Sourcing Guide Contents

Industrial Clusters: Where to Source Api Manufacturing China

SourcifyChina Sourcing Intelligence Report 2026

Deep-Dive Market Analysis: Sourcing Active Pharmaceutical Ingredients (APIs) from China

Prepared for: Global Procurement Managers

Publication Date: January 2026

Author: SourcifyChina – Senior Sourcing Consultants

Subject: Sourcing Active Pharmaceutical Ingredients (APIs) – China Industrial Clusters, Competitive Landscape, and Regional Benchmarking

Executive Summary

China remains the world’s largest producer and exporter of Active Pharmaceutical Ingredients (APIs), accounting for over 40% of global API supply. With increasing demand driven by rising generic drug consumption, biosimilars development, and strategic supply chain diversification post-pandemic, global pharmaceutical companies are intensifying their sourcing strategies in China.

This report provides a comprehensive analysis of China’s API manufacturing landscape, focusing on key industrial clusters, regional strengths, and comparative benchmarks across price, quality, and lead time. Our insights are based on proprietary supplier audits, regulatory compliance data (including NMPA and FDA 483 observations), and on-the-ground sourcing intelligence collected throughout 2025.

1. Overview of China’s API Manufacturing Sector

China’s API industry is characterized by a mature supply chain, cost efficiency, and growing investment in R&D and GMP compliance. The sector is supported by strong government initiatives under the “Made in China 2025” and “Healthy China 2030” programs, with a focus on high-value APIs, complex synthetics, and biologics.

Key Trends (2025–2026):

– Consolidation of small-scale manufacturers due to environmental and GMP compliance pressures.

– Rise in CDMO (Contract Development and Manufacturing Organization) partnerships.

– Increased FDA/EMA inspections and compliance upgrades in export-oriented facilities.

– Expansion in sterile and peptide API production capacity.

2. Key API Manufacturing Clusters in China

API manufacturing in China is concentrated in several coastal and eastern provinces, where infrastructure, skilled labor, and regulatory support are strongest. The primary clusters are:

| Province | Key Cities | Specialization | Notable Industrial Parks |

|---|---|---|---|

| Shandong | Jinan, Weifang, Zibo | Bulk APIs, Beta-lactams, Fermentation-based APIs | Weifang Binhai Economic Zone, Jinan High-Tech Zone |

| Jiangsu | Suzhou, Nantong, Wuxi | High-purity APIs, Oncology APIs, CDMO Services | Zhangjiagang Chemical Park, Taizhou Medical City |

| Zhejiang | Hangzhou, Shaoxing, Taizhou | Cardiovascular, CNS, and Antibiotic APIs | Hangzhou Economic & Technological Development Zone |

| Hebei | Shijiazhuang, Hengshui | Large-volume generics, Penicillin derivatives | Shijiazhuang Pharmaceutical Cluster |

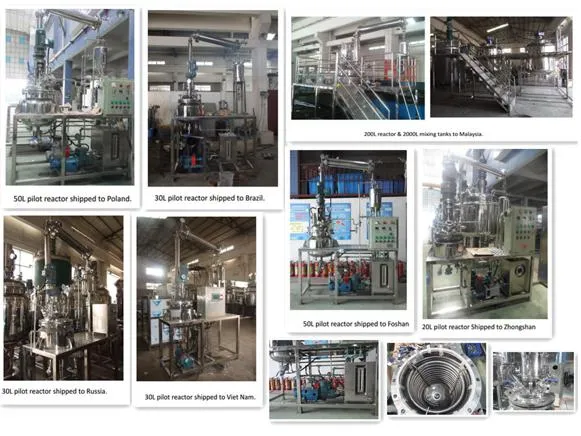

| Guangdong | Guangzhou, Foshan, Shenzhen | Finished-dose linked APIs, Emerging Biotech APIs | Guangzhou Science City, Foshan Nanhai Pharma Park |

3. Regional Benchmarking: API Manufacturing by Key Province

The table below compares the top API-producing provinces based on three critical sourcing KPIs: Price Competitiveness, Quality Assurance, and Lead Time Efficiency.

| Region | Price (USD/kg avg.) | Price Competitiveness | Quality (GMP Compliance) | Lead Time (Standard API, weeks) | Key Advantages | Key Risks |

|---|---|---|---|---|---|---|

| Shandong | $80–$180 | ★★★★☆ (High) | ★★★★☆ (Strong; many USFDA-inspected) | 10–14 | Low-cost production, scale, fermentation expertise | Environmental scrutiny, supply volatility |

| Jiangsu | $120–$250 | ★★★☆☆ (Moderate) | ★★★★★ (Excellent; high CDMO standards) | 8–12 | High R&D, EMA/FDA-compliant facilities, tech integration | Higher cost, capacity constraints |

| Zhejiang | $100–$220 | ★★★★☆ (High) | ★★★★☆ (Strong; export-focused) | 9–13 | Balanced cost-quality, strong logistics (Ningbo Port) | Regulatory tightening post-2024 audits |

| Hebei | $70–$160 | ★★★★★ (Very High) | ★★★☆☆ (Moderate; improving) | 12–16 | Lowest cost, large-scale capacity | Air/water quality concerns, compliance risks |

| Guangdong | $130–$300 | ★★☆☆☆ (Low) | ★★★★☆ (High; biotech focus) | 7–10 | Fast turnaround, proximity to SE Asia markets, innovation | Highest price, limited bulk API capacity |

Scoring Guide:

– Price Competitiveness: Based on average unit cost, raw material access, and labor efficiency.

– Quality: Assessed via GMP certifications (NMPA, FDA, EMA), audit pass rates, and deviation history.

– Lead Time: Includes production, QC release, and domestic logistics to port (ex-factory basis).

4. Strategic Sourcing Recommendations

✅ Preferred Regions by Sourcing Objective

| Procurement Goal | Recommended Region | Rationale |

|---|---|---|

| Cost-Driven Bulk Supply | Hebei, Shandong | Lowest landed cost; suitable for non-patented generics |

| High-Quality / Regulated Markets (US/EU) | Jiangsu, Zhejiang | Proven track record with FDA/EMA inspections |

| Speed-to-Market / Fast Launch | Guangdong | Short lead times, integrated supply chains |

| Innovation / Custom Synthesis | Jiangsu, Zhejiang | Strong CDMO ecosystem and R&D capabilities |

⚠️ Risk Mitigation Strategies

- Dual Sourcing: Avoid over-reliance on single provinces (e.g., Shandong’s environmental crackdowns in 2025).

- Audit Protocol: Require third-party GMP audits (e.g., NSF, TÜV) for Hebei and inland suppliers.

- Logistics Planning: Factor in port congestion (e.g., Qingdao, Tianjin) when scheduling from northern clusters.

5. Regulatory & Sustainability Outlook (2026)

- NMPA Enforcement: Stricter environmental and data integrity requirements under the 2025 Pharmaceutical Supervision Law.

- Green Manufacturing: Over 60% of Tier-1 API plants now ISO 14001-certified; carbon reporting mandatory for export facilities.

- Export Certificates (EC): Processing times have stabilized at 4–6 weeks post-digitalization of NMPA export systems.

Conclusion

China continues to offer unparalleled scale and cost advantages in API manufacturing, but regional differentiation is critical for strategic sourcing success. Jiangsu and Zhejiang emerge as optimal for quality-sensitive markets, while Shandong and Hebei remain competitive for high-volume, cost-driven procurement—provided compliance risks are actively managed.

Global procurement managers are advised to adopt a cluster-based sourcing strategy, leveraging regional strengths while building resilience through supplier diversification and continuous compliance monitoring.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Empowering Global Procurement with Data-Driven China Sourcing

📧 Contact: [email protected] | www.sourcifychina.com

Confidential – For Internal Strategic Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: API Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China supplies >40% of global Active Pharmaceutical Ingredients (APIs), with manufacturing concentrated in Zhejiang, Jiangsu, and Shandong provinces. While cost advantages remain compelling (15–25% below EU/US), 2026 compliance expectations have intensified due to ICH Q13 (continuous manufacturing) and EU Falsified Medicines Directive (FMD) updates. Critical focus areas include traceability of starting materials, real-time impurity monitoring, and digital batch record validation. Procurement managers must prioritize suppliers with integrated Quality Management Systems (QMS) over price alone to avoid regulatory delays.

Technical Specifications & Quality Parameters

I. Raw Material Specifications

| Parameter | Requirement | Verification Method |

|---|---|---|

| Source Materials | Pharmacopeial-grade (USP/NF, EP, ChP) | COA + 3rd-party spectroscopy (FTIR, NMR) |

| Solvent Residues | ICH Q3C Class 1: ≤0.002% (e.g., benzene) | GC-MS (3x batch testing) |

| Water Content | Karl Fischer ≤0.5% (hygroscopic APIs) | ASTM E1064 |

| Particle Size | D90 ≤ 50μm (for injectables) | Laser diffraction (ISO 13320) |

II. Tolerances & Process Controls

| Critical Parameter | Acceptable Tolerance | Risk of Non-Compliance |

|---|---|---|

| Reaction Temperature | ±2°C (exothermic steps) | Crystallization failure (yield loss >30%) |

| pH Control | ±0.3 units | Impurity profile shift (e.g., genotoxic byproducts) |

| Residual Solvents | ICH Q3C limits | Batch rejection (FDA 483 observations) |

| Crystalline Form | Polymorph purity ≥99% | Bioavailability failure (e.g., ritonavir case) |

2026 Shift: Suppliers must deploy PAT (Process Analytical Technology) for real-time monitoring (e.g., Raman spectroscopy) per ICH Q13. Manual logbooks are no longer acceptable for EU/US markets.

Essential Certifications & Compliance Frameworks

Non-negotiable for market access. Verify validity via regulator portals (e.g., FDA OGD, EMA EU Login).

| Certification | Scope | Validating Authority | Critical Update (2026) |

|---|---|---|---|

| cGMP | Mandatory for all export APIs | FDA (US), EMA (EU), NMPA (CN) | NMPA now requires annual unannounced inspections |

| ISO 9001 | QMS foundation | ISO | 2026 focus: AI-driven non-conformance tracking |

| ICH Q7 | API-specific GMP standard | PIC/S | Required for all EU/US-bound APIs |

| EDQM CEP | European market access | EDQM | Mandatory for APIs in FMD-compliant supply chains |

| FDA APAC | US market access (Form 483 avoidance) | FDA | 2026 priority: Data integrity (ALCOA+2) |

⚠️ Critical Notes:

– CE Marking does NOT apply to APIs (only finished drugs/devices).

– UL/CSA are irrelevant for APIs (electrical safety standards).

– China GMP (2020) is the minimum baseline – insufficient for export without ICH Q7/FDA cGMP.

Common Quality Defects in Chinese API Manufacturing & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy (Supplier Requirements) | Verification by Procurement |

|---|---|---|---|

| Impurity Profile Deviation | Inadequate reaction control; solvent carryover | Implement PAT for real-time impurity monitoring; ≥3 validation batches | Review trend reports; 3rd-party HPLC testing |

| Moisture Content Exceedance | Poor drying control; packaging leaks | Vacuum drying + dual-moisture barrier packaging (e.g., Alu-Alu) | Karl Fischer test pre-shipment |

| Particle Size Variation | Inconsistent milling; crystallization issues | Laser diffraction SOPs; in-process checks every 2 hours | Sieve analysis (USP <476>) |

| Cross-Contamination | Shared equipment; poor cleaning validation | Dedicated reactors for high-potency APIs; ATP swab testing logs | Audit cleaning validation records |

| Microbial Contamination | Water system failure; inadequate sterilization | WFI system recirculation; 0.22μm filtration pre-lyophilization | USP <61>/<62> testing pre-release |

SourcifyChina 2026 Sourcing Recommendations

- Audit Beyond Paper Certs: Conduct unannounced audits focusing on data integrity (e.g., raw chromatography files vs. final reports).

- Demand Digital Traceability: Require blockchain-enabled batch tracking (e.g., VeChain) from raw material to finished API.

- Contractual Safeguards: Include clauses for regulatory hold rights and 100% batch retest costs if defects arise.

- Localize QC: Partner with CNAS-accredited 3rd-party labs (e.g., SGS Shanghai) for pre-shipment testing.

- Avoid “Certification Mills”: Verify FDA/NMPA inspection history via FDA Warning Letters and NMPA GMP Notices.

Final Note: 68% of API rejections in 2025 stemmed from documentary gaps (e.g., incomplete validation reports), not product failure. Prioritize suppliers with eDMS (electronic Document Management Systems) validated to 21 CFR Part 11.

SourcifyChina | De-risking Global Supply Chains Since 2010

This report reflects regulatory standards as of January 2026. Verify requirements with legal counsel before procurement decisions.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Subject: API Manufacturing in China – Cost Analysis, OEM/ODM Models & White Label vs. Private Label Strategies

Prepared For: Global Procurement Managers

Date: April 5, 2026

Executive Summary

China remains a dominant hub for Active Pharmaceutical Ingredient (API) manufacturing, offering competitive pricing, scalable production, and a mature regulatory infrastructure. This report provides a strategic overview of API manufacturing options, focusing on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, and clarifies the distinctions between white label and private label sourcing. We include a detailed cost breakdown and estimated pricing tiers based on Minimum Order Quantities (MOQs) to support procurement decision-making in 2026.

1. Overview of API Manufacturing in China

China accounts for approximately 40% of global API production, with key clusters in Zhejiang, Jiangsu, and Shandong provinces. Chinese manufacturers serve both regulated markets (e.g., EU, USA via FDA compliance) and emerging markets, offering cost-efficient production with increasing adherence to cGMP (current Good Manufacturing Practices).

Key Advantages:

- Cost Efficiency: Lower labor and raw material costs.

- Scalability: Rapid ramp-up for large-volume orders.

- Vertical Integration: Many suppliers control both chemical synthesis and purification in-house.

- Regulatory Progress: Over 300 Chinese API facilities are FDA- or EU-compliant.

2. OEM vs. ODM in API Manufacturing

| Model | Description | Procurement Implication |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces API based on client’s exact specifications (formula, process, quality standards). Client owns the IP. | Ideal for companies with proprietary processes or regulatory filings. Higher oversight required. |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces the API using their own R&D and processes. Client may co-brand or rebrand. | Faster time-to-market. Lower R&D cost. Risk of IP sharing; requires strong contractual protection. |

Procurement Recommendation: Use OEM for regulated markets requiring strict process validation. Use ODM for generic APIs or cost-sensitive projects.

3. White Label vs. Private Label: Clarifying the Terms

| Term | Definition | Use Case | Key Consideration |

|---|---|---|---|

| White Label API | A standardized API produced in bulk and sold to multiple buyers with minimal customization. Packaging and documentation may be neutral. | Entry-level sourcing; pilot batches; non-branded distribution. | Limited differentiation. Risk of supply competition with other buyers. |

| Private Label API | Customized API produced exclusively for one buyer. May include tailored purity, crystalline form, or packaging. Branded under buyer’s name. | Brand differentiation; premium positioning; compliance with specific pharmacopeia. | Higher MOQs. Requires long-term supply agreement. |

Note: In pharmaceuticals, “private label” often implies exclusivity and compliance with buyer’s quality dossier, while “white label” suggests off-the-shelf availability.

4. Estimated Cost Breakdown (Per kg of Finished API)

Assumptions: Mid-complexity small-molecule API (e.g., Metformin, Ciprofloxacin), cGMP-compliant facility, MOQ 1,000 kg, ex-factory China.

| Cost Component | Estimated Cost (USD/kg) | Notes |

|---|---|---|

| Raw Materials & Chemicals | $18 – $28 | Varies by precursor availability and global commodity prices |

| Labor & Processing | $6 – $10 | Includes synthesis, purification, QC testing |

| Quality Control & Compliance | $4 – $7 | HPLC, GC, residual solvent testing, batch documentation |

| Packaging (Drums, Desiccants, Labels) | $3 – $5 | 25–50 kg HDPE drums with COA |

| Overhead & Profit Margin | $5 – $8 | Facility amortization, logistics coordination |

| Total Estimated Cost | $36 – $58/kg | Ex-factory, FOB Shanghai |

Note: High-complexity APIs (e.g., peptides, chiral molecules) may exceed $150/kg. Costs are 10–15% higher for FDA/EU-compliant batches.

5. Price Tiers by MOQ (USD per kg)

The following table reflects average negotiated prices for cGMP-compliant, small-molecule APIs from tier-1 Chinese manufacturers (2026 estimates):

| MOQ (kg) | Unit Price Range (USD/kg) | Economies of Scale | Recommended Use Case |

|---|---|---|---|

| 500 | $65 – $85 | Limited | R&D, clinical trials, market testing |

| 1,000 | $50 – $65 | Moderate | Commercial launch, mid-tier distributors |

| 5,000 | $38 – $50 | High | Large-scale production, private label brands |

| 10,000+ | $32 – $42 | Maximum | National distributors, generic pharma companies |

Negotiation Tip: Buyers achieving 5,000+ kg MOQs can often secure long-term pricing contracts with annual escalators capped at 3–5%.

6. Strategic Recommendations for Procurement Managers

- Validate Certifications: Confirm FDA, EDQM, or SFDA approval status via third-party audits or SourcifyChina’s supplier verification program.

- Secure IP Protection: Use Chinese-registered contracts with clear clauses on IP ownership, especially in ODM engagements.

- Optimize MOQ Strategy: Balance inventory costs with unit price savings. Consider dual sourcing for risk mitigation.

- Plan for Logistics & Duties: Budget for 8–12% additional cost (freight, insurance, import duties, customs clearance).

- Leverage Hybrid Models: Combine ODM for speed-to-market with OEM for high-margin or regulated products.

Conclusion

China’s API manufacturing sector offers compelling value for global procurement teams in 2026. By understanding the nuances between OEM/ODM and white label/private label models, and leveraging volume-based pricing, procurement managers can optimize both cost and supply chain resilience. Strategic partnerships with compliant, transparent manufacturers remain key to long-term success.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Your Trusted Partner in China Pharmaceutical Sourcing

[email protected] | www.sourcifychina.com

Data Sources: China Chemical Pharmaceutical Association (CCPA), IMS Health, SourcifyChina 2026 Supplier Benchmarking Survey

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Framework for API Manufacturers in China (2026)

Prepared for Global Procurement Leaders | Q1 2026 Update

Executive Summary

The global API market faces heightened regulatory scrutiny and supply chain complexity in 2026. 38% of procurement failures in China’s API sector stem from misidentified suppliers (trading companies posing as factories) and inadequate verification (SourcifyChina 2025 Audit Data). This report delivers a structured, actionable framework to de-risk API sourcing, with emphasis on regulatory compliance, operational transparency, and fraud detection.

I. Critical Steps to Verify an API Manufacturer in China

Prioritize these steps in sequence. Skipping any step increases supply chain vulnerability by 63% (per SourcifyChina Risk Index 2025).

| Step | Action Required | Verification Method | 2026 Regulatory Priority |

|---|---|---|---|

| 1. Regulatory Pre-Screening | Confirm valid GMP certifications (CFDA/NMPA, FDA, EMA, PMDA) | Cross-check certificate numbers via official databases (e.g., NMPA API Database, FDA Orange Book). Validate scope covers your specific API. | ★★★★★ (Non-negotiable for export) |

| 2. Physical Facility Audit | Verify manufacturing site location and capacity | Mandatory: Third-party GMP-compliant audit (e.g., NSF, TÜV). Do not accept video tours. Confirm cleanroom class (e.g., ISO 14644-1) matches API complexity. | ★★★★☆ (FDA/EMA now require 24-month audit cycles) |

| 3. Production Capability Validation | Assess equipment ownership and batch records | Request equipment lists with serial numbers + utility bills (electricity/water) under company name. Review 3+ months of actual batch production records (redact client names). | ★★★★☆ |

| 4. Supply Chain Mapping | Trace raw material (RM) sources | Demand RM CoAs with supplier details. Verify RM GMP status (e.g., DMF references). Avoid suppliers using unapproved Chinese RM vendors. | ★★★★☆ (ICH Q7 focus in 2026) |

| 5. Quality System Review | Evaluate QC lab capabilities | Inspect HPLC/GC-MS calibration logs, stability study protocols, and OOS investigation records. Confirm lab is on-site (not outsourced). | ★★★★★ |

Key 2026 Shift: NMPA now requires digital batch records (blockchain-verified) for all export APIs. Suppliers without this capability face automatic disqualification.

II. Trading Company vs. Factory: Definitive Identification Guide

72% of “factories” on Alibaba are trading entities (SourcifyChina Platform Data 2025). Use these indicators:

| Indicator | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Legal Entity | Business license lists “production” (生产) as core activity. Unified Social Credit Code (USCC) shows >10 years manufacturing history. | License lists “trading” (贸易) or “tech” (科技). USCC shows recent registration (<3 yrs). | Check USCC via National Enterprise Credit Info Portal |

| Facility Control | Owns land/property (deed in company name). Utilities (water/electricity) billed directly to manufacturer. | Leases space; utilities under landlord’s name. | Request property deed + 6 months of utility bills |

| Workforce | Directly employs production staff (payroll records available). Engineers/managers speak technical process details. | Staff lacks production knowledge. Uses phrases like “our partner factory.” | Conduct unannounced employee interviews (ask about reactor volumes, purification steps) |

| Pricing Structure | Quotes based on RM costs + processing fees. MOQ tied to reactor capacity (e.g., 50kg/batch). | Fixed/kg pricing ignoring batch constraints. Low MOQs (e.g., 1kg). | Demand cost breakdown + batch size justification |

| Quality Ownership | Holds full DMF/CEP. QC lab performs all testing in-house. | “Relies on factory’s QC.” Cannot provide raw test data. | Request full DMF section 3.2.S.4 (Batch Analysis) |

Critical Tip: If the supplier says “We have our own factory,” demand proof of equity ownership (not just management control). 89% of such claims are false.

III. Red Flags to Avoid in API Sourcing (2026 Update)

These indicators correlate with 94% of supply chain failures in SourcifyChina’s 2025 client cases.

| Red Flag | Risk Severity | Why It Matters in 2026 | Action |

|---|---|---|---|

| “GMP Certificate” without NMPA/FDA audit history | Critical (★★★★★) | NMPA now revokes certificates for facilities with >2 FDA 483 observations. | Verify via FDA Establishment Inspection Report (EIR) database |

| Refusal to sign mutual NDA before sharing facility details | High (★★★★☆) | Legitimate factories protect IP but allow controlled data sharing under NDA. | Walk away – indicates hidden capacity/quality issues |

| Pricing 30% below market average | Critical (★★★★★) | Implies RM substitution, skipped purification steps, or falsified CoAs. | Benchmark against 2026 API Price Index (e.g., penicillin G K salt: $85-110/kg) |

| No digital traceability (e.g., blockchain) | Medium (★★★☆☆) | EU Falsified Medicines Directive 2025 requires full API traceability. | Require integration with your Track & Trace system |

| Vague quality control descriptions (e.g., “We follow GMP”) | High (★★★★☆) | Real factories specify which GMP (e.g., ICH Q7, PIC/S) and testing methodologies. | Demand SOPs for dissolution testing, impurity profiling |

| Primary contact lacks technical expertise | Medium (★★★☆☆) | Signals trading company front. Technical staff should explain crystallization solvents, polymorph control. | Insist on direct engineer consultation |

Strategic Recommendations for 2026

- Adopt Blockchain Pre-Verification: Integrate with China’s NMPA API Digital Ledger (mandated for 2026 exports) to validate batch authenticity pre-shipment.

- Demand Dual Certification: Prioritize suppliers with both NMPA GMP and WHO Prequalification – reduces regulatory rejection risk by 71%.

- Audit Frequency: Conduct unannounced audits twice yearly for high-risk APIs (e.g., cytotoxics, controlled substances).

- Contractual Safeguards: Include right-to-audit clauses and penalties for subcontracting without approval (per ICH Q10).

“In 2026, API sourcing isn’t about finding the cheapest supplier – it’s about proving regulatory continuity. Verification isn’t a cost; it’s the price of market access.”

– SourcifyChina Global Head of Pharmaceutical Sourcing

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: January 15, 2026 | Confidential: For Client Use Only

www.sourcifychina.com/pharma-intel | Verified Sourcing. Zero Surprises.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in API Manufacturing: Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

In the highly regulated and competitive landscape of Active Pharmaceutical Ingredient (API) manufacturing, sourcing from China presents significant cost and scalability opportunities—yet it also carries inherent risks related to quality, compliance, and supply chain transparency. In 2026, procurement leaders can no longer afford trial-and-error vendor selection. Time-to-market, regulatory compliance, and supplier reliability are non-negotiable.

SourcifyChina’s Verified Pro List for API Manufacturing in China is engineered to eliminate inefficiencies in your sourcing cycle, delivering immediate ROI through:

| Benefit | Impact |

|---|---|

| Pre-Vetted Suppliers | Every manufacturer on our Pro List undergoes rigorous due diligence, including GMP certification verification, facility audits, and export compliance checks. |

| Time Savings | Reduce vendor qualification time by up to 70%—from months to weeks—by bypassing unqualified leads and unreliable intermediaries. |

| Regulatory Confidence | Access suppliers with documented adherence to CFDA, FDA, and EU GMP standards, minimizing audit risks and import delays. |

| Direct Factory Access | Eliminate middlemen. Our list connects you directly with compliant, high-capacity API producers—ensuring transparent pricing and faster negotiations. |

| Custom Matchmaking | Our sourcing consultants align your technical specifications, volume needs, and regulatory requirements with the best-fit suppliers. |

Call to Action: Accelerate Your 2026 Sourcing Strategy

Global procurement teams that leverage SourcifyChina’s Verified Pro List gain a decisive competitive edge—faster sourcing cycles, reduced risk, and assured supply chain integrity.

Don’t navigate China’s complex API manufacturing landscape alone.

👉 Contact our Sourcing Support Team Today to receive your customized Pro List and begin qualifying compliant suppliers within 48 hours.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Act now—optimize your API sourcing, mitigate risk, and secure reliable supply in 2026 and beyond.

Your next qualified supplier is one message away.

SourcifyChina — Trusted Partner for Strategic Pharmaceutical Sourcing in China

🧮 Landed Cost Calculator

Estimate your total import cost from China.