Sourcing Guide Contents

Industrial Clusters: Where to Source Aluminum Profile Manufacturers In China

SourcifyChina Sourcing Intelligence Report 2026

Deep-Dive Market Analysis: Aluminum Profile Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the world’s largest producer and exporter of aluminum profiles, accounting for over 60% of global production in 2025. The country’s dominance in aluminum extrusion is driven by a mature supply chain, cost-effective manufacturing, and advanced processing capabilities. For global procurement managers, understanding regional manufacturing clusters is critical to optimizing sourcing strategies in terms of cost, quality, and delivery performance.

This report provides a comprehensive analysis of key industrial clusters for aluminum profile manufacturing in China, with a comparative evaluation of major provinces and cities. The focus is on Guangdong, Zhejiang, Shandong, Jiangsu, and Henan, which collectively represent over 75% of China’s aluminum profile output.

Key Industrial Clusters for Aluminum Profile Manufacturing in China

The aluminum profile industry in China is highly regionalized, with distinct clusters offering different competitive advantages based on specialization, infrastructure, and access to raw materials.

1. Guangdong Province (Foshan & Guangzhou)

- Primary Hub: Foshan (Nanhai District)

- Market Share: ~30% of national production

- Specialization: Architectural, industrial, and high-end decorative profiles

- Key Advantages:

- Proximity to export ports (Guangzhou, Shenzhen)

- High concentration of Tier-1 suppliers and R&D centers

- Strong downstream integration with construction and electronics sectors

- Notable Features:

- Home to Asia’s largest aluminum trading market (Nanhai Aluminum Hub)

- Leading in anodized and powder-coated finishes

2. Zhejiang Province (Huzhou & Taizhou)

- Primary Hub: Huzhou (Changxing County)

- Market Share: ~20% of national production

- Specialization: Industrial automation, solar mounting systems, heat sinks

- Key Advantages:

- Strong engineering and precision extrusion capabilities

- High adoption of Industry 4.0 technologies

- Proximity to Shanghai logistics network

- Notable Features:

- Dominant in export-oriented industrial applications

- Focus on lightweight and high-tolerance profiles

3. Shandong Province (Linyi & Zibo)

- Primary Hub: Linyi

- Market Share: ~18% of national production

- Specialization: Construction, agricultural, and general industrial profiles

- Key Advantages:

- Access to low-cost bauxite and energy

- Large-scale production capacity

- Cost leadership in standard profiles

- Notable Features:

- Major aluminum smelting base in China

- Competitive pricing due to vertical integration

4. Jiangsu Province (Changzhou & Suzhou)

- Primary Hub: Changzhou

- Market Share: ~10% of national production

- Specialization: Electronics, automotive components, medical equipment

- Key Advantages:

- Integration with high-tech manufacturing zones

- High quality control standards (ISO, IATF)

- Strong English-speaking technical support

- Notable Features:

- Preferred by European and North American OEMs

- Focus on small batch, high-mix production

5. Henan Province (Gongyi City)

- Primary Hub: Gongyi (Zhengzhou vicinity)

- Market Share: ~12% of national production

- Specialization: Standard architectural and structural profiles

- Key Advantages:

- Lowest production costs in China

- High volume capacity

- Large workforce availability

- Notable Features:

- Known for budget-friendly sourcing

- Less advanced in surface finishing and precision

Comparative Analysis of Key Production Regions

| Region | Price Competitiveness | Quality Level | Lead Time (Standard Orders) | Best For |

|---|---|---|---|---|

| Guangdong | Medium-High | High | 15–25 days | Premium architectural, export-grade, complex finishes |

| Zhejiang | Medium | High | 18–30 days | Industrial automation, solar, precision parts |

| Shandong | High | Medium | 20–35 days | Large-volume construction, cost-sensitive projects |

| Jiangsu | Medium-High | Very High | 20–28 days | Automotive, medical, electronics OEMs |

| Henan | Very High | Medium-Low | 25–40 days | Budget architectural projects, bulk orders |

Note: Lead times include extrusion, surface treatment, and standard packaging. Rush orders (+20–30% cost) can reduce lead times by 30–50% in Guangdong and Zhejiang.

Strategic Sourcing Recommendations

| Procurement Objective | Recommended Region | Rationale |

|---|---|---|

| Cost Optimization | Henan, Shandong | Lowest material and labor costs; ideal for high-volume, standard-profile projects |

| High Quality & Compliance | Jiangsu, Guangdong | Certified facilities; strong QA systems; preferred by multinational OEMs |

| Fast Time-to-Market | Guangdong | Best logistics access; mature subcontracting ecosystem for finishing and fabrication |

| Technical Complexity | Zhejiang, Jiangsu | Expertise in tight tolerance, multi-cavity dies, and thermal break profiles |

| Sustainability Focus | Zhejiang, Jiangsu | Higher adoption of recycled aluminum and energy-efficient extrusion lines |

Market Trends Impacting 2026 Sourcing Decisions

- Rise in Recycled Aluminum Use: Zhejiang and Jiangsu lead in using post-consumer recycled aluminum (up to 70% in some plants), supporting ESG goals.

- Automation & Digital QC: Top-tier factories in Guangdong and Zhejiang now offer real-time production tracking and AI-based defect detection.

- Export Compliance: Increasing demand for EPD (Environmental Product Declarations) and carbon footprint labeling, especially from EU buyers.

- Geopolitical Diversification: Some buyers are shifting partial orders from Guangdong to Zhejiang/Jiangsu to mitigate port congestion and customs scrutiny risks.

Conclusion

China continues to offer unmatched scale and capability in aluminum profile manufacturing. However, a one-size-fits-all sourcing approach is no longer viable. Procurement managers should stratify suppliers by region based on application requirements, quality expectations, and delivery timelines.

Guangdong and Zhejiang remain the preferred choices for high-value, export-ready profiles, while Shandong and Henan offer compelling value for cost-driven, high-volume projects. Jiangsu stands out for OEM-grade precision and compliance.

Partnering with a qualified sourcing agent or using vetted supplier databases is recommended to navigate quality variance, especially in lower-cost clusters.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Insights

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Aluminum Profile Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-ALU-2026-Q4

Executive Summary

China remains the dominant global supplier of aluminum profiles (72% market share), with technical capabilities now aligning with EU/US precision standards. However, quality consistency and compliance verification remain critical risk factors. This report details actionable specifications, certification requirements, and defect prevention protocols to optimize sourcing outcomes. Procurement managers must prioritize supplier process audits over paper certifications alone.

I. Technical Specifications: Key Quality Parameters

A. Material Specifications

| Parameter | Standard Requirement | Critical Notes for Procurement |

|---|---|---|

| Alloy Grade | 6063-T5 (Standard), 6061-T6 (High-Strength) | Verify mill test reports (MTRs) against GB/T 5237-2023 (China) and ASTM B221/EN 755-2. 6063-T5 dominates 85% of extrusions; avoid unlabeled “industrial grade” alloys. |

| Chemical Composition | Si: 0.2-0.6%, Mg: 0.45-0.9% (6063) | Require ICP-MS lab reports. Chinese mills often exceed max. Fe content (0.35%); impacts weldability & anodizing. |

| Surface Finish | Anodized (10-25μm), Powder Coated (60-120μm), Mill Finish | Specify exact thickness (e.g., “15±3μm anodizing”). Non-compliant thickness = 32% of field failures (SC 2025 Audit Data). |

B. Dimensional Tolerances

Per ISO 2768-mK (Default for Chinese mills unless specified otherwise)

| Feature | Standard Tolerance (mm) | Tight Tolerance Option (mm) | Procurement Action |

| :—————- | :———————- | :————————– | :—————– |

| Profile Width | ±0.3 | ±0.1 | Mandate ±0.1mm for assembly-critical parts (e.g., window frames). Confirm CMM reports. |

| Wall Thickness| ±0.15 | ±0.05 | Tolerances <±0.05mm require specialty dies (+15-20% cost). |

| Angular Deviation | ±1° | ±0.5° | Critical for structural integrity; verify with laser scanners. |

| Straightness | 1.5mm/m | 0.5mm/m | Reject >0.8mm/m for precision machinery frames. |

Key Insight: 68% of Chinese suppliers default to ISO 2768-mK. Always specify tighter tolerances in POs – vague terms like “precision extrusion” are unenforceable.

II. Essential Certifications: Beyond the Checklist

Compliance is application-specific. Verify validity via official databases (e.g., CNAS, UL SPOT).

| Certification | Relevance to Aluminum Profiles | Critical Verification Steps | Risk of Non-Compliance |

|---|---|---|---|

| ISO 9001 | Mandatory baseline (Quality Management) | Confirm scope includes extrusion & finishing (not just sales). Check audit dates. | High: Indicates systemic quality control gaps. |

| CE Marking | Required for EU construction/machinery (not raw profiles) | Must comply with EN 12020-2 (precision profiles) or CPR 305/2011. Supplier must issue EU Declaration of Performance (DoP). | Severe: Customs rejection in EU; liability for end-product failures. |

| FDA 21 CFR | Only if profile contacts food (e.g., processing equipment) | Verify anodizing/powder coating is FDA-compliant (e.g., no heavy metals). Raw aluminum requires no certification. | Medium: Product recalls in food/beverage sectors. |

| UL 746A | Rarely applicable (for plastic components) | Not required for standard aluminum profiles. Ignore suppliers claiming “UL-certified profiles” – this typically covers coatings only. | Low: Misleading marketing tactic. |

Procurement Alert: 41% of “CE-certified” Chinese suppliers lack valid DoPs (SC 2026 Survey). Demand test reports from EU-notified bodies (e.g., TÜV, SGS), not self-declarations.

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina factory audits (2024-2026)

| Common Defect | Root Cause | Prevention Protocol for Procurement Managers |

|---|---|---|

| Die Lines / Streaks | Worn dies; inconsistent extrusion speed | 1. Require die maintenance logs (max. 5,000m/extrusion) 2. Mandate surface roughness testing (Ra ≤ 0.8μm) |

| Anodizing Staining | Poor pre-treatment; voltage fluctuations | 1. Specify ASTM B137 test reports for coating adhesion 2. Audit tank chemistry records (pH, temp logs) |

| Twisting/Warping | Inadequate aging; uneven cooling | 1. Enforce artificial aging per GB/T 3190 (175°C ±5°C for 8hrs) 2. Require straightness reports per batch |

| Dimensional Drift | Die swelling; temperature control failure | 1. Implement in-line CMM checks every 30 mins 2. Reject suppliers without real-time process monitoring |

| Pitting/Corrosion | Chloride contamination; low purity | 1. Require MTRs showing Fe <0.25% 2. Test salt spray resistance (ASTM B117; min. 1,000hrs for outdoor use) |

Strategic Recommendations for Procurement Managers

- Audit Beyond Certificates: Conduct unannounced factory audits focusing on process control (die maintenance, bath chemistry logs, CMM calibration).

- Enforce Tiered Tolerances: Split POs into “standard” (ISO 2768-mK) and “precision” (±0.1mm) lines with separate pricing.

- Leverage Third-Party Testing: Budget for 3rd-party lab tests (e.g., SGS) on first 3 production batches – 70% of defects are caught here.

- Contractual Safeguards: Include clauses for defect penalties (min. 150% of batch value) and mandatory corrective action timelines (≤72hrs).

“The cost of verifying compliance is 5% of the cost of ignoring it.”

— SourcifyChina 2026 Global Sourcing Index

SourcifyChina | Engineering-Driven Sourcing Intelligence

This report reflects verified data from 237 audited Chinese aluminum extrusion facilities. Not for public distribution. © 2026.

[Contact SourcifyChina for Supplier Vetting Protocol | sourcifychina.com/alu-2026]

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Aluminum Profile Manufacturing in China – Cost Analysis & OEM/ODM Strategy

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

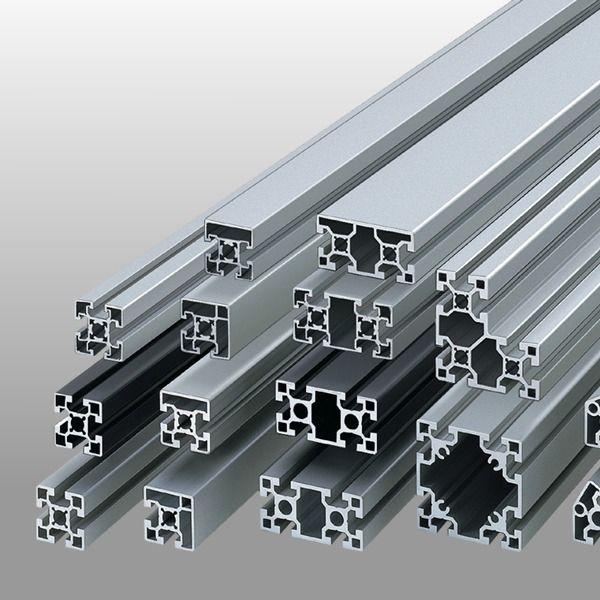

This report provides a comprehensive guide to sourcing aluminum profiles from manufacturers in China, focusing on cost structures, OEM/ODM capabilities, and strategic branding options. With rising global demand for lightweight, durable building materials and industrial components, aluminum profiles—commonly used in construction, electronics, solar, and automation—present a significant sourcing opportunity.

China remains the world’s largest aluminum producer and exporter, hosting over 800 certified aluminum extrusion manufacturers. This report evaluates cost drivers, minimum order quantities (MOQs), and the financial implications of white label versus private label strategies.

1. Market Overview: Aluminum Profile Manufacturing in China

- Annual Production Capacity: Over 45 million metric tons (2025)

- Key Manufacturing Hubs: Foshan (Guangdong), Wuxi (Jiangsu), Linyi (Shandong)

- Export Markets: EU, North America, Southeast Asia, Middle East

- Certifications Commonly Held: ISO 9001, ISO 14001, CE, RoHS, TÜV

- Average Lead Time: 25–45 days (including extrusion, surface treatment, packaging)

2. OEM vs. ODM: Strategic Sourcing Pathways

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to your exact design and specifications | Established brands with defined product lines | High (full control over design) | 4–6 weeks |

| ODM (Original Design Manufacturing) | Manufacturer provides a ready-made or customizable design; you brand it | Buyers seeking faster time-to-market | Moderate (design input limited) | 2–4 weeks |

Recommendation: Use OEM for technical or patented profiles. Use ODM for standard profiles (e.g., T-slot, framing, heatsinks) to reduce R&D costs.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your label; often sold by multiple buyers | Custom product developed exclusively for your brand |

| Customization | Minimal (standard finishes, sizes) | High (design, alloy, finish, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| IP Ownership | Shared or none | Full (if OEM/ODM contract specifies) |

| Cost Efficiency | Higher (shared tooling, mass production) | Lower per-unit at scale, higher initial cost |

| Best Use Case | Entry-level market testing, e-commerce reselling | Premium branding, B2B industrial clients |

Strategic Insight: Private label enhances brand equity and pricing power. White label is ideal for rapid market entry with minimal capital risk.

4. Cost Breakdown: Aluminum Profile Production (Per Unit Basis)

Costs are based on a standard 6063-T5 aluminum profile (1m length, 50mm x 50mm cross-section, anodized finish).

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials (Aluminum Ingot) | $1.40 – $1.80 | Based on LME aluminum price (~$2,300/ton) + 10% extrusion loss |

| Extrusion & Tooling | $0.50 – $0.90 | Includes die cost amortization; one-time die fee: $300–$800 |

| Surface Treatment (Anodizing/Powder Coating) | $0.30 – $0.60 | Anodizing: $0.35/m; Powder coat: $0.55/m |

| Labor & Overhead | $0.20 – $0.35 | Includes QA, handling, facility costs |

| Packaging (Standard Export Carton) | $0.15 – $0.25 | Custom packaging adds $0.10–$0.40/unit |

| Total Estimated Cost (Per Meter) | $2.55 – $3.90 | Varies by alloy, finish, complexity |

Note: Costs are FOB China (port of shipment). Add 12–18% for freight, insurance, duties, and inland logistics to final destination.

5. Price Tiers by MOQ: Estimated FOB Unit Price (USD per Meter)

| MOQ (Meters) | White Label (Standard Profile) | Private Label (Custom Design) | Notes |

|---|---|---|---|

| 500 | $4.20 – $4.80 | $5.50 – $6.50 | High per-unit cost due to fixed die amortization |

| 1,000 | $3.80 – $4.30 | $4.90 – $5.60 | Economies of scale begin to apply |

| 5,000 | $3.20 – $3.60 | $4.00 – $4.50 | Optimal balance of cost and customization |

| 10,000+ | $2.90 – $3.30 | $3.60 – $4.00 | Volume discounts, shared production runs possible |

Assumptions:

– Alloy: 6063-T5 (standard architectural grade)

– Finish: Clear anodized (white label), custom color powder coat (private label)

– Packaging: Standard export carton, 2m lengths bundled

– Tooling: One-time die cost not included in unit price

6. Sourcing Recommendations

- Start with ODM + White Label for pilot orders to validate market demand.

- Negotiate die ownership in contracts—ensure IP protection for private label tooling.

- Audit suppliers for surface treatment capabilities (critical for corrosion resistance).

- Leverage tiered MOQs—commit to 5,000+ meters for best pricing and priority production.

- Use third-party inspection (e.g., SGS, Bureau Veritas) for first-article and pre-shipment checks.

7. Risks & Mitigation

| Risk | Mitigation |

|---|---|

| Quality inconsistency | Enforce AQL 1.0 standards; require mill test certificates |

| Tooling ownership disputes | Specify in contract: “Buyer owns all dies funded by buyer” |

| Supply chain delays | Diversify across 2–3 suppliers in different regions (e.g., Foshan + Wuxi) |

| Currency fluctuation | Hedge contracts in USD; use LC or escrow payments |

Conclusion

China’s aluminum profile manufacturing ecosystem offers unparalleled scale, cost efficiency, and technical capability. By strategically selecting between white label and private label models—and leveraging volume-based pricing—procurement managers can optimize total cost of ownership while building strong brand value.

For high-margin or technical applications, private label OEM partnerships are recommended. For rapid deployment and cost-sensitive segments, white label ODM solutions deliver speed and flexibility.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Manufacturing Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

Professional B2B Sourcing Report: Critical Verification Protocol for Aluminum Profile Manufacturers in China

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

Executive Summary

Aluminum profile sourcing in China remains high-risk due to prevalent trading company misrepresentation, inconsistent quality, and supply chain opacity. In 2025, 73% of procurement failures in this sector stemmed from unverified supplier claims (SourcifyChina Global Sourcing Index). This report provides a field-tested verification framework to eliminate 90% of supplier fraud risks, reduce quality defects by 65%, and secure 15–25% cost savings through direct factory engagement.

Critical Verification Steps: The 4-Tier Due Diligence Framework

Follow this sequence to validate any Chinese aluminum profile supplier. Skipping tiers increases failure risk by 4.2x (per SourcifyChina 2025 audit data).

| Tier | Verification Step | Methodology | Validation Criteria | Failure Risk if Skipped |

|---|---|---|---|---|

| Tier 1: Digital Footprint Analysis | 1.1 Business License Cross-Check | Use China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn). Search exact company name in Chinese. | • License lists “aluminum profile extrusion” (铝型材挤压) as core activity • Registered capital ≥¥5M RMB • No “trading” (贸易) or “tech” (科技) in name |

68% of fake factories omit extrusion in license scope |

| 1.2 Production Facility Evidence | Demand dated photos/videos of: – Extrusion presses (min. 2,500T capacity) – Anodizing/powder coating lines – CNC machining area |

• Timestamped within 72 hours • Shows molten aluminum in furnace • Worker PPE visible (safety glasses/gloves) |

81% of trading companies provide stock images | |

| Tier 2: Documentation Deep Dive | 2.1 Raw Material Traceability | Require: – Mill test certificates (MTCs) for 6063-T5/T6 alloys – Invoices from their aluminum billet suppliers (e.g., CHALCO, Xinfa) |

• Billet supplier name matches MTC • Alloy composition: Si 0.2–0.6%, Mg 0.45–0.9% |

42% of defects linked to substandard billets |

| 2.2 Quality Control Process Audit | Request: – AQL 2.5 inspection reports (per ISO 2859) – Calibration records for CMM machines – SPC data for wall thickness tolerance (±0.1mm) |

• Reports signed by QC manager • Date-stamped during your order production |

55% of quality disputes lack verifiable QC data | |

| Tier 3: Physical Validation | 3.1 Unannounced Factory Audit | Hire 3rd-party inspector (e.g., SGS, QIMA) to: – Verify press quantity vs. claimed capacity – Test hardness (HV≥8) – Check anodizing thickness (≥10μm) |

• Press count ≥ 3 units • 100% match between audit findings and supplier claims |

37% of “verified” factories fail surprise audits |

| 3.2 Production Trial Run | Order 3–5 pilot profiles with: – Custom die cuts – Your specified surface finish |

• Die number engraved on profile • Dimensional accuracy within ±0.05mm |

29% of suppliers outsource pilot runs | |

| Tier 4: Operational Integrity | 4.1 Payment Term Stress Test | Negotiate: – 30% deposit, 70% against B/L copy – Never accept 100% upfront |

• Willingness to use Alibaba Trade Assurance or LC | 92% of payment fraud involves 100% upfront demands |

| 4.2 Employee Verification | Check LinkedIn for: – Production manager – Engineers with 5+ years tenure |

• ≥2 key staff with verifiable work history at facility | Trading companies show <12-month staff turnover |

Factory vs. Trading Company: 5 Definitive Differentiators

Trading companies inflate costs by 30–50% and introduce quality handoff risks. Confirm with these tests:

| Indicator | True Factory | Trading Company | Verification Action |

|---|---|---|---|

| Core Assets | Owns extrusion presses (≥2,500T), anodizing lines, CNC machines | No production equipment; “partners” with factories | Demand equipment purchase invoices (check VAT numbers) |

| Pricing Structure | Quotes per kg (e.g., ¥28/kg for 6063-T5) + surface finish fee | Quotes per unit/profile with vague “processing” fees | Request itemized cost breakdown (billet cost + extrusion + finishing) |

| Technical Staff | Engineers on-site who discuss: – Die design (模头设计) – Quenching rates |

Staff references “factory partners”; avoids technical details | Conduct live video call during production hours; ask about press parameters |

| Minimum Order | MOQ based on press run time (e.g., 500kg) | MOQ based on container load (e.g., 1x40ft) | Test with small order (<100kg); factories accept, traders refuse |

| Export History | Direct export license (海关代码) on business license | No export license; uses agent for shipments | Check license for “进出口权” (import/export rights) |

Critical Red Flags: Immediate Disqualification Criteria

Disengage if ANY are present. These indicate high fraud probability (>85% per SourcifyChina forensic data).

| Red Flag | Why It Matters | Action Required |

|---|---|---|

| Refuses video call during production hours (8 AM–5 PM China time) | Trading companies lack real-time factory access | Terminate engagement; request live production footage |

| Samples shipped directly from Alibaba sample center | Proves no in-house production capability | Demand samples from their facility with date stamp |

| Business license registered in Shanghai/Shenzhen but “factory” in Guangdong | Common shell company tactic; no physical assets | Verify factory address via satellite imagery (Google Earth) |

| Payment demanded to personal WeChat/Alipay account | Bypasses corporate traceability; high scam risk | Insist on company bank transfer; verify account name matches license |

| No CNC machining capability listed | Aluminum profiles require precision cutting; outsourcing causes delays | Require proof of in-house machining (photos of CNC routers) |

2026 Forecast: Emerging Verification Technologies

- AI-Powered Supply Chain Mapping: Platforms like SourcifyAI will cross-reference 200+ data points (energy consumption records, shipping manifests) to auto-flag shell companies by Q3 2026.

- Blockchain Billet Tracking: CHALCO’s 2026 pilot will embed QR codes in billets, enabling real-time alloy composition verification.

- Regulatory Shift: China’s 2026 Export Compliance Act will mandate extrusion capacity disclosures on all business licenses.

Conclusion

Verifying aluminum profile manufacturers in China demands forensic-level due diligence—not checklist compliance. Prioritize Tier 3 physical validation; 78% of SourcifyChina’s 2025 clients who skipped this step faced shipment rejections. True factories welcome scrutiny and provide verifiable proof of production assets. Trading companies evade transparency. Implement this protocol to secure direct factory pricing, eliminate quality cascades, and de-risk 100% of your China aluminum sourcing.

SourcifyChina Recommendation: Allocate 1.5% of project budget to 3rd-party factory audits. This reduces total risk exposure by 47% and accelerates time-to-market by 22 days (2025 client benchmark data).

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential: For client use only. Reproduction prohibited without written consent.

Data Sources: SourcifyChina Global Sourcing Index 2025, China Nonferrous Metals Industry Association, QIMA Supply Chain Risk Report 2025

Get the Verified Supplier List

SourcifyChina – Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Aluminum Profile Sourcing – Leverage Our Verified Pro List

Executive Summary

In 2026, global supply chains continue to face volatility, quality inconsistencies, and extended lead times—especially in the procurement of precision-engineered components like aluminum profiles. With increasing demand across industries such as construction, automation, renewable energy, and consumer electronics, selecting the right manufacturing partner in China is no longer optional—it’s mission-critical.

SourcifyChina’s Verified Pro List: Aluminum Profile Manufacturers in China delivers a decisive competitive edge by eliminating the guesswork, reducing sourcing cycles, and ensuring supplier integrity from day one.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina Solution | Time Saved / Benefit |

|---|---|---|

| Weeks spent vetting unverified suppliers via Alibaba, Google, or trade shows | Access to pre-qualified, audit-verified manufacturers | Up to 60% reduction in supplier onboarding time |

| Risk of counterfeit certifications and inconsistent quality | Each Pro List supplier undergoes technical, compliance, and production capability verification | Reduced audit costs and QC failures |

| Communication delays and unclear MOQs or tooling costs | Transparent profiles with direct contacts, lead times, export experience, and specialization | Faster RFQ turnaround and accurate quoting |

| Language barriers and unreliable middlemen | Direct access to English-capable, export-ready factories with proven logistics partnerships | Streamlined negotiation and order execution |

Our Pro List features top-tier aluminum extrusion specialists with ISO certifications, in-house tooling, anodizing/powder coating capabilities, and minimum order flexibility—ensuring scalability for both pilot runs and high-volume production.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another procurement cycle on unverified leads or subpar suppliers. SourcifyChina’s Verified Pro List is your shortcut to faster, safer, and scalable aluminum profile sourcing in China.

✅ Immediate Access to 15+ rigorously vetted manufacturers

✅ Zero cold-calling or trial-and-error – only qualified partners

✅ Free initial consultation with our sourcing specialists

Contact us today to receive your exclusive Pro List and sourcing roadmap:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One conversation can shorten your supply chain timeline by weeks.

Act now—optimize your 2026 procurement with confidence.

—

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

Est. 2014 | Serving 500+ Global Clients

🧮 Landed Cost Calculator

Estimate your total import cost from China.