The global aluminum round tube market is experiencing robust growth, driven by increasing demand across key industries such as automotive, construction, aerospace, and renewable energy. According to a report by Grand View Research, the global aluminum tubing market size was valued at USD 27.6 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Factors such as aluminum’s lightweight properties, corrosion resistance, and recyclability are accelerating its adoption, particularly in fuel-efficient vehicles and sustainable infrastructure projects. Mordor Intelligence further projects that rising investments in electric vehicles (EVs) and solar energy systems will continue to boost aluminum tube consumption through 2028. With this expanding demand, the competitive landscape has evolved, giving rise to a network of manufacturers that combine technological innovation with scalable production. The following list highlights the top 10 aluminum round tube manufacturers leading this growth, evaluated based on production capacity, global reach, product quality, and industry certifications.

Top 10 Aluminum Round Tube Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Aluminum Round Tubes (6061 & 6063)

Domain Est. 1999

Website: industrialmetalsupply.com

Key Highlights: 30-day returns6061 AL round tubing is formable, machinable, and weldable, offering an excellent strength-to-weight ratio. This aluminum alloy can be heat treated and is ……

#2 Round Aluminum Tubing

Domain Est. 2010

Website: eagle-aluminum.com

Key Highlights: $25 delivery 30-day returnsExplore high-quality round aluminum tubing from Eagle Aluminum. Our extruded aluminum tubing is ideal for construction, fabrication, and industrial use….

#3 Aluminum Round Tube Extrusion Factory

Domain Est. 2016

Website: pailian-aluminium.com

Key Highlights: We provide various styles of round tubes, square tubes, and special pipes available in different sizes of excellent quality at reasonable price. We are glad to ……

#4 Extruded Aluminum Round Tube Solutions

Domain Est. 1995

Website: brazeway.com

Key Highlights: Brazeway designs round tube with precise and consistent dimensional control, delivering less variation and higher yields in your process….

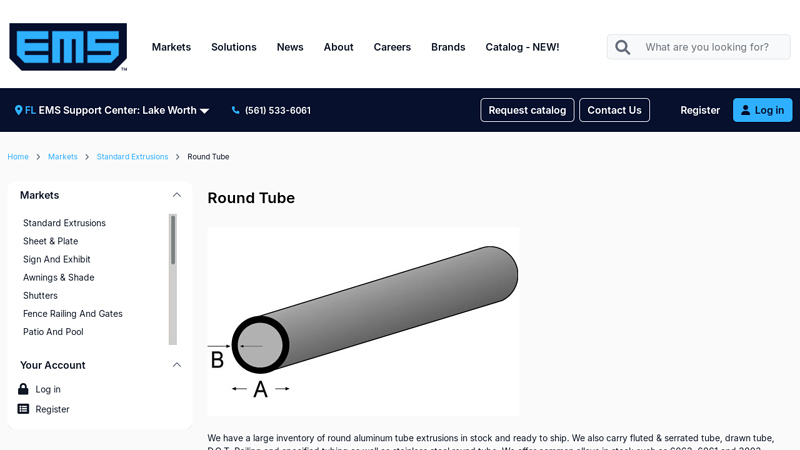

#5 Aluminum Round Tube

Domain Est. 1996

Website: easternmetal.com

Key Highlights: Eastern Metal Supply’s aluminum round tube extrusions include fluted & serrated tube, drawn tube, D.O.T. Railing, stainless steel, and many more….

#6 Aluminum Tubing Supplier

Domain Est. 1997

Website: twmetals.com

Key Highlights: As a market leader in tubing products, TW Metals stocks a wide variety of metals, grades, shapes, and specifications….

#7 Aluminum Round Tubing

Domain Est. 1998

Website: continentalsteel.com

Key Highlights: 6061 is the least expensive and most versatile of the heat-treatable aluminum alloys. It has most of the good qualities of aluminum….

#8 Aluminum Tubing

Domain Est. 1999

#9 Round Tube

Domain Est. 2000

Website: clintonaluminum.com

Key Highlights: Clinton is an aluminum round tube distributor. These round tubes are available in the following alloy: 6061. For complete pricing and stock information…

#10 Dover Tubular

Domain Est. 2003

Website: dovertubularalloys.com

Key Highlights: Dover Tubular Alloys is a master distributor of stainless steel & aluminum tube and pipe selling exclusively to Metal Service Centers, Distributors, and other ……

Expert Sourcing Insights for Aluminum Round Tube

2026 Market Trends for Aluminum Round Tube

The global aluminum round tube market is expected to experience steady growth and significant transformation by 2026, driven by evolving industrial demands, sustainability imperatives, and technological advancements. Key trends shaping the market include:

1. Rising Demand in Transportation and Automotive Sectors

The push for fuel efficiency and electrification is accelerating the adoption of lightweight materials. Aluminum round tubes are increasingly used in electric vehicle (EV) frames, battery enclosures, and structural components due to their strength-to-weight ratio. By 2026, the automotive segment is projected to be one of the largest consumers, with growing investments in EV infrastructure across North America, Europe, and Asia-Pacific supporting demand.

2. Expansion in Renewable Energy Infrastructure

Aluminum round tubes play a vital role in solar panel mounting systems, wind turbine components, and energy storage frameworks. As global renewable energy capacity expands to meet climate targets, demand for corrosion-resistant and durable aluminum tubing will rise significantly, particularly in utility-scale solar installations.

3. Growth in Construction and Architectural Applications

The construction industry is adopting aluminum round tubes for modern façades, handrails, and structural supports due to their aesthetic appeal, low maintenance, and recyclability. Urbanization and green building initiatives are expected to boost demand, especially in emerging markets.

4. Advancements in Manufacturing and Alloys

Innovations in extrusion technology and high-performance aluminum alloys (e.g., 6000 and 7000 series) are enhancing the mechanical properties of round tubes, enabling thinner walls and greater load-bearing capacity. These improvements support use in high-stress applications and reduce material usage, aligning with sustainability goals.

5. Sustainability and Circular Economy Drivers

With increasing regulatory pressure and corporate ESG commitments, the recyclability of aluminum—requiring up to 95% less energy to recycle than produce from raw materials—is a major market advantage. By 2026, producers are expected to emphasize closed-loop recycling and low-carbon production methods to meet green procurement standards.

6. Regional Market Shifts and Supply Chain Reconfiguration

Asia-Pacific, led by China and India, will remain the largest producer and consumer, but nearshoring trends in North America and Europe are prompting new capacity investments to reduce reliance on imports and strengthen supply chain resilience.

7. Price Volatility and Raw Material Challenges

Fluctuations in bauxite supply, alumina refining costs, and energy prices may impact aluminum tube pricing. However, long-term contracts and vertical integration strategies among key players are expected to mitigate some volatility by 2026.

In summary, the 2026 aluminum round tube market will be characterized by robust demand from high-growth sectors, technological innovation, and a strong focus on sustainability, positioning aluminum as a critical material in the global transition to lightweight, energy-efficient solutions.

Common Pitfalls When Sourcing Aluminum Round Tube (Quality & IP)

Sourcing aluminum round tube requires careful attention to both material quality and intellectual property (IP) considerations. Overlooking these areas can lead to performance issues, project delays, legal disputes, and reputational damage.

Poor Material Quality and Specification Non-Conformance

One of the most frequent issues is receiving aluminum tubing that fails to meet specified standards. Suppliers may provide tubes with incorrect alloy composition (e.g., mislabeling 6061-T6 as 6063), inconsistent temper conditions, or inadequate mechanical properties. Variations in dimensional tolerances—such as outside diameter, wall thickness, and straightness—can compromise fit and function in precision applications. Additionally, surface defects like scratches, dents, or oxidation may go unnoticed during inspection but affect both aesthetics and structural integrity.

Inadequate Certifications and Traceability

Many suppliers, especially those outside certified supply chains, fail to provide proper material test reports (MTRs) or mill certifications. Without verifiable documentation, it’s impossible to confirm that the aluminum meets required industry standards (e.g., ASTM B221, AMS, or EN 755). Lack of traceability also complicates quality audits and regulatory compliance, particularly in aerospace, medical, or defense sectors where full material lineage is mandatory.

Counterfeit or Gray Market Materials

Purchasing from unauthorized distributors or gray market sources increases the risk of receiving counterfeit aluminum products. These materials may be misrepresented in terms of alloy, origin, or certification, potentially violating safety and performance requirements. Counterfeit tubing may originate from recycled or substandard stock, posing serious risks in critical applications.

Intellectual Property (IP) Infringement Risks

Using aluminum round tube in patented designs or proprietary systems without proper licensing can lead to IP violations. Some suppliers may offer tubes engineered to mimic patented profiles or dimensions, which could expose the buyer to infringement claims. Additionally, copying custom extrusion dies or tooling designs without permission—whether from a previous supplier or competitor—constitutes a serious IP breach and may result in litigation.

Insufficient Due Diligence on Suppliers

Failing to vet suppliers thoroughly can result in partnerships with entities lacking proper quality management systems (e.g., ISO 9001) or ethical sourcing practices. This oversight increases exposure to supply chain disruptions, subpar materials, and potential legal liabilities. It’s essential to audit supplier capabilities, production processes, and compliance history before procurement.

Avoiding these pitfalls requires clear specifications, rigorous supplier qualification, third-party testing when necessary, and legal review of designs and sourcing agreements to ensure both quality and IP compliance.

Logistics & Compliance Guide for Aluminum Round Tube

This guide outlines key considerations for the safe, efficient, and compliant transportation, handling, and regulatory adherence related to aluminum round tubes.

H2: Transportation & Handling

Packaging & Unitization:

* Bundling: Tubes are typically bundled using steel or plastic strapping, securely fastened at multiple points (usually 3-5 per bundle) to prevent shifting. Bundle size (length, diameter, weight) must be manageable for standard handling equipment.

* End Protection: Plastic or cardboard caps/plugs are essential to protect thread forms (if applicable) and prevent damage to tube ends during transit and handling. “V” blocks or cradles may be used for larger diameters.

* Palletization: Bundles are often loaded onto wooden or plastic pallets. Ensure proper weight distribution and secure strapping/bracing to the pallet to prevent collapse or shifting. Use edge protectors where straps contact tubes.

* Special Handling for Long Lengths: Extra-long tubes (>20ft/6m) may require specialized flatbed trailers, over-length permits, and careful securing with load bars, chains, and dunnage to prevent bending or whipping.

Loading & Securing:

* Vehicle Compatibility: Select trailers (enclosed van, flatbed, step deck) appropriate for tube length, weight, and environmental protection needs (e.g., moisture).

* Securing Loads: Use appropriate tie-down straps, chains, or load bars meeting DOT/FMVSS standards. Secure bundles/pallets to the vehicle’s anchor points to prevent movement in all directions (forward, backward, sideways, upward). Follow load securement regulations (e.g., US 49 CFR Part 393, EU Directive 2014/47/EU).

* Dunnage & Separation: Use wood dunnage between layers or between tubes and the trailer floor/walls to prevent abrasion, allow airflow, and distribute weight. Separate different bundle types/sizes clearly.

Handling Equipment:

* Use forklifts with appropriate attachment (forks, clamps) to avoid crushing tubes. Cranes with lifting beams or spreader bars are necessary for heavy or long bundles. Ensure operators are trained on handling fragile/long loads.

H2: Regulatory Compliance

Material Certification & Traceability:

* Mill Test Certificates (MTC/CoC): Must accompany shipments, certifying compliance with specified alloy (e.g., 6061-T6), temper, dimensions, and mechanical/chemical properties (per ASTM B221, ISO 6361, or other relevant standards).

* Traceability: Maintain records linking material batches to MTCs for quality and recall purposes. Required for aerospace, automotive, and other regulated industries.

Hazardous Materials (Hazmat) & Safety:

* Classification: Aluminum metal itself is generally not classified as hazardous for transport (non-flammable solid, UN3089 or UN3090 may apply only if in specific forms like powder or turnings). Confirm with Safety Data Sheet (SDS).

* Safety Data Sheet (SDS): Provide the current SDS (GHS-compliant) to customers and carriers. While bulk solid aluminum has low hazard, the SDS covers potential risks (dust from machining, fire hazard of fine powders, environmental concerns).

* Markings & Labels: If classified as non-hazardous, standard shipping marks suffice. If classified (e.g., aluminum powder), full Hazmat regulations (DOT 49 CFR, ADR, IATA/IMDG) apply with proper UN number, hazard class, labels, and documentation.

Trade & Customs Compliance:

* HTS/HS Codes: Correct classification is crucial. Common codes include:

* 7604.10 / 7604.21 / 7604.29: Aluminum tubes, pipes, and hollow profiles (specific code depends on alloy, temper, dimensions, wall thickness).

* 7606.11 / 7606.12 / 7606.91 / 7606.92: Aluminum plates, sheets, strip, and foil (if applicable based on wall thickness relative to diameter).

* Verify exact code based on detailed product specs and destination country’s tariff schedule.

* Country of Origin: Clearly mark origin (e.g., “Made in USA”) on packaging or documentation. Critical for trade agreements (USMCA, CUSMA, EU origin rules) and potential tariffs/quotas.

* Export Controls: Generally, standard aluminum tubes are not subject to strict export controls (like ITAR/EAR). However, verify if tubes are for specific end-uses (e.g., military, aerospace propulsion) that might trigger controls. Check Commerce Control List (CCL).

* Documentation: Accurate Commercial Invoice, Packing List, Bill of Lading/Air Waybill, Certificate of Origin (if required for preferential tariffs), and MTC/CoC are mandatory.

Environmental & Recycling:

* Waste Management: Packaging waste (plastic, wood, metal strapping) must be managed according to local regulations. Aluminum is highly recyclable; promote recycling of scrap and packaging.

* REACH (EU): Confirm compliance with REACH SVHC (Substances of Very High Concern) regulations if applicable (less common for pure aluminum alloys, but check additives/finishes).

* RoHS (EU/China): Generally not applicable to raw aluminum tubing, but relevant if the tube has a lead-based coating or is part of an electronic component.

Quality & Industry Standards:

* Adherence: Ensure production and testing comply with customer specifications and relevant standards (e.g., ASTM B221, AMS QQ-A-200/8 for aerospace, DIN EN 755, JIS H 4040).

* Inspection: Implement quality checks (dimensional, visual, mechanical/chemical test results) before shipment. Documentation must support claims.

Key Takeaway: Successful logistics and compliance require meticulous attention to packaging, secure loading, accurate documentation (especially MTC and HTS code), and awareness of destination-specific regulations. Always verify requirements with carriers, customs brokers, and customers.

Conclusion for Sourcing Aluminum Round Tube

After evaluating various suppliers, material specifications, cost structures, and lead times, the most viable option for sourcing aluminum round tubes has been identified. The selected supplier offers a strong balance of quality, cost-efficiency, and reliability, providing aluminum tubes that meet required industry standards (such as ASTM B221 or AMS-QQ-A-200/8) in the desired alloys (e.g., 6061-T6 or 6063-T5).

Key advantages include competitive pricing, consistent material certification, on-time delivery performance, and the ability to accommodate custom lengths and finishes. Additionally, their proximity reduces shipping costs and environmental impact, while their responsive customer service enhances supply chain resilience.

In conclusion, moving forward with this supplier will ensure a steady supply of high-quality aluminum round tubing, supporting production timelines and product performance while maintaining budgetary control. Continuous monitoring of quality and delivery performance will be implemented to sustain a long-term, mutually beneficial partnership.