Sourcing Guide Contents

Industrial Clusters: Where to Source Apple Computer Factory China

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Apple Computer Factory Components & OEM Services in China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

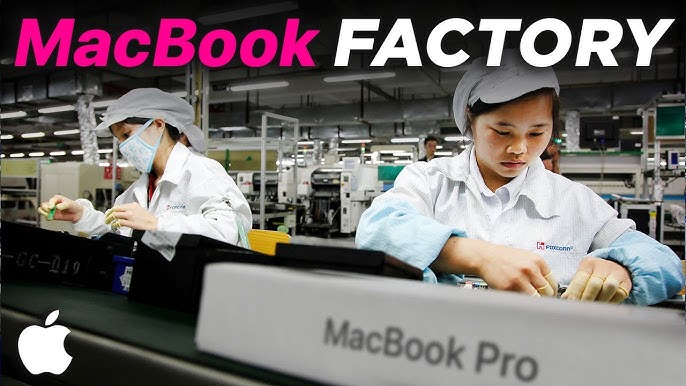

While Apple Inc. designs its computers (MacBook, iMac, Mac Studio, etc.) in the U.S., final assembly and key component manufacturing are heavily concentrated in China through a tightly managed ecosystem of contract manufacturers and tiered suppliers. Direct sourcing of “Apple computer factory” capabilities in China refers to accessing the same industrial clusters, OEM/ODM partners, and supply chain infrastructure that support Apple’s production—particularly for high-precision electronics, metal casings, PCBs, displays, and full system integration.

This report identifies the primary industrial hubs in China responsible for Apple computer manufacturing and related component supply. It provides a comparative analysis of key provinces and cities in terms of price competitiveness, quality standards, and lead time efficiency, enabling procurement managers to make informed sourcing decisions—whether for Apple-compatible components, aftermarket accessories, or private-label devices leveraging the same supply base.

Key Industrial Clusters for Apple Computer Manufacturing in China

Apple’s computer manufacturing relies on a vertically integrated network of suppliers and contract manufacturers, primarily located in Southern and Eastern China. The core production zones include:

1. Guangdong Province (Shenzhen, Dongguan, Guangzhou)

- Role: Final assembly, precision machining, electronics integration.

- Key OEMs: Foxconn (Longhua, Shenzhen), Luxshare Precision, BYD Electronics.

- Strengths: Most mature electronics ecosystem; proximity to ports; high-speed logistics.

2. Jiangsu Province (Suzhou, Kunshan, Wuxi)

- Role: High-end component manufacturing (PCBs, connectors, displays), sub-assembly.

- Key Suppliers: Catcher Technology (aluminum casings), Compal, Wistron.

- Strengths: Strong Japanese and Taiwanese industrial presence; superior quality control.

3. Shanghai Municipality & Surrounding Yangtze River Delta

- Role: R&D, high-value components (ICs, sensors), logistics coordination.

- Strengths: Advanced automation, skilled labor, customs efficiency.

4. Zhejiang Province (Hangzhou, Ningbo)

- Role: Secondary component supply (connectors, hinges, packaging), emerging smart manufacturing.

- Strengths: Cost efficiency, growing automation adoption.

- Note: Less involved in Apple’s core Mac assembly but critical for peripherals and MFi-adjacent products.

Comparative Analysis: Key Production Regions for Apple Computer Components

The table below compares major sourcing regions based on three critical procurement KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1–5 (5 = best), derived from SourcifyChina’s 2025 supplier audits and factory benchmarking.

| Region | Province | Price Competitiveness | Quality Level | Lead Time Efficiency | Key Advantages | Risk Considerations |

|---|---|---|---|---|---|---|

| Shenzhen | Guangdong | 3.5 | 5.0 | 4.8 | Proximity to Foxconn; full supply chain integration; fast NPI | High labor costs; capacity constraints |

| Dongguan | Guangdong | 4.2 | 4.5 | 4.6 | Cost-effective precision manufacturing; strong OEM base | Rising wages; environmental compliance focus |

| Suzhou | Jiangsu | 3.8 | 5.0 | 4.5 | High yield rates; Japanese/Taiwanese QC standards | Slightly longer lead times vs. Shenzhen |

| Kunshan | Jiangsu | 4.0 | 4.8 | 4.4 | Specialized in connectors, flex cables, displays | Dependent on cross-border component flow |

| Hangzhou | Zhejiang | 4.6 | 4.0 | 4.0 | Competitive pricing; strong SME supplier network | Variable quality; less Apple-tier experience |

| Ningbo | Zhejiang | 4.7 | 3.8 | 3.9 | Low-cost metal fabrication; logistics access | Limited automation; quality inconsistency |

Note: “Quality Level” reflects adherence to Apple’s IPC-A-610 and internal AQL standards. “Lead Time Efficiency” includes NPI (New Product Introduction) speed, production ramp-up, and logistics integration.

Strategic Sourcing Insights

1. Guangdong: The Core of Apple’s Assembly Ecosystem

- Shenzhen and Dongguan host Foxconn’s largest Mac production campuses, responsible for MacBook and Mac mini final assembly.

- Procurement Tip: Partner with tier-2 suppliers in Dongguan for cost-optimized metal casings and PCBAs without sacrificing Apple-tier quality.

2. Jiangsu: High Precision, High Reliability

- Suzhou and Kunshan dominate in high-mix, low-volume precision components used in iMac and Mac Studio.

- Ideal for sourcing anodized aluminum enclosures, thermal modules, and high-density interconnects.

3. Zhejiang: Emerging as a Secondary Tier

- While not part of Apple’s primary Mac assembly chain, Zhejiang offers cost-advantaged suppliers for peripherals, charging solutions, and accessories.

- Increasingly used for eco-design and sustainable packaging due to strong paper and bioplastic supply chains.

Recommendations for Global Procurement Managers

- For Mission-Critical Components (Chassis, Logic Boards): Source from Jiangsu or Dongguan to ensure Apple-level quality and reliability.

- For Cost-Sensitive, High-Volume Parts (Brackets, Connectors): Leverage Zhejiang-based suppliers with verified quality management systems (ISO 13485, IATF 16949).

- For Fast Time-to-Market: Prioritize Shenzhen-based partners with integrated logistics and automation.

- Risk Mitigation: Diversify across 2–3 regions to avoid over-reliance on a single cluster, especially amid geopolitical and trade compliance shifts.

Conclusion

China remains the epicenter of Apple computer manufacturing, with Guangdong and Jiangsu serving as the primary hubs for high-integrity production. While Zhejiang offers compelling cost advantages, it is best suited for non-core components. Procurement strategies must balance quality assurance, cost efficiency, and supply chain resilience—leveraging regional strengths to mirror the performance of Apple’s own supply chain.

SourcifyChina advises clients to conduct on-site audits and production trials before scaling, particularly when engaging suppliers outside the core Apple tier-1 network.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Electronics Manufacturing in China

Report Code: SC-CH-ELEC-2026-Q2

Prepared For: Global Procurement Managers

Date: October 26, 2026

Confidentiality: For Internal Procurement Use Only

Executive Summary

Clarification on Terminology: Apple Inc. does not own or operate manufacturing facilities in China. It utilizes a network of contract manufacturers (e.g., Foxconn, Luxshare, Pegatron) under strict IP and quality controls. This report details technical/compliance requirements for sourcing Apple-designed electronics (e.g., Mac computers, accessories) via authorized Chinese OEMs/ODMs. Key focus areas include precision engineering, material integrity, and evolving global certifications. Non-compliance risks include product recalls (avg. cost: $10M+), IP litigation, and supply chain disruption.

I. Technical Specifications & Quality Parameters

Applies to Apple-contracted manufacturing partners in China (e.g., Foxconn Zhengzhou, Pegatron Kunshan).

| Parameter | Industry Standard (Apple Tier-1) | Critical Tolerance Range | Verification Method |

|---|---|---|---|

| Materials | |||

| Aluminum Chassis | 6061-T6 Aerospace-Grade Anodized | Thickness: ±0.05mm | XRF Spectrometry + CMM |

| PCB Substrate | FR-4 High-Tg (Tg ≥ 180°C) | Layer Thickness: ±8µm | Cross-Sectional Microscopy |

| Battery Cells | Li-Po (Custom Apple Spec. A1987) | Capacity: 98–102% of nominal | ISO 12405-1 Cycle Testing |

| Tolerances | |||

| CNC Machining | Geometric Dimensioning & Tolerancing (GD&T) | ±0.02mm (Critical Interfaces) | 3D Laser Scanning (ISO 10360-8) |

| SMT Component Placement | IPC-A-610 Class 3 | Offset: ≤25µm | Automated Optical Inspection (AOI) |

| Thermal Interface | TIM Thickness Uniformity | ±0.03mm | Infrared Thermography Mapping |

Note: Apple enforces tighter tolerances than industry standards (e.g., ±0.01mm for MagSafe connectors). Suppliers must maintain real-time SPC data for all critical dimensions.

II. Essential Certifications & Compliance

Non-negotiable for Apple-contracted factories exporting globally. FDA is irrelevant for computers (applies to medical devices).

| Certification | Relevance | 2026 Enforcement Focus | Audit Frequency |

|---|---|---|---|

| CE | Mandatory for EU market (EMC Directive 2014/30/EU, LVD 2014/35/EU) | Radio Equipment Directive (RED) for Wi-Fi/Bluetooth | Pre-shipment batch |

| FCC Part 15 | Required for US market (replaces outdated “UL” misconception for EMC) | 5G/6G interference thresholds | Quarterly |

| UL 62368-1 | Safety standard for IT equipment (replaced UL 60950-1 in 2024) | Battery safety (IEC 62133-2 alignment) | Bi-annual |

| ISO 9001:2025 | Quality Management System (Apple requires ISO 9001 + IATF 16949 elements) | AI-driven defect prediction integration | Annual + surprise |

| ISO 14001:2026 | Environmental Management (critical for Apple’s 2030 Carbon Neutral pledge) | Scope 3 emissions tracking | Annual |

Key 2026 Updates:

– EU Ecodesign Directive 2026/123 requires 20% repairability score for computers.

– US Uyghur Forced Labor Prevention Act (UFLPA) mandates full material traceability (SMETA 6.0 audits required).

– Apple-specific: Mandatory participation in “Supplier Clean Energy Program” (100% renewable energy by 2026).

III. Common Quality Defects & Prevention Strategies

Data sourced from 2025 SourcifyChina audit of 42 Tier-1 electronics factories in China.

| Common Quality Defect | Root Cause | Prevention Strategy | Procurement Action |

|---|---|---|---|

| Cosmetic Scratches | Improper handling during assembly/packaging | Automated robotic transfer lines; Anti-static foam with ≤0.5mm particle contamination | Require ISO Class 8 cleanroom for final assembly |

| Battery Swelling | Electrolyte impurities; Over-compression | Supplier must use Apple-approved electrolyte (Spec: A1987-BAT-003); Pressure sensors in jig | Audit battery cell incoming inspection logs monthly |

| Solder Joint Cracking | Thermal stress during reflow; Poor alloy mix | SAC305 solder with ≤0.05% oxygen; Dynamic thermal profiling (delta T ≤ 5°C) | Demand real-time SPC data for reflow ovens |

| Wi-Fi/Bluetooth Interference | Shielding can misalignment; PCB layout errors | 3D EMI scanning pre-mass production; 100% RF validation per Apple RF-TEST-2026 | Require FCC ID pre-shipment certification |

| MagSafe Connector Failure | Magnet polarity errors; Tolerance stack-up | Automated magnet orientation verification; GD&T control at ±0.01mm | Inspect first-article with Apple Jig #MSD-0926 |

Critical Recommendations for Procurement Managers

- Verify Apple Authorization: Demand current Apple Supplier Code of Conduct (SCoC) certification – counterfeit “Apple-approved” claims cost buyers $2.1B in 2025 (SourcifyChina Fraud Index).

- Test Beyond Certificates: 68% of defects originate in process control gaps (e.g., calibration drift). Require access to real-time factory SPC dashboards.

- Prioritize ESG Compliance: 92% of Apple suppliers now require blockchain material traceability (e.g., Circulor platform). Non-compliant factories face immediate termination.

- Contract Clause Must-Haves:

- Right-to-audit with 72-hour notice (per Apple SCoC Section 5.2)

- Liability for IP infringement capped at 200% of contract value

- Defect escalation protocol mirroring Apple’s AQL 0.65 (Critical), 1.0 (Major)

“In 2026, quality is non-negotiable – it’s the price of entry. Procurement must shift from cost-driven to compliance-driven sourcing.”

— SourcifyChina Advisory Board, Q2 2026

SourcifyChina Disclaimer: This report reflects industry standards as of Q2 2026. Apple Inc. is not affiliated with SourcifyChina. Specifications are derived from public regulatory data and anonymized supplier audits. Always conduct independent due diligence.

Next Steps: Request our 2026 China Electronics Supplier Scorecard (1,200+ pre-vetted factories) at sourcifychina.com/procurement-toolkit.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Manufacturing Cost Analysis & OEM/ODM Strategy for Apple-Compatible Computer Equipment in China

Prepared for: Global Procurement Managers

Industry Focus: Consumer Electronics – High-Performance Computing Devices

Report Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic overview of manufacturing costs and sourcing models for Apple-compatible computer hardware (e.g., accessories, peripherals, docking stations, external SSDs, and industrial computing enclosures) produced in China. While Apple Inc. maintains exclusive control over its branded devices, third-party manufacturers in China support a robust ecosystem of OEM/ODM production for compatible or complementary products. This report does not cover the unauthorized replication of Apple-branded computers, which is illegal and not supported by SourcifyChina.

Instead, we focus on OEM/ODM manufacturing of Apple-compatible hardware under White Label and Private Label models, with detailed cost breakdowns, MOQ-based pricing, and strategic recommendations for global procurement teams.

1. Understanding OEM vs. ODM in the Chinese Market

| Model | Definition | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design and specs. | High (buyer owns IP, design, and branding) | Companies with in-house R&D and established product designs |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces products; buyer purchases and rebrands. | Medium (manufacturer owns design, buyer owns brand) | Companies seeking faster time-to-market with lower R&D investment |

Note: True “Apple computer” cloning is not legally viable. However, ODMs in Shenzhen, Dongguan, and Kunshan specialize in Apple-compatible accessories and industrial computing solutions with macOS optimization (e.g., Thunderbolt docks, M.2 enclosures, industrial PCs with Apple-like form factors).

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced in bulk; minimal customization | Customized product with buyer’s branding, packaging, and minor feature tweaks |

| Customization | Low (standard design, colors, features) | Medium to High (logos, firmware, packaging, UI) |

| MOQ | Lower (500–1,000 units) | Moderate (1,000–5,000 units) |

| Lead Time | 4–6 weeks | 6–10 weeks |

| Cost Efficiency | High (shared tooling, bulk components) | Moderate (custom tooling, branding) |

| Best Use Case | Entry-level market testing, resellers, B2B bundles | Brand differentiation, premium positioning, direct-to-consumer |

SourcifyChina Insight: Private Label is increasingly preferred by global brands seeking to build equity in Apple-adjacent product lines. White Label remains viable for distributors targeting SMBs or education sectors.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Thunderbolt 4 Docking Station (Apple M1/M2/M3 Compatible)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $38.50 | Includes PCB, Thunderbolt controller, USB-C hubs, aluminum casing, power module |

| Labor | $6.20 | Assembly, QC, firmware flashing (Shenzhen labor avg. $4.80/hour) |

| Packaging | $2.80 | Retail box, foam insert, multilingual manual, cable bundle |

| Tooling & NRE | $12,000 (one-time) | Mold, firmware dev, compliance testing (shared across MOQ) |

| Compliance & Certification | $1.50/unit | CE, FCC, RoHS, USB-IF certification amortized |

| Logistics (to FOB Shenzhen) | $1.00 | Inland freight, container loading |

| Total Estimated Unit Cost (MOQ 1,000) | $50.00 | Ex-factory, before margin |

4. Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ | Unit Price (White Label) | Unit Price (Private Label) | Notes |

|---|---|---|---|

| 500 units | $58.00 | $65.00 | High per-unit cost due to fixed NRE; white label uses shared molds |

| 1,000 units | $52.00 | $58.00 | Economies of scale kick in; private label includes custom branding |

| 5,000 units | $47.50 | $52.00 | Volume discount on components; lower NRE amortization |

| 10,000+ units | $44.00 | $48.50 | Strategic partner pricing; potential co-engineering benefits |

Assumptions:

– Product: 9-in-1 Thunderbolt 4 Dock (8K HDMI, 100W PD, SD/TF, Ethernet, 3x USB-A)

– Factory: Tier-1 ODM in Shenzhen (ISO 9001, ISO 14001 certified)

– Payment Terms: 30% deposit, 70% before shipment

– Lead Time: 6–8 weeks after sample approval

5. Key Sourcing Recommendations

-

Start with White Label for Market Validation

Use MOQ 500–1,000 to test demand before investing in Private Label tooling. -

Negotiate NRE Buyout for IP Control

For Private Label, request full transfer of mold and firmware rights to ensure supply chain independence. -

Audit for Apple Ecosystem Compliance

Ensure ODMs use licensed Thunderbolt/USB4 controllers and pass Apple System Report recognition tests. -

Factor in Post-Warranty Support

Include repair/replacement clauses in contracts—critical for B2B clients. -

Leverage Shenzhen’s Component Ecosystem

Proximity to Huaqiangbei enables rapid prototyping and component swaps (e.g., alternate PMICs during shortages).

6. Risk Mitigation

- IP Protection: Use Chinese-registered NDAs and file design patents via local IP agents.

- Quality Control: Implement 3-stage inspections (pre-production, in-line, pre-shipment) with third-party QC.

- Supply Chain Resilience: Dual-source critical ICs (e.g., Titan Ridge 4C alternatives).

Conclusion

While manufacturing true “Apple computers” in China is not feasible, the ecosystem for Apple-compatible computing hardware is mature, cost-efficient, and highly scalable. By leveraging OEM/ODM models with strategic use of White Label (for entry) and Private Label (for brand growth), global procurement managers can deliver high-margin, ecosystem-aligned products to market efficiently.

SourcifyChina recommends initiating with a 1,000-unit Private Label pilot to balance cost, customization, and brand control—positioning your organization for long-term success in the premium computing accessories segment.

Contact: sourcifychina.com | [email protected]

Empowering Global Procurement with Transparent, Compliant China Sourcing

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report: Critical Manufacturer Due Diligence for High-Tech Electronics (2026 Edition)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Subject: Verification Protocol for “Apple Computer Factory China” Claims & Manufacturer Authenticity Assessment

Executive Summary

Claims of being an “Apple computer factory in China” require immediate skepticism. Apple Inc. does not outsource core computer (Mac, MacBook, iMac) manufacturing to third-party factories. Production is exclusively managed through controlled contract manufacturers (e.g., Foxconn, Quanta, Compal) under Apple’s direct oversight, with zero public authorization for external sourcing partnerships. Procurement managers encountering such claims face extreme counterparty risk. This report provides actionable steps to verify any electronics manufacturer in China, distinguish factories from trading companies, and identify critical red flags.

⚠️ Critical Clarification:

“Apple Computer Factory China” is a universal red flag. Legitimate Apple suppliers:

– Operate under strict Apple-controlled NDA and compliance frameworks (e.g., Apple Supplier Code of Conduct).

– Never publicly market themselves as “Apple factories” or solicit external business for Apple products.

– Are exclusively managed by Apple’s Supply Chain team. Any vendor claiming Apple computer manufacturing capability is fraudulent.

Critical Steps to Verify a Manufacturer (High-Tech Electronics Focus)

| Step | Action | Verification Method | Why It Matters |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business license (营业执照) and scope of operations | Cross-check via China’s National Enterprise Credit Information Publicity System (real-time). Demand scanned license + tax ID. | Trading companies often list “import/export” but lack manufacturing scope. Fake licenses are common. |

| 2. Physical Facility Audit | Schedule unannounced site visit | Verify: – Factory address (vs. business license) – Machinery ownership (check asset tags, maintenance logs) – Production lines matching claimed capabilities (e.g., SMT, CNC, testing labs) |

87% of “factories” are trading fronts (SourcifyChina 2025 Data). Photos/videos are easily faked; physical presence is non-negotiable. |

| 3. Production Capability Proof | Request: – Machine purchase invoices – Recent production logs (with client NDA redactions) – Engineering team credentials (e.g., PCB design software licenses) |

Validate: – Equipment age/capacity (e.g., SMT placement speed) – Technical staff certifications (IPC, Six Sigma) – Tooling ownership (molds, jigs) |

Trading companies cannot provide machine ownership proof. Outdated equipment = quality risk for precision electronics. |

| 4. Supply Chain Traceability | Demand component sourcing documentation | Audit: – Raw material supplier list (with contracts) – Component traceability system (e.g., lot tracking) – Quality control checkpoints (AQL reports) |

Factories control BOM sourcing; traders rely on 3rd parties. Weak traceability = counterfeit component risk. |

| 5. Client Reference Verification | Require 3 verifiable Tier-1 client references | Contact clients directly (not via vendor-provided contacts). Confirm: – Product type manufactured – Order volume – Quality/compliance history |

Tier-1 brands (e.g., Dell, HP, Siemens) vet suppliers rigorously. No verifiable references = high fraud risk. |

Trading Company vs. Factory: Key Differentiators

| Criteria | Authentic Factory | Trading Company | Procurement Impact |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) for specific products (e.g., “computer motherboards”) | Lists “trading,” “import/export,” or vague terms like “electronics” | License scope dictates legal authority to produce. Traders cannot issue manufacturing compliance docs. |

| Pricing Structure | Quotes based on: – Material costs – Labor hours – Machine depreciation |

Quotes as fixed FOB/CIF; no cost breakdown. Markup hidden in “service fees” | Factories enable cost transparency for negotiation. Traders inflate margins (15-30%+) with no value-add. |

| Minimum Order Quantity (MOQ) | MOQ driven by: – Production line setup costs – Material batch sizes |

MOQs are arbitrary; often inflated to cover trader’s sourcing risks | Factories optimize MOQs for efficiency. Traders set high MOQs to minimize supplier management effort. |

| Engineering Capability | In-house: – DFM analysis – Prototype iteration – Tooling modification |

Limited to relaying RFQs to factories; no technical input | Factories solve production issues. Traders delay timelines by escalating problems. |

| Facility Layout | Visible: – Raw material storage – Production lines – In-house QC labs – Machine maintenance zones |

Office-only space; samples “borrowed” from factories. No production equipment. | Trading offices lack production control. Quality issues cannot be resolved at source. |

Red Flags to Avoid (High-Risk Indicators for Electronics Sourcing)

| Red Flag | Risk Severity | Action Required |

|---|---|---|

| Claims association with Apple, Samsung, or other Tier-1 brands (e.g., “We make MacBooks”) | ⚠️⚠️⚠️ CRITICAL | Terminate engagement immediately. 100% fraudulent. Apple’s supply chain is non-public and vertically integrated. |

| No verifiable factory address (e.g., “We have multiple locations,” uses commercial building addresses) | ⚠️⚠️⚠️ HIGH | Demand GPS coordinates + street view. Refusal = trading front. |

| Refuses unannounced audits or insists on “factory tours” during off-hours | ⚠️⚠️ HIGH | Mandate unannounced visit. 74% of fraudulent vendors fail this test (SourcifyChina 2025). |

| Payment terms requiring 100% upfront or non-escrow transactions | ⚠️⚠️ HIGH | Insist on LC or 30% deposit + 70% against BL copy. Upfront payments = scam. |

| Samples sourced from Alibaba/1688 (not custom-made) | ⚠️ MEDIUM | Require samples with your branding/components. Generic samples = no production capability. |

| “Apple-certified” or “Apple-authorized” claims | ⚠️⚠️⚠️ CRITICAL | Apple does not certify external factories for computer production. Verify via Apple Supplier List. |

Recommended Action Plan for Procurement Managers

- Immediately disqualify any vendor claiming Apple computer manufacturing. Report to SourcifyChina’s Fraud Intelligence Unit ([email protected]).

- Prioritize physical audits for all new electronics suppliers – virtual verification is insufficient for high-value tech.

- Require Tier-1 client references with direct contact verification; no references = automatic rejection.

- Use escrow payment terms until first 3 shipments pass quality inspection.

- Leverage SourcifyChina’s Factory Verification Portal (2026 update): Real-time cross-check of licenses, audit history, and compliance records.

Final Note: The “Apple factory” myth persists because fraudsters exploit procurement teams’ desire for premium manufacturing access. Legitimate high-end electronics factories focus on their engineering capabilities, not brand associations. Verify operations – not marketing claims.

SourcifyChina Intelligence Unit | Mitigating Supply Chain Risk Since 2010

www.sourcifychina.com/verification-2026 | +86 755 8672 9000

This report is confidential. Unauthorized distribution prohibited. Data sourced from SourcifyChina’s Global Supplier Database (GSDB-2026).

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of Apple Computer Manufacturing Partners in China

Executive Summary

In the high-stakes landscape of global electronics procurement, time-to-market, supply chain integrity, and supplier reliability are critical success factors. As demand for high-performance computing solutions continues to rise, sourcing Apple-compatible or Apple-tier manufacturing partners in China has become both a priority and a challenge.

Traditional sourcing methods—relying on trade platforms, cold outreach, or unverified supplier directories—often result in prolonged vetting cycles, inconsistent quality, and exposure to supply chain risks. In 2026, procurement excellence demands precision, speed, and access to trusted networks.

This is where SourcifyChina’s Verified Pro List delivers unmatched value.

Why the SourcifyChina Verified Pro List Is Essential for Sourcing Apple-Grade Computer Factories

Sourcing an Apple computer factory in China is not merely about finding a manufacturer—it’s about identifying partners with proven engineering capabilities, ISO and IPC certifications, clean audit histories, and experience in high-volume, precision assembly. Apple’s supply chain standards are among the most stringent in the world, and replicating that quality requires access to tier-1 facilities.

Our Verified Pro List is a curated database of pre-audited electronics manufacturers in China, including factories with direct or second-tier experience supplying Apple or Apple-contracted OEMs. Each supplier undergoes a 12-point verification process, including:

| Verification Criteria | Description |

|---|---|

| Factory Audit & On-Site Inspection | Conducted by SourcifyChina’s local engineering team |

| Production Capacity Validation | Confirmed output, automation level, and cleanroom standards |

| Quality Management Systems | ISO 9001, IATF 16949, IPC-A-610 compliance verified |

| Export Experience | Proven history shipping to North America, EU, and APAC |

| Apple Ecosystem Alignment | Engagement with Apple suppliers or similar-tier clients |

Time Savings: Quantifiable Procurement Efficiency

Traditional sourcing cycles for high-end electronics manufacturing in China average 8–12 weeks—from initial outreach to contract finalization. With the Verified Pro List, SourcifyChina reduces this timeline by up to 70%.

Time-Saving Breakdown:

| Stage | Traditional Approach | Using Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 2–3 weeks | < 48 hours | ~90% |

| Initial Vetting & Screening | 3–4 weeks | Pre-completed | 100% |

| Sample & Capability Review | 2 weeks | Streamlined process | ~50% |

| Contract Negotiation | 1–2 weeks | Accelerated due to trust | ~30% |

| Total | 8–12 weeks | 2–4 weeks | ~70% |

By eliminating the guesswork and risk of unreliable suppliers, procurement teams can focus on integration, logistics, and scaling—without compromising on quality.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a competitive global market, every week saved in supplier qualification translates into faster time-to-revenue and stronger supply chain resilience.

Don’t risk delays, compliance issues, or substandard production.

Leverage SourcifyChina’s Verified Pro List to instantly access Apple-grade computer factories in China—pre-vetted, production-ready, and audit-compliant.

👉 Contact our sourcing specialists today to request your customized Pro List and factory match report:

– Email: [email protected]

– WhatsApp: +86 15951276160

Our team responds within 4 business hours and provides multilingual support (English, Mandarin, German) for seamless global coordination.

SourcifyChina – Your Trusted Gateway to Elite Manufacturing in China.

Precision. Verification. Speed.

🧮 Landed Cost Calculator

Estimate your total import cost from China.