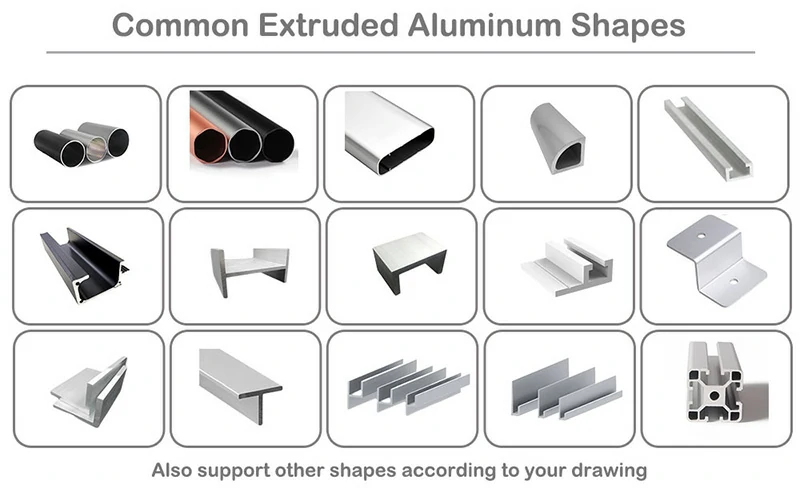

The global aluminum extrusion market is experiencing robust growth, driven by rising demand from industries such as construction, automotive, and renewable energy. According to Grand View Research, the market was valued at USD 72.8 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2030. This expansion is fueled by aluminum’s lightweight properties, recyclability, and energy efficiency—key factors in sustainability-focused manufacturing. As demand for custom extrusion profiles increases, a select group of manufacturers have emerged as leaders in producing complex and high-precision aluminum shapes. Leveraging advanced die technology, vertical integration, and global supply chain capabilities, these top 10 alum extrusion shape manufacturers are setting industry benchmarks in quality, innovation, and scalability.

Top 10 Alum Extrusion Shapes Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 International Extrusions: Aluminum Extrusion

Domain Est. 1998

Website: extrusion.net

Key Highlights: As America’s leading aluminum extrusion manufacturer, we offer a wide range of deliverables in variable billet sizes for industrial or commercial applications….

#2 80/20 Aluminum T-slot Building Systems

Domain Est. 1997

Website: 8020.net

Key Highlights: T-Slots, aluminum extrusions, and parts. Architectural solutions and frames for industrial machine guards, workstations, data center enclosures, and more….

#3 Apex Extrusions

Domain Est. 2010

Website: apexextrusions.ca

Key Highlights: Apex Aluminum is a state-of-the-art aluminum extrusion factory located in Langley, British Columbia, Canada. With a 170000 square foot aluminum extrusion……

#4 Taber Extrusions

Domain Est. 1998

Website: taberextrusions.com

Key Highlights: Taber is proud to be an ISO 9001 certified extruder. With a full range of aluminum alloys, custom aluminum shapes, and diverse machining, we claim the broadest ……

#5 Aluminum Extrusion

Domain Est. 1999

Website: shapecorp.com

Key Highlights: Shape is recognized worldwide as a premier aluminum extruder, fabricator and finisher; capable of producing the most difficult, complex and intricate extrusions ……

#6 Aluminum Extruded Shapes

Domain Est. 2002

Website: alum-ext.com

Key Highlights: Provider of custom extruded shapes, taking concepts from design through development and manufacturing. Call 513.563.2205 Email [email protected] ……

#7 Custom Aluminum Extrusions, Fabrication, Finishing

Domain Est. 2002

Website: starext.com

Key Highlights: Star provides custom aluminum extrusions, simple to complex fabrication, powder coating, anodized finishing, CNC machining & complete assembly….

#8 Bonnell Aluminum

Domain Est. 2007

Website: bonnellaluminum.com

Key Highlights: Bonnell Aluminum extrudes a variety of shapes used in architectural systems such as storefront, curtain walls and other flushed glazed projects. Learn More….

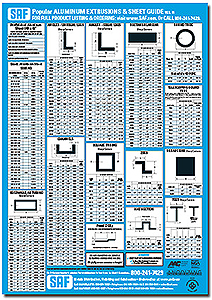

#9 SAF

Website: saf.com

Key Highlights: As the largest single source for architectural aluminum sheet, extruded shapes, aluminum anodizing, painting, and fabricating services, we look forward to ……

#10 Small Custom Aluminum Extrusions

Website: minalex.com

Key Highlights: Minalex is a trusted, worldwide supplier of Aluminum Window Extrusions. We manufacture extruded aluminum profiles for windows in various shapes, sizes, and ……

Expert Sourcing Insights for Alum Extrusion Shapes

H2: 2026 Market Trends for Aluminum Extrusion Shapes

The global aluminum extrusion shapes market is poised for significant transformation by 2026, driven by technological advancements, sustainability demands, and evolving end-use industries. This analysis highlights key trends expected to shape the market landscape over the coming years.

-

Growth in Sustainable Construction and Green Buildings

The construction sector remains a dominant consumer of aluminum extrusion shapes, and by 2026, demand will be increasingly influenced by green building standards such as LEED and BREEAM. Aluminum’s recyclability, lightweight nature, and durability make it a preferred material for energy-efficient windows, curtain walls, and structural frameworks. Governments worldwide are promoting low-carbon infrastructure, further accelerating the adoption of aluminum in sustainable architecture. -

Automotive Lightweighting and Electric Vehicles (EVs)

The transportation sector, especially automotive manufacturing, will be a key growth driver. As automakers strive to meet stringent emissions regulations and extend EV battery range, aluminum extrusions are being used extensively in chassis components, battery enclosures, and structural frames. The shift toward electric mobility is expected to boost demand for complex, high-strength aluminum profiles optimized for safety and efficiency. -

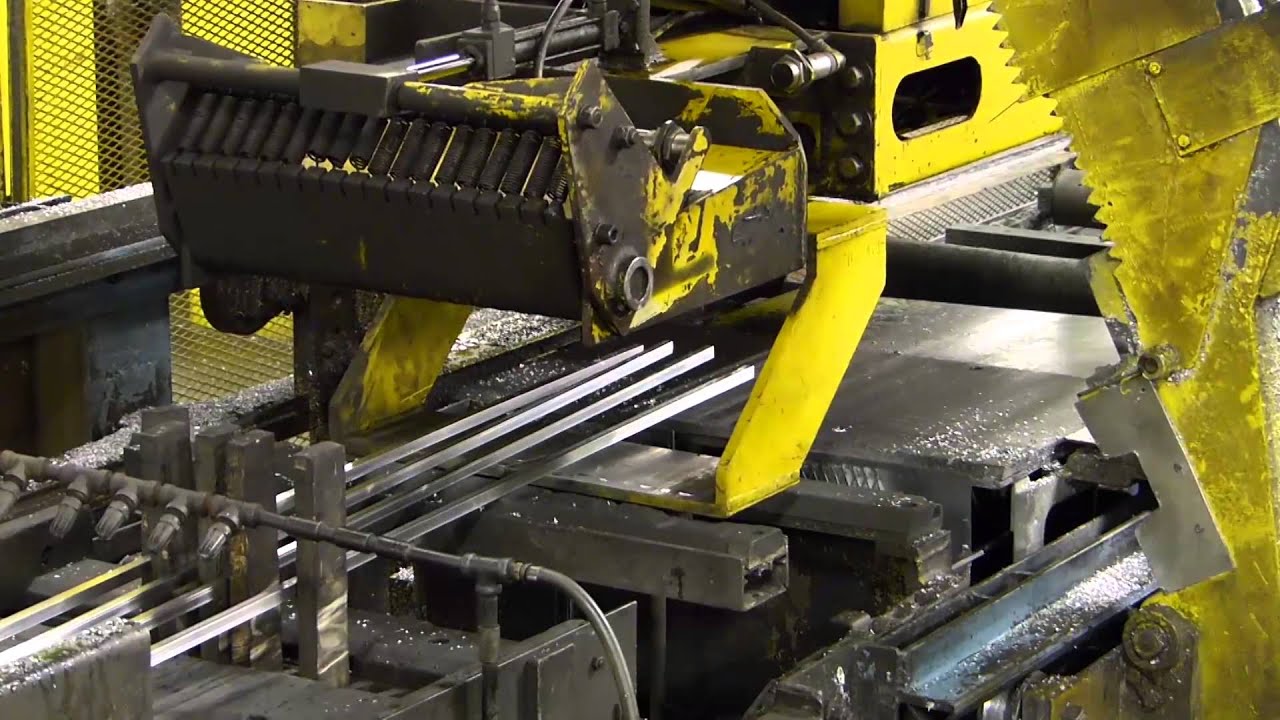

Advancements in Precision and Complex Profile Design

Technological improvements in extrusion tooling, simulation software, and automation are enabling manufacturers to produce highly intricate and customized shapes with tighter tolerances. By 2026, the ability to deliver tailored solutions—especially for aerospace, electronics, and medical devices—will differentiate leading suppliers and expand applications in high-performance industries. -

Rise of Recycling and Circular Economy Models

Sustainability pressures are pushing companies to adopt closed-loop recycling systems. Aluminum’s infinite recyclability with minimal energy loss positions it favorably. Major extruders are investing in post-consumer scrap processing and partnering with recyclers to secure feedstock. Regulatory frameworks, particularly in the EU and North America, are expected to mandate higher recycled content, influencing supply chain strategies. -

Regional Shifts and Supply Chain Resilience

Geopolitical factors and supply chain disruptions have prompted a reevaluation of production footprints. Nearshoring and regionalization trends are gaining momentum, especially in North America and Europe, where onshoring incentives support domestic aluminum extrusion capacity. Meanwhile, Asia-Pacific—led by China, India, and Southeast Asia—will continue to grow due to urbanization and industrial expansion. -

Digitalization and Industry 4.0 Integration

By 2026, digital technologies such as IoT-enabled monitoring, predictive maintenance, and AI-driven process optimization will become standard in extrusion facilities. These innovations enhance energy efficiency, reduce scrap rates, and improve product consistency, giving early adopters a competitive edge. -

Increased Demand in Renewable Energy Infrastructure

Solar panel frames, wind turbine components, and energy storage systems are emerging as high-growth applications. Aluminum extrusions offer corrosion resistance and structural integrity ideal for outdoor and harsh environments. As global investments in renewable energy surge, this segment is expected to contribute significantly to market expansion.

In conclusion, the 2026 aluminum extrusion shapes market will be defined by sustainability, innovation, and adaptability. Companies that invest in eco-friendly practices, advanced manufacturing, and strategic market positioning will be best positioned to capitalize on these evolving trends.

Common Pitfalls Sourcing Aluminum Extrusion Shapes (Quality, IP)

Sourcing aluminum extrusion shapes presents unique challenges, particularly concerning quality consistency and intellectual property (IP) protection. Overlooking these aspects can lead to production delays, increased costs, legal disputes, and compromised product performance.

Quality Inconsistencies and Tolerance Deviations

One of the most frequent issues in sourcing aluminum extrusions is inconsistent product quality across production batches. Variations in alloy composition, temper (e.g., 6061-T6), dimensional tolerances, surface finish, and straightness can occur due to differences in manufacturing processes, tooling wear, or inadequate process controls at the extruder. These inconsistencies may result in parts that do not fit as intended in assembly, require additional post-processing, or fail under operational stress. To mitigate this, buyers must establish clear specifications (e.g., ASTM B221 standards), conduct regular inspections, and work with extruders who maintain robust quality management systems (e.g., ISO 9001 certification).

Intellectual Property (IP) Risks and Unauthorized Tooling Use

Aluminum extrusion often involves custom dies designed specifically for a client’s geometry. A major IP pitfall arises when extrusion suppliers retain or reuse die tooling without authorization, potentially producing identical or similar profiles for competing customers. This not only undermines competitive advantage but may also constitute a breach of contract or IP law. Additionally, unclear ownership agreements regarding die tooling can lead to disputes over rights to modify, replicate, or transfer the tooling. To protect IP, buyers should formalize die ownership in contracts, require non-disclosure agreements (NDAs), and consider working with trusted domestic or certified international suppliers with enforceable legal frameworks.

Inadequate Material Certification and Traceability

Many suppliers fail to provide proper material certifications (e.g., mill test reports or MTRs), making it difficult to verify alloy type, heat treatment, and compliance with industry standards. Lack of traceability increases the risk of receiving substandard or counterfeit materials, particularly in high-performance or regulated applications (e.g., aerospace, medical, or structural uses). Ensuring full documentation and chain-of-custody from raw billet to finished extrusion is essential for quality assurance and regulatory compliance.

Poor Surface Finish and Post-Processing Defects

Surface defects such as die lines, scratches, oxidation streaks, or uneven anodizing can occur during extrusion or finishing processes. These flaws may affect both aesthetics and functionality—especially when parts require tight sealing, painting, or bonding. Buyers often underestimate the need to specify surface quality requirements upfront, leading to rejected shipments or costly rework. Clear communication of finish expectations and process controls (e.g., handling, packaging, and storage) is crucial.

Supply Chain and Lead Time Risks

Reliance on a single or distant extruder can expose buyers to long lead times, logistical delays, and supply chain disruptions. Custom extrusions often require significant tooling lead time (4–8 weeks or more), and any changes or rework can compound delays. Diversifying suppliers, investing in dual sourcing, and maintaining strategic inventory of critical profiles can help mitigate these risks.

By proactively addressing these common pitfalls—through detailed specifications, strong contracts, supplier vetting, and ongoing quality monitoring—companies can ensure reliable, high-quality aluminum extrusion sourcing while protecting their intellectual property and operational continuity.

Logistics & Compliance Guide for Aluminum Extrusion Shapes

Overview

Aluminum extrusion shapes are widely used across industries such as construction, automotive, aerospace, and consumer electronics due to their strength, lightweight nature, and versatility. However, shipping and handling these products require careful attention to logistics and compliance with international, national, and industry-specific regulations. This guide outlines key considerations for the safe and compliant transportation, storage, and documentation of aluminum extrusion shapes.

Packaging & Handling Requirements

Proper packaging ensures aluminum extrusions arrive undamaged and meet quality standards.

- Protective Wrapping: Extrusions should be wrapped in plastic film, kraft paper, or protective sleeves to prevent surface scratches, oxidation, and moisture exposure.

- Bundling: Shapes are typically bundled using steel or plastic strapping. Bundles must be sized to allow safe lifting and handling.

- End Protection: Use plastic or cardboard end caps to protect cut edges and prevent injuries.

- Palletization: Secure bundles to wooden or composite pallets using strapping or shrink wrap. Pallets should meet ISPM 15 standards for international shipments.

- Labeling: Clearly label each bundle with product specifications, alloy type, finish, heat number, and handling instructions (e.g., “Fragile,” “This Side Up”).

Transportation & Shipping

Selecting the appropriate mode of transport and packaging is critical to avoid damage and delays.

- Domestic Shipping: Use flatbed or enclosed trailers for truck transport. Ensure loads are secured with straps or chains to prevent shifting.

- International Shipping:

- Containerized Freight: For sea freight, use 20’ or 40’ dry containers. Maximize space while ensuring ventilation to prevent condensation.

- Air Freight: Reserved for urgent or high-value shipments; cost-prohibitive for bulk orders.

- Incoterms: Clearly define responsibilities using standard Incoterms (e.g., FOB, CIF, DDP) in contracts.

- Hazardous Materials: Aluminum extrusions are generally non-hazardous, but finished products with chemical coatings (e.g., anodizing, painting) may require SDS documentation.

Storage Guidelines

Improper storage can lead to corrosion, warping, or contamination.

- Dry Environment: Store in a covered, dry area to prevent moisture accumulation and oxidation.

- Elevated Racking: Keep materials off the floor using racks or pallets to avoid water contact and facilitate airflow.

- Separation by Alloy/Finish: Prevent galvanic corrosion by storing different alloys or coated/uncoated materials separately.

- First-In, First-Out (FIFO): Implement FIFO inventory management to reduce aging and quality degradation.

Regulatory Compliance

Adherence to regulatory standards ensures legal and safe distribution.

- Customs Documentation:

- Commercial Invoice

- Packing List

- Bill of Lading / Air Waybill

- Certificate of Origin (required for preferential tariffs under trade agreements like USMCA, EU-FTA)

- Harmonized System (HS) Code: Typically 7604.10 or 7604.21 for aluminum profiles, depending on alloy and dimensions.

- REACH & RoHS (EU): Ensure compliance with chemical restrictions if extrusions are used in electronics or consumer goods.

- Buy American Act / Berry Amendment (U.S.): Government contracts may require domestic sourcing or specific material traceability.

- Quality Certifications: Provide mill test certificates (MTCs) or Material Test Reports (MTRs) confirming compliance with ASTM B221, EN 755, or other applicable standards.

Environmental & Safety Considerations

- Recyclability: Aluminum is 100% recyclable. Promote sustainability by using recycled content and offering take-back programs.

- Worker Safety: Provide PPE (gloves, safety glasses) for handling sharp edges. Train staff on proper lifting techniques to prevent injury.

- Waste Management: Recycle packaging materials and dispose of non-recyclable waste in accordance with local regulations.

Traceability & Documentation

Maintain full traceability from production to delivery.

- Heat/Lot Number Tracking: Record and document alloy heat numbers for quality control and recalls.

- Digital Records: Use ERP or supply chain software to track orders, certifications, and shipment details.

- Audit Preparedness: Keep records accessible for compliance audits by customers, regulators, or certification bodies.

Conclusion

Effective logistics and compliance management for aluminum extrusion shapes involves a combination of proper packaging, regulatory adherence, safe handling, and thorough documentation. By following this guide, manufacturers, distributors, and logistics providers can ensure timely, safe, and compliant delivery of aluminum extrusions to global markets.

Conclusion on Sourcing Aluminum Extrusion Shapes

Sourcing aluminum extrusion shapes requires a strategic approach that balances quality, cost, lead times, and customization capabilities. Aluminum extrusions offer exceptional versatility, strength-to-weight ratio, and corrosion resistance, making them ideal for a wide range of applications across industries such as construction, transportation, electronics, and renewable energy.

When sourcing, it is critical to select a reliable supplier with proven expertise in extrusion design, metallurgical consistency, and finishing options (such as anodizing, powder coating, or milling). Working closely with suppliers during the design phase can optimize material usage, reduce waste, and improve manufacturability. Additionally, considering regional versus global sourcing options helps manage costs and supply chain resilience, especially in light of logistical challenges and fluctuating raw material prices.

Ultimately, successful sourcing of aluminum extrusions hinges on building strong supplier relationships, leveraging design for manufacturability (DFM), and ensuring alignment with project specifications and sustainability goals. By doing so, companies can achieve cost-effective, high-performance solutions that support long-term product success and innovation.