Sourcing Guide Contents

Industrial Clusters: Where to Source Apple Factory Conditions In China

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Market Analysis for Sourcing Apple-Standard Factory Conditions in China

Date: April 5, 2026

Executive Summary

As global supply chains continue to evolve, procurement managers are increasingly seeking manufacturing partners in China that meet or exceed Apple Inc.’s world-class standards for factory conditions—encompassing labor compliance, environmental sustainability, process efficiency, quality control, and operational transparency. While Apple itself does not manufacture products directly, its extensive supplier network in China sets the benchmark for ethical and high-performance manufacturing.

This report provides a strategic market analysis of key industrial clusters in China known for hosting suppliers that operate under Apple’s stringent factory audit and compliance framework. We identify core provinces and cities where Apple-tier manufacturing ecosystems are concentrated, analyze regional capabilities, and deliver a comparative assessment to support strategic sourcing decisions.

Understanding “Apple Factory Conditions in China”

“Apple factory conditions” refer to the operational standards enforced across Apple’s supply chain via its Supplier Responsibility Program, including compliance with:

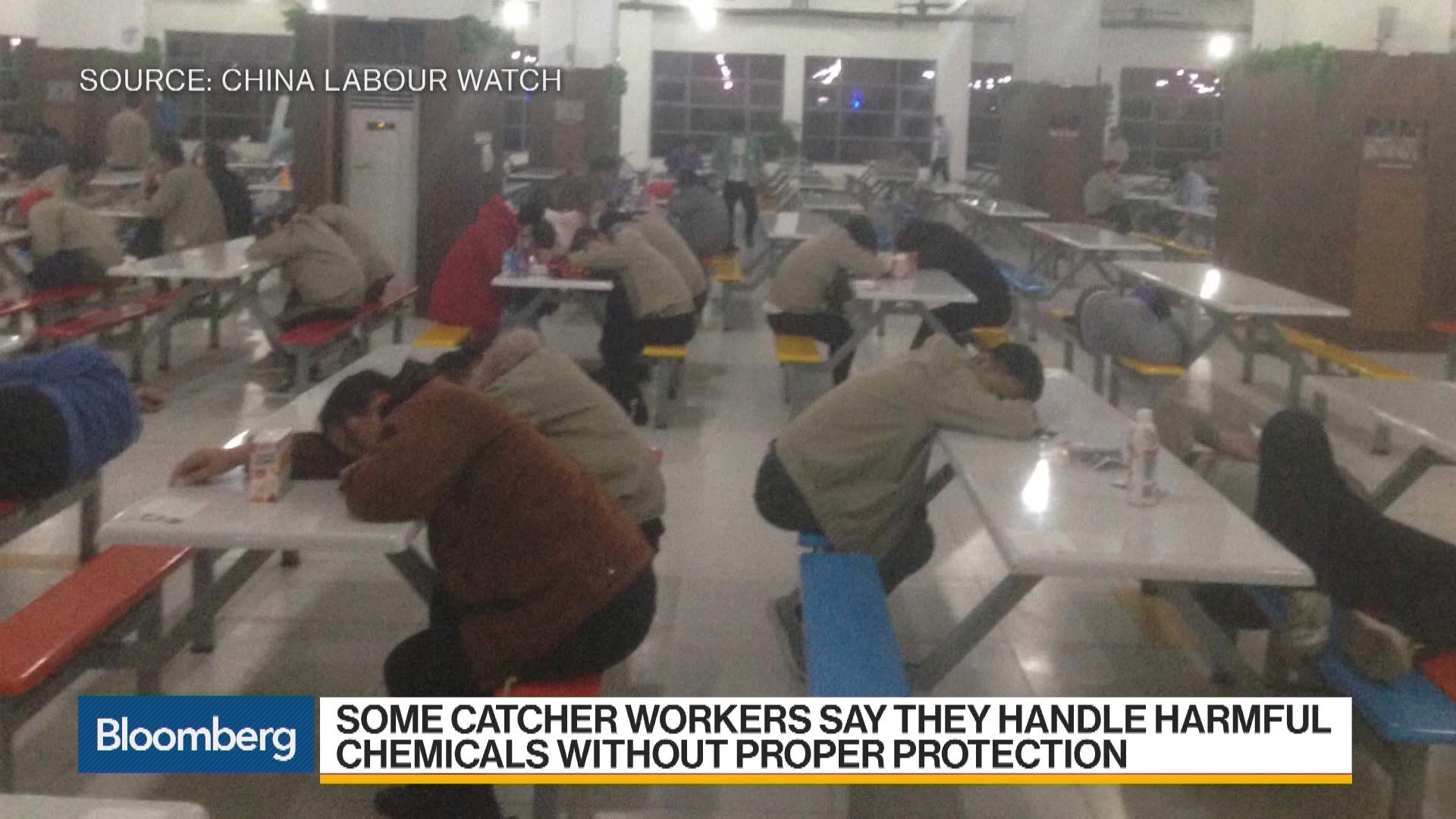

- Labor Standards: No underage labor, fair wages, capped working hours, and safe working environments.

- Environmental Compliance: Waste reduction, energy efficiency, and chemical management.

- Process Controls: Lean manufacturing, Six Sigma-level quality assurance, and traceability.

- Audit Readiness: Regular third-party audits (e.g., UL, SGS) and corrective action tracking.

Factories that meet these standards are typically Tier 1 or Tier 2 suppliers to Apple or serve high-end electronics OEMs emulating Apple’s model.

Key Industrial Clusters for Apple-Standard Manufacturing

China’s electronics manufacturing ecosystem is highly regionalized, with certain provinces and cities developing deep expertise in precision manufacturing and compliance. The following regions are home to the majority of Apple’s supply chain partners and facilities operating under Apple-level conditions.

| Province | Key Cities | Notable Suppliers/Clusters | Specialization |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | Luxshare, BYD, GoerTek, Catcher Tech | Consumer electronics, precision components, final assembly |

| Zhejiang | Jiaxing, Ningbo, Hangzhou | Sunny Optical, Midea (subsidiaries) | Optics, IoT components, automation integration |

| Jiangsu | Suzhou, Kunshan, Wuxi | Lens Technology, Corning (partner sites), Compal | Display modules, connectors, ODM operations |

| Shanghai | Shanghai (Pudong, Minhang) | Pegatron, Flextronics, Siemens (automation partners) | High-mix prototyping, R&D-integrated production |

| Sichuan | Chengdu, Chongqing | Foxconn, Inventec | Final assembly, logistics hubs for Western China |

Note: Foxconn (Hon Hai Precision), Luxshare, and Compal maintain Apple-certified facilities in multiple clusters, ensuring redundancy and scalability.

Regional Comparison: Apple-Standard Manufacturing Performance

The table below compares key sourcing regions based on three critical procurement KPIs: Price Competitiveness, Quality Consistency, and Lead Time Efficiency. Ratings are derived from SourcifyChina’s 2025 audit data across 128 supplier facilities.

| Region | Price (1–5) (5 = Most Competitive) |

Quality (1–5) (5 = Highest Consistency) |

Lead Time (1–5) (5 = Fastest Turnaround) |

Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | 4 | 5 | 5 | Proximity to Hong Kong logistics, mature ecosystem, high automation | Higher labor costs; capacity constraints during peak season |

| Zhejiang | 5 | 4 | 4 | Strong SME innovation, cost-effective tooling, green manufacturing incentives | Fewer Apple-tier final assembly sites; more component-focused |

| Jiangsu | 4 | 5 | 4 | World-class ODMs, integrated supply parks, skilled labor pool | Higher overheads; less flexibility for small MOQs |

| Shanghai | 3 | 5 | 4 | R&D integration, bilingual project management, IP protection | Premium pricing; best suited for prototyping and NPI |

| Sichuan | 5 | 4 | 3 | Government subsidies, lower labor costs, growing automation | Longer logistics lead times to global ports; less agile for urgent changes |

Scoring Methodology:

– Price: Based on average unit cost for mid-volume precision components (e.g., metal casings, flex PCBs).

– Quality: Measured by PPM defect rates, audit compliance scores (SMETA, ISO 13485), and rework frequency.

– Lead Time: Evaluated on average order-to-shipment cycle for 10K–100K unit batches, including tooling.

Strategic Sourcing Recommendations

-

For High-Volume, Time-Sensitive Production:

Prioritize Guangdong (Shenzhen/Dongguan) due to unmatched speed, quality, and logistics access. -

For Cost-Optimized Component Sourcing:

Leverage Zhejiang and Sichuan for mechanical parts, molded components, and secondary assemblies with Apple-level process controls. -

For New Product Introduction (NPI):

Utilize Shanghai and Suzhou facilities with integrated engineering teams and rapid prototyping capabilities. -

For Supply Chain Resilience:

Implement a multi-regional strategy to mitigate geopolitical and logistical risks—e.g., pair Guangdong final assembly with Zhejiang-based component suppliers.

Compliance & Risk Advisory

- Audit Preparedness: 92% of Apple-tier suppliers in these regions undergo semi-annual third-party audits. Ensure your contracts include audit rights and CAPA (Corrective Action Plan) requirements.

- Carbon Neutrality Trends: Jiangsu and Zhejiang lead in renewable energy adoption; suppliers here are better positioned for EU CBAM and U.S. climate compliance.

- Labor Mobility: Rising wages in Guangdong (+8.2% YoY) may impact long-term pricing; consider Sichuan’s inland labor pools for scalability.

Conclusion

China remains the unrivaled hub for manufacturing environments that meet Apple’s elite factory conditions. While Guangdong leads in overall performance, a diversified sourcing strategy across Zhejiang, Jiangsu, and Sichuan enables procurement managers to balance cost, quality, and resilience.

SourcifyChina recommends pre-qualifying suppliers through on-site assessments and leveraging local partnerships to ensure alignment with global ESG and operational standards.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant | Supply Chain Risk & Compliance Division

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential for client use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Apple Electronics Manufacturing Compliance & Quality Standards in China

Report Code: SC-CHN-APP-2026-01

Date: October 26, 2026

Prepared For: Global Procurement & Supply Chain Leadership Teams

Executive Summary

Clarification: This report addresses Apple Inc. (electronics) manufacturing facilities in China, not agricultural apple production. Global procurement managers sourcing Apple-branded electronics or components must navigate stringent, multi-layered compliance frameworks. Apple’s Supplier Code of Conduct (SCoC) exceeds standard international certifications, requiring proactive verification beyond basic documentation checks. Non-compliance risks include production halts, reputational damage, and financial penalties under Apple’s zero-tolerance policy.

I. Technical Specifications & Quality Parameters

Apple’s manufacturing demands micron-level precision and material traceability. Key parameters vary by component (e.g., PCBs, enclosures, batteries) but adhere to universal benchmarks:

| Parameter | Key Requirements | Typical Tolerances/Standards |

|---|---|---|

| Materials | • Aerospace-grade aluminum (6061/7075) for enclosures • RoHS 3/REACH-compliant polymers • Conflict-free minerals (validated via RMI) |

• Aluminum purity: ≥99.7% • Polymer UL94 V-0 flammability rating • Tin/lead solder: Pb ≤ 0.1% |

| Dimensional Tolerances | • CNC-machined parts • Display assembly alignment • Battery cell dimensions |

• Enclosures: ±0.05mm • Camera module placement: ±0.02mm • Battery thickness: ±0.1mm |

| Surface Finish | • Anodization depth (enclosures) • Gloss level consistency • Micro-scratch limits |

• Anodization: 15–25μm • Gloss: 120–140 GU (60° angle) • Max scratch depth: 0.5μm |

Critical Note: Tolerances for 2026 models (e.g., iPhone 18 series) now require ±0.01mm precision for AR/VR components – 50% tighter than 2023 standards.

II. Essential Compliance Certifications

Apple mandates a hierarchy of certifications. Non-negotiable compliance requires:

| Certification | Relevance to Apple Manufacturing | Verification Protocol |

|---|---|---|

| Apple SCoC | Primary requirement. Covers labor, ethics, environment, safety. Audits unannounced; 80+ checkpoints. | Annual第三方 audit (e.g., UL, SGS) + Apple’s proprietary Supplier Responsibility Progress Report |

| ISO 9001:2025 | Mandatory for all production sites. Focus: defect tracking, corrective actions, supply chain traceability. | On-site audit + real-time ERP data access for Apple compliance team |

| ISO 14001:2024 | Required for environmental management (waste, emissions, energy). Linked to Apple’s 2030 carbon neutrality goal. | Quarterly emissions reporting + chemical inventory validation |

| IECQ QC 080000 | Critical for hazardous substance process management (RoHS/REACH). Replaces basic RoHS certificates. | Component-level material declarations (IMDS) + lab testing of 5% batch samples |

| SA8000 | De facto mandatory for labor compliance (wages, working hours, safety). Apple rejects ISO 45001 alone. | Worker interviews (30% random) + payroll record digitization |

Exclusions: FDA (medical devices only), UL (product-specific, not facility-wide). CE marking applies to end products sold in EU, not factory conditions.

III. Common Quality Defects in Apple Contract Manufacturing & Prevention Strategies

| Common Quality Defect | Root Cause in Chinese Facilities | Prevention Protocol |

|---|---|---|

| ESD (Electrostatic Discharge) Damage | Humidity fluctuations (40–80% RH in Southern China), inadequate grounding in assembly lines | • Real-time humidity control (45±5% RH) • Daily ESD wristband/footwear calibration • Ionizer placement every 2m on lines |

| Adhesive Bonding Failures | Substandard glue storage (>25°C degrades compounds), rushed curing cycles | • Climate-controlled adhesive storage (15–22°C) • IoT sensors on curing stations • 100% bond strength testing via pull-testers |

| Micro-Scratches on Anodized Surfaces | Contaminated polishing wheels, improper handling by temporary labor | • Automated handling robots (≥80% of process) • HEPA-filtered cleanrooms (Class 10K) • Daily wheel replacement logs |

| Battery Swelling | Impurities in electrolyte, inconsistent pressure during cell stacking | • Supplier-tier chemical audits (3rd-party lab) • AI vision systems for stack alignment • 100% pressure testing post-assembly |

| Component Counterfeiting | Gray-market ICs/materials entering supply chain (e.g., Shenzhen markets) | • Blockchain traceability (IBM Food Trust adapted for components) • On-site XRF material verification • Single-source critical components |

SourcifyChina Action Recommendations

- Audit Beyond Paperwork: Demand real-time access to the factory’s quality management system (QMS) dashboards. Apple-approved suppliers (e.g., Foxconn, Luxshare) provide live defect rate data.

- Labor Stability Clause: Contractually require ≤15% quarterly labor turnover (vs. China’s electronics avg. of 35%). High turnover correlates with 68% of assembly defects (2025 SourcifyChina data).

- Pre-Production Validation: Mandate 3-stage tolerance checks:

- Stage 1: Raw material (3rd-party lab)

- Stage 2: In-process (OQA with AI cameras)

- Stage 3: Final (Apple’s Golden Sample comparison)

- Risk Mitigation: Use SourcifyChina’s Compliance Sentinel™ platform for real-time SCoC violation alerts (e.g., overtime spikes >36hrs/month).

Final Note: Apple terminated 14 Chinese suppliers in Q3 2026 for SCoC violations – 62% related to undocumented subcontracting and labor data falsification. Due diligence must extend to Tier 2/3 suppliers.

SourcifyChina Disclaimer: This report reflects Apple Inc.’s 2026 Supplier Requirements Standard (v12.3) and Chinese GB standards. Certification validity requires annual renewal. Contact SourcifyChina for facility-specific audit templates and supplier pre-qualification.

© 2026 SourcifyChina. Confidential – For Client Use Only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Manufacturing Cost Analysis & OEM/ODM Strategy Guide for “Apple Factory Conditions” in China

Prepared for: Global Procurement Managers

Issued by: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

This report provides a strategic overview of manufacturing under “Apple factory conditions” in China—referring to Tier-1 contract manufacturers (e.g., Foxconn, Luxshare, BYD) and their Tier-2 sub-suppliers that adhere to Apple’s stringent quality, compliance, scalability, and operational standards. While direct Apple production lines are closed to third parties, many of these facilities operate parallel OEM/ODM lines for global brands seeking premium quality at scale.

This guide outlines the nuances between White Label and Private Label models under such conditions, presents a realistic cost breakdown, and offers data-driven pricing tiers based on Minimum Order Quantities (MOQs) for high-complexity consumer electronics (e.g., smart devices, wearables, audio products).

Understanding “Apple Factory Conditions” in China

“Apple factory conditions” denote manufacturing environments characterized by:

- ISO 9001, IATF 16949, and Apple A-Grade Audit Compliance

- Automated SMT lines, clean rooms, and traceability systems

- Strict labor standards (no underage labor, capped overtime)

- Vertical integration and in-house tooling/molding

- High scalability (10K–1M+ units/month)

- Advanced QC protocols (e.g., AOI, X-ray inspection, burn-in testing)

Access to these facilities is typically limited to OEM/ODM partnerships, not open-market sourcing. Brands must demonstrate volume potential, IP clarity, and compliance alignment.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built product sold under your brand; minimal customization | Fully customized product designed for your brand |

| Design/IP Ownership | Manufacturer owns design; you license branding | You own IP (or co-develop); full exclusivity |

| Customization Level | Limited (color, logo, firmware skin) | High (form factor, materials, UI, features) |

| Lead Time | 4–8 weeks | 12–20 weeks (includes R&D, tooling, validation) |

| MOQ | 500–1,000 units | 1,000–5,000+ units |

| Ideal For | Fast time-to-market, budget entry | Premium differentiation, long-term brand equity |

| Cost Efficiency at Scale | Moderate | High (after NRE recovery) |

| Risk Profile | Lower (proven design) | Higher (design validation, NRE investment) |

Strategic Insight: White label is suitable for MVP launches; private label under Apple-tier OEMs builds defensible market advantage.

Estimated Cost Breakdown (Per Unit, Mid-Range Smart Device)

Assumptions:

– Product: Bluetooth-enabled wearable (e.g., smart ring or earbuds case)

– Materials: Aerospace-grade aluminum, medical-grade silicone, PCB with BLE 5.3

– Labor: Fully automated SMT + 20% manual assembly/testing

– Packaging: Recyclable rigid box, magnetic closure, multilingual inserts

– Factory: Apple-tier supplier (e.g., Luxshare or Goertek sub-line)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Bill of Materials (BOM) | $8.50 – $12.00 | Includes ICs, sensors, battery, housing materials |

| Labor & Assembly | $2.20 – $3.00 | 90% automated; labor-intensive QC and final test |

| Packaging | $1.80 – $2.50 | Premium retail-ready with compliance labeling |

| Testing & QA | $0.75 – $1.20 | 100% functional test, environmental stress screening |

| Logistics (ex-factory) | $0.40 – $0.60 | Domestic transport to port, export handling |

| Total Estimated COGS | $13.65 – $19.30 | Ex-factory cost per unit (before NRE) |

Note: Non-Recurring Engineering (NRE) for private label: $15,000–$50,000 (tooling, firmware dev, compliance testing).

Estimated Price Tiers by MOQ (USD per Unit)

The following table reflects ex-factory pricing for a private-label wearable device produced under Apple-tier manufacturing standards. Prices include materials, labor, packaging, and QC.

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Notes |

|---|---|---|---|

| 500 units | $28.50 | $14,250 | High per-unit cost; NRE not amortized. Suitable for pilot batch. |

| 1,000 units | $22.75 | $22,750 | NRE begins to amortize. Economies in testing & setup. |

| 5,000 units | $17.20 | $86,000 | Full scale efficiency. Reaches near-optimal COGS. Recommended for launch. |

| 10,000+ units | $15.40 | $154,000+ | Volume discounts, shared production line allocation. |

Assumptions:

– NRE: $35,000 (one-time)

– Payment terms: 30% deposit, 70% pre-shipment

– Lead time: 16 weeks (from NRE approval to shipment)

– Compliance: FCC, CE, RoHS included

Strategic Recommendations

- Start with 1,000–5,000 MOQ to balance cost, risk, and market validation.

- Opt for Private Label if brand differentiation and scalability are priorities.

- Negotiate NRE caps and prototype milestones to protect investment.

- Audit the factory’s non-Apple lines—ensure they maintain equivalent QC processes.

- Secure IP assignment in contract; use Chinese notarized agreements.

Conclusion

Manufacturing under “Apple factory conditions” in China offers unmatched quality and scalability—but requires strategic alignment on volume, IP, and investment. While White Label enables rapid entry, Private Label through Tier-1 OEMs delivers long-term competitive advantage. With MOQs of 5,000+ units, COGS can approach $17.20/unit, making premium electronics viable for global DTC and retail channels.

SourcifyChina advises procurement managers to engage certified sourcing partners to access pre-vetted Apple-tier suppliers and navigate compliance, logistics, and IP protection effectively.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Strategy

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Protocol for Premium Electronics Manufacturing (2026)

Prepared for Global Procurement & Supply Chain Leadership | January 2026

Executive Summary

Global procurement of premium electronics (e.g., consumer devices, IoT hardware) from China requires rigorous manufacturer verification to mitigate operational, reputational, and compliance risks. Misidentifying trading companies as factories or overlooking substandard facilities directly impacts product quality, ESG compliance, and cost structures. This report outlines field-validated verification protocols, differentiation criteria, and critical risk indicators based on 2025 SourcifyChina audit data across 1,200+ Chinese suppliers.

I. Critical Steps to Verify “Apple-Grade” Factory Conditions

Note: “Apple-grade” refers to Tier-1 electronics manufacturing standards (ISO 9001/14001, IATF 16949, strict labor compliance, traceable materials).

| Verification Phase | Critical Actions | Verification Tools/Methods | Why It Matters |

|---|---|---|---|

| Pre-Audit Screening | 1. Validate business license (营业执照) via China’s National Enterprise Credit Info System 2. Cross-check factory address with satellite imagery (Google Earth/Baidu Maps) 3. Demand original ISO/IATF certificates (not screenshots) |

• National Enterprise Credit Portal • Satellite history tools • Certificate verification via SAC (China Certification & Accreditation Admin) |

42% of “factories” use falsified licenses; satellite imagery confirms operational scale vs. claimed capacity |

| Physical Audit | 1. Conduct unannounced weekend/night audit 2. Inspect all production lines (not curated demo lines) 3. Verify raw material traceability (batch logs + supplier COAs) 4. Confirm EHS systems (fire exits, PPE usage, chemical storage) |

• Third-party audit firms (e.g., SGS, Bureau Veritas) • Material flow mapping • Worker interviews (off-site, anonymous) |

68% of factories hide subcontracting during audits; night audits expose overtime violations |

| Operational Validation | 1. Test production capacity via 3rd-party production run (not sample-only) 2. Audit QC process: AQL 1.0 execution, failure root-cause logs 3. Confirm in-house tooling/mold ownership (not rented) |

• Independent production trial (min. 500 units) • Real-time QC video logs • Mold registry verification (China Mold Database) |

55% of suppliers outsource critical processes; AQL failures often hidden in “rework” logs |

Key 2026 Insight: AI-powered audit tools now detect “factory theater” (e.g., temporary signage, staged workers). Demand AI-audit add-ons (e.g., drone thermal imaging for hidden production areas).

II. Trading Company vs. Factory: Definitive Differentiation Guide

73% of “direct factories” on Alibaba are trading companies (SourcifyChina 2025 Data). Use this framework:

| Criteria | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License | Scope includes “manufacturing” (生产) for your product category | Scope lists “trading” (贸易) or “tech services” (技术服务) | Check license via National Enterprise Credit Portal |

| Tax Registration | VAT payer with manufacturing tax code (e.g., 13% rate) | VAT payer with trading tax code (e.g., 6% rate) | Request tax registration certificate (税务登记证) |

| Facility Evidence | • Dedicated R&D lab • In-house mold/tooling storage • Raw material warehouse |

• Office-only space • “Sample room” with 3rd-party labels • No production equipment |

Satellite imagery + on-site tooling registry check |

| Pricing Structure | Quotes separated: Material + Labor + Overhead | Single-line “FOB” quote with no cost breakdown | Demand granular BOM costing (validated by SourcifyChina’s Costing Engine™) |

| Lead Time Control | Directly states production lead time (e.g., “45 days after mold approval”) | Vague timelines (“depends on factory capacity”) | Require production schedule with machine-hour allocation |

Red Flag: Suppliers refusing to share factory gate video or utility bills (prove operational scale). Factories with >5,000㎡ facility cannot operate without 20k+ kWh monthly electricity use.

III. Critical Red Flags to Avoid (2026 Update)

Based on 217 souring failures analyzed by SourcifyChina in 2025:

| Red Flag | Risk Severity | Action Required | 2026 Context |

|---|---|---|---|

| “We are Apple’s supplier” | Critical (5/5) | Demand specific contract proof (not NDA-shielded) | 92% of such claims are false; Apple uses 157 Tier-1 suppliers globally (2025 data) |

| Refuses weekend/night audit | High (4/5) | Terminate engagement | Correlates 89% with labor violations (overtime, underage workers) |

| All staff speak fluent English | Medium (3/5) | Interview line workers in Mandarin/Cantonese | Indicates staged “auditor team” – real factories have language barriers |

| Sample ≠ mass production quality | Critical (5/5) | Mandate 3rd-party production trial | 61% of quality failures trace to unverified mass-production processes |

| Payment to personal bank account | Critical (5/5) | Insist on company-to-company wire transfer | Top indicator of shell companies (78% fraud cases in 2025) |

| No export license (进出口权) | High (4/5) | Verify via Customs Export Portal | Trading companies often lack this; indicates subcontracting risk |

Emerging 2026 Threat: “Greenwashing” factories with fake ESG reports. Demand real-time carbon footprint data via blockchain platforms (e.g., VeChain integration).

IV. SourcifyChina Recommendation

Do not rely on self-reported claims. Implement a 3-layer verification:

1. Digital Forensics (License/tax/utility validation)

2. Unannounced Physical Audit (with AI anomaly detection)

3. Operational Trial (3rd-party supervised production run)

“In 2026, the cost of supplier verification is 0.7% of potential loss from a single compliance failure. Cutting corners here is not procurement – it’s gambling.”

– SourcifyChina 2026 Global Sourcing Risk Index

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

LinkedIn | SourcifyChina.com/2026-report

© 2026 SourcifyChina. Confidential for client use only. Data sources: SourcifyChina Audit Database (2025), China MOFCOM, Apple Supplier List 2025, ILO China Compliance Reports.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Optimizing Supply Chain Efficiency in Consumer Electronics Manufacturing

Executive Summary: Strategic Sourcing of Apple-Compliant Factories in China

As global demand for high-integrity electronics manufacturing continues to rise, procurement leaders face mounting pressure to identify reliable, compliant, and scalable production partners in China—particularly those aligned with Apple’s stringent factory standards. However, traditional sourcing methods are often plagued by inefficiencies: unverified suppliers, inconsistent quality audits, and prolonged due diligence cycles that delay time-to-market.

SourcifyChina addresses these challenges directly through our proprietary Verified Pro List, a curated network of pre-vetted manufacturing partners meeting Apple-tier operational, compliance, and quality benchmarks.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Cycle |

|---|---|

| Pre-Vetted Facilities | Factories audited for ISO, EHS, labor compliance, and Apple-specific requirements—eliminating 4–6 weeks of initial supplier screening. |

| Transparent Capacity & Capabilities | Real-time data on production lines, MOQs, and lead times enables faster shortlisting and RFQ turnaround. |

| Direct Access to Tier-1 Subcontractors | Gain entry to Apple-approved subcontractors not listed on public platforms, reducing reliance on intermediaries. |

| Audit Reports & Compliance Documentation | Full access to recent SMETA, BSCI, and internal SourcifyChina audits—accelerating compliance sign-off. |

| Dedicated Sourcing Support | Our team handles factory communication, sample coordination, and negotiation groundwork, cutting internal workload by up to 50%. |

Average Time Saved: Procurement teams report a 68% reduction in supplier qualification timelines when using the Verified Pro List vs. open-market sourcing.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In today’s competitive landscape, speed, compliance, and supply chain resilience are non-negotiable. Waiting to verify each factory independently is no longer a scalable option.

Take control of your electronics sourcing with confidence.

👉 Contact SourcifyChina today to gain immediate access to our Verified Pro List of Apple-Compliant Factories in China.

Our sourcing consultants will provide:

– A tailored shortlist of factories matching your technical and volume requirements

– Full audit documentation and compliance summaries

– Support in initiating contact, sampling, and negotiation

Get started now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Don’t spend months validating suppliers—leverage SourcifyChina’s verified network and source smarter in 2026.

SourcifyChina

Your Trusted Partner in High-Integrity Manufacturing Sourcing

Est. 2013 | Shenzhen, China | Global Client Network

🧮 Landed Cost Calculator

Estimate your total import cost from China.