The global aluminium windows market is experiencing robust growth, driven by increasing demand for energy-efficient and durable building materials in residential and commercial construction. According to a 2023 report by Mordor Intelligence, the global aluminium windows and doors market was valued at USD 24.7 billion in 2022 and is projected to grow at a CAGR of 6.8% from 2023 to 2028. This expansion is fueled by rising urbanization, stricter energy regulations, and the growing preference for modern architectural designs that prioritize sleek aesthetics and low maintenance. Additionally, Grand View Research highlights the Asia Pacific region as a key growth driver, attributing the surge to rapid infrastructure development and expanding real estate markets in countries like India and China. As sustainability becomes a priority in construction, aluminium’s recyclability and thermal performance enhancements through advanced framing technologies are further boosting its appeal. In this evolving landscape, a selection of leading manufacturers has emerged, setting industry benchmarks in innovation, quality, and global reach.

Top 10 Aluminium Window Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

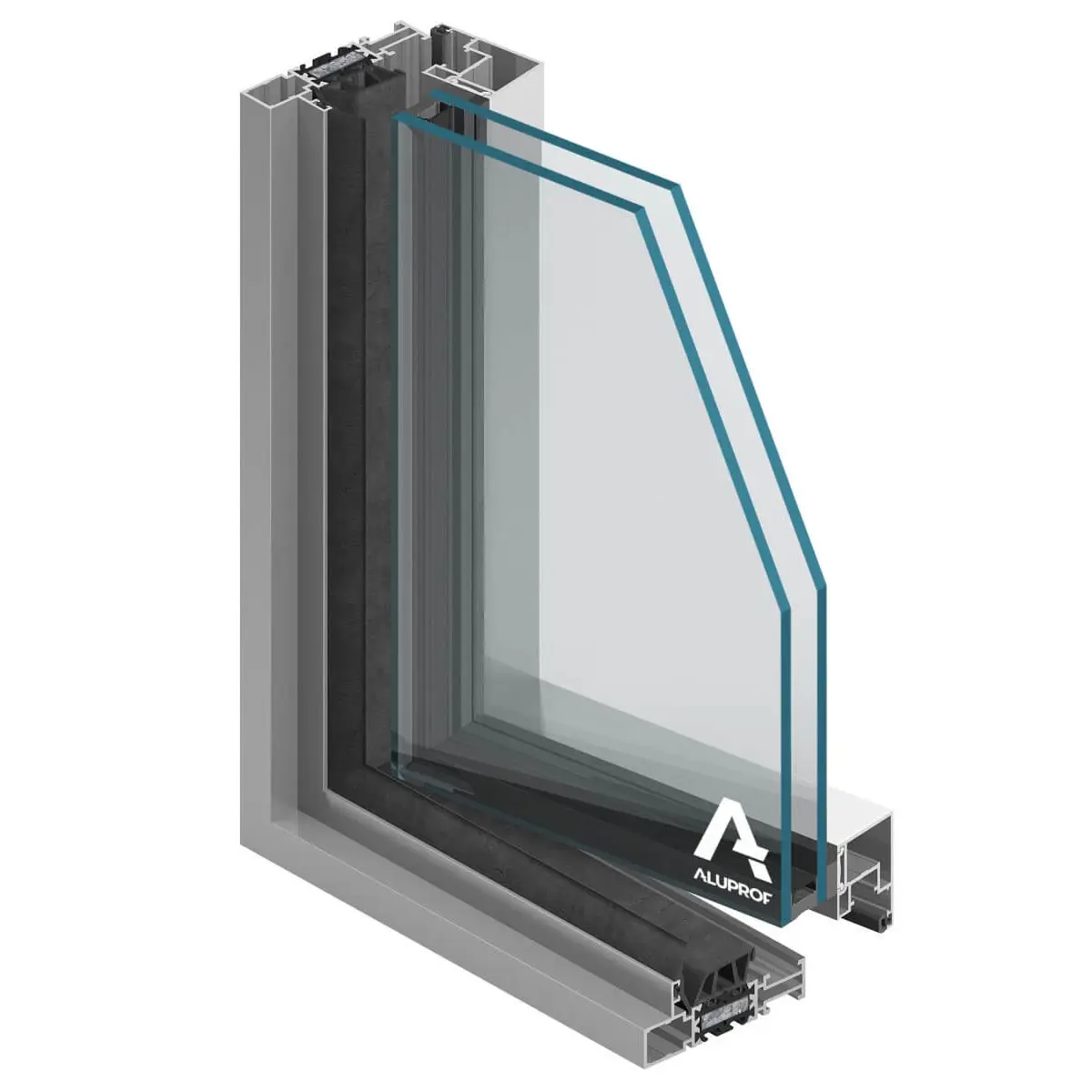

#1 Aluprof

Domain Est. 2001

Website: aluprof.com

Key Highlights: Aluprof is an internationally acclaimed producer of systems for aluminium windows, doors and facades, as well as modern sunshades and pergolas in Europe….

#2 Windows and Doors

Domain Est. 1995

Website: marvin.com

Key Highlights: Marvin creates windows and doors inspired by how people live. Explore our product lines and enhance your new construction, remodel or replacement project….

#3 Atrium Windows & Doors

Domain Est. 1996

Website: atrium.com

Key Highlights: Atrium manufactures energy efficient replacement windows, new-construction windows and patio doors designed to increase the comfort and beauty of any home….

#4 Manufacturers of vinyl and aluminum windows and doors …

Domain Est. 1997 | Founded: 1957

Website: intlwindow.com

Key Highlights: Since 1957, International Window Corporation (IWC) has manufactured outstanding vinyl and aluminum windows and doors known for their comfort, convenience and ……

#5 Door and Window Manufacturer

Domain Est. 1998

Website: crystalwindows.com

Key Highlights: Crystal Windows is a leading U.S. door and window manufacturer delivering custom solutions known for quality, durability, and energy efficiency….

#6 NT Window

Domain Est. 2000

Website: ntwindow.com

Key Highlights: We’re proud to be a leading custom window manufacturer of vinyl and aluminum windows, and sunrooms. serving the replacement and new construction markets….

#7 Reynaers

Domain Est. 1996

Website: reynaers.com

Key Highlights: Reynaers Aluminium is a leading specialist in the development and marketing of innovative, sustainable aluminium solutions for windows, doors and façades….

#8 Commercial Windows and Doors & Aluminum Window Replacement …

Domain Est. 1998

Website: boydaluminum.com

Key Highlights: Boyd builds commercial windows and doors, specializing in all areas of commercial windows aluminum including aluminum window replacement….

#9 Alumil, aluminum systems for windows & doors

Domain Est. 1998

Website: alumil.com

Key Highlights: Alumil’s 35-year experience, 3.200 employees and 18 factories make it one of the major global companies designing and producing architectural aluminium ……

#10 MI Windows and Doors

Domain Est. 2004

Website: miwindows.com

Key Highlights: MI Windows and Doors provides simply better built windows. At MI you will find the best replacement and new construction windows….

Expert Sourcing Insights for Aluminium Window

H2: 2026 Market Trends for Aluminium Windows

The global aluminium window market is poised for significant transformation by 2026, driven by evolving construction practices, sustainability mandates, and technological advancements. As urbanization accelerates and green building standards gain prominence, aluminium windows are emerging as a preferred choice in both residential and commercial sectors. This analysis explores key market trends expected to shape the industry through 2026 under the H2 (second half) outlook.

1. Rising Demand for Energy-Efficient Solutions

With governments reinforcing energy efficiency regulations—such as the EU’s Energy Performance of Buildings Directive (EPBD) and similar initiatives in North America and Asia-Pacific—there is growing demand for thermally broken aluminium windows. These products offer improved insulation, reducing heating and cooling loads. By H2 2026, the integration of multi-chamber profiles and warm-edge spacers is expected to become standard, especially in cold and temperate climates.

2. Growth in Sustainable and Recyclable Materials

Aluminium’s 100% recyclability with minimal loss in quality positions it favorably in eco-conscious markets. By 2026, manufacturers are increasingly adopting low-carbon aluminium produced using renewable energy, in line with ESG (Environmental, Social, and Governance) goals. The use of recycled aluminium content in window frames is projected to rise above 60% in developed markets by H2 2026, driven by consumer preference and regulatory incentives.

3. Expansion in Emerging Economies

Rapid urbanization in India, Southeast Asia, the Middle East, and Africa is fueling construction booms, particularly in mid- to high-rise residential and commercial developments. Aluminium windows, known for their durability and low maintenance, are gaining traction in these regions. By H2 2026, Asia-Pacific is expected to dominate global market growth, accounting for over 45% of demand, supported by infrastructure investments and smart city initiatives.

4. Technological Integration and Smart Windows

The convergence of building automation and window technology is accelerating. By 2026, smart aluminium windows with integrated sensors, automated ventilation, UV control, and IoT connectivity are anticipated to capture a growing niche. In commercial buildings, such systems enhance occupant comfort and energy management, with early adoption in North America and Western Europe. Vendors are increasingly partnering with tech firms to offer bundled smart building solutions.

5. Shift Toward Customization and Aesthetic Design

Architectural trends favoring minimalist design, floor-to-ceiling glazing, and slim sightlines are driving demand for customizable aluminium window systems. Powder-coated and anodized finishes in diverse colors and textures allow greater design flexibility. By H2 2026, modular and prefabricated window systems will gain popularity, reducing on-site installation time and enabling precision in high-rise projects.

6. Supply Chain Optimization and Localized Production

Geopolitical uncertainties and post-pandemic supply chain disruptions have prompted manufacturers to regionalize production. Companies are investing in localized manufacturing hubs to reduce lead times and logistics costs. In H2 2026, nearshoring trends—particularly in North America and Europe—are expected to strengthen, with increased partnerships between window fabricators and regional aluminium extruders.

7. Competitive Landscape and Consolidation

The market is witnessing increased consolidation, with major players acquiring niche innovators to expand product portfolios in high-performance and smart window segments. Companies like Schüco, Aluprof, and YKK AP are leading R&D efforts, focusing on thermal efficiency and digital integration. Smaller regional players are differentiating through customization and rapid delivery models.

Conclusion

By H2 2026, the aluminium window market will be defined by sustainability, innovation, and regional diversification. As energy codes tighten and smart infrastructure expands, aluminium windows will play a pivotal role in shaping energy-efficient, aesthetically pleasing, and technologically advanced building envelopes. Stakeholders who invest in R&D, circular economy practices, and digital integration will be best positioned to capture value in this evolving landscape.

Common Pitfalls When Sourcing Aluminium Windows (Quality & IP)

Sourcing aluminium windows, especially from international suppliers, involves navigating several potential pitfalls related to quality assurance and intellectual property (IP) protection. Overlooking these areas can lead to project delays, cost overruns, legal disputes, and reputational damage. Below are key challenges to be aware of:

Poor Quality Control and Inconsistent Manufacturing Standards

One of the most frequent issues is receiving aluminium windows that do not meet specified quality standards. This can include inconsistent extrusion thickness, subpar surface finishes, weak thermal breaks, or poor sealant application. Suppliers in regions with lax regulatory oversight may cut corners to reduce costs. Without rigorous on-site inspections or third-party testing, defects may only become apparent after installation, leading to costly rework.

Use of Substandard or Non-Compliant Materials

Suppliers may use inferior alloys or non-certified components (e.g., gaskets, hardware, or glazing) that fail to meet international standards such as ISO, BS, or AAMA. This compromises structural integrity, energy efficiency, and weather resistance. Buyers must verify material certifications and ensure compliance with local building codes to avoid safety hazards and non-compliance penalties.

Lack of Transparency in Supply Chain

Many suppliers outsource parts of the manufacturing process without disclosing this to buyers. This fragmented supply chain makes it difficult to trace material origins and maintain consistent quality. Hidden subcontractors may not adhere to the same quality protocols, increasing the risk of defective products.

Intellectual Property Infringement

Sourcing from regions with weak IP enforcement raises the risk of receiving windows that replicate patented designs, profiles, or system technologies without authorization. Using such products—even unknowingly—can expose the buyer to legal action from original manufacturers, especially in markets with strong IP laws. This is particularly common with high-performance window systems that feature unique engineering or aesthetic designs.

Inadequate Documentation and Technical Support

Suppliers may fail to provide complete technical documentation, including test reports, installation manuals, or warranty details. This lack of support complicates compliance verification, installation, and after-sales service. It also hinders the ability to defend against IP claims or quality disputes.

Misrepresentation of Certifications and Capabilities

Some suppliers falsely claim certifications (e.g., CE marking, NFRC ratings, or thermal performance data) to appear more credible. Without independent verification, buyers may assume compliance that doesn’t exist. This misrepresentation can lead to failed building inspections and liability issues.

Insufficient Contractual Protections

Procurement agreements that lack clear clauses on quality specifications, IP indemnity, and dispute resolution increase exposure to risk. Without explicit terms holding the supplier accountable for IP violations or defective goods, enforcement becomes difficult—especially across jurisdictions.

To mitigate these pitfalls, buyers should conduct thorough due diligence, require third-party audits, insist on material traceability, verify IP rights, and include robust legal protections in contracts.

Logistics & Compliance Guide for Aluminium Windows

Product Overview and Classification

Aluminium windows are pre-fabricated building components typically classified under HS (Harmonized System) Code 7610.90, which covers “Windows, doors and their frames, of aluminium.” Accurate classification is essential for customs clearance, duty calculation, and compliance with international trade regulations. Variants such as fixed, casement, sliding, or tilt-and-turn windows may have different specifications affecting transport and compliance.

Packaging and Handling Requirements

Aluminium windows must be securely packaged to prevent damage during transit. Standard practices include:

– Protective wrapping with plastic film or kraft paper to prevent scratches and corrosion.

– Use of timber or metal framing to stabilize units and avoid deformation.

– Corner guards and edge protectors for vulnerable corners.

– Secure strapping on wooden pallets or in crates, especially for sea freight.

– Clear labeling indicating “Fragile,” “This Side Up,” and handling instructions.

Transport and Shipping Considerations

- Mode of Transport: Suitable for sea, road, and rail freight. For long distances, containerized shipping (20’ or 40’ containers) is preferred.

- Stackability: Non-stackable or limited stackability due to risk of frame deformation; must be communicated to freight forwarders.

- Weather Protection: Must be kept dry during transit; use of moisture barriers and waterproof covers is essential, particularly for ocean transport.

- Weight and Dimensions: Pre-shipment measurement of weight and dimensions is critical for freight cost calculation and load planning.

Import and Export Compliance

- Documentation: Required documents include commercial invoice, packing list, bill of lading/airway bill, certificate of origin, and product conformity certificates.

- Customs Duties and Tariffs: Vary by destination country; importers must verify preferential tariff treatment under trade agreements (e.g., ASEAN, EU, USMCA).

- Regulatory Approvals: Some countries require prior notification or import permits for construction materials.

Building and Safety Standards Compliance

Aluminium windows must meet destination country building codes and performance standards, such as:

– Thermal and Energy Efficiency: Compliance with standards like NFRC (USA), CE marking (EU), or BIS (India) for U-values, solar heat gain, and air leakage.

– Structural Integrity: Must withstand wind load, impact, and pressure as per local regulations (e.g., ASTM E330 in the U.S., BS 6375 in the UK).

– Safety Glazing: If fitted with glass, ensure compliance with safety glazing standards (e.g., ANSI Z97.1, EN 12600).

Environmental and Sustainability Regulations

- RoHS and REACH Compliance: Ensure coatings and finishes are free from restricted hazardous substances (e.g., lead, cadmium, certain phthalates).

- Recyclability: Aluminium is highly recyclable; provide recycling information to support sustainability claims.

- Carbon Footprint: Some markets may require Environmental Product Declarations (EPDs) or carbon labeling.

Certification and Testing Requirements

- Third-Party Testing: Windows may require testing by accredited labs for air/water infiltration, structural performance, and thermal efficiency.

- CE Marking (EU): Mandatory for windows sold in the European Economic Area; requires conformity assessment and technical documentation.

- NFRC or ENERGY STAR (USA): Required for energy performance claims in North America.

Labeling and Marking

Each unit or package must include:

– Manufacturer name and address

– Model number and dimensions

– Batch/serial number

– CE mark or other applicable certification marks

– Installation and handling instructions (if applicable)

Final Destination and Installation Support

- Coordinate with buyers for delivery scheduling to avoid on-site storage.

- Provide installation manuals and technical support documentation.

- Ensure clear communication between logistics, customs, and installation teams to prevent delays.

Risk Management and Insurance

- Obtain comprehensive cargo insurance covering damage, loss, or delay.

- Include clauses addressing liability for improper packaging or non-compliance with standards.

- Audit logistics partners for experience in handling architectural glazing products.

By adhering to this guide, exporters and importers can ensure smooth logistics operations and full compliance with international regulations for aluminium windows.

In conclusion, sourcing aluminium window manufacturers requires a strategic approach that balances quality, cost, reliability, and compliance with industry standards. It is essential to conduct thorough due diligence by evaluating potential suppliers based on their manufacturing capabilities, product certifications, experience, and track record in delivering durable, energy-efficient, and aesthetically pleasing window systems. Visiting production facilities, requesting samples, and reviewing client references can provide valuable insights into a manufacturer’s credibility and performance.

Additionally, prioritizing manufacturers that utilize high-quality materials, advanced production technologies, and sustainable practices not only ensures long-term product performance but also aligns with environmental and regulatory requirements. Clear communication, well-defined specifications, and solid contractual agreements are critical to avoiding misunderstandings and ensuring timely delivery.

Ultimately, selecting the right aluminium window manufacturer contributes significantly to the success of construction and renovation projects, enhancing building performance, occupant comfort, and overall project value. A well-chosen partner will offer not only competitive pricing but also technical support, reliable after-sales service, and a commitment to excellence—key factors in achieving long-term satisfaction and sustainable outcomes.