The global Bitcoin mining hardware market is experiencing robust growth, driven by increasing cryptocurrency adoption and advancements in mining technology. According to Grand View Research, the market was valued at USD 4.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.2% from 2023 to 2030. As demand for high-efficiency ASIC miners like the Antminer S17 continues to rise, a handful of manufacturers have emerged as leaders in producing and distributing these powerful units. These companies play a critical role not only in supply chain reliability but also in after-sales support, firmware optimization, and energy efficiency improvements. Below are the top 6 Antminer S17 manufacturers shaping the competitive landscape of the mining hardware industry.

Top 6 Antminer S17 Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Bitmain admits hardware problems with Antminer S17

Domain Est. 2011

Website: coingeek.com

Key Highlights: Chinese processing hardware manufacturer Bitmain has admitted there are problems with its Antminer S17, following a growing number of ……

#2 Bitmain Reveals Specifications For Its ‘Profitable’ Antminer 17 Series

Domain Est. 2011

Website: bitcoinmagazine.com

Key Highlights: Bitmain, the world’s largest bitcoin miner manufacturer, has announced specifications for its Antminer 17 series machines….

#3 BITMAIN

Domain Est. 2007

Website: bitmain.com

Key Highlights: Looking for crypto mining products? BITMAIN offers hardware and solutions, for blockchain and artificial intelligence (AI) applications. Order now!…

#4 Firmware Download

Domain Est. 2007

Website: service.bitmain.com

Key Highlights: Firmware Download … Updates:. 1. Optimized firmware. Please make sure the miner type and firmware type are the same before upgrading the miner firmware….

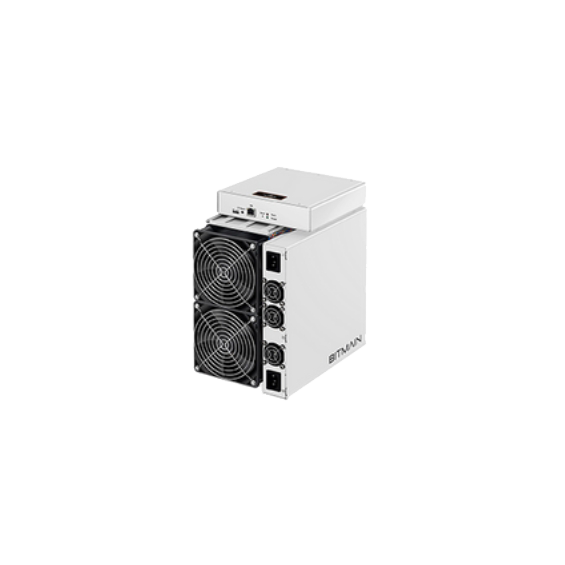

#5 ANTMINER S17

Domain Est. 2007

Website: support.bitmain.com

Key Highlights: What’s new? Specifications > Buying a S17 How to purchase > How to make payment > Use coupon for your……

#6 Antminer S17 on sale now

Domain Est. 2014

Website: antminerdistribution.com

Key Highlights: The Antminer S17 achieves top of the line hashing power of 53 TH/s, a breakthrough for miners globally….

Expert Sourcing Insights for Antminer S17

H2: 2026 Market Trends for the Antminer S17

By 2026, the Antminer S17—a once-flagship Bitcoin mining rig released in 2019—will be operating well beyond its prime and facing significant headwinds in the evolving cryptocurrency mining landscape. While it may still hold marginal utility in niche scenarios, its overall market relevance will be sharply diminished due to technological obsolescence, rising operational costs, and intensified competition from newer hardware.

1. Declining Profitability & Rising Operational Costs

- Energy Efficiency Gap: The S17’s efficiency (~40-50 J/TH) will be drastically outpaced by 2026-generation ASICs (e.g., future 3nm/2nm chips targeting <20 J/TH). With electricity costs remaining volatile or increasing, the S17’s power consumption will make it unprofitable for most miners under standard grid rates.

- Network Difficulty Surge: Bitcoin’s hashrate is projected to grow as newer, more efficient miners (like successors to the S21 or competitors from Bitmain, MicroBT, and Canaan) dominate. The S17’s 53–56 TH/s output will contribute minimally, resulting in negligible block rewards unless powered by ultra-low-cost or stranded energy.

2. Secondary Market Collapse

- Resale Value Erosion: The secondhand market for S17 units will be saturated, with prices likely dropping below $100/unit (from peak resale highs of $1,000+ in 2021). Buyers will be limited to hobbyists, educational users, or miners in off-grid/low-cost settings.

- Parts & Repair Economy: Demand may shift toward harvesting reusable components (PSUs, fans, control boards) rather than whole units, turning scrapyards and repair shops into the primary S17 ecosystem.

3. Niche Use Cases & Geographic Constraints

- Low-Cost Energy Havens: S17s may persist in regions with subsidized, surplus, or stranded energy (e.g., remote hydro plants, flared gas sites) where electricity is near-zero cost. However, even here, newer models will be prioritized for better uptime and efficiency.

- Educational & Testing Purposes: Universities, hobbyists, and small labs may use S17 units for teaching blockchain fundamentals or testing mining software due to their availability and simplicity.

4. Environmental & Regulatory Pressures

- E-Waste Concerns: As sustainability regulations tighten (e.g., EU Ecodesign, U.S. energy standards), the energy-inefficient S17 may face restrictions or higher compliance costs, accelerating decommissioning.

- Carbon Footprint Scrutiny: Miners under ESG mandates will phase out high-energy devices like the S17 to meet emissions targets, favoring next-gen hardware with better efficiency.

5. Technological Obsolescence

- Replacement by Advanced ASICs: By 2026, miners will widely adopt models with 3x–5x better efficiency than the S17. The S17’s 16nm process will be considered archaic, with reliability issues (aging chips, thermal degradation) increasing downtime and maintenance costs.

Conclusion

In 2026, the Antminer S17 will be a relic of the early 2020s mining boom. Its role will be confined to non-competitive, low-margin, or non-commercial applications. Mainstream mining operations will have long retired S17 fleets, replacing them with cutting-edge hardware to survive in an increasingly efficient and consolidated industry. For investors and miners, the S17 represents a cautionary tale of rapid technological turnover in the Bitcoin ecosystem—valuable in hindsight, but unsustainable in the future.

Common Pitfalls When Sourcing Antminer S17: Quality and IP Concerns

Quality-Related Pitfalls

Purchasing Refurbished or Used Units Marketed as New

Many sellers advertise Antminer S17 units as “new” when they are actually refurbished or previously used. This can lead to reduced hash rate, higher failure rates, and shorter lifespans. Buyers may not receive the expected performance or durability, impacting mining profitability.

Inadequate or Fake Components

Counterfeit or substandard parts—such as power supply units (PSUs), fans, or control boards—are sometimes used in rebuilt or tampered units. These components may fail prematurely under continuous operation, increasing downtime and maintenance costs.

Lack of Factory Testing and Burn-In

Reputable suppliers typically conduct burn-in tests to ensure stability. However, some third-party sellers skip these quality checks, delivering units with undetected hardware flaws. This increases the risk of early failure upon deployment.

Inconsistent Performance Across Units

Even genuine S17 models have variations in actual hash rate and power efficiency. Buyers sourcing in bulk may receive a mix of units with inconsistent performance, making it difficult to predict ROI accurately.

Intellectual Property (IP) and Authenticity Risks

Gray Market or Unauthorized Resellers

Many Antminer S17 units are sold through unauthorized distributors who may lack official Bitmain support. These gray market sellers often cannot provide valid warranties or firmware updates, leaving buyers without recourse in case of defects.

Firmware Tampering and Backdoors

Units sourced from untrusted channels may come with modified firmware that includes mining pool redirects, reduced efficiency, or security vulnerabilities. These alterations can compromise profitability and network security.

Counterfeit or Cloned Devices

While less common with the S17, counterfeit ASIC miners mimicking Bitmain’s design have appeared in the market. These clones often use inferior chips and lack genuine Bitmain IP, resulting in poor performance and no manufacturer support.

Lack of Software and Security Updates

Genuine Bitmain devices receive regular firmware updates for performance optimization and security. Sourcing through unofficial channels may cut off access to these updates, exposing the hardware to exploits or obsolescence.

Final Recommendation

To mitigate these risks, always purchase Antminer S17 units directly from Bitmain or authorized resellers. Verify serial numbers, request proof of authenticity, and insist on factory-sealed packaging and valid warranty documentation.

Logistics & Compliance Guide for Antminer S17

Overview of the Antminer S17

The Antminer S17 is a high-performance Bitcoin mining hardware developed by Bitmain. Known for its efficiency and hashing power, it is widely used in mining operations globally. Proper logistics planning and adherence to regulatory compliance are essential for the legal and efficient import, export, and operation of the S17.

Import and Export Regulations

The Antminer S17 may be subject to export controls and import restrictions depending on the country. Exporters must comply with the regulations of the country of origin (typically China). Key considerations include:

– Export Licenses: Some jurisdictions require export licenses for advanced computing hardware due to dual-use technology concerns.

– Customs Classification: The S17 is typically classified under HS Code 8471.41 (Automatic data processing machines) or 8543.70 (Electrical apparatus for transmitting information). Confirm the correct classification for accurate duty assessment.

– Sanctions Compliance: Ensure the destination country is not under international sanctions (e.g., OFAC, EU restrictions).

Power and Electrical Requirements

The Antminer S17 requires a stable power supply and proper electrical infrastructure:

– Voltage: Operates at 220–230V AC (regional variants may differ).

– Power Consumption: Approximately 2,200–3,000 watts depending on model.

– Power Supply Unit (PSU): Requires a compatible, high-efficiency PSU (e.g., APW9).

– Compliance: Devices and PSUs should carry local safety certifications such as CE (Europe), UL (USA), or CCC (China).

Packaging and Shipping

To ensure safe transit:

– Use original or reinforced packaging with shock-absorbing materials.

– Mark packages as “Fragile” and “This Side Up.”

– Include anti-static protection for sensitive components.

– For bulk shipments, use pallets and secure load distribution to prevent shifting.

Import Duties and Taxes

Importers must account for:

– Customs Duties: Vary by country; check local tariff schedules.

– Value-Added Tax (VAT) or Goods and Services Tax (GST): Typically applied to the landed cost (product value + shipping + insurance + duties).

– Import Declarations: Accurate commercial invoices, packing lists, and certificates of origin are required.

Environmental and E-Waste Compliance

- WEEE Compliance (EU): The S17 falls under Waste Electrical and Electronic Equipment directives, requiring proper end-of-life recycling.

- RoHS Compliance: Ensure the device meets Restriction of Hazardous Substances standards (lead, mercury, etc.).

- Local E-Waste Laws: Adhere to national regulations for disposal and recycling of electronic mining equipment.

Operational and Safety Compliance

- Noise Levels: The S17 produces significant noise (approx. 75–80 dB). Ensure compliance with local noise ordinances, especially in residential or urban areas.

- Heat Dissipation: Adequate ventilation and cooling systems are required to meet workplace safety standards.

- Fire Safety: Install in well-ventilated areas with accessible fire suppression equipment; avoid combustible materials nearby.

Documentation Requirements

Maintain complete records for audit and customs purposes:

– Commercial invoice with itemized pricing

– Bill of lading or air waybill

– Certificate of origin

– Packing list

– Proof of compliance with safety and emissions standards

– Import/export licenses (if applicable)

Country-Specific Considerations

- United States: No federal ban on mining, but check state-level regulations (e.g., environmental impact in New York).

- European Union: Compliance with CE marking, RoHS, and WEEE is mandatory.

- China: Export of mining equipment may be restricted; verify current policies.

- Russia, Kazakhstan, Iran: Mining regulations vary; some require licensing or reporting of operations.

Conclusion

Shipping and operating the Antminer S17 requires careful attention to logistics, customs, and compliance regulations. Proactive planning, accurate documentation, and adherence to local laws will ensure smooth deployment and legal operation of mining hardware. Consult with customs brokers and legal advisors when entering new markets.

In conclusion, sourcing an Antminer S17 requires careful consideration of several key factors to ensure a successful and reliable investment. It is essential to purchase from reputable suppliers—such as authorized resellers or well-established distributors—to avoid counterfeit or refurbished units misrepresented as new. Buyers should compare pricing across trusted platforms, keeping in mind that significantly lower prices may indicate scams or substandard equipment. Additionally, evaluating warranty terms, after-sales support, shipping logistics, and import regulations is crucial, especially when sourcing internationally. Given the S17’s high hash rate and energy efficiency relative to older models, it remains a competitive option for Bitcoin mining, provided it is acquired at a fair price and integrated into a cost-effective mining operation. Conducting thorough due diligence during the sourcing process will maximize long-term profitability and operational reliability.