The U.S. solar manufacturing sector is experiencing a period of robust expansion, fueled by increasing demand for clean energy, supportive federal policies like the Inflation Reduction Act (IRA), and a national push for energy independence. According to Grand View Research, the U.S. solar photovoltaic (PV) market was valued at approximately USD 27.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030. Similarly, Mordor Intelligence forecasts a CAGR of 6.5% for the U.S. solar power market over the same decade, driven by declining technology costs and rising utility-scale installations. This resurgence has catalyzed domestic manufacturing, with American companies scaling production of solar panels, inverters, and mounting systems. As supply chain resilience becomes a strategic priority, these homegrown manufacturers are playing an increasingly vital role in shaping the nation’s energy future—making it an ideal time to spotlight the top 10 American solar manufacturers leading the charge.

Top 10 American Solar Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Suniva

Domain Est. 2005 | Founded: 2007

Website: suniva.com

Key Highlights: Suniva is America’s oldest and largest monocrystalline solar cell manufacturer in North America. Suniva was founded in 2007….

#2 Imperial Star Solar

Domain Est. 2005

Website: imperialstar.com

Key Highlights: Imperial Star Solar is an American solar manufacturer with deep Tier 1 experience, driving energy independence through precision-built, customizable modules ……

#3 SEG Solar

Domain Est. 2012

Website: segsolar.com

Key Highlights: We are a Leading US Solar Module Manufacturer with A Fully Integrated Supply Chain. About us. 1GW+. Global Cumulative Module Shipments. 1GW. Global PV Module ……

#4 Illuminate USA

Domain Est. 2019

Website: illuminateusa.com

Key Highlights: Illuminate USA is the largest single-site solar panel manufacturer in North America, using advanced manufacturing to supply the American solar market….

#5

Domain Est. 2022

Website: semacoalition.org

Key Highlights: The SEMA Coalition is reviving American solar manufacturing, advocating for policies to reshore a competitive and innovative solar supply chain….

#6 American Alliance for Solar Manufacturing Trade Committee

Domain Est. 2024

Website: americansolartradecmte.org

Key Highlights: The American Alliance for Solar Manufacturing Trade Committee represents the leading manufacturers working to build and re-shore this critical American ……

#7 First Solar

Domain Est. 1999

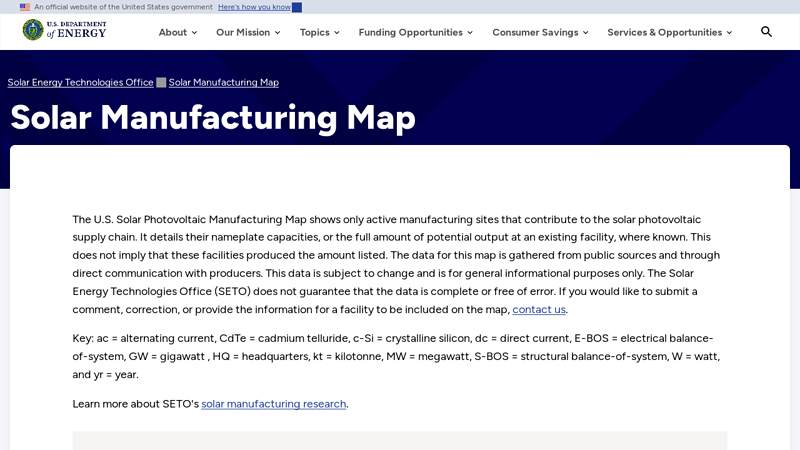

#8 Solar Manufacturing Map

Domain Est. 1999

Website: energy.gov

Key Highlights: The US Solar Photovoltaic Manufacturing Map shows only active manufacturing sites that contribute to the solar photovoltaic supply chain….

#9 American Solar

Domain Est. 2003

Website: americansolar.net

Key Highlights: As the leading clean energy company in Northern California, we specialize in solar systems, energy storage, estate scale battery backup and electric pool ……

#10 First Solar

Domain Est. 2020

Website: americassolarcompany.com

Key Highlights: We make the most of every day, building innovative solar solutions to meet our nation’s ever-growing need for more secure, affordable and renewable energy….

Expert Sourcing Insights for American Solar

H2: Market Trends Shaping American Solar in 2026

As the U.S. solar industry moves into 2026, several key market trends are reshaping the landscape for American solar companies, driven by policy shifts, technological advancements, supply chain dynamics, and evolving consumer demand. The second half of 2026 (H2 2026) reveals a mature but rapidly transforming sector, characterized by consolidation, innovation, and increased integration with broader energy systems.

1. Policy and Regulatory Momentum Accelerates Deployment

The full implementation of the Inflation Reduction Act (IRA) tax credits continues to fuel growth in 2026. Investment Tax Credits (ITC) at 30%, extended through 2032, have significantly lowered the cost barrier for both utility-scale and residential solar projects. In H2 2026, new state-level mandates—particularly in Midwest and Southeast states—are driving solar adoption in previously underpenetrated markets. Regulatory support for community solar and virtual net metering is expanding access, especially in urban and low-income areas.

2. Technological Advancements Drive Efficiency and Storage Integration

In H2 2026, American solar firms are increasingly deploying next-generation technologies. Bifacial modules and perovskite-silicon tandem cells are becoming commercially viable, boosting panel efficiency beyond 25%. Simultaneously, the integration of solar with energy storage is now standard—over 60% of new residential solar installations include battery systems, largely due to falling lithium-ion prices and innovations in solid-state batteries. AI-driven energy management platforms are optimizing self-consumption and grid services, enhancing ROI for consumers and utilities.

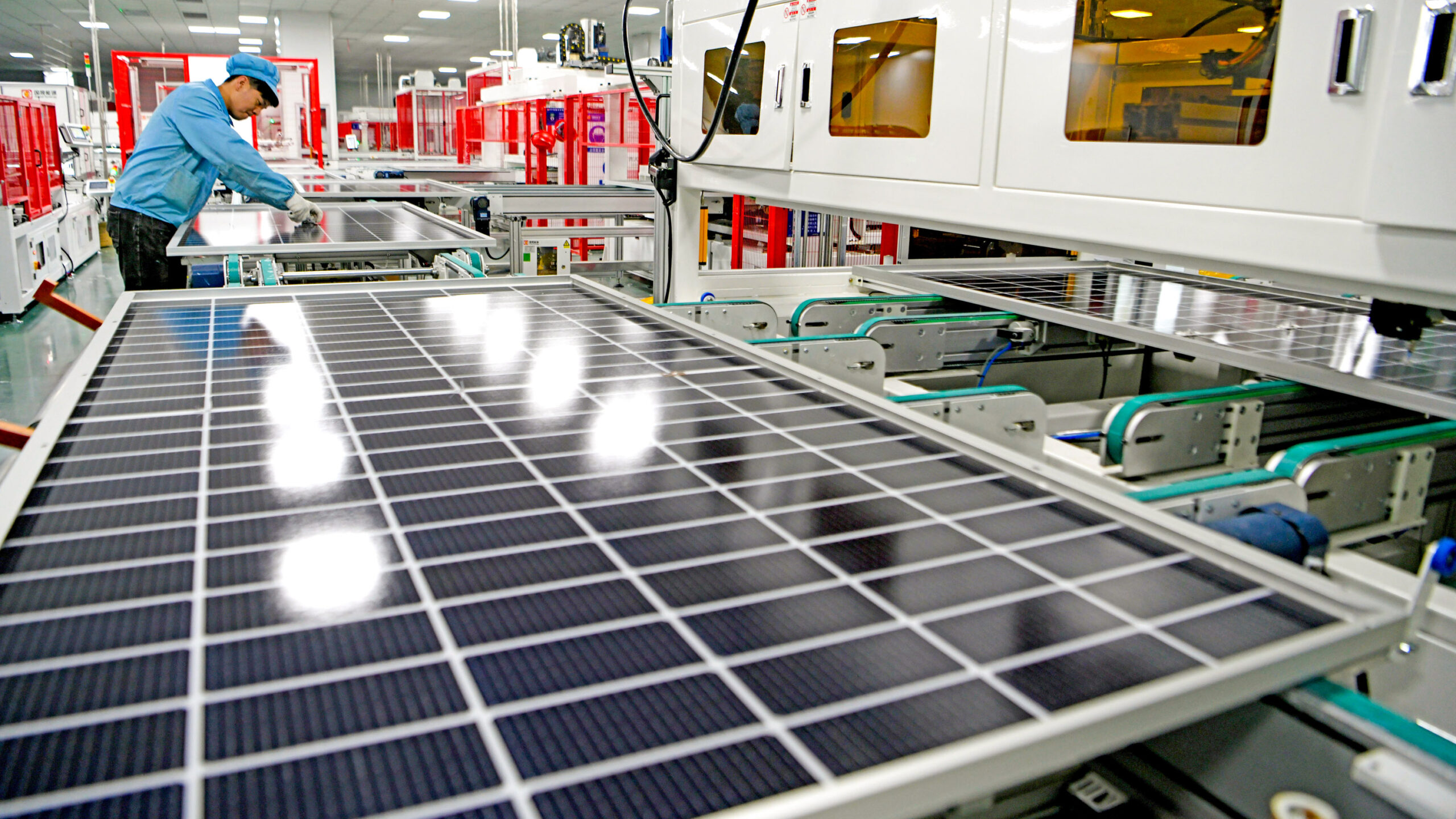

3. Supply Chain Resilience and Domestic Manufacturing Expansion

The U.S. solar supply chain has undergone significant reshoring since 2022. By H2 2026, domestic module production capacity has tripled, supported by IRA manufacturing credits. Companies like First Solar, Qcells, and new entrants are operating gigawatt-scale facilities in the Southeast and Midwest, reducing reliance on Asian imports. Trade policy remains protective, with continued scrutiny on circumvention of tariffs, prompting greater transparency in supply chain sourcing.

4. Grid Modernization and Utility-Scale Growth

With over 150 GW of solar capacity now online, grid integration is a top priority. In H2 2026, advanced inverter standards and smart grid investments are enabling higher solar penetration without destabilizing the grid. FERC Order 2023 reforms have streamlined interconnection queues, cutting project delays from years to months. Utility-scale solar with co-located storage is dominating new capacity additions, particularly in Texas, California, and the Southwest, where PPA prices have stabilized around $25–35/MWh.

5. Consolidation and Market Maturation

The solar industry is consolidating. Smaller installers unable to scale or access capital are being acquired or exiting the market. In H2 2026, the top 10 solar developers control nearly 50% of the residential market, driven by vertical integration and brand trust. Meanwhile, private equity and institutional investors are increasing stakes in solar asset portfolios, viewing them as stable long-term infrastructure investments.

6. Consumer Demand Shifts Toward Energy Independence

Homeowners are increasingly viewing solar not just as a cost-saving measure, but as a resilience strategy. With rising frequency of extreme weather and grid outages, demand for solar-plus-storage systems has surged. In H2 2026, solar adoption is growing fastest in suburban and rural areas, where homeowners value energy independence. Subscription and leasing models are declining, replaced by cash purchases and low-interest green financing.

7. Workforce and Equity Challenges Persist

Despite growth, the industry faces a skilled labor shortage. In H2 2026, federal and industry-led workforce development programs are scaling up training in solar installation, electrical safety, and battery systems. Equity in solar access remains a focus, with new programs targeting underserved communities through grant-funded installations and inclusive financing.

Conclusion

By H2 2026, the American solar market is transitioning from rapid expansion to sustainable maturation. Policy stability, technological innovation, and grid integration are enabling solar to become a cornerstone of the U.S. clean energy transition. Companies that adapt to these trends—prioritizing storage, domestic supply chains, and equitable access—are poised to lead the next phase of solar growth in America.

Common Pitfalls When Sourcing American Solar: Quality and Intellectual Property Risks

Sourcing solar products from American manufacturers may seem like a straightforward way to ensure quality and protect intellectual property (IP), but several pitfalls can still arise. Being aware of these challenges is critical for businesses aiming to build reliable, compliant, and secure supply chains.

Quality Inconsistencies Despite Domestic Sourcing

Even when sourcing from U.S.-based manufacturers, quality can vary significantly due to inconsistent production standards, supply chain dependencies on foreign components, and limited scalability. Some American solar companies assemble modules domestically but rely heavily on imported raw materials—such as polysilicon, glass, or junction boxes—mostly from Asia. This introduces potential quality control gaps if suppliers fail to meet specifications.

Additionally, smaller U.S. manufacturers may lack the rigorous testing protocols and certifications (e.g., UL, IEC) of larger international competitors. Without thorough due diligence, buyers risk receiving subpar products that underperform or fail prematurely, undermining project ROI and reputation.

Intellectual Property Exposure and Misappropriation

Although the U.S. has strong IP protection laws, sourcing solar technology domestically doesn’t automatically safeguard proprietary innovations. Collaborating with American manufacturers often involves sharing technical designs, system architectures, or software algorithms—information vulnerable to misuse if proper contractual safeguards are absent.

A common pitfall is inadequate IP clauses in manufacturing agreements, which may fail to clearly assign ownership of improvements or restrict reverse engineering. In joint development scenarios, ambiguity over IP rights can lead to disputes or even unintended licensing of technology to competitors. Furthermore, workforce mobility in the U.S. solar sector increases the risk of trade secret leakage, especially if non-disclosure agreements (NDAs) and employee training are not enforced.

To mitigate these risks, companies must implement robust IP strategies, including comprehensive contracts, monitoring of manufacturing processes, and proactive patent or trade secret protection.

Logistics & Compliance Guide for American Solar

This guide outlines key logistics and compliance considerations for American Solar to ensure efficient operations, regulatory adherence, and successful project delivery across the United States.

Supply Chain Management

Establish reliable partnerships with solar panel, inverter, and racking manufacturers. Prioritize domestic suppliers where possible to reduce lead times and transportation costs. Implement inventory tracking systems to prevent shortages and overstocking. Conduct regular supplier audits to ensure product quality and compliance with U.S. standards.

Transportation & Equipment Handling

Coordinate with certified freight carriers experienced in solar equipment transport. Use enclosed trailers or protective packaging to prevent damage during transit. Follow proper loading/unloading procedures for fragile components like PV modules. Adhere to Department of Transportation (DOT) regulations, including weight limits, load securement (FMCSA standards), and required documentation.

Import Compliance (if applicable)

For imported components, ensure compliance with U.S. Customs and Border Protection (CBP) requirements. Verify tariff classifications (HTS codes) and monitor Section 201 and 301 trade actions affecting solar products. Maintain accurate records of country of origin, invoices, and bills of lading. Consider using a licensed customs broker for complex imports.

Domestic Regulatory Compliance

Comply with federal, state, and local regulations throughout the solar supply chain. This includes adherence to the Buy American Act and Domestic Content Requirements under the Inflation Reduction Act (IRA) for eligible projects. Maintain documentation to substantiate the U.S. content of materials for tax credit eligibility.

Installation & Safety Standards

Ensure all logistics and staging activities follow OSHA safety guidelines. Train personnel on handling heavy equipment, fall protection, and electrical safety. Coordinate delivery schedules with installation crews to minimize on-site storage and theft risk. Follow National Electrical Code (NEC) and local permitting requirements during installation.

Environmental & Sustainability Practices

Implement recycling programs for packaging materials and damaged components. Comply with EPA regulations for hazardous materials (e.g., batteries, electronic waste). Optimize transportation routes to reduce carbon emissions and fuel consumption. Document sustainability efforts to support corporate ESG goals.

Recordkeeping & Audits

Maintain detailed records of shipments, customs documentation, compliance certifications (e.g., UL, IEEE), and chain of custody. These records are essential for IRS audits related to tax credits and for demonstrating regulatory compliance during inspections.

Risk Management & Insurance

Secure comprehensive insurance coverage for cargo in transit, warehousing, and installation sites. Develop contingency plans for supply chain disruptions, natural disasters, or regulatory changes. Regularly review and update logistics protocols to address emerging risks.

In conclusion, sourcing solar products from American manufacturers offers several strategic advantages, including support for domestic economies, enhanced supply chain resilience, reduced transportation emissions, and compliance with regulatory requirements such as the Buy American Act or the Inflation Reduction Act (IRA). U.S.-based solar manufacturers often adhere to high standards of labor, environmental sustainability, and product quality, providing greater transparency and accountability. While American-made solar panels and components may sometimes carry a higher upfront cost compared to international alternatives, the long-term benefits—such as improved durability, warranty support, and potential eligibility for federal and state incentives—can outweigh these initial expenses.

Additionally, increased domestic manufacturing capacity strengthens national energy independence and supports the growth of a clean energy workforce. As investment in U.S. solar manufacturing continues to expand, driven by policy support and technological innovation, the availability and competitiveness of American-made solar solutions are expected to improve. Therefore, sourcing from American solar manufacturers aligns with both environmental sustainability goals and broader economic and security interests, making it a prudent choice for businesses, government agencies, and consumers committed to building a resilient and responsible energy future.