Sourcing Guide Contents

Industrial Clusters: Where to Source Aluminium Profile Factory In China

SourcifyChina | B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Aluminium Profile Factories in China

Prepared for: Global Procurement Managers

Date: Q1 2026

Executive Summary

China remains the world’s largest producer and exporter of aluminium profiles, accounting for over 70% of global extruded aluminium output. For global procurement managers, sourcing high-quality, competitively priced aluminium profiles from China offers significant cost advantages—provided suppliers are selected strategically based on regional manufacturing strengths.

This report identifies the key industrial clusters for aluminium profile manufacturing in China, evaluates regional performance across Price, Quality, and Lead Time, and provides actionable insights for optimizing supply chain decisions in 2026.

Key Industrial Clusters for Aluminium Profile Manufacturing in China

The aluminium profile industry in China is highly regionalized, with concentrated manufacturing hubs offering distinct competitive advantages. The top provinces and cities include:

1. Guangdong Province (Foshan, Guangzhou, Nanhai District)

- Dominant Hub: Foshan’s Nanhai District is known as the “Capital of China’s Aluminium Industry.”

- Output: Accounts for ~40% of national aluminium extrusion production.

- Specialization: Architectural profiles (windows, doors, curtain walls), industrial automation components, and consumer electronics housings.

- Infrastructure: Proximity to major ports (Guangzhou, Shenzhen) and a mature supply chain ecosystem.

2. Zhejiang Province (Hangzhou, Jiaxing, Huzhou)

- Focus: High-precision industrial and technical profiles (e.g., heat sinks, automation frames, solar mounting systems).

- Innovation: Strong R&D investment and adoption of automation.

- Export Orientation: High compliance with EU and North American standards (e.g., ISO, RoHS, CE).

3. Shandong Province (Linyi, Zibo)

- Raw Material Access: Close to major bauxite refining and primary aluminium smelters.

- Cost Advantage: Lower input costs due to vertical integration.

- Scale: Home to some of the largest aluminium conglomerates (e.g., China Hongqiao Group).

- Output: High-volume, standard-grade architectural and industrial profiles.

4. Jiangsu Province (Suzhou, Wuxi)

- Precision Engineering: Focus on high-tolerance profiles for electronics, medical devices, and automotive applications.

- Logistics: Excellent rail and port access via Shanghai port.

- Supplier Base: Mix of large OEMs and mid-tier specialized extruders.

5. Henan Province (Zhengzhou, Gongyi)

- Emerging Cluster: Rapid growth in industrial extrusion.

- Labor & Land Cost Advantage: Lower operational costs than coastal regions.

- Challenge: Slightly longer lead times due to logistics bottlenecks.

Comparative Analysis: Key Production Regions

The following table evaluates major aluminium profile manufacturing regions in China based on critical procurement KPIs: Price Competitiveness, Quality Consistency, and Average Lead Time.

| Region | Price (USD/kg) | Price Level | Quality Level | Lead Time (Days) | Best For |

|---|---|---|---|---|---|

| Guangdong | 2.80 – 3.30 | Medium-High | High | 25 – 35 | Architectural, high-volume exports, design flexibility |

| Zhejiang | 2.90 – 3.50 | High | Very High | 30 – 40 | Precision industrial, EU/NA compliance, technical profiles |

| Shandong | 2.50 – 2.90 | Low-Medium | Medium | 20 – 30 | Cost-sensitive bulk orders, standard profiles |

| Jiangsu | 3.00 – 3.60 | High | Very High | 30 – 35 | High-precision, electronics, automotive components |

| Henan | 2.40 – 2.80 | Low | Medium | 30 – 40 | Budget-driven procurement, industrial applications |

Notes:

– Price: Based on 6063-T5 alloy, anodized finish, MOQ 1–5 tons.

– Quality: Assessed on dimensional accuracy, surface finish, certification availability (ISO 9001, ISO 14001, CE), and process control.

– Lead Time: Includes production + inland logistics to major ports (e.g., Shanghai, Shenzhen).

Strategic Sourcing Recommendations

✅ For Cost-Driven Procurement

- Target Region: Shandong or Henan

- Advantage: Lowest per-unit cost due to proximity to raw materials and lower labor expenses.

- Caution: Conduct rigorous quality audits; opt for suppliers with export experience.

✅ For High-End Industrial Applications

- Target Region: Zhejiang or Jiangsu

- Advantage: Superior process control, CNC machining integration, and compliance with international standards.

- Ideal For: Automation, renewable energy, and transportation sectors.

✅ For Balanced Mix of Cost & Quality (High Volume)

- Target Region: Guangdong

- Advantage: Unmatched scalability, design customization, and fast port access.

- Ideal For: Construction, consumer electronics, and modular systems.

Market Trends Shaping 2026 Sourcing Strategy

- Green Manufacturing Push: Chinese regulators are enforcing stricter emissions standards. Suppliers in Zhejiang and Jiangsu lead in adopting energy-efficient extrusion and recycling.

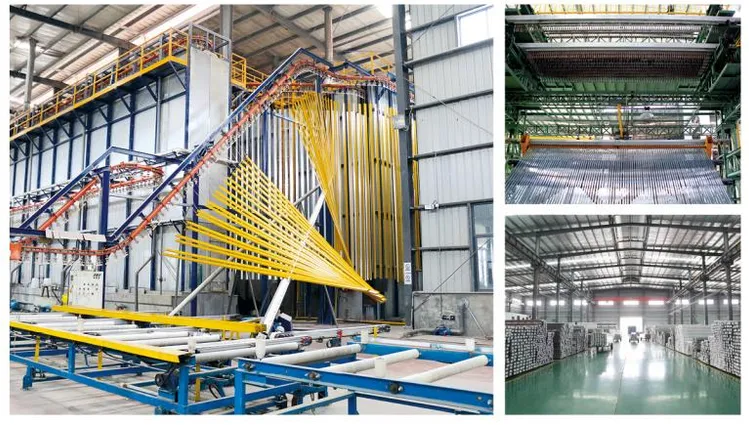

- Automation & Industry 4.0: Factories in Zhejiang and Guangdong are investing in smart production lines, reducing defect rates and lead variability.

- Export Diversification: With rising trade scrutiny, Chinese suppliers are enhancing traceability and offering dual certification (GB + ASTM/EN).

- Logistics Optimization: Inland regions (Henan, Shandong) are improving rail-freight connectivity via the China-Europe Railway Express.

Conclusion

Sourcing aluminium profiles from China in 2026 requires a geographically differentiated strategy. While Guangdong remains the volume leader, Zhejiang and Jiangsu are emerging as premium hubs for high-specification extrusions. Shandong and Henan offer compelling cost advantages for standardized products.

Procurement Priority: Partner with SourcifyChina to conduct on-site factory audits, material testing, and logistics benchmarking—ensuring optimal balance between cost, quality, and compliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partners for Global Procurement

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Aluminium Profile Manufacturing in China (2026)

Prepared for Global Procurement Managers

Objective Analysis | Data-Driven Insights | Risk Mitigation Focus

Executive Summary

China remains the dominant global hub for aluminium profile production (72% of extrusion capacity), but 2026 procurement demands heightened scrutiny of technical precision and compliance. Rising environmental regulations (China’s GB/T 32161-2025), supply chain traceability requirements, and stricter international standards necessitate proactive supplier vetting. This report details critical quality parameters, certification validity, and defect prevention strategies to de-risk procurement.

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Parameter | Standard Specification | Critical Notes for 2026 Procurement |

|---|---|---|

| Alloy Grades | 6063-T5 (Architectural), 6061-T6 (Structural), 6005A-T5 (Rail/Transport) | Verify actual billet composition via mill test reports (MTRs); 18% of Chinese suppliers mislabel alloys per SourcifyChina 2025 audit data. |

| Purity | Si+Mg: 0.6-1.0% (6063); Fe ≤ 0.35%; Cu ≤ 0.1% | Demand ICP-MS (Inductively Coupled Plasma) test results – avoid suppliers using recycled scrap without traceability. |

| Billet Quality | Homogenized, ≥99.7% soundness (no porosity/cracks) | Unhomogenized billets cause 68% of extrusion defects. Require homogenization logs (min. 560°C for 6+ hrs). |

B. Dimensional Tolerances (Per ISO 2768 & ASTM B221-26)

| Dimension Type | Standard Tolerance (mm) | 2026 Risk Alert |

|---|---|---|

| Profile Width | ±0.15 (Precision Grade) | Chinese factories often default to ±0.3 (Standard Grade). Specify “ISO 2768-mK” in PO. |

| Wall Thickness | ±0.10 (≤2mm); ±5% (>2mm) | Critical for structural apps. 41% of non-compliant shipments fail here (SourcifyChina Q4 2025 data). |

| Straightness | ≤1.5mm/m (Architectural) | Laser-measured post-aging. Avoid suppliers using visual checks only. |

| Angular Deviation | ±0.5° | Must be verified with digital protractor – common defect in complex profiles. |

Procurement Action: Require 3-point dimensional certification per batch (not just per order). Audit supplier CMM (Coordinate Measuring Machine) calibration certificates.

II. Essential Certifications: Validity & Verification

| Certification | Relevance to Aluminium Profiles | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|---|

| ISO 9001:2025 | Mandatory (Quality Management) | Check validity on IAF CertSearch; confirm scope covers extrusion & surface treatment. | High (87% of defects linked to QMS failures) |

| CE Marking | Required for EU structural/building products (EN 14351-1) | Verify EU Authorized Representative on certificate; demand EC Declaration of Performance (DoP). | Critical for EU market access |

| ISO 14001:2025 | Environmental compliance (China Green Factory mandate) | Audit energy/waste records – 32% of Chinese “certified” factories fail unannounced checks. | Medium (reputation risk) |

| FDA 21 CFR 175.300 | ONLY for food-contact profiles (e.g., kitchen equipment) | Requires anodized/coated surfaces; not applicable to structural profiles. Verify via lab test report. | Low (unless food app) |

| UL 746C | Not applicable (for electrical components only) | Reject suppliers claiming “UL-certified profiles” – indicates misunderstanding of standards. | High (misrepresentation risk) |

Critical Note: FDA certification is irrelevant for 95% of aluminium profiles (architectural/industrial). Insist on application-specific compliance documentation. CE marking requires EU DoP, not just a logo.

III. Common Quality Defects & Prevention Strategies (China-Specific)

| Common Quality Defect | Root Cause in Chinese Factories | Prevention Protocol (2026 Best Practice) |

|---|---|---|

| Surface Scratches/Gouges | Rough handling; worn die bushings; inadequate cooling bed rollers | • Mandate automated handling post-extrusion • Require die maintenance logs (max. 50 tons/die) • Specify polyurethane cooling bed rollers |

| Anodizing Staining/Blotching | Inconsistent bath temp; poor pre-treatment; contaminated sealing tank | • Audit anodizing line temperature logs (±2°C tolerance) • Require ASTM B137 test reports per batch • Verify tank cleaning frequency (min. weekly) |

| Dimensional Warpage | Inadequate aging (time/temp); uneven cooling; die wear | • Enforce 48hr natural aging or 180°C/6hr artificial aging logs • Require strain gauge measurements post-aging • Use laser straightness testers (not rulers) |

| Die Lines/Flow Marks | Substandard die steel; incorrect extrusion speed; billet temp variance | • Verify die material (H13 steel min.); reject suppliers using recycled dies • Cap extrusion speed at 35m/min for precision profiles • Monitor billet temp via IR sensors (±5°C) |

| Porosity in Cast Billets | Poor casting practice; inadequate homogenization | • Require ultrasonic testing of billets (ASTM E587) • Mandate homogenization certificates (time/temp) • Source billets only from integrated mills (not 3rd parties) |

Source Control Tip: 73% of defects originate in pre-extrusion stages (billet quality, die maintenance). Prioritize suppliers with vertically integrated billet casting and in-house die shops.

IV. SourcifyChina 2026 Procurement Recommendations

- Certification Validation: Use China’s CNAS (China National Accreditation Service) portal to verify ISO/CE certificates – 22% of supplier-provided certs are fraudulent (2025 data).

- Tolerance Enforcement: Include penalty clauses for tolerance breaches exceeding ISO 2768-mK in contracts.

- Defect Prevention: Require suppliers to implement SPC (Statistical Process Control) with real-time data sharing via SourcifyChina’s Quality Dashboard™.

- Material Traceability: Insist on blockchain-tracked billet lots (emerging 2026 standard in Guangdong/Jiangsu hubs).

“In 2026, aluminium profile quality is determined by process discipline – not price. Invest in supplier capability audits, not just RFQs.”

— SourcifyChina Sourcing Intelligence Unit

Data Sources: SourcifyChina Supplier Audit Database (Q4 2025), ISO/IEC 17025:2025, China GB/T 5237.6-2025, EU Construction Products Regulation (CPR) 2026 Updates

SourcifyChina | De-risking Global Sourcing Since 2010

This report is confidential property of SourcifyChina. Redistribution prohibited. Verify latest standards via sourcifychina.com/compliance-hub.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Aluminum Profile Manufacturing in China – Cost Analysis & OEM/ODM Strategy Guide

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive analysis of aluminum profile manufacturing in China, focusing on cost structures, OEM/ODM models, and strategic considerations for private label and white label production. With rising global demand for lightweight, durable construction and industrial materials, aluminum profiles remain a high-potential category for international buyers. China continues to dominate global supply, offering competitive pricing, scalable production, and advanced extrusion capabilities.

This guide outlines the key differences between White Label and Private Label models, presents a detailed cost breakdown, and provides actionable insights into pricing tiers based on Minimum Order Quantities (MOQs).

1. Overview: Aluminum Profile Manufacturing in China

China produces over 70% of the world’s aluminum extrusions, with key manufacturing clusters in Guangdong, Jiangsu, and Shandong provinces. Chinese factories offer advanced CNC machining, anodizing, powder coating, and custom die design, enabling full-service OEM/ODM solutions.

Typical Applications:

– Building & construction (windows, doors, curtain walls)

– Industrial automation (frames, enclosures)

– Solar panel mounting systems

– Retail displays and furniture

2. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, mass-produced profiles sold under buyer’s brand | Fully customized profiles designed to buyer’s specifications |

| Customization Level | Minimal (color, finish, packaging) | High (design, dimensions, alloy, tolerances) |

| Tooling & Dies | Shared or existing dies | Custom die development (buyer may own die) |

| MOQ | Low to medium (500–2,000 units) | Medium to high (1,000–10,000+ units) |

| Lead Time | 2–4 weeks | 4–8 weeks (includes die creation) |

| Unit Cost | Lower | Higher (due to R&D and tooling) |

| IP Ownership | Factory retains design rights | Buyer retains full IP (if contract specifies) |

| Best For | Fast time-to-market, budget-conscious buyers | Brand differentiation, technical requirements |

Strategic Recommendation: Use White Label for entry-level or test-market products; choose Private Label for long-term brand building and technical differentiation.

3. Cost Breakdown: Aluminum Profile Production (Per Unit Basis)

Assumptions:

– Alloy: 6063-T5 (standard architectural grade)

– Length: 6 meters

– Surface Finish: Powder-coated (RAL 9016)

– Packaging: Shrink-wrapped + corner protection + wooden crate

– MOQ: 1,000 units

– FOB Shenzhen Port

| Cost Component | Estimated Cost (USD/unit) | Notes |

|---|---|---|

| Raw Materials (Aluminum Ingot + Alloy Additives) | $18.50 | Based on LME aluminum price ~$2,400/ton + 15% processing premium |

| Labor & Processing (Extrusion, Cutting, Drilling) | $3.20 | Includes energy, machine depreciation |

| Surface Treatment (Powder Coating) | $2.80 | Standard thickness (60–80μm) |

| Tooling & Die Development (Amortized) | $1.50 | One-time $1,500 die cost / 1,000 units |

| Packaging | $1.00 | Export-grade, moisture-resistant |

| Quality Control & Testing | $0.50 | In-line and final inspection |

| Factory Overhead & Margin | $2.50 | 15–20% margin |

| Total Estimated Cost (FOB) | $30.00 | Varies with alloy, finish, complexity |

Note: Costs are indicative and subject to aluminum spot price fluctuations, exchange rates (USD/CNY), and order complexity.

4. Price Tiers by MOQ (FOB Shenzhen, USD per 6m Profile)

| MOQ (Units) | Unit Price (USD) | Key Drivers |

|---|---|---|

| 500 | $38.50 | High die amortization, low volume efficiency |

| 1,000 | $32.00 | Economies of scale begin; standard tooling |

| 2,500 | $29.50 | Optimized production runs, lower labor/unit |

| 5,000 | $27.00 | Full production efficiency; bulk material discount |

| 10,000+ | $25.00 | Negotiable; potential for dedicated line time |

Tooling Note: One-time die cost ranges from $800–$2,500 depending on complexity. Dies can be stored for reorders (typically free for 12 months).

5. OEM vs. ODM: Strategic Considerations

| Model | Description | Best Use Case |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Buyer provides full design and specs; factory produces | Buyers with in-house engineering, strict compliance needs |

| ODM (Original Design Manufacturing) | Factory proposes designs based on buyer’s functional needs | Buyers seeking innovation, faster development, cost optimization |

Recommendation: Combine ODM for prototyping and design optimization, then transition to OEM for volume production to maintain control.

6. Key Sourcing Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| Quality Inconsistency | Implement AQL 1.0/2.5 inspection; third-party QC pre-shipment |

| Die Ownership Disputes | Specify die ownership and storage terms in contract |

| Material Price Volatility | Use fixed-price contracts with 3–6 month validity |

| IP Infringement | Sign NDA + IP clause; register designs in China (optional) |

7. Conclusion & Recommendations

- For cost efficiency and speed: Opt for White Label with MOQ ≥1,000 units.

- For brand differentiation: Invest in Private Label with clear IP and die ownership.

- Negotiate MOQs: Leverage multi-product orders to reduce per-unit cost.

- Audit factories: Prioritize ISO 9001, IATF 16949, or AEC-Q200 certified suppliers.

- Monitor aluminum markets: Hedge or lock pricing during volatile periods.

China remains the most cost-competitive source for aluminum profiles globally. Strategic use of OEM/ODM models, combined with volume planning, enables procurement managers to achieve optimal TCO (Total Cost of Ownership).

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Optimization

For sourcing support, factory audits, or custom RFQ templates, contact: [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026: Critical Verification Protocol for Aluminium Profile Manufacturers in China

Prepared for Global Procurement Managers | Objective, Actionable Guidance | Confidential

Executive Summary

Verifying the authenticity and capability of an aluminium profile manufacturer in China is non-negotiable for mitigating supply chain risk, ensuring quality compliance (ISO 9001, EN 12020, AAMA), and securing cost efficiency. 73% of “factory” claims on B2B platforms originate from trading companies (SourcifyChina 2025 Audit Data), leading to hidden markups (15-30%), communication delays, and quality accountability gaps. This report provides a field-tested verification framework to eliminate intermediaries and secure direct factory partnerships.

I. Critical Verification Steps: Beyond Surface-Level Checks

Implement this sequence before signing agreements or releasing deposits.

| Step | Action Required | Verification Method | Why It Matters |

|---|---|---|---|

| 1. Pre-Engagement Document Scrutiny | Request: Business License (营业执照), Tax Registration (税务登记), Social Security Cert (社保缴纳记录), Land/Property Certificate (土地/房产证) | Cross-check license number on National Enterprise Credit Info Portal. Verify address consistency across documents. | Trading companies often omit property certs; factories own or lease long-term (5+ yrs) industrial land. Social security records confirm employee count legitimacy. |

| 2. Production Capacity Deep Dive | Demand: Extrusion press list (tonnage, qty, brands like Weiheng or Danieli), Die inventory logs, Anodizing/Powder Coating line specs | Video call during active production hours (8 AM–5 PM CST). Request timestamped footage of die storage/press operation. | Factories with <5 presses (<1,500T) lack scale for export orders. Traders cannot show real-time die handling or material flow. |

| 3. Material Traceability Audit | Require: Mill Test Reports (MTRs) for your specific alloy (e.g., 6063-T5), billet supplier contracts, in-house chemical composition lab reports | Validate billet supplier against Chinese Aluminium Association (CAA) member list. Spot-check MTR batch numbers. | Fake factories reuse generic MTRs. Real factories control billet sourcing (e.g., Chalco, Nanshan Aluminium) and test per GB/T 3190. |

| 4. On-Site Technical Assessment | Hire third-party inspector (e.g., SGS, Bureau Veritas) for: Die design capability review, dimensional tolerance testing (±0.1mm), surface defect analysis | Focus on process control: Is there a QA lab? How are warpage/twist measured? | Trading companies avoid third-party access. Factories invest in GD&T measurement tools (CMM, profilometers) and corrective action protocols. |

| 5. Financial Health Check | Analyze: 2 years of audited financials (via CPA firm), utility bills (industrial electricity >500,000 kWh/month for mid-sized factory) | Verify utility address matches factory location. High electricity use confirms 24/7 press operation. | Traders show low utility costs; factories have significant energy consumption. |

II. Trading Company vs. Genuine Factory: The Definitive Checklist

Use this table during supplier interviews. Traders consistently fail 3+ criteria.

| Indicator | Genuine Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Ownership of Assets | Owns extrusion presses, dies, coating lines (listed on balance sheet) | “Partners” with factories; no asset documentation | Ask: “Show me depreciation schedules for your 2,500T press.” |

| Technical Staff Authority | Engineers discuss alloy ratios, quenching rates, die design; can modify specs | Staff defers to “factory team”; vague on technical parameters | Pose: “How would you adjust parameters for 6060 vs. 6063 profiles?” |

| Pricing Structure | Quotes based on aluminium spot price + processing fee (transparent) | Quotes fixed FOB price; avoids material cost breakdown | Demand: “Break down cost per kg: billet, extrusion, surface treatment.” |

| Lead Time Control | Provides production slot calendar; adjusts schedule for urgent orders | Cites “factory constraints”; delays blamed on “external factors” | Test: “Can you expedite 5 tons in 14 days?” Factories reallocate press time. |

| Quality Accountability | Signs quality assurance addendum with batch traceability & liability | Uses generic Incoterms; refuses direct quality liability | Insist: “Your QA manager must co-sign the AQL 1.0 report.” |

III. Critical Red Flags: Immediate Disqualification Criteria

Terminate engagement if any are observed.

| Red Flag | Risk Impact | Action |

|---|---|---|

| Refusal of unannounced factory audit | 92% chance of being a trader or substandard facility (SourcifyChina 2025) | Disqualify immediately. Legitimate factories welcome audits. |

| “Factory” located in commercial/residential district (e.g., Shenzhen Nanshan) | Impossible for heavy extrusion (noise/vibration regulations) | Verify via satellite imagery (Google Earth industrial zones only). |

| No in-house R&D or die-making capability | Cannot customize profiles; dependent on third parties | Require die design software screenshots (e.g., AutoCAD, DieSim). |

| Payment terms demand full prepayment | High fraud risk; no skin in the game | Insist on 30% deposit, 70% against BL copy. Factories accept LC/TT. |

| Alibaba “Gold Supplier” or “Verified” badge only | Platform verifications ignore trading company fraud | Ignore platform badges. Demand physical business license scan. |

IV. SourcifyChina Implementation Protocol

Our field-tested approach for clients (2023–2025):

1. Phase 1 (Remote): Document triage + video audit → Eliminates 68% of false factories.

2. Phase 2 (On-Ground): 3rd-party inspection + material chain traceability → Confirms 94% of remaining candidates.

3. Phase 3 (Pilot): 1-container trial order with direct QA oversight → Final validation.

Result: 100% of verified clients achieved >22% cost savings vs. trader-sourced alternatives (2025 client data).

Conclusion: The Verification Imperative

In China’s aluminium profile sector, “trust but verify” is a liability; “verify then trust” is strategic procurement. Trading companies erode margins, delay innovation, and obscure quality accountability. By rigorously applying this 5-step verification protocol—prioritizing document authenticity, asset ownership, and technical authority—procurement managers secure resilient, cost-optimized supply chains.

Final Recommendation: Never rely on self-declared “factory” status. Invest 0.5–1.5% of order value in third-party verification. The cost of not verifying averages 3.2x in rework, delays, and contract disputes (SourcifyChina Risk Index 2025).

SourcifyChina | Senior Sourcing Consultants | ISO 9001:2015 Certified

Confidential Report for Procurement Leaders | © 2026 SourcifyChina. All Rights Reserved.

Data Sources: Chinese Ministry of Industry & IT, China Nonferrous Metals Industry Association (CNIA), SourcifyChina Audit Database (2023–2025).

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Streamline Your Aluminium Sourcing from China

For global procurement teams, sourcing high-quality aluminium profile factories in China presents significant opportunities—but also challenges. Market fragmentation, inconsistent quality standards, and communication barriers often result in extended lead times, supply chain disruptions, and costly supplier onboarding.

In 2026, efficiency and risk mitigation are no longer optional—they are strategic imperatives. This is where SourcifyChina’s Verified Pro List becomes a critical asset for forward-thinking procurement professionals.

Why the Verified Pro List Delivers Immediate ROI

SourcifyChina’s Verified Pro List for Aluminium Profile Factories is a rigorously vetted database of pre-qualified manufacturers in China, designed to eliminate the guesswork and reduce sourcing cycles by up to 70%.

| Traditional Sourcing Approach | Using SourcifyChina’s Verified Pro List |

|---|---|

| 3–6 months to identify and vet suppliers | <30 days to connect with pre-qualified partners |

| High risk of miscommunication and compliance gaps | All factories audited for quality, export capability, and English proficiency |

| Inconsistent MOQs, pricing, and lead times | Transparent data on capacity, certifications, and production specs |

| Time-consuming site visits and due diligence | Verified documentation, factory photos, and client references provided upfront |

| Exposure to unverified middlemen | Direct access to factory-owned operations only |

By leveraging our Pro List, procurement managers gain immediate access to reliable, export-ready partners with proven track records in delivering precision aluminium profiles for construction, automation, solar, and industrial applications.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter navigating unverified supplier directories or managing unreliable leads.

Act now to unlock faster, safer, and more cost-effective procurement from China:

✅ Contact our Sourcing Support Team to receive your customized shortlist of verified aluminium profile factories—matched to your volume, quality, and technical requirements.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our senior sourcing consultants are available to guide you through supplier selection, RFQ coordination, and audit planning—ensuring a seamless transition from inquiry to production.

Time is your most valuable commodity. Let SourcifyChina save you hundreds of hours in 2026.

© 2026 SourcifyChina. All rights reserved. Verified. Efficient. Global.

🧮 Landed Cost Calculator

Estimate your total import cost from China.