The global aluminum caps market is experiencing robust growth, driven by rising demand across the beverage, pharmaceutical, and personal care industries. According to a report by Grand View Research, the global aluminum packaging market was valued at USD 61.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030, with aluminum closures representing a significant segment. Similarly, Mordor Intelligence projects the aluminum caps market to grow steadily, citing increased emphasis on sustainable, lightweight, and recyclable packaging solutions as key growth drivers. As brands shift toward eco-efficient packaging and premium product presentation, aluminum cap manufacturers are scaling innovation in design, material efficiency, and production capacity. In this competitive landscape, identifying the top performers becomes crucial for partners seeking reliability, compliance, and technological edge. The following list highlights the top 10 aluminum cap manufacturers shaping the industry’s future through scale, sustainability, and strategic global reach.

Top 10 Aluminum Cap Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Bericap

Domain Est. 1997

Website: bericap.com

Key Highlights: We are an experienced, trusted solution provider developing innovative, high-quality closures for food, beverage, and industrial applications….

#2 Aluminum screw caps for wine and spirits manufacturer

Domain Est. 1998

Website: inspiral.com

Key Highlights: An unparalleled screw cap collection. Manufactured in aluminum, with multiple design options and unique finishes reflecting the desired personality….

#3 Manufacturer of ROPP Caps & Aluminium Caps by Bottle Closures …

Domain Est. 2015

Website: bottle-closures.com

Key Highlights: We are counted as leading Manufacturer, Supplier, Exporter and Trader of Bottle Caps. Our products are in huge demand and widely acknowledged across the globe….

#4 Innovative anodized aluminum packaging for the world’s top brands

Domain Est. 1997

Website: anomatic.com

Key Highlights: Anomatic is a global supplier of high volume anodized aluminum packaging serving the beauty, personal care, auto, medical, electronics, and spirits ……

#5 Guala Closures

Domain Est. 1998 | Founded: 1954

Website: gualaclosures.com

Key Highlights: A world leader in the innovation and creation of screwcaps, T-bars, crown corks and custom bottle closures since 1954: discover the world of Guala Closures….

#6 Aluminum Ropp Caps

Domain Est. 1999

Website: sacmi.com

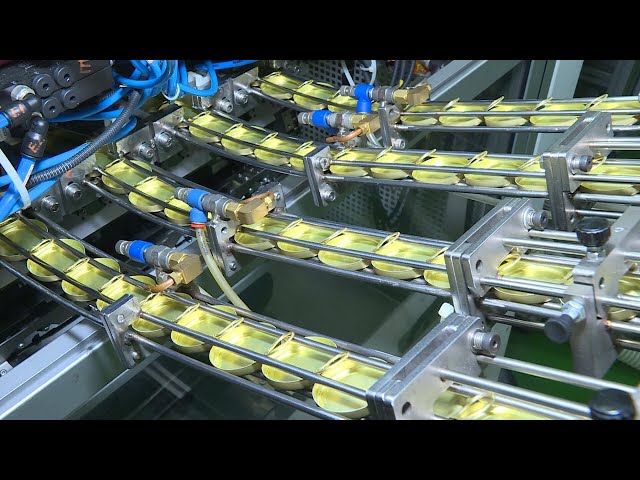

Key Highlights: Aluminum caps are used to close glass bottles filled with mineral and natural waters, non-alcoholic and alcoholic beverages, pharmaceutical and technical ……

#7 Metal closures, aluminum bottles and aerosol cans

Domain Est. 2001

Website: tecnocapclosures.com

Key Highlights: We are a proud member of: Tecnocap Group develops and manufactures highly functional, attractive and reliable Metal Closures, Aluminum Bottles and Aerosol Cans ……

#8 Aluminum Caps

Domain Est. 2006

Website: emapharma.com

Key Highlights: Our range of aluminum caps includes different designs. Each design of aluminium cap is available in different diameters and colors….

#9 Manufacture of aluminum caps

Domain Est. 2007

Website: eurobouchage.com

Key Highlights: Since 20 years, we are expert in manufacturing and design of aluminum crimp and screw caps/closures, especially for pharmaceutical industry/products : aluminum ……

#10 of CSI Closures

Domain Est. 2008

Website: csiclosures.com

Key Highlights: CSI has plastic and aluminum beverage closure solutions that satisfy consumers and bottlers alike. CSI’s one-piece and two-piece designs are suitable for a wide ……

Expert Sourcing Insights for Aluminum Cap

Market Trends Analysis for Aluminum Caps (2026 Outlook) – H2 2025 Update

As we progress through the second half of 2025, the global market for aluminum caps—used primarily in the packaging sectors of beverages, pharmaceuticals, cosmetics, and household chemicals—is exhibiting key trends that are shaping expectations for 2026. This analysis outlines the dominant drivers, challenges, innovations, and regional dynamics anticipated to influence the aluminum cap market in 2026.

1. Sustainability and Circular Economy Driving Demand

- Recyclability Advantage: Aluminum remains 100% recyclable without degradation, making aluminum caps increasingly favored over plastic and composite alternatives. Regulatory pressures in the EU, North America, and parts of Asia are pushing brands toward sustainable packaging.

- Extended Producer Responsibility (EPR): Governments are enforcing stricter EPR schemes, incentivizing the use of mono-material packaging like aluminum. Brands are revising cap designs to ensure compatibility with recycling streams.

- Closed-Loop Initiatives: Major beverage companies (e.g., Coca-Cola, AB InBev) are expanding partnerships with recyclers and cap manufacturers to close the loop on aluminum usage, boosting demand for recycled-content aluminum caps.

Outlook for 2026: Demand for recycled aluminum caps is expected to grow at a CAGR of 6.5% globally, with Europe leading adoption due to EU Packaging and Packaging Waste Regulation (PPWR).

2. Lightweighting and Material Efficiency

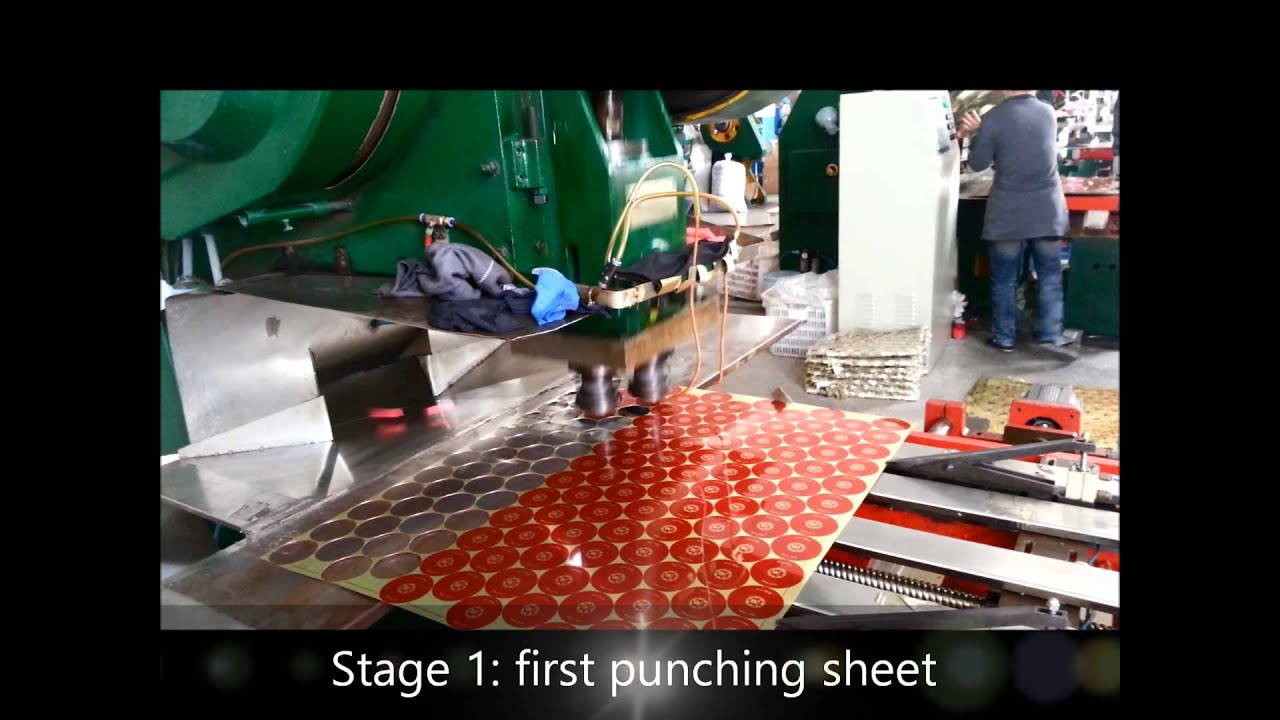

- Ultra-Thin Cap Designs: Innovations in aluminum alloying and forming technologies (e.g., 3-piece drawn & wall-ironed caps) are enabling thinner, lighter caps without compromising structural integrity.

- Cost and Carbon Benefits: Lighter caps reduce material use, transportation emissions, and overall costs—key metrics for ESG-conscious manufacturers.

2026 Projection: Average aluminum cap weight is expected to decrease by 8–10% from 2023 levels, primarily in beverage applications.

3. Growth in Non-Beverage Applications

- Pharmaceuticals & Cosmetics: Rising demand for tamper-evident, sterile, and premium-feel closures is driving aluminum cap adoption in vials, dropper bottles, and luxury skincare products.

- Personal Care Expansion: Brands in the beauty and wellness sector are switching to aluminum for sustainability credentials, especially in refillable and reusable packaging models.

Market Insight: The non-beverage segment is expected to grow at 7.2% CAGR through 2026, outpacing beverage cap demand in high-income markets.

4. Regional Market Dynamics

- Europe: Leading in sustainable packaging regulations. The PPWR and Single-Use Plastics Directive (SUPD) are accelerating the shift from plastic to aluminum closures.

- Asia-Pacific: Fastest growth region due to urbanization, rising middle class, and expansion of beverage and cosmetic markets—particularly in India, Southeast Asia, and China. Local production of aluminum caps is increasing to meet demand.

- North America: Steady growth driven by craft beverage industries (e.g., craft beer, premium seltzers) and brand sustainability commitments.

- Latin America & Africa: Emerging markets with increasing FDI in packaging infrastructure. Aluminum cap penetration remains low but is expected to grow as formal beverage and pharmaceutical sectors expand.

2026 Regional Share Forecast:

– Asia-Pacific: 38%

– Europe: 28%

– North America: 22%

– RoW: 12%

5. Supply Chain and Raw Material Considerations

- Aluminum Price Volatility: Prices remain influenced by energy costs (especially in Europe), geopolitical tensions, and bauxite supply chains. However, long-term contracts and recycling are helping stabilize input costs.

- Energy Transition Impact: Aluminum smelters are shifting to renewable energy (e.g., hydro-powered plants in Canada, Iceland), reducing carbon footprint and aligning with Scope 3 emissions goals of end-users.

- Recycled Aluminum Supply: Growth in collection rates and advanced sorting tech (e.g., AI-assisted MRFs) are increasing the availability of high-grade recycled aluminum (e.g., 5182 alloy), critical for cap manufacturing.

2026 Outlook: Over 50% of aluminum used in caps in developed markets is projected to come from recycled sources.

6. Technological and Design Innovation

- Smart Packaging Integration: Trials are underway to integrate NFC tags and QR codes into aluminum caps for brand authentication, consumer engagement, and anti-counterfeiting—especially in pharma and luxury goods.

- Improved Seal Technologies: Enhanced liner materials (e.g., biobased or recyclable polymers) are being developed to maintain compatibility with aluminum while improving sustainability.

- Digital Printing: On-cap printing enables mass customization and limited editions, appealing to DTC (direct-to-consumer) brands.

7. Challenges Ahead

- Cost Competition from Plastic: In price-sensitive markets, plastic closures remain cheaper, though regulatory trends are narrowing the gap.

- Recycling Infrastructure Gaps: In many developing regions, collection and sorting systems for aluminum packaging remain underdeveloped.

- Alloy Availability: Specific alloys (e.g., 3004, 5182) required for cap stock face periodic supply constraints due to limited rolling capacity.

Conclusion: 2026 Market Outlook

The global aluminum cap market is poised for steady growth in 2026, driven by sustainability mandates, material innovation, and expanding applications. Total market value is projected to reach $8.7 billion by 2026, up from ~$7.3 billion in 2023 (CAGR: ~6.1%).

Key Growth Levers for 2026:

– Regulatory tailwinds in Europe and North America

– Expansion in Asia-Pacific’s consumer goods markets

– Increased use of recycled aluminum

– Diversification into pharmaceutical and premium cosmetic packaging

Manufacturers who invest in lightweighting, recycling partnerships, and value-added features (e.g., smart caps) will be best positioned to capture market share in the evolving 2026 landscape.

—

Note: Data based on H2 2025 industry reports from Smithers, AMI Consulting, CRU Group, and EU Commission policy assessments.

Common Pitfalls When Sourcing Aluminum Caps: Quality and Intellectual Property Risks

Sourcing aluminum caps—used in industries ranging from pharmaceuticals and cosmetics to food and beverage—can present several critical challenges, particularly concerning product quality and intellectual property (IP) protection. Failing to address these pitfalls can lead to production delays, regulatory non-compliance, reputational damage, or legal disputes. Below are key risks to watch for:

Quality-Related Pitfalls

1. Inconsistent Material Composition

One of the most common quality issues is receiving aluminum caps made from substandard or inconsistent alloys. Suppliers may use recycled aluminum without proper certification, leading to variations in strength, corrosion resistance, or appearance. Always require material test reports (MTRs) and verify compliance with industry standards (e.g., ASTM B209 for aluminum sheet).

2. Poor Surface Finish and Coating Defects

Aluminum caps often require precise surface treatments such as anodizing, painting, or lacquering for aesthetics and protection. Inadequate coating thickness, uneven application, or adhesion failures can result in premature degradation, especially in humid or acidic environments. Conduct regular batch inspections and specify coating requirements in contracts.

3. Dimensional Inaccuracy and Tolerance Drift

Caps that do not meet tight dimensional tolerances may fail to seal properly or be incompatible with filling and capping machinery. Offshore suppliers, in particular, may lack consistent quality control processes. Use first-article inspections (FAI) and statistical process control (SPC) data to monitor conformity.

4. Lack of Process Validation and Traceability

Reliable suppliers should maintain full traceability from raw materials to finished goods. A lack of documented quality management systems (e.g., ISO 9001 or IATF 16949) increases the risk of undetected defects. Ensure suppliers can provide lot traceability and validation of production processes.

Intellectual Property Risks

1. Unauthorized Use or Replication of Designs

Custom-designed aluminum caps (e.g., embossed logos, proprietary threading) are vulnerable to IP theft. Unscrupulous suppliers may replicate and sell your designs to competitors or create knock-offs. This is especially prevalent in regions with weak IP enforcement.

2. Inadequate Legal Protections in Contracts

Many sourcing agreements fail to include robust IP clauses. Without clear language assigning ownership of tooling, molds, and designs to the buyer—and prohibiting third-party use—suppliers may retain rights to your IP. Always include confidentiality agreements (NDAs) and explicit IP ownership terms.

3. Tooling and Mold Ownership Ambiguity

If your company funds the creation of custom molds or tooling, ensure ownership is legally transferred and physically secured. Suppliers may claim ownership or refuse to release tooling upon contract termination. Specify in writing that tooling is your property and include provisions for retrieval.

4. Reverse Engineering by Suppliers or Subcontractors

Even with NDAs, suppliers or their subcontractors may reverse engineer your cap designs to offer similar products. Mitigate this by limiting design disclosure, using modular designs, and auditing supplier facilities when possible.

Best Practices to Avoid Pitfalls

- Conduct thorough supplier audits, including on-site quality system reviews.

- Require certifications (ISO, RoHS, REACH) and third-party testing reports.

- Use secure contracts with enforceable IP and confidentiality clauses.

- Perform regular product audits and maintain dual sourcing where feasible.

- Register unique designs under industrial design patents or trademark law.

By proactively addressing these quality and IP-related pitfalls, companies can ensure reliable supply, protect innovation, and maintain brand integrity in competitive markets.

H2: Logistics & Compliance Guide for Aluminum Caps

1. Overview

Aluminum caps are widely used in industries such as packaging (e.g., beverage, pharmaceuticals, cosmetics), construction, and manufacturing. Due to their material composition and potential for recycling, aluminum caps are subject to various logistics and compliance requirements related to transportation, environmental regulations, and international trade.

This guide outlines key logistics considerations and compliance obligations for the handling, transport, storage, and disposal of aluminum caps under H2 framework principles—emphasizing safety, environmental responsibility, and regulatory adherence.

2. Regulatory Compliance

2.1. Material Classification

- HS Code (Harmonized System): 7616.10 – “Aluminum closures (e.g., caps, lids), hollowware, and other household articles.”

- UN Number: Not typically classified as hazardous unless contaminated.

- REACH (EU): Aluminum is not a Substance of Very High Concern (SVHC), but ensure no restricted substances (e.g., chromates) are used in coatings.

- RoHS (EU): Applies if caps are used in electrical/electronic equipment; aluminum itself is exempt, but coatings may require assessment.

- TSCA (USA): Aluminum is listed; ensure no prohibited additives are present.

2.2. Environmental & Recycling Regulations

- Waste Framework Directive (EU): Aluminum caps must be recyclable; labeling may be required to indicate recyclability.

- EPR (Extended Producer Responsibility): In certain jurisdictions (e.g., EU, Canada), producers may be responsible for end-of-life management.

- Recyclability Standards: Follow ISO 14021 (Environmental Labels and Declarations) for recyclability claims.

2.3. International Trade Compliance

- Export Controls: Generally unrestricted, but check for dual-use potential (e.g., military applications).

- Customs Documentation: Include accurate descriptions, weight, quantity, and value. Provide certificates of origin if required under trade agreements.

- Country-Specific Rules:

- USA: FDA compliance if used in food or pharmaceutical packaging.

- EU: Compliance with EU 1935/2004 (food contact materials).

- China: Requires CCC certification only if part of a regulated product.

3. Logistics Handling & Transportation

3.1. Packaging & Storage

- Use moisture-resistant packaging to prevent oxidation and corrosion.

- Store in dry, ventilated areas away from corrosive substances (e.g., acids, chlorides).

- Stack securely to prevent crushing; use pallets for bulk shipments.

3.2. Transportation Modes

- Road: IBCs (Intermediate Bulk Containers) or shrink-wrapped pallets recommended.

- Sea: Use containers with desiccants to prevent condensation; avoid mixed loads with wet goods.

- Air: No restrictions under IATA DGR as non-hazardous material.

3.3. Weight & Volume Optimization

- Aluminum caps are lightweight; optimize load density to reduce transport costs.

- Use nested or compressed packaging where possible.

4. Safety & Handling

4.1. Worker Safety

- Minimal risk; however, sharp edges may be present—use gloves during manual handling.

- Follow OSHA (USA) or similar local guidelines for general workplace safety.

4.2. Fire & Reactivity

- Aluminum is non-combustible but can burn under extreme conditions (e.g., fine powder).

- Solid caps pose negligible fire risk.

5. Sustainability & Circular Economy

5.1. Recyclability

- Aluminum caps are 100% recyclable; promote closed-loop recycling.

- Clearly label packaging to encourage consumer recycling.

5.2. Carbon Footprint

- Recycled aluminum uses ~95% less energy than primary production.

- Prioritize suppliers using recycled content (PCR – Post-Consumer Recycled).

5.3. Reporting & Certifications

- Consider obtaining:

- Aluminum Stewardship Initiative (ASI) Certification

- EPD (Environmental Product Declaration)

- ISO 14001 (Environmental Management)

6. Documentation & Traceability

6.1. Required Documents

- Commercial Invoice

- Packing List

- Certificate of Origin

- Material Safety Data Sheet (MSDS/SDS) – if requested

- Recyclability Statement

- Compliance Certificates (e.g., FDA, REACH)

6.2. Batch Traceability

- Maintain lot numbers and supplier records for quality and compliance audits.

- Use barcodes or RFID for supply chain visibility.

7. Non-Compliance Risks & Mitigation

| Risk | Mitigation Strategy |

|——|———————-|

| Customs delays | Ensure accurate HS coding and complete documentation |

| Environmental fines | Follow EPR and recycling regulations |

| Rejection at border | Verify country-specific packaging and labeling rules |

| Safety incidents | Train staff on safe handling procedures |

8. Conclusion

Aluminum caps are low-risk in terms of hazardous classification but require careful attention to environmental, trade, and packaging regulations. Adherence to H2 principles—ensuring health, safety, and environmental harmony—supports sustainable logistics and global compliance. Regular audits, supplier vetting, and investment in recyclable design will enhance compliance and reduce ecological impact.

Note: Always consult local regulations and update compliance protocols as laws evolve.

In conclusion, sourcing aluminum caps requires a strategic approach that balances quality, cost, supplier reliability, and sustainability. It is essential to partner with reputable suppliers who adhere to industry standards and can consistently deliver high-quality products with tight tolerances and excellent finish. Factors such as material grade, manufacturing process (e.g., stamping or casting), lead times, and logistics should be carefully evaluated to ensure seamless integration into the production process. Additionally, considering environmental impact and recyclability aligns with growing sustainability goals. Conducting thorough supplier assessments, requesting samples, and negotiating favorable terms will ultimately lead to a reliable and cost-effective sourcing solution for aluminum caps.