The global anodized aluminum market is experiencing robust growth, driven by rising demand across architectural, automotive, and consumer electronics sectors. According to a 2023 report by Mordor Intelligence, the global anodized aluminum market was valued at USD 4.8 billion in 2022 and is projected to grow at a CAGR of over 6.2% through 2028. This expansion is fueled by the material’s superior corrosion resistance, durability, and aesthetic flexibility—qualities that make it ideal for both structural and decorative applications. As sustainability and lightweight material solutions gain priority across industries, anodized aluminum stands out for its recyclability and low environmental impact. Leading manufacturers are increasingly investing in advanced surface treatment technologies to enhance performance and meet stringent industry standards. In this evolving landscape, a select group of companies has emerged as key innovators in anodized aluminum finishing and paint solutions, setting benchmarks in quality, consistency, and technical expertise.

Top 10 Anodized Aluminium Paint Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Anodics Inc.

Domain Est. 2007

Website: anodics.com

Key Highlights: Anodics is a Nadcap™ accredited company specializing in anodized metal finishing and chromate plating, based in Fort Worth, Texas….

#2 Specialists in Anodized Aluminum and Industrial Paint

Domain Est. 2009

Website: abc-aluminum.com

Key Highlights: Our anodizing, powder coating and bright-dip finishing services significantly improve resistance to corrosion caused by factors such as production processes ……

#3 CHEMEON Surface Technology

Domain Est. 2015

Website: chemeon.com

Key Highlights: Anodizing Additive — A leader in Best Practice Training Classes for Aluminum and Titanium Anodizing. Anodizing Pre and Post Treatments + Organic Dyes….

#4 – Lorin

Domain Est. 1996

Website: lorin.com

Key Highlights: Lorin Industries has dedicated itself to the art of aluminum anodizing, achieving unrivaled expertise and delivering exceptional, tailor-made solutions to ……

#5 Alanod high

Domain Est. 1996

Website: alanod.com

Key Highlights: Our anodized metal surfaces are robust, scratch-resistant and weatherproof. A sign of clever, well thought-out architecture and stylish design….

#6 Alpha Metal Finishing

Domain Est. 1997 | Founded: 1976

Website: alphametal.com

Key Highlights: Since 1976 Alpha Metal Finishing has been a family-owned company with a focus on providing superior quality, rapid turnaround finishing….

#7 Aluminum Anodizers Council

Domain Est. 1998

Website: anodizing.org

Key Highlights: Anodizing is an electrochemical process that converts the metal surface into a decorative, durable, corrosion-resistant, anodic oxide finish….

#8 Aluminum Anodizing Companies

Domain Est. 2000

Website: aluminumanodizing.com

Key Highlights: Instantly connect with the leading aluminum anodizing companies who offer top-of-the-line customer support and high quality products for competitive prices….

#9 Anodized Aluminum Colors & Finishes

Domain Est. 2010

Website: eagle-aluminum.com

Key Highlights: Discover the beauty and durability of anodized aluminum finishes at Eagle Aluminum. Choose from a variety of colors and finishes for your project….

#10 Anodizing Industries

Website: anodizingindustries.com

Key Highlights: Anodizing Industries specializes in high volume quality metal finishing. For 46 years Anodizing industries has been a reliable quality service provider….

Expert Sourcing Insights for Anodized Aluminium Paint

H2: 2026 Market Trends for Anodized Aluminium Paint

The global market for anodized aluminum paint is poised for significant evolution by 2026, driven by advancements in surface treatment technologies, increasing demand from key end-use industries, and a growing emphasis on sustainability. While traditional anodizing involves an electrochemical process that forms a durable oxide layer on aluminum, “anodized aluminum paint” typically refers to coatings that replicate the aesthetic and performance characteristics of real anodized finishes—offering metallic sheens, corrosion resistance, and UV stability—without the need for electrolytic processing. This segment is gaining traction due to its ease of application, versatility, and compatibility with complex geometries.

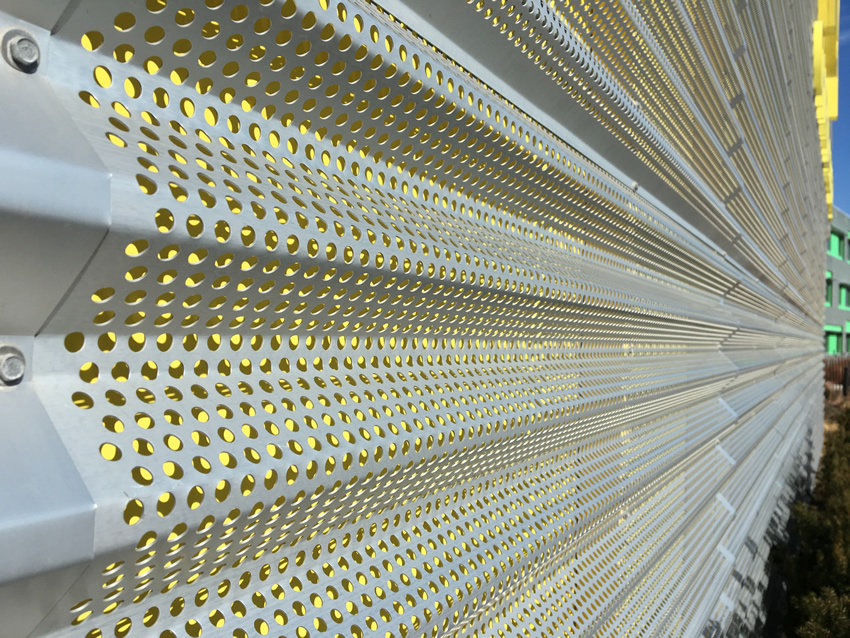

1. Rising Demand in Construction and Architecture

By 2026, the construction sector is expected to remain the largest consumer of anodized aluminum finishes. Urbanization in emerging economies and the global shift toward energy-efficient, aesthetically pleasing building designs are fueling demand for architectural aluminum components with durable, low-maintenance coatings. Anodized aluminum paint is increasingly used on window frames, curtain walls, facades, and roofing, where it mimics the sleek, metallic luster of true anodization while offering cost and logistical advantages.

2. Growth in Automotive and Transportation Applications

The automotive industry is adopting lightweight materials to enhance fuel efficiency and meet emissions regulations. Aluminum, often coated with anodized-look paints, is being used more extensively in vehicle trims, grilles, wheels, and interior elements. By 2026, electric vehicle (EV) manufacturers are expected to drive demand for premium finishes that combine durability with modern design, positioning anodized aluminum paints as a go-to solution for high-end aesthetic appeal.

3. Technological Advancements in Coating Formulations

Innovation in water-based and powder coating technologies is enabling manufacturers to produce anodized aluminum paints with improved hardness, weather resistance, and color consistency. By 2026, hybrid coatings combining ceramic nanoparticles or sol-gel technologies are anticipated to enter mainstream markets, offering performance closer to real anodization. These advancements will expand the usability of such paints in harsh environments, including marine and industrial settings.

4. Sustainability and Regulatory Drivers

Environmental regulations, particularly in North America and Europe, are pushing the coatings industry toward low-VOC (volatile organic compound) and non-toxic formulations. Anodized aluminum paints based on eco-friendly resins and renewable raw materials are gaining favor. Additionally, the recyclability of aluminum substrates aligns with circular economy goals, further boosting market appeal. By 2026, compliance with standards such as REACH, LEED, and Cradle to Cradle will be a key differentiator for product adoption.

5. Regional Market Dynamics

Asia-Pacific is projected to dominate the anodized aluminum paint market by 2026, driven by rapid industrialization in China, India, and Southeast Asia. The region’s booming construction and electronics manufacturing sectors will sustain demand. Meanwhile, North America and Europe will focus on high-performance and sustainable coatings, with steady growth in retrofit and renovation projects.

6. Competitive Landscape and Strategic Moves

Key players such as PPG Industries, AkzoNobel, Sherwin-Williams, and Hempel are investing in R&D to differentiate their product lines. Strategic partnerships with aluminum extruders and architects are expected to strengthen market positioning. By 2026, customization, digital color matching, and smart coating solutions (e.g., self-cleaning or anti-graffiti properties) will become competitive advantages.

In conclusion, the anodized aluminum paint market in 2026 will be shaped by the convergence of aesthetics, performance, and sustainability. As industries seek cost-effective alternatives to traditional anodizing without compromising quality, these advanced coatings are set to play a pivotal role across multiple sectors.

Common Pitfalls When Sourcing Anodized Aluminium Paint (Quality & IP)

Sourcing anodized aluminium paint—often used to replicate the appearance of real anodized aluminum—requires careful attention to both quality consistency and intellectual property (IP) considerations. Overlooking these aspects can lead to product failure, legal disputes, or reputational damage. Below are key pitfalls to avoid:

Quality-Related Pitfalls

1. Inconsistent Color and Finish Matching

One of the most frequent issues is variability in color, gloss level, and metallic effect between batches. Since anodized aluminum has a unique depth and sheen, paint formulations must precisely mimic this. Poor quality control by suppliers can result in visible mismatches in final products, especially in large-scale or multi-part assemblies.

2. Poor Durability and Weather Resistance

Not all paints claiming to simulate anodized finishes offer equivalent performance. Cheaper alternatives may lack UV stability, leading to fading, chalking, or gloss loss over time. They may also be prone to chipping, scratching, or corrosion in harsh environments, undermining the perceived value of the product.

3. Inadequate Adhesion and Substrate Compatibility

Anodized aluminum paint must adhere well to various substrates (e.g., aluminum, galvanized steel, or composites). Using incompatible primers or surface preparation methods can result in peeling or delamination. Suppliers may not provide sufficient technical data, leading to application failures.

4. Misrepresentation of Performance Claims

Some suppliers exaggerate performance metrics (e.g., “AAMA 2604 compliant”) without certification or third-party testing. Without verifying test reports for salt spray resistance, QUV exposure, or impact resistance, buyers risk selecting substandard products.

Intellectual Property (IP)-Related Pitfalls

1. Unauthorized Use of Brand-Specific Formulations

Certain anodized finishes (e.g., RAL, custom OEM colors) are protected by trademark or design rights. Sourcing paints that replicate proprietary finishes without licensing can expose buyers to infringement claims, especially in regulated industries like architecture or consumer electronics.

2. Use of Counterfeit or Reverse-Engineered Paints

Some suppliers offer “compatible” or “equivalent” paints that may be reverse-engineered versions of patented formulations. These can infringe on chemical composition patents or trade secrets, leading to legal liability for both the supplier and end-user.

3. Lack of IP Indemnification in Contracts

Many supply agreements do not include clauses that protect the buyer from IP disputes. If a third party sues for patent or trademark infringement related to the paint, the buyer may face costly litigation unless the supplier provides indemnification.

4. Opaque Supply Chain and Unverified Sources

Sourcing from unverified distributors or gray market suppliers increases the risk of receiving counterfeit or IP-violating products. Without traceability to the original manufacturer, it becomes difficult to ensure authenticity and legal compliance.

Conclusion

To mitigate these risks, buyers should conduct thorough due diligence: request sample testing, verify certifications, audit supplier compliance, and ensure contractual IP protections. Partnering with reputable, transparent suppliers who provide full technical and legal documentation is essential for reliable and legally safe sourcing of anodized aluminium paint.

Logistics & Compliance Guide for Anodized Aluminium Paint

Overview

Anodized Aluminium Paint refers to specialized coatings designed for application over anodized aluminum surfaces. These paints are formulated to adhere to the porous, oxide layer created during the anodizing process while maintaining aesthetic and protective qualities. Due to their chemical composition and application requirements, proper logistics handling and regulatory compliance are essential for safe transportation, storage, and use.

1. Classification and Regulatory Status

1.1 Chemical Classification

Anodized Aluminium Paints are typically solvent-based or water-based coatings containing resins (e.g., acrylic, polyurethane), pigments, and additives. Depending on the formulation, they may be classified as:

– Flammable liquids (if solvent-based, typically Class 3 under UN GHS)

– Hazardous substances under OSHA Hazard Communication Standard (HCS) and EU CLP Regulation

Common UN Numbers:

– UN1263 – Paint, flammable, n.o.s.

– UN3082 – Environmentally hazardous substances, liquid, n.o.s. (if applicable)

1.2 Regulatory Frameworks

Ensure compliance with the following:

– GHS (Globally Harmonized System) – For hazard classification and labeling

– REACH (EU) – Registration, Evaluation, Authorization, and Restriction of Chemicals

– TSCA (USA) – Toxic Substances Control Act

– OSHA HCS 2012 – Hazard Communication Standard

– ADR/RID/ADN (Europe) – For road, rail, and inland waterway transport

– IMDG Code (International Maritime) – Sea transport regulations

– IATA DGR (Air Transport) – Air shipment compliance

2. Packaging and Labeling Requirements

2.1 Packaging

- Use UN-certified packaging suitable for liquids (e.g., steel or plastic drums, pails, or jerricans)

- Ensure containers are tightly sealed to prevent leakage and vapor emissions

- Use secondary containment (e.g., palletized overpacks) for bulk shipments

- Packaging must withstand vibration, temperature changes, and stacking during transport

2.2 Labeling and Marking

Each container must display:

– Proper Shipping Name (e.g., “PAINT, FLAMMABLE, N.O.S.”)

– UN Number (e.g., UN1263)

– Hazard Class Label(s) (e.g., Class 3 Flammable Liquid, Class 9 Miscellaneous if environmentally hazardous)

– GHS Pictograms (e.g., flame, exclamation mark, health hazard)

– Supplier Information (name, address, emergency contact)

– Net Quantity

3. Storage and Handling

3.1 Storage Conditions

- Store in a cool, dry, well-ventilated area away from direct sunlight and heat sources

- Keep temperature between 10°C and 30°C (50°F–86°F)

- Flammable formulations must be stored in a flammable storage cabinet or dedicated hazardous materials storage area

- Segregate from oxidizers, acids, and strong bases

3.2 Handling Precautions

- Use grounding and bonding when transferring flammable liquids

- Prohibit smoking, open flames, or sparks in handling areas

- Use appropriate PPE: chemical-resistant gloves, safety goggles, and respiratory protection if vapor levels exceed exposure limits

4. Transportation Requirements

4.1 Ground Transport (Road/Rail)

- Comply with ADR (Europe) or 49 CFR (USA) for hazardous materials

- Vehicles must display placards for Class 3 (Flammable Liquid) if quantity thresholds are exceeded

- Driver must have appropriate training (e.g., Hazmat Endorsement in the U.S.)

- Transport documents must include emergency response information

4.2 Air Transport (IATA)

- Limited to specific packing instructions (e.g., PI 970 for small quantities)

- Quantity restrictions apply per package and per aircraft

- Must pass leakproofness and pressure differential tests

4.3 Sea Transport (IMDG)

- Must be stowed away from heat sources and living quarters

- Segregation from incompatible substances (e.g., oxidizing agents) required

- Proper documentation: Dangerous Goods Declaration, Material Safety Data Sheet (MSDS/SDS)

5. Documentation and Compliance

5.1 Required Documents

- Safety Data Sheet (SDS) – Must be up-to-date (GHS-compliant, 16-section format)

- Transport Emergency Card (TREM Card) – For ADR-compliant shipments

- Dangerous Goods Declaration – For air and sea freight

- Export Compliance Forms – ECCN (Export Control Classification Number), if applicable

5.2 Record Keeping

- Maintain SDS and shipping records for minimum of 3–5 years (varies by jurisdiction)

- Training logs for personnel handling hazardous materials

6. Environmental and Safety Considerations

6.1 Spill Response

- Immediate action: Contain spill with absorbent materials (e.g., spill kits)

- Prevent entry into drains or waterways

- Report large spills to local environmental agencies (e.g., EPA, ECHA)

6.2 Waste Disposal

- Dispose of waste paint, containers, and cleanup materials as hazardous waste

- Follow local, state, and federal regulations (e.g., RCRA in the U.S.)

- Use licensed hazardous waste disposal contractors

6.3 Worker Safety

- Conduct regular training on hazard communication, spill response, and PPE use

- Monitor air quality in spray areas; use ventilation systems (LEV)

7. Special Considerations for Anodized Aluminium Paint

- Surface Compatibility: Ensure paint formulation is specifically designed for anodized aluminum to prevent adhesion failure

- Curing Requirements: Some paints may require heat curing; ensure compliance with fire safety codes in curing ovens

- VOC Content: Monitor VOC levels to comply with regional air quality regulations (e.g., EPA Method 24, EU Directive 2004/42/EC)

8. Emergency Response

- Inhalation: Move to fresh air; seek medical attention if symptoms persist

- Skin Contact: Wash with soap and water; remove contaminated clothing

- Eye Contact: Flush with water for at least 15 minutes; consult physician

- Fire: Use dry chemical, CO₂, or foam extinguishers; water may be ineffective on solvent-based fires

Emergency Contact: Include 24/7 emergency hotline number on SDS and labels (e.g., CHEMTREC, IChemE)

Conclusion

Proper logistics and compliance management for Anodized Aluminium Paint ensures safety, regulatory adherence, and environmental protection. Always consult the product-specific SDS and stay updated on evolving regulatory requirements in target markets. Regular audits and staff training are critical components of a robust compliance program.

Conclusion for Sourcing Anodized Aluminum Paint:

Sourcing anodized aluminum paint requires careful consideration of both product specifications and supplier reliability. While true anodized finishes are achieved through an electrochemical process rather than paint, coatings that mimic the appearance and durability of anodized aluminum—such as high-performance PVDF (polyvinylidene fluoride) or FEVE-based fluoropolymer paints—are commonly used in architectural and industrial applications. These coatings offer excellent UV resistance, color retention, and longevity, closely resembling real anodization.

When sourcing such finishes, it is crucial to select reputable suppliers and manufacturers with proven track records in delivering consistent quality and technical support. Factors such as environmental durability, compliance with industry standards (e.g., AAMA 2605), color matching capabilities, and warranty terms should guide decision-making. Additionally, considering the application method, substrate preparation, and long-term maintenance requirements will ensure optimal performance.

In summary, although anodized aluminum cannot be replicated exactly with paint, high-quality fluoropolymer coatings provide a viable and cost-effective alternative. A strategic sourcing approach focused on performance, sustainability, and supplier expertise will ensure successful project outcomes and long-term satisfaction.