The global aluminium doors and windows market is experiencing robust growth, driven by rising urbanization, increasing demand for energy-efficient building materials, and the expanding construction sector—particularly in emerging economies. According to a report by Mordor Intelligence, the market was valued at USD 139.2 billion in 2023 and is projected to reach USD 207.8 billion by 2029, growing at a CAGR of approximately 6.8% during the forecast period. This growth is further amplified by the material’s inherent advantages, including durability, low maintenance, and superior thermal performance, making aluminium a preferred choice in both residential and commercial construction. As sustainability and architectural aesthetics gain prominence, manufacturers are investing heavily in innovation, such as thermally broken profiles and smart window integration. Against this backdrop, identifying the leading aluminium doors and windows manufacturers becomes critical for architects, developers, and procurement professionals seeking high-performance, reliable solutions. The following list highlights the top 10 manufacturers shaping the industry through technological advancement, global reach, and consistent product excellence.

Top 10 Aluminium Doors And Windows Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Aluprof

Domain Est. 2001

Website: aluprof.com

Key Highlights: Aluprof is an internationally acclaimed producer of systems for aluminium windows, doors and facades, as well as modern sunshades and pergolas in Europe….

#2 Windows and Doors

Domain Est. 1995

Website: marvin.com

Key Highlights: Marvin creates windows and doors inspired by how people live. Explore our product lines and enhance your new construction, remodel or replacement project….

#3 Atrium Windows & Doors

Domain Est. 1996

Website: atrium.com

Key Highlights: Atrium manufactures energy efficient replacement windows, new-construction windows and patio doors designed to increase the comfort and beauty of any home….

#4 Manufacturers of vinyl and aluminum windows and doors …

Domain Est. 1997 | Founded: 1957

Website: intlwindow.com

Key Highlights: Since 1957, International Window Corporation (IWC) has manufactured outstanding vinyl and aluminum windows and doors known for their comfort, convenience and ……

#5 Door and Window Manufacturer

Domain Est. 1998

Website: crystalwindows.com

Key Highlights: Crystal Windows is a leading U.S. door and window manufacturer delivering custom solutions known for quality, durability, and energy efficiency….

#6 NT Window

Domain Est. 2000

Website: ntwindow.com

Key Highlights: NT Window is a leading window manufacturer of replacement windows in the Southern United States. All windows are NFRC and AAMA certified. Contact us today!…

#7 Reynaers

Domain Est. 1996

Website: reynaers.com

Key Highlights: Reynaers Aluminium is a leading specialist in the development and marketing of innovative, sustainable aluminium solutions for windows, doors and façades….

#8 Aluminum Windows & Doors

Domain Est. 1996

Website: andersenwindows.com

Key Highlights: Aluminum windows & doors provide a virtually maintenance-free exterior that resists the elements. Our selection offers a wide variety of colors and styles….

#9 Commercial Windows and Doors & Aluminum Window Replacement …

Domain Est. 1998

Website: boydaluminum.com

Key Highlights: Boyd builds commercial windows and doors, specializing in all areas of commercial windows aluminum including aluminum window replacement….

#10 MI Windows and Doors

Domain Est. 2004

Website: miwindows.com

Key Highlights: MI Windows and Doors provides simply better built windows. At MI you will find the best replacement and new construction windows….

Expert Sourcing Insights for Aluminium Doors And Windows

H2: 2026 Market Trends for Aluminium Doors and Windows

As the construction and architectural sectors evolve, the global market for aluminium doors and windows is poised for significant transformation by 2026. Driven by technological innovation, sustainability demands, and shifting consumer preferences, the aluminium fenestration industry is adapting to meet the needs of modern infrastructure. Below are key market trends expected to shape the aluminium doors and windows sector in 2026.

Sustainable and Energy-Efficient Designs

Environmental concerns and stringent energy regulations are pushing manufacturers toward eco-friendly aluminium solutions. By 2026, demand for thermally broken aluminium profiles, double- or triple-glazed windows, and low-emissivity (Low-E) coatings will surge. These features enhance thermal insulation, reduce carbon footprints, and align with global green building standards such as LEED and BREEAM. Recyclable aluminium—already one of the most sustainable building materials—will further strengthen its appeal in energy-conscious markets.

Urbanization and High-Rise Construction

Rapid urbanization, especially in Asia-Pacific and Africa, will fuel demand for durable, lightweight, and low-maintenance building materials. Aluminium’s strength-to-weight ratio makes it ideal for high-rise residential and commercial buildings. In 2026, architects will increasingly specify aluminium doors and windows for skyscrapers due to their structural integrity, design flexibility, and resistance to corrosion and extreme weather.

Smart Building Integration

The rise of smart homes and intelligent buildings will significantly impact the aluminium fenestration market. By 2026, integration of IoT-enabled features—such as automated opening systems, sensors for temperature and humidity, and app-controlled window blinds—will become standard in premium aluminium door and window products. This trend will be particularly strong in North America and Western Europe, where smart home adoption is accelerating.

Design Innovation and Customization

Consumers and developers are demanding greater aesthetic flexibility. Aluminium’s malleability allows for sleek, minimalist designs with slimmer frames and larger glass areas—maximizing natural light and offering panoramic views. In 2026, expect widespread use of customizable finishes (e.g., wood grain, anodized, powder-coated) and modular systems that enable faster installation and architectural creativity.

Growth in Emerging Markets

Countries like India, Indonesia, Vietnam, and Nigeria are experiencing construction booms driven by expanding middle classes and government infrastructure initiatives. The affordability, durability, and low maintenance of aluminium make it a preferred choice over traditional materials like wood and steel. By 2026, these emerging economies will represent the fastest-growing segments in the aluminium doors and windows market.

Impact of Material and Supply Chain Dynamics

Global supply chain resilience and raw material costs will influence pricing and production strategies. Although aluminium is energy-intensive to produce, advancements in recycling technologies and the use of renewable energy in smelting are expected to stabilize costs. Manufacturers will increasingly localize production to mitigate trade uncertainties and transportation expenses, especially in response to geopolitical fluctuations.

Regulatory Influence

Building codes and energy efficiency mandates will continue to shape product development. The EU’s Energy Performance of Buildings Directive (EPBD) and similar regulations in the U.S. and China will drive demand for high-performance aluminium systems. By 2026, compliance with such standards will be a key competitive advantage for manufacturers.

In conclusion, the 2026 aluminium doors and windows market will be defined by sustainability, technological integration, urban growth, and customization. Companies that invest in innovation, eco-design, and regional market adaptation will be well-positioned to capitalize on these evolving trends.

Common Pitfalls When Sourcing Aluminium Doors and Windows (Quality, IP)

Sourcing aluminium doors and windows involves navigating various challenges, particularly around quality assurance and intellectual property (IP) protection. Failing to address these pitfalls can lead to substandard products, legal risks, and reputational damage. Below are key areas to watch:

Poor Material Quality

One of the most frequent issues is receiving aluminium profiles made from substandard alloys or incorrect thicknesses. Some suppliers may use recycled or off-spec materials to cut costs, leading to reduced structural integrity, corrosion, and shorter product lifespan. Always verify compliance with international standards such as ISO 9001 or EN 14024.

Inadequate Surface Finishing

Low-quality anodizing or powder coating can result in fading, chipping, or uneven finishes. Poor surface treatment compromises both aesthetics and durability, especially in harsh weather conditions. Ensure suppliers provide test reports for coating thickness (e.g., 60–80 microns for powder coating) and adherence to standards like Qualicoat or AAMA.

Weak Thermal Performance

Many aluminium windows fail to deliver good thermal insulation if they lack proper thermal breaks. Sourcing non-thermally broken profiles in cold climates leads to energy inefficiency and condensation. Confirm that the profiles include polyamide thermal breaks and meet U-value requirements for your region.

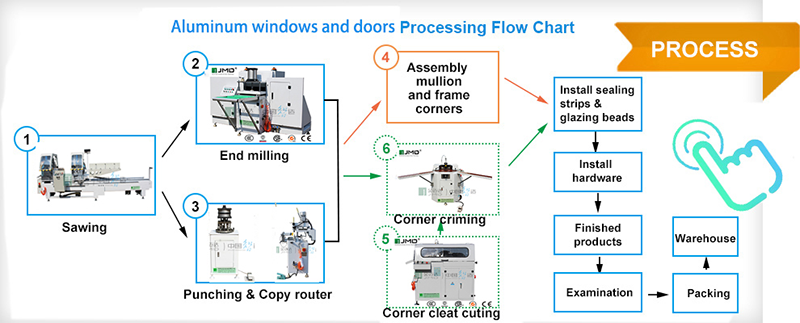

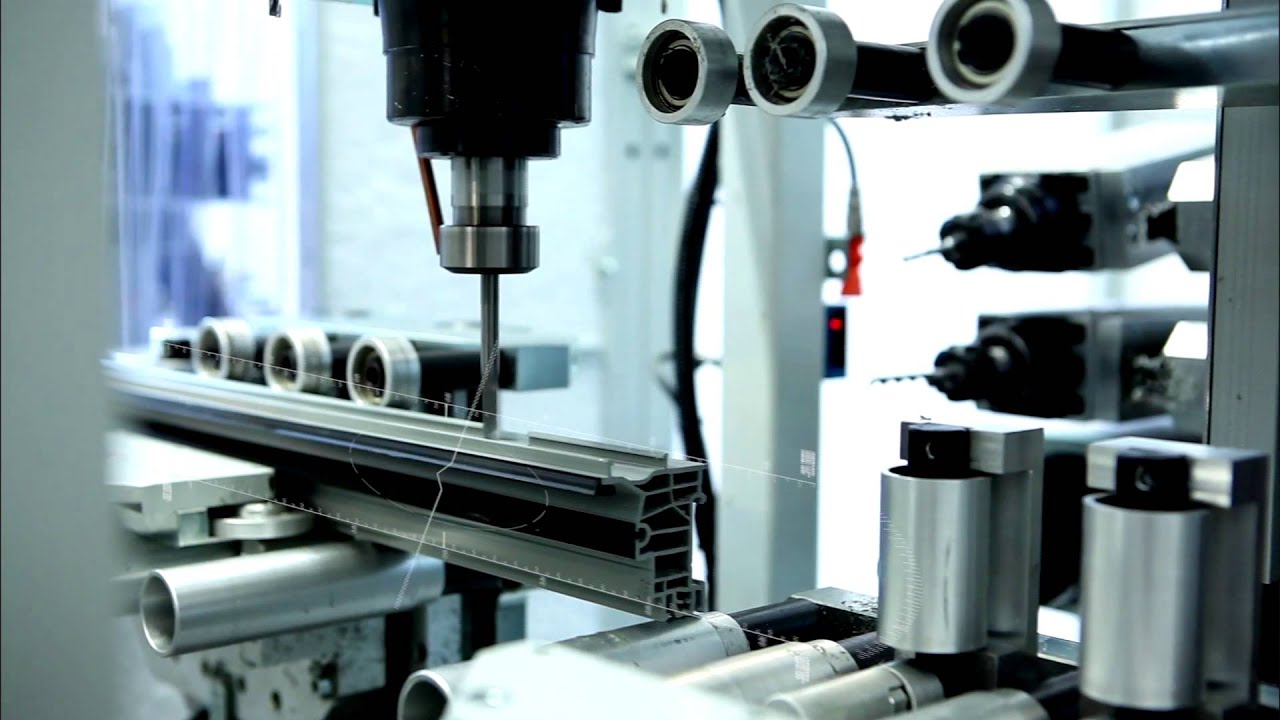

Inconsistent Manufacturing Tolerances

Poorly manufactured components may not fit together correctly during installation, leading to air leaks, water ingress, and operational issues. Check that suppliers use CNC machinery and maintain tight tolerances (±0.5 mm or better) across all components.

Lack of Certification and Testing

Reputable suppliers should provide third-party test reports for air/water penetration, structural load resistance, and thermal performance. Beware of suppliers who cannot produce valid certifications from accredited labs, as this may indicate non-compliance with building codes.

Intellectual Property (IP) Infringement

Many popular window systems (e.g., Schüco, Reynaers, Aluk) are protected by patents and trademarks. Sourcing “look-alike” products from manufacturers that replicate patented designs can expose buyers to IP litigation. Always verify that the supplier owns the design or has proper licensing rights.

Hidden Costs and Unclear Specifications

Some suppliers quote low prices but omit costs for hardware, glazing, or installation accessories. Additionally, vague product specifications can lead to mismatched expectations. Request detailed quotations and technical drawings before placing orders.

Inadequate After-Sales Support and Warranty

Lack of reliable technical support, spare parts availability, or enforceable warranties can pose long-term risks. Choose suppliers with a clear warranty policy (e.g., 10–15 years on finishes) and established service networks.

Conclusion

To avoid these pitfalls, conduct thorough due diligence: audit suppliers, request samples, verify certifications, and consult legal experts when IP concerns arise. Investing time upfront ensures high-quality, compliant, and legally safe aluminium doors and windows.

Logistics & Compliance Guide for Aluminium Doors and Windows

Product Classification and HS Code

Aluminium doors and windows are typically classified under the Harmonized System (HS) Code 7610.90, which covers “Doors, windows and their frames and thresholds, of aluminum.” Accurate classification is essential for international shipping, customs clearance, and determining applicable duties and taxes. Always verify the exact HS code with local customs authorities, as sub-classifications may vary by country.

Packaging and Handling Requirements

Proper packaging is critical to prevent damage during transit. Aluminium doors and windows should be:

– Wrapped in protective plastic film or kraft paper to prevent scratches and corrosion.

– Secured with corner protectors, especially on frame edges.

– Palletized and tightly strapped to prevent shifting.

– Labeled with handling instructions such as “Fragile,” “This Side Up,” and “Protect from Moisture.”

– Stored and transported in a dry, well-ventilated environment to avoid oxidation or water damage.

Transportation and Shipping Considerations

When shipping aluminium doors and windows:

– Use enclosed, dry freight containers or trucks to protect from weather and contaminants.

– Ensure cargo is evenly distributed and secured to minimize movement.

– For international shipments, choose reliable freight forwarders experienced with building materials.

– Consider dimensional weight and oversized load regulations for large units.

– Coordinate delivery schedules with on-site construction timelines to prevent long-term outdoor storage.

Import/Export Documentation

Key documentation for international trade includes:

– Commercial Invoice

– Packing List

– Bill of Lading (for sea) or Air Waybill (for air)

– Certificate of Origin

– Import/Export License (if required by the destination country)

– Customs Declaration Form

Ensure all documents accurately describe the product, quantity, value, and HS code to avoid delays or penalties.

Regulatory Compliance and Standards

Aluminium doors and windows must comply with relevant national and international standards, including:

– ISO 9001: Quality management systems.

– EN 14351-1: European standard for windows and doors (CE marking required for EU market).

– ASTM E283/E330: U.S. standards for air and water infiltration and structural performance.

– AS/NZS 2047: Australian and New Zealand standard for windows and external doors.

– Energy Efficiency Regulations: Such as NFRC ratings (U.S.) or Window Energy Rating Scheme (WERS) in Australia.

Verify compliance with target market regulations and obtain necessary certifications before export.

Environmental and Sustainability Compliance

Many markets require adherence to environmental standards:

– REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals – ensure no restricted substances in coatings or finishes.

– RoHS Compliance: Restriction of Hazardous Substances, particularly relevant for coated or treated aluminium.

– Recyclability: Aluminium is highly recyclable; provide documentation supporting sustainable practices if marketing eco-friendly products.

Customs Duties and Trade Agreements

Research applicable tariffs based on the destination country. Leverage free trade agreements (e.g., USMCA, RCEP, or EU-South Korea FTA) where eligible to reduce or eliminate import duties. Obtain a Certificate of Origin to claim preferential tariff treatment under such agreements.

Installation and On-Site Compliance

Ensure products meet local building codes for:

– Wind load resistance

– Thermal performance (U-values)

– Acoustic insulation

– Safety glazing requirements

– Accessibility standards (e.g., ADA in the U.S.)

Provide installers with technical specifications, compliance certificates, and installation manuals to ensure code-compliant fitting.

After-Sales and Warranty Logistics

Establish a clear process for handling returns, replacements, and warranty claims:

– Track product batches and serial numbers for traceability.

– Maintain spare parts inventory for common components.

– Define response timeframes for service requests in customer contracts.

Conclusion

Successful logistics and compliance for aluminium doors and windows require attention to detail across classification, packaging, transportation, documentation, and regulatory standards. Proactive planning ensures smooth cross-border operations, minimizes risks, and supports market access in compliance with local and international requirements.

In conclusion, sourcing aluminium doors and windows offers a compelling combination of durability, energy efficiency, low maintenance, and aesthetic versatility, making them an excellent choice for both residential and commercial projects. Their resistance to corrosion, minimal upkeep requirements, and ability to support large glass panes enhance natural light and architectural appeal. When sourcing, it is crucial to evaluate factors such as material quality, thermal performance (e.g., thermal break technology), compliance with industry standards, and the reputation of suppliers or manufacturers. Additionally, considering local climatic conditions and long-term lifecycle costs can ensure optimal performance and return on investment. By partnering with reliable suppliers and prioritizing high-quality, sustainably produced aluminium systems, stakeholders can achieve durable, energy-efficient, and visually striking building solutions that stand the test of time.