The global aluminum market continues to expand, driven by increasing demand across aerospace, automotive, construction, and renewable energy sectors. According to Mordor Intelligence, the aluminum market was valued at USD 193.4 billion in 2022 and is projected to grow at a CAGR of over 4.5% from 2024 to 2029. A key contributor to this growth is the rising use of lightweight materials to improve fuel efficiency and reduce emissions—applications where aluminum 1/16-inch sheets, known for their strength-to-weight ratio and corrosion resistance, play a pivotal role. As industries seek consistent quality, precision gauging, and sustainable sourcing, the demand for reliable aluminum sheet manufacturers has intensified. Based on production capacity, global reach, material certifications, and innovation in alloy development, here are the top 9 aluminum 1/16-inch sheet manufacturers shaping the current supply landscape.

Top 9 Aluminum 1 16 Sheet Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Alcoa

Domain Est. 1986

Website: alcoa.com

Key Highlights: Aluminum. Our aluminum segment includes smelting, casting and select energy assets. · Alumina. We are the world’s largest third-party producer of alumina….

#2 Metals Supplier & Service Center

Domain Est. 1997

Website: sss-steel.com

Key Highlights: Triple-S Steel is one of the largest metals distributor and service center in North and South America. Whether your project is large or small, local or global,…

#3 Industrial Metal Supply Co.

Domain Est. 1999

Website: industrialmetalsupply.com

Key Highlights: Industrial Metal Supply stocks a broad range of metal materials, including aluminum, steel, stainless steel, copper and brass, and specialty metals….

#4 Premium Metals & Plastics Distributor

Domain Est. 1996

Website: alro.com

Key Highlights: Your one-stop-shop for premium metals and plastics, offering a vast inventory of in-stock products and processing service options with next day delivery….

#5 80/20 Aluminum Extrusions

Domain Est. 1997

Website: 8020.net

Key Highlights: Custom aluminum framing from 80/20 lets you design your own machine guarding and enclosures. Learn More…

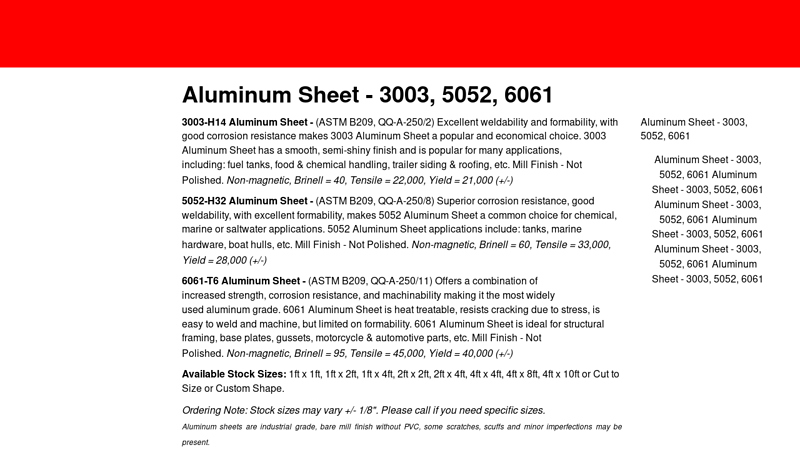

#6 Aluminum Sheet

Domain Est. 1999

#7 DIRTT Construction Systems

Domain Est. 2003

Website: dirtt.com

Key Highlights: Speed up construction by up to 30% with DIRTT’s modular construction systems. Get accurate, real-time pricing and adaptable solutions for any project….

#8 1/16″ Aluminum Plate 4′ x 8′

Domain Est. 2011

Website: commercial-refrigeration-gaskets.com

Key Highlights: In stock Free delivery1/16″ Aluminum Plate 4′ x 8′ – Smooth on both sides 5052-H32 ( 48″ x 96″ ). Be the first to review this product. $349.99. 1/16 ……

#9 5052 Aluminum Plate

Domain Est. 2018

Website: nblasermalaga.com

Key Highlights: About This Product. Looking for some quality 5052 aluminum plate? This 1/16 inch thick sheet measuring 12×24 inches is seriously versatile stuff….

Expert Sourcing Insights for Aluminum 1 16 Sheet

H2: Projected Market Trends for Aluminum 1/16-Inch Sheet in 2026

The global market for aluminum 1/16-inch sheet is expected to experience steady growth by 2026, driven by increasing demand across key industrial sectors, advancements in manufacturing technologies, and a growing emphasis on lightweight, sustainable materials. This analysis explores the primary market trends shaping the supply, demand, and pricing dynamics for aluminum sheets of this specific thickness.

1. Rising Demand in Transportation and Automotive Sectors

The automotive industry continues to be a major driver for aluminum 1/16-inch sheet consumption. As manufacturers strive to meet stringent fuel efficiency and emissions regulations, the shift toward lightweight vehicle designs has accelerated. Aluminum sheets are increasingly used in body panels, chassis components, and electric vehicle (EV) battery enclosures. By 2026, the expansion of EV production—particularly in North America, Europe, and China—is expected to significantly boost demand for thin aluminum sheets, including the 1/16-inch (approximately 1.59 mm) gauge.

2. Growth in Aerospace and Defense Applications

The aerospace sector is another key consumer of precision aluminum sheet products. Aluminum 1/16-inch sheets, often made from alloys like 2024, 5052, or 6061, are used in aircraft fuselages, wing components, and interior structures due to their optimal strength-to-weight ratio. With global air travel recovering and new aircraft orders rising, demand for high-quality aluminum sheets is expected to grow, particularly in regions with robust aerospace manufacturing such as the U.S., Canada, and Western Europe.

3. Expansion in Renewable Energy and Construction

The construction and renewable energy industries are adopting aluminum for solar panel frames, roofing systems, cladding, and structural supports. Aluminum 1/16-inch sheets offer durability, corrosion resistance, and ease of fabrication—making them ideal for modular building designs and solar infrastructure. As governments worldwide push for green building standards and renewable energy targets, the demand for lightweight aluminum solutions is projected to rise through 2026.

4. Regional Production and Supply Chain Shifts

China remains the largest producer and consumer of aluminum, but rising energy costs and environmental regulations are prompting manufacturers to diversify supply chains. North American and European producers are investing in recycling infrastructure and domestic rolling capacity to meet local demand and reduce reliance on imports. This regional shift is expected to support price stability and ensure a more resilient supply of aluminum sheets.

5. Sustainability and Recycling Trends

Aluminum’s high recyclability (up to 75% of all aluminum ever produced is still in use) positions it favorably in a sustainability-focused market. By 2026, increased use of recycled aluminum (post-consumer and post-industrial) in sheet production is anticipated, particularly in eco-conscious industries like automotive and architecture. Regulatory incentives and corporate ESG (Environmental, Social, and Governance) goals will further drive the adoption of low-carbon aluminum products.

6. Price Volatility and Raw Material Influences

Aluminum prices are subject to fluctuations based on energy costs (especially electricity for smelting), bauxite availability, and geopolitical factors. In 2026, prices for aluminum 1/16-inch sheet are expected to remain moderately volatile, with potential upward pressure from increased demand and energy transition challenges. However, improved recycling rates and process efficiencies may help stabilize costs over the medium term.

Conclusion

The market for aluminum 1/16-inch sheet in 2026 will be shaped by technological innovation, environmental regulations, and shifting industrial needs. With strong growth anticipated in transportation, aerospace, construction, and renewable energy sectors, demand for this versatile material is poised to rise. Manufacturers and suppliers who invest in sustainable production, advanced alloy development, and supply chain resilience will be best positioned to capitalize on emerging opportunities.

Common Pitfalls When Sourcing Aluminum 1/16″ Sheet (Quality & IP)

Sourcing aluminum 1/16″ sheet (approximately 1.59 mm thick) requires careful attention to both material quality and intellectual property (IP) considerations. Overlooking these aspects can lead to project delays, increased costs, safety issues, and legal exposure. Here are the most common pitfalls to avoid:

1. Assuming Uniform Quality Across Suppliers

One of the biggest mistakes is treating all aluminum 1/16″ sheet as interchangeable. Quality can vary significantly based on:

- Alloy & Temper Inconsistency: Failing to specify the exact alloy (e.g., 3003-H14, 5052-H32, 6061-T6) and temper can result in sheets that don’t meet strength, formability, corrosion resistance, or weldability requirements. A supplier might substitute a cheaper or readily available alloy.

- Dimensional Tolerances: 1/16″ is a relatively thin gauge. Suppliers may provide material outside ASTM B209 (or relevant) thickness tolerances. Undersized material compromises structural integrity; oversized material can cause fit issues in assemblies.

- Surface Defects: Thin sheet is more susceptible to visible surface imperfections like scratches, dents, roll marks, or corrosion (e.g., pitting). Accepting material without a thorough surface inspection can lead to rework or rejection downstream, especially for visible/finished parts.

- Flatness Issues (Camber & Bow): Thin sheets are prone to warping, camber (edge curvature), and crossbow (center curvature). Poor flatness can cause feeding issues in automated processes (like stamping or CNC) and assembly problems.

- Certification & Traceability: Not demanding mill test reports (MTRs) or certificates of conformance (CoC) specific to the batch/lot. This lack of documentation makes it impossible to verify the material meets specifications or trace issues back to the source mill.

2. Neglecting Intellectual Property (IP) Protection

Using aluminum sheet in manufacturing, especially for enclosures, consumer products, or patented components, raises significant IP risks:

- Infringing on Design Patents: Sourcing sheet for parts with unique shapes, textures, or ornamental features without verifying freedom-to-operate. Simply fabricating a part from standard aluminum sheet doesn’t negate infringement if the design is patented.

- Using Proprietary Tooling or Processes: Partnering with a fabricator who uses tooling or processes (e.g., specific forming techniques, bonding methods) that are patented by a third party, potentially exposing the buyer to infringement claims.

- Reverse Engineering Risks: Sourcing sheet to replicate a competitor’s product without proper legal clearance. Even minor modifications might not avoid infringement of utility or design patents.

- Overlooking Trademarked Finishes: Using surface finishes (e.g., specific anodized colors, brush patterns) that are trademarked or trade-dressed by another company, potentially misleading consumers.

- Contractual IP Gaps: Failing to include clear IP clauses in supplier contracts regarding ownership of designs, tooling developed for the project, and indemnification against third-party IP claims related to the supplied material or its use.

3. Overlooking Supply Chain & Logistical Risks

- Minimum Order Quantities (MOQs): Thin sheet often has higher MOQs from mills or distributors. Sourcing small quantities can be expensive or impossible without a supplier network.

- Lead Time Variability: Delays at the mill, distributor backlogs, or transportation issues can disrupt just-in-time production. Not having a reliable timeline or backup plan is a major pitfall.

- Coil vs. Cut-to-Length (CTL): Not specifying the required form (coil for high-volume stamping, cut sheets for laser cutting or forming). Receiving coil when CTL is needed (or vice-versa) causes significant processing delays and waste.

- Packaging & Handling Damage: Thin sheet is easily damaged during transit. Inadequate packaging (e.g., lack of interleaving paper, poor edge protection) leads to surface scratches and dents, requiring inspection and potentially rejection upon receipt.

4. Underestimating Processing Challenges with Thin Gauge

- Fabrication Difficulties: 1/16″ sheet is prone to warping, buckling, or distortion during welding, bending, or machining. Sourcing without considering the fabrication process can lead to scrap and rework. Specialized techniques (e.g., clamping, heat sinking) might be needed.

- Finishing Limitations: Thin material can be more challenging to anodize or paint uniformly without burning (anodizing) or warping. The final finish quality is highly dependent on the substrate quality and processing parameters.

- Strength vs. Weight Trade-offs: Assuming 1/16″ is sufficient without proper engineering analysis. It may be adequate for enclosures but fail under structural loads, leading to field failures.

Mitigation Strategies:

- Specify Precisely: Define alloy, temper, thickness, tolerances (per ASTM B209), surface finish, flatness requirements, and form (coil/CTL) in the purchase order.

- Require Documentation: Mandate MTRs/CoC for traceability and verification.

- Conduct Incoming Inspection: Implement checks for dimensions, flatness, and surface quality.

- Perform IP Due Diligence: Conduct patent and trademark searches for critical designs; consult IP counsel.

- Use Clear Contracts: Include IP ownership, indemnification, and quality clauses with suppliers.

- Qualify Suppliers: Audit key suppliers for quality systems (e.g., ISO 9001) and reliable supply chains.

- Engage Early: Involve materials engineers and fabricators early to understand processing requirements for thin gauge.

By proactively addressing these quality and IP pitfalls, you can ensure the reliable and legally sound sourcing of aluminum 1/16″ sheet for your application.

Logistics & Compliance Guide for Aluminum 1/16″ Sheet

Overview

Aluminum 1/16″ sheet, a thin gauge aluminum product typically made from alloys such as 3003, 5052, or 6061, is widely used in manufacturing, construction, signage, and industrial applications due to its lightweight, corrosion resistance, and formability. Proper logistics and compliance management are essential to ensure safe handling, regulatory adherence, and timely delivery.

Packaging & Handling

- Protective Packaging: Sheets should be separated with kraft paper or plastic interleaving to prevent scratching. Bundled sheets must be secured with edge protectors and banded tightly to avoid shifting.

- Palletization: Stack sheets on sturdy wooden or plastic pallets. Use stretch wrap to secure loads and prevent moisture ingress. Max stack height should not exceed manufacturer recommendations to avoid bottom sheet deformation.

- Handling Equipment: Use forklifts or cranes with padded forks or slings to avoid surface damage. Never drag sheets across surfaces.

- Storage Conditions: Store indoors in a dry, well-ventilated area. Avoid ground contact; use pallets. Keep away from corrosive materials and moisture to prevent oxidation or staining.

Transportation

- Domestic Shipping (US/Canada):

- Flatbed or enclosed trailers are commonly used. Secure loads with straps and edge protectors.

- Comply with FMCSA (Federal Motor Carrier Safety Administration) load securement rules (49 CFR Part 393).

- International Shipping:

- Sea freight: Use containerized shipping with desiccants to control humidity. Mark containers with “Fragile” and “This Side Up” if applicable.

- Air freight: Suitable for urgent or high-value shipments; ensure weight and dimensional limits are observed.

- Documentation: Include bill of lading (BOL), packing list, and commercial invoice. For exports, provide Harmonized System (HS) code 7606.12.00 (Flat-rolled aluminum, not alloyed, over 0.2 mm thick).

Regulatory Compliance

- DOT (Department of Transportation): No hazardous material classification under 49 CFR; standard non-hazardous freight rules apply.

- ITAR/EAR: Aluminum sheets are generally not ITAR-controlled. However, if used in defense or aerospace applications, verify Export Administration Regulations (EAR) under ECCN 1C990 (metals and alloys not otherwise specified).

- REACH & RoHS (EU): Aluminum 1/16″ sheet typically complies with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) as it contains no restricted substances. Provide compliance documentation upon request.

- Customs Clearance: Accurate classification and valuation are required. Provide mill test certificates (e.g., ASTM B209) to verify material specifications.

Environmental & Safety Considerations

- Recyclability: Aluminum is 100% recyclable. Promote recycling programs and document scrap handling procedures.

- Workplace Safety: Follow OSHA guidelines for material handling. Use PPE (gloves, safety glasses) during sheet handling to prevent cuts from sharp edges.

- Spill & Waste Management: No special waste classification; recycle production scrap. Follow local environmental regulations for disposal of packaging materials.

Quality Assurance & Documentation

- Mill Certifications: Obtain and retain material test reports (MTRs) showing chemical composition and mechanical properties.

- Inspection Upon Receipt: Check for surface defects, warping, or damage during transit. Report discrepancies immediately to the carrier and supplier.

- Traceability: Maintain batch/lot tracking for quality control and compliance audits.

Special Considerations

- Alloy-Specific Requirements: 6061-T6 may require heat treatment certification; 5052-H32 may need formability reports. Confirm specifications with the supplier.

- Coated or Anodized Variants: If the sheet has a protective or decorative coating, handle with extra care and verify coating compliance (e.g., AAMA for architectural finishes).

Conclusion

Effective logistics and compliance management for Aluminum 1/16″ sheet ensures product integrity, regulatory adherence, and supply chain efficiency. Partner with certified suppliers, maintain proper documentation, and train personnel in safe handling practices to minimize risk and optimize performance.

In conclusion, sourcing a 1/16-inch aluminum sheet requires careful consideration of several key factors including alloy type (such as 3003, 5052, or 6061), temper (e.g., H14, H32, or T6), intended application, required certifications, and supplier reliability. Aluminum 1/16-inch sheets are widely used in aerospace, automotive, signage, and fabrication industries due to their favorable strength-to-weight ratio, corrosion resistance, and formability. When sourcing, it is essential to balance cost, lead time, and quality by evaluating multiple suppliers, requesting material certifications, and confirming dimensional accuracy. Partnering with reputable metal distributors or manufacturers ensures material consistency and compliance with industry standards, ultimately supporting project success and performance longevity.