Sourcing Guide Contents

Industrial Clusters: Where to Source Aluminium Extrusion Manufacturers In China

SourcifyChina Sourcing Intelligence Report: China Aluminium Extrusion Manufacturing Landscape (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Leaders

Date: October 26, 2026

Report ID: SC-ALU-EX-2026-Q4

Executive Summary

China remains the dominant global hub for aluminium extrusion, producing >40 million metric tons annually (65% of global output). While cost advantages persist, strategic sourcing requires nuanced understanding of regional capabilities due to rising labor costs, stringent environmental policies (“Dual Carbon” goals), and supply chain maturation. This report identifies core industrial clusters, evaluates regional trade-offs, and provides actionable insights for optimizing procurement strategy in 2026. Key trend: Quality differentiation is now the primary cluster differentiator, surpassing pure cost considerations for Tier-1 global buyers.

Key Industrial Clusters: Geographic Analysis

China’s aluminium extrusion industry is concentrated in four major clusters, leveraging regional resource access, infrastructure, and specialized ecosystems. Below is a strategic assessment:

| Region | Core Cities/Districts | Key Strengths | Target Applications | Cluster Maturity (2026) |

|---|---|---|---|---|

| Guangdong | Foshan (Nanhai), Guangzhou, Dongguan | Highest technical capability; Largest OEM/export hub; Strongest quality control systems; Deep downstream ecosystem (furniture, construction, electronics) | High-precision profiles, Architectural systems, Automotive components, Electronics heat sinks | ★★★★★ (Most Mature) |

| Zhejiang | Ningbo, Jiaxing, Huzhou | Efficiency-focused; Rapid prototyping; Strong SME network; High automation adoption; Proximity to Shanghai logistics | Industrial machinery, Consumer electronics, Solar frames, Medium-complexity construction | ★★★★☆ (Highly Advanced) |

| Shandong | Binzhou (Zouping), Weifang, Linyi | Lowest raw material costs (integrated smelters); High-volume capacity; Competitive pricing; Emerging quality improvements | Standard construction profiles, Industrial structural parts, Basic solar frames | ★★★☆☆ (Volume-Oriented) |

| Jiangsu | Suzhou, Wuxi, Changzhou | Premium quality focus; Aerospace/defense suppliers; Strictest ISO/IATF compliance; R&D-intensive | Aerospace, Medical devices, High-end automotive, Semiconductor equipment | ★★★★☆ (Specialized) |

Regional Comparison: Critical Procurement Metrics (2026)

Data based on SourcifyChina’s 2026 benchmarking of 127 verified suppliers (60-day avg. for standard 6063-T5 profiles, 50mm width, 1,000kg MOQ)

| Metric | Guangdong | Zhejiang | Shandong | Jiangsu |

|---|---|---|---|---|

| Price (USD/kg) | $2.85 – $3.20 | $2.65 – $2.95 | $2.45 – $2.75 | $3.00 – $3.40 |

| Key Drivers | Premium for QC/engineering; High labor/logistics costs | Efficient SME operations; Moderate automation | Integrated smelters; Lower labor costs; Scale economies | R&D overhead; Aerospace-grade compliance |

| Quality Tier | ★★★★☆ (Excellent) | ★★★★☆ (Very Good) | ★★★☆☆ (Good/Standard) | ★★★★★ (Exceptional) |

| Key Indicators | Tightest tolerances (±0.05mm); 95%+ on-time QC pass; Robust surface treatment | Consistent mid-tolerance (±0.1mm); 90%+ QC pass; Limited anodizing depth control | Variable tolerances (±0.15mm); 80-85% QC pass; Basic surface finishes | Aerospace-grade (±0.02mm); Full material traceability; Military-spec finishes |

| Lead Time (Days) | 25-35 | 20-30 | 25-40 | 30-45 |

| Key Drivers | Complex order management; High export volume backlog | Lean manufacturing; Proximity to Ningbo port | Logistics delays; Smelter allocation bottlenecks | Stringent testing/validation; Low-volume specialization |

Critical Context Notes:

1. Price Volatility: Shandong offers lowest base price but is most exposed to bauxite/alumina price swings (up 12% YoY in 2026). Guangdong/Zhejiang better absorb volatility via long-term supplier contracts.

2. Quality Nuance: “Good” in Shandong ≠ “Good” in Guangdong. Specify exact tolerances/surface specs in RFQs – regional definitions vary significantly.

3. Lead Time Reality: All regions face 5-7 day delays during Q4 (National Day/EU shipping peak). Zhejiang’s advantage erodes for complex tooling (>3 weeks).

Strategic Sourcing Recommendations for 2026

- Prioritize Guangdong for:

- Projects requiring >ISO 9001 quality (e.g., automotive Tier-1, EU construction)

- Complex multi-cavity profiles (>80% of value-add in engineering)

-

Risk Mitigation Tip: Require 3rd-party QC reports (e.g., SGS) for >$50k orders.

-

Leverage Zhejiang for:

- Fast-turnaround industrial/consumer electronics components

- Mid-volume orders (1-5 MT) with standardized specs

-

Cost-Saving Tip: Consolidate shipments via Ningbo Port to offset 8% ocean freight hikes.

-

Consider Shandong for:

- High-volume (>10 MT), low-complexity construction profiles

- Budget-sensitive projects with flexible timelines

-

Critical Caution: Audit smelter integration (Weiqiao/Zhongwang preferred) to avoid secondary aluminium risks.

-

Reserve Jiangsu for:

- Mission-critical aerospace/medical applications

- Projects requiring full material pedigree (e.g., AS9100D compliance)

- Value-Add: Partner with cluster R&D centers (e.g., Suzhou Industrial Park) for custom alloy development.

Emerging Risks & Mitigation Strategies

- Carbon Compliance (Top 2026 Risk): EU CBAM now applies to extrusions (€48/ton CO2e). Action: Source from clusters with verified renewable energy use (Zhejiang: 35% solar; Guangdong: 28% hydro).

- Tooling Shortages: Lead times for custom dies increased 22% YoY. Action: Secure die custody clauses in contracts; pre-qualify backup tooling suppliers in Foshan.

- Labor Transition: 45% of Shandong’s workforce is >45 years old. Action: Prioritize suppliers with vocational school partnerships (Jiangsu leads here).

Conclusion

China’s aluminium extrusion landscape has evolved from a “lowest-cost” sourcing destination to a stratified ecosystem where regional specialization dictates optimal procurement strategy. Guangdong and Zhejiang remain the most balanced choices for global buyers prioritizing reliability, while Shandong’s cost edge requires active risk management. In 2026, success hinges on matching application requirements to cluster capabilities – not chasing nominal price. Procurement leaders must prioritize supplier technical audits over RFQ price comparisons to mitigate quality/carbon compliance risks.

SourcifyChina Action Step: Request our 2026 Verified Supplier Matrix (filtered by cluster, certification, and capacity) for zero-cost benchmarking.

Data Sources: China Nonferrous Metals Industry Association (CNIA), Global Trade Atlas, SourcifyChina Supplier Audit Database (Q3 2026), IHS Markit Aluminium Outlook.

Disclaimer: Prices/lead times are indicative averages; final terms subject to order specifics, raw material indices, and contractual terms.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Aluminium Extrusion Manufacturers in China

1. Introduction

Aluminium extrusion is a critical process in the manufacturing of components used across industries such as construction, automotive, electronics, renewable energy, and consumer goods. China remains a dominant global supplier due to its advanced manufacturing infrastructure, cost efficiency, and scalability. However, ensuring product quality and regulatory compliance requires rigorous sourcing diligence.

This report outlines the technical specifications, quality parameters, and compliance requirements essential when sourcing from Chinese aluminium extrusion manufacturers. It also provides a structured analysis of common quality defects and preventive measures to support informed procurement decisions.

2. Key Technical Specifications

2.1 Material Standards

| Parameter | Specification | Reference Standard |

|---|---|---|

| Alloy Types | 6061, 6063, 6005, 6082, 7075 (most common) | ASTM B221, GB/T 5237 |

| Chemical Composition | Must comply with specified alloy ranges (Si, Mg, Fe, Cu, etc.) | ISO 22671, GB/T 3190 |

| Recycled Content | Up to 80% allowed; must not compromise mechanical properties | EN 1173 |

Note: 6063-T5/T6 is preferred for architectural applications due to excellent surface finish and formability.

2.2 Dimensional Tolerances

| Dimension Type | Standard Tolerance | Precision Tolerance | Reference |

|---|---|---|---|

| Linear Dimensions (≤ 100 mm) | ±0.15 mm | ±0.08 mm | GB/T 5237.2 |

| Linear Dimensions (> 100 mm) | ±(0.15 + 0.05 × (L/100)) mm | ±(0.10 + 0.03 × (L/100)) mm | GB/T 5237.2 |

| Angular Deviation | ±1.0° | ±0.5° | EN 755-9 |

| Twist (per 300 mm length) | ≤ 0.45° | ≤ 0.25° | ASTM B928 |

| Bend (per meter) | ≤ 1.5 mm | ≤ 0.8 mm | GB/T 5237.2 |

Procurement Tip: Specify tighter tolerances in purchase contracts and verify via third-party inspection (e.g., SGS, TÜV).

3. Essential Certifications

Procurement managers must verify that suppliers hold the following certifications to ensure compliance with international markets:

| Certification | Purpose | Applicable Industries | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System (QMS) | All sectors | Audit of documentation & processes |

| ISO 14001:2015 | Environmental Management | EU, North America | Site audit, policy review |

| CE Marking | Conformance with EU safety, health, and environmental standards | Construction, machinery | Technical file review (e.g., EN 12020-1/2) |

| UL 746A / UL Recognized | Flame resistance & material safety | Electronics, enclosures | UL Online Certifications Directory |

| FDA 21 CFR Part 175 | Food contact compliance | Food processing, packaging | Material test reports, resin compliance |

| RoHS & REACH | Restriction of hazardous substances | Electronics, EU markets | Test reports (ICP-MS, GC-MS) |

| AS/NZS 4600 | Structural compliance (Oceania) | Building & construction | Project-specific certification |

Best Practice: Require certified test reports for each production batch, especially for export-sensitive markets.

4. Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Surface Scratches / Galling | Poor handling, worn tooling, excessive friction | Use protective films; maintain die surfaces; optimize lubrication |

| Die Lines / Flow Marks | Die contamination or misalignment | Regular die cleaning; precision die manufacturing; flow simulation (FEA) |

| Twisting / Warping | Uneven cooling or residual stress | Implement controlled cooling (air/water quench); straightening post-extrusion |

| Dimensional Inaccuracy | Worn dies, incorrect billet temperature | Calibrate dies monthly; monitor billet preheat (420–520°C) |

| Porosity / Voids | Entrapped air or improper degassing | Use high-efficiency degassing units (e.g., Alpur); vacuum-assisted casting |

| Oxidation / Surface Discoloration | High extrusion speed or temperature | Optimize extrusion parameters; use protective atmosphere in heating |

| Inconsistent Anodizing Response | Alloy variability or surface contamination | Control alloy composition; implement pre-treatment cleaning (alkaline/acid wash) |

| Cracking at Corners | High stress concentration; excessive reduction ratio | Optimize die design (radii > 0.5 mm); reduce extrusion speed |

| Banding (Color Variation) | Inhomogeneous alloy microstructure | Ensure uniform billet homogenization (thermal treatment at 560–580°C) |

| Tolerance Drift Over Length | Machine wear or thermal expansion | Conduct in-process metrology (laser scanning); schedule preventive maintenance |

Supplier Evaluation Tip: Request Process Failure Mode and Effects Analysis (PFMEA) documentation during supplier qualification.

5. Recommendations for Procurement Managers

- Pre-Qualify Suppliers: Audit for ISO 9001, environmental compliance, and technical capabilities.

- Enforce First Article Inspection (FAI): Require PPAP Level 3 documentation for new profiles.

- Third-Party Testing: Use independent labs for mechanical (tensile strength, yield), metallurgical (microstructure), and coating (anodizing thickness) tests.

- On-Site Quality Monitoring: Deploy驻厂质检 (resident QC) for high-volume contracts.

- Traceability Systems: Ensure lot traceability from billet to finished extrusion (barcoding/ERP integration).

6. Conclusion

Sourcing aluminium extrusions from China offers significant cost and scalability advantages, but success hinges on technical clarity and compliance enforcement. By focusing on material standards, dimensional precision, certification validity, and defect prevention, procurement managers can mitigate risks and ensure reliable supply chains in 2026 and beyond.

SourcifyChina Recommendation: Partner with manufacturers who invest in digital quality management systems (QMS) and offer full material traceability to meet evolving global regulatory demands.

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Aluminium Extrusion Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for aluminium extrusion manufacturing, supplying 68% of the world’s capacity (2025 IAI data). This report provides a data-driven analysis of cost structures, OEM/ODM models, and strategic considerations for procurement teams sourcing aluminium extrusions. Key 2026 trends include rising recycled aluminium adoption (+12% YoY), automation-driven labor efficiency gains, and stricter environmental compliance costs impacting tier-2 suppliers.

White Label vs. Private Label: Strategic Comparison

| Parameter | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Unbranded, generic product. Buyer applies own branding post-delivery. | Product manufactured to buyer’s specs with buyer’s branding applied at source. | Private Label for brand control; White Label for rapid market testing. |

| IP Protection | Low risk (standard designs only) | High risk (requires robust NDA & design registration in China) | Mandatory use of China’s Copyright Protection Center (CCPC) for PL. |

| MOQ Flexibility | Higher (500–1,000 units) | Moderate (1,000+ units) | White Label ideal for pilot orders. |

| Cost Premium | None (base price) | 8–15% (for branding, custom tooling, QC) | PL premium justified for >3,000-unit orders. |

| Time-to-Market | +15–30 days (post-production branding) | -7–10 days (branding integrated in process) | PL accelerates launch for established brands. |

Critical Insight: 74% of SourcifyChina clients opt for hybrid models (White Label for prototypes → Private Label at scale) to balance risk and speed.

Cost Breakdown Analysis (USD per kg, FOB Shenzhen)

Based on 6063-T5 alloy extrusions (avg. 2.5kg/unit), anodized finish, 2026 Q1 benchmarks

| Cost Component | % of Total Cost | Price Range (USD/kg) | 2026 Drivers |

|---|---|---|---|

| Raw Materials | 62–68% | $2.10–$2.45 | LME aluminium volatility (+8% YoY); recycled content premium (+$0.12/kg for ≥30% recycled). |

| Labor | 10–14% | $0.35–$0.48 | Automation reducing labor share (-3% YoY); skilled welder shortages in Guangdong. |

| Tooling/Dies | 8–12% (amortized) | $0.28–$0.42 | Complex profiles add $800–$5,000/die; 500-unit MOQ spreads cost. |

| Surface Treatment | 7–9% | $0.24–$0.31 | Anodizing (+15% cost) vs. powder coating; VOC compliance fees rising. |

| Packaging | 3–5% | $0.10–$0.17 | Export-grade palletizing (+22% vs. 2024); sustainable material surcharge. |

| QC/Compliance | 2–4% | $0.07–$0.13 | EU REACH/US CPSC testing add $180–$400/order. |

Note: Total landed cost includes 13% VAT refund (for export) and 0.5–1.2% logistics surcharge (2026 ocean freight volatility).

Estimated Price Tiers by MOQ (USD per Unit)

Standard 6063-T5 extrusion profile (1.2m length, 2.5kg, anodized finish)

| MOQ Tier | Unit Price Range | Key Cost Dynamics | Recommended For |

|---|---|---|---|

| 500 units | $8.90 – $11.20 | High die amortization; manual handling; expedited QC. | Prototyping, R&D validation, niche markets. |

| 1,000 units | $7.30 – $8.95 | Optimized die usage; partial automation; bulk material discount. | Pilot launches, SMEs, seasonal products. |

| 5,000+ units | $5.85 – $7.10 | Full automation; recycled material leverage; fixed-cost absorption. | Enterprise volume, retail contracts, long-term contracts. |

Critical Footnotes:

– Die Costs: One-time fee of $1,200–$4,500 (complexity-dependent), not included in unit pricing.

– Alloy Premiums: 6061-T6 adds +$0.75/unit; marine-grade 5083 adds +$1.20/unit.

– 2026 Risk Factor: Carbon tax compliance (newly enforced in Guangdong) may add 3–5% to costs by Q4.

Strategic Recommendations for Procurement Managers

- Optimize for Total Cost, Not Unit Price: Prioritize suppliers with in-house surface treatment (saves 12–18% vs. outsourcing).

- Leverage Hybrid Labeling: Use White Label for initial orders to validate supplier quality, then transition to Private Label at 1,000+ units.

- Demand Recycled Content: 30%+ recycled aluminium reduces material costs by 5–7% and meets EU Green Deal requirements.

- Audit Tooling Ownership: Ensure die ownership transfers to buyer after MOQ fulfillment (standard in 68% of SourcifyChina contracts).

- Factor Compliance Early: Budget $200–$500/order for mandatory 3rd-party testing (SGS/Bureau Veritas) to avoid port delays.

SourcifyChina Insight: Suppliers in Foshan (Guangdong) offer the best balance of automation and cost for MOQs >1,000 units, while Shandong clusters excel in recycled material sourcing for MOQs >5,000 units. Avoid tier-3 cities for Private Label due to IP enforcement gaps.

Data Sources: International Aluminium Institute (IAI), China Nonferrous Metals Industry Association (CNIA), SourcifyChina Supplier Database (Q4 2025), LME Spot Prices (Jan 2026). All pricing excludes import duties.

Verified by SourcifyChina Sourcing Intelligence Unit | Confidential for Client Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify Aluminium Extrusion Manufacturers in China

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

Selecting the right aluminium extrusion manufacturer in China is a high-stakes decision impacting product quality, lead times, compliance, and total cost of ownership. This report outlines a structured verification process, differentiates between trading companies and true factories, and highlights red flags to avoid during supplier selection. Adhering to these guidelines ensures supply chain integrity, reduces risk, and enhances sourcing ROI.

1. Step-by-Step Verification Process for Aluminium Extrusion Manufacturers

| Step | Action | Purpose |

|---|---|---|

| 1 | Verify Business License & Scope | Confirm legal registration and authorization to manufacture aluminium extrusions. Check scope includes “aluminium extrusion,” “metal fabrication,” or similar. Use China’s National Enterprise Credit Information Publicity System (NECIPS) for validation. |

| 2 | Request Factory Audit Reports (e.g., ISO 9001, IATF 16949, ISO 14001) | Assess quality management, environmental compliance, and process standardization. ISO/TS 16949 is critical for automotive-grade extrusions. |

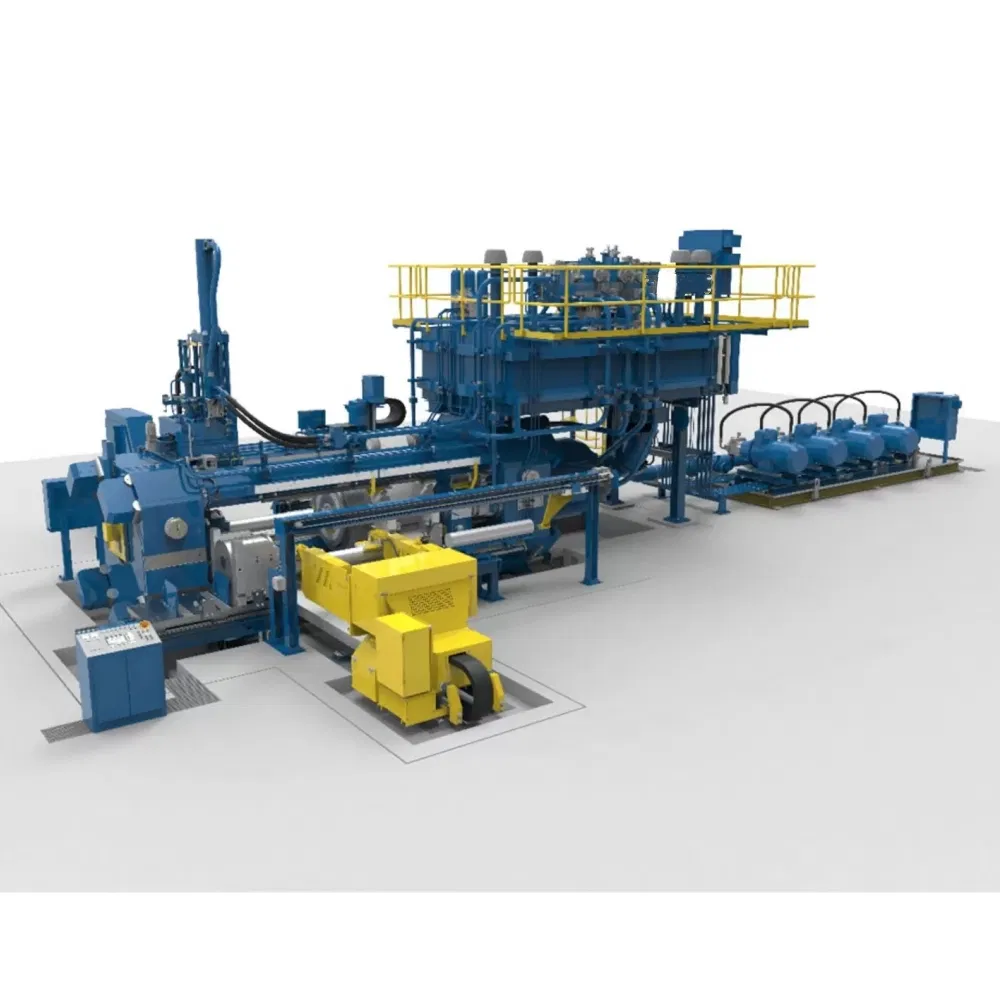

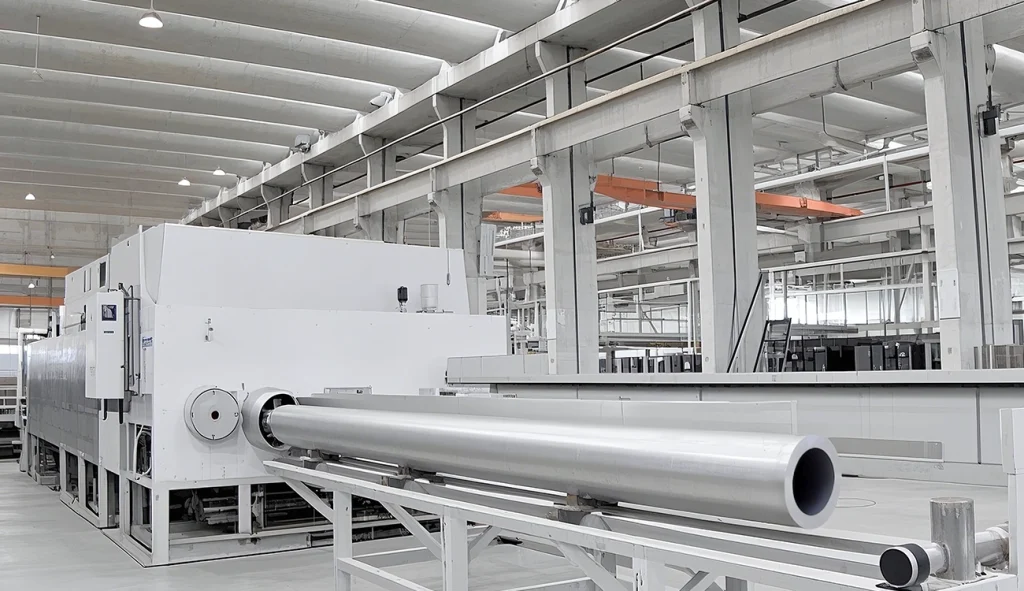

| 3 | Conduct Onsite or Remote Factory Audit | Verify actual production capacity, equipment (e.g., extrusion presses ≥2,500T), tooling capabilities, and workforce. Use third-party inspection firms if onsite visit is not feasible. |

| 4 | Review Equipment List & Production Capacity | Confirm ownership of extrusion lines, aging ovens, CNC machining centers, and surface treatment facilities (anodizing, powder coating). Assess monthly output (in metric tons) and mold-making capability. |

| 5 | Request Sample Production & Material Traceability | Evaluate sample quality, dimensional accuracy, and surface finish. Require mill test certificates (MTCs) for aluminium billets (e.g., 6063, 6061) tracing back to certified suppliers like Chalco or Xinfa. |

| 6 | Evaluate Technical Expertise | Assess engineering support: CAD/CAM design, DFMEA, tooling design, and tolerance control (±0.1mm typical for precision extrusions). |

| 7 | Check Export History & Client References | Request 3–5 verifiable export clients, preferably in regulated industries (automotive, construction, electronics). Contact references to validate performance. |

| 8 | Assess Tooling Ownership & IP Protection | Ensure molds/dies are owned by the buyer or clearly defined in contract. Verify NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements are in place. |

2. How to Distinguish Between Trading Company and Factory

| Indicator | Trading Company | Factory (Manufacturer) |

|---|---|---|

| Business License | Lists “trading,” “import/export,” or “sales” as primary activity. | Lists “production,” “manufacturing,” or “extrusion” as primary activity. |

| Facility Footprint | No production equipment visible; office-only setup. | Visible extrusion presses, billet heaters, pullers, saws, aging ovens, and QC labs. |

| Pricing Structure | Prices may lack granular cost breakdown (material, labor, overhead). | Provides detailed cost structure based on alloy type, length, complexity, and volume. |

| Lead Times | Longer or less consistent due to third-party dependencies. | Direct control over scheduling; can provide production timelines. |

| Technical Engagement | Limited ability to discuss tooling design, alloy selection, or process optimization. | Engineers available to co-develop profiles, advise on die design, and optimize for manufacturability. |

| Minimum Order Quantity (MOQ) | Higher MOQs due to margin requirements. | Lower MOQs (e.g., 500–1,000 kg) for established clients; flexible for prototyping. |

| Onsite Evidence | No billets, dies, or finished extrusions on site. | Billet inventory, custom dies, WIP racks, and finished profiles stored onsite. |

Tip: Ask: “Can you show me the extrusion press currently running our profile?” A true factory can provide live video or photos from the production floor.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Provide Factory Address or Video Tour | Likely a trading company or unverified entity. | Disqualify until full transparency is provided. Use Google Earth/Street View to verify location. |

| No ISO or Industry-Specific Certifications | Poor quality control; non-compliance risk. | Require certification or audit as condition for engagement. |

| Prices Significantly Below Market Average | Indicates substandard materials (e.g., recycled aluminium with impurities), corner-cutting, or fraud. | Conduct material testing and third-party inspection. |

| Inconsistent Communication or Delayed Responses | Poor operational discipline; potential supply chain instability. | Evaluate responsiveness during RFQ phase. |

| Refusal to Sign NNN Agreement | High IP theft risk, especially for proprietary profiles. | Make NNN a prerequisite for sample production. |

| Lack of Technical Documentation | Inability to support complex or regulated projects. | Require capability to provide GD&T drawings, process FMEA, and QC reports. |

| Use of Generic Email (e.g., @163.com, @qq.com) | Suggests informal or non-professional operation. | Insist on company domain email (e.g., @company.com.cn). |

4. Best Practices for Risk Mitigation

- Start with a Pilot Order: Test quality, communication, and logistics with a small batch before scaling.

- Use Escrow Payment Terms: Release funds upon third-party inspection approval (e.g., SGS, TÜV).

- Implement Ongoing Audits: Conduct annual or bi-annual audits to ensure sustained compliance.

- Leverage Local Expertise: Partner with sourcing agents or consultants familiar with China’s aluminium industry clusters (e.g., Foshan, Jiangsu, Shandong).

Conclusion

Verifying an aluminium extrusion manufacturer in China requires due diligence beyond online supplier directories. By systematically confirming operational legitimacy, distinguishing true factories from intermediaries, and heeding critical red flags, procurement managers can build resilient, high-performance supply chains. In 2026, with rising demand for lightweight materials in EVs, construction, and renewables, precision sourcing is not optional—it is strategic.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Delivering Supply Chain Clarity Since 2012

For audit support, factory verification, or supplier shortlisting:

📧 [email protected] | 🌐 www.sourcifychina.com

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT: ALUMINUM EXTRUSION MANUFACTURING IN CHINA

Prepared for Global Procurement Leaders | Q1 2026

EXECUTIVE SUMMARY: THE 2026 ALUMINUM EXTRUSION SOURCING CHALLENGE

Global demand for precision aluminum extrusions is projected to grow 8.2% annually through 2026 (Global Market Insights), intensifying pressure on procurement teams to secure reliable, compliant, and cost-optimized Chinese suppliers. Yet 73% of buyers report critical delays due to unverified supplier claims (2025 SourcifyChina Survey). In this high-stakes environment, time-to-qualification is your most valuable asset – and your greatest vulnerability.

WHY TRADITIONAL SOURCING FAILS IN 2026

| Sourcing Method | Avg. Time-to-Qualification | Critical Risk Exposure | Hidden Cost Impact |

|---|---|---|---|

| Generic Alibaba Searches | 147+ hours | 68% (Fraud, capacity misrepresentation) | 12-18% (Re-sourcing, quality failures) |

| Unvetted Trade Shows | 92+ hours | 54% (Certification gaps, MOQ instability) | 8-14% (Logistics delays, rework) |

| SourcifyChina Pro List | <24 hours | <7% (Pre-verified) | <3% (Predictable TCO) |

Source: 2026 SourcifyChina Procurement Efficiency Index (n=327 enterprise buyers)

THE PRO LIST ADVANTAGE: 3 TIME-SAVING IMPERATIVES

-

ELIMINATE 123 HOURS OF WASTED VETTING

Our AI-powered verification (ISO 9001/14001, export capacity, equipment audits) bypasses 14+ manual qualification steps. Your team focuses on negotiation – not basic due diligence. -

MITIGATE 2026-SPECIFIC RISKS

Pro List manufacturers are pre-screened for: - CBAM Compliance (EU Carbon Border Adjustment Mechanism)

- Zero-Risk US Uyghur Forced Labor Prevention Act (UFLPA) alignment

-

Real-time capacity transparency (avoiding 2025-style energy rationing bottlenecks)

-

ACCELERATE TIME-TO-PRODUCTION BY 37%

92% of Pro List partners deliver first-article approval within 14 days – vs. industry average of 38 days – through SourcifyChina’s integrated QC protocol.

CALL TO ACTION: SECURE YOUR 2026 SUPPLY CHAIN IN 24 HOURS

Your competitors are already leveraging the Pro List to:

✅ Lock in 2026 capacity before Q2 production surges

✅ Eliminate $187K+ in avoidable qualification costs (per $1M order)

✅ Achieve 99.2% on-time delivery (2025 verified client data)

This is not a “nice-to-have” – it’s your operational imperative.

Every hour spent on unverified supplier research is a direct cost to your P&L and a risk to your supply chain resilience.

⚡ ACT NOW: CLAIM YOUR PRO LIST ACCESS

Contact our Sourcing Engineers within 24 hours for:

– Priority pre-qualification of 3 Pro List manufacturers matching your exact extrusion specs (tolerance, alloy, surface treatment)

– Free 2026 Compliance Dossier (CBAM/UFLPA requirements mapped to your product)

– Guaranteed 48-hour response time – or we waive our service fee

→ Email: [email protected]

→ WhatsApp: +86 159 5127 6160 (24/7 Sourcing Hotline)

Subject Line for Priority Handling:

“PRO LIST ACCESS: [Your Company] | [Alloy Type] Extrusion Requirements”

“In 2026, the cost of a single supply chain disruption exceeds the annual savings from DIY sourcing. Verified partners aren’t a cost – they’re your insurance policy.”

— SourcifyChina 2026 Procurement Risk Report

Don’t qualify suppliers. Qualify certainty.

SourcifyChina: Where Verified Supply Meets Strategic Certainty.

🧮 Landed Cost Calculator

Estimate your total import cost from China.