The U.S. boiler manufacturing industry is experiencing steady growth, driven by rising demand for energy-efficient heating solutions and industrial process optimization. According to Grand View Research, the global boiler market was valued at USD 56.5 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030, with North America accounting for a significant share due to stringent energy regulations and increasing investments in infrastructure modernization. Similarly, Mordor Intelligence projects a CAGR of over 5.8% through 2028, citing advancements in condensing boiler technology and growing adoption in commercial and residential sectors. Within this competitive landscape, American manufacturers continue to lead in innovation, reliability, and compliance with EPA and ASME standards. Below are the top seven U.S.-based boiler manufacturers shaping the industry through technological advancement and market reach.

Top 7 American Boiler Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 American Boiler Manufacturer Association

Domain Est. 1996

Website: abma.com

Key Highlights: ABMA convened for the 2025 Annual Meeting, January 17 – 20, at the stunning JW Marriott Plant Riverside District in Savannah, GA….

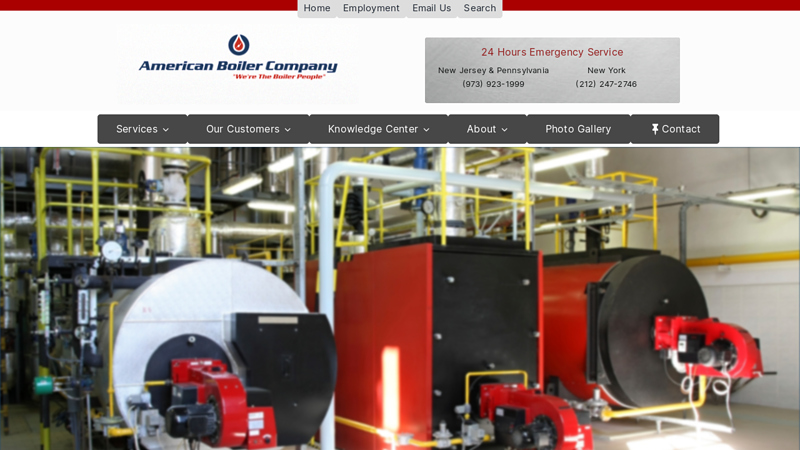

#2 American Boiler Company

Domain Est. 2008

Website: americanboilercompany.com

Key Highlights: We supply everything from industrial boiler systems, industrial biomass boilers, Industrial Boilers, Thermic Fluid Heaters, Large Boilers, Waste ……

#3 U.S. Boiler Company

Domain Est. 2010

Website: usboiler.net

Key Highlights: US Boiler Company is a leading manufacturer of home heating equipment, water boilers, steam boilers, hot water heaters, radiators and boiler control systems….

#4 Energy Kinetics

Domain Est. 1996

Website: energykinetics.com

Key Highlights: Energy Kinetics manufactures a variety of high efficiency Residential Gas Boilers and Oil Boilers, as well as Commercial Gas and Oil Boilers, for all your ……

#5 American Water Heaters

Domain Est. 1998

Website: americanwaterheater.com

Key Highlights: Switch to a residential American Heat Pump Water Heater today and save over $600 per year in energy costs. View Rebates »View Product ». Check with your tax ……

#6 Cleaver

Domain Est. 1998

Website: cleaverbrooks.com

Key Highlights: Cleaver-Brooks is your total solution provider for boilers and boiler room systems, including rentals, maintenance programs, parts, and training….

#7 ABMA BOILER Expo

Domain Est. 2022

Website: abmaboilerexpo.com

Key Highlights: ABMA BOILER Expo exhibit sales for returning companies began the second week of December based on priority rankings. General membership sales opened on March 4, ……

Expert Sourcing Insights for American Boiler

H2: Projected 2026 Market Trends for American Boiler Industry

As the U.S. approaches 2026, the boiler manufacturing and service sector—commonly referred to as the “American boiler” industry—is expected to undergo significant transformation driven by regulatory shifts, technological innovation, and evolving energy priorities. Key trends shaping the market include the accelerated adoption of high-efficiency and low-emission systems, increased integration of smart technologies, and a growing emphasis on sustainability and decarbonization.

-

Regulatory and Environmental Pressures

Federal and state regulations are tightening emissions standards for commercial and industrial boilers, with the U.S. Environmental Protection Agency (EPA) expected to enforce stricter NOx, SOx, and particulate matter limits by 2026. These regulations are pushing manufacturers to innovate cleaner combustion technologies and explore alternative fuels such as hydrogen blends and biofuels. Compliance will become a major differentiator, favoring companies that proactively invest in green boiler solutions. -

Rise of Condensing and High-Efficiency Boilers

Condensing boilers, which recover heat from flue gases to achieve efficiencies over 90%, are projected to dominate new installations. Driven by energy cost savings and utility rebate programs, demand for these systems will grow particularly in commercial real estate, healthcare, and education sectors. By 2026, condensing boilers could represent over 60% of new residential and light commercial boiler sales. -

Electrification and Heat Pump Integration

As part of the broader electrification of heating systems, traditional gas-fired boilers face competition from electric heat pumps, especially in mild climate zones. Hybrid systems—combining high-efficiency boilers with air- or ground-source heat pumps—are emerging as a transitional solution. American boiler manufacturers are increasingly partnering with HVAC electrification firms to offer integrated thermal systems that optimize energy use year-round. -

Digitalization and IoT Integration

Smart boiler systems equipped with IoT sensors, remote monitoring, and predictive maintenance capabilities will gain market share. Real-time data analytics will enable facility managers to optimize performance, reduce downtime, and lower operational costs. By 2026, over 40% of new commercial boiler installations are expected to include cloud-connected controls and AI-driven diagnostics. -

Workforce and Supply Chain Challenges

The industry continues to face skilled labor shortages, particularly in boiler installation and service. Automation in manufacturing and augmented reality (AR) tools for technician training are being adopted to bridge the gap. Additionally, supply chain resilience remains a concern, with manufacturers reshoring critical components and diversifying raw material sources to mitigate delays. -

Growth in Retrofit and Replacement Markets

With a significant portion of the U.S. boiler fleet exceeding 20 years of age, the replacement market will be a primary growth driver. Incentives from the Inflation Reduction Act (IRA), including tax credits for energy-efficient equipment, will accelerate retrofits in both industrial and multifamily residential buildings.

In conclusion, the 2026 American boiler market will be defined by sustainability, digital innovation, and regulatory adaptation. Companies that invest in clean technology, smart integration, and customer-centric service models will be best positioned to lead in this evolving landscape.

Common Pitfalls When Sourcing American Boilers: Quality and Intellectual Property Risks

Sourcing American boilers—especially those from reputable U.S. manufacturers—can offer performance and reliability benefits. However, companies, particularly international buyers or distributors, often encounter significant pitfalls related to quality assurance and intellectual property (IP) protection. Understanding these risks is critical to avoiding costly legal, operational, and reputational consequences.

Quality Concerns in Sourcing American Boilers

One of the primary motivations for sourcing American boilers is the perceived high standard of engineering and manufacturing. However, several quality-related pitfalls can undermine this expectation.

Counterfeit or Substandard Replicas

The strong global reputation of American boiler brands makes them prime targets for counterfeiting. Unauthorized manufacturers, particularly in regions with lax regulatory enforcement, often produce look-alike units bearing fake certifications or logos. These replicas may use inferior materials and lack proper safety features, posing serious operational and safety hazards.

Inconsistent Manufacturing Standards

Even when dealing with authorized suppliers, inconsistencies can arise if production is outsourced or if quality control processes are not rigorously enforced. Variations in welding, material thickness, or control system integration can compromise efficiency and longevity, especially when units are modified or rebranded without proper oversight.

Lack of Certification Verification

American boilers are typically certified by bodies such as ASME (American Society of Mechanical Engineers) and bear the “S” or “U” stamp. Buyers may fail to verify these certifications, accepting falsified documentation. Without proper validation, there is no guarantee the boiler meets U.S. safety and performance codes.

After-Sales Support and Spare Parts Availability

Poor sourcing channels often result in inadequate access to technical support, maintenance documentation, or genuine spare parts. This undermines long-term reliability and increases downtime, effectively negating any initial quality advantages.

Intellectual Property (IP) Infringement Risks

Beyond quality, sourcing American boilers carries substantial intellectual property risks, particularly when dealing with unofficial suppliers or third-party manufacturers.

Unauthorized Use of Brand Names and Logos

Many suppliers falsely claim affiliation with established American boiler brands (e.g., Cleaver-Brooks, Fulton, Weil-McLain) to gain credibility. This constitutes trademark infringement and exposes buyers to legal liability, especially if the units are imported into jurisdictions with strong IP enforcement.

Patented Technology Replication

American boilers often incorporate patented combustion technologies, control systems, or heat exchanger designs. Unauthorized replication of these features—even if not branded—can constitute patent infringement. Buyers who import or distribute such units may be held complicit in IP violations, leading to seizures, fines, or litigation.

Gray Market and Parallel Imports

Purchasing “genuine” American boilers through unofficial distribution channels (gray market) may appear legitimate but can breach the manufacturer’s distribution agreements. These units might not be configured for the buyer’s region, lack warranty coverage, or involve diverted inventory, creating both IP and compliance risks.

Design and Technical Specification Theft

In some cases, suppliers reverse-engineer American boiler designs and sell them as generic or rebranded products. This not only violates IP rights but also results in diminished performance and safety, as the copied designs may not include proprietary improvements or rigorous testing protocols.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Verify supplier authenticity through manufacturer-authorized distributor lists.

– Require and validate ASME, UL, and other relevant certifications.

– Conduct factory audits or third-party inspections before bulk purchases.

– Consult legal counsel to assess IP compliance, especially for importation.

– Ensure purchase agreements include warranties, IP indemnification clauses, and quality guarantees.

By proactively addressing quality and IP concerns, organizations can safely leverage the benefits of American boiler technology while minimizing exposure to risk.

Logistics & Compliance Guide for American Boiler

Overview

This guide outlines the essential logistics and compliance protocols for American Boiler to ensure safe, efficient, and legally compliant operations. Adherence to these standards supports regulatory alignment, operational reliability, and customer satisfaction.

Regulatory Compliance

Federal Regulations

American Boiler must comply with all applicable federal laws, including those set forth by the U.S. Department of Transportation (DOT), Environmental Protection Agency (EPA), Occupational Safety and Health Administration (OSHA), and the Department of Labor (DOL). Key compliance areas include hazardous materials transportation (49 CFR), emissions standards, workplace safety, and labor practices.

Boiler Safety Standards

All boilers manufactured, serviced, or distributed by American Boiler must conform to the ASME Boiler and Pressure Vessel Code (BPVC). Certification by the National Board of Boiler and Pressure Vessel Inspectors is required for installation and operation in all U.S. jurisdictions.

Environmental Compliance

Operations must follow EPA guidelines for air quality, waste disposal, and chemical handling. Facilities emitting regulated substances must maintain proper permits under the Clean Air Act and submit periodic environmental reports as required.

Logistics Operations

Transportation & Shipping

All boiler units and components must be shipped using DOT-compliant carriers with appropriate documentation, including bills of lading and hazardous materials declarations when applicable. Crating and securing loads must follow industry best practices to prevent damage during transit.

Inventory Management

Implement a real-time inventory tracking system to monitor stock levels, part serialization, and warehouse locations. Conduct quarterly audits to ensure accuracy and support just-in-time delivery schedules.

Supply Chain Partnerships

Only authorized and vetted suppliers and distributors may be used. All partners must provide proof of compliance with relevant safety, quality, and ethical standards. Contracts should include performance metrics and compliance clauses.

Documentation & Recordkeeping

Required Records

Maintain accurate records of inspections, maintenance, certifications, shipment logs, safety data sheets (SDS), and employee training. Records must be retained for a minimum of seven years unless otherwise specified by regulation.

Digital Compliance Portal

All compliance documentation must be uploaded to the secure company portal, ensuring accessibility for auditors, regulators, and internal review teams. Access is restricted to authorized personnel only.

Employee Training & Safety

Mandatory Training Programs

All employees must complete annual training on OSHA safety protocols, hazardous materials handling, emergency response procedures, and equipment operation. New hires undergo onboarding that includes compliance fundamentals.

Safety Inspections

Conduct monthly facility safety audits and equipment inspections. Corrective actions must be documented and resolved within 30 days of identification.

Incident Reporting & Response

Reporting Protocol

Any compliance violation, safety incident, or transportation accident must be reported within 24 hours to the Compliance Officer. A formal incident report must be filed using the company’s standardized form.

Corrective Action Plan

Each reported incident triggers a root cause analysis and development of a corrective action plan. The plan must be approved by management and implemented with follow-up verification.

Audits & Continuous Improvement

Internal Audits

Schedule biannual internal audits to evaluate compliance across all departments. Audit findings are presented to executive leadership, and action plans are tracked to resolution.

Regulatory Updates

Assign a compliance officer to monitor changes in federal, state, and local regulations. Updates are communicated company-wide, and policies are revised as needed to maintain alignment.

Conclusion

American Boiler is committed to upholding the highest standards in logistics and regulatory compliance. This guide serves as a living document—reviewed annually and updated to reflect evolving industry requirements and operational best practices.

Conclusion for Sourcing American Boiler

In conclusion, sourcing an American boiler presents a strategic advantage for businesses and industries seeking reliable, high-efficiency, and code-compliant heating solutions. American boilers are renowned for their robust engineering, adherence to strict manufacturing standards such as ASME (American Society of Mechanical Engineers), and compatibility with a wide range of commercial and industrial applications. By sourcing from reputable U.S.-based manufacturers, buyers gain access to advanced technology, comprehensive customer support, and faster service response times, which contribute to reduced downtime and long-term operational efficiency.

Moreover, sourcing domestically supports supply chain resilience, reduces logistical complexities, and ensures easier compliance with local regulations and environmental standards. While initial costs may be higher compared to international alternatives, the total cost of ownership—factoring in durability, energy efficiency, and maintenance—is often more favorable. Therefore, sourcing American boilers is a prudent investment that aligns with goals of quality, sustainability, and operational reliability.