The global aluminum boat market is experiencing steady growth, driven by increasing demand for durable, low-maintenance, and fuel-efficient vessels across recreational and commercial sectors. According to Grand View Research, the global aluminum boat market size was valued at USD 3.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. This growth is fueled by rising consumer preference for aluminum due to its corrosion resistance, lightweight properties, and long service life—attributes particularly advantageous in cuddy cabin designs that blend day-cruising comfort with open-water performance. As demand for versatile, all-welded aluminum cuddy cabin boats rises in North America and coastal regions worldwide, a handful of manufacturers have emerged as industry leaders, leveraging advanced fabrication techniques and innovative layouts to capture market share. The following list highlights the top 10 aluminum cuddy cabin boat manufacturers shaping this evolving segment.

Top 10 Aluminum Cuddy Cabin Boats Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Excel Boats

Domain Est. 1998

Website: excelboats.com

Key Highlights: Excel Boats is the nation’s premier aluminum boat manufacturer of an affordable and tough line of boats for outdoor enthusiasts….

#2 LUND Aluminum Fishing Boats for Anglers & Families

Domain Est. 1995

Website: lundboats.com

Key Highlights: Legendary premier aluminum and fiberglass fishing boats made for bass and crappie fishing, hunting and utility, and more. Shop sport fishing boats that ……

#3 Stingray Boats

Domain Est. 1997

Website: stingrayboats.com

Key Highlights: Using tools that were unavailable just a few years ago, Stingray boats are built with unequalled precision and efficiency….

#4 Weldcraft Marine

Domain Est. 1998 | Founded: 1968

Website: weldcraftmarine.com

Key Highlights: Weldcraft Marine has been the leader in building quality welded aluminum boats since 1968. Designed for Living. Welded for Life … CUDDY KING · OCEAN KING ……

#5 Silver Streak Boats

Domain Est. 2001

Website: silverstreakboats.com

Key Highlights: Based on the West Coast of British Columbia Canada – just a stone’s throw away from Seattle. We are proudly pioneers in the field of aluminum boat builders….

#6 KingFisher Welded Aluminum Boats

Domain Est. 2004

Website: kingfisherboats.com

Key Highlights: KingFisher Boats is the fastest growing brand of all welded heavy-gauge aluminum adventure boats. With 22 models for lake, river and ocean, we build tough boats ……

#7 Cutwater Boats

Domain Est. 2008

Website: cutwaterboats.com

Key Highlights: At Cutwater Boats we believe in building the definitive Do-It-All Cruiser. Our boats are designed by lifelong boaters with a passion for having fun on the ……

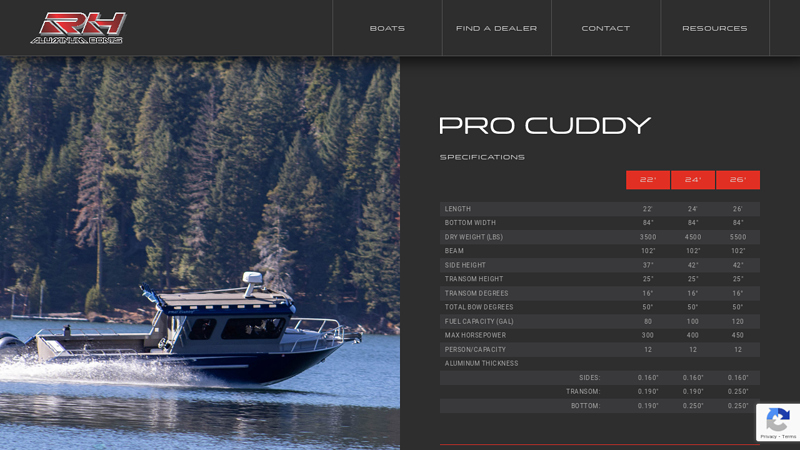

#8 Pro Cuddy

Domain Est. 2012

Website: rhboats.com

Key Highlights: Full hard-top cabin 78″ H x 96″ L · Alaskan Bulk Head with Framed Swing Door · Top Trays · Slider Side Windows with Screens (port and star) · 3″ Roof-Top Rails · 6 ……

#9 Crestliner

Domain Est. 1995

Website: crestliner.com

Key Highlights: Crestliner has an all-welded aluminum boat that will bring your adventures to life. Our advanced line of Deep-V boats are equally adept at multi-species big- ……

#10 Best Value Aluminum Boat by Starcraft Marine

Domain Est. 1998

Website: starcraftmarine.com

Key Highlights: We’re proud to be the largest name in aluminum fishing and pleasure boats, with five trusted brands you know and love—Smoker Craft, Starcraft, Sylvan, SunChaser ……

Expert Sourcing Insights for Aluminum Cuddy Cabin Boats

H2: Projected Market Trends for Aluminum Cuddy Cabin Boats in 2026

The market for aluminum cuddy cabin boats is poised for notable growth and transformation by 2026, driven by shifting consumer preferences, technological advancements, and broader economic and environmental trends. As a niche within the recreational marine industry, aluminum cuddy cabin boats—compact, durable vessels featuring a small enclosed cabin for shelter and storage—are gaining popularity due to their versatility, low maintenance, and cost-efficiency. Below are key trends expected to shape this segment in 2026:

-

Increased Demand for Lightweight and Durable Boats

Aluminum’s natural resistance to corrosion, combined with its lightweight properties, makes it an ideal material for coastal and inland waterway use. As consumers prioritize longevity and reduced maintenance, demand for aluminum-hulled cuddy cabins is expected to outpace that of fiberglass alternatives, particularly in regions with saltwater exposure or extreme weather conditions. -

Growth in Recreational and Coastal Fishing Markets

The resurgence of recreational boating and fishing post-pandemic continues to fuel demand. Anglers and weekend adventurers are increasingly drawn to cuddy cabin models for their ability to offer basic overnight accommodations and protection from the elements without the high cost of larger cruisers. This trend is strongest in North America and coastal regions of Europe and Oceania. -

Sustainability and Eco-Conscious Manufacturing

Environmental awareness is influencing boat manufacturing practices. Aluminum is highly recyclable, and many producers are emphasizing sustainable sourcing and energy-efficient production methods. By 2026, eco-certifications and green branding are expected to become competitive differentiators in marketing aluminum cuddy cabin boats. -

Technological Integration

Boat manufacturers are incorporating smart technologies into smaller vessels, including GPS navigation, fishfinders, remote diagnostics, and hybrid or electric propulsion systems. Aluminum cuddy cabins are becoming platforms for innovation, with modular designs allowing for easier tech upgrades. The integration of lithium-ion batteries and solar charging options is expected to expand in this segment. -

Expansion of Entry-Level and Mid-Range Models

To capture younger and first-time boat buyers, manufacturers are focusing on affordable, feature-rich models. These boats often include customizable layouts, improved ergonomics, and enhanced aesthetic finishes, blurring the line between utilitarian workboats and leisure craft. Financing options and rental-to-ownership programs are also emerging, increasing market accessibility. -

Geographic Market Shifts

While North America remains the largest market, growth in Asia-Pacific—particularly in countries like Australia, Japan, and South Korea—is accelerating. Rising disposable incomes, coastal urbanization, and government initiatives promoting marine tourism are contributing to increased adoption of small recreational vessels. -

Supply Chain and Material Cost Volatility

Though aluminum offers long-term savings, fluctuations in raw material prices and supply chain constraints (e.g., from geopolitical factors or energy costs) may impact production timelines and pricing. Manufacturers are responding by securing long-term supplier contracts and investing in domestic production to reduce dependency on global markets. -

Customization and Direct-to-Consumer Sales

Digital platforms are enabling greater customization and direct sales models, reducing reliance on traditional dealerships. Online configurators allow buyers to tailor their cuddy cabin boats with preferred features, colors, and performance upgrades, improving customer engagement and satisfaction.

In summary, the 2026 market for aluminum cuddy cabin boats will be defined by innovation, sustainability, and accessibility. As consumer demand evolves and technology advances, manufacturers who adapt to these trends will be well-positioned to capture a growing share of the recreational marine market.

Common Pitfalls When Sourcing Aluminum Cuddy Cabin Boats: Quality and Intellectual Property Concerns

Logistics & Compliance Guide for Aluminum Cuddy Cabin Boats

This guide provides essential information for the transportation, handling, and regulatory compliance associated with aluminum cuddy cabin boats. Whether you are a manufacturer, dealer, distributor, or private owner, understanding these elements ensures safe, efficient, and legal operations.

Transportation and Handling

Proper logistics begin with the safe movement of aluminum cuddy cabin boats from production or storage to the end user. Key considerations include:

- Trailer Compatibility: Use marine-rated trailers with appropriate weight capacity (GVWR), correct axle configuration, and bunk or roller systems designed for aluminum hulls to prevent scratches or structural damage.

- Securing the Load: Always secure the boat with multiple tie-down straps (minimum of four) attached to designated strong points on the hull and trailer frame. Use safety chains crossed under the trailer tongue.

- Towing Vehicle Requirements: Ensure the towing vehicle has adequate towing capacity, braking system (especially for heavier models), and proper hitch class. Observe local towing laws regarding mirrors, lights, and speed limits.

- Over-the-Road Compliance: Adhere to state and federal regulations regarding vehicle dimensions, weight restrictions, and permit requirements for oversized loads, if applicable.

Storage and Environmental Protection

Protecting aluminum cuddy cabin boats during storage is critical for maintaining structural integrity and appearance:

- Indoor vs. Outdoor Storage: Prefer covered or indoor storage to minimize exposure to UV rays, salt spray, and temperature extremes. If stored outdoors, use a breathable, marine-grade boat cover.

- Hull Protection: Place the boat on padded supports or a trailer to avoid point loading. Avoid prolonged ground contact to prevent moisture accumulation and corrosion.

- Corrosion Prevention: In saltwater environments, rinse the hull thoroughly after use. Apply anti-corrosion treatments and inspect for galvanic corrosion, especially around through-hull fittings and bonding systems.

Regulatory Compliance

Aluminum cudy cabin boats must meet various federal, state, and local regulations to operate legally:

- U.S. Coast Guard (USCG) Requirements: Ensure the boat complies with USCG standards for construction, flotation, capacity, and safety equipment. All boats manufactured or imported for sale in the U.S. must have a Compliance Notice and a Hull Identification Number (HIN).

- State Registration and Titling: Register the boat with the appropriate state agency. Display registration numbers visibly and carry required documentation onboard.

- Safety Equipment: Equip the boat with USCG-mandated safety gear, including life jackets (PFDs), fire extinguishers, visual distress signals, sound-producing devices, and navigation lights.

- Emissions and Environmental Standards: If powered by an outboard or inboard engine, ensure compliance with Environmental Protection Agency (EPA) and California Air Resources Board (CARB) emissions standards, where applicable.

International Shipping Considerations

For cross-border or overseas logistics, additional compliance steps are necessary:

- Customs Documentation: Prepare a commercial invoice, bill of lading, packing list, and certificate of origin. Include HIN and engine serial numbers.

- Harmonized System (HS) Code: Use the correct HS code for aluminum boats (e.g., 8903.91 or 8903.99, depending on specifications) to determine tariffs and import regulations.

- Marine Survey and Certification: Some countries require an independent marine survey or proof of compliance with international standards (e.g., CE marking in the EU).

- Packaging and Crating: For container or vessel transport, secure the boat in a custom crate with protective padding to prevent movement and environmental exposure.

Maintenance and Compliance Recordkeeping

Maintain detailed records to support compliance and resale value:

- Service Logs: Document all maintenance, repairs, and upgrades, particularly those affecting safety systems or structural components.

- Compliance Certificates: Retain copies of USCG compliance documents, registration, and any import/export permits.

- Inspection Reports: Keep records of annual or pre-purchase inspections to demonstrate due diligence and adherence to safety standards.

By following this guide, stakeholders in the aluminum cuddy cabin boat supply chain can ensure smooth logistics operations and full regulatory compliance, promoting safety, longevity, and legal operation of these versatile marine vessels.

In conclusion, sourcing aluminum cuddy cabin boats requires a strategic approach that balances quality, cost, durability, and supplier reliability. Aluminum cuddy cabin boats offer significant advantages, including lightweight construction, corrosion resistance, low maintenance, and long service life—making them ideal for commercial, rescue, and recreational applications. When sourcing, it is essential to evaluate suppliers based on craftsmanship, material standards (such as marine-grade 5083 or 5086 aluminum), customization capabilities, production capacity, and compliance with safety and regulatory standards.

Engaging with reputable manufacturers—whether domestic or international—should be supported by thorough due diligence, including site visits, review of certifications, and analysis of customer feedback. Additionally, considering total cost of ownership rather than initial price alone ensures long-term value. Establishing strong partnerships with suppliers who offer excellent after-sales support and warranty terms further enhances reliability.

Ultimately, successful sourcing of aluminum cuddy cabin boats hinges on aligning supplier capabilities with operational needs, ensuring performance, safety, and cost-efficiency across the vessel’s lifecycle.