The global aluminum reflector market is experiencing steady expansion, driven by rising demand across industries such as lighting, solar energy, and automotive. According to Grand View Research, the global reflective materials market was valued at USD 8.6 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030, with aluminum-based reflectors playing a pivotal role due to their durability, reflectivity, and thermal conductivity. This growth is further fueled by advancements in LED lighting technologies and increased adoption of concentrated solar power systems. As demand intensifies, a select group of manufacturers have emerged as industry leaders, combining innovative engineering with large-scale production capabilities. Based on market presence, product performance, and global reach, the following seven companies represent the top aluminum reflector manufacturers shaping the future of reflective technology.

Top 7 Aluminum Reflector Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Reflector designer and manufacturer in China

Domain Est. 2003

Website: nata.cn

Key Highlights: Nata is the biggest reflector designer and manufacturer in China, Profession aluminum reflector, plastic reflector, LENs, light pipe and ODM/OEM….

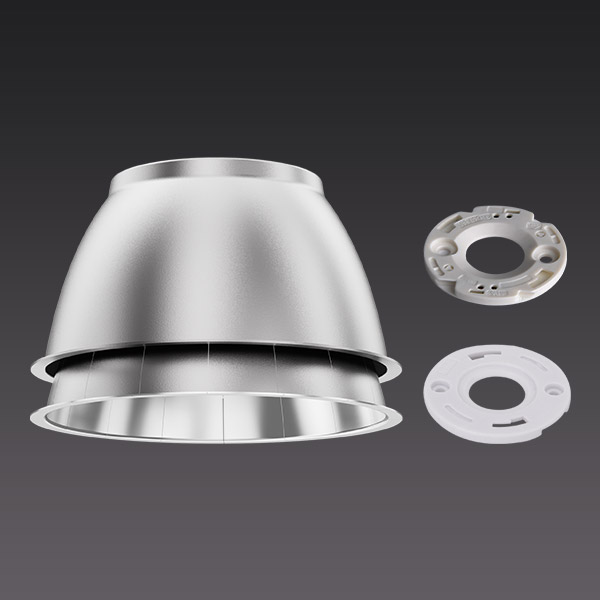

#2 Aluminum Light Reflectors Factorys

Domain Est. 2021

Website: shinlandoptics.com

Key Highlights: Aluminum Light Reflectors Factorys – Manufacturers, Factory, Suppliers from China. We are proud of the high customer satisfaction and wide acceptance due to our ……

#3 FI-FOIL® Reflective Insulation Manufacturer

Domain Est. 1998

Website: fifoil.com

Key Highlights: Based in Florida, FI-FOIL® is your leading source for sustainable, high-value, advanced performance reflective insulation products and systems….

#4 Anomet

Domain Est. 1996

Website: anomet.com

Key Highlights: Anomet’s expansive selection of flawless in stock reflective materials, lampholders and reflectors allow us to meet your just in time requirements….

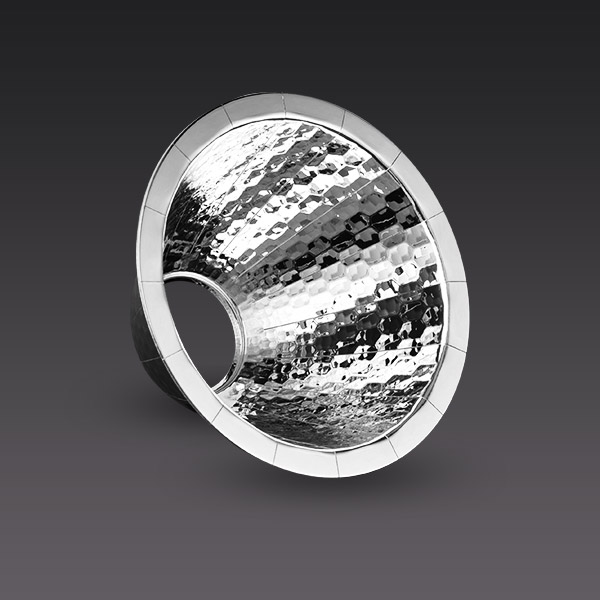

#5 Reflectors

Domain Est. 2006

Website: kaidomain.com

Key Highlights: 12mm (D) x 13mm (H) SMO Aluminum Reflector for XPE.. – suitable for XPE / XPG LEDProduct Specifications:Material:Aluminum Textured / SMO ReflectorDimensi….

#6 Aluminum Reflector

Domain Est. 2011

Website: eledlights.com

Key Highlights: In stock Free 30-day returnsTechnical drawing of an Aluminum Reflector showing dimensions in millimeters and inches for height and diameter. Technical drawing of an Aluminum Reflec…

#7 Aluminum Reflector for BPHE2 Series Round High Bay

Domain Est. 2018

Website: commercialledlights.com

Key Highlights: In stock $27.60 deliveryAluminum Reflector for BPHE2 Series Round High Bay – 16″ OD x 11.7″ ID x 7.5″ H – White Finish | MaxLite BPHE2-ALREF. $27.99. Availability: In stock….

Expert Sourcing Insights for Aluminum Reflector

H2: Projected Market Trends for Aluminum Reflectors in 2026

The global aluminum reflector market is poised for significant transformation by 2026, driven by advancements in materials technology, rising energy efficiency demands, and shifting industry applications. Several key trends are expected to shape the market landscape in the coming years.

-

Increased Demand in LED and Solid-State Lighting

By 2026, aluminum reflectors will continue to play a critical role in LED lighting systems due to their superior thermal conductivity and reflectivity. As governments worldwide phase out incandescent and fluorescent lighting in favor of energy-efficient alternatives, demand for high-performance aluminum reflectors in residential, commercial, and industrial LED fixtures is projected to grow at a CAGR of approximately 6–8%. Innovations in surface treatments—such as enhanced anodizing and PVD coatings—will boost reflectivity beyond 90%, further solidifying aluminum’s dominance over plastic or glass alternatives. -

Expansion in Renewable Energy and Solar Applications

The solar thermal and concentrated photovoltaic (CPV) sectors are expected to drive new demand for aluminum reflectors. With global investments in renewable energy accelerating, aluminum’s lightweight, corrosion-resistant, and highly reflective properties make it ideal for solar reflector panels. Emerging markets in Asia-Pacific and the Middle East will lead installations, supported by government incentives and falling solar technology costs. -

Automotive and EV Lighting Integration

The automotive sector, particularly electric vehicles (EVs), will increasingly adopt aluminum reflectors in advanced headlight and interior lighting systems. As vehicle design emphasizes aerodynamics and energy efficiency, aluminum reflectors offer thermal management benefits crucial for high-output LED and adaptive driving beam (ADB) systems. By 2026, the integration of smart lighting systems is expected to increase reflector complexity and customization, favoring precision-engineered aluminum components. -

Sustainability and Recycling Initiatives

Environmental regulations and corporate sustainability goals will push manufacturers toward using recycled aluminum. Aluminum reflectors are inherently recyclable, and by 2026, industry leaders are expected to shift toward closed-loop recycling systems to reduce carbon footprints. This trend will be bolstered by consumer and regulatory pressure for greener supply chains, especially in Europe and North America. -

Regional Market Shifts and Manufacturing Consolidation

Asia-Pacific will remain the largest producer and consumer of aluminum reflectors, led by China, India, and South Korea. However, nearshoring and supply chain resilience concerns may spur growth in regional manufacturing hubs in Eastern Europe and Mexico. Additionally, consolidation among reflector manufacturers is anticipated as companies seek economies of scale and expanded R&D capabilities to meet evolving technical standards. -

Technological Innovations and Customization

Advancements in 3D printing and automated fabrication will enable more complex, application-specific reflector designs. By 2026, digital twin modeling and AI-driven optical simulations will facilitate rapid prototyping and performance optimization, allowing manufacturers to deliver tailored solutions for niche markets such as horticultural lighting, medical devices, and aerospace.

In conclusion, the aluminum reflector market in 2026 will be characterized by technological innovation, sustainability imperatives, and diversified applications across energy, automotive, and lighting industries. Companies that invest in material science, digital manufacturing, and circular economy models are likely to gain a competitive edge in this dynamic market environment.

Common Pitfalls When Sourcing Aluminum Reflectors (Quality & IP)

Sourcing aluminum reflectors—commonly used in lighting, solar energy, and optical systems—can be fraught with challenges, especially concerning product quality and intellectual property (IP) protection. Avoiding these pitfalls is critical to ensuring performance, compliance, and long-term business integrity.

Poor Material Quality and Finish

One of the most frequent issues is receiving aluminum reflectors made from substandard alloys or with inadequate surface treatments. Low-grade aluminum (e.g., non-6061 or 6063 alloys) may lack the necessary reflectivity, durability, or thermal resistance. Additionally, poorly executed anodizing, polishing, or coating processes result in low reflectance, corrosion, or premature degradation under UV exposure or harsh environments.

Impact: Reduced optical efficiency, shorter product lifespan, and potential safety hazards in high-temperature applications.

Best Practice: Specify alloy type, surface finish (e.g., specular vs. diffuse), reflectance values (measured in %), and required certifications (e.g., ISO, ASTM). Conduct batch testing and request material certifications from suppliers.

Inconsistent Dimensional Accuracy and Tolerances

Aluminum reflectors often require tight tolerances to ensure proper fit and alignment in optical assemblies. Suppliers, particularly low-cost manufacturers, may deliver parts with inconsistent wall thicknesses, warping, or deviations in curvature, impacting light distribution and system performance.

Impact: Misalignment in fixtures, hotspots or shadows in lighting patterns, increased assembly time, and field failures.

Best Practice: Provide detailed technical drawings with clear geometric dimensioning and tolerancing (GD&T). Require first-article inspections (FAI) and statistical process control (SPC) data from the manufacturer.

Lack of Intellectual Property Protection

When designing custom reflector geometries or proprietary optical profiles, companies risk IP theft if suppliers are not bound by strong legal agreements. Unauthorized replication, reverse engineering, or resale of designs to competitors is a serious concern, especially when sourcing from regions with weaker IP enforcement.

Impact: Loss of competitive advantage, revenue erosion, and potential legal disputes.

Best Practice: Execute comprehensive non-disclosure agreements (NDAs) and intellectual property assignment clauses before sharing design files. Limit access to sensitive CAD data and work with trusted suppliers in jurisdictions with enforceable IP laws. Consider patenting unique reflector designs where applicable.

Inadequate Testing and Certification Documentation

Some suppliers may claim high reflectivity or IP ratings (e.g., IP65, IP67) without proper third-party validation. False or undocumented claims about environmental protection (dust/water resistance) or optical performance can lead to compliance failures and product recalls.

Impact: Non-compliance with industry standards (e.g., IEC, UL), warranty claims, and reputational damage.

Best Practice: Require test reports from accredited labs for optical performance, salt spray resistance, and ingress protection. Verify that the reflector’s IP rating applies to the full assembly, not just the component in isolation.

Supply Chain and Scalability Risks

Over-reliance on a single supplier or region, especially without alternative sourcing options, exposes businesses to disruptions. Additionally, suppliers may promise scalability but lack the tooling or quality control to maintain consistency during volume ramp-up.

Impact: Production delays, inconsistent quality across batches, and inability to meet market demand.

Best Practice: Diversify the supplier base and conduct factory audits. Ensure tooling ownership and verify scalability through pilot production runs before full-scale rollout.

By proactively addressing these quality and IP-related pitfalls, businesses can secure reliable, high-performance aluminum reflectors while protecting their innovations and market position.

H2: Logistics & Compliance Guide for Aluminum Reflector

This guide outlines the essential logistics and compliance considerations for the safe, efficient, and legal transportation, storage, and handling of aluminum reflectors. Adherence ensures product integrity, regulatory compliance, and supply chain reliability.

H2: Packaging & Marking

- Protective Packaging: Securely pack reflectors using materials preventing scratches, dents, and deformation. Use edge protectors, corner boards, and void fill (e.g., bubble wrap, foam) within sturdy cardboard boxes or wooden crates. For bulk shipments, ensure interlayer protection (kraft paper, foam sheets).

- Prevent Corrosion: Include desiccants in sealed packaging if shipped to humid environments or for long durations to mitigate potential surface oxidation.

- Secure Stacking: Design packaging for stable stacking. Clearly mark the maximum stack height on the exterior.

- Mandatory Markings: Clearly label each package with:

- Product Name & Part Number

- Net and Gross Weight

- Dimensions (L x W x H)

- “Fragile” and “This Side Up” indicators

- Batch/Lot Number (for traceability)

- Manufacturer/Sender & Consignee Details

- Handling Symbols (e.g., forklift, no hooks)

H2: Transportation & Handling

- Mode Selection: Choose transport (road, sea, air, rail) based on urgency, cost, volume, and destination. Road freight is common for regional distribution; sea freight for international bulk; air for urgent, low-volume shipments.

- Load Securing: Use straps, load bars, dunnage, or pallet collars to prevent movement during transit. Palletize efficiently (e.g., block-stacked) and secure loads to the vehicle floor.

- Forklift Handling: Ensure clear forklift entry points. Use appropriate fork size and capacity. Handle pallets carefully to avoid edge damage.

- Environmental Protection: Protect from rain, snow, and direct sunlight during loading/unloading and transit. Use waterproof tarpaulins or enclosed trailers. Avoid condensation in containers (use container desiccants if needed).

- Temperature: While aluminum is robust, avoid extreme temperature exposure that could affect coatings or packaging adhesives.

H2: Storage Requirements

- Indoor Storage: Store in a clean, dry, well-ventilated warehouse. Protect from direct weather, flooding, and excessive humidity.

- Pallet Stacking: Stack pallets within the maximum height limit indicated on packaging. Avoid mixing different models or batches unless clearly segregated.

- Ventilation: Ensure adequate airflow around pallets to prevent moisture buildup, especially critical for coated reflectors.

- Separation: Keep reflectors away from corrosive chemicals, solvents, or materials generating dust or fumes.

- Inventory Management: Implement FIFO (First-In, First-Out) or FEFO (First-Expired, First-Out) inventory rotation to minimize aging and ensure quality.

H2: Regulatory Compliance

- International Trade:

- HS Code: Use the correct Harmonized System code (e.g., 7616.99 – Other articles of aluminum, or specific codes based on exact form/finish). Verify with local customs authorities.

- Export Controls: Confirm no export licenses are required (generally unlikely for standard aluminum reflectors, but verify based on destination and end-use).

- Customs Documentation: Prepare accurate commercial invoices, packing lists, and certificates of origin as required by importing country.

- Safety & Handling:

- MSDS/SDS: Provide a Safety Data Sheet (SDS) detailing material composition, handling precautions (e.g., sharp edges), and disposal information. Aluminum metal itself is low hazard, but coatings or machining residues may require specific handling.

- DOT/ADR/IMDG: For road (DOT/ADR) or sea (IMDG) transport, classify the goods correctly. Aluminum reflectors are typically non-hazardous (UN3089, Environmentally Hazardous Substance, if applicable due to oils/lubricants from manufacturing, otherwise often “Not Restricted”). Label and document accordingly.

- Environmental & Recycling:

- WEEE (EU): If the reflector is part of an electrical/electronic equipment (EEE), the final product may fall under WEEE. Ensure traceability and compliance obligations are understood by the manufacturer of the final product.

- Recycling: Promote aluminum’s high recyclability. Provide guidance on end-of-life separation and recycling streams for customers.

- Product Standards: Ensure reflectors comply with relevant industry standards for dimensions, reflectivity, and material quality (e.g., ASTM B209 for aluminum sheet, or specific industry standards like those for lighting or automotive).

H2: Documentation & Traceability

- Maintain Records: Keep detailed records of production batches, material certifications (mill test reports for aluminum alloy), packaging specifications, shipping documents (BOL), and customs paperwork for the required retention period.

- Traceability: Implement a system (e.g., batch/lot numbering) to track reflectors from raw material to final shipment, enabling effective recall management if necessary.

Adhering to this guide ensures the reliable delivery of high-quality aluminum reflectors while meeting all logistical and regulatory obligations. Always consult specific regional regulations and customer requirements for detailed compliance.

Conclusion for Sourcing Aluminum Reflector

After a thorough evaluation of suppliers, material quality, cost, lead times, and performance specifications, sourcing aluminum reflectors from qualified and reliable manufacturers is a strategic decision that balances efficiency, durability, and cost-effectiveness. Aluminum reflectors offer excellent reflectivity, lightweight properties, and corrosion resistance, making them ideal for lighting, solar, and optical applications.

By partnering with suppliers who adhere to international quality standards (such as ISO certifications) and who demonstrate strong manufacturing capabilities, we ensure consistent product performance and scalability. Additionally, considering factors such as surface finish (e.g., anodized or polished), geometric precision, and customization options further enhances application-specific effectiveness.

In conclusion, the recommended sourcing approach emphasizes long-term supplier relationships, continuous quality validation, and periodic market assessment to maintain competitiveness and technical excellence. This strategy supports sustainable operations, meets project demands, and ensures optimal performance of aluminum reflectors across intended applications.