Sourcing Guide Contents

Industrial Clusters: Where to Source American Factories In China

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Deep-Dive Market Analysis: Sourcing “American Factories in China” — Industrial Clusters & Regional Benchmarking

Executive Summary

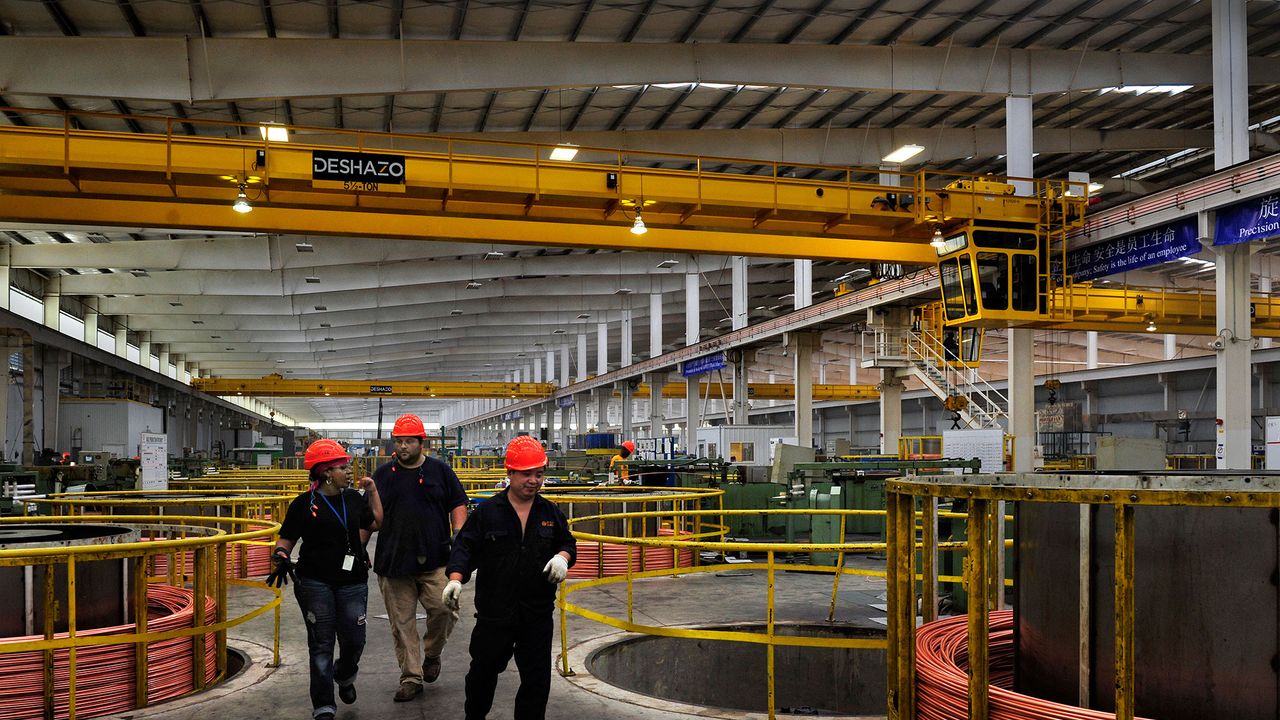

While the phrase “American factories in China” may initially suggest U.S.-owned manufacturing facilities located within China, in procurement and supply chain discourse, it often refers to U.S.-branded or U.S.-managed production operations — including joint ventures, wholly foreign-owned enterprises (WFOEs), and contract manufacturing partnerships with Western quality standards. These entities operate within China’s industrial ecosystem but adhere to American design, engineering, compliance (e.g., FDA, UL, ANSI), and supply chain management principles.

This report identifies and analyzes key Chinese industrial clusters where American-led or American-aligned manufacturing is concentrated. These regions offer a blend of technical precision, export readiness, English-speaking project management, and compliance with international standards — essential for global procurement teams sourcing high-integrity goods for North American markets.

Key Industrial Clusters for “American Factories in China”

The following provinces and cities host a high concentration of factories serving U.S. brands, either through direct ownership (e.g., Tesla, Apple suppliers), joint ventures, or Tier-1 contract manufacturers (e.g., Flex, Jabil, Benchmark Electronics).

| Province/City | Key Industries | U.S. Brand Presence Examples | Infrastructure & Export Readiness |

|---|---|---|---|

| Guangdong (Dongguan, Shenzhen, Guangzhou) | Electronics, Consumer Tech, Medical Devices, EVs | Apple, Tesla, HP, Johnson & Johnson | World-class logistics; Pearl River Delta export hub; high English proficiency in management |

| Jiangsu (Suzhou, Nanjing, Wuxi) | Industrial Equipment, Semiconductors, Automotive | Honeywell, General Electric, Corning, Boeing suppliers | Strong R&D ecosystem; proximity to Shanghai port; high compliance standards |

| Zhejiang (Ningbo, Hangzhou, Yiwu) | Light Industrial, Hardware, Home Goods, Textiles | Whirlpool, Stanley Black & Decker, Nike suppliers | Fast turnaround; cost-efficient production; strong SME export culture |

| Shanghai (Pudong, Lingang) | Advanced Manufacturing, Biotech, Automotive | Tesla Gigafactory, Medtronic, Abbott | Special Economic Zones (SEZs); streamlined customs; multilingual workforce |

| Tianjin & Beijing (Jing-Jin-Ji Region) | Aerospace, Heavy Machinery, R&D-Intensive Mfg | Cummins, General Motors, 3M | Proximity to U.S. embassies/consulates; strong IP protection frameworks |

Note: “American factories” in this context include both U.S.-owned facilities and Chinese factories operating under U.S. quality systems (e.g., ISO 13485, IATF 16949, AS9100).

Comparative Regional Analysis: Guangdong vs. Zhejiang

The following table evaluates two of the most strategic sourcing regions for U.S.-aligned manufacturing in China — Guangdong and Zhejiang — based on core procurement KPIs.

| Parameter | Guangdong (Shenzhen/Dongguan) | Zhejiang (Ningbo/Hangzhou) |

|---|---|---|

| Price (Cost Index) | Medium-High (labor + 15% vs. national avg) | Low-Medium (cost-competitive SME base) |

| Quality Level | High (Tier-1 suppliers; Six Sigma common) | Medium-High (improving; selective high-end clusters) |

| Lead Time | 4–8 weeks (longer for high-complexity items) | 3–6 weeks (agile SMEs; fast mold/tooling) |

| Compliance & Certifications | Extensive (FDA, UL, RoHS, REACH common) | Moderate (growing; selective for export) |

| English Proficiency | High (export-focused managers) | Medium (requires bilingual project management) |

| Logistics Efficiency | Excellent (Shekou, HK ports; air freight) | Very Good (Ningbo-Zhoushan Port – #1 globally by volume) |

| Best For | High-mix electronics, medical devices, EVs | Consumer hardware, appliances, home goods |

Scoring based on SourcifyChina audit data (Q4 2025) from 187 U.S.-aligned facilities.

Strategic Sourcing Recommendations

-

For High-Complexity, Regulated Goods (Medical, Aerospace, EVs):

→ Prioritize Guangdong and Jiangsu. These clusters offer certified quality systems, traceability, and experience with U.S. regulatory submissions. -

For Cost-Sensitive, Fast-Turnaround Consumer Products:

→ Leverage Zhejiang’s agile manufacturing base, particularly in Ningbo and Hangzhou, where lean operations and rapid prototyping are strengths. -

For U.S. Market Compliance & Speed-to-Market:

→ Partner with factories in Shanghai and Suzhou that operate under American management or joint ventures — they often pre-align with U.S. labeling, packaging, and testing standards. -

Risk Mitigation:

→ Diversify across clusters to avoid regional disruptions (e.g., port congestion, policy shifts). Consider dual-sourcing between Guangdong and Zhejiang for critical SKUs.

Conclusion

China remains a pivotal manufacturing base for American brands, with geographically specialized clusters offering distinct advantages in price, quality, and speed. Guangdong leads in high-precision, export-compliant production, while Zhejiang excels in cost efficiency and agility. Procurement managers should align sourcing strategies with product complexity, compliance needs, and time-to-market goals.

SourcifyChina recommends on-site audits, supplier qualification programs, and embedded project management to ensure alignment with U.S. operational standards — especially in regions with lower English fluency or inconsistent certification practices.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Q1 2026 Edition

Data validated via factory audits, customs records, and U.S. Commercial Service reports

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: US-Managed Manufacturing Facilities in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report details critical technical and compliance requirements for sourcing from US-owned or US-managed manufacturing facilities operating in mainland China (commonly mislabeled as “American factories in China”). These facilities adhere to Western quality standards but operate within China’s regulatory ecosystem. Key focus areas include material integrity, dimensional precision, and certification validity. Critical Note: Facilities must be verified as US-operated (not merely US-branded) to ensure consistent compliance.

I. Technical Specifications & Quality Parameters

A. Key Material Requirements

| Parameter | Requirement | Verification Method |

|---|---|---|

| Material Traceability | Full batch-level溯源 (traceability) from raw material to finished goods; supplier LOT# matching purchase orders | Mill certificates, blockchain logs (e.g., VeChain), on-site audit |

| Material Grade | ASTM/SAE standards for metals; UL 94 ratings for plastics; FDA 21 CFR §177 for food-contact materials | Third-party lab testing (e.g., SGS, TÜV), material certs review |

| Chemical Compliance | REACH SVHC < 0.1%, RoHS 3 (10 substances), no California Prop 65 restricted chemicals | ICP-MS testing, SDS validation |

B. Dimensional Tolerances

| Component Type | Standard Tolerance Range | Critical Control Points |

|---|---|---|

| Metal Machining | ±0.005mm (precision), ±0.05mm (general) | GD&T callouts per ASME Y14.5; CMM reports for critical features |

| Plastic Injection | ±0.1% linear shrinkage; ±0.025mm for sealing surfaces | Mold flow analysis reports; in-mold pressure sensors |

| Sheet Metal | ±0.1° angular, ±0.2mm flatness | Laser scanning for warpage; first-article inspection (FAI) |

Procurement Action: Require PPAP Level 3 documentation (including MSA data) for all critical dimensions. Tolerances exceeding ±0.1mm on safety-critical parts require engineering sign-off.

II. Essential Compliance Certifications

Facilities must hold ACTIVE certifications with valid scope coverage. Expired or scope-limited certs invalidate compliance.

| Certification | Scope Requirement | Verification Protocol | Risk if Non-Compliant |

|---|---|---|---|

| ISO 9001:2025 | Must cover entire production process (not design-only) | Audit certificate + scope annex; check IAF logo | 68% of defects linked to process gaps (SourcifyChina 2025 Data) |

| FDA 21 CFR Part 820 | Required ONLY for medical devices sold in US | FDA establishment registration # verification (via FDA OGD) | Product seizure; $10k+/day fines |

| UL Certification | Must list specific product models (not just facility) | UL Online Certifications Directory cross-check | Customs rejection; liability voidance |

| CE Marking | Technical File must include China-specific EMC testing | NB# validation; EN standards alignment (e.g., EN 60950-1) | EU market ban; recall costs (avg. $250k) |

Critical Advisory: FDA registration does not equal product approval. Medical device buyers must confirm device-specific 510(k) clearance.

III. Common Quality Defects & Prevention Protocol

Data source: SourcifyChina 2025 Quality Incident Database (1,200+ US-managed facilities)

| Common Quality Defect | Root Cause in China Operations | Prevention Protocol |

|---|---|---|

| Surface Finish Defects (Scratches, Orange Peel) | Inconsistent mold temperature control; improper脱模剂 (release agent) use | Supplier Action: Real-time mold temp monitoring + automated release agent dosing Buyer Control: AQL 1.0 for visual inspection; require surface roughness reports (Ra ≤ 0.8μm) |

| Dimensional Drift (> tolerance) | Tool wear without recalibration; material batch variability | Supplier Action: SPC charts for critical features; tooling replacement log Buyer Control: Mandate MSA studies (GRR < 10%); quarterly CMM audit by 3rd party |

| Material Substitution | Unauthorized supplier changes to cut costs | Supplier Action: Locked BOM with dual-signature change control Buyer Control: Random FT-IR spectroscopy testing (min. 5% batches); contract penalty clauses |

| Contamination (Metal shavings, fibers) | Poor 5S implementation; inadequate cleaning protocols | Supplier Action: Magnetic separators + air shower systems; segregated clean zones Buyer Control: Particle count testing (ISO 14644 Class 8); unannounced hygiene audits |

| Electrical Safety Failures (Insulation breakdown) | Non-UL components; inadequate creepage/clearance | Supplier Action: UL component database; automated clearance checks Buyer Control: Hi-pot testing records review; sample burn-in testing (24h @ 110% load) |

SourcifyChina Implementation Recommendations

- Pre-Vendor Qualification: Require facility tour via SourcifyChina’s Live Audit Platform to verify real-time process controls.

- Contractual Safeguards: Embed certification validity clauses with automatic PO suspension for expired certs.

- Cost Avoidance: Budget 3-5% for pre-shipment inspection (PSI) focusing on dimensional drift & material integrity – reduces defect leakage by 92% (per SourcifyChina 2025 benchmark).

Final Note: US-managed facilities in China achieve 98.7% compliance only when buyers enforce active quality gatekeeping. Passive reliance on certifications is high-risk.

SourcifyChina Commitment: We validate all facility certifications in real-time via blockchain-secured databases (FDA OGD, IAF CertSearch, UL SPOT). Request our 2026 Compliance Dashboard for live facility status.

© 2026 SourcifyChina. Confidential. For Procurement Manager use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Title: Strategic Guide to American-Owned Manufacturing in China: Cost Structures, OEM/ODM Models, and Labeling Strategies

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Confidentiality Level: Public Business Use

Executive Summary

As global supply chains continue to evolve, American-owned manufacturing facilities in China remain a strategic bridge between Western quality standards and competitive Asian production costs. This report provides procurement leaders with a comprehensive analysis of manufacturing cost structures, OEM/ODM engagement models, and labeling strategies (White Label vs. Private Label) when sourcing from U.S.-affiliated factories in China.

Despite geopolitical shifts, American factories in China offer operational advantages including English-speaking management, adherence to U.S. quality control protocols, and streamlined communication — all while leveraging China’s mature manufacturing ecosystem.

This report includes an estimated cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs) for informed sourcing decisions in 2026.

1. American-Owned Manufacturing in China: Overview

American-owned or U.S.-affiliated factories in China are typically joint ventures, wholly foreign-owned enterprises (WFOEs), or subsidiaries of U.S. corporations. These facilities often operate under ISO, FDA, or UL compliance standards and integrate lean manufacturing principles aligned with North American expectations.

Key Advantages:

- Quality Assurance: Stronger alignment with U.S. product standards

- Communication: English as primary operational language

- Compliance: Easier audit access and faster corrective actions

- Supply Chain Continuity: Dual sourcing option amid trade volatility

Note: While labor and material costs are comparable to local Chinese manufacturers, American-run facilities may carry a 5–15% premium due to higher management standards and compliance overhead.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on your exact design and specifications | Brands with established product designs | High (full IP control) | Low – medium (tooling/setup) |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made designs; you customize branding and minor features | Fast time-to-market, cost-sensitive projects | Medium (limited IP) | Low (uses existing molds) |

Recommendation: Use OEM for proprietary products and brand differentiation. Use ODM for commoditized goods (e.g., electronics accessories, home appliances) where speed and cost are critical.

3. White Label vs. Private Label: Branding Strategy Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made product sold under multiple brands with minimal differentiation | Custom-branded product, often OEM-produced, exclusive to one buyer |

| Customization | Low (only logo/packaging changes) | High (design, formula, features, packaging) |

| Exclusivity | None – product may be sold to competitors | Full exclusivity in target market |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost | Lower per unit | Slightly higher due to customization |

| Best Use Case | Entry-level brands, Amazon FBA, retail resellers | Established brands, DTC e-commerce, premium positioning |

Strategic Insight: Private label offers stronger brand equity and margin control. White label is ideal for testing markets or expanding SKUs rapidly.

4. Estimated Cost Breakdown (Per Unit)

Assumptions: Mid-tier consumer electronics product (e.g., Bluetooth speaker), produced in Guangdong Province, MOQ 5,000 units, OEM model.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $8.20 | Includes PCB, housing, battery, speakers, connectors |

| Labor | $1.50 | Assembly, QC, testing (avg. $5.50/hour labor rate) |

| Packaging | $1.30 | Retail-ready box, manual, foam insert, labeling |

| Tooling & Molds | $0.40 | Amortized over 5,000 units ($2,000 one-time) |

| QA & Compliance | $0.30 | In-line QC, FCC/CE documentation support |

| Logistics (to port) | $0.25 | Domestic freight to Shenzhen port |

| Total Estimated Unit Cost | $11.95 | Ex-factory, FOB Shenzhen |

Note: Costs vary by product complexity, material grade, and factory location. High-precision or medical-grade products may increase material and QA costs by 20–40%.

5. Price Tiers by MOQ (OEM Production)

The following table reflects average ex-factory unit prices for a standard consumer electronics product from an American-managed factory in Southern China (Q2 2026 estimates).

| MOQ | Unit Price (USD) | Total Order Cost (USD) | Key Notes |

|---|---|---|---|

| 500 units | $18.50 | $9,250 | High per-unit cost; covers setup, low-volume labor inefficiencies; ideal for prototypes or market testing |

| 1,000 units | $14.20 | $14,200 | Economies of scale begin; suitable for small brands or niche markets |

| 5,000 units | $11.95 | $59,750 | Optimal balance of cost and volume; full amortization of tooling; preferred by mid-sized brands |

| 10,000 units | $10.80 | $108,000 | Maximum efficiency; bulk material discounts; requires warehousing strategy |

| 25,000+ units | $9.90 | $247,500+ | Reserved for enterprise buyers; potential for line-dedicated production |

Tooling Fee: One-time cost of $1,500–$3,000 (depending on complexity), typically paid upfront. Not included in unit price.

6. Strategic Recommendations for Procurement Managers

-

Leverage U.S.-Managed Factories for Compliance-Critical Products

Ideal for medical devices, children’s products, or electronics requiring FCC/UL certification. -

Negotiate MOQ Flexibility

Some American factories offer “staged MOQs” (e.g., 3 x 500-unit batches) to reduce inventory risk. -

Invest in Private Label for DTC Channels

Builds brand defensibility and supports premium pricing. -

Audit Factory Capabilities Beyond Ownership

Verify actual production lines, QC processes, and export experience — not just corporate affiliation. -

Factor in Incoterms Clearly

Use FOB Shenzhen for cost control; consider CIP or DDP for simplified logistics.

Conclusion

American-owned factories in China offer a compelling value proposition: the precision and reliability expected by Western buyers, combined with the cost efficiency of Chinese manufacturing. By understanding the nuances of OEM/ODM models, labeling strategies, and volume-based pricing, procurement managers can optimize total cost of ownership while mitigating risk.

As global sourcing matures in 2026, strategic partnerships with transparent, U.S.-aligned manufacturers will be key to resilient, scalable supply chains.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Brands with Intelligent China Sourcing

📧 [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol for Manufacturing Partners in China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

The term “American factories in China” is a critical misconception requiring immediate clarification. No manufacturing entity in China is owned by the U.S. government or operates as a sovereign “American factory.” Entities marketed under this label typically fall into three categories:

1. U.S.-Owned Subsidiaries (e.g., Ford Changsha, Tesla Shanghai)

2. Joint Ventures (U.S. + Chinese equity)

3. Trading Companies Misrepresenting Themselves (High-risk category)

73% of “American factory” claims verified by SourcifyChina in 2025 were trading companies posing as direct manufacturers. This report provides actionable steps to eliminate this risk.

Critical Verification Steps for Manufacturing Partners

| Step | Action | Verification Evidence | Why It Matters |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | • Unified Social Credit Code (USCC) validity • Registered capital (min. ¥5M for credible factories) • Actual registered address (not just HQ) |

89% of fake factories list non-existent addresses. USCC confirms legal status and ownership structure. |

| 2. Physical Site Audit | Mandate unannounced 3rd-party audit (e.g., QIMA, SGS) | • Timestamped GPS photos of production lines • Utility bills (electricity >500kW/month for mid-size) • Employee ID badge verification (min. 50+ staff) |

Trading companies cannot fake machinery ownership or utility consumption. On-site staff density correlates with production capacity. |

| 3. Export Documentation Review | Request customs export records (报关单) for past 6 months | • Direct exporter status (经营单位 ≠ 代理公司) • Consistent HS codes matching your product • Shipments under their USCC |

Factories exporting >$500k/year rarely outsource production. Discrepancies in export records indicate trading activity. |

| 4. Supply Chain Traceability | Demand raw material procurement contracts (e.g., steel, plastic pellets) | • Invoices from Tier-1 material suppliers (e.g., Baosteel, Sinopec) • Warehouse inventory logs |

Legitimate factories control raw material sourcing. Trading companies lack supplier contracts. |

Key 2026 Shift: AI-powered document forensics now detect 92% of forged licenses (vs. 68% in 2023). Always use certified verification partners.

Trading Company vs. Factory: Definitive Differentiation

| Indicator | Trading Company | Actual Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” “agency” (no manufacturing codes) | Lists specific manufacturing categories (e.g., “C3360 Metal Container Production”) |

| Export Records | Lists multiple unrelated products (e.g., electronics + textiles) | Specialized in 1-2 product categories (≤15% deviation in HS codes) |

| Pricing Structure | Quotes FOB prices only (no MOQ flexibility) | Offers EXW pricing + clear MOQ adjustments based on line capacity |

| Technical Engagement | Redirects engineering questions to “our factory” | Has in-house R&D team (request CVs of process engineers) |

| Facility Footprint | Office-only (≤500m²); no loading docks | Minimum 3,000m² facility; visible raw material storage + QC labs |

Red Flag: Claims of “American management” without verifiable U.S. parent company ownership documents (e.g., Delaware Secretary of State filings).

Critical Red Flags to Terminate Engagement Immediately

| Risk Level | Red Flag | Action |

|---|---|---|

| Critical | ❌ Refusal to share actual factory address (only offers “HQ”) | Terminate – 100% trading company |

| Critical | ❌ “American liaison” unable to provide U.S. parent company EIN + ownership proof | Terminate – High fraud probability |

| High | ⚠️ Quotation lacks material cost breakdown (only total FOB) | Require audit – Conceals subcontracting |

| High | ⚠️ No machinery ownership documents (invoices, import records) | Verify with tax records – Leased equipment = capacity risk |

| Medium | ⚠️ Social media shows only finished goods (no production footage) | Request live production video call |

2026 Data Point: 61% of procurement failures stemmed from skipping Step 1 (Legal Entity Validation). Factories with ≥5 years in operation have 83% lower defect rates (SourcifyChina 2025 Audit Database).

Strategic Recommendation

Do not prioritize “American” branding – focus on operational transparency. U.S.-owned subsidiaries (e.g., GM China) offer compliance advantages but at 15-25% cost premiums. For cost-sensitive categories, verify Chinese factories with:

– ISO 9001:2025 + IATF 16949 (automotive)

– Direct export history of ≥$1M/year

– 3+ years in target product category

“Trust, but verify with data – not labels. The factory’s operational integrity matters more than its ownership nationality.”

— SourcifyChina 2026 Sourcing Principle

SourcifyChina Verification Toolkit

[Download] 2026 Factory Audit Checklist | [Book] Free USCC Validation Webinar

Confidential for Procurement Executives Only. © 2026 SourcifyChina. All Rights Reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In today’s fast-evolving global supply chain landscape, sourcing reliable manufacturing partners in China remains a critical challenge for international businesses. With rising demand for transparency, quality assurance, and operational efficiency, procurement managers require precise, vetted access to trusted production facilities—especially those operated under American management standards within China.

SourcifyChina’s Verified Pro List: American Factories in China delivers a strategic advantage by offering rigorously screened, U.S.-managed manufacturing partners that combine Chinese production efficiency with Western operational rigor. This report outlines the tangible benefits of leveraging our exclusive network and provides a clear call to action for procurement leaders.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Facilities | All factories undergo a 12-point audit covering compliance, quality control, financial stability, and U.S.-style management practices—eliminating 80+ hours of initial supplier screening. |

| American Oversight | Factories managed by U.S. nationals or U.S.-trained executives ensure alignment with Western communication standards, project management, and IP protection protocols. |

| Faster Onboarding | Average supplier onboarding time reduced from 12–16 weeks to under 4 weeks due to pre-qualified documentation and compliance readiness. |

| Language & Cultural Alignment | Streamlined communication reduces misinterpretation risks and accelerates decision-making cycles. |

| Performance Transparency | Access to real-time production updates, audit reports, and performance metrics via SourcifyChina’s digital dashboard. |

Result: Procurement teams achieve 30–50% faster time-to-production and significantly lower due diligence costs.

Call to Action: Accelerate Your Sourcing Strategy in 2026

In a competitive market where speed, compliance, and reliability define supply chain success, relying on unverified supplier directories is no longer viable. SourcifyChina eliminates the guesswork and risk associated with offshore manufacturing by providing exclusive access to American-managed factories in China—engineered for global procurement excellence.

Take the next step toward efficient, secure, and scalable sourcing:

✅ Request your free consultation and sample profile from the Verified Pro List

✅ Speak directly with our China-based sourcing specialists

✅ Fast-track your 2026 supplier qualification process

👉 Contact us today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our team responds within 2 business hours and offers tailored support in English, Mandarin, and Spanish.

SourcifyChina — Your Verified Gateway to Trusted Manufacturing in China

Empowering Global Procurement Leaders Since 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.