The global ornamental plants market, which includes premium flowering bulbs like amaryllis, is experiencing steady expansion driven by rising consumer demand for indoor and outdoor landscaping. According to a 2023 report by Grand View Research, the global ornamental plants and shrubs market size was valued at USD 51.6 billion and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is fueled by increasing urbanization, the proliferation of green spaces in residential and commercial developments, and a surge in e-commerce platforms offering live plants directly to consumers. As demand for high-quality amaryllis bulbs rises—particularly during the holiday season—wholesale manufacturers play a critical role in supplying consistent, disease-free, and vibrant cultivars to retailers, landscapers, and distributors. Based on production capacity, global reach, varietal innovation, and supply chain reliability, the following six manufacturers stand out as leaders in the amaryllis bulb wholesale market.

Top 6 Amaryllis Bulbs Wholesale Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Colorblends Wholesale Flower Bulbs / Tulips and Daffodils

Domain Est. 1996

Website: colorblends.com

Key Highlights: Discover Colorblends, your go-to wholesale flower bulb company offering premium daffodils, tulips, hyacinths, amaryllis, and more….

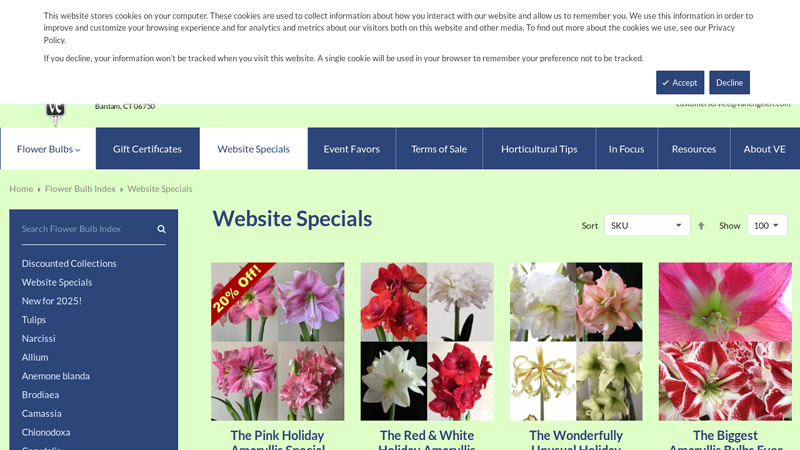

#2 Website Specials

Domain Est. 1997

#3 Amaryllis Bulb Company

Domain Est. 1998

#4 Wholesale Amaryllis Bulbs

Domain Est. 2003

Website: adrbulbs.com

Key Highlights: These bulbs produce striking floral displays atop sturdy, leafless stems, reaching 18 to 30 inches tall. Easy to grow and long-lasting….

#5 Bloomaker

Domain Est. 2005

Website: bloomaker.com

Key Highlights: As a wholesale customer, you’ll have the opportunity to order our signature waxed amaryllis bulbs and a variety of other seasonal favorites. By partnering with ……

#6 Lobby

Domain Est. 2020

Website: amaryllisflowerbulbs.com

Key Highlights: THE MOST BEAUTIFUL LOW-MAINTENANCE FLOWERS ON THE PLANET. Buy Wholesale · Buy Retail. This site uses cookies to collect information. Learn more on our…

Expert Sourcing Insights for Amaryllis Bulbs Wholesale

H2: 2026 Market Trends for Amaryllis Bulbs Wholesale

The wholesale amaryllis bulb market is poised for notable growth and transformation by 2026, driven by shifting consumer preferences, advancements in horticultural practices, and increased demand in both traditional and emerging markets. Key trends shaping the industry include the rise in indoor gardening, sustainability demands, e-commerce expansion, and the influence of seasonal gifting cycles.

Growing Popularity of Indoor Gardening

The global surge in indoor and container gardening continues to fuel demand for ornamental bulbs like amaryllis. As urban populations expand and living spaces become more compact, consumers seek low-maintenance, visually striking plants. Amaryllis bulbs, known for their dramatic blooms and ease of cultivation, are increasingly favored for home and office decor. This trend is expected to strengthen the wholesale market, particularly in North America and Western Europe, where indoor plant ownership has risen significantly post-pandemic.

Seasonal Demand and Gifting Culture

Amaryllis bulbs remain a staple in holiday gifting, especially during the Christmas and winter seasons. Their ability to bloom indoors during colder months makes them a popular choice for festive decorations. By 2026, wholesalers are likely to see heightened pre-holiday orders, with retailers bundling bulbs with pots and decorative packaging. The trend toward experiential gifts—where recipients grow and nurture the bulb—adds further value, supporting premium pricing and expanded product lines.

Sustainability and Ethical Sourcing

Eco-conscious consumers and B2B buyers are demanding greater transparency in sourcing and production. Wholesalers who can verify sustainable cultivation practices, reduced chemical usage, and carbon-efficient logistics will gain a competitive edge. The trend toward organic and peat-free growing mediums is also influencing bulb production, prompting suppliers to adopt greener practices to meet retailer and consumer expectations.

E-Commerce and Direct-to-Retail Expansion

Digital platforms are transforming how amaryllis bulbs are distributed. Online garden centers, subscription box services, and social commerce are creating new wholesale opportunities. By 2026, expect more partnerships between bulb producers and e-commerce retailers, with data-driven inventory management optimizing supply chains. Additionally, wholesalers are increasingly offering private-label options and customized packaging to meet the branding needs of digital-first sellers.

Innovation in Varieties and Breeding

Plant breeders are introducing novel amaryllis varieties with unique colors, patterns, and extended bloom times. These innovations cater to niche markets and premium segments, allowing wholesalers to differentiate their offerings. Double-flowering, miniature, and fragrant cultivars are gaining traction, enabling higher margins and broader appeal beyond traditional red and white types.

Geographic Market Expansion

While Europe and North America remain dominant markets, growth is accelerating in Asia-Pacific and Latin America, where gardening as a hobby is on the rise. Countries like South Korea, Japan, and Brazil are seeing increased interest in ornamental bulbs, supported by urban gardening initiatives and social media influence. Wholesalers who establish early distribution networks in these regions may capture first-mover advantages.

Supply Chain Resilience and Climate Challenges

Climate variability and extreme weather events pose risks to bulb cultivation, particularly in key growing regions like the Netherlands and South Africa. By 2026, leading wholesalers are expected to invest in diversified sourcing, climate-controlled storage, and predictive analytics to mitigate supply disruptions. Additionally, advancements in cold-chain logistics will support global distribution while maintaining bulb viability.

In conclusion, the 2026 wholesale amaryllis bulb market will be shaped by a blend of consumer behavior shifts, technological integration, and sustainability imperatives. Wholesalers who adapt to these trends—by innovating product offerings, enhancing supply chain resilience, and leveraging digital channels—will be well-positioned for sustained growth in an increasingly competitive landscape.

Common Pitfalls Sourcing Amaryllis Bulbs Wholesale (Quality, IP)

When sourcing amaryllis bulbs wholesale, businesses often encounter significant challenges related to product quality and intellectual property (IP) rights. Overlooking these pitfalls can lead to customer dissatisfaction, legal issues, and reputational damage. Below are key areas to watch out for:

Quality-Related Pitfalls

Inconsistent Bulb Size and Health

Wholesale suppliers may offer bulbs that vary widely in size (measured in centimeters around the circumference). Smaller or underdeveloped bulbs often produce weaker stems and fewer flowers. Buyers must specify minimum size standards (e.g., 32–34 cm) and inspect samples before bulk orders.

Poor Storage and Handling Practices

Improper storage—such as exposure to moisture, extreme temperatures, or prolonged dormancy—can lead to mold, rot, or desiccation. Ensure suppliers maintain climate-controlled conditions and provide recent harvest dates.

Lack of Disease Screening

Amaryllis bulbs are susceptible to fungal and viral infections (e.g., red blotch, mosaic virus). Reputable suppliers should provide phytosanitary certificates and conduct regular pathogen testing. Without these, diseased bulbs can spread infections to other plants.

Delayed or Off-Season Shipments

Timing is crucial. Late deliveries may miss peak planting seasons, reducing flower performance. Confirm shipping schedules and ensure bulbs are shipped at the correct dormancy stage for your market’s growing cycle.

Intellectual Property (IP) Pitfalls

Unauthorized Propagation of Protected Cultivars

Many premium amaryllis varieties (e.g., ‘Papilio’, ‘Double Record’) are protected under Plant Breeders’ Rights (PBR) or Plant Patents. Sourcing bulbs from unauthorized propagators violates IP laws and can result in fines or import seizures. Always verify the supplier holds proper licensing.

Mislabeling and Cultivar Fraud

Some suppliers misrepresent generic or inferior bulbs as premium branded varieties. This not only breaches IP but also damages buyer credibility. Request official certification or trademarks (e.g., Royal Horticultural Society registration) and conduct DNA or visual verification when possible.

Grey Market Imports

Bulbs imported through unofficial distribution channels may be genuine but lack authorization for sale in your region. These “grey market” products can still infringe on regional IP rights and void warranties or support from the breeders.

Lack of Traceability and Documentation

Without proper documentation—such as breeder licenses, propagation certificates, or chain-of-custody records—it’s difficult to prove legal sourcing. Insist on full transparency and audit trails from suppliers.

Mitigation Strategies

- Request references and third-party lab results for quality assurance.

- Work directly with licensed breeders or authorized distributors to avoid IP risks.

- Include quality and IP compliance clauses in supply contracts.

- Conduct pre-shipment inspections and small trial orders before scaling up.

Avoiding these pitfalls ensures you deliver high-performing, legally compliant amaryllis bulbs that meet market expectations and protect your business from liability.

Logistics & Compliance Guide for Amaryllis Bulb Wholesale

Overview

This guide provides essential logistics and compliance information for wholesale distributors, importers, and exporters handling amaryllis bulbs (genus Hippeastrum). Proper handling, documentation, and adherence to phytosanitary regulations are critical to ensure successful international and domestic trade while preventing the spread of pests and diseases.

Botanical and Commercial Classification

Amaryllis bulbs traded in the wholesale market typically belong to the genus Hippeastrum, despite common mislabeling as Amaryllis belladonna. These are tender, tropical bulbs grown for ornamental flowers. They are classified as live plant propagative material under international phytosanitary standards, subject to specific import and export controls.

Seasonal Harvest and Supply Chain Timing

Amaryllis bulbs are typically harvested in late summer to early fall (July–October in the Northern Hemisphere). For optimal market readiness, bulbs should be cured, graded, and shipped during this period to arrive at distribution centers or retailers in time for the holiday season (November–January). Timing logistics around peak demand is crucial for maximizing profitability.

Packaging and Storage Requirements

- Packaging: Bulbs must be packed in ventilated cartons with protective cushioning (e.g., wood shavings or paper) to prevent bruising. Each bulb should be individually wrapped or separated.

- Labeling: Include variety name, size (circumference in cm), country of origin, batch number, and supplier details.

- Storage: Store in a cool (13–16°C / 55–60°F), dry, and dark environment with good air circulation. Avoid exposure to ethylene gas and high humidity to prevent mold and premature sprouting.

Temperature and Humidity Control in Transit

During shipping, maintain temperatures between 10–16°C (50–60°F). Avoid freezing and excessive heat. Relative humidity should be kept below 70% to prevent rot. Use refrigerated containers (reefers) for ocean freight and climate-controlled trucks for overland transport. Monitor conditions with data loggers when possible.

Phytosanitary Certification

Most countries require a Phytosanitary Certificate issued by the national plant protection organization (e.g., USDA-APHIS in the U.S., NPPO of the Netherlands) of the exporting country. This certificate confirms that the bulbs have been inspected and are free from regulated pests and diseases, including:

– Stem nematode (Ditylenchus dipsaci)

– Fusarium oxysporum f.sp. cepivorum

– Penicillium and Botrytis spp.

– Hippeastrum mosaic virus (HiMV)

Import Regulations by Key Markets

- United States: Requires a USDA-APHIS PPQ 587 Permit for Importation and a phytosanitary certificate. Bulbs may be subject to inspection and treatment upon arrival.

- European Union: Must comply with EU Regulation (EU) 2016/2031. Bulbs require a Phytosanitary Certificate and may need to originate from a registered production site. Specific requirements vary by member state.

- Canada: Enforced by the Canadian Food Inspection Agency (CFIA). A phytosanitary certificate is mandatory, and bulbs may be inspected at the port of entry.

- Australia & New Zealand: Strict biosecurity laws. Requires import permits, pre-shipment treatments, and post-entry quarantine in some cases. Early coordination with regulatory authorities (e.g., DAFF in Australia) is essential.

Pest and Disease Management Protocols

Suppliers must implement integrated pest management (IPM) practices, including:

– Pre-harvest field inspections

– Post-harvest fungicide treatment (if permitted)

– Nematode testing of soil and bulbs

– Clean handling and packing facilities

Record keeping of treatments and inspections is required for audit and compliance purposes.

Documentation Checklist

Ensure the following documents accompany each shipment:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Phytosanitary Certificate

– Import Permit (if required by destination country)

– Certificate of Origin (for tariff classification)

– Treatment records (if applicable)

Labeling and Traceability

Each shipment must be fully traceable to its source. Use batch coding and digital tracking where possible. Labels should be durable, weather-resistant, and include the above documentation details. Compliance with Global Trade Item Number (GTIN) standards enhances supply chain transparency.

Cold Chain Integrity and Transit Time

Minimize transit time to reduce stress on bulbs. Ocean freight should not exceed 4–6 weeks. Air freight is preferred for long distances or time-sensitive deliveries. Validate cold chain integrity through temperature monitoring and third-party logistics (3PL) partners experienced in perishable goods.

Returns and Non-Compliance Handling

Establish protocols for handling rejected shipments due to non-compliance. Options include:

– Re-export within a defined timeframe

– Destruction under official supervision

– Treatment and re-inspection (if permitted)

Costs and liabilities should be clarified in contracts with buyers and freight forwarders.

Best Practices for Compliance and Efficiency

- Partner with certified nurseries and registered exporters

- Stay updated on changing regulations via official NPPO websites

- Conduct mock audits and train staff on compliance procedures

- Use accredited inspection services prior to export

Adhering to this guide ensures reliable delivery of high-quality amaryllis bulbs while minimizing regulatory risks and supply chain disruptions.

In conclusion, sourcing amaryllis bulbs wholesale offers numerous advantages for retailers, landscapers, and event planners seeking to meet seasonal demand efficiently and cost-effectively. By purchasing in bulk, businesses can significantly reduce per-unit costs, ensure consistent supply during peak seasons, and maintain product quality when partnering with reputable suppliers. Key considerations when selecting a wholesale supplier include bulb quality, variety selection, shipping reliability, and minimum order requirements. Establishing strong relationships with trusted growers or distributors not only enhances supply chain stability but also allows access to exclusive varieties and early-season availability. Ultimately, strategic wholesale sourcing of amaryllis bulbs supports profitability, scalability, and customer satisfaction—making it a smart investment for any horticulture-focused business.