The Indian apparel manufacturing industry has emerged as a key player in the global textile and garment landscape, driven by rising domestic consumption, increasing exports, and robust government initiatives such as “Make in India.” According to a 2023 report by Mordor Intelligence, the India Apparel Market was valued at USD 64.1 billion in 2022 and is projected to grow at a CAGR of 10.4% from 2023 to 2028. This growth is fueled by the expanding organized retail sector, rising disposable incomes, and growing demand for fashion-forward and sustainable apparel. Additionally, India’s strong raw material base – particularly cotton – and cost-competitive labor make it an attractive destination for both domestic and international brands seeking reliable manufacturing partners. As the demand for customized, scalable, and agile production increases, a new league of apparel manufacturers has risen to prominence, combining technological integration, ethical practices, and export readiness. Here’s a look at the top 10 apparel manufacturers in India shaping the future of the industry.

Top 10 Apparel In India Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

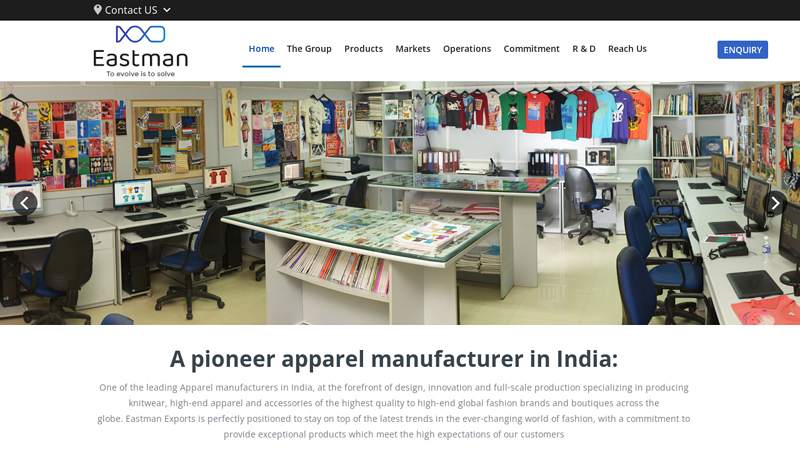

#1 Eastman Exports

Domain Est. 1997

Website: eastmanexports.com

Key Highlights: Eastman Exports is one of the leading apparel manufacturers in India. Most trusted T-shirt manufacturers and garment Exporters in Tirupur, India for more ……

#2 Organic Clothes Manufacturers in India

Domain Est. 2004

Website: organicandmore.com

Key Highlights: Organic And More (Sustainable Apparel Manufacturing Company) Is an Organic Clothes Manufacturer in India to Contribute Towards Sustainable Fashion….

#3 CMAI

Domain Est. 2007

Website: cmai.in

Key Highlights: The Clothing Manufacturers Association Of India (CMAI) is the pioneer and most representative Association of the Indian apparel industry for over five decades….

#4 Sai Creations

Domain Est. 2007 | Founded: 1994

Website: saicreations.co.in

Key Highlights: Established in 1994, Sai Creations is a government recognized Star Export House of India which deals in apparels, fashion accessories and home goods products….

#5 Vritti Designs

Domain Est. 2012

Website: vrittidesigns.com

Key Highlights: Vritti Designs is Organic Clothing Manufacturer in India to contribute towards sustainable fashion. We are Fair trade clothing manufacturer….

#6 Vicchu Creations

Domain Est. 2020

Website: vicchucreations.com

Key Highlights: At Vicchu Creations, we are proud to be one of the top clothing manufacturers in India, offering seamless third party garment manufacturing solutions to fashion ……

#7 Srokam Exports

Domain Est. 2022

Website: srokam.com

Key Highlights: Srokam Exports is a leading custom clothing manufacturer in India. We offer a wide range of services, including design, production, and quality control….

#8 Apparel Manufacturing Company In India

Domain Est. 2016

Website: aryanapparels.com

Key Highlights: We are a well-certified, tried and tested, customized apparel manufacturing and exporting company with end-to-end product designing, sourcing, manufacturing, ……

#9 Best Readymade Garment Manufacturers and Exporter Companies …

Domain Est. 1999 | Founded: 1979

Website: modelama.com

Key Highlights: Modelama Exports is one of the largest garment manufacturers in India. Established in 1979, It is one of the top mens garments manufacturers and suppliers ……

#10 Apparel Factory

Domain Est. 2023

Website: apparelfactory.co.in

Key Highlights: We at Apparel Factory offers the widest selection of corporate, institutional and promotional apparels at effective price points….

Expert Sourcing Insights for Apparel In India

H2: Apparel Market Trends in India (2026 Outlook)

As India moves toward 2026, the apparel market is poised for dynamic transformation driven by shifting consumer behaviors, technological advancements, economic growth, and evolving sustainability demands. Here’s a comprehensive analysis of key market trends expected to shape the Indian apparel industry by 2026:

1. Digital-First and Omnichannel Expansion

By 2026, e-commerce will solidify its dominance in apparel retail. Online channels—led by platforms like Myntra, Ajio, Flipkart, and emerging D2C brands—are expected to account for over 35% of total apparel sales. Consumers increasingly demand seamless omnichannel experiences, including click-and-collect, virtual try-ons, and AI-driven personalization. Social commerce via Instagram, YouTube, and WhatsApp will become a critical sales funnel, particularly among Gen Z and millennials.

2. Rise of Homegrown and D2C Brands

Indian consumers are gravitating toward homegrown brands that offer authenticity, cultural relevance, and value. D2C (Direct-to-Consumer) brands like BIBA, Sabyasachi, Nykaa Fashion, and emerging startups such as Bewakoof and The Souled Store will gain market share by leveraging social media, agile supply chains, and customer data. These brands can quickly adapt to fashion trends and localize offerings, outmaneuvering traditional retail and global fast-fashion entrants.

3. Sustainability and Ethical Fashion Gains Momentum

Environmental consciousness is reshaping consumer preferences. By 2026, eco-friendly materials (organic cotton, recycled polyester), sustainable production practices, and transparent supply chains will become key differentiators. Government initiatives promoting circular fashion and consumer awareness campaigns will accelerate demand for sustainable apparel. Brands investing in green certifications and take-back programs are likely to win brand loyalty, especially in urban centers like Mumbai, Delhi, and Bengaluru.

4. Tier 2 and Tier 3 Cities Driving Growth

While metros remain important, the fastest growth will come from Tier 2 and Tier 3 cities. Rising disposable incomes, improved internet penetration, and digital literacy are enabling consumers in cities like Jaipur, Lucknow, and Coimbatore to participate in the fashion economy. Localized marketing, regional language interfaces, and affordable fashion lines tailored to regional tastes will be crucial for brand success.

5. Casualization and Athleisure Dominance

Post-pandemic lifestyle shifts have cemented casual and comfort wear as wardrobe staples. The athleisure segment—encompassing yoga wear, joggers, and hybrid work-leisure apparel—will continue its strong growth trajectory. Brands offering functional, stylish, and versatile clothing suitable for both home and public settings will lead the trend.

6. Technology Integration and Personalization

AI, AR, and data analytics will play a pivotal role in 2026. Virtual fitting rooms powered by augmented reality will reduce return rates and enhance online shopping experiences. Predictive analytics will enable hyper-personalized recommendations, while AI-driven demand forecasting will optimize inventory management. Blockchain may also emerge for verifying authenticity and sustainability claims.

7. Government and Policy Support

The Indian government’s Production-Linked Incentive (PLI) scheme for textiles aims to boost domestic manufacturing and exports. By 2026, this initiative is expected to strengthen the “Make in India” narrative, attracting investment in technical textiles and garment production. This could reduce import dependence and enhance global competitiveness.

8. Inflation and Value Consciousness

Economic headwinds, including inflation and fluctuating raw material costs, may pressure consumer spending. As a result, value-for-money offerings, promotional strategies, and private-label growth in organized retail will become more prominent. However, premiumization will coexist, with affluent consumers continuing to invest in luxury and designer wear.

Conclusion

By 2026, the Indian apparel market will be characterized by digital innovation, sustainability, regional inclusivity, and brand authenticity. Success will depend on agility, customer-centricity, and the ability to balance affordability with quality and ethical values. Players who anticipate and adapt to these H2 trends will capture significant market share in one of the world’s fastest-growing fashion economies.

Common Pitfalls Sourcing Apparel in India: Quality and Intellectual Property Risks

Sourcing apparel from India offers cost advantages and a wide range of manufacturing capabilities, but it also comes with significant challenges—particularly in the areas of quality control and intellectual property (IP) protection. Understanding these pitfalls is essential for brands and importers to avoid reputational damage, financial loss, and legal complications.

Quality Control Challenges

One of the most persistent issues when sourcing apparel from India is maintaining consistent product quality. Despite the presence of world-class manufacturers, variability across suppliers and production batches remains a key concern.

Inconsistent Fabric and Construction Standards

Indian textile mills produce a broad spectrum of fabric qualities—from premium handlooms to mass-produced synthetics. Buyers may receive samples of high quality, only to discover that bulk production uses inferior materials or deviates from specifications. Variations in dye lots, stitching, fabric weight, and finishing are common if oversight is inadequate.

Lack of Standardized Processes Across Units

Many suppliers operate multiple subcontracting units or work with decentralized home-based labor, especially in clusters like Tiruppur or Ludhiana. This fragmentation can lead to inconsistent workmanship and make it difficult to enforce quality standards uniformly.

Inadequate Quality Assurance Infrastructure

Smaller or mid-tier factories may lack robust quality management systems or trained QA personnel. Without third-party inspections or on-site monitoring, defects such as misaligned prints, incorrect labeling, or sizing inaccuracies often go undetected until goods reach the destination market.

Intellectual Property Risks

Protecting designs, trademarks, and proprietary information is another critical challenge when sourcing from India, where IP enforcement can be inconsistent.

Design Theft and Counterfeiting

India’s apparel sector is highly competitive, and some unscrupulous manufacturers may replicate or sell original designs to multiple buyers. Without formal design registration under the Designs Act, 2000, legal recourse is limited. Branded patterns, embroidery, or unique garment constructions are particularly vulnerable.

Weak Contractual Safeguards

Many sourcing agreements fail to include strong confidentiality clauses or IP ownership terms. Suppliers may claim joint ownership or reuse design elements for other clients unless explicitly prohibited in writing. Verbal agreements or informal contracts increase exposure to IP disputes.

Limited Enforcement of IP Rights

Even with registered trademarks or designs, enforcing IP rights in India can be time-consuming and costly. Legal proceedings are often protracted, and local authorities may lack the resources or expertise to act swiftly against infringement. Customs enforcement against counterfeit exports also remains inconsistent.

Mitigation Strategies

To reduce exposure to these risks, buyers should:

– Conduct thorough due diligence on suppliers, including factory audits and reference checks.

– Implement third-party pre-shipment inspections and use detailed tech packs.

– Register designs and trademarks in India and include robust IP clauses in contracts.

– Work with legal counsel to draft enforceable agreements covering confidentiality and IP ownership.

– Build long-term relationships with vetted suppliers to foster accountability and trust.

By proactively addressing quality and IP concerns, businesses can leverage India’s strengths in apparel manufacturing while minimizing potential downsides.

Logistics & Compliance Guide for Apparel in India

Overview of the Apparel Industry in India

India is one of the largest producers and exporters of apparel globally, with a diverse supply chain that includes cotton farming, textile manufacturing, garment production, and distribution. The sector benefits from government initiatives such as “Make in India” and the Production Linked Incentive (PLI) scheme. However, navigating logistics and compliance requirements is essential for businesses—both domestic and international—to operate efficiently and avoid penalties.

Key Logistics Considerations

Supply Chain Structure

The apparel supply chain in India typically includes:

– Raw material suppliers (e.g., cotton, synthetic fibers)

– Spinning and weaving units

– Garment manufacturers (including export-oriented units and SEZs)

– Distributors and retailers

– E-commerce fulfillment centers

Efficient coordination across these stages is crucial for on-time delivery and cost control.

Transportation and Warehousing

- Inbound Logistics: Movement of raw materials and fabrics to manufacturing units via road, rail, or air.

- Outbound Logistics: Distribution of finished garments to domestic retailers, e-commerce platforms, or export hubs.

- Cold Chain Not Required: Unlike perishable goods, apparel does not require temperature-controlled storage, but proper ventilation and pest control in warehouses are important.

- 3PL Partners: Many brands use third-party logistics (3PL) providers for warehousing, packaging, and last-mile delivery.

Export Logistics

- Apparel exports are shipped primarily from major ports such as Mumbai (JNPT), Chennai, and Kolkata.

- Air freight is used for high-value or time-sensitive consignments.

- Documentation: Requires commercial invoice, packing list, bill of lading/airway bill, certificate of origin, and shipping bill.

Regulatory and Compliance Framework

Textile and Apparel Standards (BIS)

The Bureau of Indian Standards (BIS) mandates quality standards for textiles under IS 14448:2016 (for color fastness) and IS 1701:2011 (for dress materials). While BIS certification is voluntary for most garments, it’s compulsory for certain products like infant and children’s clothing.

Labeling Requirements

Apparel sold in India must comply with labeling norms under the Legal Metrology (Packaged Commodities) Rules, 2011:

– Name and address of manufacturer/packer/importer

– Generic name of the product (e.g., cotton shirt)

– Size or dimensions

– Fiber composition (e.g., 100% cotton)

– Country of origin (for imported garments)

– Maximum Retail Price (MRP) in Indian Rupees

– Care instructions

GST and Tax Compliance

- Goods and Services Tax (GST): Apparel is taxed under GST at different rates:

- 5%: Garments with MRP ≤ ₹1,000

- 12%: Garments with MRP > ₹1,000

- Input Tax Credit (ITC) is available across the supply chain.

- E-way bills are required for inter-state movement of goods valued over ₹50,000.

Export-Import (EXIM) Policy

- Exporters must register with the Directorate General of Foreign Trade (DGFT) and obtain an Import Export Code (IEC).

- Duty Drawback or RoDTEP (Remission of Duties and Taxes on Exported Products) schemes are available to enhance export competitiveness.

- Quotas and restrictions may apply depending on the destination country (e.g., EU, USA).

Labor and Environmental Compliance

Labor Laws

Apparel manufacturers must comply with labor regulations such as:

– Factories Act, 1948 (safety, working hours, welfare)

– Minimum Wages Act, 1948

– Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013

– Compliance with social audits (e.g., SA8000) is often required by international buyers.

Environmental Regulations

- Textile units must adhere to effluent and emission standards set by the Central Pollution Control Board (CPCB).

- Consent to Establish (CTE) and Consent to Operate (CTO) are mandatory under the Air and Water Acts.

- Sustainable practices like water recycling and use of eco-friendly dyes are encouraged.

Special Economic Zones (SEZs) and Export-Oriented Units (EOUs)

- SEZs offer tax exemptions, duty-free imports, and simplified compliance for exporters.

- EOUs can import raw materials without paying customs duties, provided goods are exported.

- Apparel units in SEZs benefit from streamlined customs procedures and infrastructure support.

E-commerce Compliance

With the rise of online fashion retail:

– Platforms like Amazon, Myntra, and Flipkart require GSTIN, brand authorization, and proper labeling.

– Return logistics and reverse pick-up services must be integrated.

– FDI guidelines allow 100% foreign direct investment in B2B e-commerce, but inventory-based B2C models have restrictions for single-brand retail.

Conclusion

Success in India’s apparel industry depends on efficient logistics and strict adherence to compliance norms. Businesses must stay updated on tax regulations, labeling requirements, labor standards, and environmental laws. Leveraging technology, partnering with reliable logistics providers, and maintaining transparent supply chains will help brands remain competitive in both domestic and international markets.

Conclusion: Sourcing Apparel Suppliers in India

Sourcing apparel from India presents a compelling opportunity for global brands and retailers seeking high-quality, diverse, and cost-effective products. With its strong textile heritage, skilled workforce, and expansive manufacturing ecosystem, India is a leading global hub for apparel production — particularly in segments such as cotton wear, ethnic fashion, knitwear, and sustainable textiles.

Key advantages include competitive pricing, compliance with international quality standards, and increasing adoption of ethical and eco-friendly practices among Indian suppliers. The country’s robust infrastructure, export incentives, and free trade agreements further enhance its appeal as a reliable sourcing destination.

However, success in sourcing requires due diligence in supplier selection, clear communication, and a focus on long-term partnerships. Challenges such as lead time variability, quality control inconsistencies, and logistics coordination can be mitigated through on-the-ground verification, regular audits, and digital supply chain tools.

In conclusion, India remains a strategic and scalable source for apparel, especially for businesses prioritizing craftsmanship, sustainability, and supply chain diversification. With the right approach, sourcing from India can deliver both value and resilience to global fashion supply chains.