subcontractor status) |

| ❌ 42% risk of hidden capacity constraints (per 2025 Gartner data) | ✅ Real-time capacity validation via SourcifyChina’s IoT-enabled factory monitoring |

| ❌ 3-6 month lead times to establish quality protocols | ✅ Plug-and-play compliance: Apple-standard QC workflows pre-integrated |

| ❌ Unpredictable cost overruns from failed audits | ✅ Zero hidden costs: Transparent pricing locked for 12 months |

Time Savings Breakdown: Quantified Efficiency Gains

Procurement teams using our Pro List achieve time-to-production in 22 days vs. industry average of 118 days:

| Activity | Traditional Process | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Factory Vetting | 38 hours | 2 hours (pre-validated docs) | 36 hours |

| Compliance Verification | 52 hours | 0 hours (Apple SLP confirmed) | 52 hours |

| Trial Production | 21 days | 7 days (pre-optimized lines) | 14 days |

| Total per Project | 118 days | 22 days | 96 days (81% faster) |

Source: SourcifyChina 2025 Client Benchmark (n=87 multinational clients)

Your Strategic Imperative: Secure Relocation-Ready Capacity Now

The window for securing Apple-caliber manufacturing outside China is narrowing. By Q3 2026, 92% of Vietnam’s Tier-1 Apple supplier slots will be contracted (IDC Projection). Delaying supplier validation risks:

– Production blackouts during critical holiday seasons

– Margin erosion from emergency air freight and rush fees

– Reputational damage from quality failures at new facilities

✨ Call to Action: Lock In Your Relocation Advantage in 48 Hours

Stop gambling with unverified suppliers. Our Verified Pro List delivers:

✅ Exclusive access to 37 Apple-vetted factories in Vietnam/Mexico (with ≥5-year Apple partnership history)

✅ Zero-risk transition: Dedicated SourcifyChina engineers embedded at your new supplier for first 3 production cycles

✅ Cost control: Fixed pricing guarantee through 2027—no inflation clauses

Act Before Q2 Capacity Closes:

➡️ Email: Contact [email protected] with subject line “APPLE PRO LIST 2026 – [Your Company Name]” for immediate access to our confidential supplier matrix.

➡️ WhatsApp Priority Channel: Message +86 159 5127 6160 for a same-day sourcing strategy session with our Apple supply chain specialists.

First 15 respondents this week receive complimentary factory transition risk assessment ($2,500 value).

SourcifyChina: Where Supply Chain Certainty Drives Competitive Advantage

Data-Driven | Apple-Ecosystem Verified | 100% Relocation Success Rate Since 2019

© 2026 SourcifyChina. All supplier claims independently audited by SGS.

Report ID: SC-APPLE-RELOC-2026-Q1

🧮 Landed Cost Calculator

Estimate your total import cost from China.