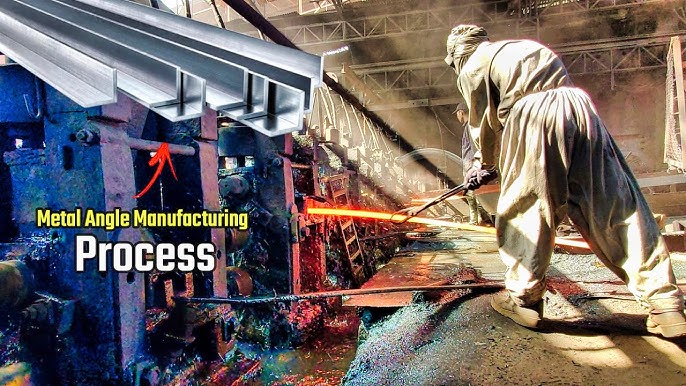

The global angle steel market is experiencing robust growth, driven by rising infrastructure development, industrial construction, and demand from the automotive and renewable energy sectors. According to Mordor Intelligence, the angle steel market was valued at USD 98.6 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029. This expansion is fueled by increasing urbanization and government-led investments in transportation and public infrastructure, particularly across Asia-Pacific and the Middle East. As demand for high-strength, cost-effective structural components intensifies, manufacturers are enhancing production efficiency and adopting sustainable practices to meet evolving industry standards. In this competitive landscape, identifying leading angle sheet manufacturers—those with strong production capabilities, global reach, and innovation in metallurgical engineering—is crucial for procurement professionals and project planners. Based on market presence, production volume, and strategic initiatives, the following list highlights the top 10 angle sheet manufacturers shaping the industry’s future.

Top 10 Angle Sheet Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

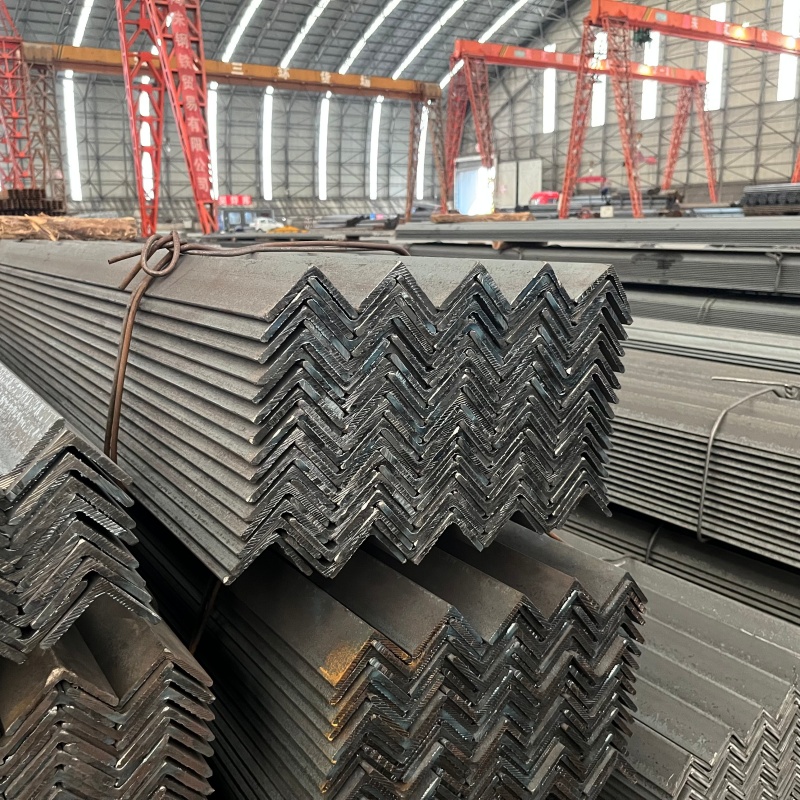

#1 China Angle steel Manufacturer, Supplier, Factory

Domain Est. 2017

Website: junnansteel.com

Key Highlights: Junnan Steel Wholesale is one of the leading China angle iron manufacturer and supplier, over the years, we have established good relationship with our ……

#2 Steel Angles

Domain Est. 2019

Website: pgisteel.com

Key Highlights: We manufacture non-standard, custom, and specialized steel angle plates for grinding machines, manual mills, and CNC machining centers….

#3 Angles and Plates

Domain Est. 1995

Website: strongtie.com

Key Highlights: Angles and plates include a variety of utility-reinforcing metal connectors with multiple uses designed to improve the stability of connections….

#4 Siskin.com

Domain Est. 1997

Website: siskin.com

Key Highlights: Siskin Steel & Supply co stocks and processes Carbon, Stainless, Aluminum, & Alloy in thousands of shapes, sizes, and grades….

#5

Domain Est. 1999

Website: anglering.com

Key Highlights: At Angle Ring, we have specialised in bending and curving metal and alloys for over 70 years. Looking for high-quality steel bending services in the UK?…

#6 Equal Steel Angles

Domain Est. 2001

Website: madar.com

Key Highlights: Our L-shaped structural steel products are strong, durable, and versatile, and are available in a range of sizes and thicknesses to meet your needs. In stock….

#7 3rd Angle Manufacturing Solutions

Domain Est. 2006

Website: 3rdanglemfg.com

Key Highlights: 3rd Angle Manufacturing Solutions was started in early 2006 with the focus of offering cost effective and quality metal fabrication manufacturing solutions….

#8 Angles & Flats lines

Domain Est. 2009

Website: ficepgroup.com

Key Highlights: Our CNC angle and flat line solutions gives the opportunity to process not only angles but also channels and flats….

#9 Right Angle Steel & Fabrication

Domain Est. 2010 | Founded: 2001

Website: rightanglesteel.com

Key Highlights: Right Angle Steel & Fabrication in Nappanee, Indiana has provided quality steel services, fabrication, and top customer service since 2001….

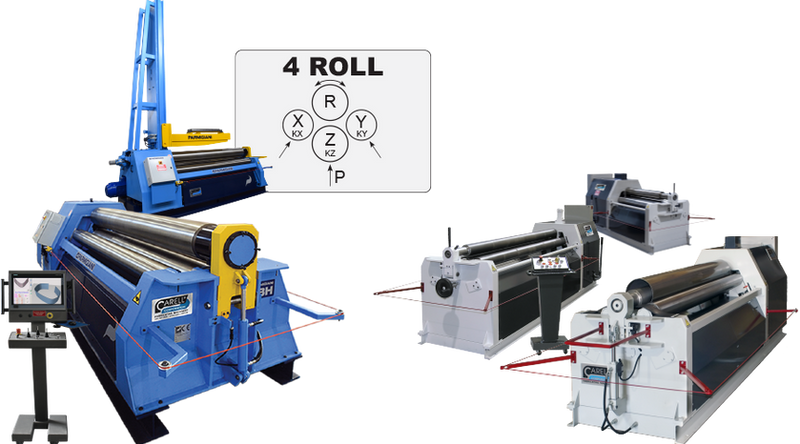

#10 Our Plate Bending, Angle Rolls & Dished Head Machineries

Domain Est. 2020

Website: faccingroup.com

Key Highlights: Discover Faccin Group’s products: Plate Bending, Angle Rolls, and Dished Head Machinery, offering customized solutions for enhanced production efficiency….

Expert Sourcing Insights for Angle Sheet

2026 Market Trends for Angle Sheets: A H2 Analysis

As we look toward 2026, the global angle sheet market is poised for continued evolution, driven by macroeconomic factors, technological advancements, and shifting industrial demands. This H2 (Hydrogen-based reduction and High-performance materials) framework analysis focuses on two critical, interconnected trends shaping the future: H2 as a driver of sustainable production (Hydrogen-based reduction) and H2 as an enabler of high-performance applications (High-performance materials).

H2 Trend 1: Hydrogen-Based Reduction – Transforming Production Sustainability

The most profound trend impacting the angle sheet market by 2026 is the accelerating shift towards green steel production using hydrogen (H2) as a reducing agent, replacing traditional coking coal in blast furnaces.

- Decarbonization Pressure: Intense global pressure to achieve net-zero emissions (driven by regulations like the EU CBAM, corporate ESG goals, and national climate targets) is forcing steelmakers to seek alternatives to carbon-intensive processes. Angle sheets, as a fundamental structural steel product, are directly impacted by the carbon footprint of their base steel.

- Direct Reduced Iron (DRI) with H2: The primary pathway involves using “green hydrogen” (produced via electrolysis using renewable energy) in Direct Reduced Iron (DRI) plants. This process emits only water vapor instead of CO2. While still in scaling phases (e.g., projects by H2 Green Steel, SSAB HYBRIT, Thyssenkrupp), significant capacity is expected to come online by 2026, particularly in Europe and regions with abundant renewables.

- Impact on Angle Sheet Supply & Cost:

- Supply Chain Restructuring: Early 2026 will likely see the first commercial volumes of “green angle sheets” from pioneers. Supply will be limited and regionally focused initially, creating a premium segment.

- Cost Dynamics: Green steel production is currently more expensive than traditional methods due to high green hydrogen costs and new infrastructure. This premium (estimated 20-50%+ in early stages) will be passed on to angle sheet prices, especially for certified low-carbon products. However, costs are expected to decrease steadily as H2 production scales and technology matures.

- Market Segmentation: A clear market split will emerge: “conventional” angle sheets (higher carbon footprint, potentially facing carbon tariffs) and “green” or “low-carbon” angle sheets (premium priced, demanded by sustainability-focused sectors like green construction, renewable energy infrastructure, and export-oriented manufacturers).

- 2026 Outlook: By H2 2026, hydrogen-based reduction will move from pilot projects to initial commercial reality. While not yet dominant, it will be a major strategic focus for steel producers, influencing investment decisions, supply chain partnerships, and customer procurement strategies for angle sheets. Demand for certified low-carbon angle sheets will be a key growth driver.

H2 Trend 2: High-Performance Materials – Enabling Advanced Applications

The second critical “H2” trend is the growing demand for high-performance materials, where advanced metallurgy and processing create angle sheets with superior properties to meet the demands of evolving industries.

- Performance Requirements: Key sectors are pushing for materials that are stronger, lighter, more durable, and more corrosion-resistant:

- Construction: Demand for longer spans, lighter structures (reducing foundation costs), and enhanced seismic resilience.

- Renewable Energy: Offshore wind turbine towers and foundations require massive, ultra-high-strength, and corrosion-resistant sections to withstand harsh marine environments and increasing turbine sizes.

- Transportation & Infrastructure: High-speed rail, bridges, and modern automotive frames (e.g., EV chassis) need high-strength, lightweight steels for efficiency and safety.

- Industrial Equipment: Machinery operating under extreme stress or corrosive conditions.

- Material Advancements Driving Angle Sheets:

- Advanced High-Strength Steels (AHSS) & Ultra-High-Strength Steels (UHSS): Grades like S690QL, S960QL, and even higher are becoming more common for angle sheets, offering significantly higher yield strength than traditional S235/S355 grades, enabling weight reduction.

- Improved Toughness & Weldability: Enhanced processing ensures better performance in low temperatures and easier, more reliable welding – crucial for critical structures.

- Enhanced Corrosion Resistance: Development of weathering steels with superior atmospheric corrosion resistance (beyond standard Corten) and optimized protective coatings for harsh environments.

- Precision Manufacturing: Tighter tolerances and improved dimensional consistency achieved through advanced rolling and finishing techniques.

- Impact on the Angle Sheet Market:

- Value Shift: The market focus moves beyond commodity pricing towards value-added solutions based on performance specifications.

- Specialization: Producers investing in R&D and specialized rolling mills gain a competitive edge. Custom grades and profiles become more viable.

- Downstream Innovation: Enables lighter, more efficient, and longer-lasting structures and products, opening new application areas for angle sections.

- 2026 Outlook: By H2 2026, high-performance angle sheets will be a significant and growing segment. Demand will be particularly strong in renewable energy (especially offshore wind), advanced construction, and specialized industrial applications. The ability to supply certified, high-specification materials will be a key differentiator for manufacturers.

Conclusion: The Dual H2 Convergence

By the second half of 2026, the angle sheet market will be fundamentally shaped by the convergence of these two “H2” trends:

- Sustainability Imperative (Hydrogen-based): The push for green steel will create a new dimension of value (low carbon footprint) and reshape supply chains, pricing, and market segmentation. “Green angle sheets” will transition from niche to a commercially relevant, albeit premium, segment.

- Performance Imperative (High-performance): Demand for stronger, lighter, more durable materials will drive innovation in steel grades and manufacturing, creating high-value products for demanding applications.

Winning strategies in 2026 will require steel producers and distributors to simultaneously navigate both fronts: investing in or securing access to green steel production technologies while developing and marketing high-performance angle sheet solutions. Customers, particularly in construction, energy, and infrastructure, will increasingly demand products that meet both stringent environmental standards and superior mechanical performance. The market will move decisively beyond commodity pricing towards value-based models centered on sustainability and enhanced functionality.

Common Pitfalls When Sourcing Angle Sheets: Quality and Intellectual Property (IP) Concerns

Sourcing angle sheets—flat steel sheets with angular cutouts or formed edges used in structural and mechanical applications—can present several challenges, particularly regarding quality consistency and intellectual property risks. Overlooking these pitfalls can lead to production delays, compliance issues, increased costs, or legal disputes.

Quality Inconsistencies and Material Deficiencies

One of the most frequent issues when sourcing angle sheets is inconsistent product quality. Suppliers may cut corners to reduce costs, leading to substandard materials or fabrication.

- Non-Compliance with Specifications: Angle sheets may not meet required dimensional tolerances, thickness standards, or material grades (e.g., ASTM A36, EN 10025). This can compromise structural integrity in end-use applications.

- Poor Surface Finish and Edge Quality: Inadequate cutting or forming processes can result in burrs, warping, or uneven edges, increasing post-processing costs and safety risks.

- Inconsistent Coatings or Corrosion Resistance: For galvanized or coated angle sheets, insufficient or uneven coating can reduce lifespan, especially in outdoor or corrosive environments.

- Lack of Traceability and Certification: Reputable suppliers provide mill test certificates (MTCs) and material traceability. Without these, verifying compliance with industry standards becomes impossible.

Intellectual Property (IP) Risks and Counterfeit Products

Sourcing from unverified suppliers—especially in global markets—increases exposure to IP infringement and counterfeit components.

- Unauthorized Replication of Proprietary Designs: If your angle sheet design includes custom geometry or patented features, suppliers may reproduce or reverse-engineer it without permission, potentially distributing it to competitors.

- Use of Counterfeit or Grey-Market Materials: Some suppliers may falsely certify materials or use recycled steel misrepresented as high-grade, leading to performance failures and legal liabilities.

- Lack of IP Clauses in Contracts: Without clear contractual terms protecting design ownership and prohibiting unauthorized use, your IP may be exploited.

- Weak Enforcement in Certain Regions: In jurisdictions with lax IP enforcement, pursuing legal action against infringement can be costly and ineffective.

Mitigation Strategies

To avoid these pitfalls, implement due diligence practices:

– Audit suppliers and request certifications (ISO, material test reports).

– Include strict quality control clauses in procurement contracts.

– Protect designs with patents or design rights and enforce confidentiality agreements.

– Source from reputable suppliers with verifiable track records and transparent supply chains.

Addressing these quality and IP issues proactively ensures reliable performance, regulatory compliance, and protection of your company’s innovations.

Logistics & Compliance Guide for Angle Sheets

This guide outlines key logistics and compliance considerations when handling, transporting, and utilizing angle sheets—typically referring to steel or metal angle iron or angle stock supplied in sheet or bar form.

Material Handling and Storage

Ensure angle sheets are stored in a dry, level, and well-ventilated area to prevent corrosion and warping. Use protective padding between layers when stacking to avoid surface damage. Store materials off the ground using wooden skids or pallets to reduce moisture exposure. Handle with appropriate lifting equipment such as forklifts with suitable attachments or overhead cranes with spreader beams to prevent bending or deformation.

Packaging and Labeling Requirements

Angle sheets should be securely bundled with steel or plastic strapping to maintain integrity during transport. Each bundle must include a legible label indicating: material grade, dimensions (leg length and thickness), length of cut, heat number, batch/lot number, and applicable standards (e.g., ASTM A36, EN 10025). Proper labeling ensures traceability and compliance with quality control procedures.

Transportation and Freight

Use flatbed trailers or enclosed trucks depending on environmental conditions and distance. Secure loads with tie-down straps or chains to prevent shifting during transit. For international shipments, comply with freight classification standards (e.g., NMFC codes in North America) and ensure proper customs documentation, including commercial invoice, packing list, and certificate of origin. Consider corrosion-resistant wrapping or VCI (Vapor Corrosion Inhibitor) paper for ocean freight.

Regulatory Compliance

Adhere to regional and international regulations applicable to metal products. In the U.S., follow OSHA guidelines for workplace handling and DOT regulations for transportation. For shipments within the EU, comply with REACH and RoHS directives, particularly regarding chemical content and worker safety. Confirm compliance with building codes and structural standards (e.g., AISC, Eurocode 3) when supplying angle sheets for construction purposes.

Import and Export Documentation

Prepare accurate documentation for cross-border shipments, including:

– Commercial Invoice

– Bill of Lading or Air Waybill

– Packing List

– Certificate of Compliance or Conformity

– Mill Test Certificate (EN 10204 3.1 or equivalent)

– Export License (if required by destination country)

Verify tariff classifications (HS Codes—typically 7216.33 or 7301.10 for steel angles) to ensure correct duties and avoid customs delays.

Environmental and Safety Standards

Dispose of packaging materials in accordance with local environmental regulations. Implement safe handling procedures to prevent injuries from sharp edges or heavy lifting. Provide appropriate PPE (gloves, safety glasses, steel-toed boots) for personnel involved in logistics operations. Follow hazardous material protocols if coatings or treatments (e.g., galvanization) are present.

Quality Assurance and Traceability

Maintain a documented quality management system (e.g., ISO 9001) to ensure product consistency. Retain material test reports and inspection records for traceability. Conduct periodic audits of logistics partners to verify compliance with agreed handling, packaging, and delivery standards.

Supplier and Vendor Compliance

Require suppliers to certify compliance with industry standards and ethical sourcing practices. Evaluate vendors based on adherence to environmental, labor, and safety regulations. Include compliance clauses in procurement contracts to mitigate supply chain risks.

By following this guide, businesses can ensure the safe, efficient, and legally compliant handling of angle sheets throughout the supply chain.

Conclusion for Sourcing Angle Sheet:

In conclusion, sourcing angle sheets requires a strategic approach that balances cost, quality, material specifications, supplier reliability, and lead times. By evaluating key factors such as material grade (e.g., ASTM A36, S275JR), dimensional accuracy, surface finish, and compliance with industry standards, organizations can ensure they procure angle sheets that meet project requirements. Establishing partnerships with reputable suppliers, conducting thorough market analysis, and considering total landed costs—including freight, tariffs, and lead times—contribute to a successful sourcing strategy. Additionally, maintaining flexibility for alternative materials or regional suppliers can enhance supply chain resilience. Effective sourcing of angle sheets not only supports structural integrity and project efficiency but also contributes to long-term cost savings and operational success.