The global amphibious vehicle market is gaining momentum, driven by rising demand across defense, emergency response, agriculture, and recreational sectors. According to a report by Grand View Research, the global amphibious vehicle market size was valued at USD 1.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. This expansion is fueled by enhanced mobility requirements in challenging terrains and increased investments in multi-environment operational capabilities. Similarly, Mordor Intelligence forecasts steady growth, citing advancements in lightweight materials and hybrid propulsion systems as key innovation drivers. As demand escalates, manufacturers are focusing on durability, fuel efficiency, and customizable configurations. In this evolving landscape, the following nine companies stand out as leading amphibious utility vehicle manufacturers, combining engineering excellence with proven performance across diverse applications.

Top 9 Amphibious Utility Vehicle Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1

Domain Est. 2016

Website: sherp.ca

Key Highlights: SHERP is a world-renowned manufacturer of amphibious utility task vehicles with features and specifications unmatched anywhere in the world….

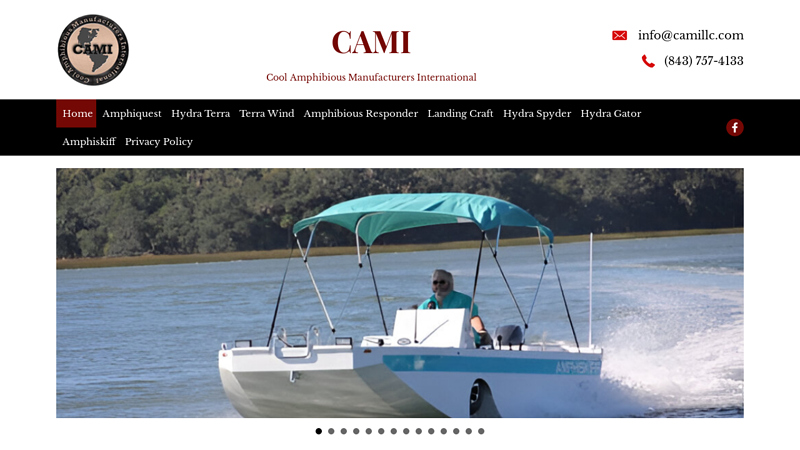

#2 Discover Amphibious Vehicles

Domain Est. 1999

Website: camillc.com

Key Highlights: We specialize in designing, creating, and manufacturing original custom built amphibious and non-amphibious vehicles for both the commercial and recreational ……

#3 Mudd

Domain Est. 2006

Website: muddox.net

Key Highlights: Mudd-Ox deliver extreme off-road mobility, making light of the most challenging terrains while offering control, usability, safety and performance….

#4 Fat Truck

Domain Est. 2010

Website: fattruck.com

Key Highlights: Fat Truck leads in the oil and gas industry with its all-terrain capabilities to reach remote sites in harsh conditions. … With amphibious capabilities ……

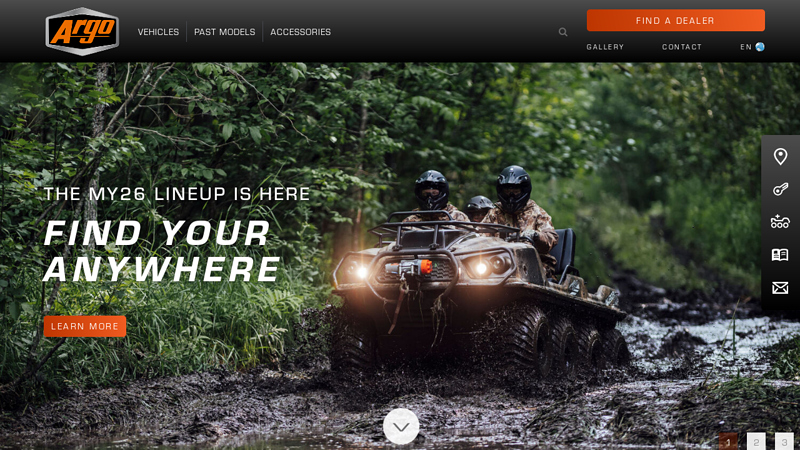

#5

Domain Est. 2014

Website: argoxtv.com

Key Highlights: ATV. Well-Equipped All-Terrain Vehicle ; SSV. Rugged Side-by-Side Series ; XTV. Amphibious Xtreme Terrain Vehicle ; COMMERCIAL. ARGO Professional Vehicles ; UGV….

#6

Domain Est. 2021

Website: sherpglobal.com

Key Highlights: It took us 20 years to develop a reliable amphibian utility task vehicle that can move on any surface and overcome the most difficult natural obstacles….

#7 tutcorp

Domain Est. 2021

Website: tutcorp.com

Key Highlights: TUT Mini 4 Seater. 144” long. 99” width. 101” height. GM gas powered LS. Fully Automatic. Amphibious. Suspension. Heater. Thick insulated walls….

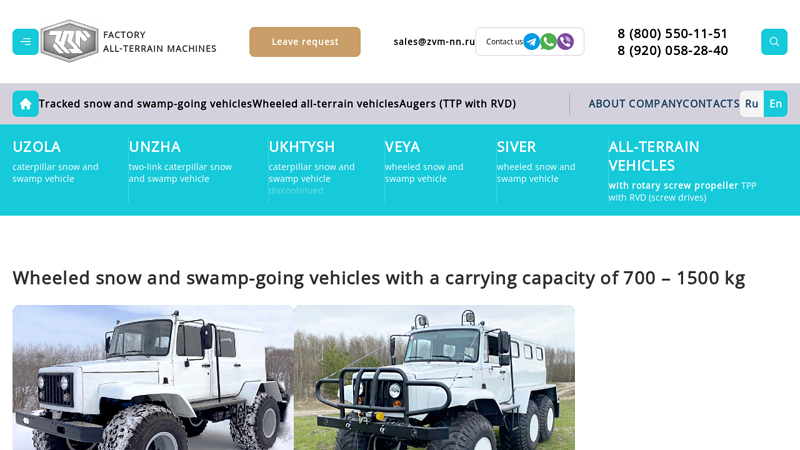

#8 FAM

Domain Est. 2021

Website: zvm-nn.ru

Key Highlights: All-terrain amphibious vehicle with high cross-country ability on low-pressure tires with portal axles. Load capacity up to 1100 kg. Clearance from 600 mm….

#9

Domain Est. 2022

Website: sherputv.com

Key Highlights: It took us more than 20 years to develop the legendary SHERP utility task vehicle, which, due to its unique patented design, is capable to dominate any terrain….

Expert Sourcing Insights for Amphibious Utility Vehicle

H2: Market Trends for Amphibious Utility Vehicles in 2026

The global market for Amphibious Utility Vehicles (AUVs) is projected to experience significant transformation by 2026, driven by technological advancements, expanding applications, and growing demand across both civilian and defense sectors. As governments and private industries increasingly prioritize versatility, resilience, and multi-environment operational capabilities, AUVs are emerging as critical assets in diverse scenarios—from disaster response to remote logistics and ecological monitoring.

-

Increased Demand in Emergency Response and Disaster Relief

By 2026, climate change-induced natural disasters such as floods, hurricanes, and wildfires are expected to rise in frequency and intensity. This will drive demand for AUVs capable of operating in flooded urban areas and rugged terrains where traditional vehicles fail. Emergency management agencies and NGOs are anticipated to invest heavily in AUV fleets to enhance rapid deployment, search-and-rescue operations, and supply delivery in inaccessible zones. -

Adoption in Remote and Rural Infrastructure Development

Infrastructure projects in remote or wetland regions—particularly in Southeast Asia, Africa, and northern Canada—will increasingly rely on AUVs for transporting construction materials, personnel, and equipment. Their ability to traverse both land and water reduces the need for costly bridges or temporary roads, making them economically viable for long-term development initiatives. -

Defense and Border Security Applications

Military and border patrol forces are expected to expand AUV usage for coastal surveillance, riverine patrols, and amphibious reconnaissance missions. Countries with extensive river networks or archipelagic territories—such as Indonesia, the Philippines, and Brazil—are likely to integrate AUVs into their strategic defense planning. Modular, stealth-enabled, and remotely operated AUVs will see increased R&D funding. -

Technological Advancements Driving Efficiency and Sustainability

By 2026, the AUV market will witness a shift toward hybrid-electric and fully electric propulsion systems. Innovations in battery technology and energy management will extend operational range and reduce environmental impact, aligning with global decarbonization goals. Additionally, integration of AI-driven navigation, real-time telemetry, and autonomous operation capabilities will enhance mission precision and reduce operator burden. -

Growth in Environmental and Scientific Research

Environmental monitoring and conservation organizations will increasingly deploy AUVs for wetland surveys, wildlife tracking, and water quality analysis. Their low ground pressure and minimal ecological disruption make them ideal for sensitive ecosystems. Partnerships between AUV manufacturers and research institutions are expected to foster specialized, data-collecting variants. -

Regulatory and Standardization Developments

As AUV usage expands, regulatory bodies in key markets (e.g., the U.S. Coast Guard, European Maritime Safety Agency) are likely to introduce standardized safety, navigation, and environmental compliance frameworks. These regulations will shape vehicle design and certification processes, promoting market consolidation around compliant manufacturers. -

Regional Market Expansion and Competitive Landscape

North America and Europe will remain dominant due to advanced defense spending and climate resilience programs. However, the Asia-Pacific region is expected to register the highest growth rate, fueled by rising investments in flood management and maritime security. Key players such as Gibbs Amphibians, WaterCar, and ST-MARINE will face increasing competition from regional entrants and startups focusing on cost-effective, scalable AUV solutions.

In conclusion, the 2026 amphibious utility vehicle market will be characterized by strong growth, technological innovation, and diversification of use cases. Stakeholders who leverage automation, sustainability, and modular design will be best positioned to capture emerging opportunities across civil, commercial, and defense domains.

Common Pitfalls in Sourcing Amphibious Utility Vehicles: Quality and Intellectual Property Concerns

Sourcing Amphibious Utility Vehicles (AUVs) presents unique challenges due to their complex dual-environment design and relatively niche market. Overlooking quality assurance and intellectual property (IP) risks can lead to significant operational, financial, and legal consequences. Below are critical pitfalls to avoid:

Quality-Related Pitfalls

Inadequate Performance Verification in Both Environments

AUVs must perform reliably on land and in water. A common mistake is validating performance in only one environment or under ideal conditions. Buyers may receive vehicles that handle well on dry land but fail during water transitions due to poor buoyancy, weak propulsion, or insufficient sealing. Always require independent, third-party testing reports covering amphibious transitions, load capacity, and durability in real-world conditions.

Compromised Build Materials and Corrosion Resistance

Due to constant exposure to water—especially saltwater—AUVs require high-grade, corrosion-resistant materials such as marine-grade aluminum or stainless steel. Sourcing from suppliers using substandard materials to reduce costs can lead to premature structural failure, leaks, and safety hazards. Ensure material specifications are contractually binding and subject to inspection.

Lack of Standardized Certification and Compliance

AUVs often fall into regulatory gray areas, straddling automotive and marine regulations. Suppliers may claim compliance without proper certification (e.g., ISO, CE, or Coast Guard standards). Sourcing without verifying compliance can result in vehicles being unusable in target markets or subject to costly retrofits. Require documentation of all relevant certifications before procurement.

Insufficient After-Sales Support and Spare Parts Availability

Many AUV manufacturers are small or specialized, with limited global service networks. Buyers may face long downtimes due to unavailable spare parts or lack of trained technicians. Assess the supplier’s service infrastructure, spare parts inventory, and technical documentation availability before finalizing agreements.

Intellectual Property-Related Pitfalls

Unclear Ownership of Design and Technology

Some AUVs incorporate proprietary drivetrains, sealing systems, or control software. If IP ownership is not explicitly defined in the sourcing contract, buyers risk future restrictions on modifications, repairs, or resale. Ensure contracts specify that purchased units do not infringe on third-party IP and clarify rights to embedded technology.

Risk of Reverse Engineering and Design Imitation

When sourcing from regions with weak IP enforcement, suppliers may reverse engineer designs or sell copies to competitors. This undermines competitive advantage and devalues innovation. Include non-disclosure agreements (NDAs) and audit rights in contracts, and consider manufacturing in jurisdictions with strong IP protections.

Use of Unlicensed or Open-Source Software Without Compliance

Modern AUVs often rely on embedded software for navigation, stability control, or hybrid propulsion. Suppliers may use unlicensed or improperly attributed open-source code to cut development costs, exposing buyers to legal liability. Require software bill of materials (SBOM) and proof of licensing compliance.

Dependency on Supplier-Specific Components

Some AUVs use custom components protected by patents or trade secrets. Buyers can become locked into a single supplier for maintenance and upgrades, increasing long-term costs. Where possible, opt for modular designs with standardized interfaces to mitigate vendor lock-in and IP-related dependencies.

By proactively addressing these quality and IP pitfalls, organizations can ensure they source reliable, compliant, and legally secure amphibious utility vehicles that meet operational demands without unexpected liabilities.

Logistics & Compliance Guide for Amphibious Utility Vehicle

Vehicle Classification and Regulatory Oversight

Amphibious Utility Vehicles (AUVs) are dual-purpose machines capable of operating on land and water, which subjects them to overlapping regulatory frameworks. Classification typically depends on primary use, weight, and propulsion method. In the United States, land-based operation falls under the Department of Transportation (DOT) and state motor vehicle departments, while waterborne operation is regulated by the U.S. Coast Guard (USCG) under Title 46 and Title 33 of the Code of Federal Regulations (CFR). Internationally, compliance may involve the International Maritime Organization (IMO) standards and regional transportation authorities. Determining whether the AUV is classified as a motor vehicle, recreational craft, or commercial vessel is essential for proper registration and operation.

Land Operation Requirements

For on-road use, AUVs must meet Federal Motor Vehicle Safety Standards (FMVSS) administered by the National Highway Traffic Safety Administration (NHTSA). This includes requirements for lighting, braking systems, mirrors, seat belts, and vehicle identification numbers (VIN). State-specific regulations may impose additional requirements such as emissions testing, insurance, and driver licensing. Operators must ensure the vehicle is titled and registered with the appropriate state motor vehicle agency. Off-road use may relax some requirements but still necessitates adherence to local land-use regulations, particularly on public lands managed by agencies such as the Bureau of Land Management (BLM) or U.S. Forest Service.

Water Operation Requirements

When operating in navigable waters, AUVs are subject to USCG regulations for vessels. Key requirements include registration or documentation with the USCG, display of official hull numbers, and compliance with vessel safety equipment mandates (e.g., personal flotation devices, fire extinguishers, visual distress signals, and sound-producing devices). Depending on size and use, the vessel may require a Certificate of Inspection (COI) if used commercially. Operators must comply with navigation rules (COLREGS), maintain proper lookout, and abide by speed and no-wake zone restrictions. In saltwater or international waters, additional maritime protocols may apply.

Environmental and Navigational Compliance

AUVs must adhere to environmental protection standards, including those enforced by the Environmental Protection Agency (EPA) and state environmental agencies. This includes regulations on fuel systems, oil discharge, and exhaust emissions. Operation in ecologically sensitive areas—such as wetlands, marine sanctuaries, or protected shorelines—may require special permits or seasonal restrictions. Compliance with the Clean Water Act and the Oil Pollution Act is mandatory to prevent contamination. Additionally, operators must follow local boating ordinances and obtain necessary access permits for launching and retrieving the vehicle from public ramps or shorelines.

Transport and Trailering Logistics

When not in operational mode, transporting an AUV typically involves trailering. Trailers must be rated for the vehicle’s weight and comply with DOT lighting, braking, and coupling standards. Secure tie-downs and proper load distribution are critical for safety. Transport across state or international borders may trigger inspections for both vehicle and trailer compliance. For air or sea freight, AUVs must be prepared according to IATA (air) or IMDG (maritime) hazardous materials regulations if carrying fuel or batteries. Adequate insurance coverage for transport is strongly recommended.

Operator Certification and Training

Operators must hold valid driver’s licenses for land operation and may need boating safety certification for water use, depending on jurisdiction. Some states require completion of a NASBLA-approved boater education course. Commercial operators may need a USCG-issued license, such as an Operator of Uninspected Passenger Vessels (OUPV) or Master credential. Employers or fleet managers should implement training programs addressing dual-environment operation, emergency procedures, and environmental stewardship. Documentation of training and certifications should be maintained onboard.

Maintenance and Inspection Regimes

Regular maintenance is critical to ensure compliance and safety in both environments. AUVs require inspections per automotive standards (e.g., brake, tire, and lighting checks) and marine standards (e.g., hull integrity, bilge pumps, corrosion control). A documented maintenance log should track service intervals for engine, transmission, seals, and waterproofing systems. Periodic inspections by certified mechanics and marine surveyors may be required for commercial operations. Pre-operation checks should include verification of watertight integrity, propulsion systems, and safety equipment functionality.

Documentation and Recordkeeping

Essential documentation includes vehicle title, registration, insurance, USCG documentation (if applicable), operator certifications, maintenance logs, and permits for restricted areas. Digital and physical copies should be maintained and accessible during operation. For cross-border movement, customs declarations and import/export documentation may be necessary. Compliance audits—internal or regulatory—rely on accurate records to demonstrate adherence to transportation, environmental, and safety standards.

Incident Reporting and Emergency Response

In the event of an accident, spill, or mechanical failure, operators must follow reporting protocols for both land and water incidents. On water, immediate notification to the USCG via VHF Channel 16 or local authorities is required for collisions, injuries, or pollution events. On land, standard motor vehicle accident reporting applies. Emergency response plans should include procedures for evacuation, fire suppression, and environmental containment. AUVs should carry emergency communication devices such as VHF radios, GPS beacons, and first aid kits suitable for remote or aquatic environments.

International Considerations

For cross-border or international use, compliance extends to foreign regulations. The AUV must meet the host country’s vehicle and vessel standards, which may differ significantly from U.S. requirements. Customs clearance, temporary import permits, and proof of insurance with international coverage are typically required. Harmonized standards such as the European Union’s Recreational Craft Directive (RCD) may apply. Prior consultation with foreign transportation and maritime authorities is recommended before deployment.

Conclusion for Sourcing an Amphibious Utility Vehicle

After a comprehensive evaluation of operational requirements, technical specifications, budget constraints, and available market options, sourcing an amphibious utility vehicle presents a strategic solution for enhancing mobility and operational flexibility in diverse terrains—particularly in areas with challenging access due to water bodies, wetlands, or flood-prone zones. These vehicles offer a unique combination of land and water capabilities, enabling efficient transportation, rescue operations, logistics support, and environmental monitoring across mixed environments.

Key considerations in the sourcing process include reliability, payload capacity, fuel efficiency, maintenance support, compliance with safety and environmental standards, and the availability of training and after-sales service. Engaging with reputable manufacturers and conducting thorough due diligence—such as site visits, performance testing, and reference checks—ensures the selected vehicle meets both immediate needs and long-term durability expectations.

Investing in an amphibious utility vehicle not only improves operational effectiveness but also demonstrates a commitment to innovative and adaptive solutions for complex logistical or emergency response challenges. With proper planning and vendor selection, the acquisition of an amphibious utility vehicle is a sound and forward-thinking decision that delivers significant value across multiple use cases.