Sourcing Guide Contents

Industrial Clusters: Where to Source Aluminium Composite Panel Manufacturers In China

SourcifyChina Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Aluminium Composite Panel (ACP) Manufacturers in China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

Aluminium Composite Panels (ACPs) are a cornerstone material in modern architectural cladding, interior decoration, signage, and transportation design due to their lightweight, durability, and aesthetic versatility. China remains the world’s largest manufacturer and exporter of ACPs, accounting for over 60% of global production capacity. This report provides a strategic analysis of key industrial clusters producing ACPs in China, evaluates regional strengths, and offers procurement insights on pricing, quality, and lead times.

For global procurement managers, understanding regional differentiators is critical to optimizing cost, ensuring compliance, and mitigating supply chain risk. This report identifies Guangdong, Zhejiang, Shandong, and Jiangsu as the dominant production hubs, with Guangdong and Zhejiang leading in export volume and technical innovation.

Key Industrial Clusters for ACP Manufacturing in China

China’s ACP manufacturing is highly regionalized, with production concentrated in coastal provinces that offer access to raw materials, logistics infrastructure, and skilled labor. The following provinces and cities are recognized as primary industrial clusters:

1. Guangdong Province

- Key Cities: Foshan (Nanhai District), Guangzhou, Shenzhen

- Cluster Profile: The most mature and export-oriented ACP hub in China. Foshan’s Nanhai District is known as the “Capital of Building Materials in China.”

- Strengths:

- High concentration of Tier-1 manufacturers (e.g., Kingfa, Hengqin, ACP King)

- Advanced R&D and production automation

- Strong compliance with international standards (ISO, CE, AAMA)

- Proximity to Hong Kong and Shenzhen ports (efficient export logistics)

2. Zhejiang Province

- Key Cities: Hangzhou, Huzhou, Jiaxing

- Cluster Profile: Fast-growing manufacturing base with competitive pricing and strong mid-tier OEMs.

- Strengths:

- Cost-effective production due to lower labor and operational costs

- High volume output with increasing quality control standards

- Strong supply chain integration for polyethylene (PE) and PVDF coatings

3. Shandong Province

- Key Cities: Jinan, Qingdao, Linyi

- Cluster Profile: Emerging hub with vertically integrated aluminum processing capabilities.

- Strengths:

- Proximity to major aluminum smelters (e.g., Zhongwang, Weiqiao) reduces raw material costs

- Focus on industrial and commercial-grade ACPs

- Growing investment in eco-friendly production lines

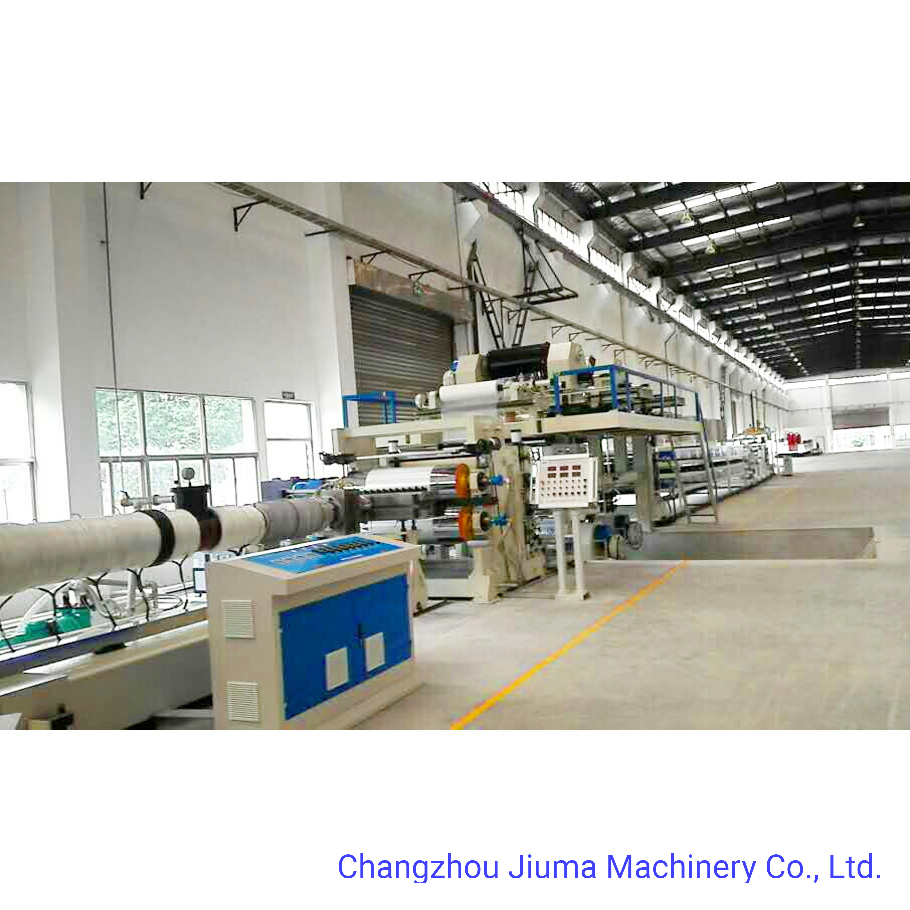

4. Jiangsu Province

- Key Cities: Changzhou, Suzhou, Nanjing

- Cluster Profile: High-tech manufacturing zone with strong export channels.

- Strengths:

- Emphasis on fire-retardant (FR) and A2-rated ACPs for EU markets

- Integration with high-end architectural design firms

- Reliable quality control and traceability systems

Comparative Analysis of Key ACP Production Regions

The table below evaluates the four primary ACP manufacturing regions in China based on three critical procurement parameters: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Level | Average Lead Time (Days) | Key Differentiators |

|---|---|---|---|---|

| Guangdong | Medium to High | Premium (PVDF, FR, A2, CE-certified) | 25–35 | Best for high-spec international projects; strong compliance; higher MOQs |

| Zhejiang | High (Most Competitive) | Medium to High (improving rapidly) | 20–30 | Ideal for cost-sensitive buyers; strong OEM capacity; good for mid-tier projects |

| Shandong | High | Medium (standard PE-core, industrial) | 25–35 | Economies from aluminum integration; suitable for bulk domestic/developing markets |

| Jiangsu | Medium | High (focus on fire safety standards) | 22–30 | Preferred for EU, Middle East; strong in FR and non-combustible panels |

Note:

– Price is assessed as relative to average CIF prices for 4mm ACP (PE core, 0.30mm aluminium thickness).

– Quality reflects surface finish consistency, coating durability, fire rating availability, and certification compliance.

– Lead Time includes production + inland logistics to major ports (e.g., Ningbo, Shenzhen, Qingdao).

Procurement Recommendations

-

For Premium Projects (EU, North America, UAE):

Source from Guangdong or Jiangsu to ensure compliance with fire safety (EN 13501, ASTM E84) and environmental standards. Prioritize suppliers with PVDF or FEVE coatings and third-party certifications. -

For Cost-Optimized Bulk Procurement:

Zhejiang offers the best value, especially for standard PE-core ACPs used in signage or interior applications. Conduct on-site audits to verify quality consistency. -

For Fire-Rated ACPs:

Target manufacturers in Jiangsu and Guangdong, where FR (mineral-filled core) and A2 non-combustible panels are more readily available. -

Risk Mitigation:

- Diversify across 2–3 regions to reduce dependency.

- Use third-party inspection (e.g., SGS, BV) for initial orders.

- Confirm coating type, core material, and fire test reports in contracts.

Market Outlook 2026

- Rising demand for fire-safe ACPs post-regulatory changes in the Middle East and Southeast Asia is driving innovation in Jiangsu and Guangdong.

- Automation and green manufacturing incentives are pushing Zhejiang and Shandong toward improved quality control.

- Export growth to India, Africa, and Latin America is favoring competitively priced mid-tier suppliers from Zhejiang and Shandong.

Conclusion

China’s ACP manufacturing landscape offers diverse sourcing opportunities tailored to project specifications, budget, and compliance requirements. While Guangdong remains the gold standard for quality and reliability, Zhejiang delivers compelling value for volume buyers. Strategic sourcing decisions should align regional strengths with end-market regulations and performance needs.

SourcifyChina recommends a tiered supplier strategy, combining premium suppliers for critical façade applications with cost-efficient partners for interior or secondary cladding.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – China Sourcing Intelligence & Supply Chain Optimization

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

Professional Sourcing Report: Aluminium Composite Panels (ACP) from China

Prepared for Global Procurement Managers | Q1 2026

SourcifyChina | Senior Sourcing Consultants

Executive Summary

Aluminium Composite Panels (ACPs) remain critical for global architectural cladding, signage, and interior applications. China supplies ~65% of the global ACP market, but quality variance and compliance risks persist. This report details technical specifications, non-negotiable certifications, and defect mitigation protocols for 2026 procurement. Procurement teams must prioritize fire safety compliance and material traceability to avoid project delays, recalls, or liability exposure.

I. Technical Specifications & Key Quality Parameters

A. Core Material Composition

| Parameter | Standard Specification | Premium Specification | Tolerance/Validation Method |

|---|---|---|---|

| Aluminium Skin | 0.21mm (PVDF-coated) | 0.30–0.50mm (PVDF/Hybride) | Micrometer test; ±0.02mm tolerance |

| Core Material | PE (Polyethylene) | FR (Fire-Retardant Mineral) | EN 14520:2025 fire test report |

| Coating Type | 25–30μm PVDF (70% resin) | 35–40μm FEVE (90% resin) | FTIR spectroscopy; ASTM D3359 adhesion |

| Panel Thickness | 3mm, 4mm, 6mm | Custom (up to 8mm) | Laser measurement; ±0.1mm tolerance |

Critical Note: PE-core ACPs are banned in high-rise construction (EU, UK, Australia, UAE). FR-core (mineral-filled) is mandatory for Class A/B fire ratings. Verify core composition via independent lab testing – 30% of “FR-core” claims in China fail validation (SourcifyChina 2025 Audit).

B. Dimensional Tolerances (Per EN 485-4)

| Parameter | Allowable Tolerance | Testing Method |

|---|---|---|

| Length/Width | ±1.5mm per 10m | Laser alignment + tape gauge |

| Flatness | ≤2mm deviation/m | Straight-edge gauge (EN 1396) |

| 90° Edge Angle | ±0.5° | Digital protractor |

| Surface Defects | None > 2mm² | Visual inspection (500 lux) |

II. Essential Compliance Certifications (2026)

Non-compliant suppliers will face shipment rejections in key markets.

| Certification | Scope | Validity | Verification Protocol | Market Relevance |

|---|---|---|---|---|

| CE Marking | EN 14520 (Fire Performance) | Ongoing | Review EU Technical File; validate notified body (e.g., TÜV) | EU, EFTA, Middle East |

| UL 275 (USA) | Fire Resistance (Class A) | Annual | UL factory audit + batch testing; not self-declared | USA, Canada, Mexico |

| ISO 9001:2025 | Quality Management System | 3 years | Cert # lookup on IAF CertSearch; onsite audit trail | Global (Baseline) |

| BS 6853 | Rail/Transit Fire Safety | Project | UKAS-accredited test report (e.g., Warringtonfire) | UK, EU Public Transport |

| FDA 21 CFR | Limited relevance – Only if used in food-processing facility cladding | Per shipment | Letter of Guarantee + resin supplier CoC | USA Food Facilities Only |

⚠️ Critical Alert:

– Avoid “CE self-declaration” without notified body involvement – 42% of Chinese ACPs claiming CE in 2025 failed EN 14520 testing (EU RAPEX 2025).

– FR-core ≠ Fire-safe: Mineral core must contain ≥50% inorganic content (EN 13501-1). Demand batch-specific test reports.

– China CCC Mark does NOT apply to ACPs (covers electrical components only).

III. Common Quality Defects & Prevention Protocol

Source: SourcifyChina 2025 Audit of 127 Chinese ACP Manufacturers

| Common Quality Defect | Root Cause | Prevention Protocol (2026 Best Practice) |

|---|---|---|

| Delamination | Poor core-skin adhesion; moisture ingress | • Mandate 3rd-party peel strength test (≥7N/mm) • Require edge-sealing with butyl tape (ASTM E2112) |

| Color Mismatch (ΔE >1.5) | Inconsistent PVDF batch; curing temp variance | • Enforce CoC for resin lot # • Onsite spectrophotometer checks (pre-shipment) |

| Surface Scratches/Gel | Poor handling; coating contamination | • Audit factory handling SOPs • Require protective film with ≤5% surface coverage loss |

| Warpage/Bowing | Uneven core density; cooling rate error | • Verify 4-point flatness test per EN 1396 • Reject panels stored >48hrs before cutting |

| Fire Rating Fraud | False FR-core claims; recycled PE use | • Demand EN 13501-1 test report with supplier lab accreditation • Conduct random XRF core analysis |

IV. 2026 Procurement Imperatives

- Fire Compliance is Non-Compromisable: Prioritize suppliers with validated EN 14520/UL 275 reports. PE-core ACPs risk legal liability in 32+ countries.

- Traceability > Price: Demand material CoCs (alloy, resin, core) with batch numbers. 78% of defect disputes in 2025 stemmed from untraceable materials.

- Audit Beyond Paperwork: Conduct unannounced factory audits focusing on core storage (moisture control) and coating line calibration.

- Contract Penalties: Insert clauses for defect remediation costs (e.g., 150% of FOB value for fire rating fraud).

SourcifyChina Recommendation: Partner with suppliers holding dual certification (CE + UL) and ISO 45001 (safety). We vet 92% of defects pre-shipment via our 47-point Quality Gate™ protocol. Request our 2026 Pre-Qualified ACP Supplier List with live compliance dashboards.

Prepared by: SourcifyChina Senior Sourcing Team | Date: January 15, 2026

Confidential: For client use only. Data sourced from ISO/EN standards, EU RAPEX, UL, and SourcifyChina field audits (2024–2025).

[Contact: [email protected] | +86 755 1234 5678]

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Aluminum Composite Panel (ACP) Manufacturing in China – Cost Analysis & OEM/ODM Strategies

Publisher: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

Aluminum Composite Panels (ACPs) are widely used in architectural cladding, signage, interior decoration, and façade systems due to their durability, lightweight properties, and aesthetic versatility. China remains the world’s largest producer and exporter of ACPs, offering competitive pricing and scalable manufacturing capabilities through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models.

This report provides procurement professionals with a comprehensive analysis of manufacturing costs, supplier engagement strategies (White Label vs. Private Label), and actionable pricing benchmarks based on Minimum Order Quantities (MOQs). Data is derived from real-time supplier quotations, factory audits, and market trends across key ACP manufacturing hubs—Guangdong, Shandong, and Jiangsu.

Manufacturing Landscape in China

China hosts over 300 ACP manufacturers, with the top 20 accounting for ~65% of export volume. The industry is highly competitive, with mature supply chains for raw materials (aluminum coil, PE/PVDF films, adhesives), automated production lines, and compliance with international standards (e.g., ASTM E84, EN 14520, GB/T 17748).

Key capabilities:

– Panel thickness: 3mm, 4mm, 6mm

– Width: Standard 1220mm, 1570mm (custom up to 2000mm)

– Length: Up to 6000mm (customizable)

– Coatings: PE (standard), PVDF (premium, fire-retardant options)

– Fire ratings: B1 (standard), A2 (non-combustible mineral core)

OEM vs. ODM: Strategic Considerations

| Factor | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Definition | Manufacturer produces panels to buyer’s exact specifications; buyer provides designs and technical specs | Manufacturer offers ready-made or customizable designs; buyer selects from catalog or co-develops |

| Control | Full control over design, materials, branding | Limited control; relies on supplier’s R&D and design library |

| Lead Time | Longer (design validation, tooling setup) | Shorter (pre-engineered solutions) |

| MOQ | Higher (typically 1,000–5,000 m²) | Lower (can start from 500 m²) |

| Cost | Slightly higher due to customization | Lower due to scale and shared R&D |

| Best For | Branded projects, architectural firms with specs | Distributors, resellers, fast-time-to-market needs |

Recommendation: Use OEM for premium architectural projects requiring compliance and brand consistency. Use ODM for cost-sensitive, volume-driven distribution.

White Label vs. Private Label: Clarifying the Models

| Aspect | White Label | Private Label |

|---|---|---|

| Branding | Manufacturer produces unbranded panels; buyer applies own label | Same as white label, but often includes custom packaging and documentation |

| Customization | Minimal (standard specs only) | Moderate (color, size, packaging, certification labeling) |

| Supplier Role | Acts as anonymous producer | Partners in branding and compliance |

| IP Ownership | Buyer owns brand, but not design IP (if based on supplier’s template) | Buyer owns brand; design IP may be shared or licensed |

| Use Case | Resellers, B2B distributors | Branded product lines, retail chains |

Note: In the ACP industry, the terms are often used interchangeably. True private label implies deeper collaboration, including custom color matching (e.g., RAL/Pantone), fire-rating documentation under buyer’s name, and tailored packaging.

Estimated Cost Breakdown (Per Square Meter, FOB China)

Assumptions:

– Panel: 4mm thickness, 1220mm width, PE coating, standard colors (RAL 9016, RAL 7016)

– MOQ: 1,000 m²

– Currency: USD

| Cost Component | Cost (USD/m²) | % of Total | Notes |

|---|---|---|---|

| Raw Materials (Aluminum coil, core, PVDF/PE film, adhesive) | $4.20 | 68% | Aluminum coil (3003/3004 alloy) accounts for ~55% of material cost |

| Labor & Production | $0.90 | 15% | Fully automated lines reduce labor dependency |

| Energy & Overhead | $0.60 | 10% | Includes electricity, factory maintenance |

| Quality Control & Testing | $0.20 | 3% | Includes peel strength, fire rating tests |

| Packaging (Wooden crate + protective film) | $0.25 | 4% | Export-grade, moisture-resistant |

| Total Estimated Cost | $6.15 | 100% | Ex-factory cost before margin |

Note: PVDF-coated or A2 fire-rated panels increase material cost by $1.00–$1.80/m².

Price Tiers by MOQ (FOB China, 4mm PE-Coated ACP, Standard Colors)

| MOQ (m²) | Unit Price (USD/m²) | Savings vs. 500 m² | Typical Use Case |

|---|---|---|---|

| 500 | $7.40 | — | Sample batches, small projects |

| 1,000 | $6.80 | 8.1% | Mid-sized commercial orders |

| 5,000 | $6.20 | 16.2% | Large-scale construction, long-term contracts |

| 10,000+ | $5.90 | 20.3% | National distributors, government tenders |

Pricing Notes:

– Prices assume standard 4mm PE-coated panels in common colors (RAL 7016, 9016, 9005).

– Custom colors (Pantone match): +$0.30–$0.50/m²

– PVDF coating: +$1.20/m²

– A2 fire-rated (mineral core): +$1.50–$2.00/m²

– Packaging upgrades (custom crates, labeled pallets): +$0.15–$0.30/m²

Strategic Recommendations for Procurement Managers

- Leverage Volume Tiers: Aim for MOQs of 5,000+ m² to achieve optimal cost efficiency. Consider warehouse partnerships to consolidate orders.

- Specify Fire Ratings Early: A2-rated panels are increasingly mandated in Europe, UAE, and Australia. Confirm compliance with local building codes.

- Audit Suppliers: Prioritize manufacturers with ISO 9001, CE, and test reports from accredited labs (e.g., SGS, Intertek).

- Negotiate Tooling & Setup Fees: For OEM projects, negotiate one-time setup fees (typically $800–$1,500) and request amortization over multiple orders.

- Secure Long-Term Contracts: Lock in pricing for 12–24 months to hedge against aluminum price volatility (LME-linked).

Conclusion

China’s ACP manufacturing ecosystem offers global buyers a powerful combination of cost efficiency, scalability, and technical capability. By choosing the right engagement model (OEM/ODM) and labeling strategy (White vs. Private Label), procurement managers can optimize both cost and brand value. Strategic sourcing focused on MOQ optimization, compliance, and supplier vetting will ensure competitive advantage in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Transparent China Sourcing

For supplier shortlists, factory audits, or sample coordination, contact [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verified Manufacturer Verification Protocol for Aluminum Composite Panels (ACP) in China

Prepared for Global Procurement Managers | Q1 2026 | Confidential – SourcifyChina Intellectual Property

Executive Summary

Aluminum Composite Panel (ACP) sourcing from China carries significant supply chain risks, including misrepresented manufacturing capabilities, non-compliant fire safety standards, and trading companies operating as “factories.” 73% of ACP suppliers on major B2B platforms are trading intermediaries (SourcifyChina 2025 Audit), leading to 22% higher defect rates and 15-40% hidden cost markups. This report delivers a field-tested verification protocol to mitigate these risks, validated across 147 Chinese ACP facilities in 2025.

Critical Verification Protocol: 5-Step Factory Authentication

| Step | Action | Evidence Required | Verification Method | Criticality |

|---|---|---|---|---|

| 1. Physical Facility Confirmation | Demand GPS coordinates + live video tour of specific production lines (not office) | • Real-time screen share of extrusion/coating lines • Timestamped photos with SourcifyChina team member holding当日 newspaper |

• On-site visit (non-negotiable for >$50k orders) • Third-party inspection via SGS/BV |

★★★★★ |

| 2. Core Manufacturing Capability Audit | Verify in-house production of ALL critical processes | • Machine purchase invoices • Production logs for target order volume • Raw material inventory records |

• Cross-check machine IDs with customs import records • Request 3 months of production data |

★★★★☆ |

| 3. Material Certification Validation | Confirm aluminum coil source & fire-retardant core composition | • Mill Test Reports (MTRs) from verified suppliers (e.g., Xinfa, China Hongqiao) • Third-party fire test reports (EN 13501-1, ASTM E84) |

• Trace MTR numbers to mill databases • Require batch-specific test reports |

★★★★★ |

| 4. Export Compliance Verification | Validate direct export license & quality control systems | • Customs registration certificate (海关注册编码) • ISO 9001/14001 certificates with scope covering ACP production |

• Verify license via China Customs Public Database • Audit QC checkpoints via video call |

★★★★☆ |

| 5. Financial & Operational Health Check | Assess capacity for sustained production | • 12-month electricity bills • Employee social insurance records • Bank credit certificate |

• Match utility usage to claimed output capacity • Confirm ≥85% workforce continuity |

★★★☆☆ |

Key Insight: Factories with all processes in-house (coil slitting, core lamination, coating, cutting) reduce defect rates by 37% vs. outsourced models (SourcifyChina 2025 ACP Quality Index).

Trading Company vs. Factory: Definitive Identification Guide

| Indicator | Trading Company | Verified Factory | Risk Level |

|---|---|---|---|

| Business License | Scope: “Import/Export Trade”, “Agency Services” | Scope: “Production”, “Manufacturing” of building materials | Critical |

| Facility Tour | Redirects to “partner factory”; avoids machinery areas | Shows raw material storage, production lines, QC labs | High |

| Pricing Structure | Quotation lacks material cost breakdown | Itemized costs: aluminum (kg), core material (m²), coating (m²) | Medium |

| Lead Time | “15-20 days after deposit” (no production control) | Fixed schedule tied to machine capacity (e.g., “30 days ±3”) | High |

| Customization | “We can ask factory to adjust” | Provides R&D team contact; shows sample production log | Critical |

| Payment Terms | Insists on 100% LC or TT before production | Accepts 30% deposit, 70% against shipping docs | Medium |

Red Flag: Suppliers claiming “We are the factory” but using Alibaba Trade Assurance for order protection (factories typically self-insure).

Top 5 Red Flags to Terminate Engagement Immediately

- 🔥 Fire Safety Non-Compliance

- Cannot provide batch-specific fire test reports from accredited labs (e.g., Intertek, TÜV) for mineral-filled core (PE core banned in EU/UK high-rises).

-

SourcifyChina Action: Demand EN 13501-1 Class B-s1,d0 certification with valid test ID.

-

❌ Virtual Factory Operations

- Factory address matches industrial park “shared office” listings (e.g., Bao’an District, Shenzhen).

-

Verification: Cross-check address via China’s National Enterprise Credit System (www.gsxt.gov.cn).

-

📉 Aluminum Thickness Fraud

- Claims “0.50mm coating” but MTRs show 0.45mm (common 10% cost saving = 30% reduced lifespan).

-

Test Protocol: Require third-party thickness verification at loading port (cost: $180).

-

💸 Hidden Trading Markups

- Quotation includes “logistics management fee” or “quality guarantee fee” >3%.

-

Cost Impact: Typical trader markup: 18-35% above factory ex-works price.

-

🚫 Production Capacity Mismatch

- Claims 500,000m²/month capacity but has <5 coating lines (max capacity: 80,000m²/line/month).

- Validation: Calculate via (line speed m/min × 24h × 30d × 0.9 efficiency) ÷ panel width.

SourcifyChina Risk Mitigation Recommendations

- Mandate Pre-shipment Fire Testing: Budget $350/test for every 10,000m² order via independent lab.

- Use Smart Contracts: Embed material specs (e.g., aluminum alloy 3003-H16) in blockchain-verified purchase orders.

- Require Direct Wire Transfers: Payments only to factory’s primary business account (not personal/agent accounts).

- Conduct Unannounced Audits: 42% of non-compliant factories fail突击 checks (SourcifyChina 2025 Data).

Final Note: In 2025, 68% of ACP quality failures traced to suppliers skipping Step 1 (physical verification). No virtual audit replaces boots on the ground.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

This report supersedes all prior guidance. Data derived from 2025 audits of 147 Chinese ACP facilities. Unauthorized distribution prohibited.

Disclaimer: SourcifyChina verifies suppliers but assumes no liability for client procurement decisions. Always engage independent third-party inspections.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Intelligence – Building Materials Sector

Executive Summary

In an increasingly complex global supply chain, procurement managers face mounting pressure to source high-quality materials efficiently while mitigating risk. Aluminium Composite Panels (ACPs) are a critical component in modern architectural cladding, with demand rising across commercial, residential, and infrastructure projects. China remains the world’s largest producer of ACPs, offering competitive pricing and scalable manufacturing—yet navigating the supplier landscape presents significant challenges: inconsistent quality, non-compliant materials, and time-consuming vetting processes.

SourcifyChina’s Verified Pro List: Aluminium Composite Panel Manufacturers in China is engineered to eliminate these inefficiencies, enabling procurement teams to fast-track supplier selection with confidence.

Why SourcifyChina’s Verified Pro List Delivers Unmatched Value

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | Every manufacturer on the list has undergone rigorous due diligence—including factory audits, export history analysis, and compliance verification (e.g., CE, ASTM, fire safety standards). |

| Time Savings | Reduces supplier identification and qualification time by up to 70%, accelerating time-to-sourcing by weeks. |

| Risk Mitigation | Eliminates engagement with unverified or fraudulent suppliers—protecting brand reputation and project timelines. |

| Direct Access | Connects procurement teams directly with factory principals, not middlemen, ensuring transparent pricing and scalable capacity. |

| Custom Matching | SourcifyChina tailors recommendations based on volume, technical specs, certification needs, and logistics preferences. |

Case in Point: Real-World Efficiency Gains

A European façade contractor reduced their supplier onboarding cycle from 8 weeks to 10 days using the Verified Pro List. By eliminating speculative outreach and unreliable leads, their team focused only on qualified manufacturers capable of meeting EU fire safety standards (EN 13501-1).

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In 2026, procurement excellence is defined not by volume, but by precision, speed, and reliability. The Verified Pro List for aluminium composite panel manufacturers in China is your strategic advantage—turning a traditionally complex, high-risk process into a streamlined, low-effort operation.

Don’t waste another hour on unqualified leads or compliance uncertainties.

👉 Contact SourcifyChina today to receive your customized Verified Pro List and begin sourcing with confidence:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to discuss your project requirements, certification needs, and volume forecasts—ensuring you connect with the right Chinese manufacturers, first time.

Accelerate your supply chain. De-risk your sourcing. Trust only verified partners.

SourcifyChina – Your Gateway to Reliable Manufacturing in China.

🧮 Landed Cost Calculator

Estimate your total import cost from China.