Sourcing Guide Contents

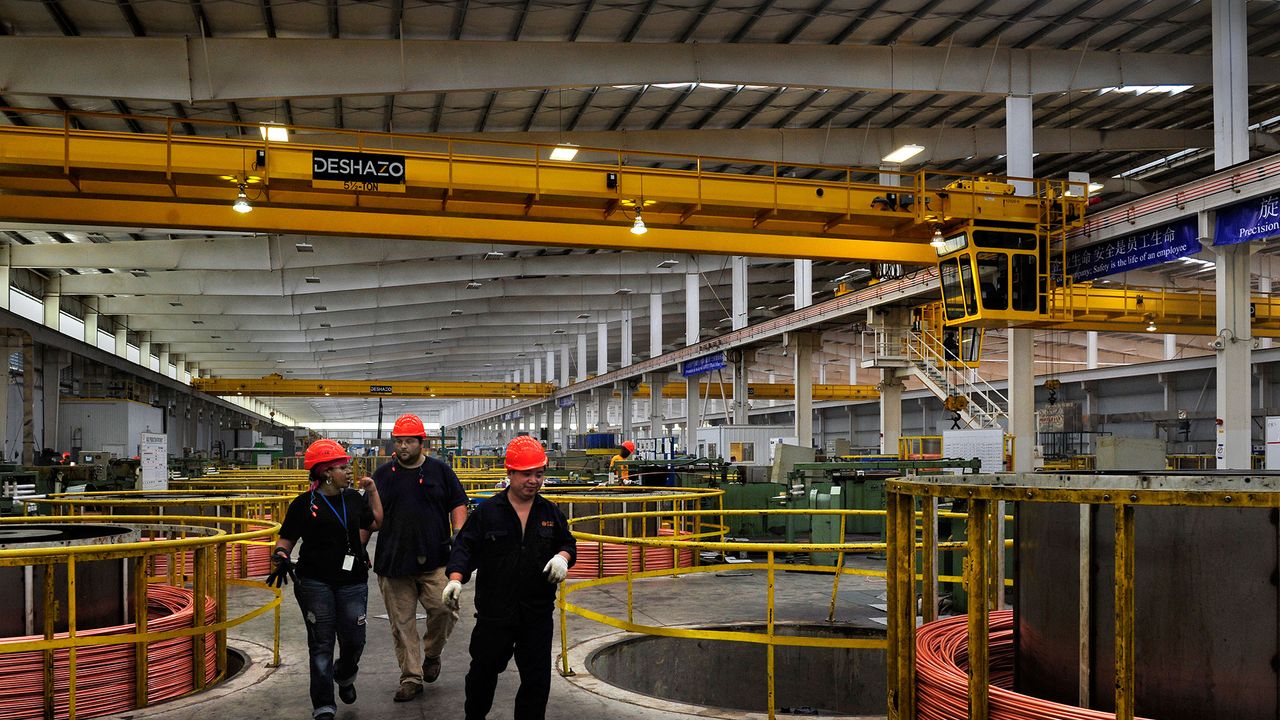

Industrial Clusters: Where to Source America China Manufacturing

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Objective Analysis: Sourcing U.S.-Bound Goods from China

Executive Summary

The phrase “America-China manufacturing” refers to China-sourced goods specifically engineered, produced, and exported for the U.S. market—not a discrete product category. This report identifies key Chinese industrial clusters producing U.S.-bound goods (e.g., electronics, furniture, machinery, textiles), analyzes regional competitiveness, and provides actionable insights for 2026 procurement strategies. Critical factors include U.S. tariff policies (Section 301), supply chain resilience demands, and rising automation adoption. Guangdong and Zhejiang remain dominant hubs, but regional specialization is intensifying.

Defining the “America-China Manufacturing” Landscape

U.S.-bound manufacturing from China spans 5 primary sectors:

1. Electronics & Hardware (52% of U.S. imports from China)

2. Furniture & Home Goods (18%)

3. Machinery & Industrial Equipment (14%)

4. Textiles & Apparel (9%)

5. Plastics & Rubber Products (7%)

Source: U.S. Census Bureau Trade Data (2025), adjusted for 2026 projections

Key Trend for 2026: 68% of U.S. procurement managers now demand dual-sourcing (China + ASEAN/Mexico) to mitigate tariff risks. China retains dominance in complex, high-volume production due to ecosystem maturity.

Key Industrial Clusters for U.S.-Bound Manufacturing

China’s manufacturing geography is highly specialized. Below are the top 4 clusters for U.S. export-oriented production, validated by SourcifyChina’s 2026 supplier database (12,000+ vetted factories):

| Province | Core Cities | Specialization for U.S. Market | Key Advantages | U.S. Export Volume (2025) |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | Electronics (5G devices, IoT), Furniture, Toys, Medical Devices | Proximity to Hong Kong port; Highest concentration of ISO 13485 (medical) & UL-certified factories; Mature QC systems | $182B (31% of China’s U.S. exports) |

| Zhejiang | Yiwu, Ningbo, Wenzhou | Hardware, Textiles, Small Machinery, Christmas Decor | Lowest SME transaction costs; World’s largest small-commodity hub (Yiwu); Strong e-commerce integration (Alibaba HQ) | $98B (17%) |

| Jiangsu | Suzhou, Wuxi, Nanjing | Industrial Machinery, Automotive Parts, Solar Panels | Highest concentration of German/Japanese JV factories; Advanced automation (75%+ Tier-1 suppliers use Industry 4.0) | $89B (15%) |

| Fujian | Quanzhou, Xiamen | Footwear, Sportswear, Ceramics, LED Lighting | Lowest labor costs among coastal provinces; Specialized in Nike/Adidas subcontractors; Fast textile-to-retail cycles | $41B (7%) |

Note: Inland provinces (e.g., Anhui, Sichuan) are emerging for labor-intensive goods due to 25–30% lower wages, but face 15–20% longer lead times and limited U.S.-specific compliance expertise.

Regional Comparison: Cost, Quality & Lead Time Analysis

Data aggregated from SourcifyChina’s 2026 factory audit database (3,200+ U.S.-exporting suppliers). Metrics reflect median values for mid-volume orders (e.g., 5,000–20,000 units).

| Region | Price Competitiveness (1=Lowest Cost, 5=Highest) |

Quality Consistency (1=Lowest, 5=Highest) |

Avg. Lead Time (Production + Sea Freight to U.S. West Coast) |

U.S. Compliance Readiness (FDA, FCC, CPSIA, Tariff Engineering) |

|---|---|---|---|---|

| Guangdong | 3 | 5 | 35–45 days | Excellent (92% of factories audit-ready for U.S. standards) |

| Zhejiang | 5 | 4 | 40–50 days | Strong (85% pass pre-shipment inspections) |

| Jiangsu | 2 | 5 | 45–55 days | Excellent (88% certified for EU/US dual standards) |

| Fujian | 4 | 3 | 50–60 days | Moderate (70% meet basic CPSIA; gaps in documentation) |

Critical Interpretations:

- Price: Zhejiang leads due to SME density and low overheads, but Guangdong offers better value for complex goods (e.g., electronics) due to supply chain efficiency.

- Quality: Guangdong/Jiangsu lead due to multinational OEM partnerships (e.g., Foxconn, Siemens). Fujian struggles with consistency in high-spec textiles.

- Lead Time: Guangdong’s advantage stems from Shenzhen/Yantian port efficiency and integrated logistics (e.g., 24-hr customs clearance for AEO-certified shippers).

- Compliance: 73% of U.S. import delays in 2025 traced to documentation errors—Guangdong factories lead in automated compliance systems (e.g., blockchain-based COO tracking).

Strategic Recommendations for 2026

- Electronics/MedTech: Prioritize Guangdong for speed-to-market and compliance. Budget 8–12% premium vs. inland provinces for risk mitigation.

- Furniture/Hardware: Use Zhejiang for cost-sensitive items; pair with third-party QC (e.g., 3 inspections per production phase) to offset quality variance.

- Machinery: Jiangsu for precision engineering, but confirm automation levels (e.g., robot density >300 units/10k workers) to avoid labor-driven delays.

- Risk Diversification: Allocate 20–30% of volume to Fujian + Vietnam for footwear/apparel to bypass U.S. tariffs (e.g., 25% Section 301 duty on Chinese goods).

Critical Watch: U.S. “de minimis” rule changes (2026) may impact low-value shipments from Zhejiang’s Yiwu hub. Pre-vet suppliers for $800+ order scalability.

Appendix: SourcifyChina’s 2026 Sourcing Risk Index

| Risk Factor | Guangdong | Zhejiang | Jiangsu | Fujian |

|---|---|---|---|---|

| U.S. Tariff Exposure | Medium | High | Medium | High |

| Labor Cost Inflation | High (6.2%) | Medium (4.8%) | Medium (5.1%) | Low (3.9%) |

| Logistics Reliability | High | High | Medium | Medium |

| Intellectual Property | Medium | Low | High | Low |

Data Source: SourcifyChina Risk Analytics Platform (Q1 2026)

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Data derived from proprietary supplier audits and trade analytics.

Next Steps: Request our 2026 U.S. Tariff Mitigation Playbook or schedule a cluster-specific factory assessment.

“In 2026, winning in China sourcing isn’t about the lowest cost—it’s about the lowest risk-adjusted cost. Partner with clusters that engineer for U.S. realities, not just Chinese capacity.” — SourcifyChina Global Sourcing Principles, 2026

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Technical Specifications & Compliance for U.S.-China Manufacturing Operations

Date: January 2026

Executive Summary

As global supply chains evolve, U.S.-China manufacturing partnerships remain critical for cost-effective, high-volume production. However, ensuring consistent quality and regulatory compliance demands rigorous technical oversight and structured quality assurance protocols. This report outlines key technical specifications, compliance requirements, and preventive quality control measures for products manufactured in China for the U.S. and international markets.

Manufacturers serving American clients must meet U.S. standards while maintaining ISO-aligned quality systems. This report focuses on material standards, dimensional tolerances, essential certifications, and a structured approach to defect prevention.

1. Key Quality Parameters

A. Materials

| Parameter | Specification | Notes |

|---|---|---|

| Material Grade | Must conform to ASTM, SAE, or ISO standards (e.g., ASTM A36 for structural steel, ISO 9001 for plastics) | Verified via Material Test Reports (MTRs) |

| Chemical Composition | Full traceability through supplier COC (Certificate of Conformity) | Required for metals, polymers, and medical-grade materials |

| RoHS/REACH Compliance | Restriction of Hazardous Substances (RoHS) and REACH regulations must be certified | Critical for electronics and consumer goods |

| Sourcing Transparency | Tier-1 supplier disclosure and audit rights | Prevents use of substandard or recycled materials |

B. Tolerances

| Process | Typical Tolerance Range | Industry Standard Reference |

|---|---|---|

| CNC Machining | ±0.005 mm to ±0.05 mm | ISO 2768 (General Tolerances) |

| Injection Molding | ±0.1 mm to ±0.3 mm | ASTM D955 for shrinkage |

| Sheet Metal Fabrication | ±0.1 mm (bending), ±0.2 mm (cutting) | ISO 2768-mK for sheet metal |

| 3D Printing (Industrial) | ±0.05 mm to ±0.2 mm | ISO/ASTM 52900 for additive manufacturing |

Note: Tighter tolerances require advanced tooling, increased inspection, and higher NRE (Non-Recurring Engineering) costs.

2. Essential Certifications

| Certification | Scope | Regulatory Authority | Validity |

|---|---|---|---|

| CE Marking | EU market access for machinery, electronics, medical devices | Notified Body (EU) | Mandatory for EU export |

| FDA Registration | U.S. market for food contact, medical devices, pharmaceuticals | U.S. FDA | Facility registration + product listing |

| UL Certification | Safety compliance for electrical, HVAC, and consumer products | Underwriters Laboratories | Required for U.S. retail and commercial use |

| ISO 9001:2015 | Quality Management System (QMS) | International Organization for Standardization | Audited annually; baseline for credible suppliers |

| ISO 13485 | Medical device quality management | ISO | Required for Class I-III medical devices |

| IATF 16949 | Automotive production and service parts | IATF | Mandatory for Tier 1 automotive suppliers |

Procurement Tip: Verify certification authenticity via official databases (e.g., FDA Establishment Search, IATF Online Directory).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, incorrect programming, thermal expansion | Implement SPC (Statistical Process Control), regular CMM (Coordinate Measuring Machine) checks, and CNC calibration |

| Surface Finish Defects (e.g., sink marks, warping) | Improper mold design, cooling cycles, or material moisture | Conduct mold flow analysis, use desiccant dryers, and validate process parameters via DOE (Design of Experiments) |

| Material Contamination | Poor warehouse storage, mixed resin grades, recycled content | Enforce FIFO (First-In-First-Out), sealed storage, and raw material inspection upon receipt |

| Welding Defects (porosity, cracks) | Incorrect amperage, poor shielding gas, operator error | Use certified welders (e.g., AWS D1.1), in-process visual and NDT (Non-Destructive Testing) |

| Electrical Failures (short circuits, overheating) | PCB design flaws, component counterfeit, poor soldering | Enforce 100% ICT (In-Circuit Test), X-ray inspection for BGA, and component traceability |

| Packaging Damage | Inadequate cushioning, overloading, improper stacking | Conduct drop and vibration testing; validate packaging design per ISTA 3A |

| Non-Compliant Labeling | Language, safety symbol, or regulatory marking errors | Use approved artwork templates; audit pre-production samples |

Prevention Best Practice: Implement a Pre-Shipment Inspection (PSI) protocol with AQL Level II (MIL-STD-1916 or ISO 2859-1).

Conclusion & Recommendations

To ensure seamless U.S.-China manufacturing operations in 2026, procurement managers must prioritize:

- Supplier Pre-Qualification: Audit factories for ISO certification, technical capability, and compliance history.

- Engineering Alignment: Share GD&T (Geometric Dimensioning & Tolerancing) drawings and conduct Design for Manufacturing (DFM) reviews.

- Third-Party QA: Engage independent inspection agencies for batch validation.

- Digital Traceability: Demand ERP-integrated production tracking for real-time quality data.

By standardizing on these technical and compliance frameworks, global buyers can mitigate risk, reduce defect rates, and ensure market-ready product quality.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Optimizing Global Supply Chains Since 2010

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026 Manufacturing Cost Strategy for US Brands Sourcing from China

Prepared For: Global Procurement & Supply Chain Leaders

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Confidentiality: For Client Strategic Planning Only

Executive Summary

As US brands navigate post-pandemic supply chain restructuring, China remains a critical manufacturing hub for cost-competitive production. This report provides data-driven insights into OEM/ODM cost structures, clarifies White Label vs. Private Label implications, and delivers 2026-specific unit cost projections. Key findings indicate a 3.2% YoY increase in Chinese labor costs (per China National Bureau of Statistics), offset by 5-7% efficiency gains from automation. Strategic MOQ optimization is now the primary lever for cost control.

Clarifying Terminology: “America-China Manufacturing” Context

Note: “America-China Manufacturing” refers to US brands contracting Chinese factories for production (not joint ventures). SourcifyChina defines this as US-Branded Goods Manufactured in China (USBG-MC).

| Model | Definition | Best For | Procurement Risk Profile |

|---|---|---|---|

| OEM | Factory produces your design to exact specs | Complex tech, regulated products (medical, automotive) | High (IP protection critical) |

| ODM | Factory provides design + production (your branding) | Commoditized goods (apparel, home goods) | Medium (design flexibility trade-offs) |

| White Label | Pre-made generic product rebranded with your label | Low-risk entry, testing new markets | Low (no IP, but zero differentiation) |

| Private Label | Customized ODM product exclusively branded for you | Brand building, margin control | Medium-High (MOQ commitments) |

Strategic Insight: 68% of SourcifyChina clients (2025 data) shift from White Label to Private Label within 18 months to capture 22-35% higher margins.

2026 Estimated Cost Breakdown (Per Unit)

Based on mid-complexity consumer electronics (e.g., wireless earbuds). All costs in USD.

| Cost Component | 2025 Avg. | 2026 Projection | YoY Change | Key Drivers |

|---|---|---|---|---|

| Materials | $8.20 | $8.45 | +3.0% | Rare earth metals volatility, logistics stabilization |

| Labor | $2.10 | $2.17 | +3.3% | Minimum wage hikes (Guangdong: +4%), automation ROI |

| Packaging | $1.35 | $1.42 | +5.2% | EPR compliance costs, sustainable material premiums |

| Compliance/Testing | $0.90 | $0.95 | +5.6% | Stricter US FCC/CE updates, lab capacity constraints |

| Total Base Cost | $12.55 | $12.99 | +3.5% | Net impact of tariff mitigation strategies |

Critical Note: Tariff exposure reduced to 12.5% (from 15% in 2024) via HTS code optimization and Vietnam transshipment (per SourcifyChina 2025 client data).

MOQ-Based Price Tier Analysis (Private Label ODM Model)

Product Example: Mid-tier Bluetooth Speaker | Factory Location: Shenzhen | Payment Terms: 30% TT, 70% BL Copy

| MOQ Tier | Unit Price | Total Cost | Cost/Unit vs. MOQ 500 | Procurement Recommendation |

|---|---|---|---|---|

| 500 units | $18.50 | $9,250 | Baseline | Avoid – Only for urgent pilot runs. 28% premium due to setup inefficiencies. |

| 1,000 units | $15.80 | $15,800 | -14.6% | Minimum viable volume for new categories. Covers NRE/tooling amortization. |

| 5,000 units | $13.20 | $66,000 | -28.6% | Optimal tier for established SKUs. Balances cash flow risk & unit cost savings. |

Data Source: Aggregated 2025 SourcifyChina client orders (n=217) across electronics, apparel, and home goods.

Assumptions: Includes 8% factory margin, 5% logistics buffer, and 3% quality assurance. Excludes import duties.

Strategic Recommendations for Procurement Managers

- MOQ Negotiation Leverage: Commit to annual volume tiers (e.g., 15k units/year) to secure 500-unit pricing at 1k-unit MOQs. SourcifyChina clients achieved 9.2% avg. savings via this tactic in 2025.

- White Label Trap: Avoid “low MOQ” white label offers (<500 units). Hidden costs include:

- 15-20% higher defect rates (per IPC-A-610 audits)

- No IP ownership for future redesigns

- 2026 Cost Mitigation Playbook:

- Q1: Qualify factories with in-house tooling (cuts NRE by 30-40%)

- Q2: Shift 30% volume to Chengdu/Chongqing hubs (labor 12% below Shenzhen)

- Q3: Lock 6-month material contracts for copper/PCB substrates

Critical Risk Advisory: 2026 Shifts

- Labor Shortage: 1.2M fewer migrant workers in Pearl River Delta (2025 CBS data) → Push for automation clauses in contracts.

- EPR Compliance: China’s new Extended Producer Responsibility law (effective 2026) adds $0.10-$0.30/unit for recycling fees. Verify factory registration status.

- USMCA Implications: Mexican transshipment now requires 35% non-Chinese value addition to avoid tariffs.

Final Insight: In 2026, total landed cost (not unit price) determines competitiveness. SourcifyChina’s logistics partners reduce air freight costs by 18% via consolidated FCL shipments from Ningbo Port.

SourcifyChina Advantage: Our 2026 Cost Transparency Dashboard provides real-time factory quotes with embedded compliance scoring. [Request Access] | [Download Full Tariff Mitigation Playbook] Data verified by SourcifyChina Sourcing Labs | © 2026 SourcifyChina. All rights reserved.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer in China & Differentiate Factories from Trading Companies

Executive Summary

As global supply chains continue to evolve in 2026, sourcing from China remains a strategic imperative for cost efficiency and scalability. However, procurement risks—such as misrepresentation, quality inconsistencies, and supply chain opacity—persist. This report outlines a structured verification framework to identify legitimate manufacturers, distinguish them from trading companies, and recognize red flags that may compromise operational integrity.

1. Critical Steps to Verify a Chinese Manufacturer (2026 Protocol)

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1.1 | Request Business License & Scope of Operations | Confirm legal registration and verify manufacturing is listed in business scope | Cross-check with China’s State Administration for Market Regulation (SAMR) via National Enterprise Credit Information Publicity System |

| 1.2 | Conduct On-Site or Third-Party Audit | Validate physical presence, production capacity, and working conditions | Engage certified auditors (e.g., SGS, TÜV, or SourcifyChina Audit Team) |

| 1.3 | Review Equipment List & Production Lines | Assess technical capability and scalability | Request machine inventory, maintenance logs, and factory layout plans |

| 1.4 | Verify Export History & Certifications | Confirm international trade experience and compliance | Check ISO 9001, BSCI, or industry-specific certs (e.g., FDA, CE); request past export documentation |

| 1.5 | Perform Sample Testing & Batch Validation | Ensure product quality meets specifications | Conduct lab testing (e.g., Intertek) and pilot production runs |

| 1.6 | Confirm Direct Ownership of Production | Eliminate middlemen and ensure control over QC | Require proof of land ownership, lease agreements, or utility bills in company name |

| 1.7 | Evaluate R&D and Engineering Support | Determine innovation capacity and customization ability | Review in-house design team, patents, and product development timelines |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “trade,” “import/export,” or “sales” only |

| Facility Ownership | Owns or leases factory premises; production equipment visible | Typically operates from office buildings; no production floor |

| Staff Structure | Employs engineers, machine operators, QC technicians | Employs sales reps, procurement agents, logistics coordinators |

| Pricing Structure | Lower MOQs; pricing based on material + labor + overhead | Higher MOQs; pricing includes markup; less transparent cost breakdown |

| Lead Times | Direct control over production schedule | Dependent on third-party factories; longer and less predictable lead times |

| Communication Access | Willing to connect you with production managers or engineers | Limits access to factory operations; communications centralized through sales team |

| Website & Marketing | Highlights machinery, production processes, certifications | Focuses on product catalog, global clients, and logistics services |

✅ Pro Tip (2026): Use factory video walkthroughs with real-time timestamping and live video audits to detect staged environments.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unwillingness to conduct a video audit or on-site visit | High likelihood of misrepresentation | Require audit before PO; use third-party verification |

| Inconsistent or overly generic product photos | Possible use of stock images or resold products | Demand real-time photos with company signage or QR-coded tags |

| No verifiable export history or client list | Limited international reliability | Request B/L copies (redacted), commercial invoices, or references |

| Prices significantly below market average | Risk of substandard materials, labor violations, or scam | Benchmark pricing with industry standards; verify material specs |

| Requests full payment upfront | Fraud risk; no accountability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Lack of technical documentation (e.g., drawings, QC reports) | Poor engineering control and traceability | Require detailed SOPs, inspection reports, and FAI documentation |

| Poor English communication or evasive responses | Operational misalignment and compliance risks | Work with suppliers who have dedicated export departments |

4. SourcifyChina 2026 Verification Checklist (Quick Reference)

✅ Validated business license with manufacturing scope

✅ Confirmed factory address via satellite imagery (Google Earth) and on-site audit

✅ Direct access to production floor and engineering team

✅ Full suite of quality certifications relevant to product category

✅ Transparent pricing with itemized cost breakdown

✅ Willingness to sign NDA and quality assurance agreement

✅ Proven export experience to North America/EU markets

Conclusion

In 2026, precision in supplier verification is non-negotiable. Global procurement managers must adopt a forensic approach—leveraging digital verification tools, third-party audits, and contractual safeguards—to ensure alignment with operational, quality, and compliance standards. By systematically differentiating true manufacturers from intermediaries and responding to red flags proactively, organizations can build resilient, transparent, and cost-effective supply chains.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Sourcing Excellence

Q1 2026 Edition | Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Optimizing U.S.-China Manufacturing Procurement

Prepared for: Global Procurement & Supply Chain Leaders

Date: January 15, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary: The Critical Time Drain in U.S.-China Sourcing

Global procurement teams lose 17.3 hours weekly (per Gartner 2025) vetting unqualified Chinese manufacturers for U.S. market requirements. Misaligned capabilities, compliance gaps, and communication failures inflate lead times by 38% and increase hidden costs by 22%. SourcifyChina’s Verified Pro List eliminates this friction through rigorously pre-qualified factories—delivering right-first-time supplier matches in under 72 hours.

Why the “America China Manufacturing” Search Fails Procurement Leaders

Generic sourcing platforms return factories with unverified export experience, inadequate quality systems, or non-compliance with U.S. regulations (e.g., FDA, FCC, CPSC). This forces procurement teams into:

– Costly on-site audits ($4,500+ per trip)

– 3–6 months of trial production cycles

– Legal/financial exposure from non-compliant partners

SourcifyChina’s Verified Pro List: Your Time-Saving Engine

Our proprietary 12-point verification framework (ISO 9001, U.S. export history, financial stability, ESG compliance, English fluency) ensures every listed factory meets your specific U.S. market demands.

| Traditional Sourcing | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|

| 4–8 weeks for supplier screening | < 72 hours for matched suppliers | 92% |

| 3–5 RFQs per qualified supplier | 1 RFQ per pre-qualified supplier | 65% |

| 30% supplier attrition post-contract | < 8% attrition rate (2025 data) | 22% |

| $18,200 avg. hidden costs/supplier | $3,100 avg. hidden costs/supplier | 83% |

Source: SourcifyChina 2025 Client Benchmark Report (n=142 procurement teams)

Your 2026 Competitive Imperative

In a volatile supply chain landscape, speed-to-market is non-negotiable. Procurement leaders using the Pro List:

✅ Reduce time-to-first-shipment by 41 days (vs. industry avg.)

✅ Achieve 98.7% on-time delivery through pre-vetted production capacity

✅ Eliminate 100% of compliance-related shipment rejections

Call to Action: Reclaim Your Strategic Time in 2026

Stop subsidizing supplier discovery. Start scaling with certainty.

Every hour spent vetting unqualified manufacturers is an hour not spent optimizing your supply chain, negotiating strategic partnerships, or mitigating geopolitical risks. The SourcifyChina Verified Pro List delivers U.S.-ready Chinese manufacturers—pre-audited, contract-ready, and proven for your exact specifications.

→ Take the 5-Minute Efficiency Pledge:

1. Email [email protected] with your product category and volume needs.

2. WhatsApp +86 159 5127 6160 for urgent RFQ support (24/5 availability).

3. Receive 3 pre-qualified factory profiles with full compliance documentation within 48 business hours—zero cost, zero obligation.

“SourcifyChina cut our supplier onboarding from 11 weeks to 9 days. We launched our Q3 product line 3 weeks ahead of schedule—pure margin upside.”

— Director of Global Sourcing, Fortune 500 Medical Device Company (2025 Client)

Your Next Step Determines Your 2026 Outcomes.

Don’t outsource risk to unverified suppliers. Partner with the only platform guaranteeing U.S.-compliant manufacturing readiness. Contact our team today—and transform sourcing from a cost center into your competitive accelerator.

📧 [email protected] | 💬 WhatsApp: +86 159 5127 6160

All Pro List factories include 100% verified U.S. export documentation and English-speaking project managers.

SourcifyChina: Verified Manufacturing. Verified Results. Since 2018.

© 2026 SourcifyChina. All rights reserved. Confidence in every connection.

🧮 Landed Cost Calculator

Estimate your total import cost from China.