The global aluminum door frames market is experiencing steady growth, driven by rising demand for energy-efficient, durable, and low-maintenance building materials in both residential and commercial construction. According to a report by Mordor Intelligence, the global aluminum profiles market—key components in door frame manufacturing—was valued at USD 64.8 billion in 2022 and is projected to grow at a CAGR of over 5.6% from 2023 to 2028. This growth is fueled by urbanization, increasing infrastructure development, and the expanding use of aluminum in green building projects due to its recyclability and lightweight properties. Additionally, Grand View Research highlights the construction sector’s shift toward sustainable materials, reinforcing aluminum’s position as a preferred choice for modern door systems. As demand surges, especially in Asia-Pacific and Latin America, a select group of manufacturers have emerged as leaders in innovation, scale, and product quality—setting the benchmark in the competitive landscape of aluminum door frame production.

Top 8 Alum Door Frames Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Timely Frames

Domain Est. 1995

Website: timelyframes.com

Key Highlights: Timely Industries is the leading manufacturer of prefinished steel door frames – Outperforming other door frames with lower opening costs….

#2 Avalon International Aluminum

Domain Est. 1998

Website: avalonint.com

Key Highlights: Avalon International Aluminum is a family owned aluminum door, frame, and window manufacturer built on the ideas of innovation, quality products, ……

#3 Element Designs

Domain Est. 2002

Website: element-designs.com

Key Highlights: Element Designs is the leading manufacturer of aluminum frame and glass cabinet doors in North America. Element Designs also offers custom shelving ……

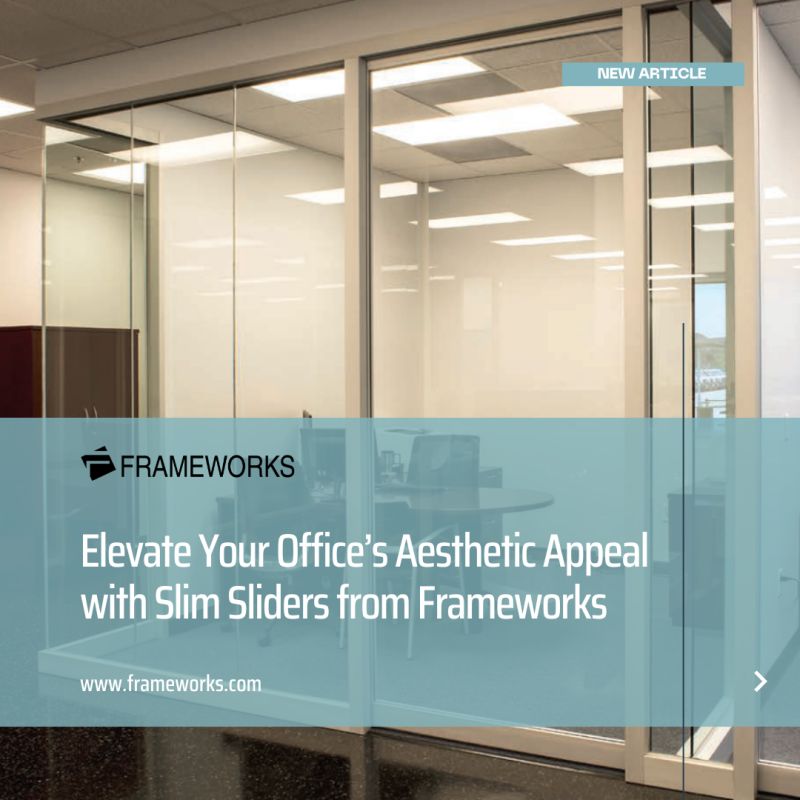

#4 Frameworks Manufacturing

Domain Est. 1995

Website: frameworks.com

Key Highlights: Frameworks has been manufacturing high quality products for interior commercial applications to provide the best customer satisfaction….

#5 Fireframes® Aluminum Series

Domain Est. 1996

Website: fireglass.com

Key Highlights: The narrow aluminum profiles of the Fireframes® Aluminum Series allow unlimited areas of glazing in fire separations and provides a barrier to radiant and ……

#6 Western Integrated Materials

Domain Est. 2001

Website: aluminumdoorframes.com

Key Highlights: Western Integrated Materials provides the commercial office construction industry with the highest quality interior aluminum door and window frames, ……

#7 Door frames

Domain Est. 2001

Website: alpha-alum.com

Key Highlights: Alpha’s door frames are designed for that modern look that architects, designers, engineers and construction professionals are looking for….

#8 Commercial Interior Aluminum Door Frames

Domain Est. 2020

Website: aodoor.net

Key Highlights: AO Door delivers quality-crafted aluminum frames cut to fit exact project specifications with clear packaging and labels for easy installation. AO Door’s team ……

Expert Sourcing Insights for Alum Door Frames

2026 Market Trends for Aluminum Door Frames

The aluminum door frames market is poised for significant evolution by 2026, driven by technological advancements, shifting consumer preferences, and global sustainability imperatives. Key trends shaping the industry include:

Rising Demand for Energy-Efficient and Sustainable Solutions

With global building codes tightening and consumer awareness of environmental impact increasing, aluminum door frames are being engineered for superior thermal performance. Innovations such as thermally broken profiles, improved sealing technologies, and integration with high-performance glazing will dominate. Manufacturers are also emphasizing recycled aluminum content and low-carbon production processes to align with green building certifications like LEED and BREEAM.

Growth in Smart Building Integration

By 2026, smart home and building technologies will be a major driver. Aluminum door frames are increasingly designed to accommodate integrated sensors, automated locking systems, and IoT-enabled access controls. The material’s durability and design flexibility make it ideal for housing smart components, supporting trends toward connected, secure, and energy-optimized buildings.

Expansion in Urban and High-Rise Construction

Urbanization, especially in emerging economies, is fueling demand for high-rise residential and commercial developments. Aluminum’s high strength-to-weight ratio, corrosion resistance, and sleek aesthetic make it a preferred choice for modern architectural designs. Curtain wall systems and large-format sliding or pivot doors using aluminum frames will see increased adoption in both new constructions and renovations.

Regional Market Diversification

While North America and Europe remain strong markets due to retrofitting and energy efficiency mandates, Asia-Pacific—particularly China, India, and Southeast Asia—is expected to lead growth. Rapid infrastructure development, government housing initiatives, and rising disposable incomes are accelerating demand for premium building materials, including aluminum door systems.

Customization and Aesthetic Innovation

Consumers and architects are increasingly seeking design flexibility. Aluminum frames offer a wide range of finishes—including anodized, powder-coated, and wood-grain effects—enabling seamless integration with diverse architectural styles. By 2026, mass customization through digital design tools and modular manufacturing will allow faster delivery of tailored solutions without sacrificing cost-efficiency.

Supply Chain Resilience and Cost Volatility

Aluminum prices and supply chain stability will remain critical challenges. Geopolitical factors, energy costs, and trade policies may impact raw material availability. Leading manufacturers are expected to respond by investing in localized production, recycling loops, and long-term supplier partnerships to mitigate risks and ensure consistent product delivery.

In summary, the 2026 aluminum door frames market will be defined by innovation in sustainability, smart technology integration, and design versatility, supported by strong demand from urban and eco-conscious construction sectors worldwide.

Common Pitfalls Sourcing Aluminium Door Frames (Quality, IP)

Sourcing aluminium door frames requires careful consideration to avoid compromising on quality, durability, and performance—especially regarding Ingress Protection (IP) ratings. Overlooking key factors can lead to premature failure, safety risks, and increased lifecycle costs. Below are common pitfalls to watch for:

Overlooking Material Grade and Thickness

Choosing door frames made from low-grade aluminium (e.g., non-6000 series alloys like 6063-T5 or 6061-T6) can result in poor structural integrity, warping, or corrosion. Similarly, insufficient wall thickness (typically less than 2.0 mm for structural components) reduces strength and longevity, especially in high-traffic or exposed environments.

Ignoring Anodizing or Powder Coating Quality

Poor surface finishing—such as thin anodizing layers (<10–15 microns) or low-quality powder coating—leads to fading, chipping, and reduced resistance to UV and corrosion. This is critical in coastal or high-humidity areas where salt spray and moisture accelerate degradation.

Misunderstanding Ingress Protection (IP) Ratings

Many buyers assume all aluminium frames are weatherproof. However, without proper sealing, gaskets, and design, even aluminium frames can allow water and dust ingress. Ensure the frame system has a tested IP rating (e.g., IP54 or higher) suitable for the installation environment—especially for outdoor, commercial, or industrial applications.

Poor Thermal Break Design

Frames lacking an effective thermal break perform poorly in temperature extremes, leading to condensation, energy loss, and discomfort. Non-thermally broken frames are unsuitable for climate-controlled buildings and may fail energy compliance standards.

Inadequate Certification and Compliance

Sourcing from suppliers without recognized certifications (e.g., ISO 9001, EN 14351-1, or local building codes) increases the risk of non-compliant products. Verify that frames meet fire safety, wind load, and accessibility standards relevant to your region.

Choosing Based on Price Alone

Low-cost frames often sacrifice quality in extrusion tolerances, weld integrity, and hardware compatibility. This leads to alignment issues, difficulty in installation, and higher maintenance or replacement costs over time.

Overlooking System Integration and Hardware Compatibility

Aluminium door frames must integrate seamlessly with locking mechanisms, hinges, glazing, and automation systems. Poorly designed profiles or lack of compatibility with certified hardware compromises security, operation, and longevity.

Inadequate Supplier Due Diligence

Failing to assess a supplier’s track record, technical support, and after-sales service can result in delayed projects, lack of spare parts, and difficulty resolving quality issues. Always request samples, test reports, and references before committing.

Avoiding these pitfalls ensures the selection of durable, high-performance aluminium door frames that meet both quality and IP requirements for long-term reliability.

Logistics & Compliance Guide for Aluminum Door Frames

Product Overview and Specifications

Aluminum door frames are lightweight, durable building components designed for both residential and commercial applications. They offer high corrosion resistance, structural integrity, and compatibility with various glazing and insulation systems. Typical specifications include standard frame dimensions (e.g., 100mm, 120mm depth), powder-coated or anodized finishes, thermal break options, and compliance with regional building codes.

Packaging and Handling Requirements

Proper packaging is essential to prevent damage during transit. Aluminum door frames must be:

– Wrapped in protective plastic film to prevent surface scratches and moisture exposure.

– Secured with corner protectors, especially on extruded edges.

– Bundled using non-abrasive strapping and placed on wooden pallets.

– Clearly labeled with handling instructions such as “Fragile,” “This Side Up,” and “Protect from Moisture.”

Avoid stacking frames directly on top of each other without padding. Use padded forklifts or lifting slings during loading and unloading to prevent deformation.

Transportation and Shipping

Aluminum door frames are typically shipped via flatbed trucks, enclosed trailers, or container freight (for international shipments). Key considerations include:

– Secure frames to prevent shifting during transit using straps and load locks.

– Protect from weather with waterproof tarpaulins or enclosed transport.

– For sea freight, ensure containers are dry and use desiccants to prevent condensation.

– Adhere to dimensional and weight restrictions for road transport in each region.

– Maintain a clear chain of custody and shipping documentation (e.g., bill of lading, packing list).

Import/Export Compliance

International shipments of aluminum door frames must comply with relevant customs and trade regulations:

– Classify products under the correct Harmonized System (HS) code (e.g., 7610.90 for aluminum doors and frames).

– Provide accurate commercial invoices, certificates of origin, and packing lists.

– Comply with anti-dumping or countervailing duties where applicable (e.g., U.S. or EU regulations on Chinese aluminum products).

– Ensure adherence to Incoterms® 2020 (e.g., FOB, CIF, DDP) to define responsibilities between buyer and seller.

Regulatory and Safety Standards

Aluminum door frames must meet applicable building and safety standards depending on the destination market:

– North America: Comply with ASTM E2112 (installation), NFRC 100/200 (thermal performance), and local building codes (e.g., IBC, IRC).

– European Union: Conform to EN 14351-1 (performance of windows and doors), CE marking requirements, and EU Construction Products Regulation (CPR).

– Other Regions: Follow local standards such as AS/NZS 4420 (Australia/New Zealand) or GCC Standardization Organization (GSO) requirements.

Provide test reports, Declaration of Performance (DoP), or certification from accredited bodies as needed.

Environmental and Sustainability Compliance

Manufacturers and distributors must observe environmental regulations:

– Ensure compliance with REACH (EU) and RoHS regarding restricted substances.

– Use recyclable packaging materials and minimize waste.

– Provide Environmental Product Declarations (EPDs) where required for green building certifications (e.g., LEED, BREEAM).

– Confirm aluminum sourcing aligns with responsible practices (e.g., aluminum stewardship via ASI – Aluminium Stewardship Initiative).

Documentation and Traceability

Maintain comprehensive documentation throughout the supply chain:

– Batch numbers, production dates, and material certifications (e.g., aluminum alloy grade 6063-T5).

– Quality inspection reports and conformity certificates.

– Shipping records and customs documentation for audit and traceability purposes.

– Digital records should be stored securely for minimum retention periods as per local regulations (typically 5–7 years).

Installation and Site Compliance

While not part of logistics per se, ensuring compliance on-site supports overall project adherence:

– Provide installation guidelines aligned with manufacturer specifications and regional codes.

– Train contractors on proper handling and installation to avoid damage and ensure warranty validity.

– Verify site conditions (e.g., humidity, temperature) meet requirements for installation and long-term performance.

Conclusion

Efficient logistics and strict compliance are critical for the successful delivery and performance of aluminum door frames. Adhering to packaging, transport, regulatory, and documentation standards ensures product integrity, legal compliance, and customer satisfaction across global markets. Regular audits and updates to procedures will help maintain alignment with evolving regulations and industry best practices.

Conclusion for Sourcing Aluminum Door Frames

After evaluating various suppliers, material specifications, pricing structures, and lead times, it is concluded that sourcing aluminum door frames requires a balanced approach that prioritizes quality, durability, cost-efficiency, and timely delivery. Aluminum door frames offer significant advantages, including lightweight construction, corrosion resistance, low maintenance, and design flexibility, making them ideal for both residential and commercial applications.

The most favorable sourcing option identified combines a reputable manufacturer with certified material standards (such as ASTM or EN specifications), competitive pricing through bulk purchasing, and a reliable supply chain to ensure on-time project execution. Additionally, considering local suppliers can reduce shipping costs and lead times while supporting sustainability goals through reduced carbon emissions.

To mitigate risks such as price volatility in aluminum markets or supply chain disruptions, establishing long-term agreements with flexible terms and multiple backup suppliers is recommended. Furthermore, ensuring proper quality control measures and pre-shipment inspections will safeguard against defects and non-compliance.

In summary, a strategic sourcing approach focusing on supplier reliability, material certification, cost management, and logistics efficiency will ensure the successful procurement of high-quality aluminum door frames that meet project requirements and performance standards.