The global laser welding market is experiencing robust expansion, driven by increasing demand for precision manufacturing across industries such as automotive, aerospace, and medical devices. According to Grand View Research, the market was valued at USD 1.79 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. This growth is fueled by advancements in high-power laser technologies, rising adoption of automation, and the need for cleaner, more efficient joining processes. In Latin America, the Andes region—spanning countries like Colombia, Ecuador, Peru, and parts of Chile and Argentina—has emerged as a burgeoning hub for industrial innovation, with several manufacturers advancing localized laser welding capabilities. Supported by growing manufacturing investment and regional supply chain integration, these Andes-based firms are positioning themselves as key contributors to South America’s evolving advanced manufacturing landscape. Here are the top three laser welding manufacturers in the Andes region, recognized for their technological adoption, product quality, and regional impact.

Top 3 Andes Laser Welding Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1

Website: andelaser.com

Key Highlights: Categories: Laser Plate Cutting, Laser Tube Cutting, Laser Welding, Laser Marking&Engraving, Laser Cleaning…

#2 Wage Determinations Davis

Website: sam.gov

Key Highlights: SAM.gov The System for Award Management (SAM) is the Official U.S. Government system that consolidated the capabilities of CCR/FedReg, ORCA, and EPLS….

#3 15 CFR Part 774

Website: ecfr.gov

Key Highlights: Bellows manufacturing equipment, including hydraulic forming equipment and bellows forming dies. c. Laser welding machines. d. MIG welders. e. E-beam welders….

Expert Sourcing Insights for Andes Laser Welding

H2: Market Trends for Andes Laser Welding in 2026

As the global manufacturing and industrial automation landscape evolves, Andes Laser Welding is positioned to benefit from several key market trends expected to shape the industry in 2026. These trends reflect advancements in technology, shifts in manufacturing demand, and growing emphasis on precision, efficiency, and sustainability. Below is an analysis of the most influential trends impacting Andes Laser Welding in 2026:

-

Increased Adoption in Electric Vehicle (EV) Manufacturing

The electric vehicle market continues to expand rapidly, driving demand for high-precision, high-speed joining technologies. Andes Laser Welding systems, known for their accuracy and minimal heat distortion, are increasingly being integrated into EV battery pack assembly, powertrain components, and lightweight body structures. By 2026, the EV sector is expected to be one of the primary growth drivers for Andes’ laser welding solutions, particularly in Asia and North America. -

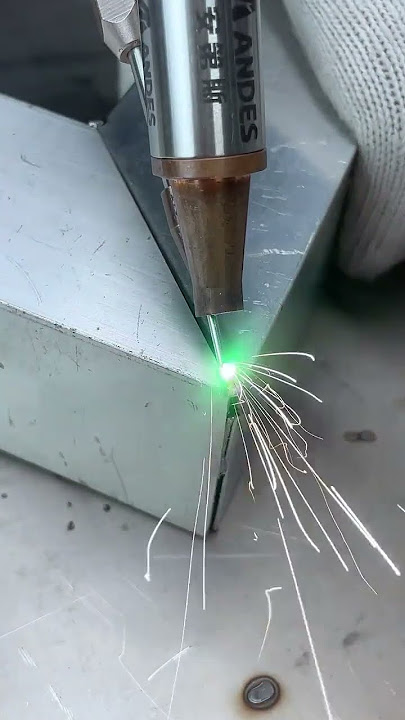

Growth in Miniaturization and Precision Engineering

Industries such as medical devices, consumer electronics, and aerospace require micro-welding capabilities with micron-level precision. Andes’ expertise in fiber laser technology enables consistent, non-contact welding of thin and dissimilar materials, making its systems ideal for applications in these high-precision sectors. The trend toward smaller, more complex components will further boost demand for Andes’ advanced laser welding platforms. -

Rise of Smart Manufacturing and Industry 4.0 Integration

By 2026, manufacturers are prioritizing connectivity, real-time monitoring, and predictive maintenance. Andes has been enhancing its systems with IoT-enabled sensors, AI-driven process optimization, and cloud-based analytics. These smart features allow seamless integration into automated production lines, improving yield rates and reducing downtime—key selling points for industrial clients embracing digital transformation. -

Sustainability and Energy Efficiency Demands

With global focus on reducing carbon emissions, manufacturers are seeking energy-efficient production methods. Laser welding consumes less energy than traditional resistance or arc welding and produces minimal waste. Andes’ low-power-consumption fiber lasers align with green manufacturing initiatives, making them attractive to environmentally conscious companies aiming to meet ESG (Environmental, Social, and Governance) standards. -

Expansion into Emerging Markets

Industrialization in Southeast Asia, India, and parts of Eastern Europe is accelerating, creating new opportunities for advanced manufacturing technologies. Andes is likely to strengthen its regional partnerships, local service networks, and distribution channels to capture market share in these growing economies, where demand for automation and high-quality welding is on the rise. -

Competition and Innovation Pressure

While Andes holds a strong niche in precision laser welding, increasing competition from global players (e.g., IPG Photonics, TRUMPF) and evolving customer expectations will push the company to innovate continuously. In 2026, success will depend on Andes’ ability to offer differentiated solutions—such as hybrid welding systems, improved beam delivery, and customizable software platforms.

Conclusion:

By 2026, Andes Laser Welding is poised to capitalize on strong tailwinds from the EV revolution, precision engineering demands, and smart factory adoption. However, sustained growth will require strategic investments in R&D, global market expansion, and digital integration. As laser welding becomes more central to advanced manufacturing, Andes’ focus on quality, precision, and innovation should position it as a key enabler of next-generation production systems.

Common Pitfalls Sourcing Andes Laser Welding (Quality, IP)

Sourcing laser welding equipment, particularly from manufacturers like Andes, requires careful due diligence to avoid significant risks related to quality consistency and intellectual property (IP) protection. Below are key pitfalls to watch for:

Quality Inconsistencies and Lack of Verification

One of the primary risks when sourcing Andes laser welding systems is inconsistent product quality. While Andes may offer competitive pricing, variations in manufacturing standards, component sourcing, and quality control processes can lead to reliability issues. Buyers may encounter units with subpar laser beam stability, premature component failure, or calibration inaccuracies. Without third-party certifications (e.g., ISO, CE) or verifiable performance data, it becomes difficult to assess real-world durability and precision. Additionally, limited access to technical support or spare parts outside the manufacturer’s region can exacerbate downtime and repair costs.

Intellectual Property Exposure and Compliance Risks

Sourcing Andes laser welding technology may expose companies to intellectual property risks. There are documented concerns in the industry about potential IP infringement, including similarities in design or software functionality with established Western or Japanese counterparts. Using equipment suspected of containing copied or reverse-engineered technology could lead to legal challenges, especially when deploying such systems in IP-sensitive industries like automotive, aerospace, or medical devices. Furthermore, incorporating non-compliant or counterfeit components may violate international trade regulations, leading to shipment seizures or reputational damage. Buyers must conduct thorough IP due diligence, including patent searches and supplier audits, to mitigate exposure.

Logistics & Compliance Guide for Andes Laser Welding

This guide outlines the key logistics and compliance considerations for the safe, efficient, and lawful transportation, handling, and operation of Andes Laser Welding equipment.

Equipment Handling and Transportation

Ensure all Andes Laser Welding systems are securely packaged using manufacturer-recommended materials. Use appropriate lifting equipment—such as forklifts or cranes with slings rated for the unit’s weight—when moving heavy components. Avoid tilting or dropping the equipment during transit. Always follow the handling instructions in the user manual to prevent damage to sensitive optical and electronic components.

Import and Export Regulations

Verify compliance with international trade regulations when shipping Andes Laser Welding systems across borders. Classify the equipment using the correct Harmonized System (HS) code—typically under 8515.21 for laser welding machines. Obtain necessary export licenses, especially if shipping to controlled destinations or when the laser power exceeds regulatory thresholds defined by the destination country. Maintain accurate commercial invoices, packing lists, and certificates of origin.

Laser Safety Compliance

All installations must adhere to local and international laser safety standards, including IEC 60825-1 and ANSI Z136.1. Ensure the laser enclosure meets required safety interlocks and beam shielding specifications. Conduct regular safety audits, provide appropriate personal protective equipment (PPE) such as laser safety goggles with correct optical density (OD), and post visible warning signs in operational areas. Register high-power laser systems with relevant regulatory bodies where required.

Electrical and Installation Requirements

Install Andes Laser Welding systems in accordance with local electrical codes (e.g., NEC in the U.S., IEC in Europe). Use dedicated power circuits with stable voltage and proper grounding to prevent interference and equipment damage. Confirm that facility infrastructure supports the required power supply (voltage, phase, frequency) and cooling needs (chiller connections, ventilation). All electrical work must be performed by certified personnel.

Environmental and Disposal Compliance

Dispose of consumables such as lenses, nozzles, and filters in accordance with local environmental regulations. Defective laser modules or electronic components must be recycled through certified e-waste programs. Minimize emissions by ensuring fume extraction systems are properly installed and maintained. Monitor and document air quality in the welding area as required by OSHA or equivalent agencies.

Documentation and Record Keeping

Maintain comprehensive records including equipment manuals, calibration logs, maintenance schedules, safety training certifications, and compliance documentation. Keep copies of import/export permits, safety certifications (e.g., CE, FCC), and inspection reports. Ensure all documentation is readily accessible for audits or regulatory inspections.

Personnel Training and Certification

Only trained and authorized personnel should operate or service Andes Laser Welding equipment. Provide mandatory training on laser safety, emergency shutdown procedures, and proper use of PPE. Maintain training records and ensure refresher courses are conducted annually. Technicians performing maintenance must be factory-certified or possess equivalent qualifications.

Conclusion on Sourcing Andes Laser Welding Equipment

Sourcing Andes laser welding technology presents a strategic opportunity for manufacturers seeking high-precision, energy-efficient, and reliable welding solutions. Andes, known for its advanced solid-state laser systems, offers robust performance in applications requiring fine control and consistency, particularly in industries such as automotive, aerospace, medical devices, and precision electronics.

The decision to source Andes laser welding systems should be guided by several key factors: superior beam quality, low maintenance requirements, high electrical efficiency, and excellent integration capabilities with automation and robotic systems. Additionally, Andes’ reputation for durability and technical support adds value, especially for operations aiming to minimize downtime and ensure long-term performance.

However, potential buyers should carefully evaluate total cost of ownership, availability of local service and support, and compatibility with existing production lines. While Andes lasers may carry a higher initial investment compared to some competitors, the return on investment is often justified through improved weld quality, reduced rework, and lower operational costs over time.

In conclusion, sourcing Andes laser welding equipment is a prudent choice for high-precision manufacturing environments prioritizing quality, reliability, and long-term efficiency. A thorough vendor assessment, including pilot testing and lifecycle analysis, is recommended to ensure optimal alignment with specific production requirements.