The global aluminium channels market is experiencing robust growth, driven by rising demand across construction, automotive, and electronics sectors. According to Grand View Research, the global aluminium profiles market was valued at USD 98.7 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 6.3% from 2024 to 2030. This growth is fueled by aluminium’s lightweight properties, corrosion resistance, and sustainability—making it a preferred material in energy-efficient building designs and electric vehicle manufacturing. Additionally, Mordor Intelligence forecasts similar momentum, citing increased infrastructure development in emerging economies and the shift toward modular construction as key market drivers. With such upward trends, identifying the top aluminium channel manufacturers becomes critical for sourcing reliable, high-performance profiles. The following list highlights the nine leading companies shaping this expanding industry through innovation, quality, and global reach.

Top 9 Aluminium Channel Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Alcoa

Domain Est. 1986

Website: alcoa.com

Key Highlights: Aluminum. Our aluminum segment includes smelting, casting and select energy assets. · Alumina. We are the world’s largest third-party producer of alumina….

#2 80/20 Aluminum Extrusions

Domain Est. 1997

Website: 8020.net

Key Highlights: T-Slots, aluminum extrusions, and parts. Architectural solutions and frames for industrial machine guards, workstations, data center enclosures, and more….

#3 Aluminum Channel Supplier

Domain Est. 2013

Website: thyssenkrupp-materials-na.com

Key Highlights: thyssenkrupp Materials NA has Aluminum Channel in-stock of 6061 and 6063 alloys. We offer these products in many grades, sizes, and lengths to suit your …Missing: aluminium manu…

#4 Aluminum Channel Extrusions Manufacturer & Supplier in China

Domain Est. 2016

Website: wellste.com

Key Highlights: 100% inspected Aluminum Channel Extrusions, Guarantee the product quality. Approved by SGS, Reliable manufacturer with 20+ Years Experience!…

#5 SAF

Domain Est. 1992

Website: saf.com

Key Highlights: SAF is the leader in metals fabrication, finishing, and distribution around the world. Learn more about how we can turn your ideas into reality….

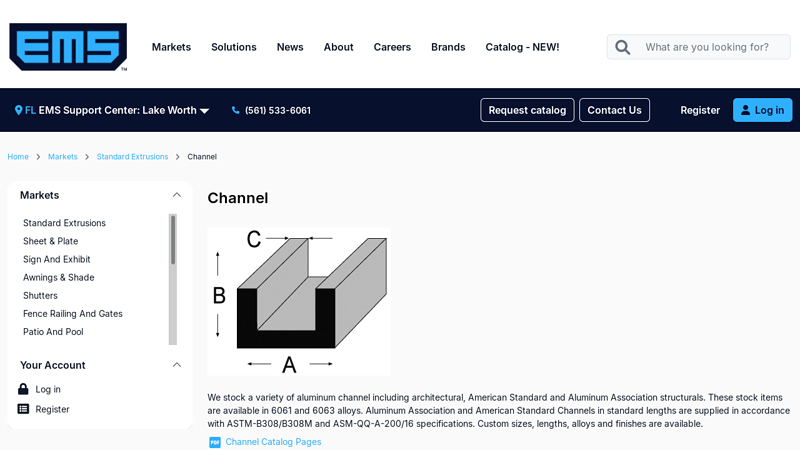

#6 Aluminum Channel Extrusions

Domain Est. 1996

Website: easternmetal.com

Key Highlights: We stock a variety of aluminum channel including architectural, American Standard and Aluminum Association structurals. These stock items are available in 6061 ……

#7 Aluminum Channel

Domain Est. 1998

Website: piercealuminum.com

Key Highlights: Pierce Aluminum supplies a full inventory of aluminum channel extrusions, as well as complete processing and fabrication services, at its 10 U.S. locations….

#8 Jindal Aluminium Limited

Domain Est. 1999

Website: jindalaluminium.com

Key Highlights: Discover quality downstream aluminium products from Jindal Aluminium, India’s largest aluminium extruded and second-largest aluminium flat-rolled product ……

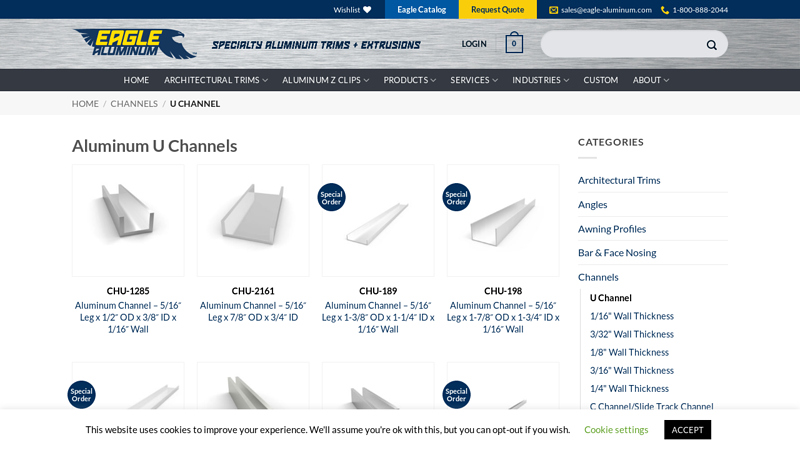

#9 Extruded U-Shaped Aluminum Channel

Domain Est. 2010

Website: eagle-aluminum.com

Key Highlights: $25 delivery 30-day returnsShop U-shaped aluminum channels at Eagle Aluminum, the leading supplier of high-quality extruded aluminum products. Browse our online selection today….

Expert Sourcing Insights for Aluminium Channel

H2: Market Trends for Aluminium Channel in 2026

The global aluminium channel market is poised for significant evolution by 2026, driven by advancements in industrial applications, sustainability initiatives, and shifting demand dynamics across key sectors. As industries increasingly prioritize lightweight, durable, and corrosion-resistant materials, aluminium channels are gaining traction in construction, transportation, renewable energy, and electronics. Below are the key trends expected to shape the aluminium channel market in 2026:

-

Growth in Green Building and Sustainable Construction

By 2026, the construction industry is anticipated to further embrace sustainable development practices. Aluminium channels, known for their recyclability and energy efficiency, are becoming integral in modular construction, curtain walling, and façade systems. Green building certifications such as LEED and BREEAM are encouraging the use of aluminium due to its low environmental impact over its lifecycle. This trend is particularly strong in North America, Europe, and parts of Asia-Pacific. -

Expansion in Renewable Energy Infrastructure

The surge in solar energy projects globally is a major driver for aluminium channel demand. Aluminium is extensively used in solar panel frames and mounting structures due to its lightweight and resistance to weathering. By 2026, with continued investments in solar farms and rooftop installations—especially in India, China, the U.S., and the EU—the need for precision-engineered aluminium channels is expected to grow significantly. -

Automotive Lightweighting and EV Adoption

As electric vehicle (EV) production ramps up worldwide, manufacturers are increasingly adopting aluminium components to reduce vehicle weight and improve energy efficiency. Aluminium channels are used in battery enclosures, chassis components, and structural reinforcements. By 2026, the EV market’s expansion will directly boost demand for customised and high-strength aluminium profiles, including channels. -

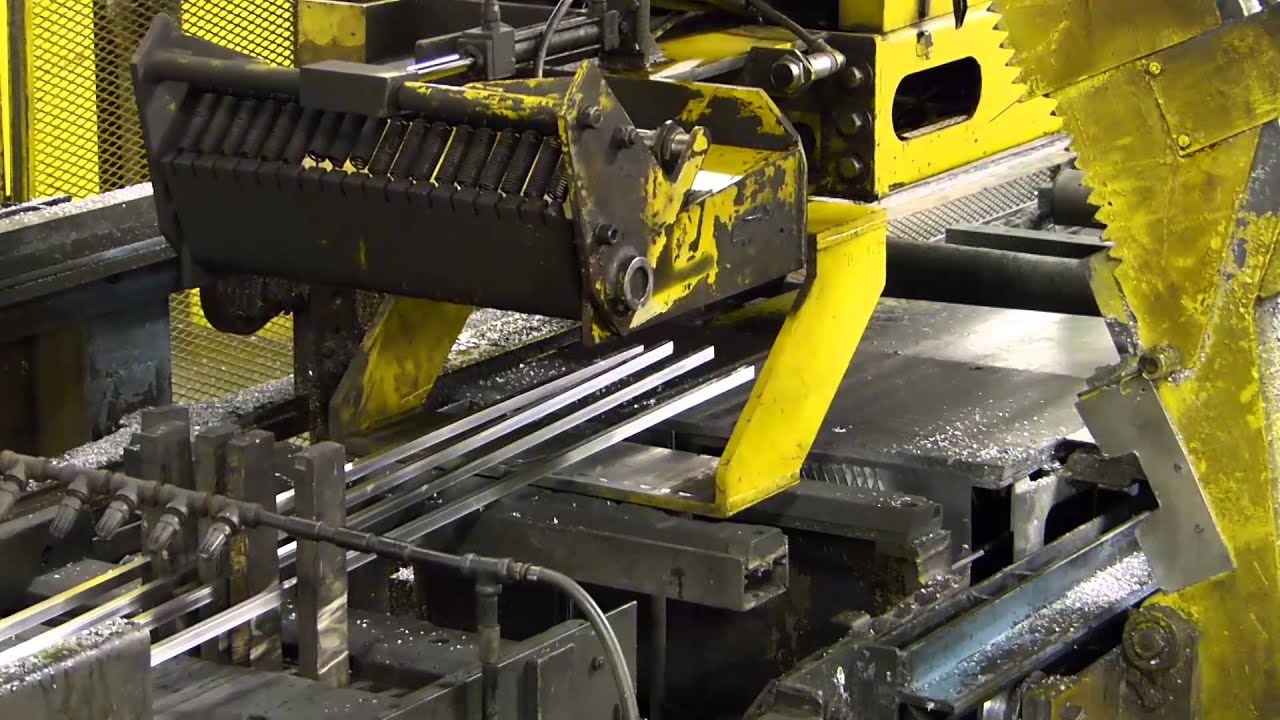

Technological Advancements in Extrusion and Finishing

Innovations in extrusion techniques—such as precision die design, high-speed extrusion, and thermal break integration—are enabling manufacturers to produce more complex and efficient aluminium channel profiles. Additionally, advanced surface treatments like powder coating, anodizing, and PVDF finishing are enhancing durability and aesthetic appeal, making aluminium channels more desirable in architectural and consumer-facing applications. -

Regional Shifts in Production and Demand

While China remains a dominant producer of aluminium, environmental regulations and energy costs are prompting a shift toward regional manufacturing hubs in Southeast Asia, India, and Eastern Europe. In parallel, North America and Western Europe are focusing on reshoring and nearshoring supply chains, especially for high-value applications in aerospace and clean energy. This regional realignment is expected to influence pricing, lead times, and product customization options by 2026. -

Rising Adoption in Consumer Electronics and Retail Fixtures

The electronics industry is increasingly using aluminium channels for heat sinks, display frames, and modular enclosures. Similarly, retail and commercial interiors are leveraging extruded aluminium channels for shelving, signage, and lighting systems due to their sleek design and structural stability. This trend is expected to accelerate with the growth of smart retail and IoT-integrated environments. -

Supply Chain Resilience and Raw Material Volatility

The aluminium channel market will continue to face challenges related to bauxite supply, alumina refining capacity, and energy-intensive smelting processes. By 2026, companies are likely to invest more in closed-loop recycling systems and partnerships with sustainable raw material suppliers to mitigate price volatility and ensure supply continuity.

In conclusion, the 2026 aluminium channel market will be shaped by sustainability, technological innovation, and sector-specific demand. Companies that prioritize eco-friendly production, customization, and supply chain agility will be best positioned to capitalize on emerging opportunities across global markets.

Common Pitfalls When Sourcing Aluminium Channel (Quality, IP)

Sourcing aluminium channels can be cost-effective and efficient, but it comes with several potential pitfalls—especially concerning quality and intellectual property (IP). Avoiding these issues is crucial to ensure product performance, compliance, and legal integrity.

Poor Material Quality and Specifications

One of the most frequent issues is receiving aluminium channels that do not meet required material standards. Suppliers may provide substandard alloys (e.g., using 6063-T5 instead of specified 6063-T6), incorrect thicknesses, or inconsistent surface finishes. This leads to structural weaknesses, poor anodizing or powder coating results, and part failures in critical applications.

Inconsistent Dimensional Tolerances

Aluminium extrusions must adhere to tight tolerances for proper fit and function. Low-cost or unqualified suppliers often lack proper tooling and quality control, resulting in warping, twisting, or out-of-spec dimensions. This can cause assembly problems, increased scrap rates, and delays in production.

Inadequate Surface Finish and Corrosion Resistance

Poor surface treatment—such as uneven anodizing, pitting, or inadequate protective coatings—compromises both appearance and durability. Channels may corrode prematurely, especially in outdoor or high-moisture environments, reducing product lifespan and customer satisfaction.

Lack of Material Certification and Traceability

Reputable applications (e.g., construction, transportation, medical) require material certifications (e.g., mill test reports, ISO compliance). Many suppliers, particularly from low-cost regions, fail to provide proper documentation, making it difficult to verify alloy composition, temper, or manufacturing processes—posing risks to compliance and safety.

Intellectual Property (IP) Infringement

Sourcing custom-designed aluminium profiles from unscrupulous suppliers increases the risk of IP theft. Some manufacturers may copy proprietary extrusion designs, sell them to competitors, or reuse tooling without permission. This undermines competitive advantage and can lead to legal disputes.

Use of Counterfeit or Grey-Market Profiles

Some suppliers offer branded or standardized profiles (e.g., Misumi, Bosch Rexroth equivalents) at suspiciously low prices. These may be counterfeit or unlicensed copies, violating IP rights and often providing inferior performance due to deviations in design and material.

Inadequate Tooling Ownership and Control

When commissioning custom extrusion dies, buyers must ensure they retain ownership of the tooling. Some suppliers claim ownership or reuse dies for third parties, leading to unauthorized production and loss of exclusivity. Clear contracts defining IP rights and die ownership are essential.

Non-Compliance with International Standards

Depending on the application, aluminium channels may need to meet standards such as ASTM, EN, or JIS. Suppliers unfamiliar with these requirements—or those cutting corners—may deliver non-compliant products, risking rejection during inspection or regulatory audits.

Avoiding these pitfalls requires due diligence: vetting suppliers, demanding certifications, securing IP agreements, and conducting third-party quality inspections. Investing time upfront ensures reliable supply, legal protection, and long-term product success.

Logistics & Compliance Guide for Aluminium Channel

Overview of Aluminium Channel

Aluminium channel, a versatile structural component, is widely used in construction, manufacturing, transportation, and industrial applications. It consists of a C-shaped extruded profile with consistent cross-sections, offering lightweight strength, corrosion resistance, and ease of fabrication. Proper logistics and compliance management are essential for its safe, efficient, and legal handling across the supply chain.

International Trade Classification

- HS Code: Typically falls under 7604.21 or 7604.29, depending on alloy composition and dimensions.

- 7604.21: Aluminium channels of non-alloy aluminium

- 7604.29: Other aluminium channels (alloyed)

- Import/Export Documentation: Ensure accurate HS code usage on commercial invoices, packing lists, and customs declarations to avoid delays or penalties.

Packaging and Handling Requirements

- Protective Packaging: Use edge protectors, plastic wrapping, or cardboard sleeves to prevent surface scratches and damage during transit.

- Bundling: Securely bundle channels using steel or plastic straps to prevent shifting.

- Labeling: Clearly label packages with product specifications, batch numbers, handling instructions (e.g., “Do Not Stack,” “Protect from Moisture”), and safety warnings.

- Handling Equipment: Use forklifts with padded forks or cranes with soft slings to minimize deformation or surface damage.

Transportation and Storage

- Modes of Transport: Suitable for road, rail, sea, and air freight. For sea freight, ensure corrosion protection due to humidity exposure.

- Loading Stability: Stack channels evenly on pallets or in containers. Use dunnage to prevent metal-to-metal contact and moisture buildup.

- Storage Conditions: Store indoors in a dry, well-ventilated area. Elevate from the floor to avoid water contact. Separate from corrosive materials (e.g., acids, salts).

Regulatory and Safety Compliance

- REACH (EU): Comply with Registration, Evaluation, Authorisation and Restriction of Chemicals regulations. Confirm that alloys do not contain restricted substances above threshold levels.

- RoHS (EU): Applicable if channels are used in electrical/electronic equipment; verify lead, cadmium, and other hazardous substance limits.

- OSHA (USA): Follow guidelines for safe material handling to prevent worker injury from sharp edges or heavy loads.

- GHS Labeling: Provide Safety Data Sheets (SDS) and use GHS-compliant labels if surface treatments (e.g., anodizing, coatings) involve hazardous chemicals.

Environmental and Recycling Considerations

- Recyclability: Aluminium is 100% recyclable. Encourage end-of-life recycling and document recycling rates for sustainability reporting.

- Carbon Footprint: Track and report emissions related to production and transport, especially for ESG compliance and green procurement programs.

Quality and Certification Standards

- Material Standards: Ensure compliance with ASTM B221 (Standard Specification for Aluminum and Aluminum-Alloy Extruded Bars, Rods, Wire, Profiles, and Tubes) or EN 755 (European standard for aluminium and aluminium alloys – Extruded rod/bar, tube and profiles).

- Certifications: Provide Mill Test Certificates (MTCs) confirming chemical composition and mechanical properties.

- Traceability: Maintain batch traceability from raw material to finished product for quality assurance and recalls.

Import/Export Controls and Duties

- Country-Specific Tariffs: Verify duty rates in destination countries; some offer preferential rates under free trade agreements (e.g., USMCA, CETA).

- Anti-Dumping Measures: Be aware of anti-dumping or countervailing duties on aluminium products from certain countries (e.g., China, Russia). Stay updated on trade remedies through official customs portals.

- Import Licenses: Some countries require import permits or product conformity certifications (e.g., SONCAP for Nigeria, SASO for Saudi Arabia).

Best Practices for Compliance Management

- Conduct regular audits of suppliers and logistics partners.

- Use certified freight forwarders experienced in metal products.

- Stay informed on evolving trade regulations via customs authorities and industry associations (e.g., Aluminum Association, European Aluminium).

By adhering to this logistics and compliance guide, businesses can ensure smooth operations, reduce risks, and maintain regulatory conformity when shipping and handling aluminium channel globally.

In conclusion, sourcing aluminium channels requires a strategic approach that balances quality, cost, availability, and supplier reliability. Aluminium channels are widely used in construction, manufacturing, and design due to their lightweight, corrosion resistance, and structural strength, making the selection of the right supplier crucial for project success. Key considerations include material specifications (such as alloy type, temper, and dimensions), adherence to industry standards (e.g., ASTM, EN), and finishing requirements. Evaluating suppliers based on reputation, certifications, production capabilities, and logistical support ensures consistent quality and timely delivery. Additionally, obtaining competitive quotes and exploring both local and international suppliers can enhance cost-efficiency. Ultimately, a well-informed sourcing strategy supports project efficiency, durability, and long-term performance, making it an essential component of effective procurement planning.