The global anodised aluminium market is experiencing robust growth, driven by rising demand across aerospace, automotive, architecture, and consumer electronics sectors. According to a 2023 report by Mordor Intelligence, the market was valued at USD 7.8 billion in 2022 and is projected to grow at a CAGR of over 5.6% from 2023 to 2028. This expansion is fueled by the material’s superior corrosion resistance, aesthetic versatility, and sustainability profile. Additionally, Grand View Research highlights increasing urbanization and infrastructure development in emerging economies as key growth accelerators, with architectural applications alone accounting for a significant share of global consumption. As demand intensifies, manufacturers are investing in advanced anodising technologies and automation to improve efficiency and meet stringent quality standards. Against this backdrop, identifying the leading anodising aluminium manufacturers becomes crucial for sourcing partners and industry stakeholders seeking reliable, high-performance solutions.

Top 10 Anodising Aluminium Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Plating, Coating, and Anodizing

Domain Est. 2000

Website: chemprocessing.com

Key Highlights: ALUMINUM ANODIZING. Chem Processing offers MIL-A-8625 Type I chromic acid anodizing for thin-film corrosion protection, Type II standard anodizing for ……

#2 – Lorin

Domain Est. 1996

Website: lorin.com

Key Highlights: Lorin Industries has dedicated itself to the art of aluminum anodizing, achieving unrivaled expertise and delivering exceptional, tailor-made solutions to ……

#3 Innovative anodized aluminum packaging for the world’s top brands

Domain Est. 1997

Website: anomatic.com

Key Highlights: Anomatic is a global supplier of high volume anodized aluminum packaging serving the beauty, personal care, auto, medical, electronics, and spirits ……

#4 AaCron Aluminum Anodizing Homepage

Domain Est. 1997 | Founded: 1968

Website: aacron.com

Key Highlights: AaCron has been providing anodized finishes for aluminum extrusions, sheet, plate, formed metal shapes and fabricated parts since 1968. worldwide customers. Our ……

#5 Pioneer Metal Finishing

Domain Est. 1997

Website: pioneermetal.com

Key Highlights: Pioneer Metal Finisher processes for gold plating, chrome plating and more! Request a quote, find your finish, or explore quality finishing services….

#6 Aluminum Anodizers Council

Domain Est. 1998

Website: anodizing.org

Key Highlights: Anodizing is an electrochemical process that converts the metal surface into a decorative, durable, corrosion-resistant, anodic oxide finish….

#7 Aluminum Anodizing Companies

Domain Est. 2000

Website: aluminumanodizing.com

Key Highlights: Instantly connect with the leading aluminum anodizing companies who offer top-of-the-line customer support and high quality products for competitive prices….

#8 Anodize Solutions

Domain Est. 2014

Website: anodizesolutions.com

Key Highlights: Anodized Solutions: Quality Aluminum Anodizing in Oregon, Washington, and the Pacific Northwest….

#9 US Anodize

Domain Est. 2014

Website: usanodize.com

Key Highlights: US Anodize is your single source for custom aluminum anodizing projects. Click here to learn more about what we can do for you….

#10 Aluproteck

Domain Est. 2018

Website: aluproteck.ca

Key Highlights: With over 30 years of experience, we’veworked with some of the world’s leadingarchitects, product designers and builders. SPECIALISTS IN ALUMINIUM ANODIZING ……

Expert Sourcing Insights for Anodising Aluminium

H2: Analysis of 2026 Market Trends for Anodising Aluminium

The anodising aluminium market is poised for significant transformation and growth by 2026, driven by technological advancements, increasing environmental regulations, and rising demand across key sectors such as construction, automotive, consumer electronics, and renewable energy. This section explores the major market trends expected to shape the anodising aluminium industry in 2026, with a focus on innovation, sustainability, regional dynamics, and shifting consumer preferences.

1. Growth in Sustainable and Eco-Friendly Practices

By 2026, environmental sustainability will be a primary driver in the anodising aluminium market. Regulatory bodies in Europe, North America, and parts of Asia are implementing stricter guidelines on chemical usage, wastewater discharge, and energy consumption. As a result, manufacturers are increasingly adopting:

– Low-VOC (Volatile Organic Compound) and chrome-free anodising processes to meet environmental standards.

– Closed-loop water recycling systems to reduce water consumption and minimize effluent.

– Renewable energy-powered anodising facilities, especially in Europe and Scandinavia, where green manufacturing is incentivized.

The shift toward sustainable anodising aligns with corporate ESG (Environmental, Social, and Governance) goals, making eco-friendly aluminium finishes more attractive to end-users in architecture and high-end consumer products.

2. Technological Innovations and Automation

The integration of Industry 4.0 technologies is revolutionizing the anodising process:

– Automated anodising lines with real-time monitoring improve consistency, reduce defects, and increase throughput.

– Smart sensors and AI-driven quality control systems enable predictive maintenance and adaptive process control, enhancing efficiency.

– Digital color matching and customization tools allow for precise aesthetic finishes, meeting the growing demand for personalized consumer electronics and architectural façades.

By 2026, leading anodising plants are expected to be highly digitized, reducing labor costs and improving product uniformity, especially in high-volume applications.

3. Rising Demand in Electric Vehicles (EVs) and Lightweighting

The automotive industry—particularly the EV sector—is a key growth engine for anodised aluminium. As automakers strive to reduce vehicle weight and improve battery efficiency, anodised aluminium components are being used for:

– Interior trims, heat sinks, and structural parts.

– Battery enclosures with enhanced corrosion resistance and thermal management.

Anodised finishes offer both functional durability and aesthetic appeal, supporting premium branding in EVs. With global EV production projected to exceed 40 million units annually by 2026, demand for anodised aluminium in this sector is expected to grow at a CAGR of over 9%.

4. Expansion in Construction and Architectural Applications

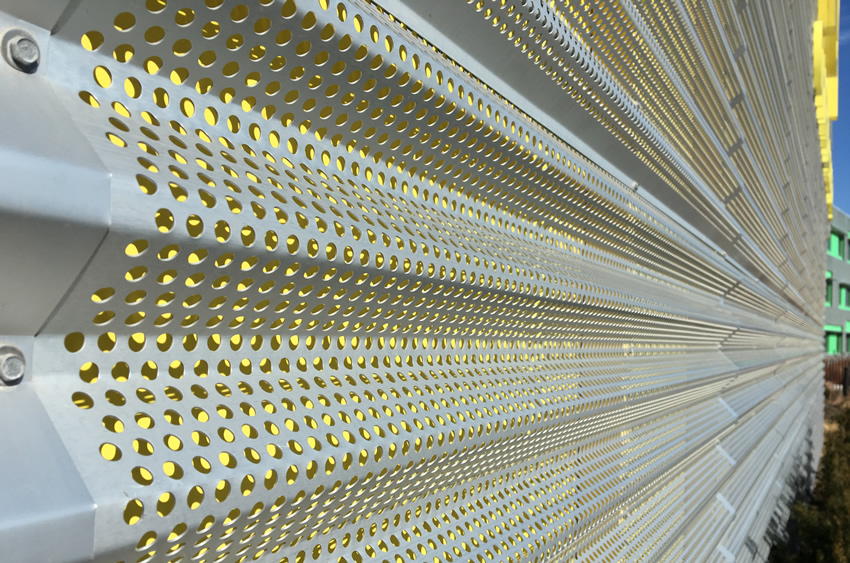

Architectural anodising remains a dominant segment, with continued growth in urban infrastructure and green buildings:

– Demand for durable, low-maintenance façades and curtain walls in commercial and residential high-rises is increasing, especially in Asia-Pacific and the Middle East.

– Anodised aluminium’s resistance to UV degradation, weathering, and corrosion makes it ideal for extreme climates.

– Aesthetic versatility, including matte, brushed, and colored finishes, supports design innovation in modern architecture.

By 2026, architectural anodising will benefit from urbanization trends and public investment in sustainable infrastructure projects.

5. Consumer Electronics and Wearables

The consumer electronics sector continues to drive demand for precision anodised aluminium:

– Smartphones, laptops, tablets, and wearables use anodised aluminium for scratch resistance, thermal conductivity, and premium look and feel.

– Technological advances allow for thinner and more complex anodised layers, supporting miniaturization and design flexibility.

– Custom color anodising and matte finishes are increasingly popular among premium brands.

With global shipments of electronic devices expected to rise, the electronics segment will remain a high-value market for anodised aluminium.

6. Regional Market Dynamics

- Asia-Pacific (APAC) will dominate the anodising aluminium market in 2026, led by China, India, and Southeast Asia. Rapid industrialization, infrastructure development, and a robust electronics manufacturing base are key growth factors.

- North America and Europe will see steady growth driven by automotive innovation, green building standards, and automation in manufacturing.

- Middle East and Africa will witness increasing demand due to large-scale construction projects (e.g., NEOM in Saudi Arabia, UAE’s Smart City initiatives).

7. Challenges and Competitive Landscape

Despite growth, the market faces challenges:

– Fluctuating aluminium prices and energy costs may impact profitability.

– Stringent environmental compliance increases capital expenditure for smaller players.

– Competition from alternative surface treatments (e.g., powder coating, PVD) requires anodising providers to differentiate through performance and sustainability.

Leading companies such as Alumil, Hydro, and Anomatic are investing in R&D and capacity expansion to capture market share. Consolidation and strategic partnerships are expected to rise by 2026.

Conclusion

By 2026, the anodising aluminium market will be characterized by a strong emphasis on sustainability, technological innovation, and cross-sector demand. Driven by growth in electric vehicles, construction, and consumer electronics, the global market is projected to exceed USD 12 billion, with a CAGR of approximately 6.5% from 2021 to 2026. Success will depend on the industry’s ability to adapt to regulatory pressures, embrace digital transformation, and deliver high-performance, eco-conscious solutions.

H2: Common Pitfalls in Sourcing Anodised Aluminium (Quality and Intellectual Property)

Sourcing anodised aluminium involves several critical considerations, particularly concerning quality consistency and intellectual property (IP) protection. Failing to address these areas can lead to production delays, cost overruns, reputational damage, or legal disputes. Below are common pitfalls in both quality and IP domains.

Quality-Related Pitfalls

- Inconsistent Anodising Layer Thickness

- Pitfall: Suppliers may not adhere to specified anodising standards (e.g., ISO 7599, AMS 2471), resulting in variable coating thickness.

- Consequence: Thin coatings compromise corrosion resistance and durability; thick coatings may cause brittleness or dimensional inaccuracies.

-

Mitigation: Enforce strict tolerance controls and verify with cross-sectional microscopy or eddy current testing.

-

Poor Color and Finish Uniformity

- Pitfall: Variability in dye lots, bath chemistry, or pre-treatment processes leads to inconsistent color or surface finish.

- Consequence: Aesthetic defects, especially problematic in architectural or consumer products.

-

Mitigation: Require color matching under standardized lighting (e.g., CIE D65) and implement batch approval samples.

-

Adhesion and Sealing Defects

- Pitfall: Inadequate sealing of the porous anodic layer or improper pre-treatment (e.g., etching, de-smutting).

- Consequence: Reduced corrosion resistance and susceptibility to staining or chalking.

-

Mitigation: Conduct seal quality tests (e.g., acid dissolution test per ASTM D1175 or impedance spectroscopy).

-

Dimensional Tolerances Affected by Anodising

- Pitfall: The anodising process adds ~50% of the coating thickness to the surface dimension, which may not be accounted for in design.

- Consequence: Interference in precision-fit assemblies.

-

Mitigation: Collaborate with suppliers early to adjust tolerances and specify coating build-up in technical drawings.

-

Use of Substandard Base Aluminium Alloys

- Pitfall: Sourcing from suppliers using non-spec alloys (e.g., high iron content in 6063) affects anodising response and finish quality.

- Consequence: Streaking, burning during anodising, or poor dye uptake.

- Mitigation: Specify alloy grade and temper (e.g., 6063-T5) and verify with material certifications (e.g., mill test reports).

Intellectual Property (IP)-Related Pitfalls

- Unauthorized Use of Proprietary Finishes or Color Formulations

- Pitfall: Suppliers may replicate custom anodised colors or textures without licensing, infringing on design IP.

- Consequence: Legal liability and loss of competitive differentiation.

-

Mitigation: Use confidentiality agreements (NDAs) and register trademarks or design patents for unique finishes.

-

Lack of IP Clauses in Supplier Contracts

- Pitfall: Contracts fail to clarify ownership of custom tooling, process specifications, or aesthetic designs developed during sourcing.

- Consequence: Supplier may claim rights or reuse designs for competitors.

-

Mitigation: Include explicit IP assignment clauses and non-compete provisions in procurement agreements.

-

Reverse Engineering by Suppliers in Low-Cost Regions

- Pitfall: Overseas anodising providers may reverse engineer samples to produce identical products for third parties.

- Consequence: Market dilution and counterfeit products.

-

Mitigation: Limit sample distribution, watermark prototypes, and audit supplier facilities for IP compliance.

-

Inadequate Protection of Process-Specific Anodising Techniques

- Pitfall: Unique multi-step anodising processes (e.g., interference coloring, matte etching) shared without protection.

- Consequence: Loss of technological edge.

- Mitigation: File process patents where applicable and restrict technical data access via tiered NDAs.

Best Practices Summary

- Audit suppliers for quality certifications (e.g., ISO 9001, AS9100) and anodising-specific capabilities.

- Define clear specifications for alloy, thickness, color (using standards like BS EN 12373), and testing protocols.

- Protect IP through legal agreements, design registrations, and controlled technical disclosures.

- Conduct regular quality audits and first-article inspections (FAI) before full production.

Avoiding these pitfalls ensures both high-quality anodised aluminium components and safeguards critical intellectual assets throughout the supply chain.

Logistics & Compliance Guide for Anodising Aluminium

Overview

Anodising aluminium is an electrochemical process that converts the metal surface into a durable, corrosion-resistant, decorative oxide finish. Given the chemical, environmental, and safety implications of this process, strict logistics and regulatory compliance are essential. This guide outlines key considerations for managing the logistics and ensuring compliance when anodising aluminium, covering transportation, handling, environmental regulations, worker safety, and international standards.

Regulatory & Safety Compliance

Hazardous Chemical Management

Anodising involves the use of several hazardous chemicals, including:

– Sulfuric acid (most common electrolyte)

– Chromic acid (in some older processes)

– Caustic soda (for cleaning and etching)

– Nitric or phosphoric acid (for desmutting)

Regulatory compliance includes:

– OSHA (Occupational Safety and Health Administration) – Requires proper handling, labeling, and employee training under the Hazard Communication Standard (HCS).

– REACH (EU) – Registration, Evaluation, Authorisation and Restriction of Chemicals. Ensure all chemicals used are registered and safe for industrial use.

– CLP Regulation (EU) – Classification, Labelling and Packaging of substances and mixtures. All chemicals must be properly labeled with hazard pictograms and safety instructions.

Best Practices:

– Maintain Safety Data Sheets (SDS) for all chemicals.

– Conduct regular risk assessments and update chemical exposure controls.

– Use closed-loop systems where possible to minimize exposure.

Waste Disposal & Environmental Regulations

Anodising generates hazardous waste, including spent acids, sludge, and rinse water containing heavy metals.

Key regulations:

– EPA (Environmental Protection Agency) – USA – Regulates discharge under the Clean Water Act and Resource Conservation and Recovery Act (RCRA). Facilities must treat wastewater and obtain NPDES permits for discharge.

– Environmental Permitting Regulations (England and Wales) – Requires an environmental permit for operations involving hazardous substances.

– ISO 14001 – Environmental Management System standard. Certification demonstrates commitment to minimizing environmental impact.

Best Practices:

– Install wastewater treatment systems to neutralize pH and remove metals.

– Recycle aluminium hydroxide sludge where feasible.

– Partner with licensed hazardous waste disposal contractors.

– Monitor effluent regularly and maintain detailed records.

Logistics Management

Raw Material Handling & Storage

- Aluminium Input: Ensure incoming aluminium alloys are properly labeled, stored in dry conditions, and free from contaminants (grease, oil, paint).

- Chemical Storage: Store acids and alkalis in corrosion-resistant, ventilated cabinets. Segregate incompatible chemicals (e.g., acids from bases).

- Spill Containment: Use spill trays and secondary containment for all chemical storage areas.

Facility Layout & Process Flow

Optimize plant layout to:

– Minimize material handling distances.

– Prevent cross-contamination between pre-treatment, anodising, coloring, and sealing stages.

– Ensure proper ventilation, especially in acid anodising tanks.

Include:

– Dedicated zones for loading/unloading, processing, quality control, and finished goods storage.

– Clear labeling of hazardous areas and emergency equipment (eyewash stations, showers, fire extinguishers).

Finished Goods Handling

- Dry and package anodised parts carefully to avoid scratching.

- Use anti-static or non-abrasive packaging materials, especially for architectural or high-gloss finishes.

- Label finished products with batch numbers, coating thickness, and compliance certifications.

Worker Health & Safety

Personal Protective Equipment (PPE)

Mandatory PPE includes:

– Acid-resistant gloves and aprons

– Face shields and safety goggles

– Respirators (if ventilation is inadequate)

– Non-slip, chemical-resistant footwear

Training & Emergency Preparedness

- Train staff on chemical handling, emergency shutdown procedures, and first aid.

- Conduct regular drills for acid spills, fires, and medical emergencies.

- Maintain accessible emergency response plans and contact lists.

International Trade & Standards

Export Compliance

If exporting anodised aluminium:

– Comply with ITAR/EAR (USA) if components are for aerospace or defense.

– Follow Customs-Trade Partnership Against Terrorism (C-TPAT) for shipments to the U.S.

– Ensure packaging meets ISPM 15 for wooden materials.

Industry Standards

Adhere to relevant performance and quality standards:

– ISO 7599: Anodizing of aluminium and its alloys – Specifications for anodic oxidation coatings.

– ASTM B137: Test method for weight of oxide coating on aluminium.

– AAMA 611: Voluntary specification for architectural anodized aluminium.

– Qualanod (Europe): Certification scheme for architectural anodising.

Certification to these standards enhances market access and customer trust.

Monitoring & Documentation

Record Keeping

Maintain logs for:

– Chemical usage and inventory

– Wastewater discharge test results

– Equipment maintenance and calibration

– Employee training records

– Incident reports and corrective actions

Audits & Continuous Improvement

- Conduct internal and third-party audits regularly.

- Use findings to improve safety, efficiency, and compliance.

- Pursue certifications such as ISO 9001 (Quality Management) and ISO 45001 (Occupational Health and Safety).

Conclusion

Successful anodising of aluminium requires meticulous attention to logistics and compliance. By adhering to environmental, safety, and quality regulations, companies can ensure operational efficiency, worker protection, and market competitiveness. Regular training, proper documentation, and investment in sustainable technologies are key to long-term success in the anodising industry.

Conclusion for Sourcing Anodized Aluminum

Sourcing anodized aluminum requires a strategic approach that balances quality, cost, lead times, and supplier reliability. Anodizing enhances aluminum’s natural properties—offering improved corrosion resistance, durability, and aesthetic versatility—making it ideal for industries such as aerospace, automotive, architecture, and consumer electronics.

To ensure successful sourcing, it is essential to partner with reputable suppliers who adhere to industry standards (e.g., ISO, MIL-A-8625) and offer consistent quality control. Evaluating factors such as anodizing thickness, color accuracy, surface finish, and environmental compliance (e.g., RoHS, REACH) is critical. Additionally, considering whether to source pre-anodized aluminum or outsource the anodizing process separately can impact cost-efficiency and supply chain logistics.

In conclusion, a well-informed sourcing strategy for anodized aluminum—one that emphasizes supplier vetting, specification clarity, and long-term collaboration—will deliver optimal performance, cost savings, and supply chain resilience. As demand for lightweight, durable, and sustainable materials grows, anodized aluminum remains a superior choice when sourced effectively.